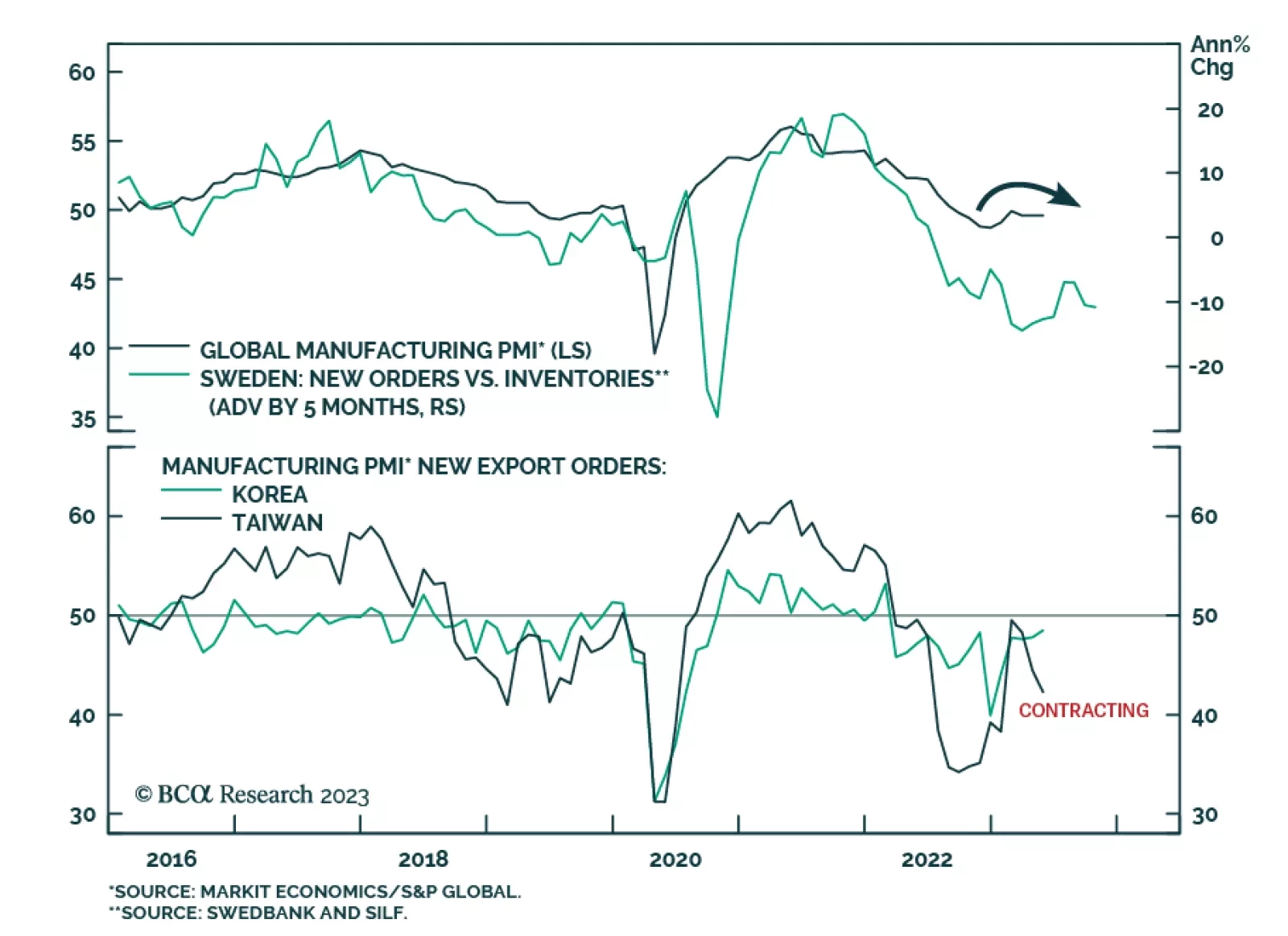

The Global Manufacturing PMI was unchanged at 49.6 in May – below the 50 boom-bust line for the ninth consecutive month. The details of the release were mixed. On the one hand, the Production sub-component rose to an 11-…

