Excess job vacancies in the US and UK reflect a labour market that cannot efficiently match unemployed workers with vacant jobs. This is because excess job vacancies reflect the shortage of labour supply in the 50 plus age cohort,…

A client concerned about the slump in asset prices, the stubbornness of inflation, and rising bond yields asks what went wrong, and what happens next? This report is the full transcript of our conversation.

In this report, we identify 5 key signposts that will mark a turn in the dollar. These include technical conditions, foreign real interest rates, US (and global) yield curves, Chinese economic conditions and geopolitics. We then…

Provided that US inflation is due to excess demand rather than supply constraints, demand destruction will likely be needed to bring core inflation below 3.5%. Such growth contraction is positive for counter-cyclical currencies like…

Falling inflation will allow bond yields to decline in the major economies over the next few quarters. As such, we recommend that investors shift their duration stance from underweight to neutral over a 12 month-and-longer horizon…

We recommend that investors use the following framework to think about whether potential disinflation would be bullish or bearish for share prices: disinflation will prove to be bullish for global share prices if it is due to an…

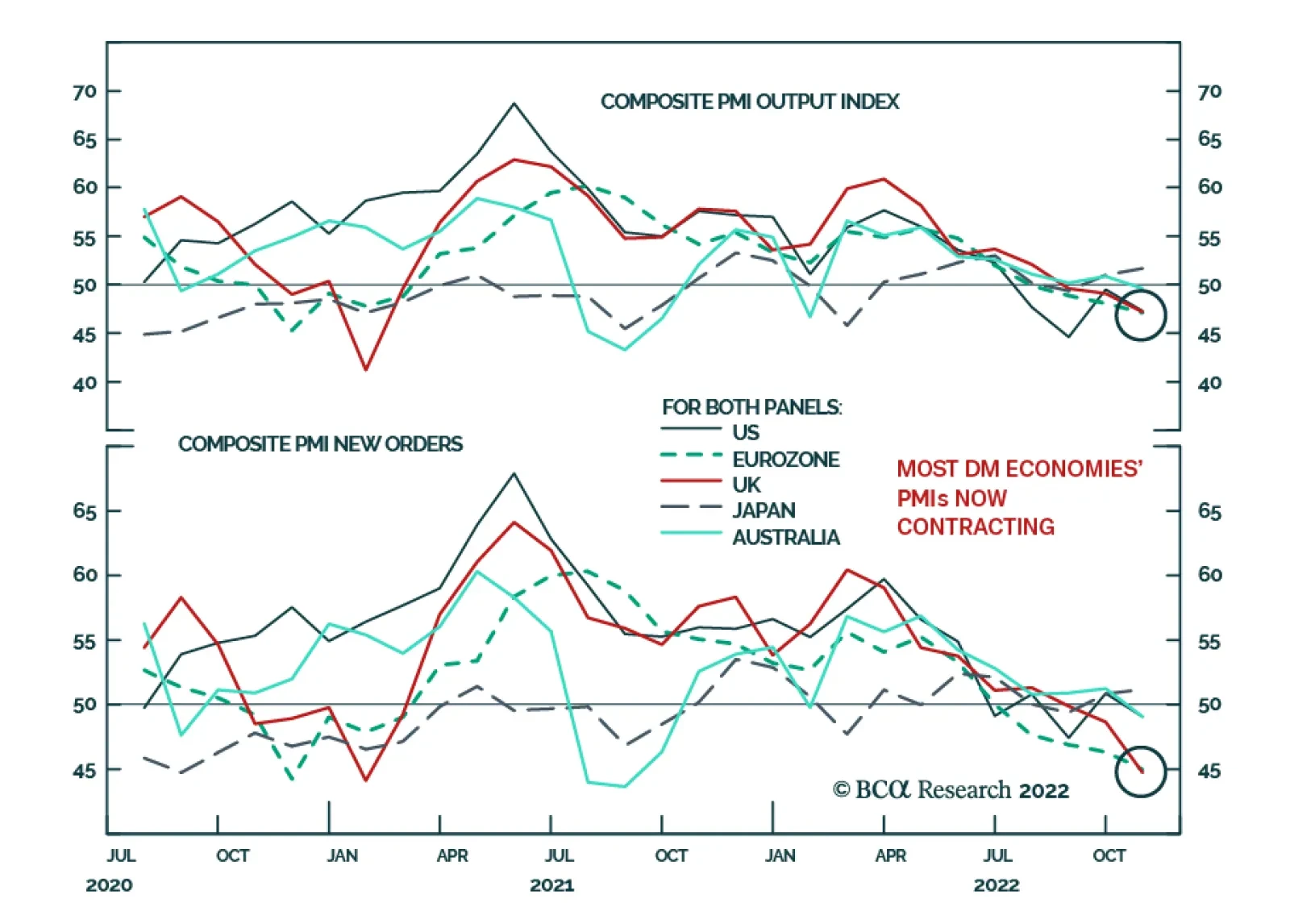

Preliminary October PMI estimates generally point to a broad-based deterioration in economic activity across DM economies. PMIs across the US, Australia, the Eurozone and the UK all deteriorated from September levels. Notably…

