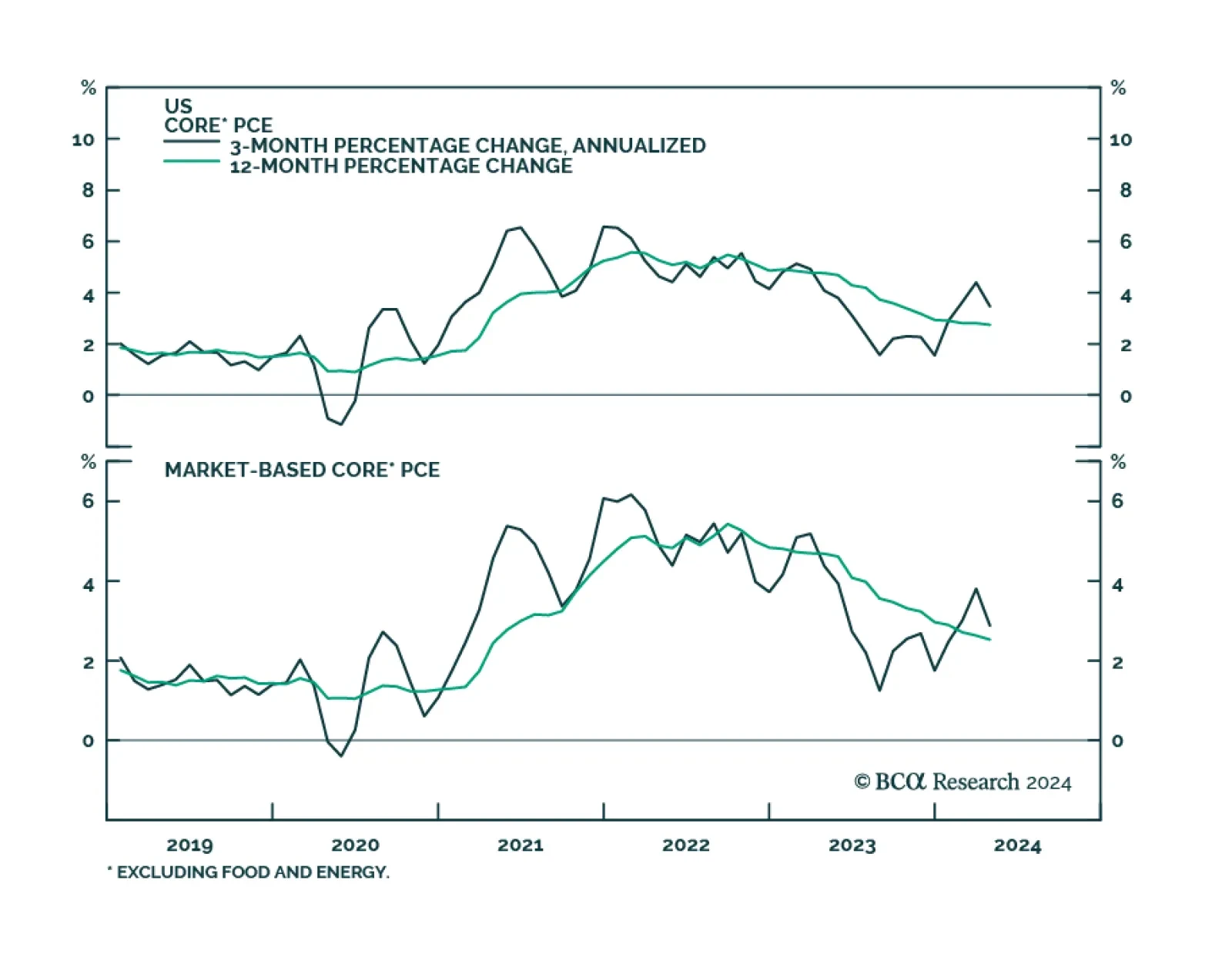

US nominal personal income growth decelerated from 0.5% m/m to 0.3% m/m in April, in line with expectations. However, nominal personal spending surprised to the downside, and contracted 0.1% m/m in real terms. Core PCE –…

