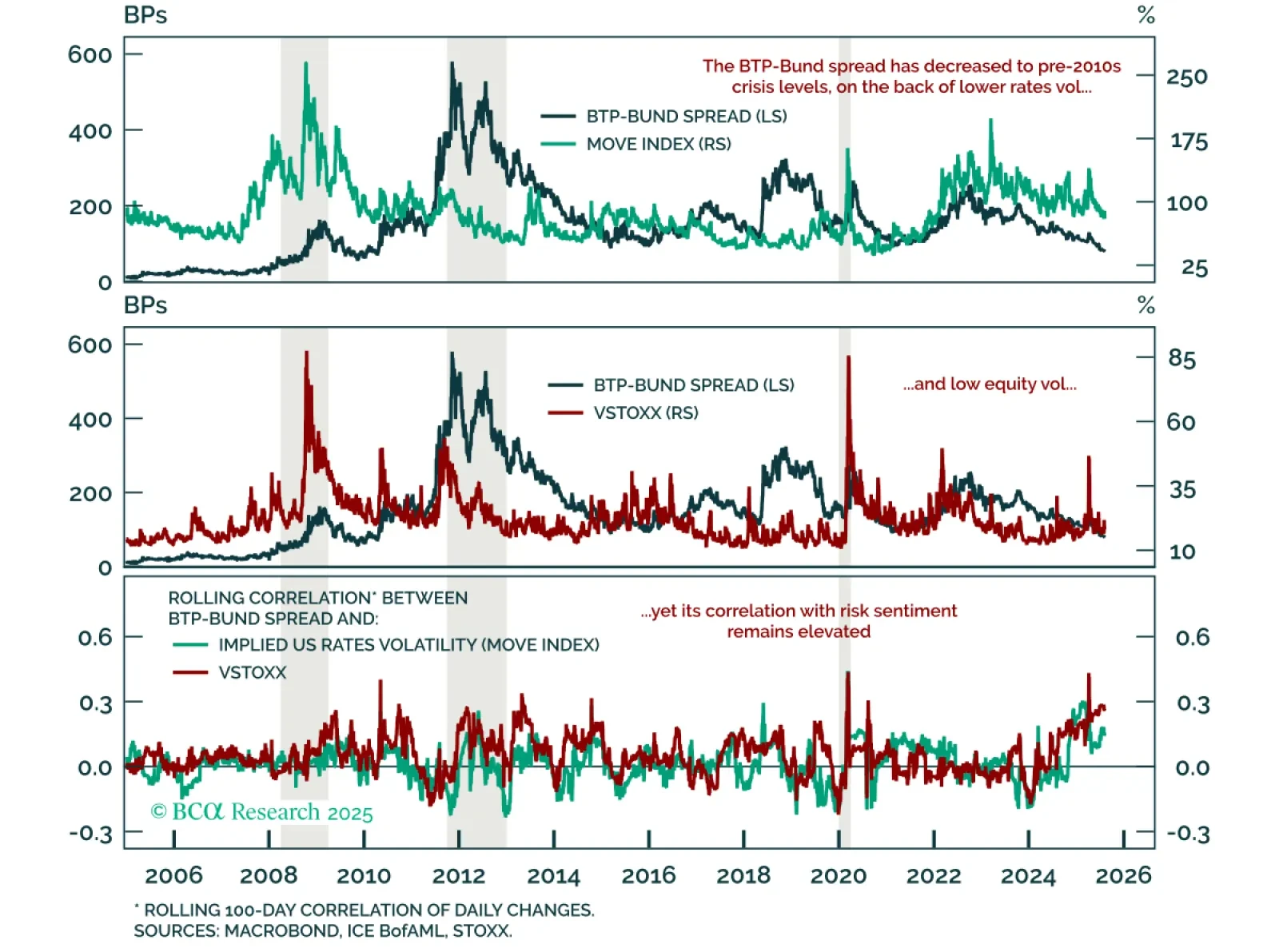

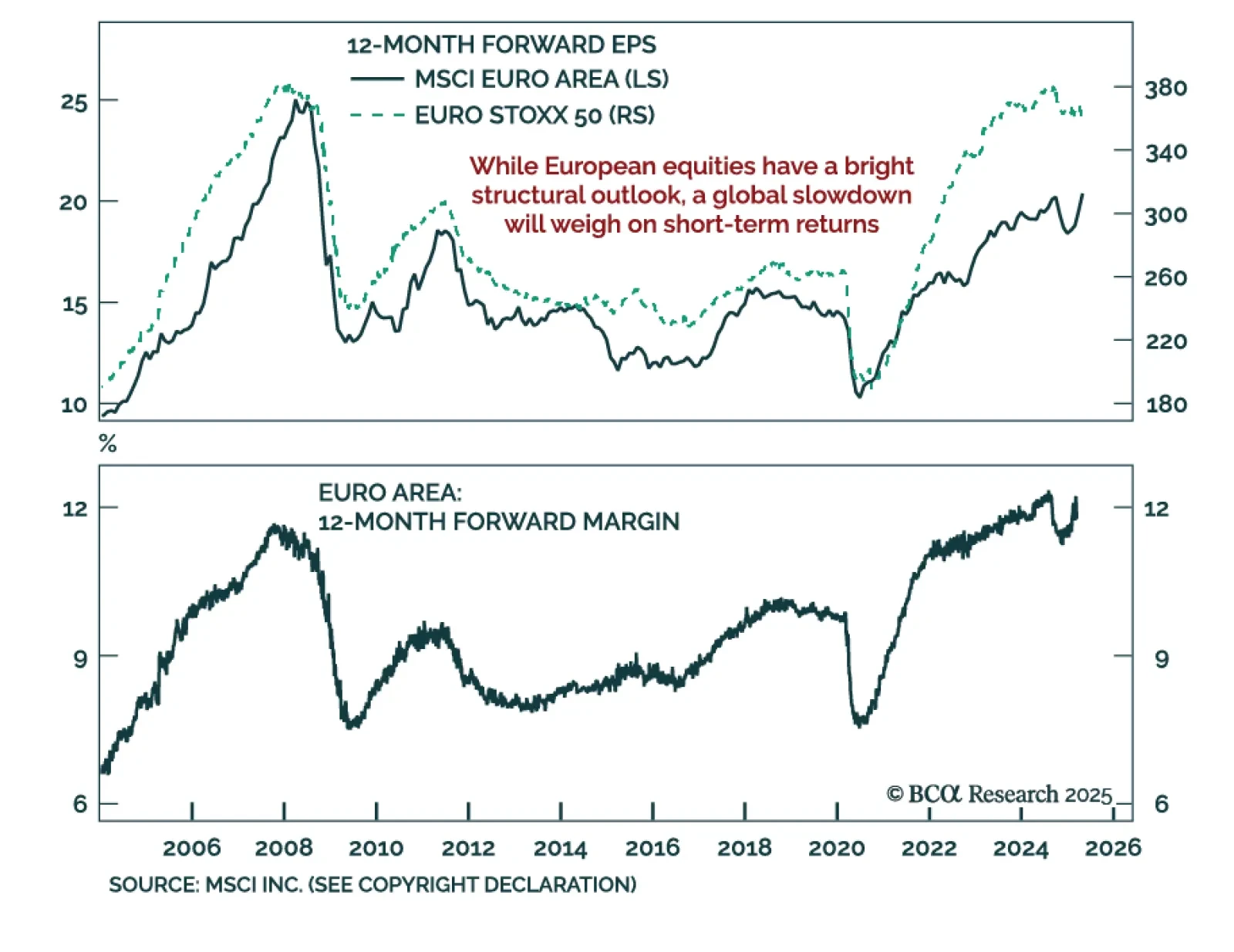

The BTP-Bund spread has tightened to pre-2010s levels, but with global growth risks we favor Gilts over Bunds and prefer BTPs over credit. While the EURO STOXX 50 remains rangebound since the Liberation Day recovery, European…

