The latest round of earnings calls from the systemically important banks was encouraging on balance. Households are still flush and still spending and consumer and business delinquencies remain remarkably low. Though a recession is…

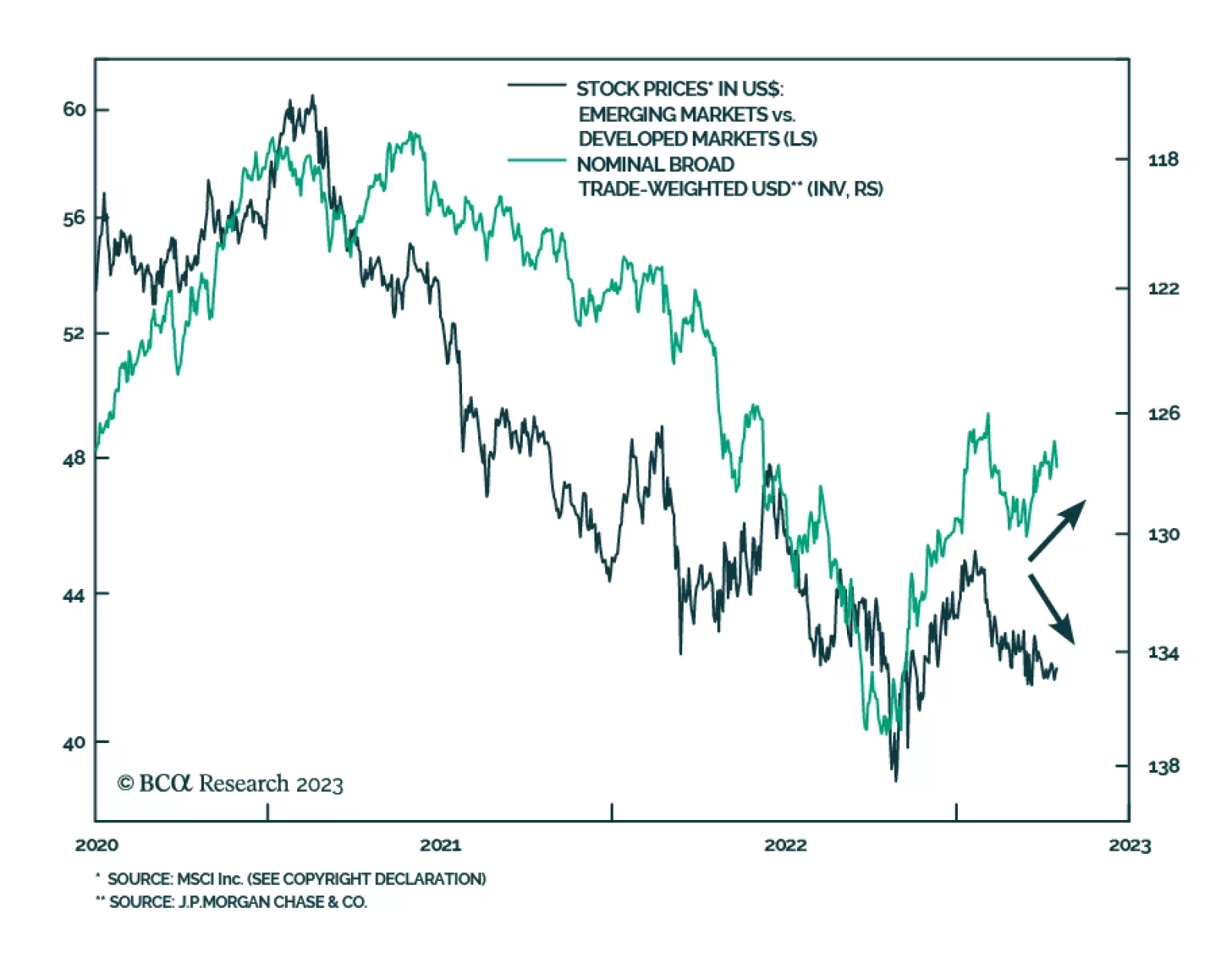

The dollar has entered a structural bear market. Although the greenback could get a temporary reprieve during the next recession, investors should position for a weaker dollar over the long haul.

