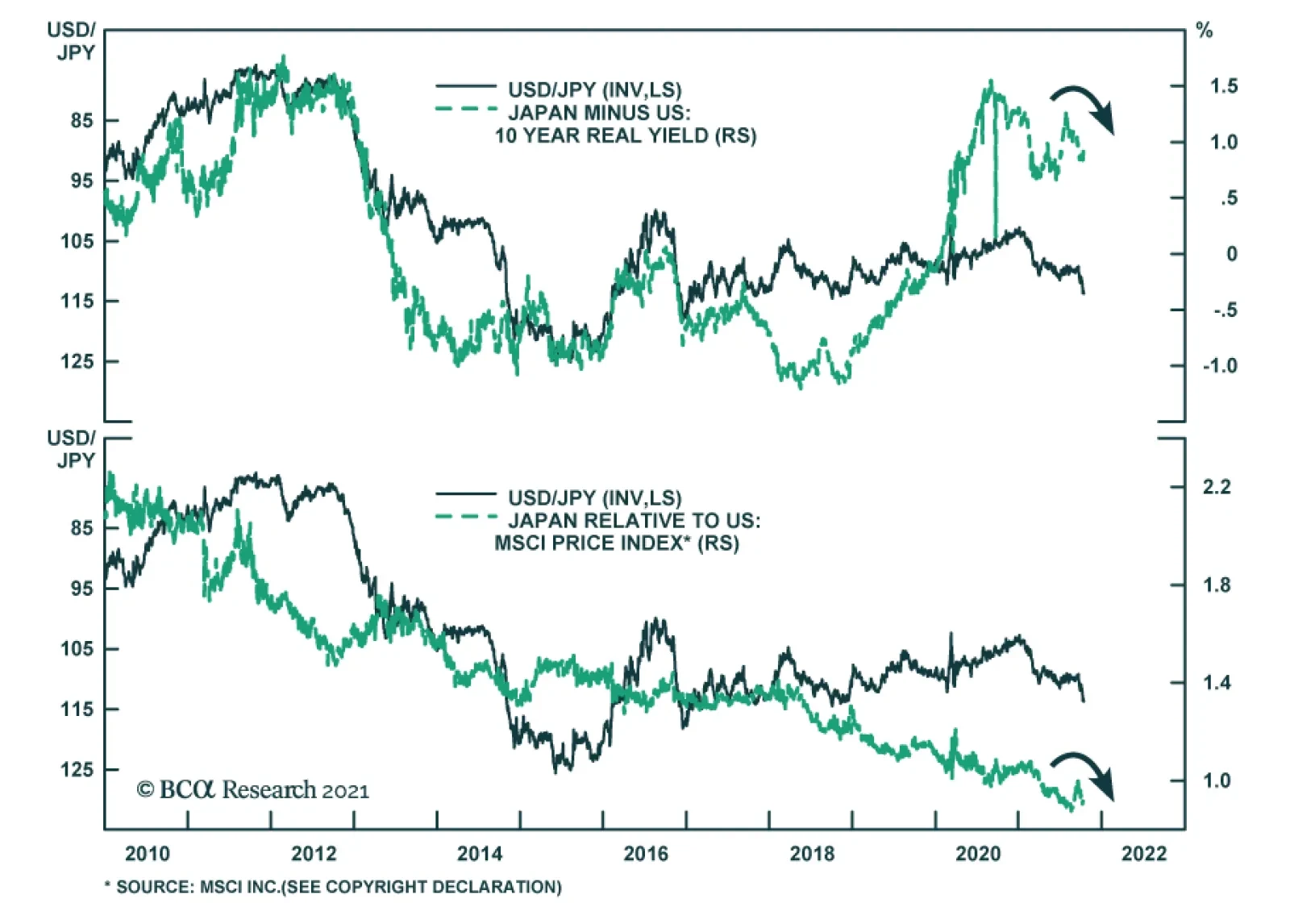

The Japanese yen has been performing poorly recently. It is the only G10 currency that has depreciated vis-à-vis the USD over the past week. Several factors explain the yen’s underperformance. First, after a period of strength…