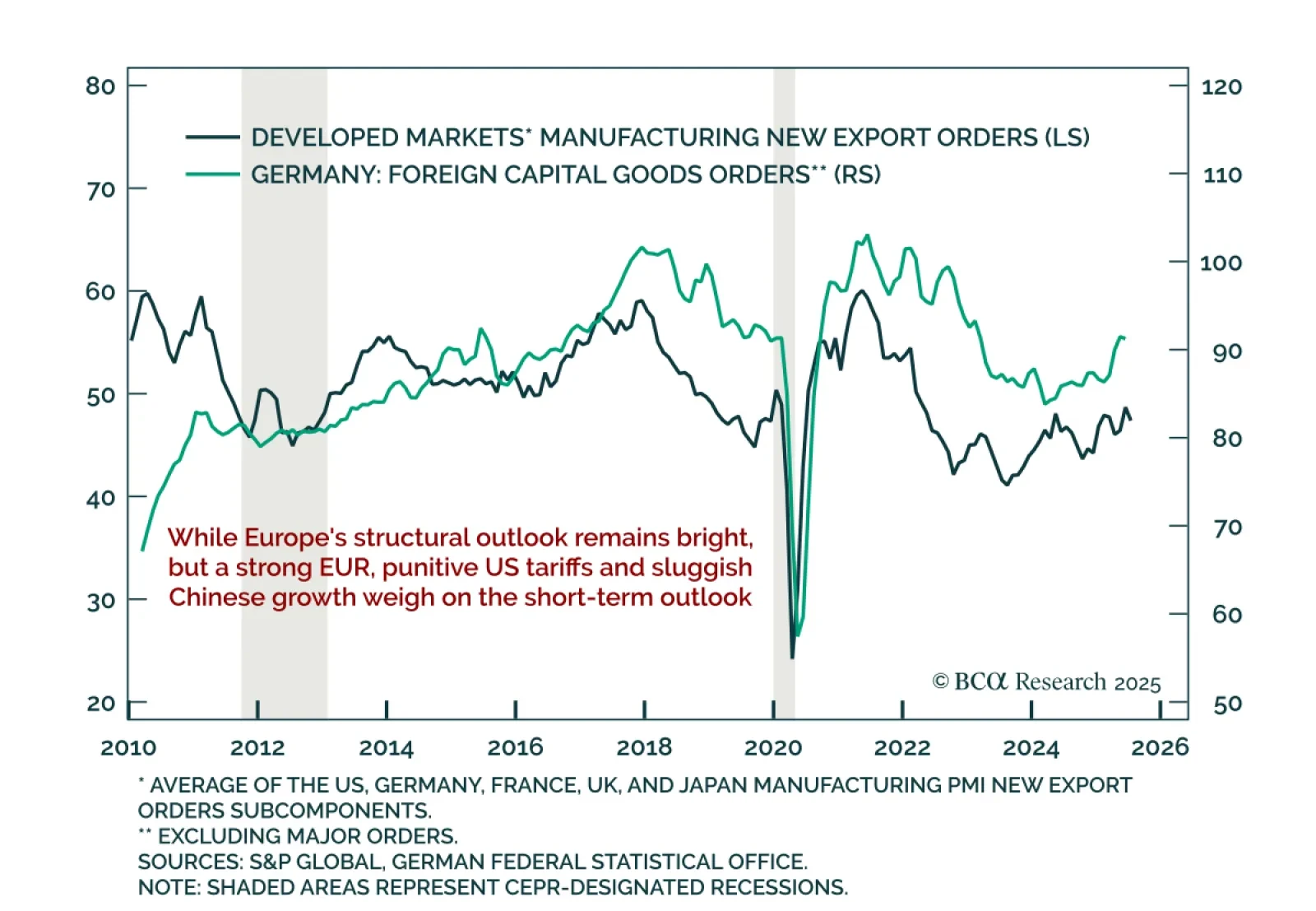

Germany’s June factory orders missed expectations, highlighting persistent headwinds reinforcing the case for a cautious tactical outlook on European assets. Orders fell 1.0% m/m, slowing to 0.8% y/y on a calendar-adjusted basis…

In this chartbook, we look at the balance of payments across DM and EM countries. The US does not fare well, but neither do a few other countries.

The European economy is losing altitude; and the second half of 2025 could get bumpier.

