The S&P 500 is down by 17% year to date, while our portfolio is up 15%. US political analysis is essential for investors but it is best done by geopolitical method rather than Washington punditry.

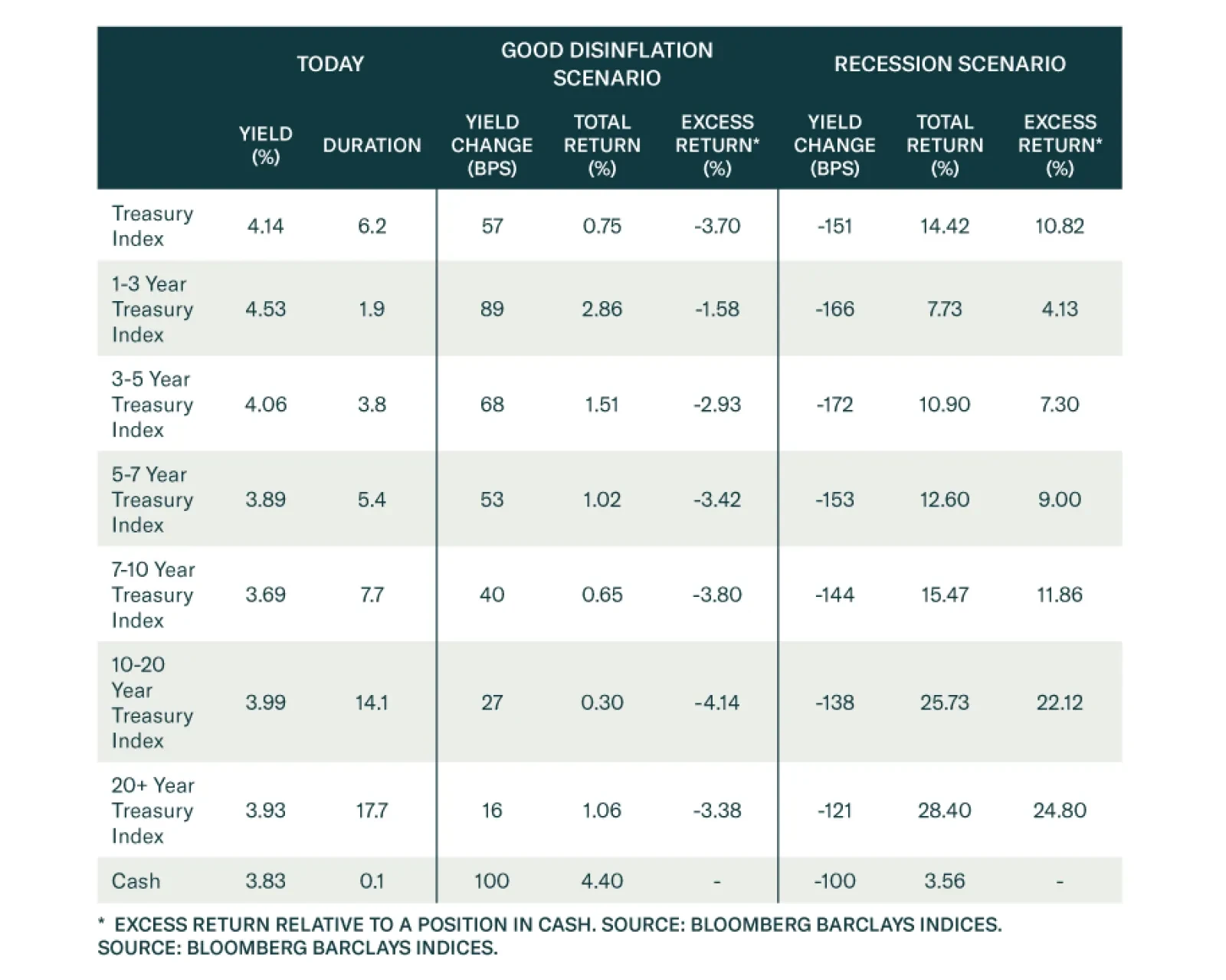

BCA Research’s US Bond Strategy service recommends that investors nudge portfolio duration up to neutral as we head into 2023. Then, starting in January, the team's task will be to call the cyclical peak in Treasury…

Crypto broker FTX’s bankruptcy does not pose a systemic threat to markets. It did reveal something deeply unflattering about excess liquidity, however, and suggests that other private investments may come a cropper.

Today, we are sending you the BCA annual outlook for 2023. The report is an edited transcript of our recent conversation with Mr. X and his daughter, Ms. X, who are long-time BCA clients with whom we discuss the economic and…

Excess job vacancies in the US and UK reflect a labour market that cannot efficiently match unemployed workers with vacant jobs. This is because excess job vacancies reflect the shortage of labour supply in the 50 plus age cohort,…

The messages from the deteriorating fundamental backdrop (tight monetary policy, slowing global growth) and improved credit valuation (elevated 12-month breakeven spreads) are giving conflicting signals on corporate bond strategy. We…