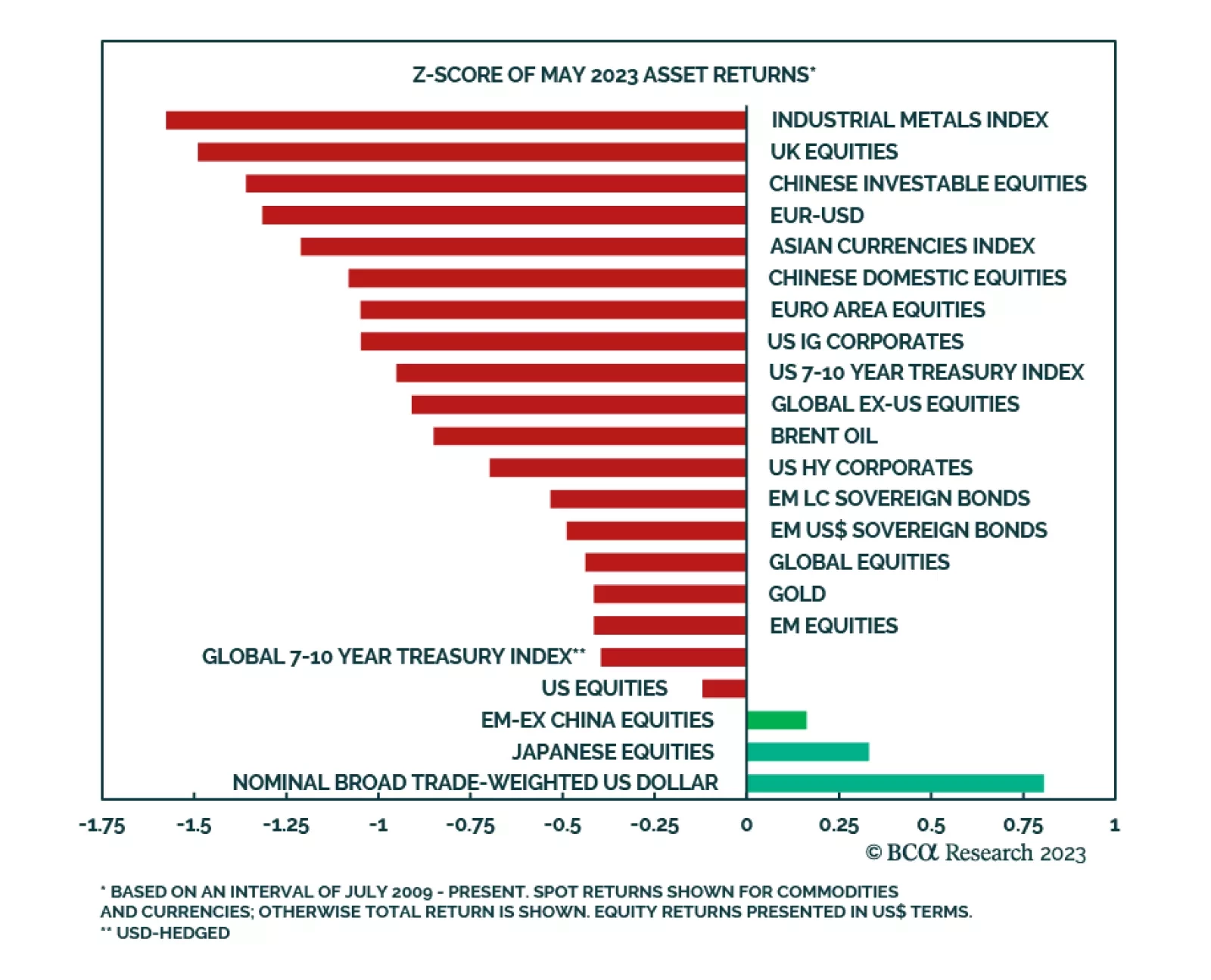

Global financial markets relapsed in May. After a relatively strong start to Q2, most of the major financial assets we track generated below average returns last month. A shift in investor expectations for the path of the Fed…

Expectations for oil demand growth through 2023-24 are way too optimistic. Until these expectations fall to -0.5-1 percent, the oil price has further downside. Plus: collapsed complexity confirms that AI is in a mania, while basic…

