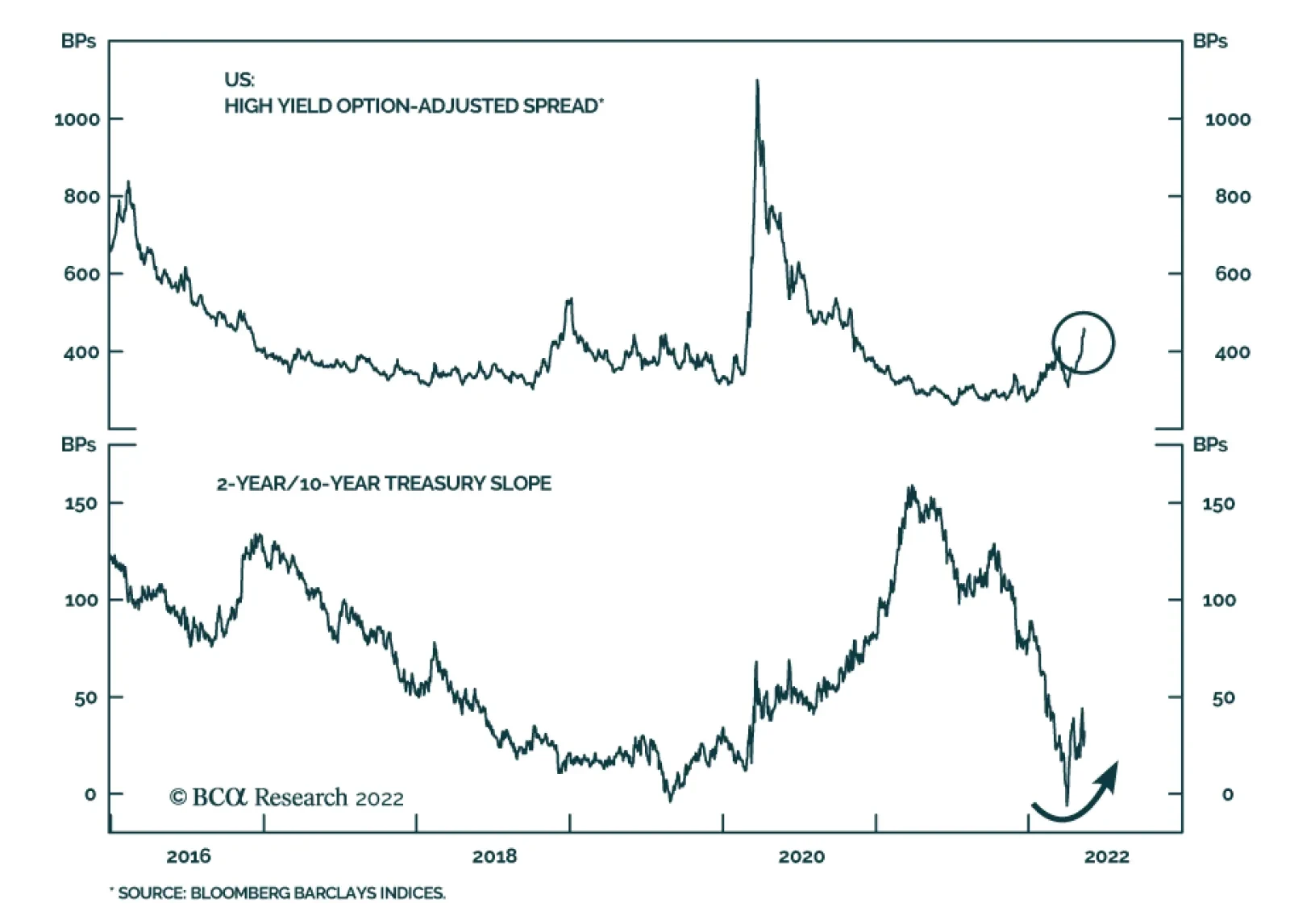

US high-yield corporate bonds have sold off sharply of late. The average index option-adjusted spread widened 50 bps last week to reach 452 bps. The latest move reverses the brief March rally and brings the spread on high-yield…

Executive Summary The Fed, Bank of England (BoE) and Reserve Bank of Australia all hiked rates last week. The BoE, however, signaled a note of caution on future UK growth, given soaring energy prices and plunging consumer and business…

