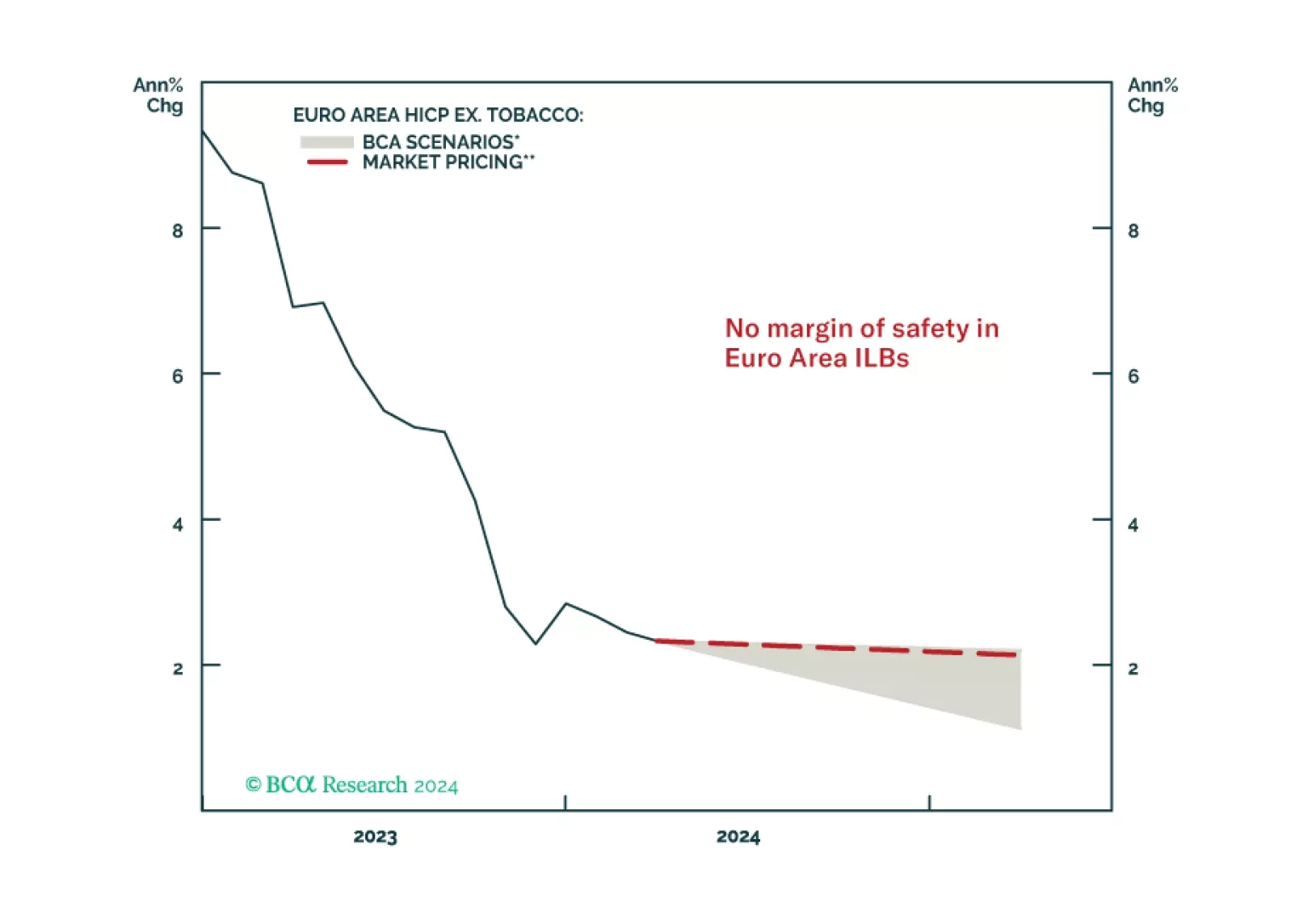

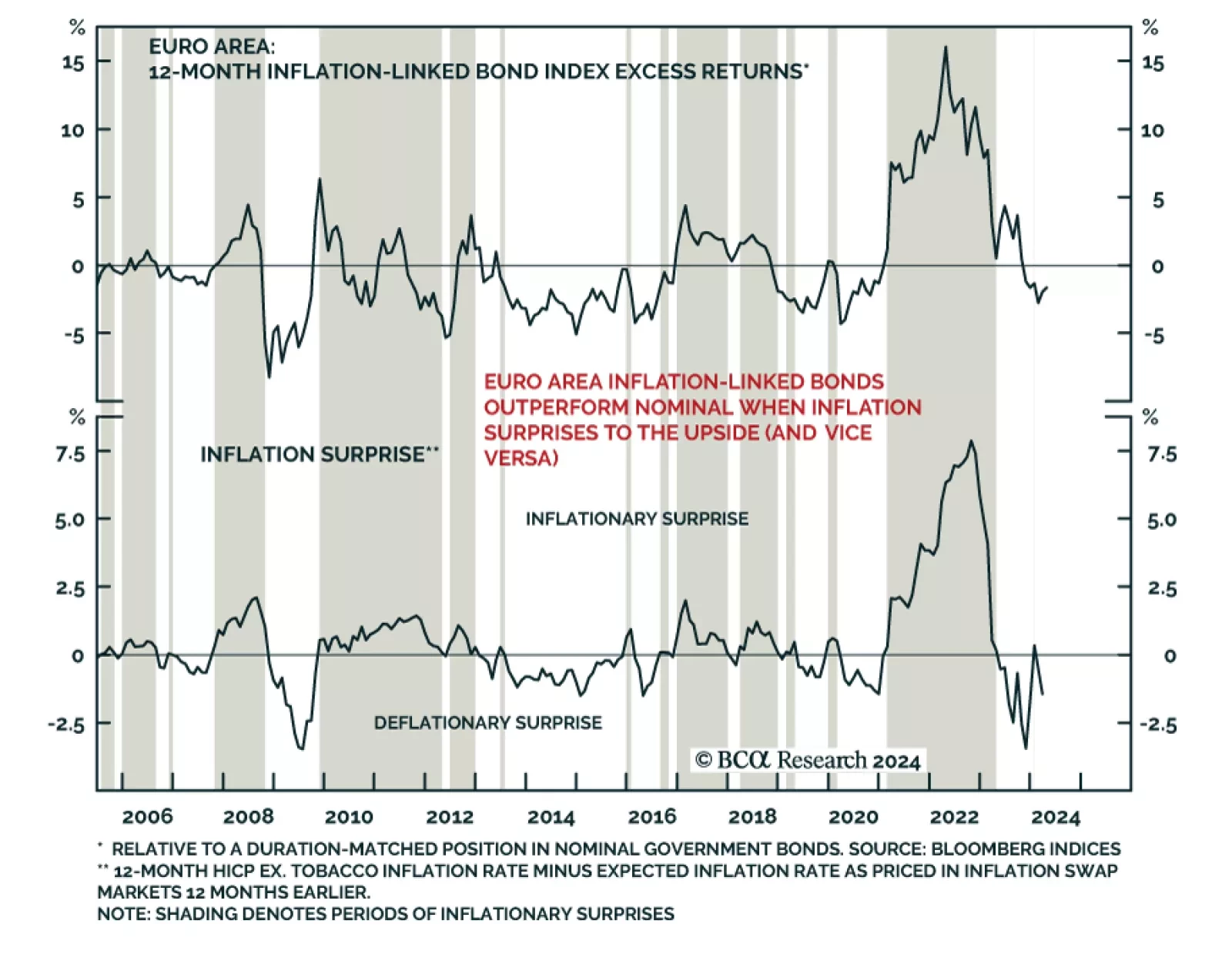

In its latest report, BCA Research’s Global Fixed Income Strategy service introduces the latest addition in its framework for investing in global inflation-linked bonds (ILB). To apply the Euro Inflation-Linked Golden…