The debt ceiling game’s endpoint will avoid default only if it implies economic pain. For the Republicans, the best strategy is not to lift the debt ceiling unless the Democrats cut spending a lot, or unless the economy starts to…

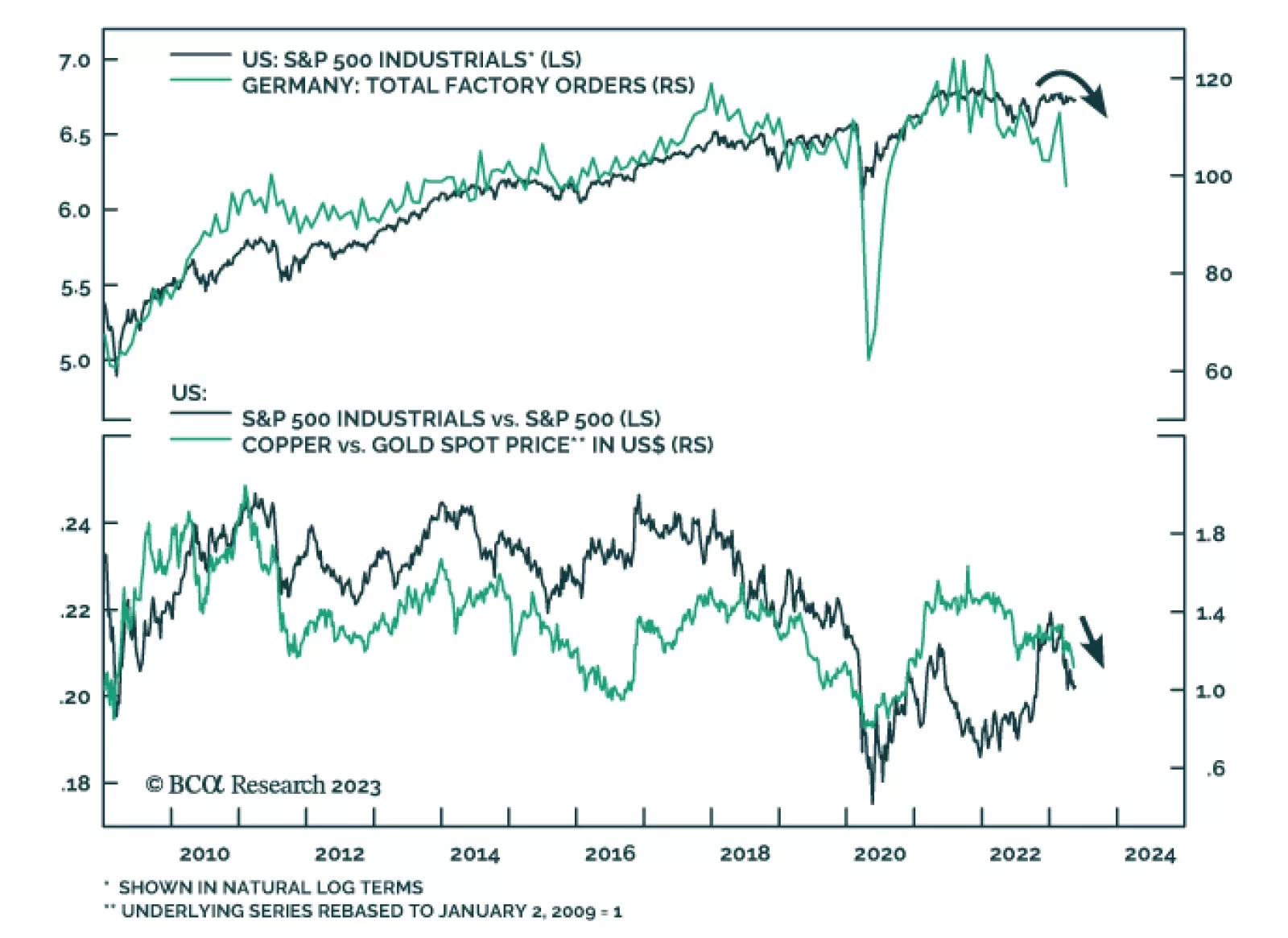

The S&P 500 Industrials index has gained 19% since its October 2022 lows and outperformed the S&P 500 gains of 15%. The sector has benefitted from American companies' efforts to "onshore" supply chains, but…

