Europe’s deflation problem is getting harder to ignore. This week’s ECB cut is just the beginning — tariffs, the euro’s rally, and softening demand all point to more easing ahead. We explain what it means for yields, equities, and…

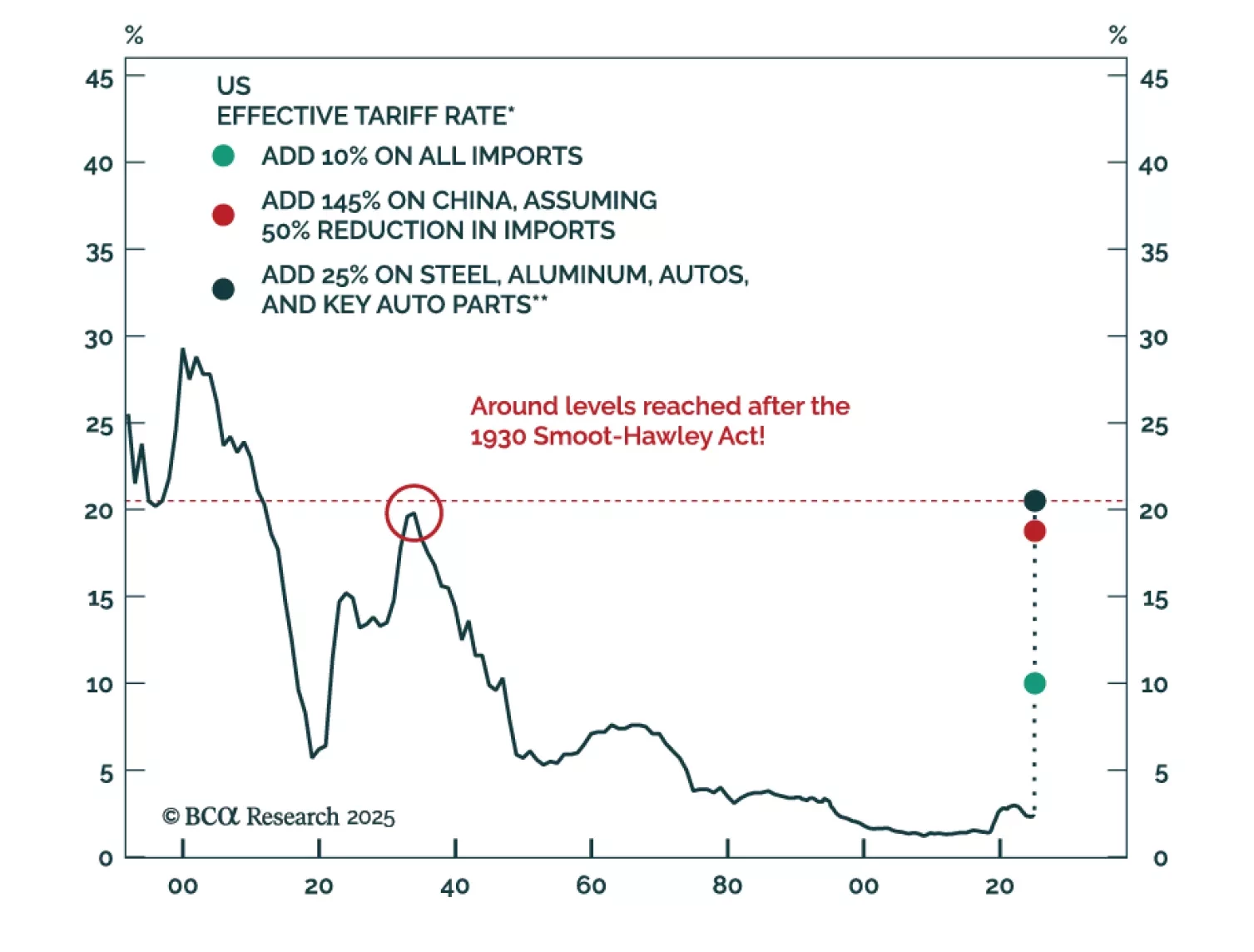

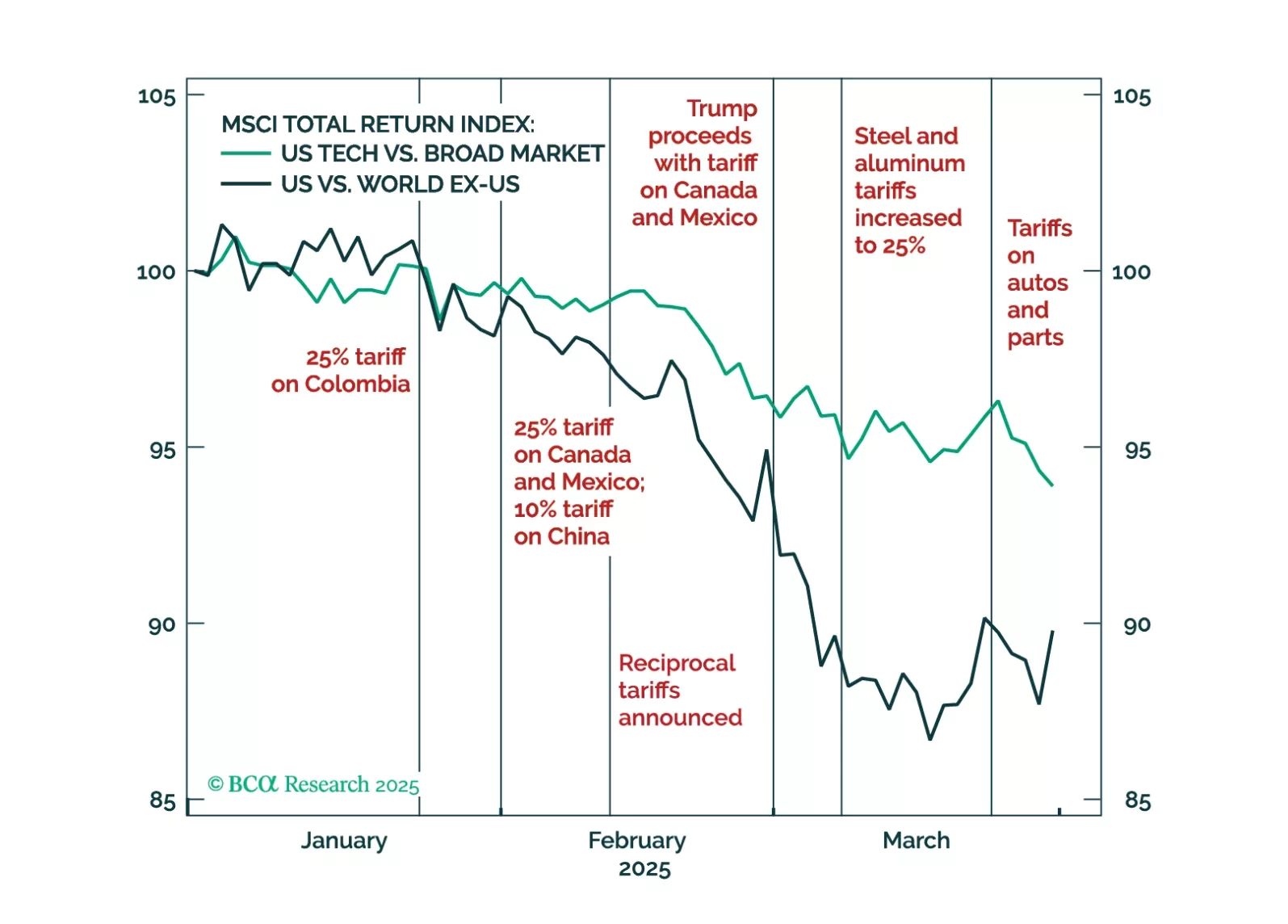

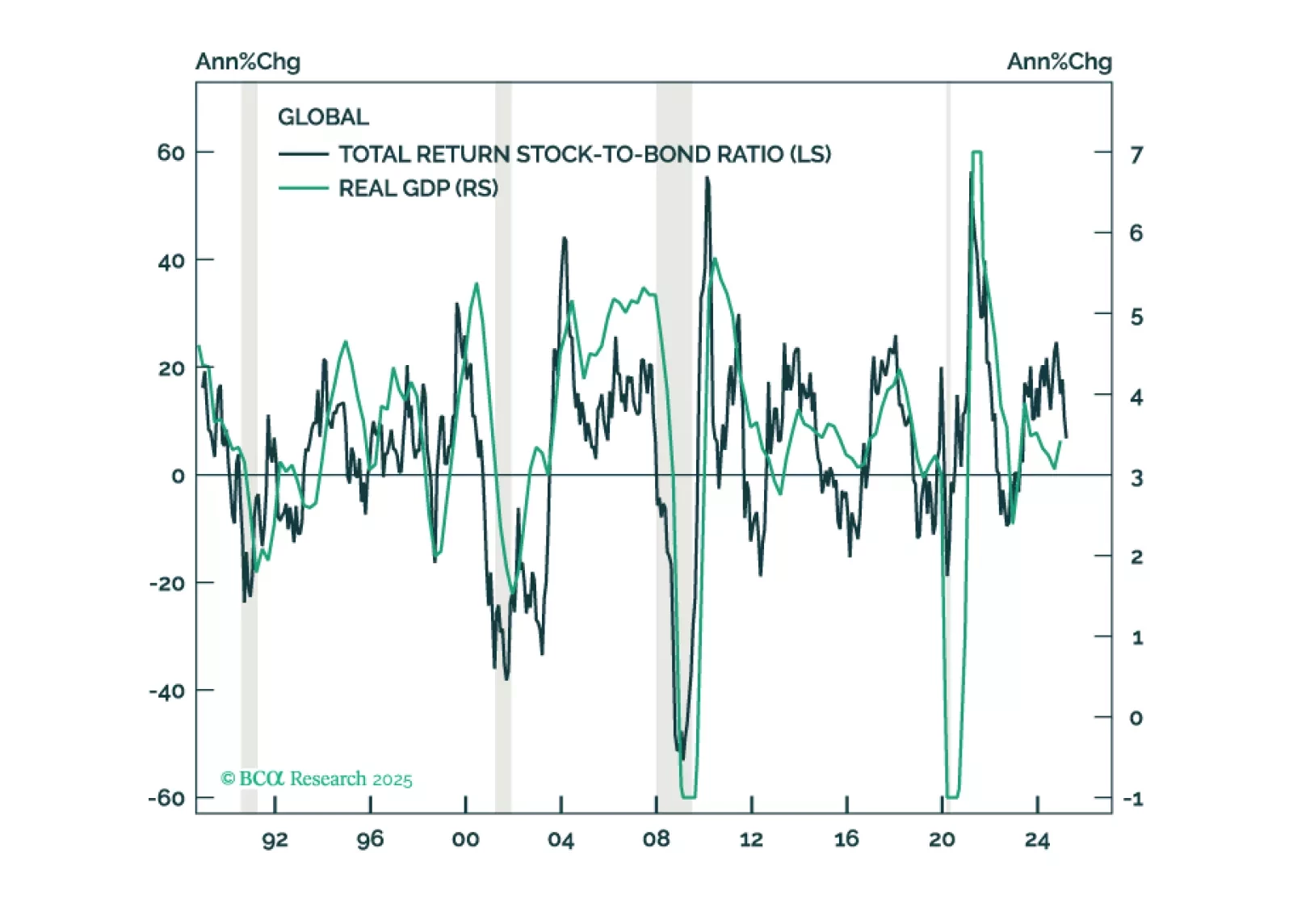

Barring a dramatic further de-escalation of the trade war, the US and much of the rest of the world will enter a recession over the next few months. Investors should remain defensively positioned for now.

The trade war is on everyone’s mind with America’s “Liberation Day” upon us! However, the reality under the surface is that the main macro narrative has been a rotation – nay… exodus – out of US assets into RoW. This was not supposed…