Join Mathieu Savary and Jérémie Peloso for our European Investment Strategy Webcast as we break down the key drivers shaping the outlook for…

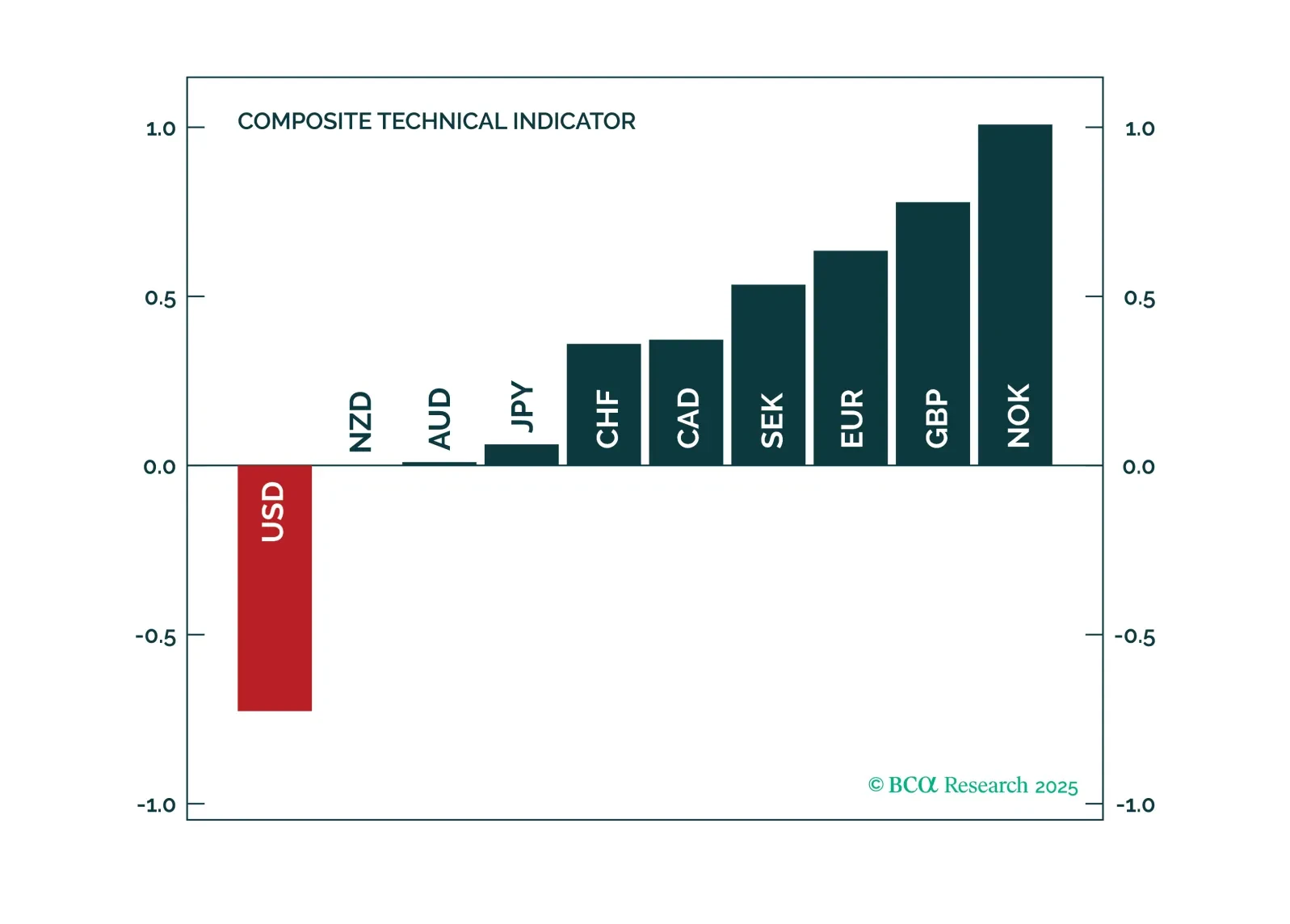

In this FX note, we provide a rationale for why it is important to pay attention to technical indicators, while still keeping your eyeball on the structural factors that drive currencies. This report answers the following questions:…