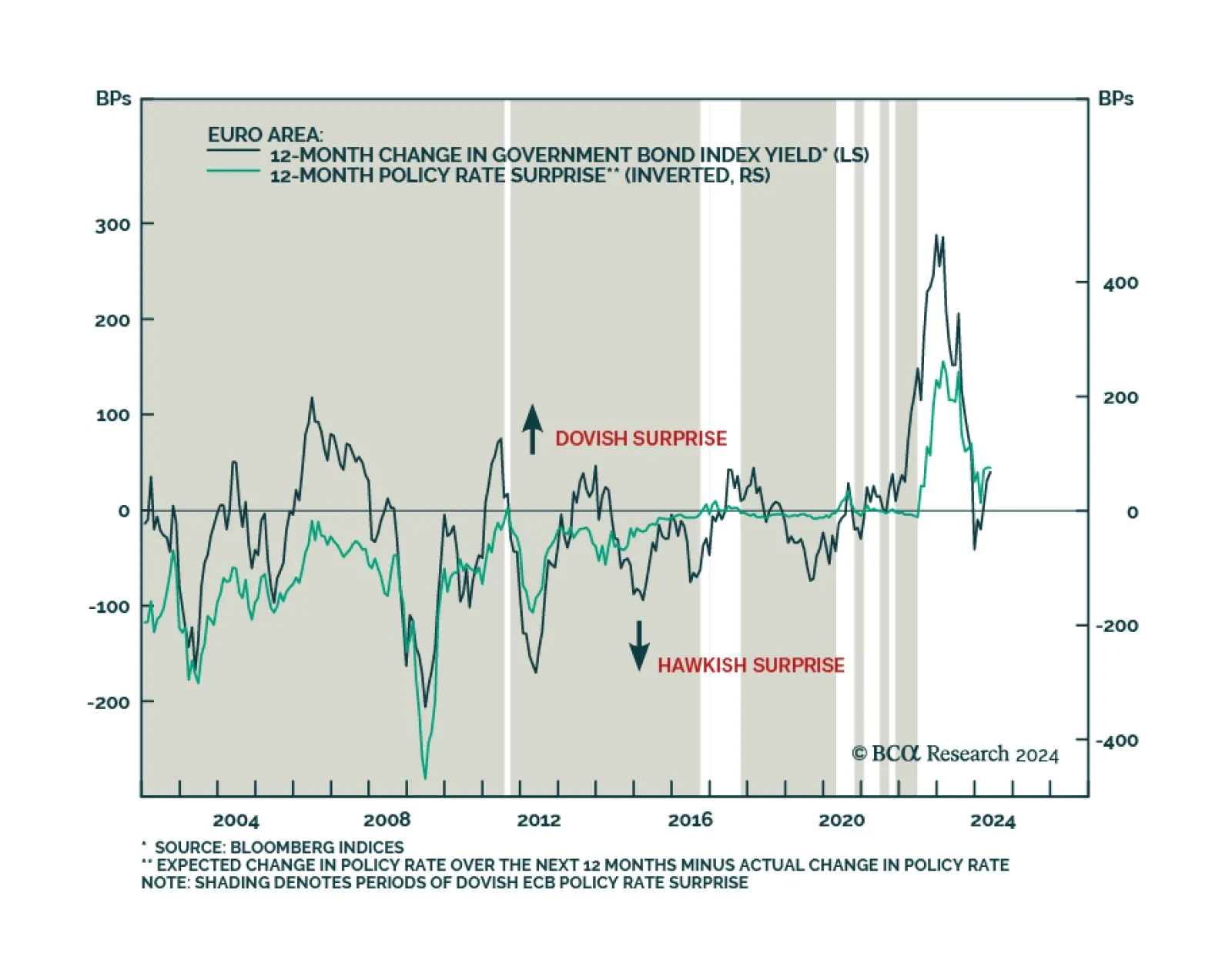

Euro Area CPI accelerated for the first time this year from 2.4% y/y to a faster-than-expected 2.6% y/y in May. Preliminary estimates also suggest that core CPI accelerated from 2.7% y/y to 2.9% y/y, against expectations of a…