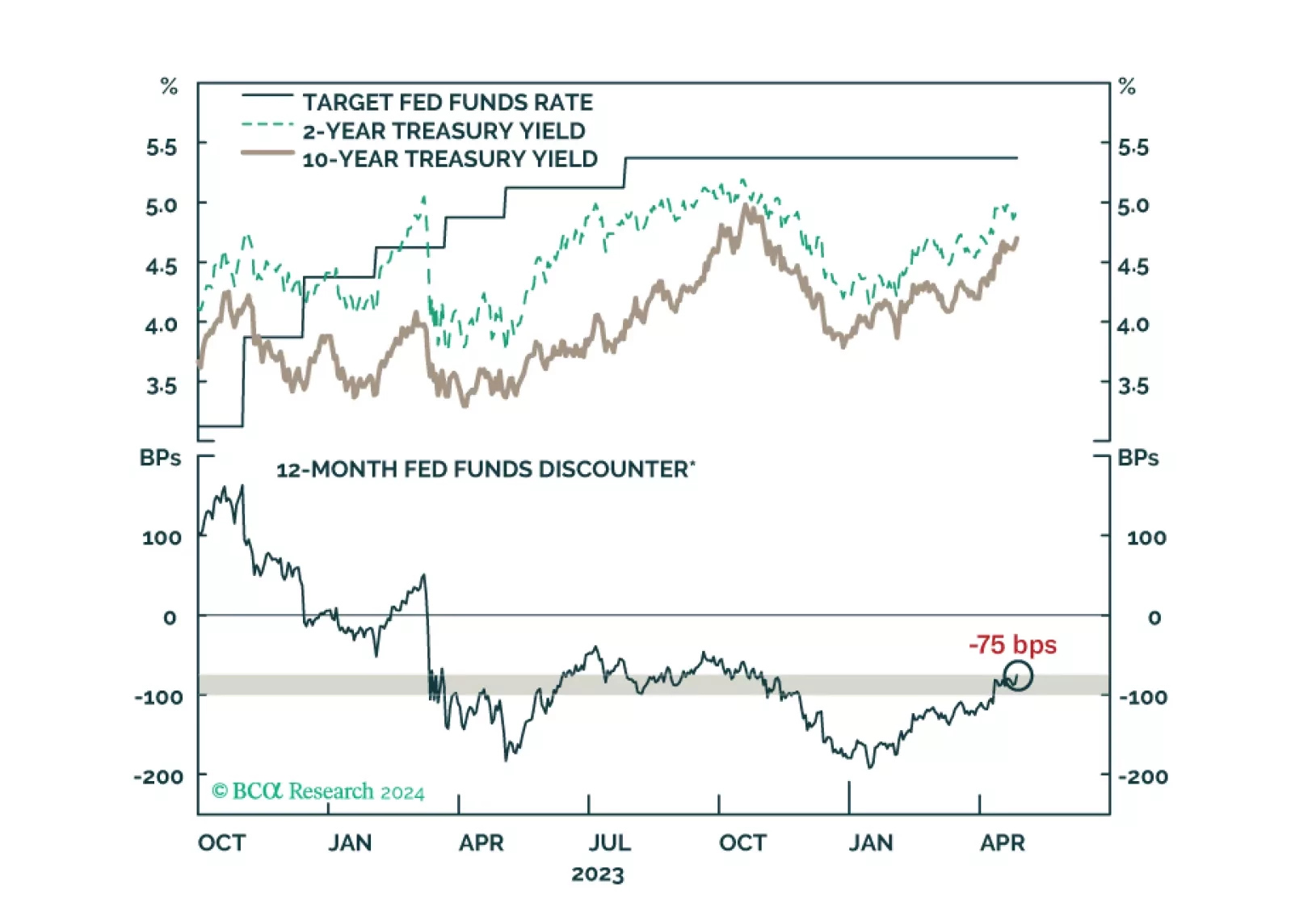

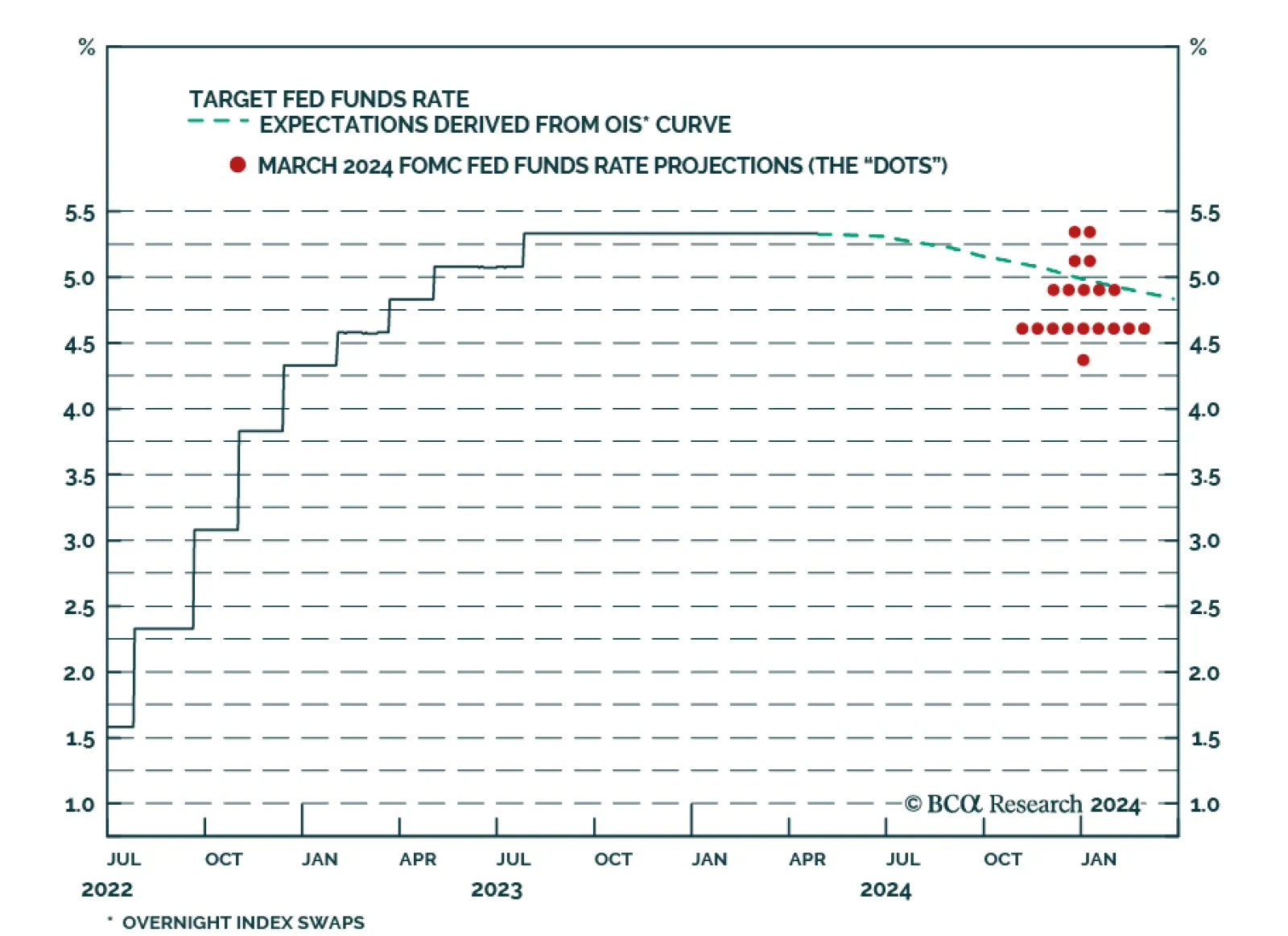

According to BCA Research’s US Bond Strategy service, the May FOMC meeting is unlikely to cause a stir in fixed income markets. The Fed will hold an FOMC meeting next week and while it will not update its economic or…