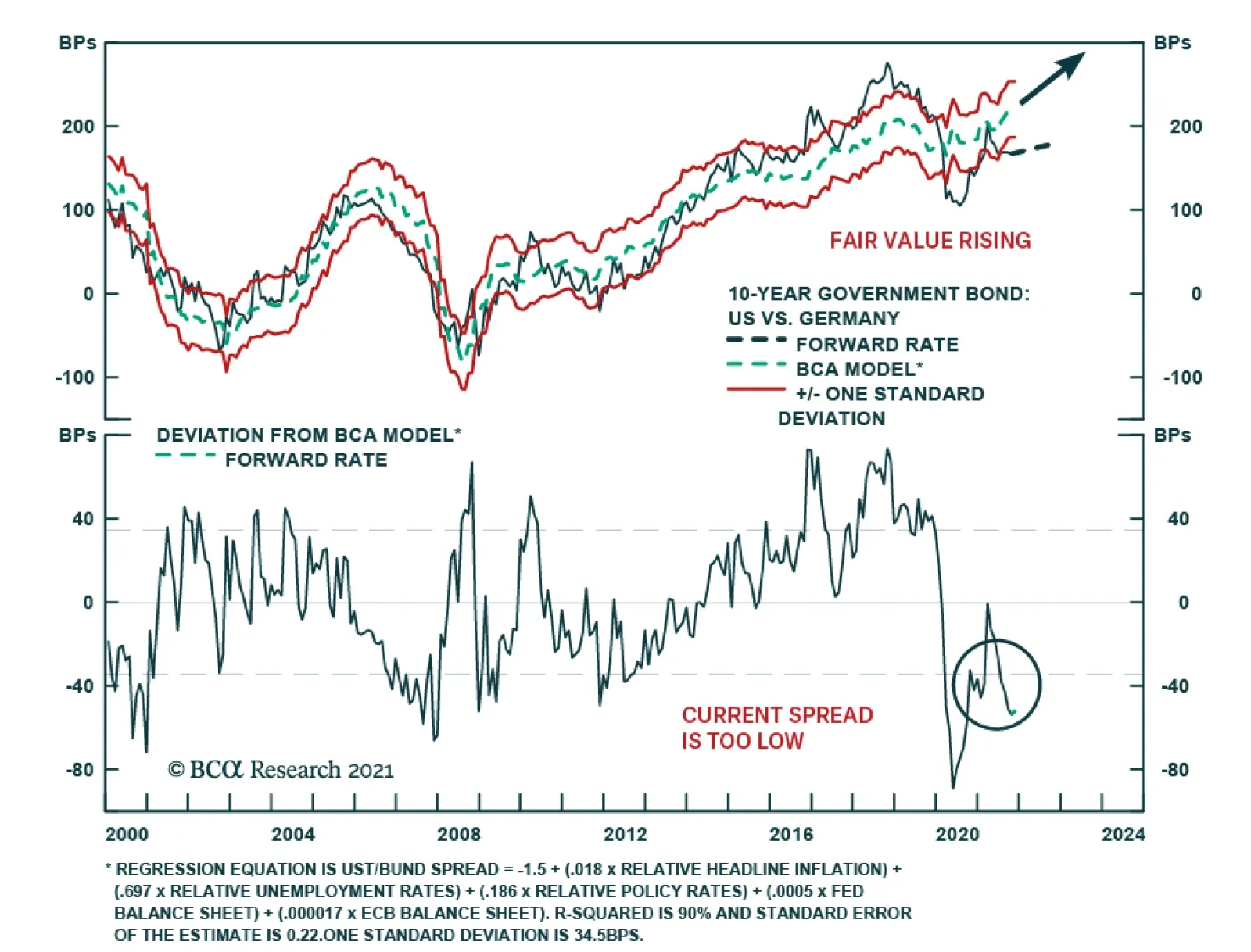

BCA Research’s Global Fixed Income Strategy service initiated a new tactical trade to position for more persistent ECB dovishness and a more hawkish Fed. The team continues to see no reason for the ECB to follow the Fed’s path…