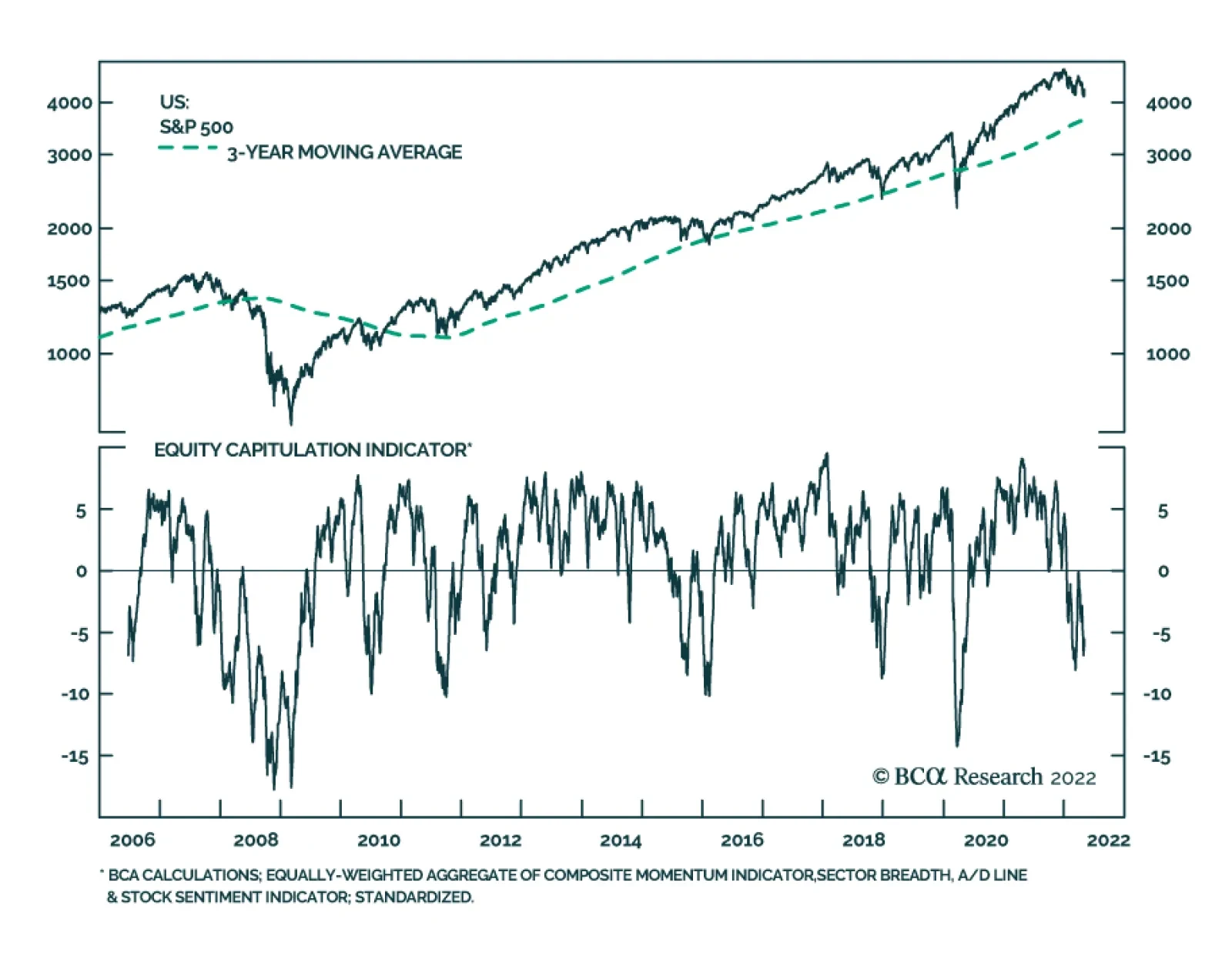

Listen to a short summary of this report. Executive Summary Global Equities Are More Attractively Valued After The Recent Sell-Off We tactically downgraded global equities in late February but see…

Executive Summary The Fed offered more explicit near-term forward rate guidance at its meeting last week. This guidance will reduce yield volatility at the front-end of the curve during the next few months. We expect the Fed to…

Last Wednesday’s post-FOMC rally proved short-lived. US equities lost all of the prior day’s gains on Thursday, with the selloff continuing on Friday. This sharp reversal tracks moves in the Treasury market. The 10-…

Executive Summary EM Credit Spreads Correlate With The EM Business Cycle A buying opportunity in EM local bonds and sovereign credit (EM USD bonds) will open up once US Treasury yields roll over and the US dollar begins its…

In lieu of next week’s report, I will be presenting a webcast titled ‘The 5 Big Mispricings In The Markets Right Now, And How To Profit From Them’. I do hope you can join. Executive Summary Just as the railway…

BCA Research’s Global Fixed Income Strategy service concludes that an appreciating US dollar is not yet a reason to expect a peak in US inflation or Treasury yields. Right now, there is not much evidence suggesting…