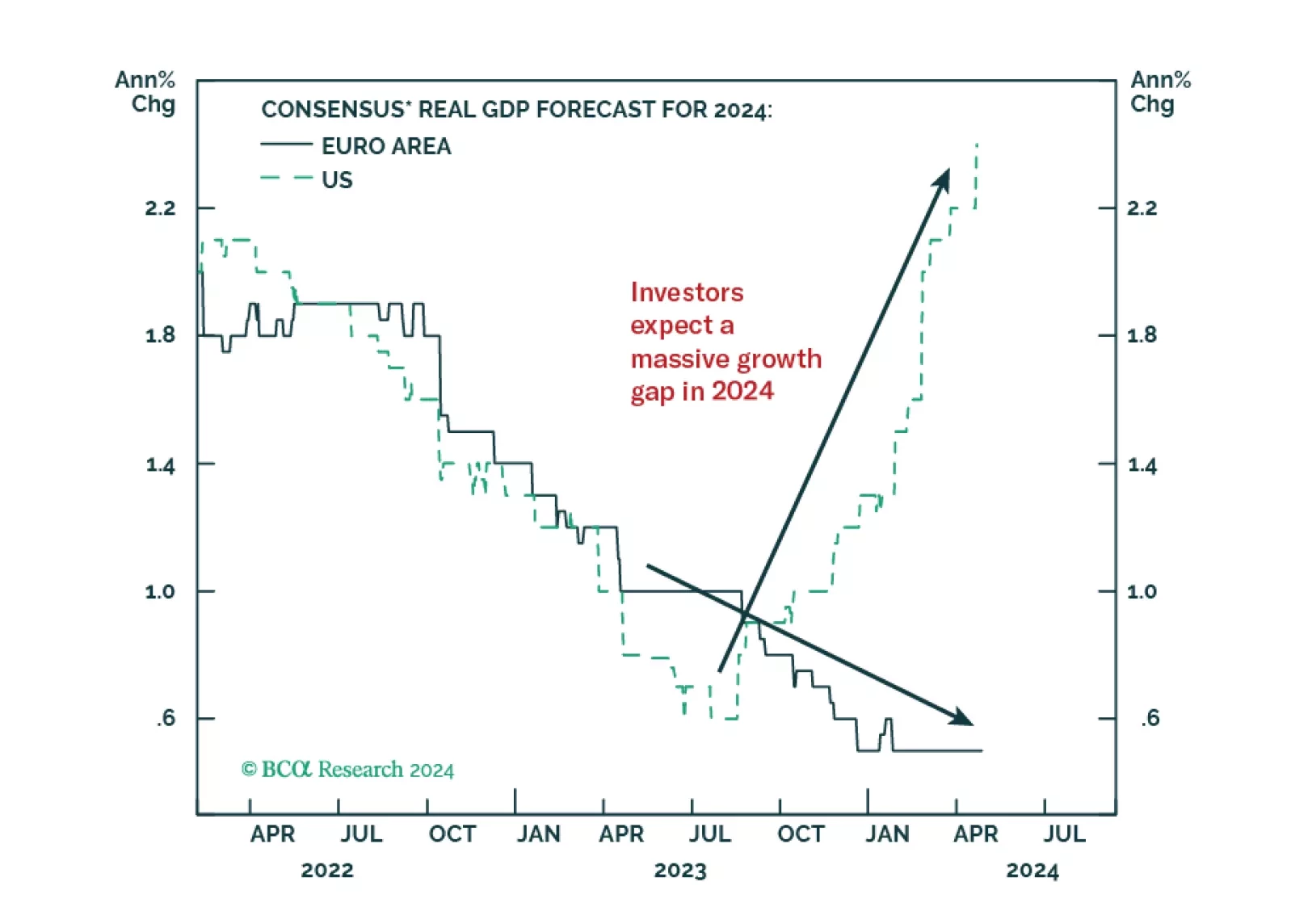

Investors anticipate a record growth gap between the US and the Eurozone in 2024. Does this skewed expectation create market opportunities?