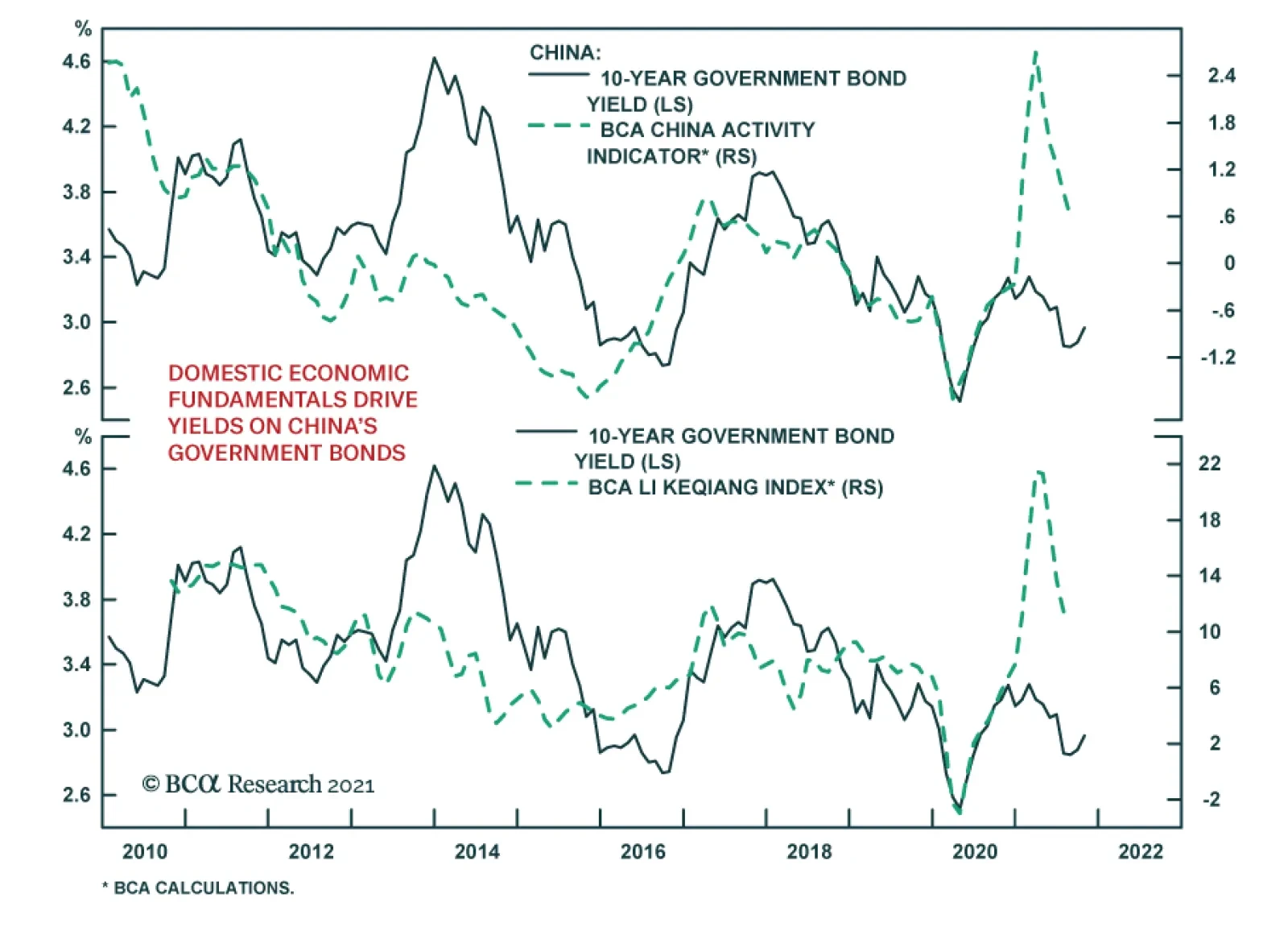

Highlights As US inflation proves to be not-so-transitory, US interest rate expectations will rise. Slowing Chinese domestic demand and rising US interest rate expectations will support the US dollar. The net impact from China’…

Highlights Cross-Atlantic Policy Divergence: A steadily tightening US labor market means that the Fed remains on track to formally announce tapering next month. Meanwhile, the ECB is signaling that they are in no hurry to do the same…

Next week is the BCA Annual Conference, at which I will debate Professor Nouriel Roubini on ‘The Outlook For Cryptocurrencies’. I will make the passioned case for cryptos, and Nouriel will make the passioned case against. I…

According to BCA Research’s China Investment Strategy service, the Chinese yield curve will likely flatten with long-term government bond yields dropping more than short-term rates in next six to nine months. The long-end of…