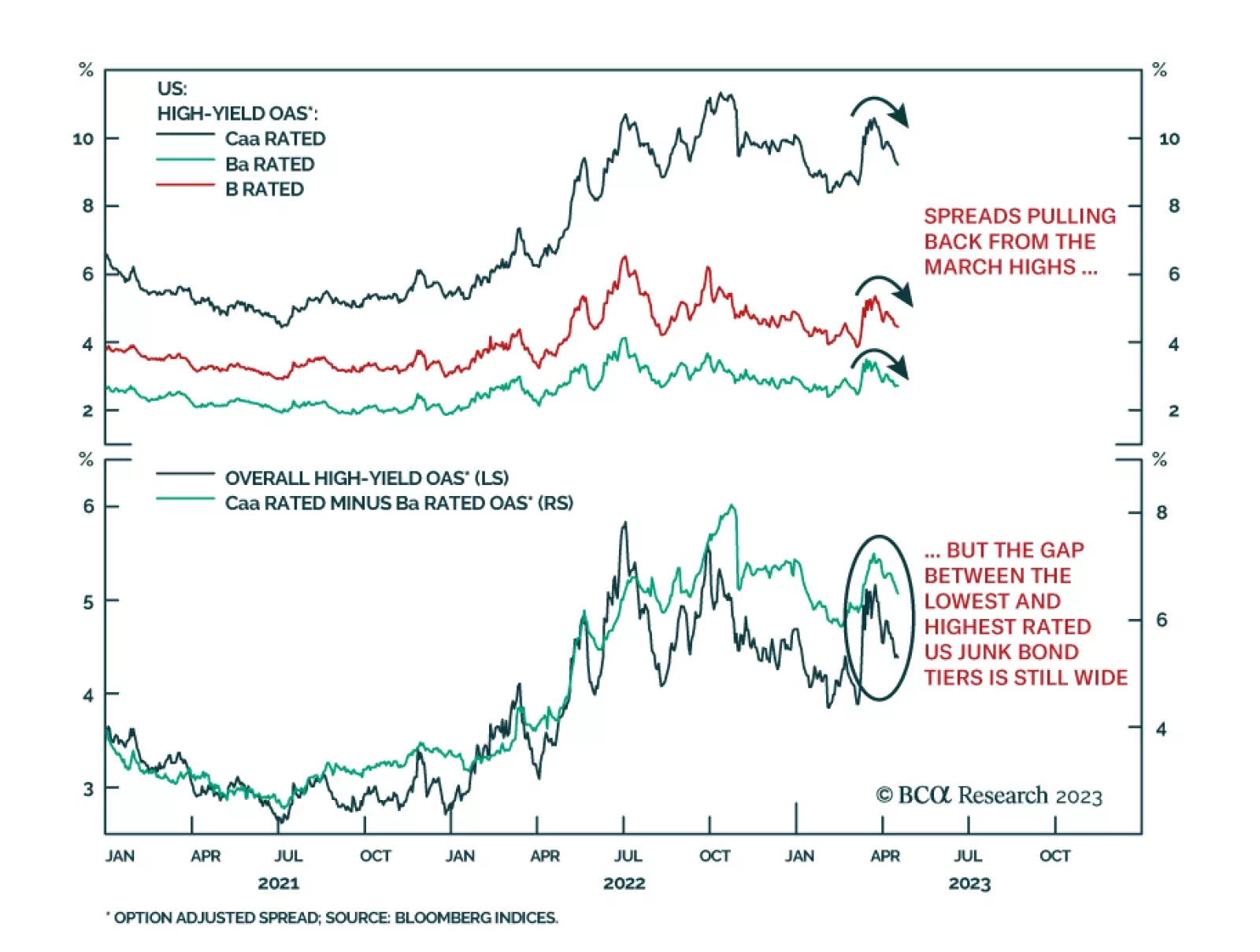

Like most other risk assets, US high-yield corporate bonds sold off in March during the banking turmoil in the US and Europe. The overall Bloomberg US high-yield index spread rose from a low of 389bps on March 6, just before the…