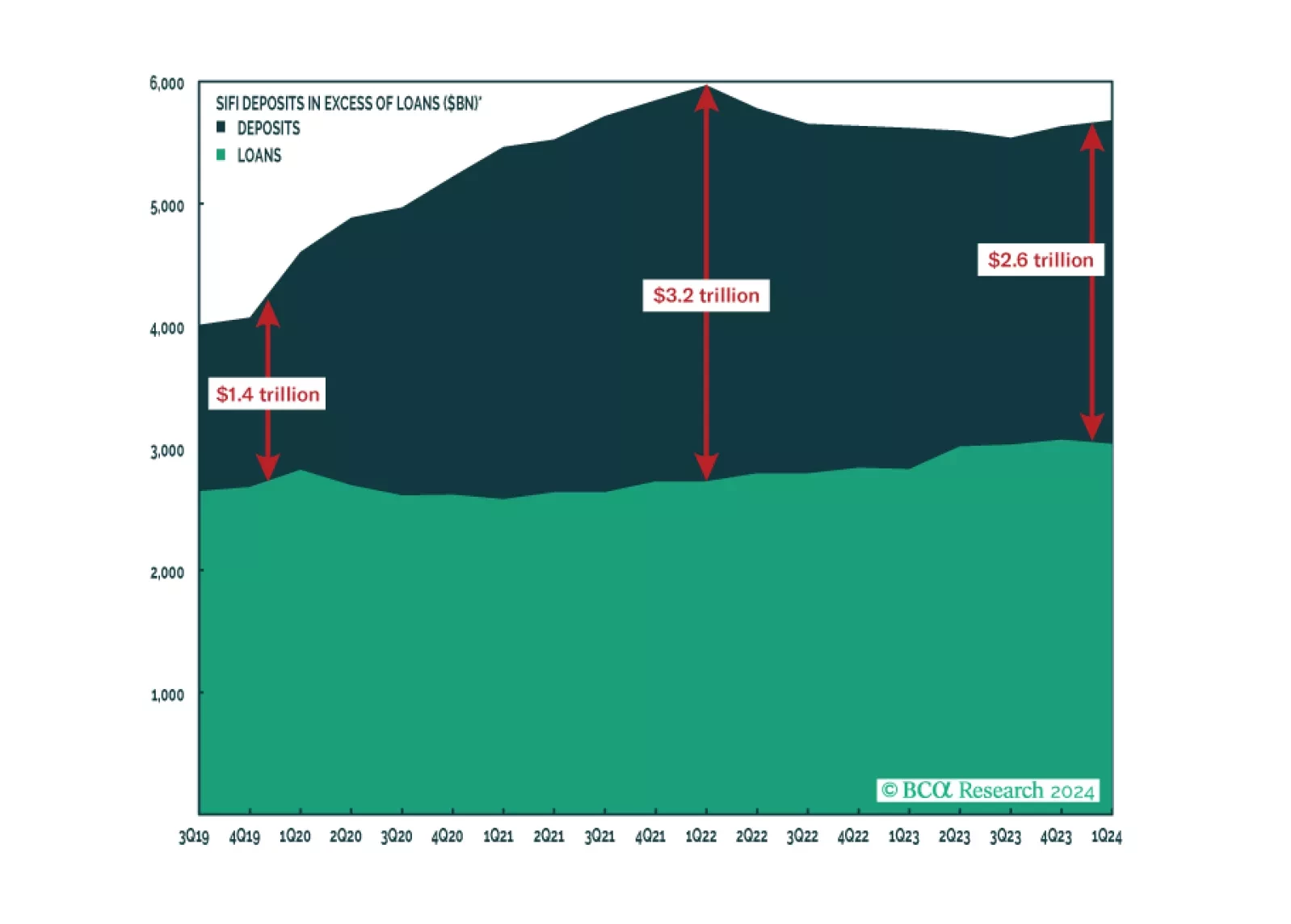

The latest edition of our Big Bank Beige Book suggests the expansion remains intact, though weakness in C’s private-label credit card portfolio could be a harbinger of distress among lower-income consumers. We remain tactically…

Our latest views on the recent increase in Treasury yields and some key things to watch at next week’s FOMC meeting.