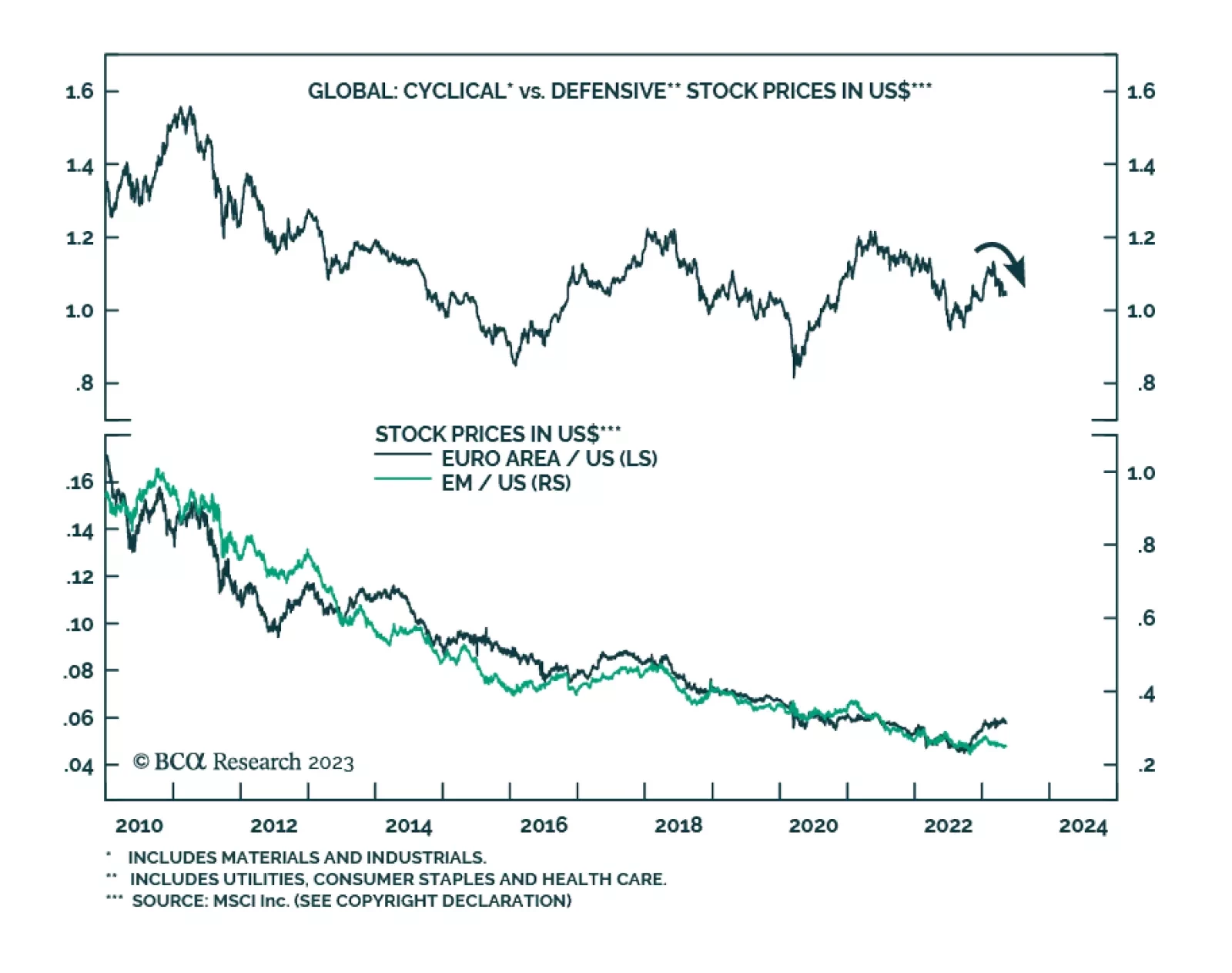

Global equities are up 18% in USD terms since they bottomed in mid-October. On the surface, this is a positive signal that risk sentiment is improving. However, internal equity dynamics indicate that the rally is running out of…

