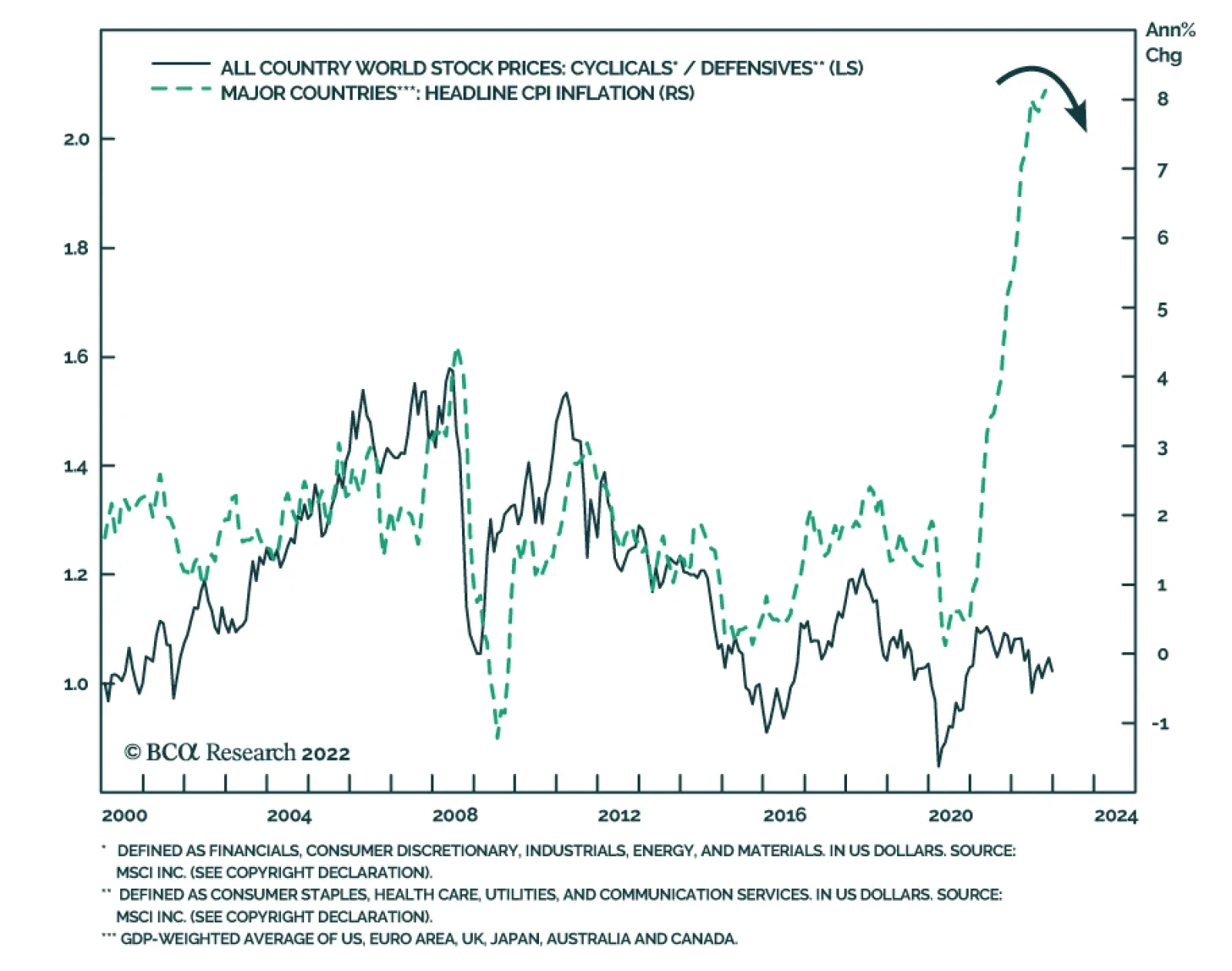

The latest CPI release provided further evidence that inflation has peaked in the US (see The Numbers). Going forward, price pressures will recede across major developed economies more broadly amid the resolution of pandemic…

