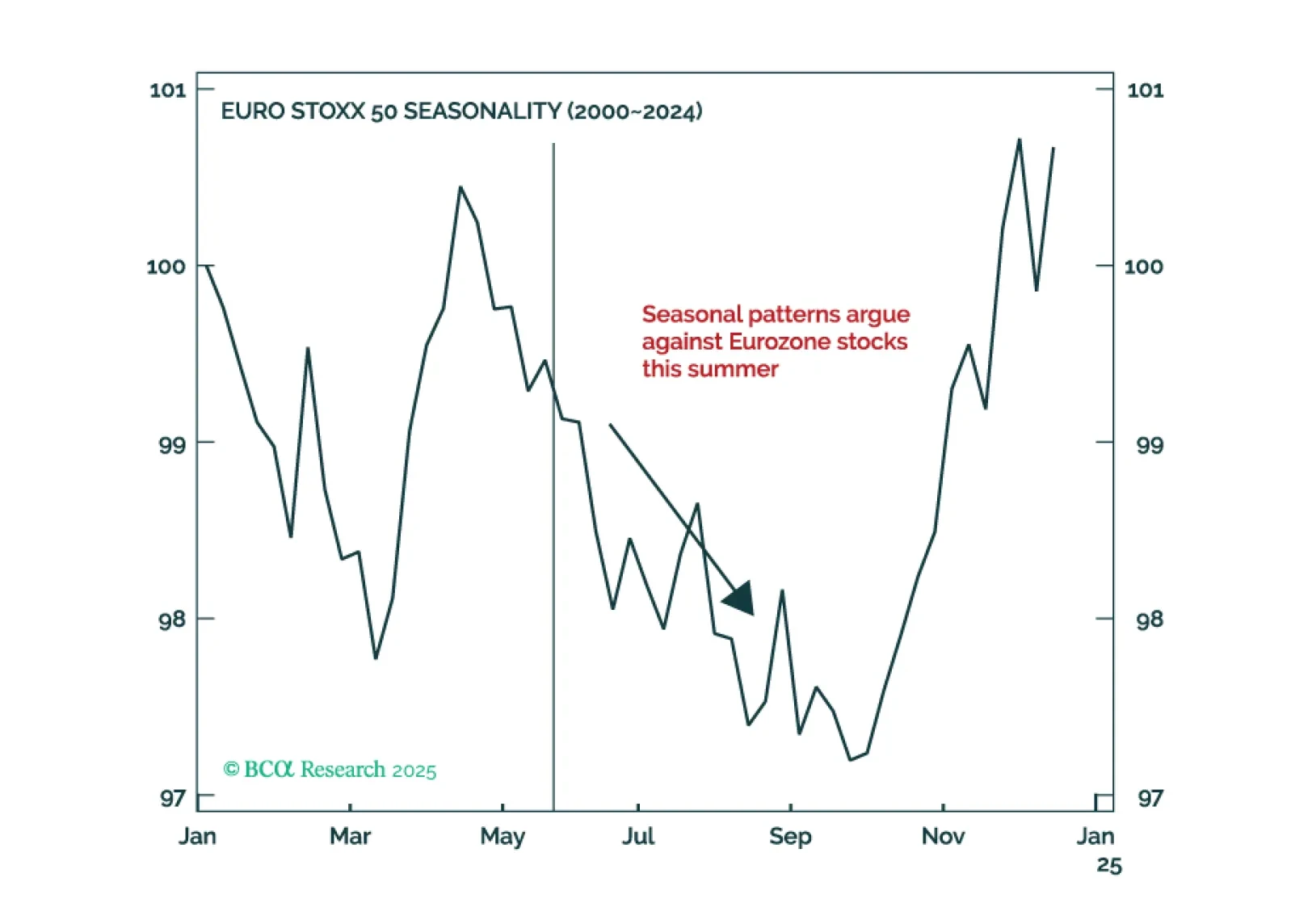

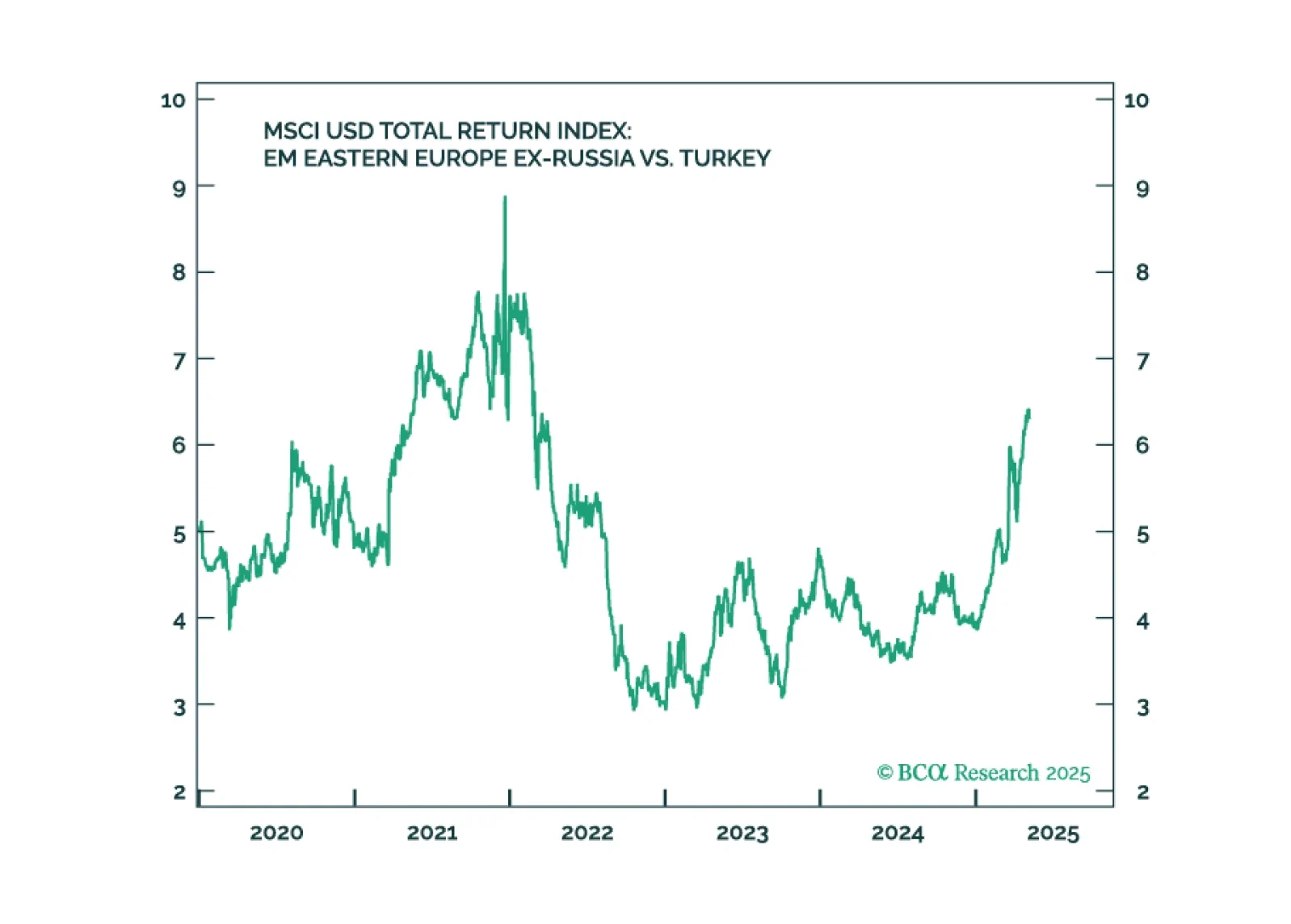

European equities will face a clash of powerful forces this summer. Expect sharp swings and false breaks, creating an ideal terrain for nimble traders but a minefield for buy-and-hold investors seeking steady gains.Within this backdrop,…

