In Section I, we address the recent improvement in several data releases over the past three months, and explain why we do not believe that these developments have increased the odds of a soft landing. US monetary policy likely…

Over the past few weeks, bond yields have risen globally amid concerns that stronger-than-anticipated economic data releases raise the risk that central banks will need to respond more forcefully to restrain demand-side price…

Since 1970, the track record of US housing recessions as the ‘canary in the coal mine’ for economic recessions is a perfect four out of four: 1974; 1980; 1990; and 2007. If this perfect track record continues, the current US housing…

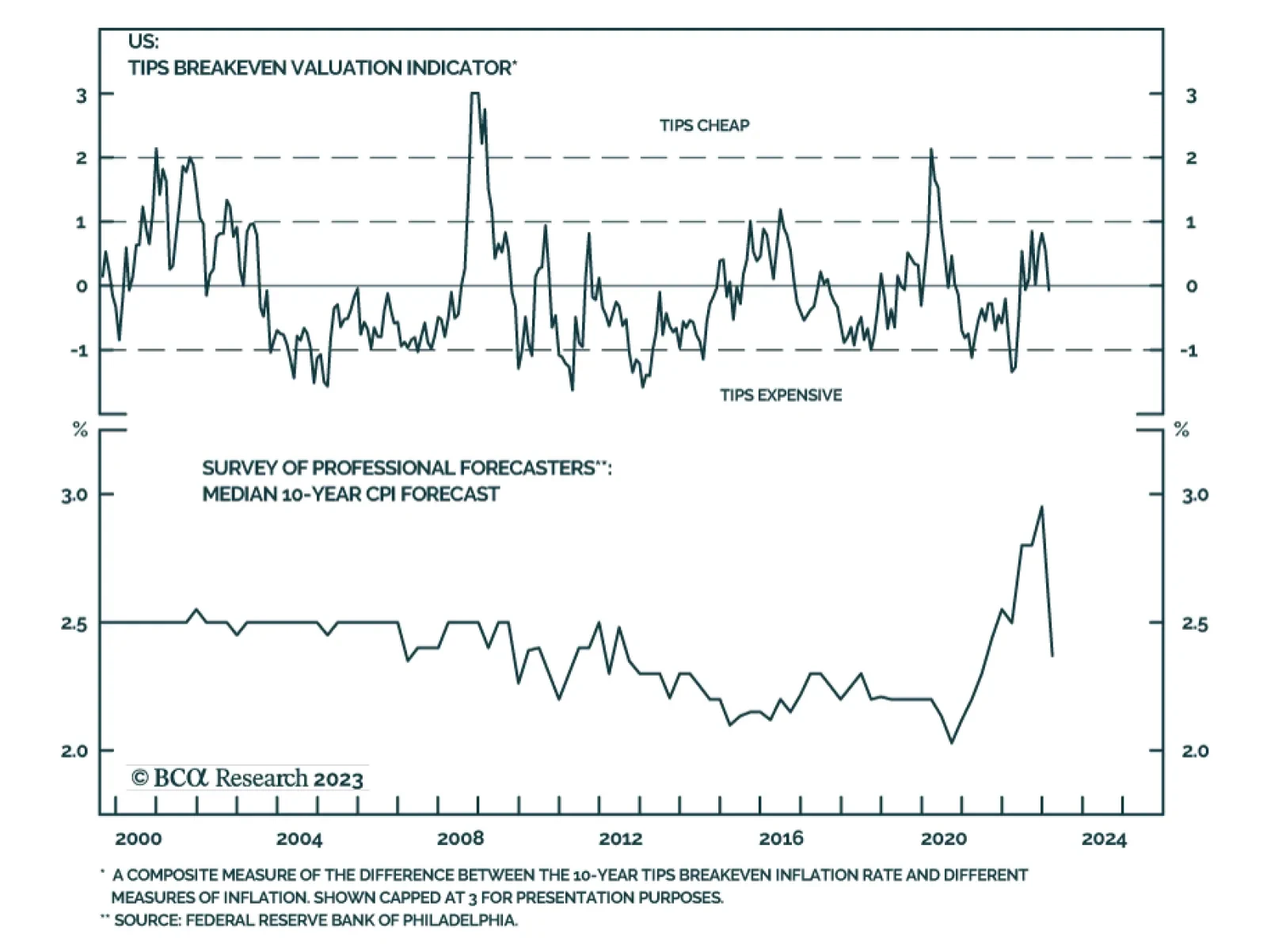

According to BCA Research’s US Bond Strategy service, US bond investors should overweight TIPS versus nominal Treasuries as a hedge against inflation taking longer to fall than they anticipate in their base case. While…

This week’s report considers the risk that inflation will be stickier than we anticipate, and looks at what a fair value for the 10-year Treasury yield might be in a scenario where the Fed keeps the policy rate on hold for a…

We refresh our 2023 plan of attack to reflect the latest data and several rounds of discussions with clients in virtual and face-to-face meetings. We continue to expect a meaningful first-half rally in the S&P 500, despite…

The risk of a recession in 2023 is being supplanted by the risk of another inflation wave. We will turn more defensive on equities if it continues to look like inflation is making a comeback.