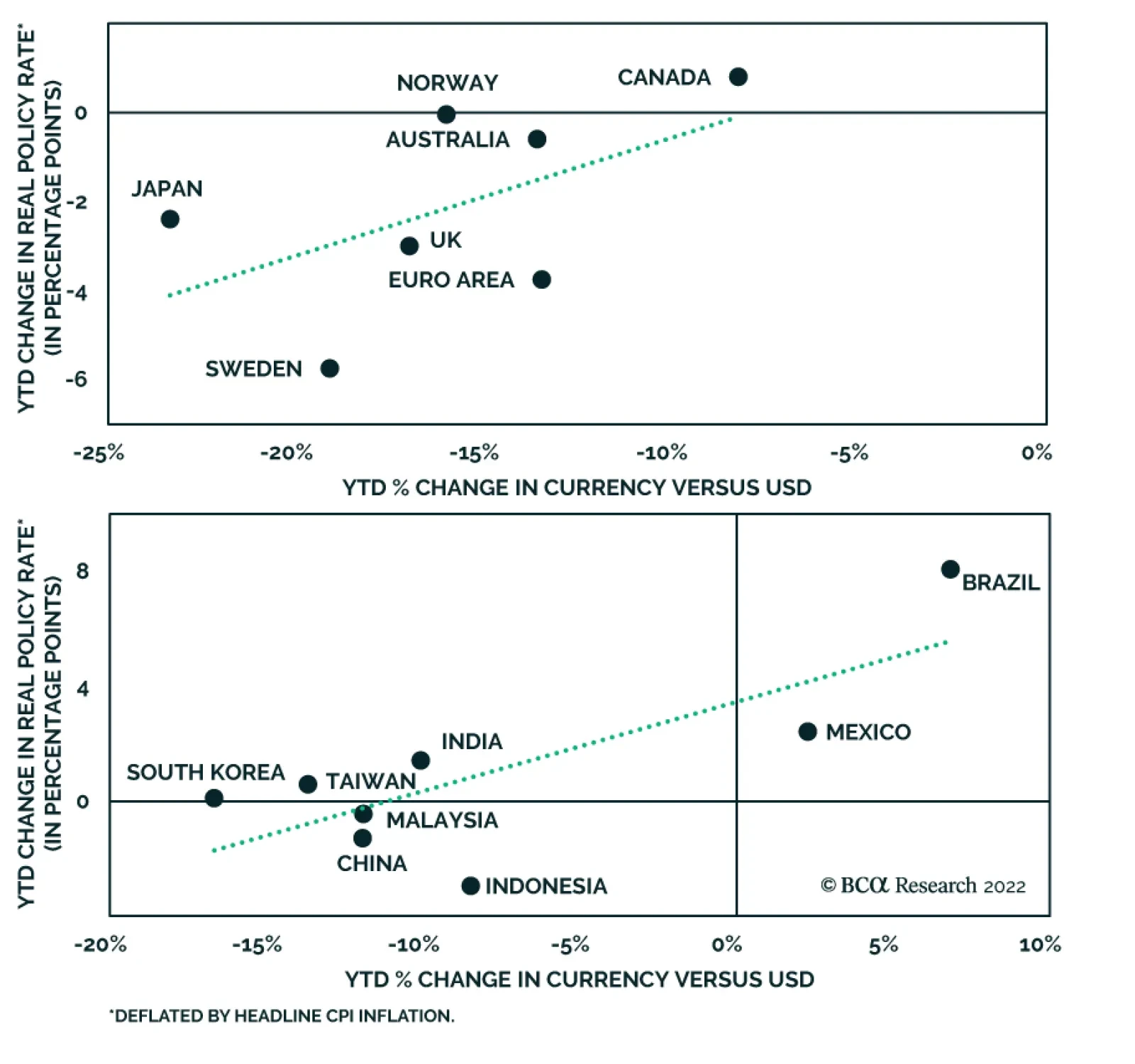

Relentless USD strength has caused nearly all major currencies to depreciate versus the greenback this year. However, the chart above highlights that domestic policy played a role in determining the extent of the weakness. The…