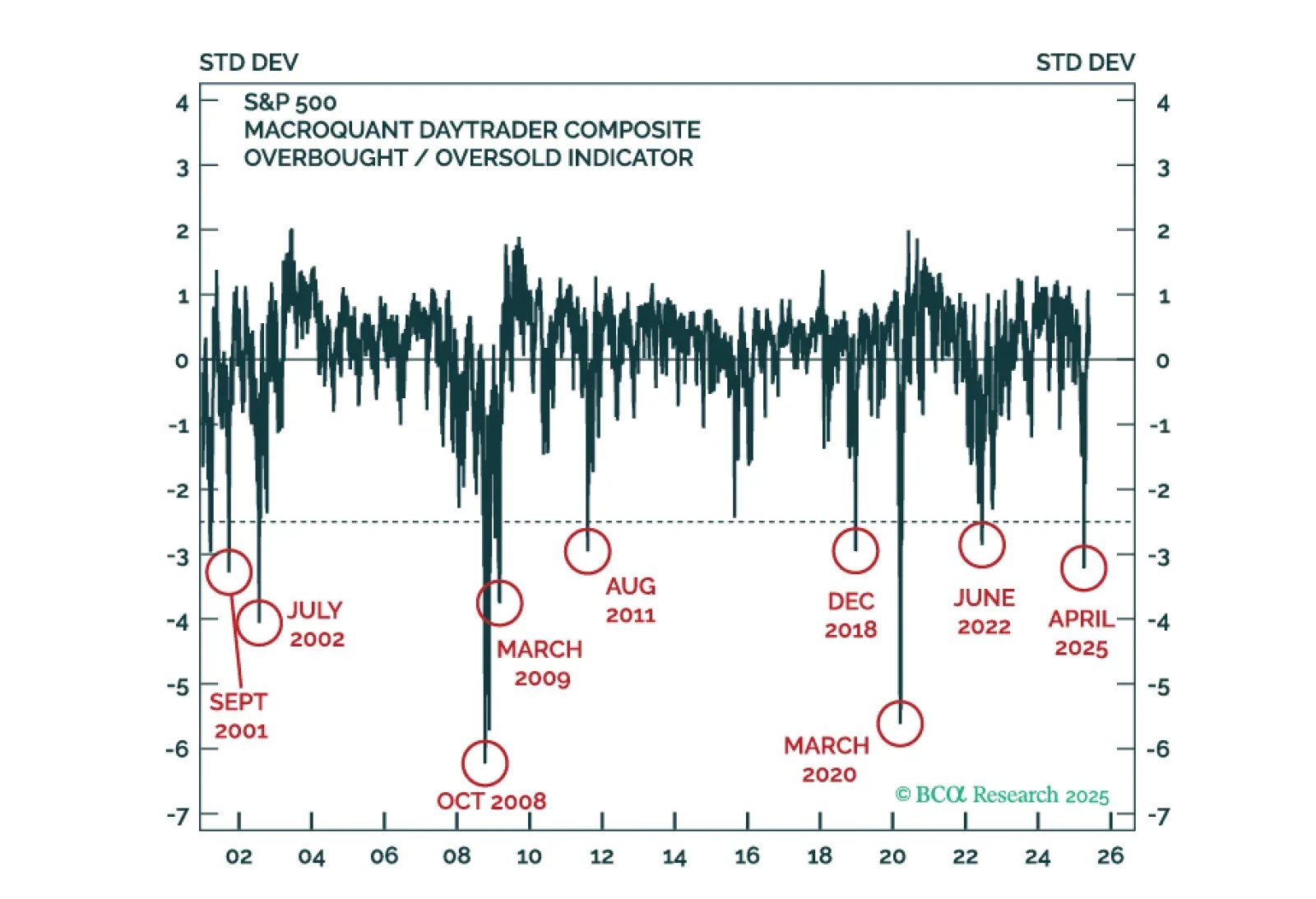

MacroQuant warns that US equities are pricing in very little economic risk. The model is shunning equities and recommends a large overweight to cash.

MacroQuant warns that US equities are pricing in very little economic risk. The model is shunning equities and recommends a large overweight to cash.