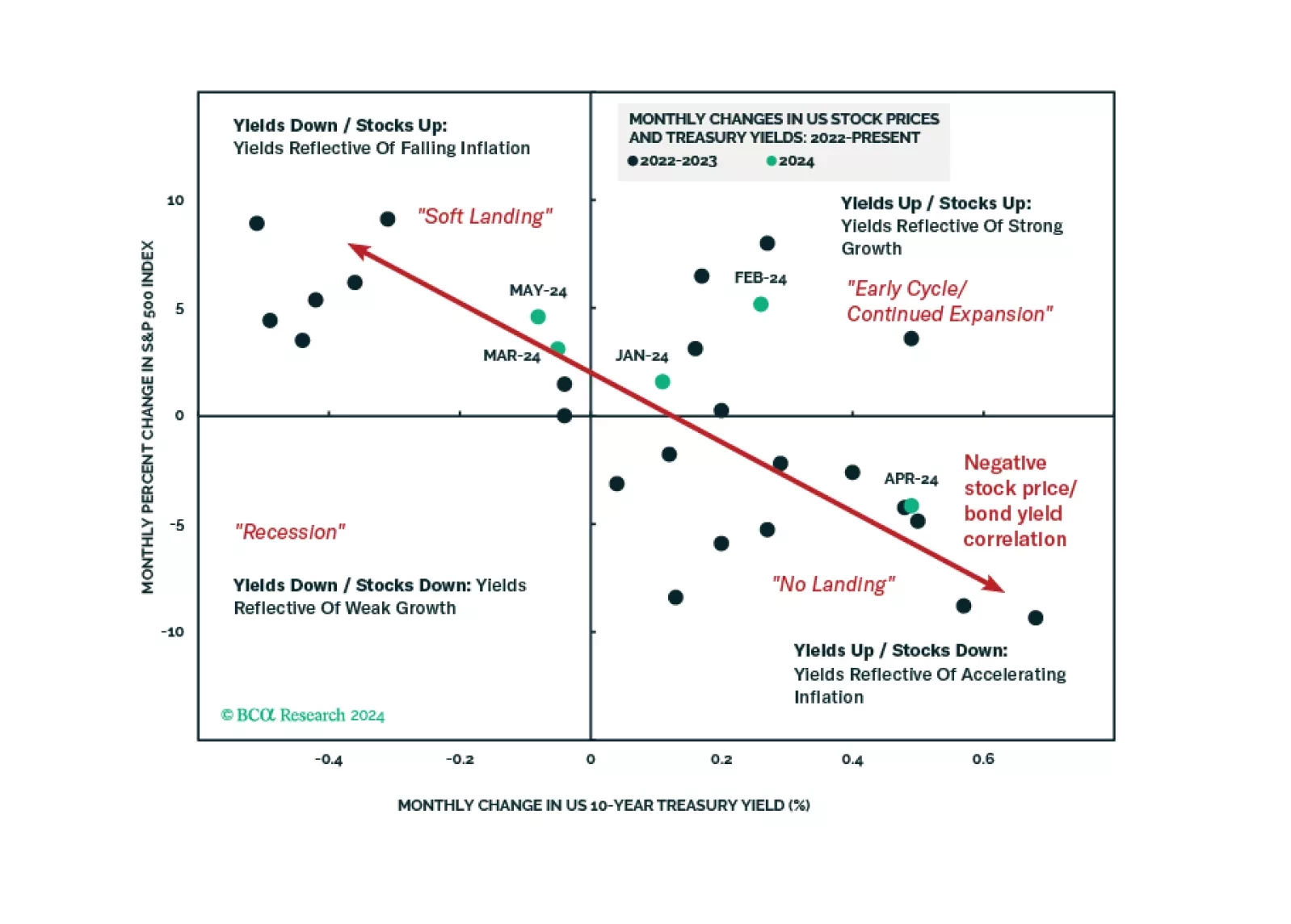

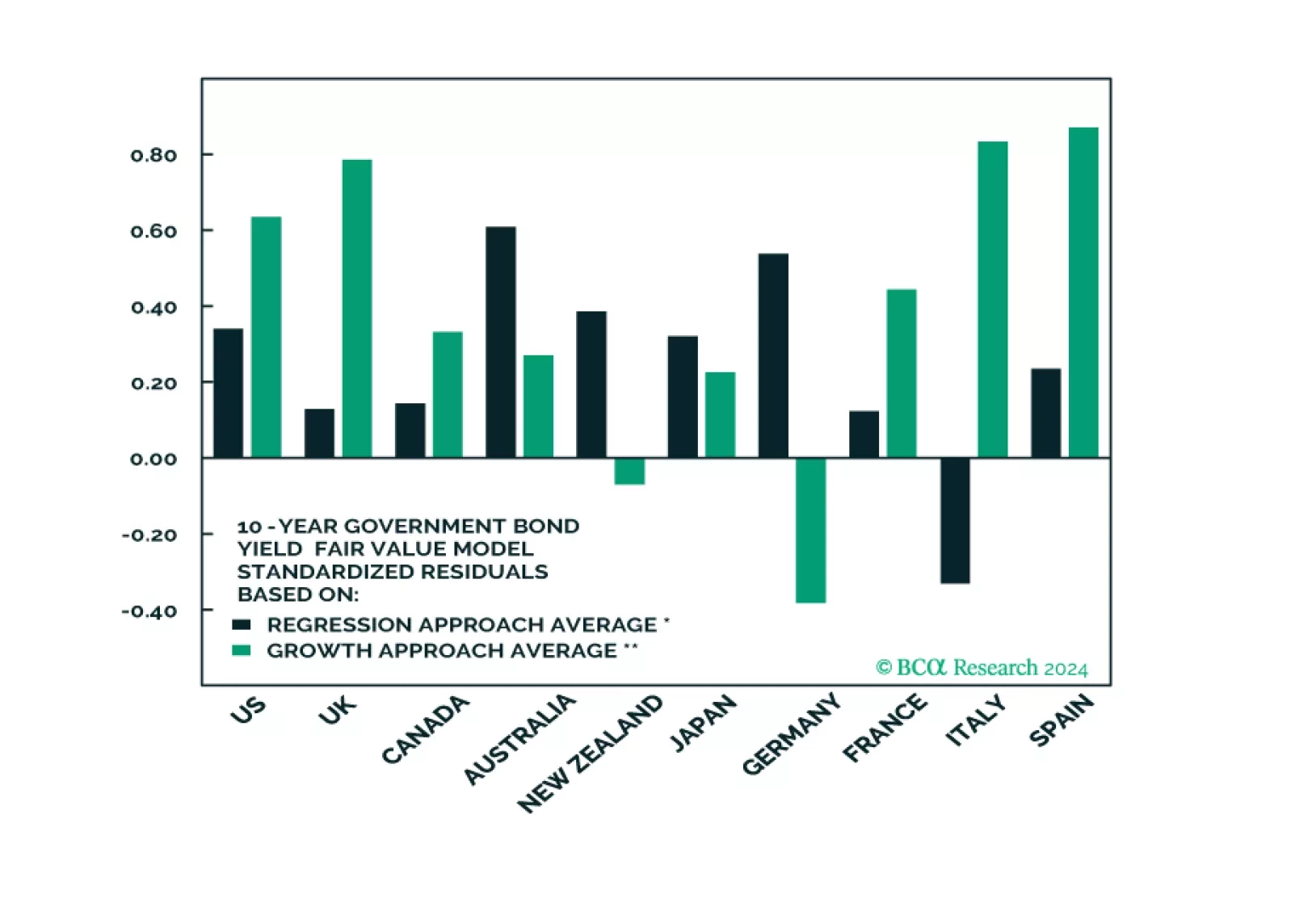

We comment on whether Treasury market valuation is sufficiently attractive to get long bonds and consider some of the common arguments for why yields may yet make new highs.