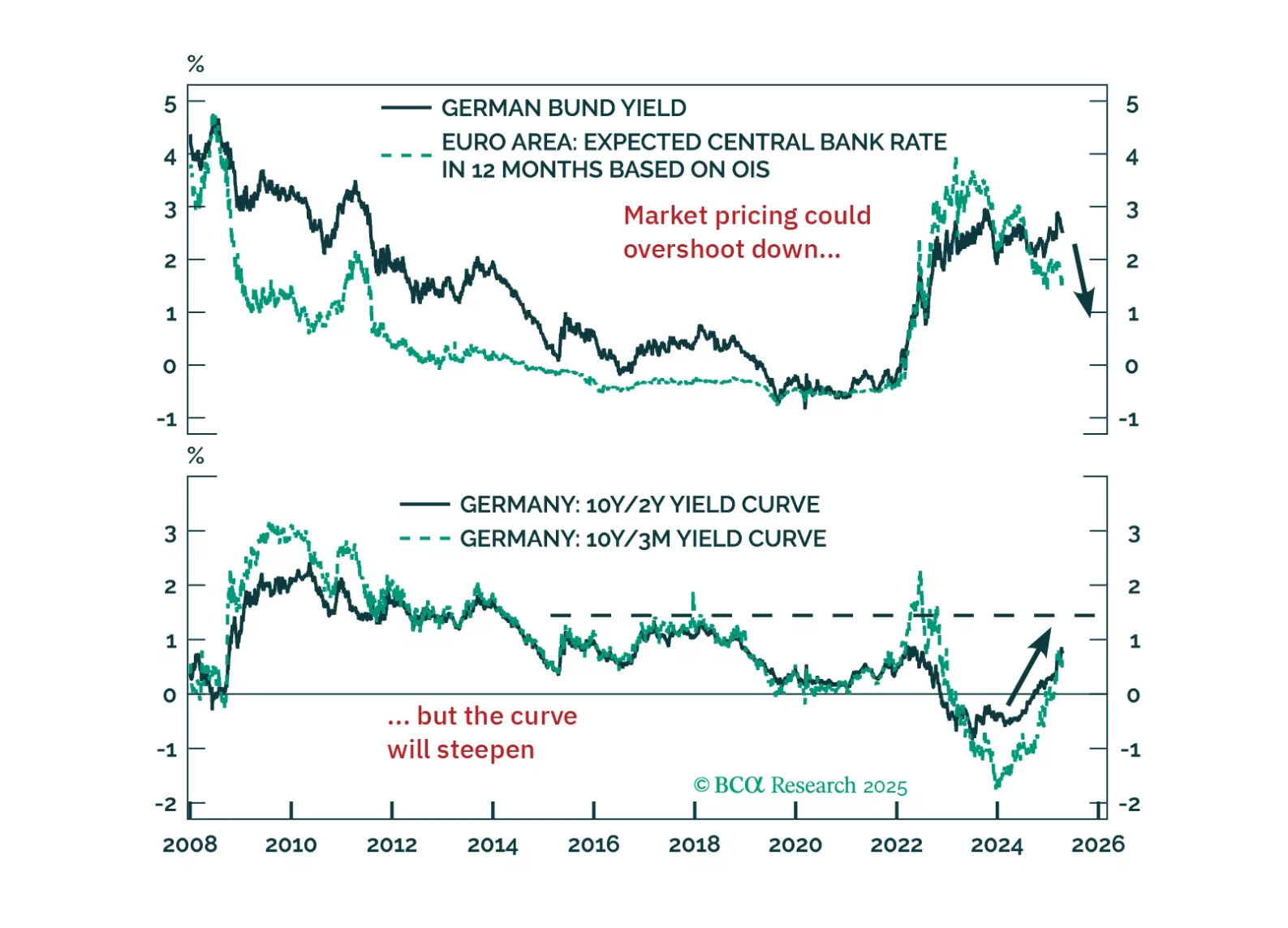

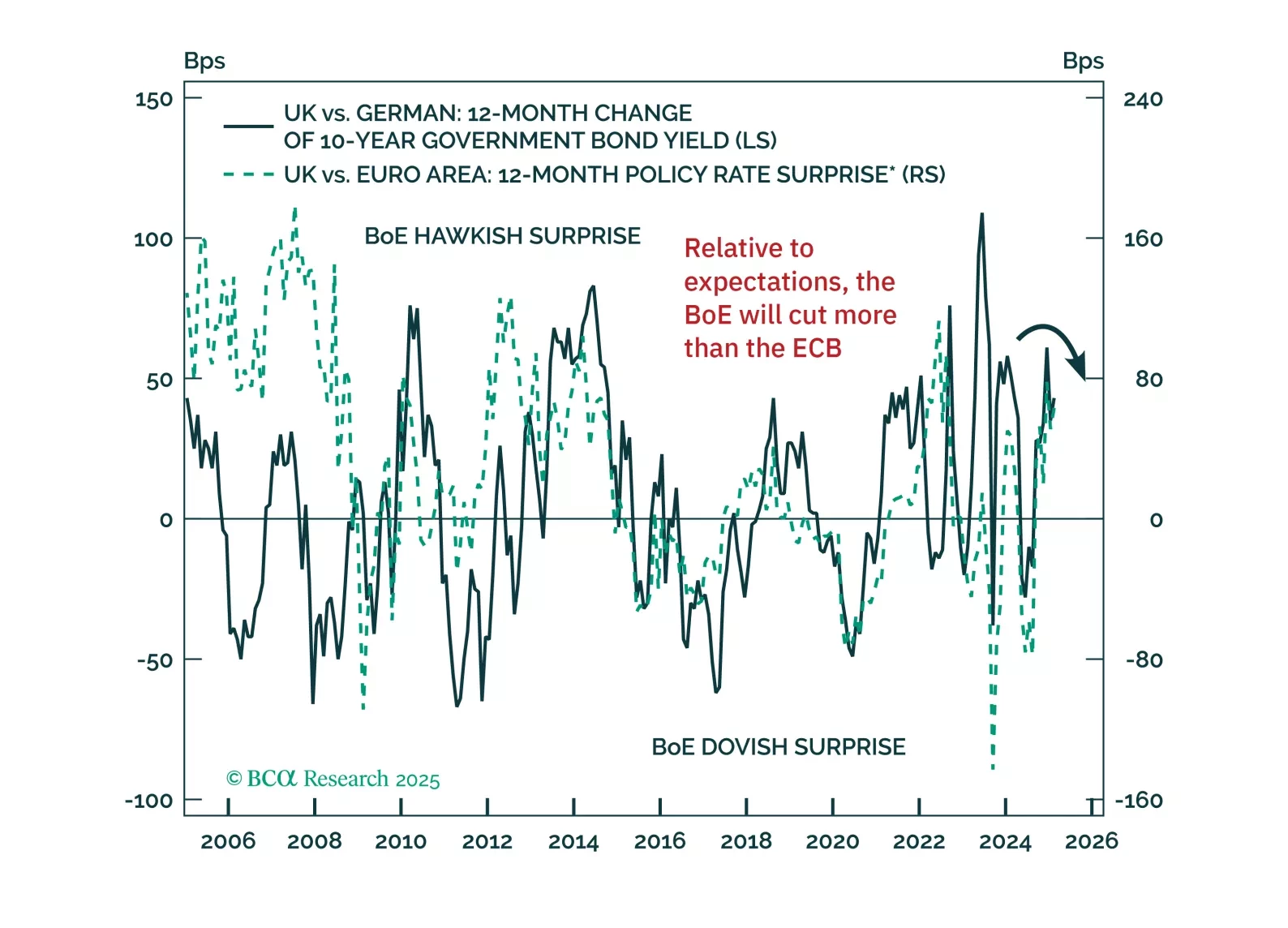

With economic headwinds building and fiscal dynamics shifting, bond markets are at a turning point. Our latest note outlines why German bund yields are set to decline and why UK gilts are poised to outperform — and how to position…