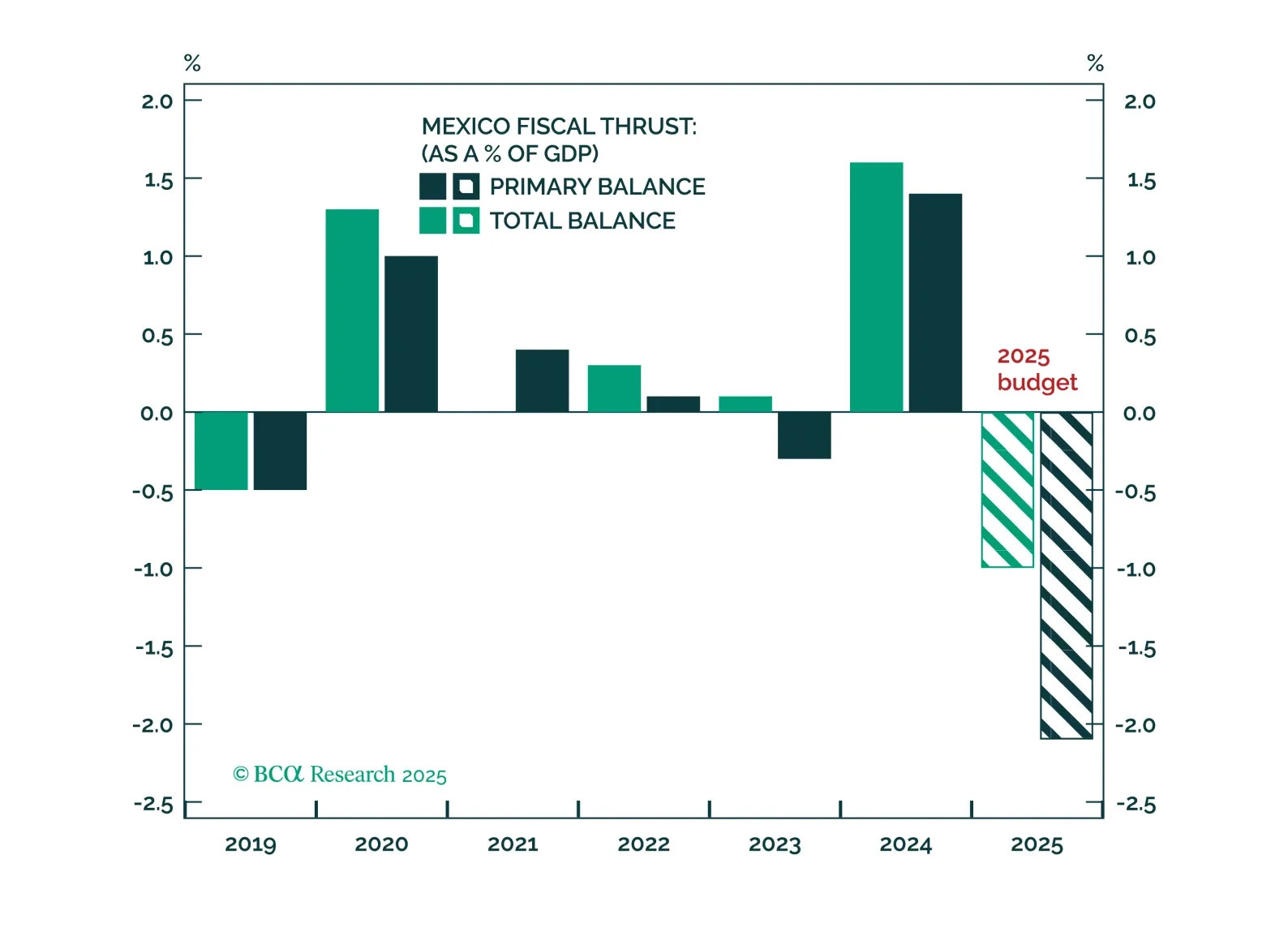

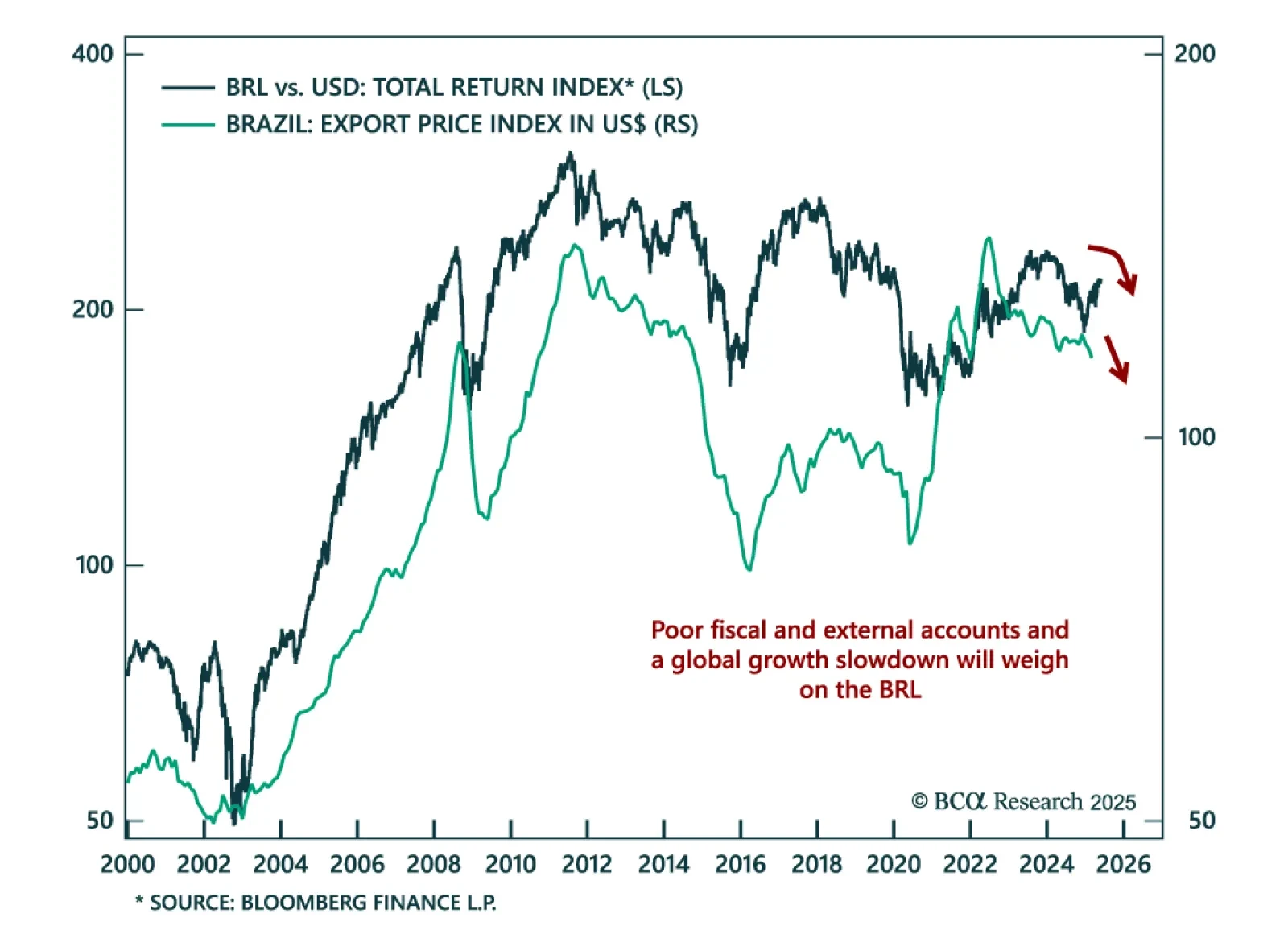

The most recent Brazilian data surprised positively, but underlying economic troubles will spoil the party for the country’s financial markets. Wholesale inflation came in at -0.49% in May relative to last month, while the…