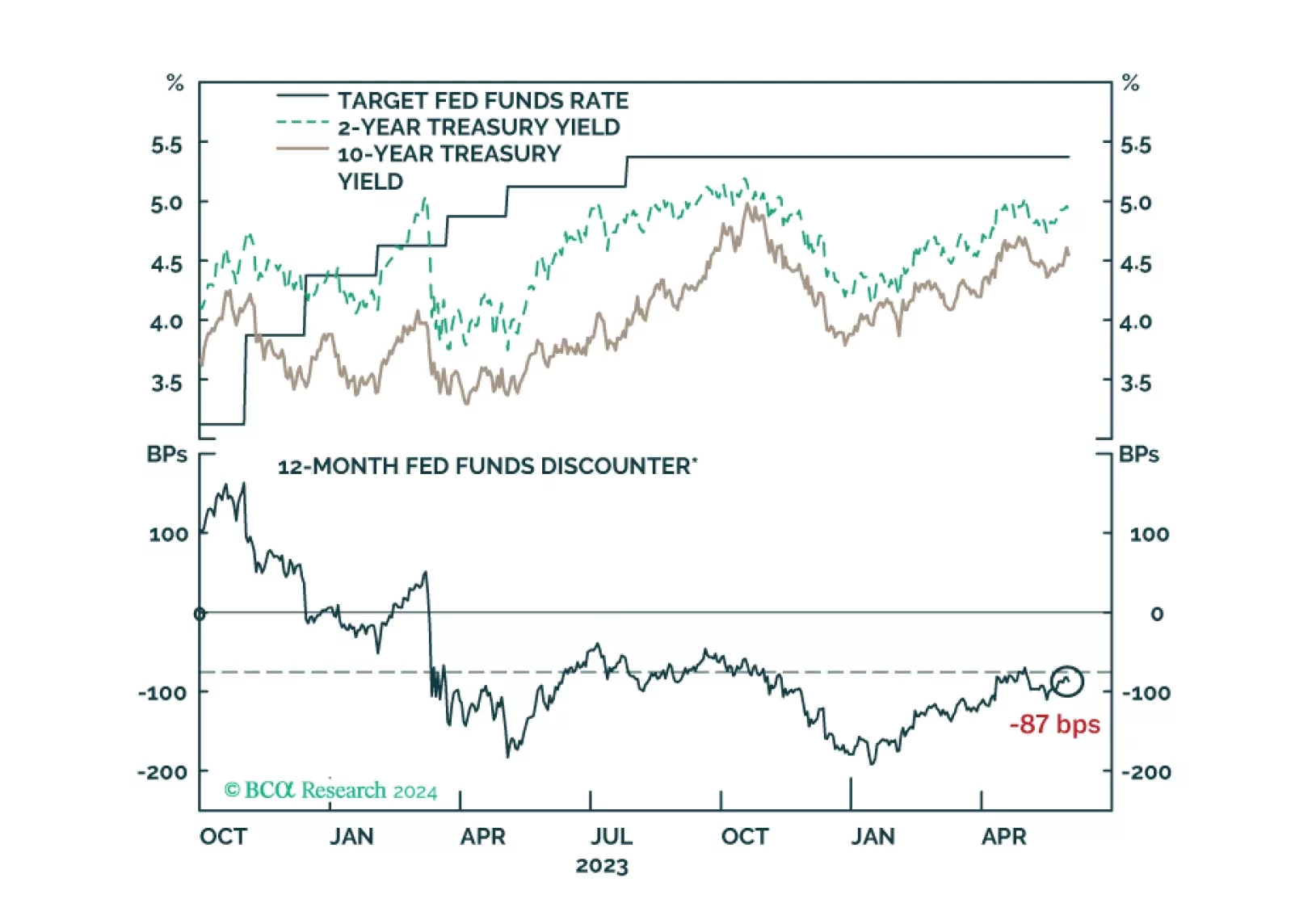

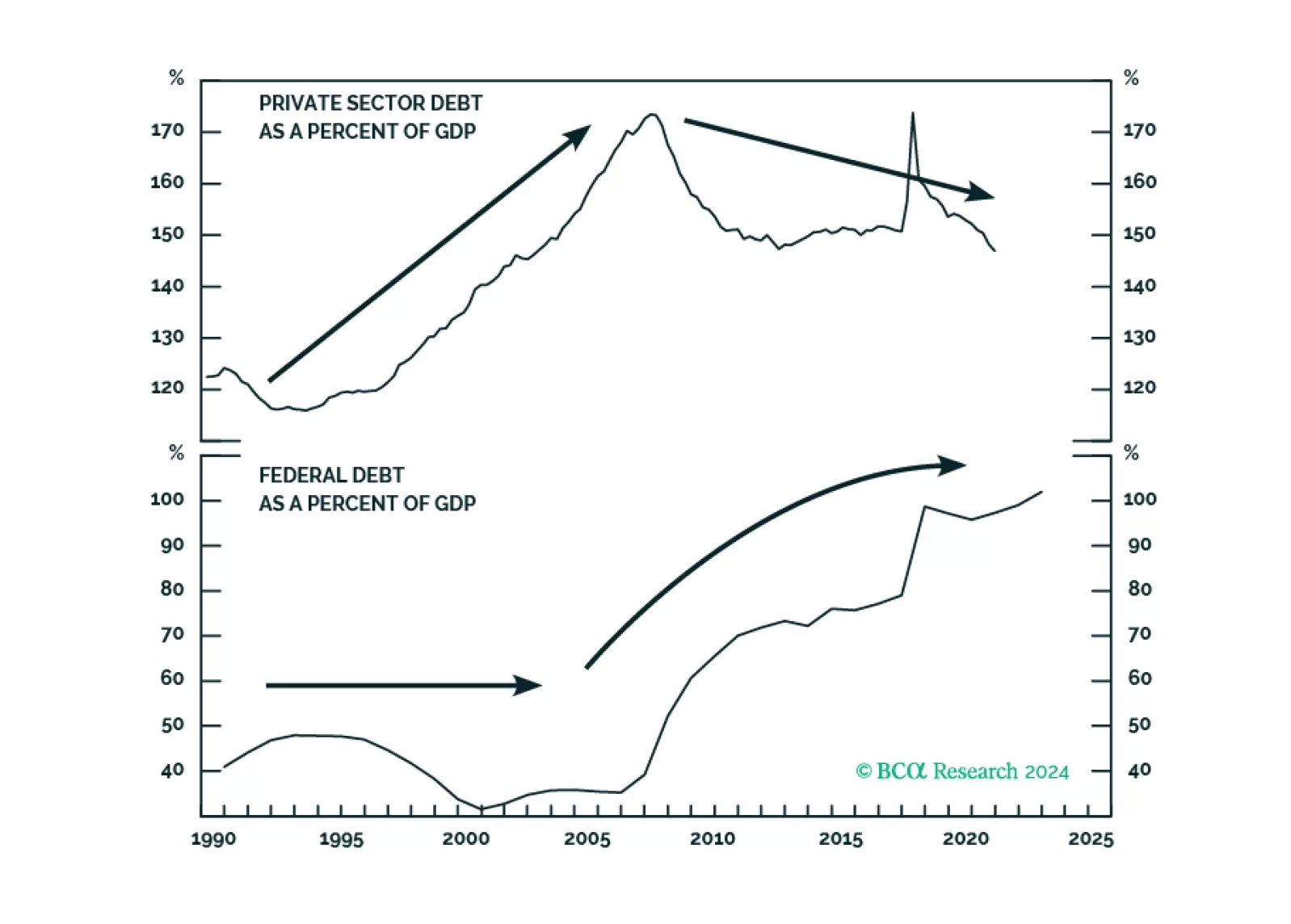

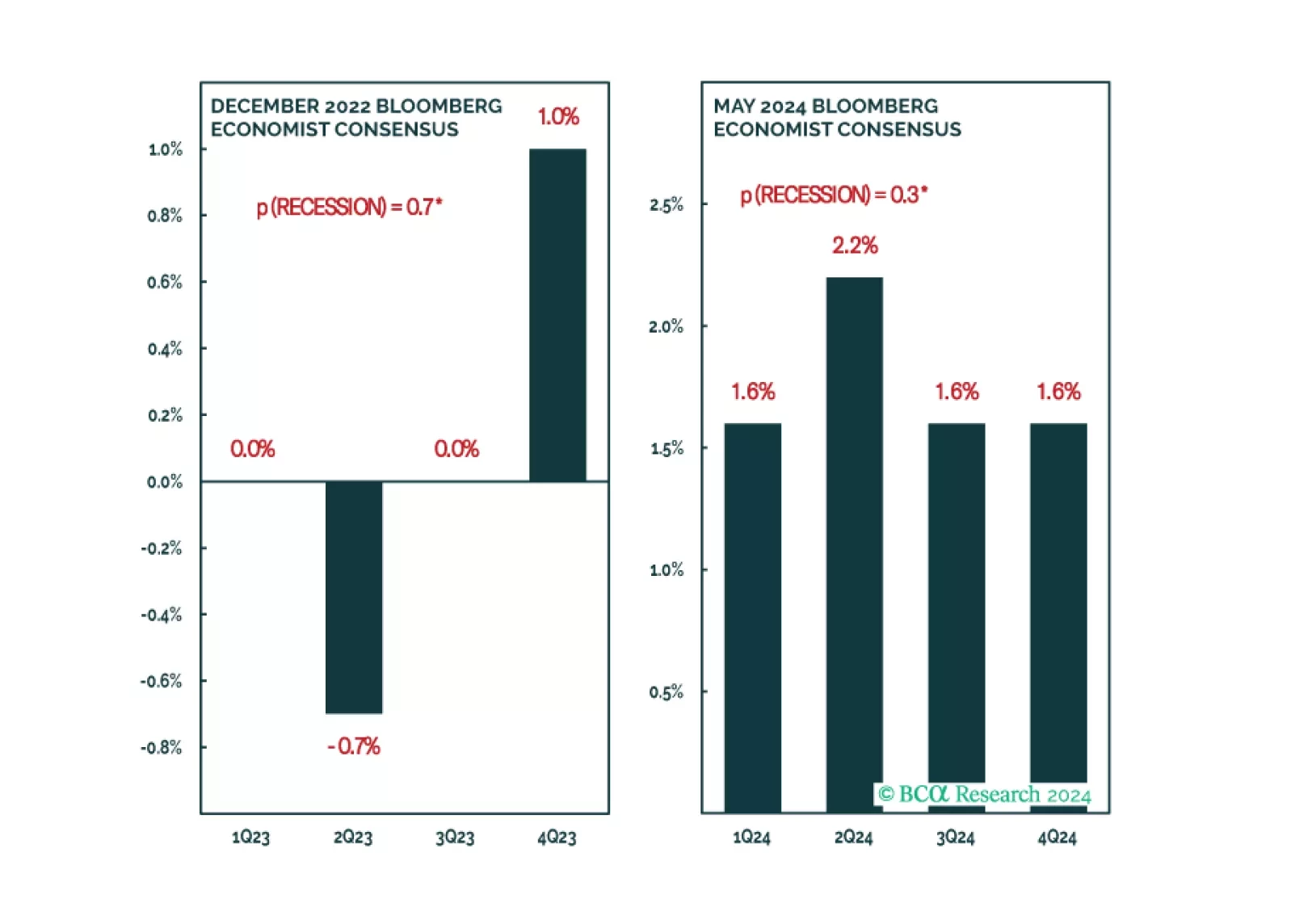

In Section I, we argue that global investors have been lulled into a false sense of security concerning the resiliency of the US economy. Tight monetary policy means that something must change for a recession to be avoided, and…