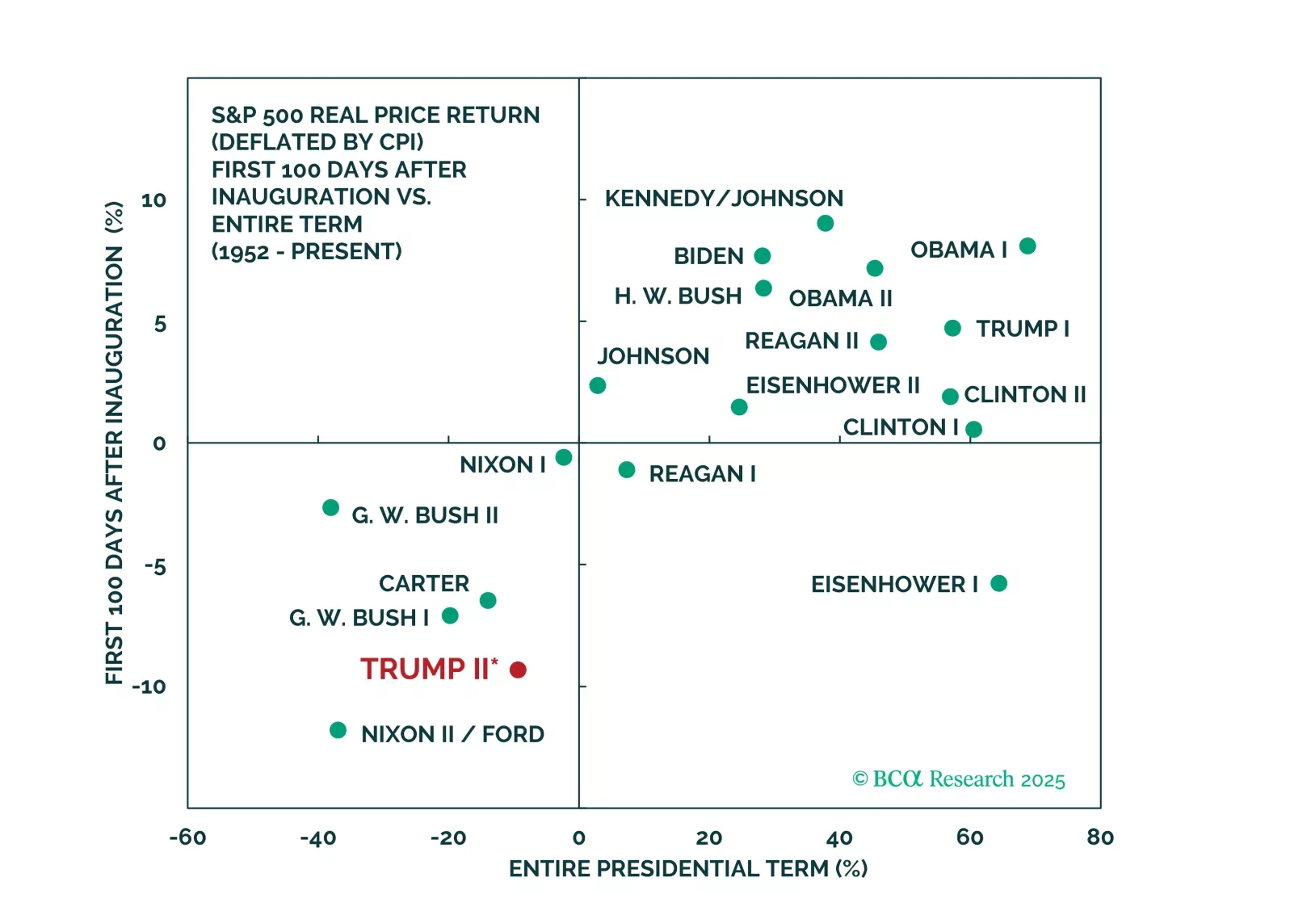

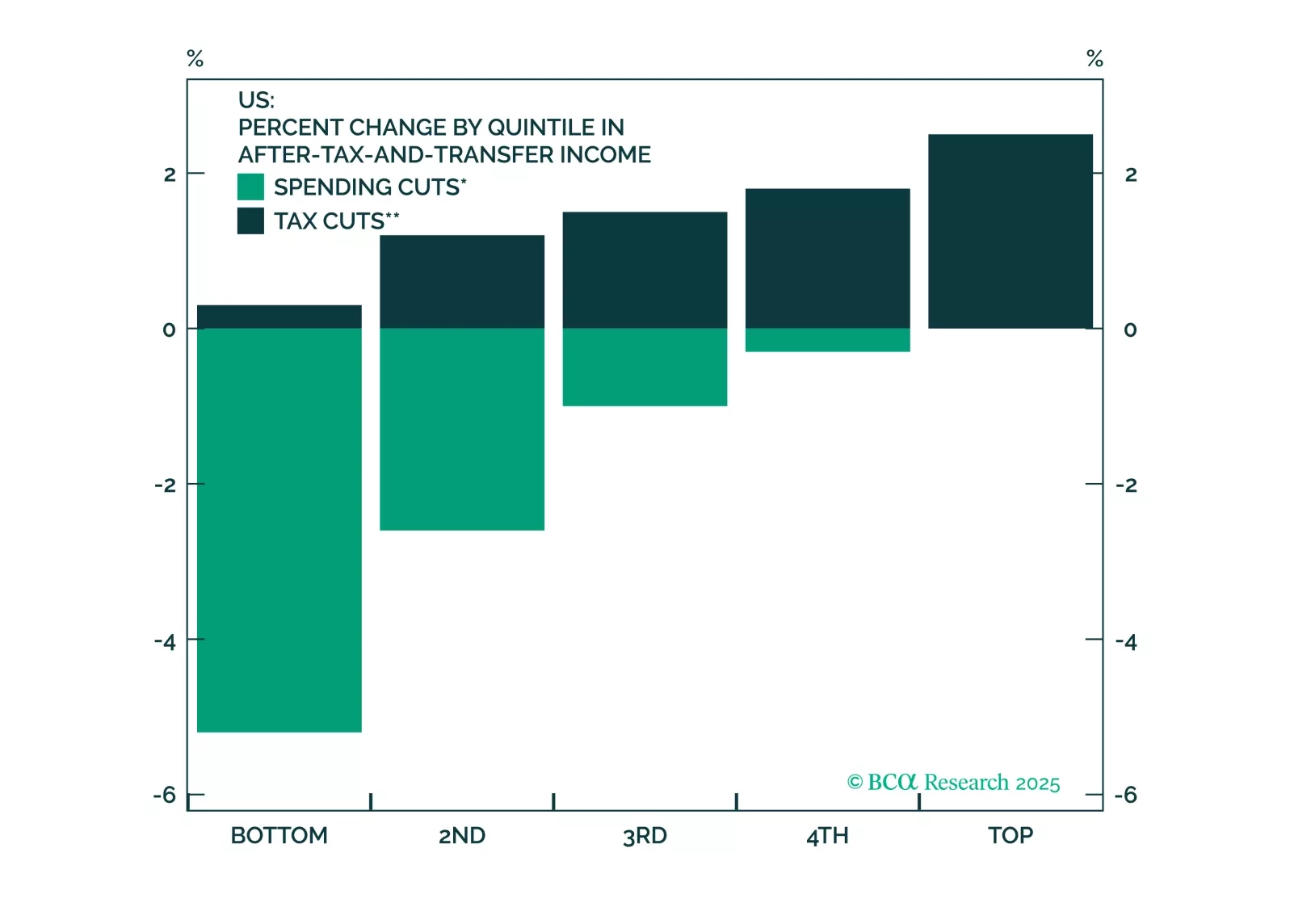

Stocks will continue to struggle in the second quarter as President Trump tries to implement tariffs. Tax cuts will only temporarily dispel growth fears, if at all. Middle Eastern instability will add oil price surprises to an…

In this Second Quarter Strategy Outlook, we explore the major trends that are set to drive financial markets for the rest of 2025 and beyond.