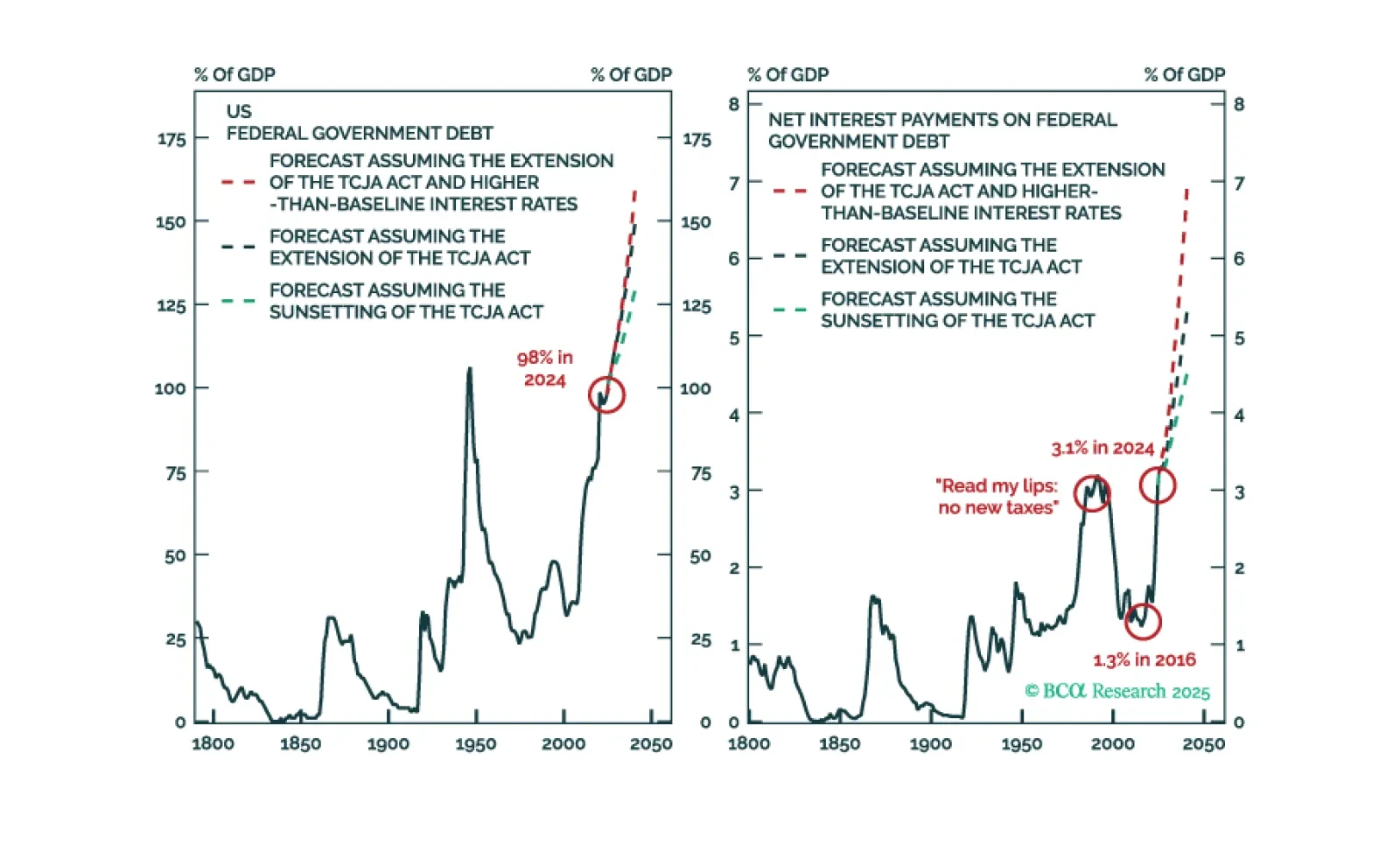

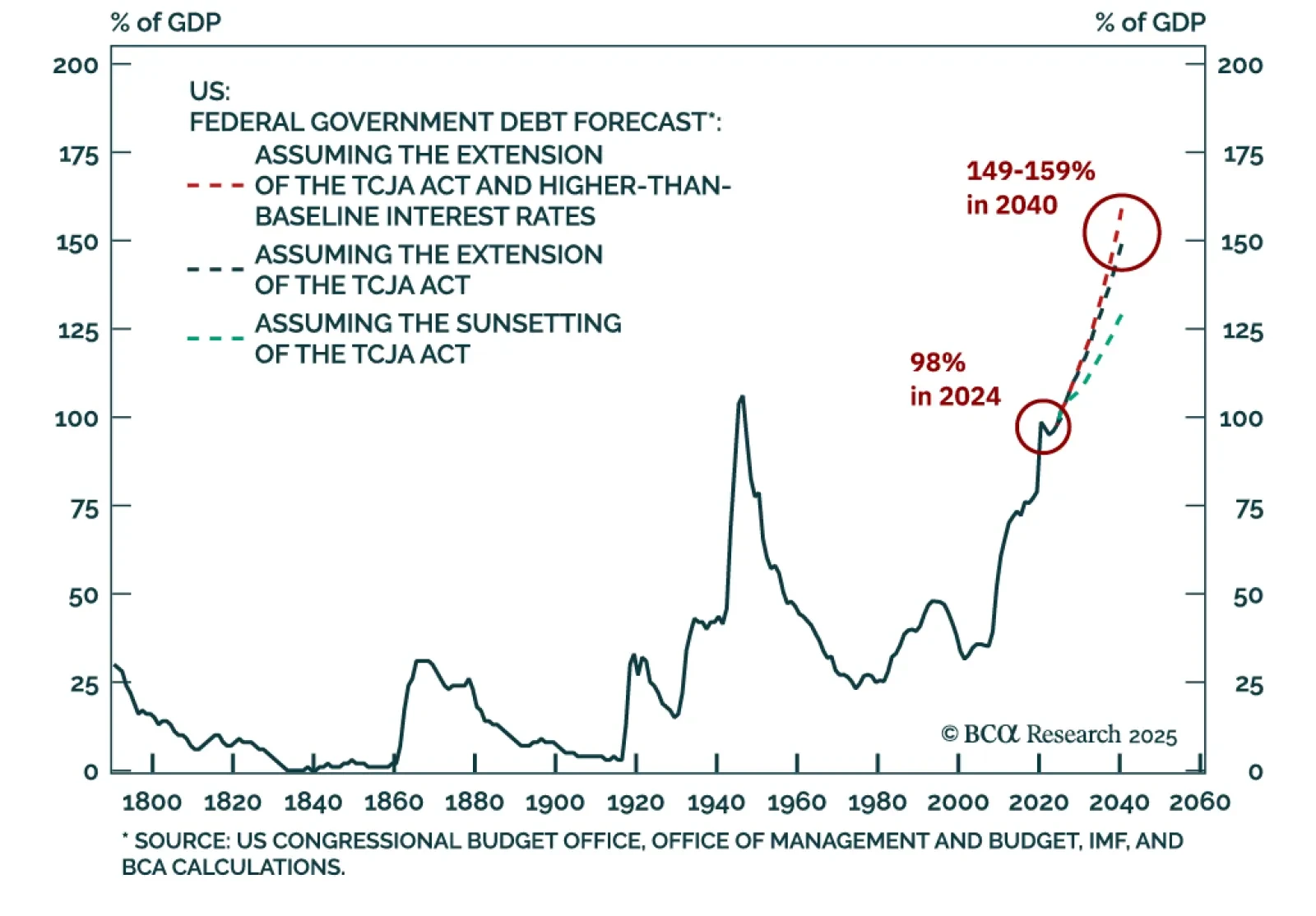

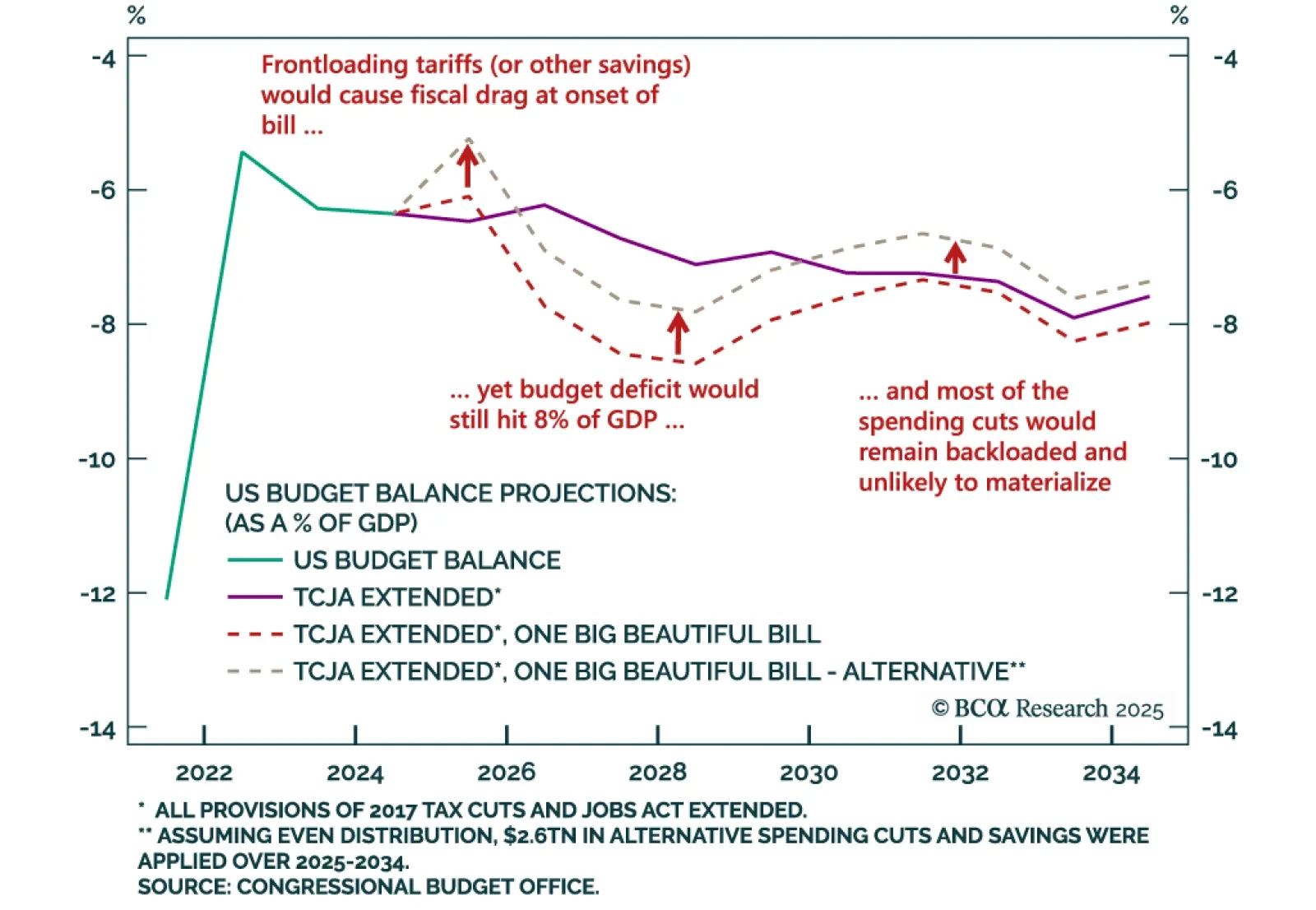

President Trump’s trade truces gave a respite to global markets, but a bigger risk lurks around the corner. Unsustainable public debt dynamics in the US demand higher bond yields, which can push the economy into trouble. The…