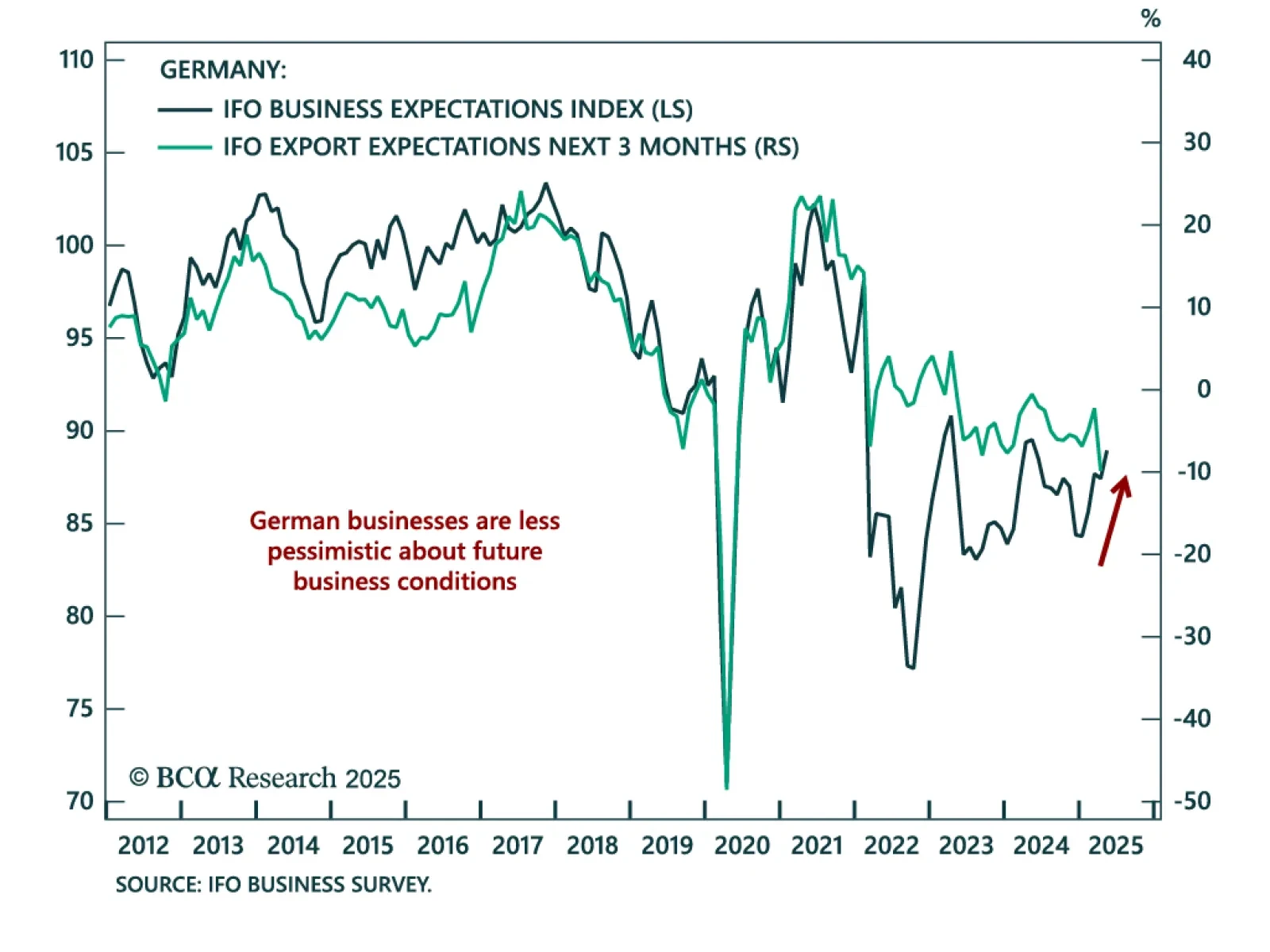

Business sentiment improved slightly in May, corroborating the message from other soft-data indicators of Eurozone business activity, which remain weak but are not plummeting. The increase in the future expectations index to 88.…

Germany's political transition supports long-term equity upside, but near-term growth risks justify caution. Friedrich Merz was narrowly elected Chancellor on Tuesday, but his fragile coalition and his decision to suspend the debt…