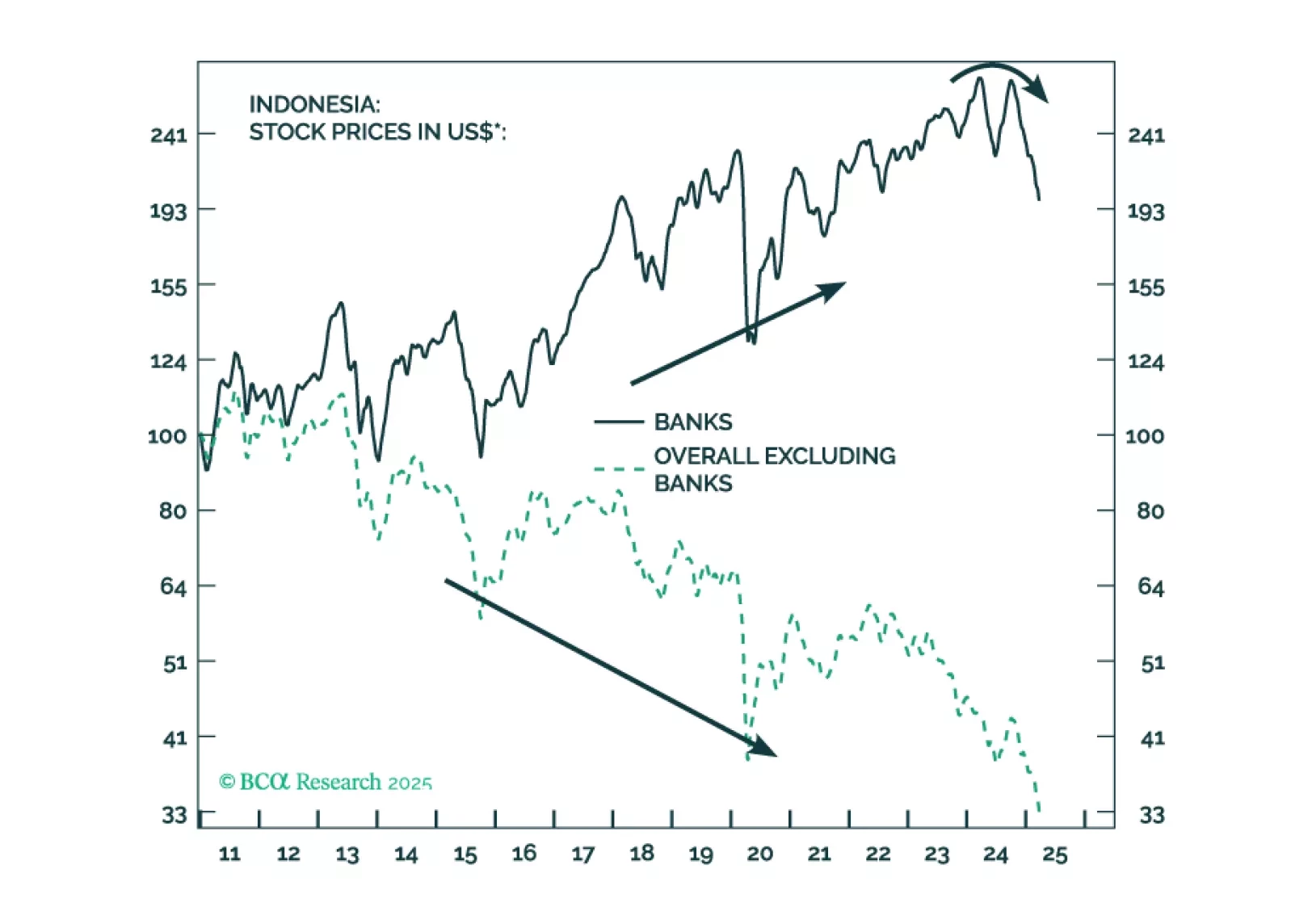

There is an ongoing regime shift in Indonesia: SOEs will be used to drive economic growth. Bank loans will accelerate, but their profit margins will shrink. Despite higher nominal growth, Indonesian equity prices in US dollar terms…