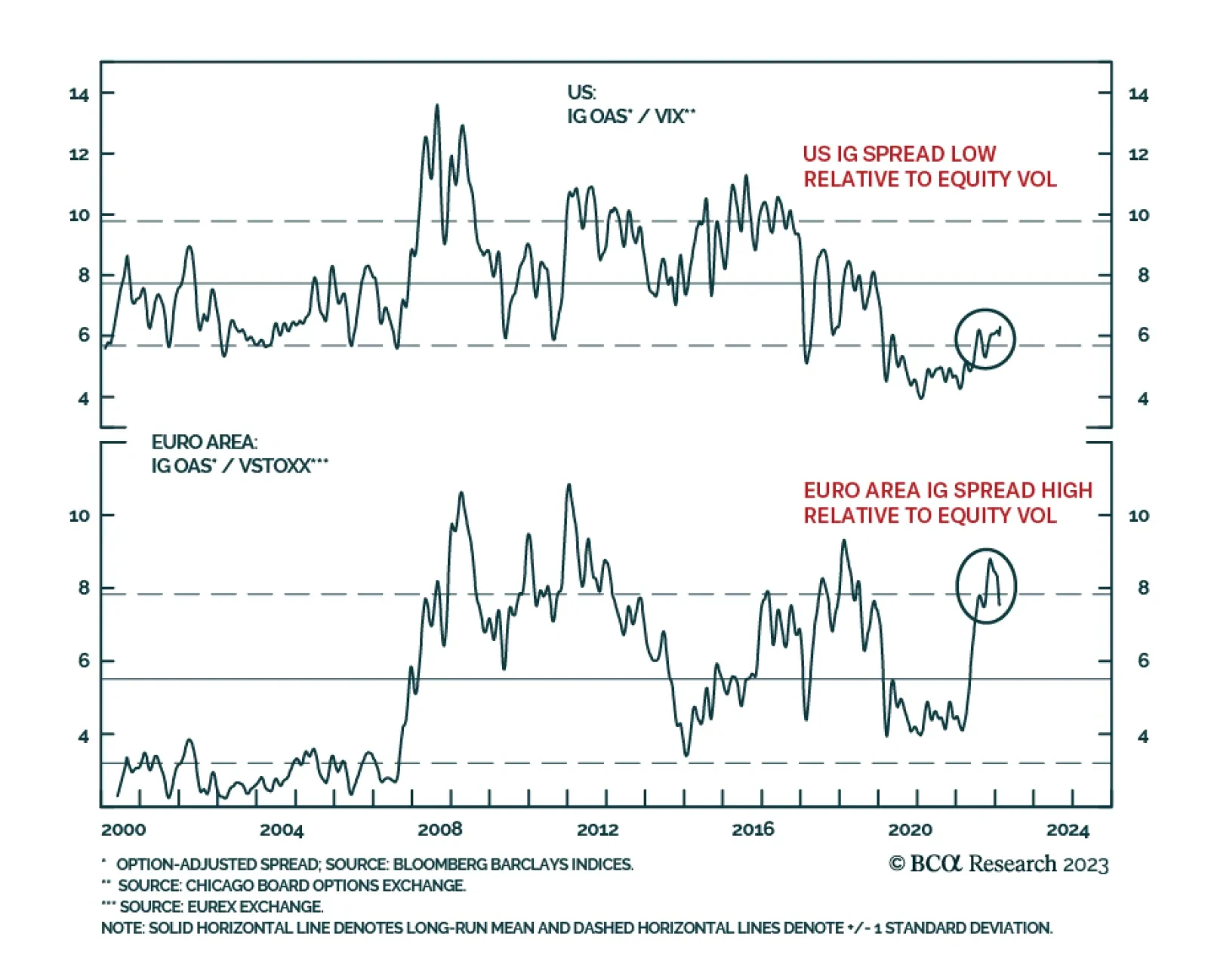

According to BCA Research’s Global Fixed Income Strategy service, European investment grade corporates are the most attractive among corporate bond markets in the US and Europe. Last year’s rise in US and European…