Russia’s conflict with the West will escalate and trigger more bad news for risky assets this fall. Beyond that, stalemate looms. Latin American equities present a potential opportunity once the macro and geopolitical backdrop…

Investors should go long US treasuries and stay overweight defensive versus cyclical sectors, large caps versus small caps, and aerospace/defense stocks. Regionally we favor the US, India, Southeast Asia, and Latin America, while…

Executive Summary EU Metal Industry Under Threat Russia’s threat to cut off all remaining exports of natural gas to the EU via Ukraine will further imperil the bloc’s struggling metals industry, particularly…

Executive Summary Higher Brent Prices, Stronger Upside Bias The Fed is pacing a globally synchronized monetary-policy tightening cycle as the war in Ukraine escalates, following Russia’s mobilization of 300k reserve…

Executive Summary The US inflation surprise increases the odds of both congressional gridlock and recession, which increases uncertainty over US leadership past 2024 and reduces the US’s ability to lower tensions with China and…

Executive Summary US Military Constraint: Strait Of Hormuz A US-Iran deal would make for a notable improvement in the geopolitical backdrop during an otherwise gloomy year. It would remove the risk of a major new oil shock…

Executive Summary Our negative view on the summer rally is coming to fruition, with equities falling back on the negative geopolitical, macro, and monetary environment. China is easing policy ahead of its full return to autocratic…

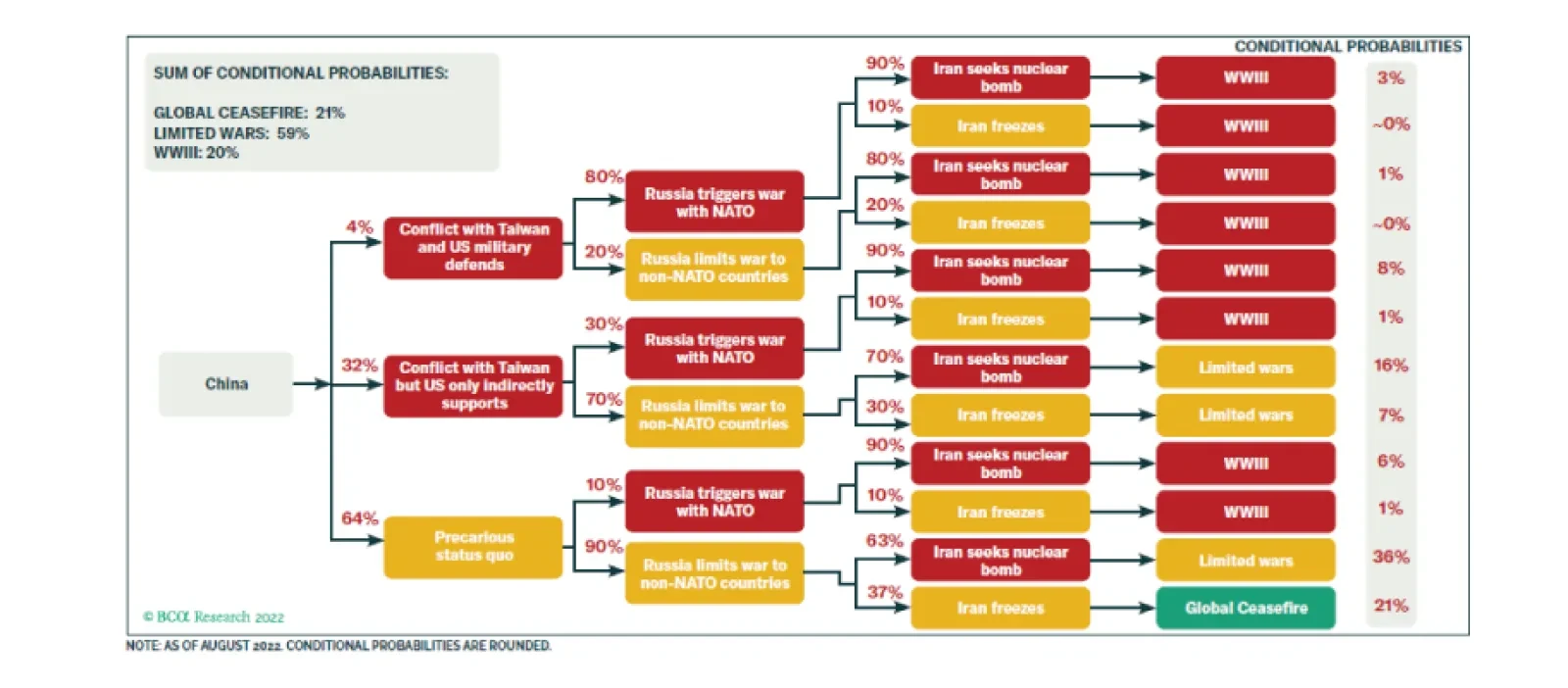

According to BCA Research’s Geopolitical strategy service, the odds of WWIII could be as high as 20% over the next two-years. The team presents a series of “decision trees” to formalize different scenarios…