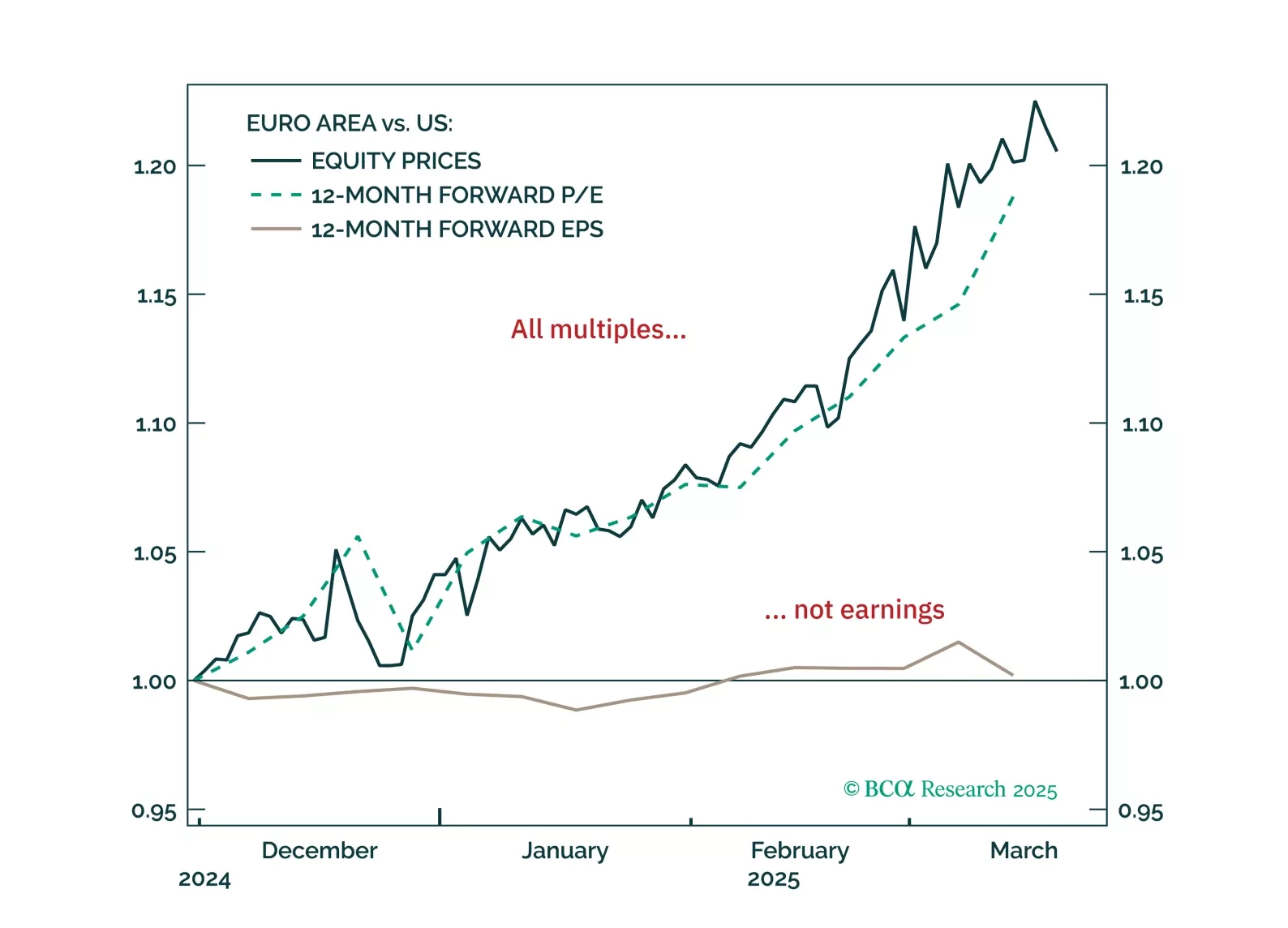

European equities have surged on hopes of a low-inflation boom—but the rally has likely gone too far, too fast. With a pullback now likely, how should investors position themselves over the next 3–6 months?