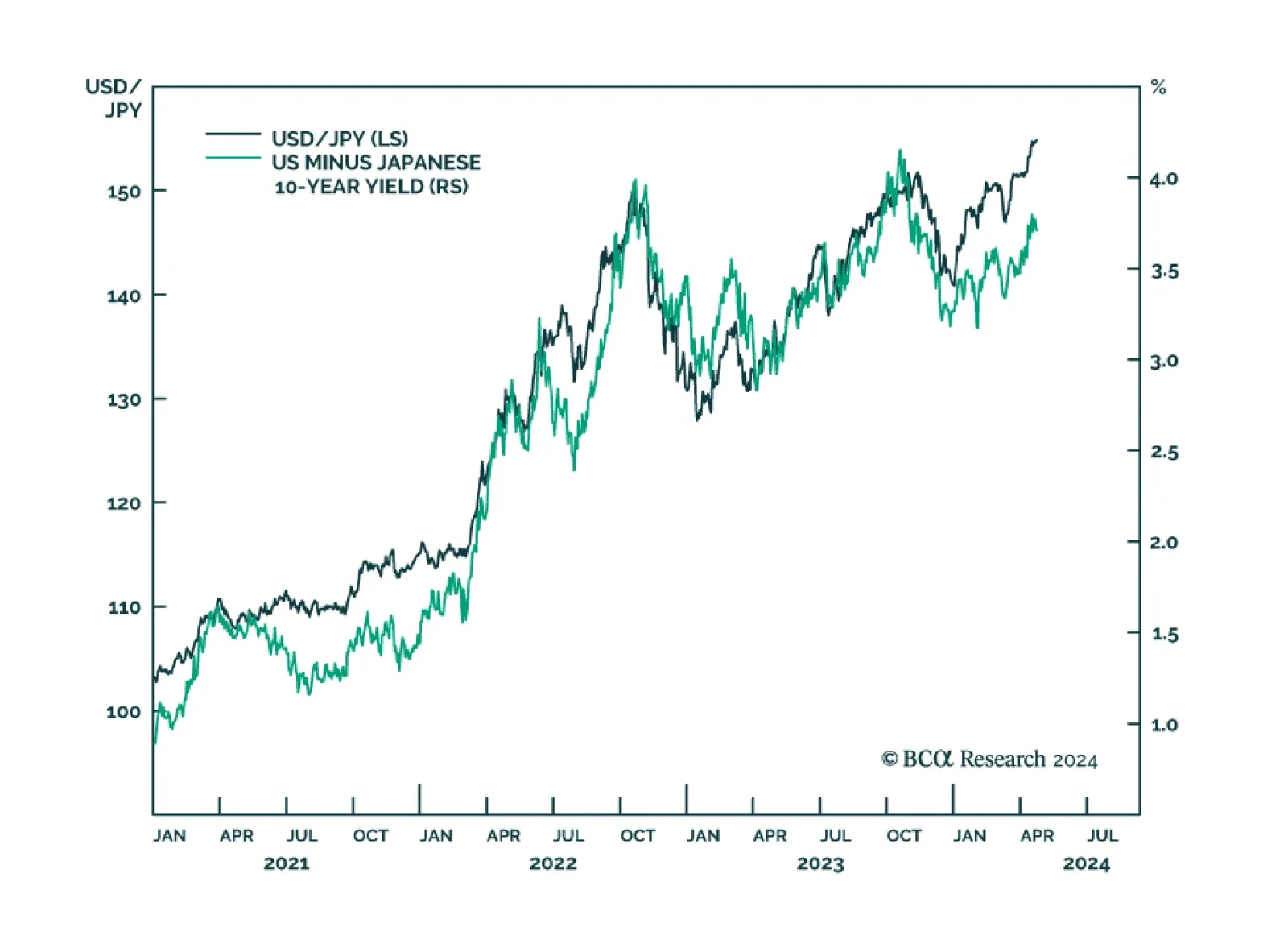

USD/JPY has appreciated by over 10% so far in 2024, making the yen the worst performing G10 currency year-to-date. This cross has also surpassed the 150 threshold which historically is the level at which the Bank of Japan begins…

China’s economy is cruising at a very low altitude. The odds are that China’s equity rebound is running out of time. The RMB will continue to depreciate versus the US dollar in the coming months, albeit the pace may be modest.