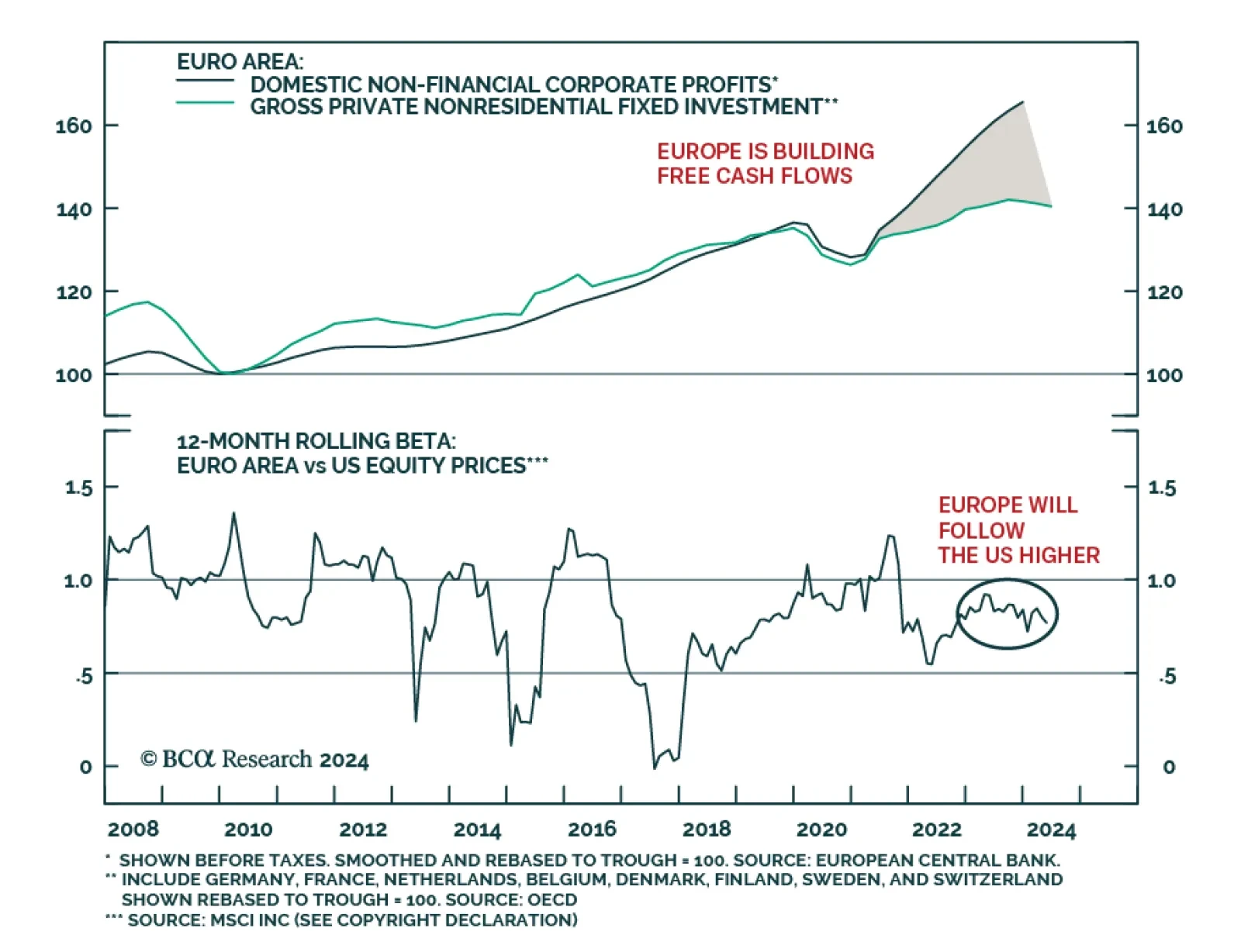

According to BCA Research’s European Investment Strategy service, the money sloshing around the financial system from pandemic-era stimulus measures disconnects near-term prospects for growth from risk asset prices. As a…