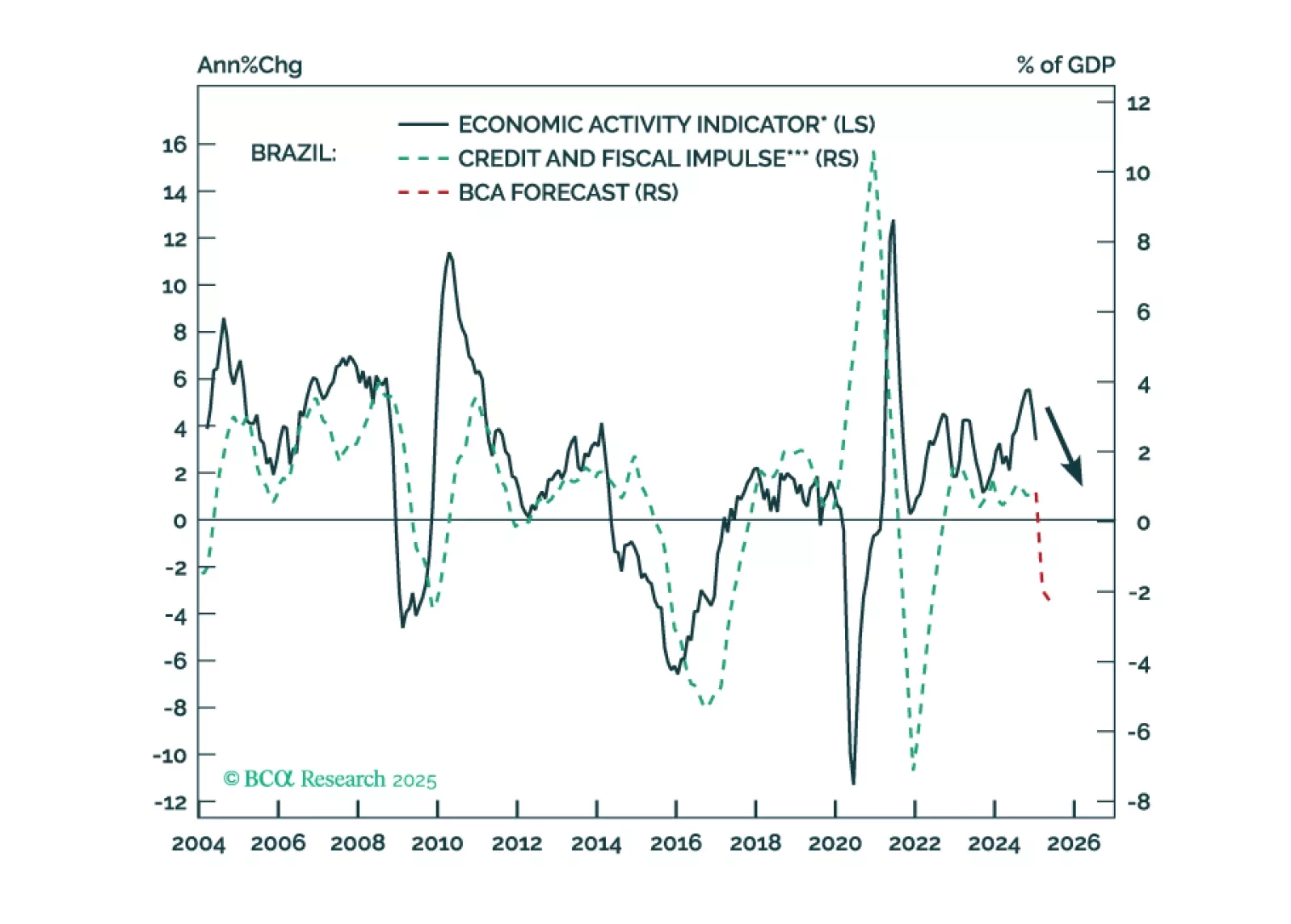

Brazilian policymakers are stuck between a rock and a hard place. There is no combination of fiscal and monetary policies that can assure decent growth, on-target inflation, a stable exchange rate, and public debt sustainability. We…