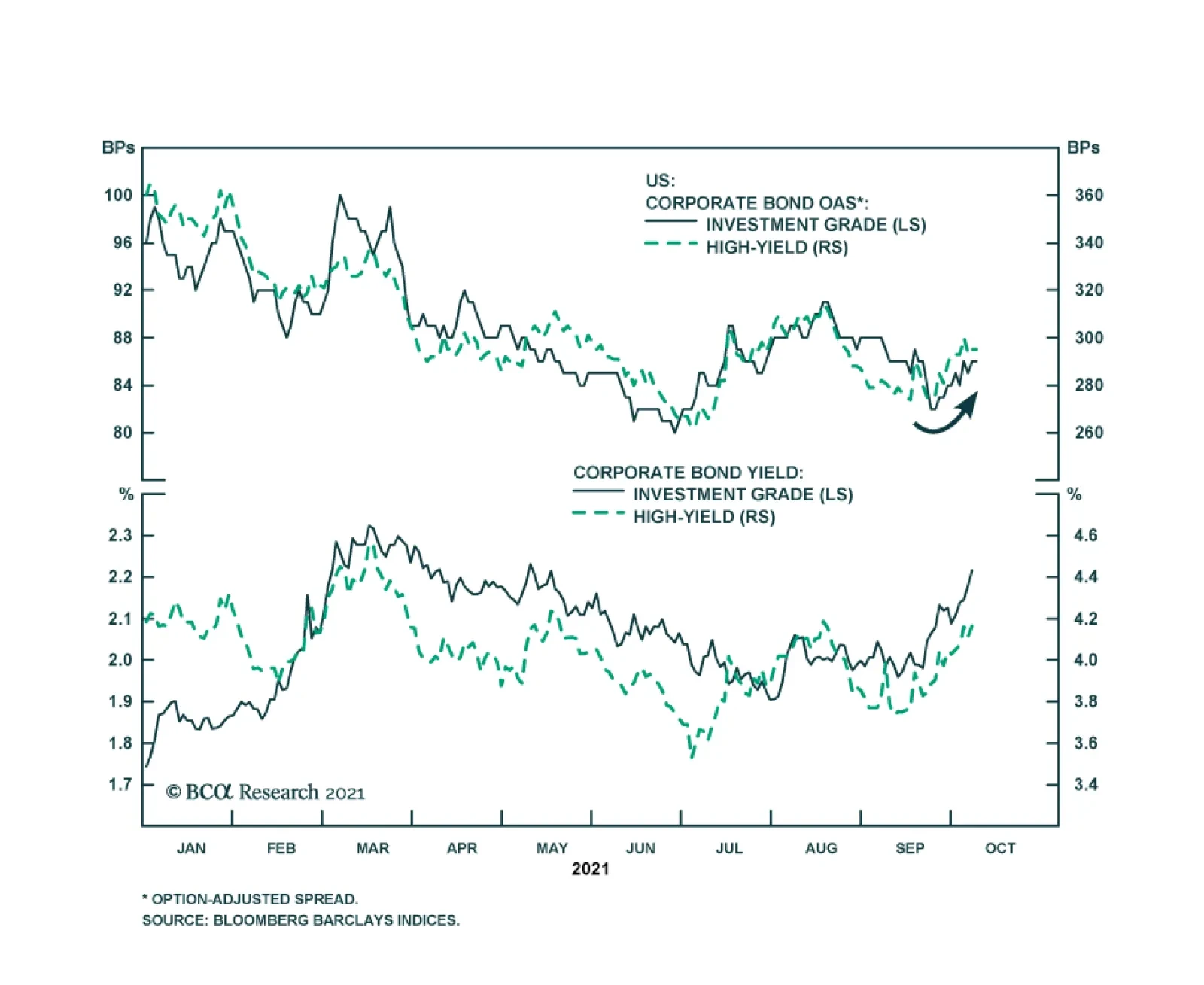

US corporate bond spreads have been widening recently and have underperformed duration-matched Treasuries so far in October. Notably, these moves are occurring against a backdrop of rising Treasury yields – marking a break in the…

Highlights Spread Product: Investors should stay overweight spread product versus Treasuries for now (with a preference for high-yield corporates over investment grade). But recent shifts in the yield/spread correlation suggest that…