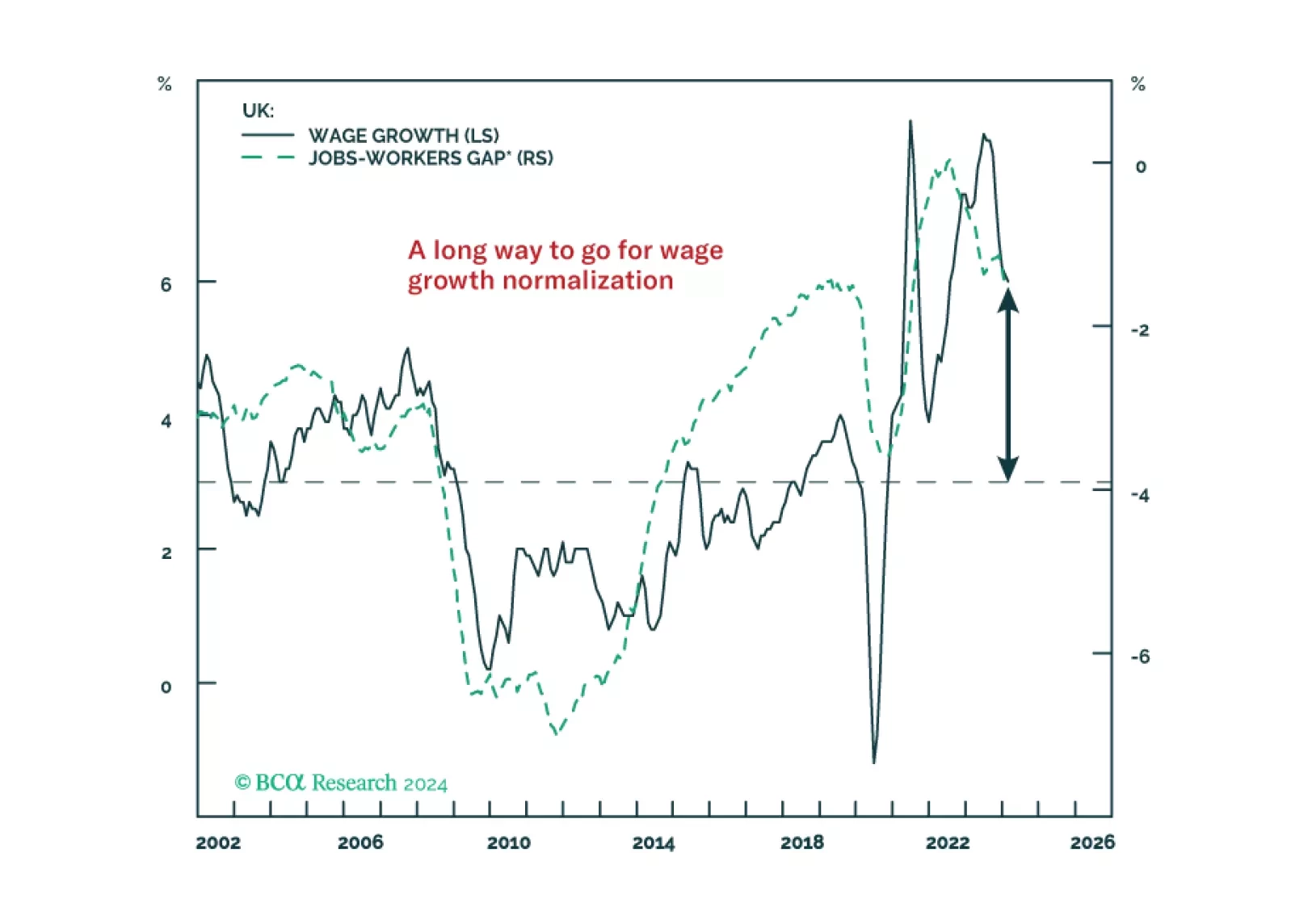

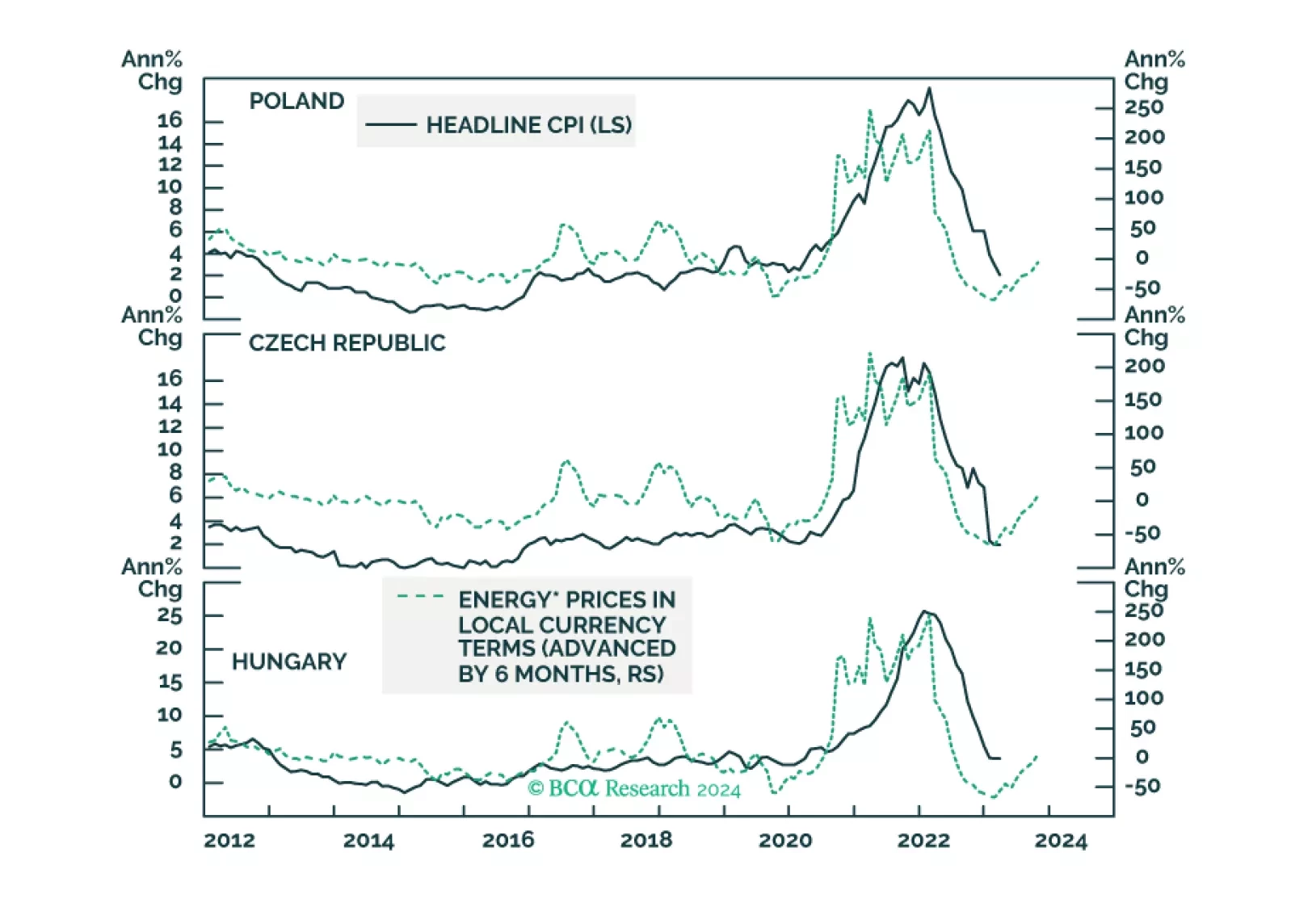

The disinflation process is over in Poland and Hungary. Only the Czech Republic will see its core inflation meet its central bank target this year. The reason is much tighter labor market dynamics in the first two. Investors should…