There is a 50:50 chance of experiencing a major deflationary shock in the next two years, and an even greater likelihood on a longer timeframe. The good news is that several assets provide a good insurance against this risk, and that…

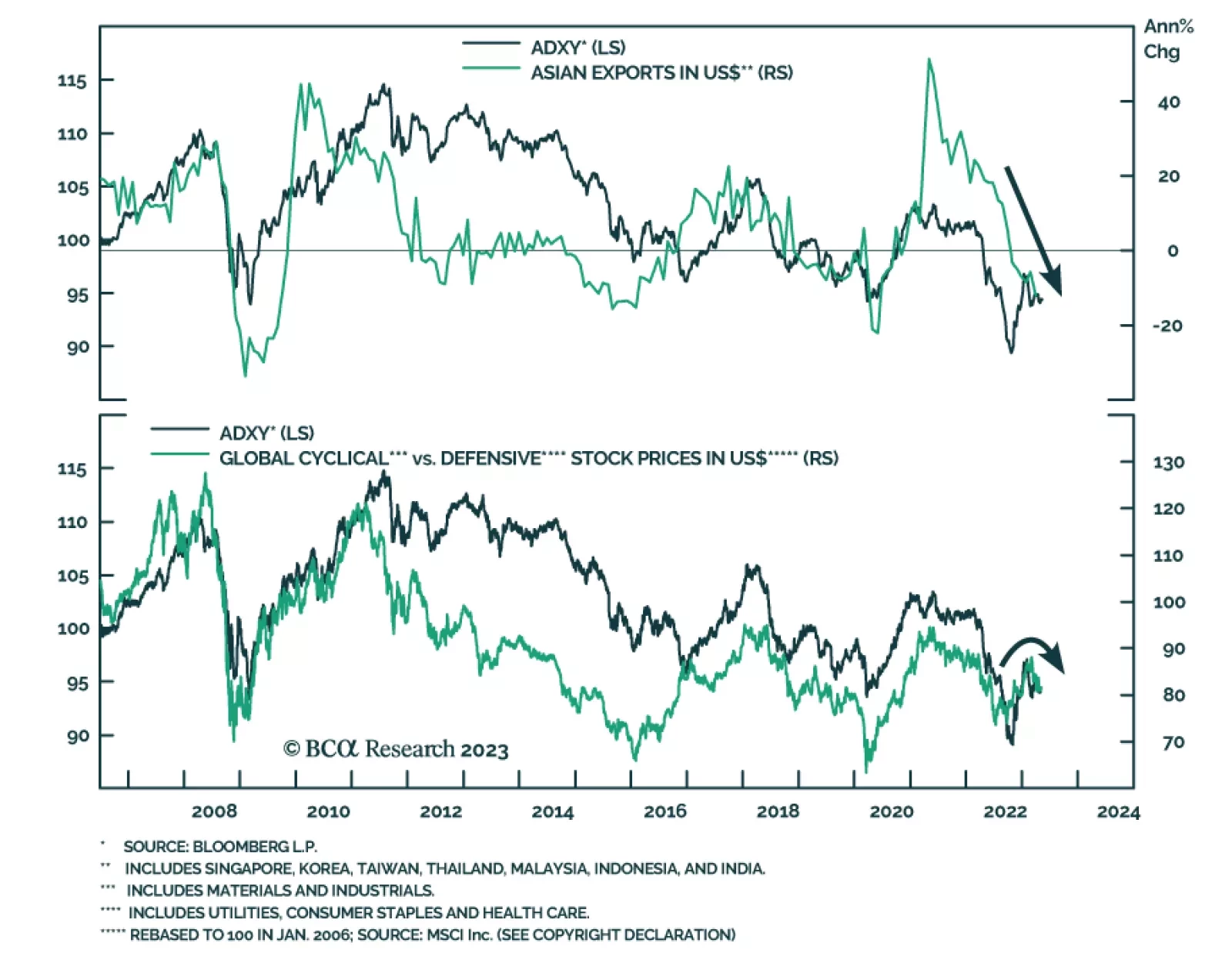

In an insight published a couple of weeks ago, we highlighted that the typically inverse relationship between the ADXY index of Asian currencies and the DXY recently broke down with both declining over the past few weeks. In…