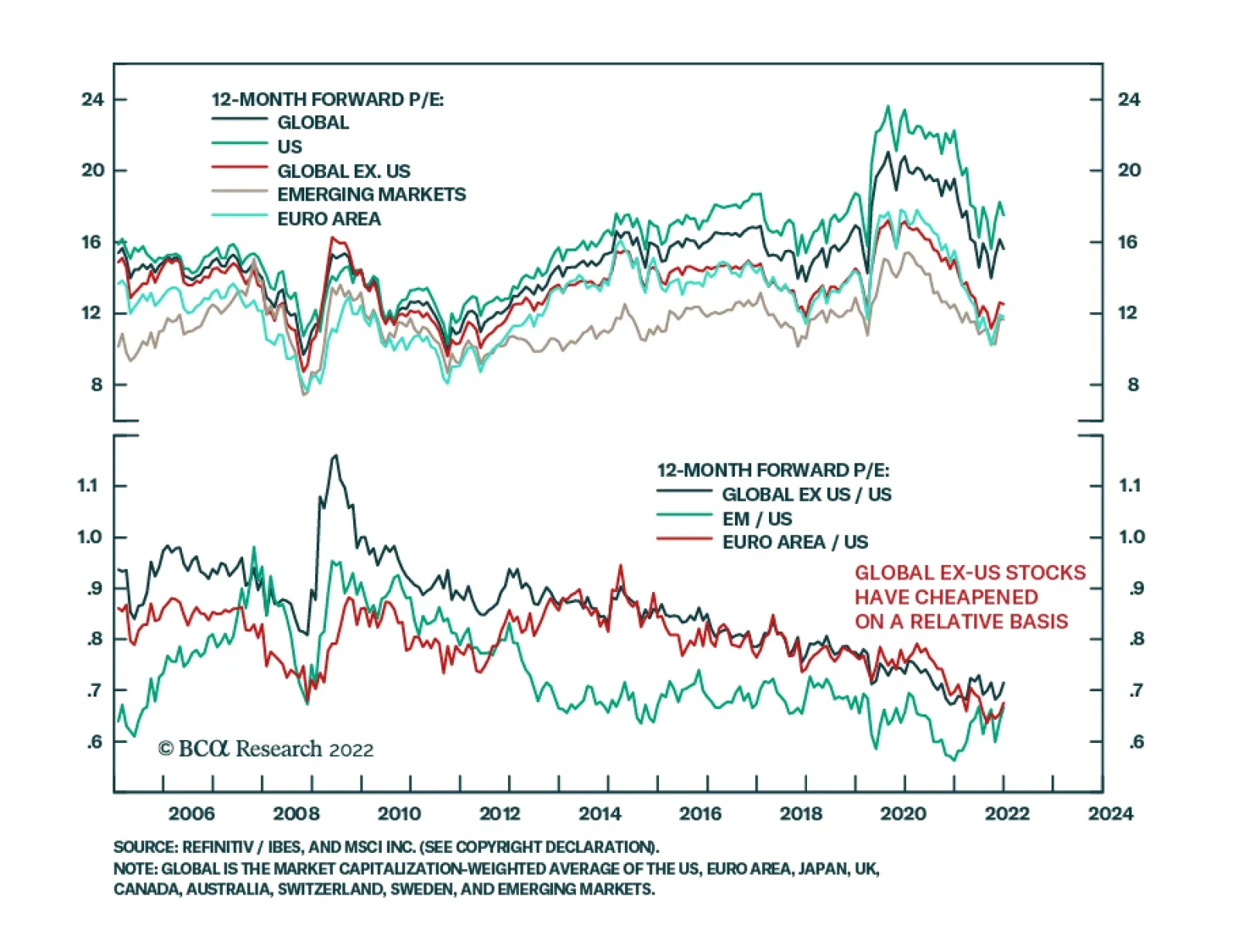

Prefer government bonds over stocks, defensive sectors over cyclicals, and large caps over small caps. Favor North America over other markets. Favor emerging markets like Southeast Asia and Latin America over Greater China, Turkey,…

In this Strategy Outlook, we present the major investment themes and views we see playing out next year and beyond.

Global ex-US equities have been outperforming US stocks since the beginning of November. While the relative improvement in European equities began earlier, it was initially offset by the underperformance of EM stocks in October.…

MacroQuant is overweight bonds, underweight equities, and neutral on cash. Within the equity universe, the model is underweight the US and overweight Japan, the UK, and Australia.

Our best calls of the year were long defensives over cyclicals, short Russia and emerging Europe, long aerospace/defense, short Greater China, and long Latin America. Our worst call of the year was long cyber security stocks.

Recession is not yet fully priced in, so markets have further to fall next year. But watch for a buying opportunity in the second half.