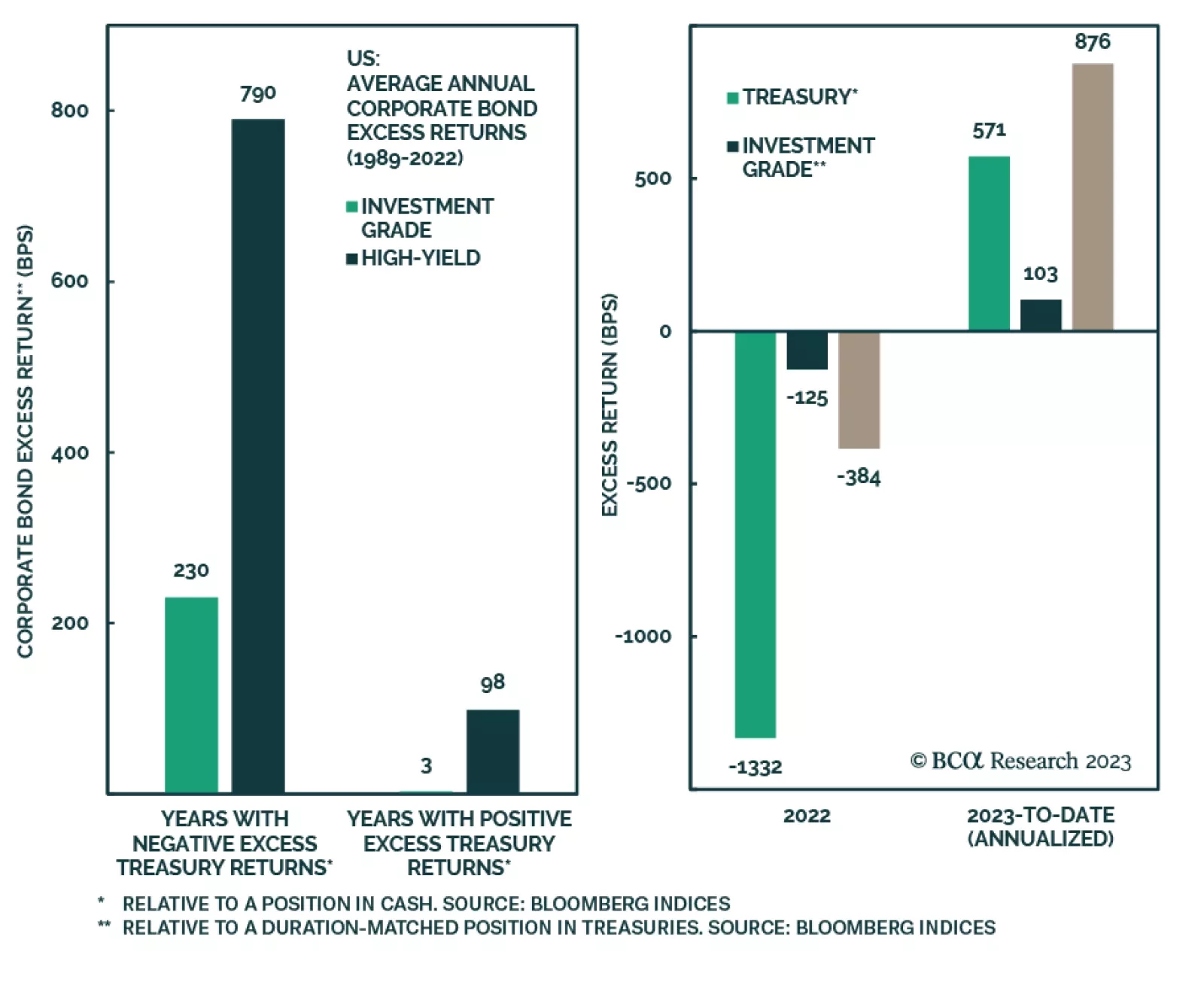

BCA Research’s US Bond Strategy service concludes that in the near-term (3-months), investors should favor bond sectors with low exposure to both rate risk and credit risk such as T-bills and agency bonds. One of the…

Typically, emerging market equities outperform when the US dollar is soft. But that has not been the case in the past month. Although the broad trade weighted US dollar has relapsed, EM stocks have continued underperforming their…

This report looks at the relationship between rate risk and credit risk and how it has changed over time. It also makes the case for favoring agency MBS within an underweight allocation to US spread product.

There are several widespread market narratives regarding US inflation, the Fed’s policy, global manufacturing/trade and China’s recovery that we disagree with. In this report, we explain our reasoning and where it puts us in terms of…