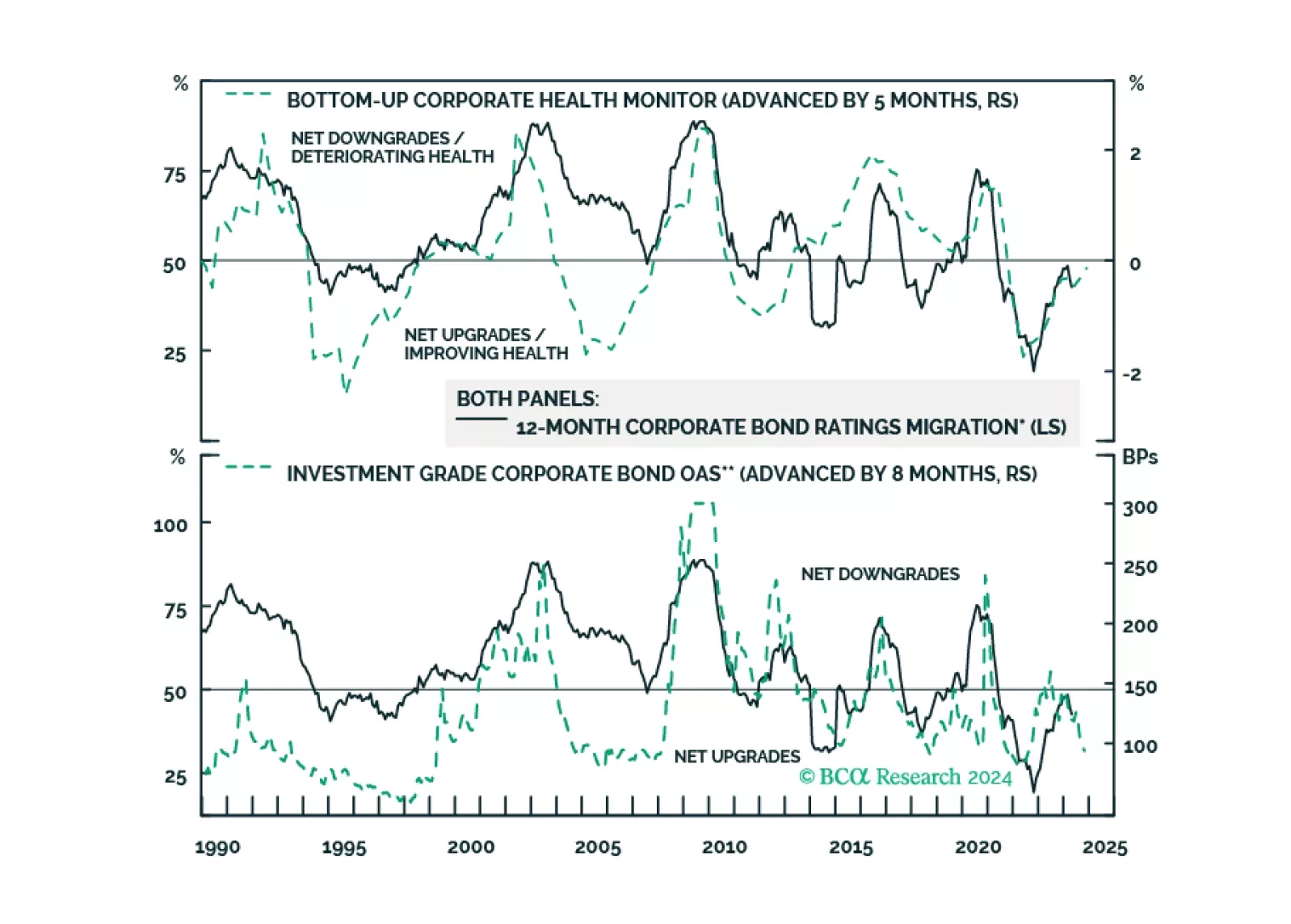

The signs of an approaching recession are starting to emerge. We will turn tactically defensive once they all fall into place.

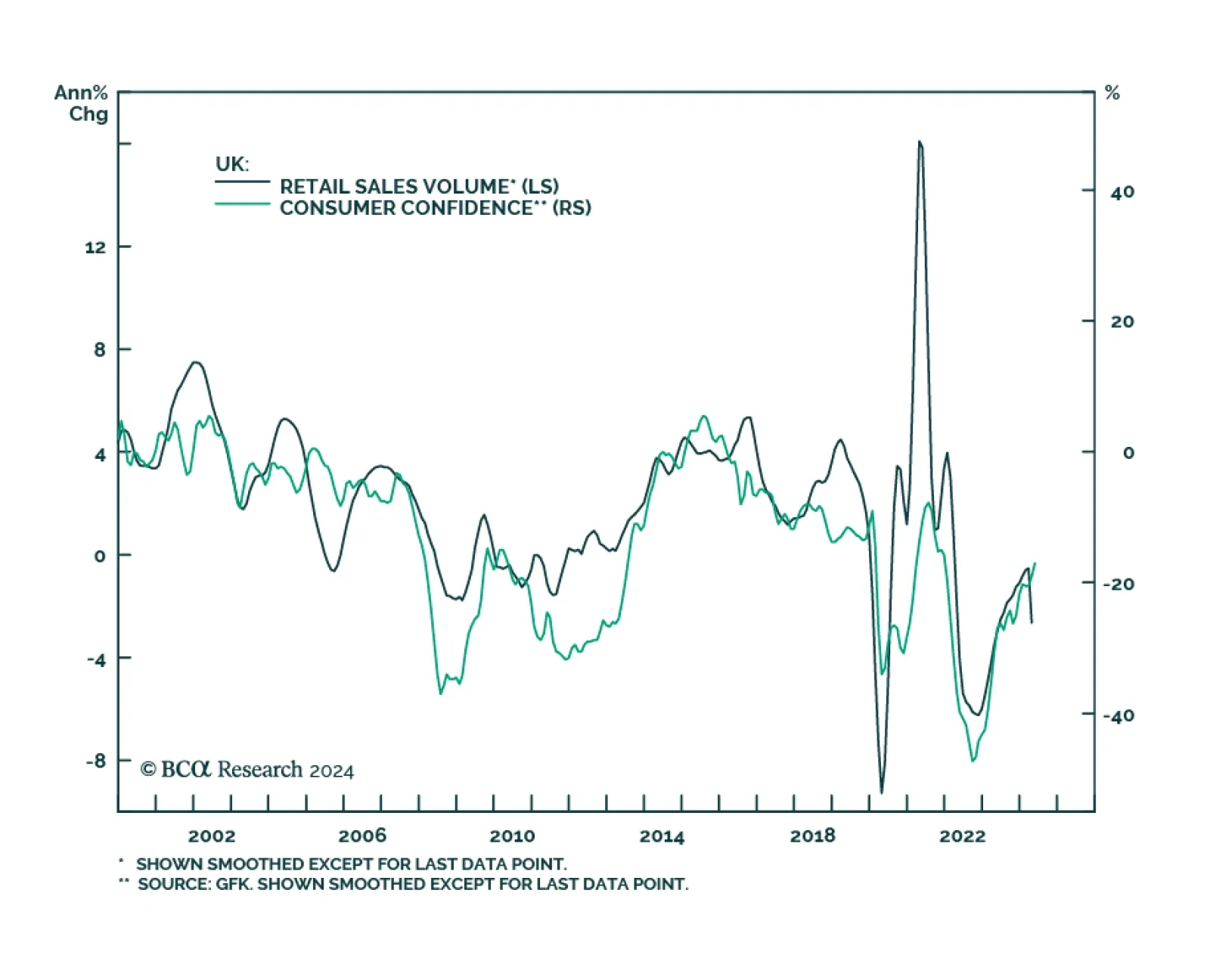

UK retail sales plunged 2.3% m/m in April from a downwardly revised 0.2% m/m contraction in March, significantly undershooting expectations of a 0.5% m/m decline. Household goods as well as clothing and footwear stores led the…