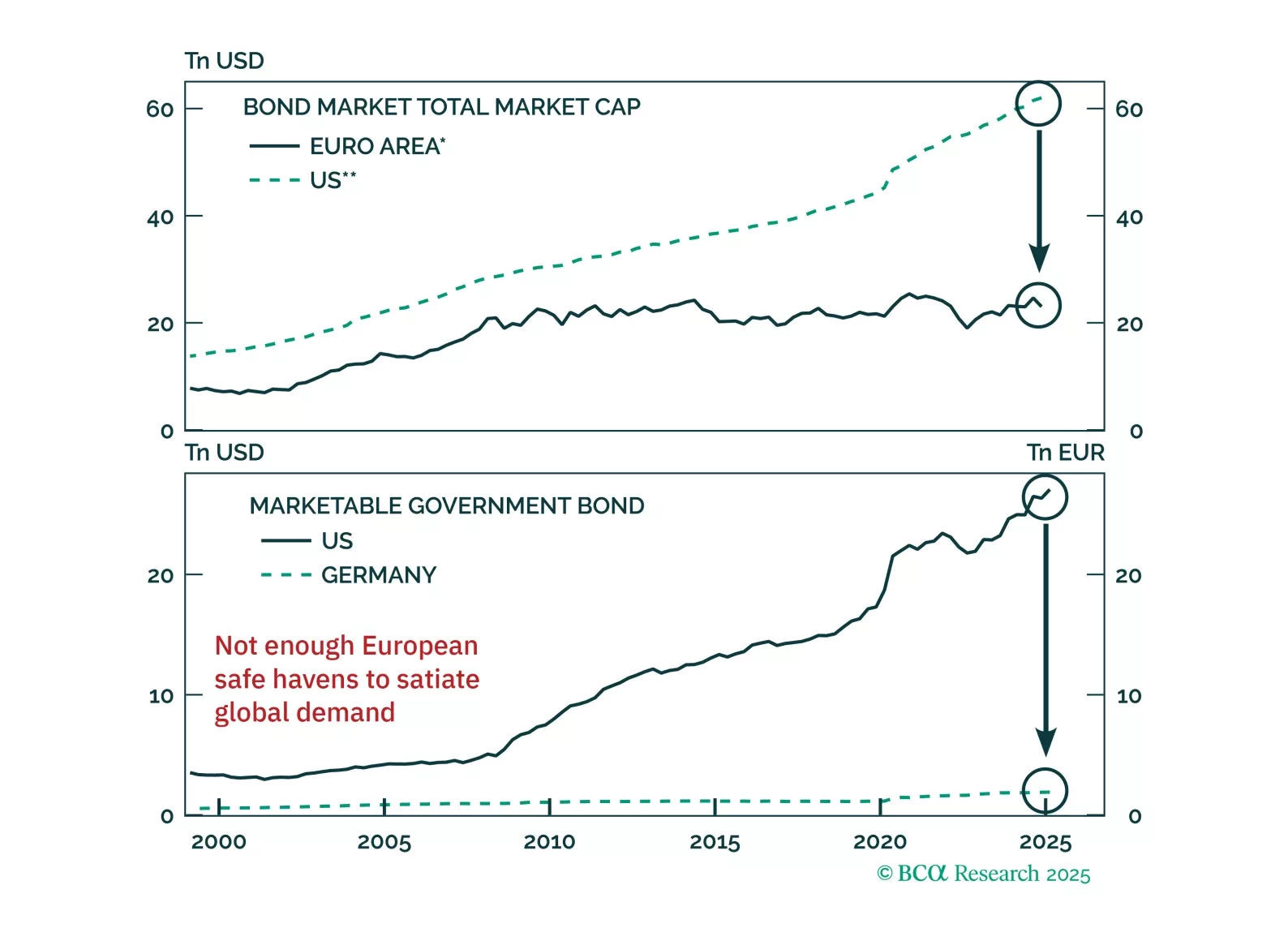

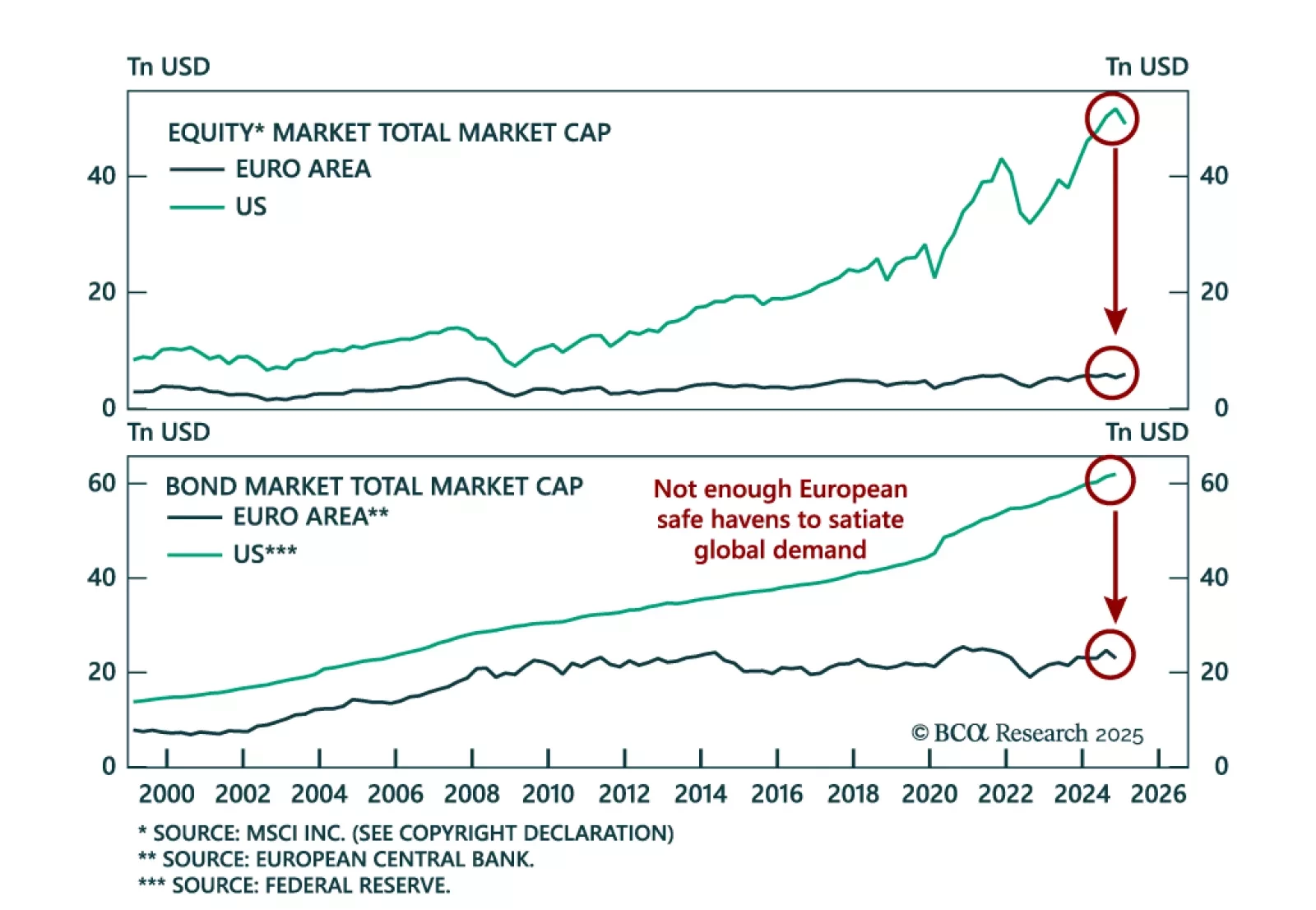

Our European Investment strategists maintain a defensive stance. Favor bunds as an emerging safe-haven complement to US Treasurys and a value tilt in equities. While the dollar and US fixed income remain the global anchor, EUR/USD…

Are bunds the new Treasurys? The euro and German debt are gaining favor as safe havens, but markets may be overplaying the shift. Our latest report dissects what's durable, what's not, and how to trade the dislocation.