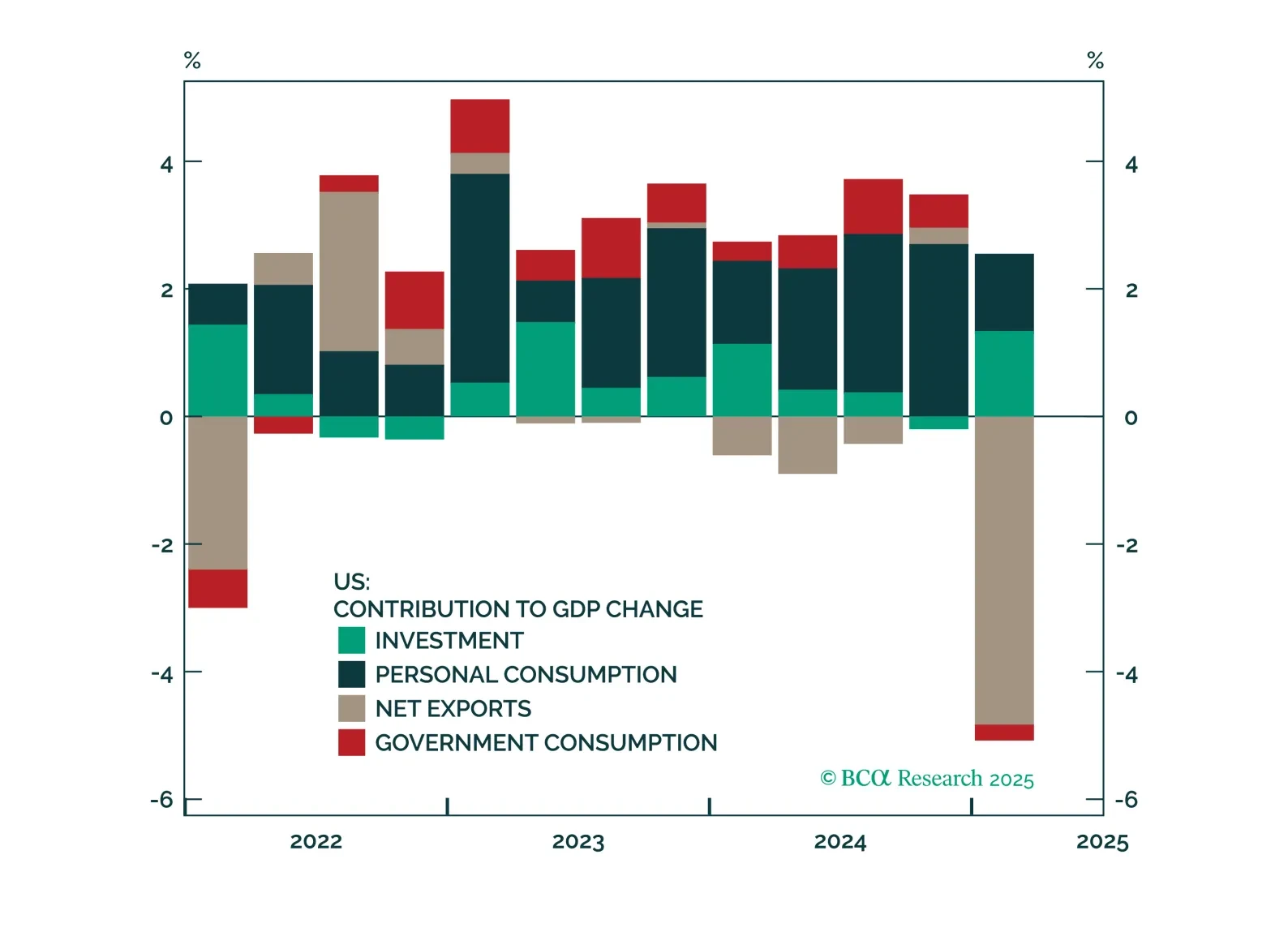

Rising bond yields may present an even greater danger to the global economy than the trade war. With equity valuations no longer discounting much economic risk, investors should position themselves defensively.

President Trump’s signature bill is surprising to the upside with budget deficits, as predicted by our Geopolitical Strategists. Some form of the bill is guaranteed to pass, no matter how many tries it takes. The bill…

Negotiations on trade, Iran, and Ukraine will prove critical this month. Markets will remain volatile because positive data surprises enable the White House to press its hawkish tariff hikes, while negative surprises force the White…