Dear Clients, In addition to this Weekly Report, you will also be getting a Special Report authored by some of our top strategists on global growth. The manufacturing recession that began in early 2018 has lasted longer than most…

One way to benefit from the global growth soft-patch is to go long global gold miners/short S&P oil & gas E&P stocks on a tactical three-to-six month basis. Since our Monday inception three days ago, this pair trade…

Highlights Portfolio Strategy Recession odds continue to tick higher, according to the NY Fed’s probability of recession model, at a time when global growth is waning, U.S. profit growth is contracting and the non-financial ex-…

Highlights The breakout in financial asset prices stands at odds with a deteriorating profit outlook. This suggests a high probability of a coiled-spring reversal in one of the two variables as we enter the thin summer trading months.…

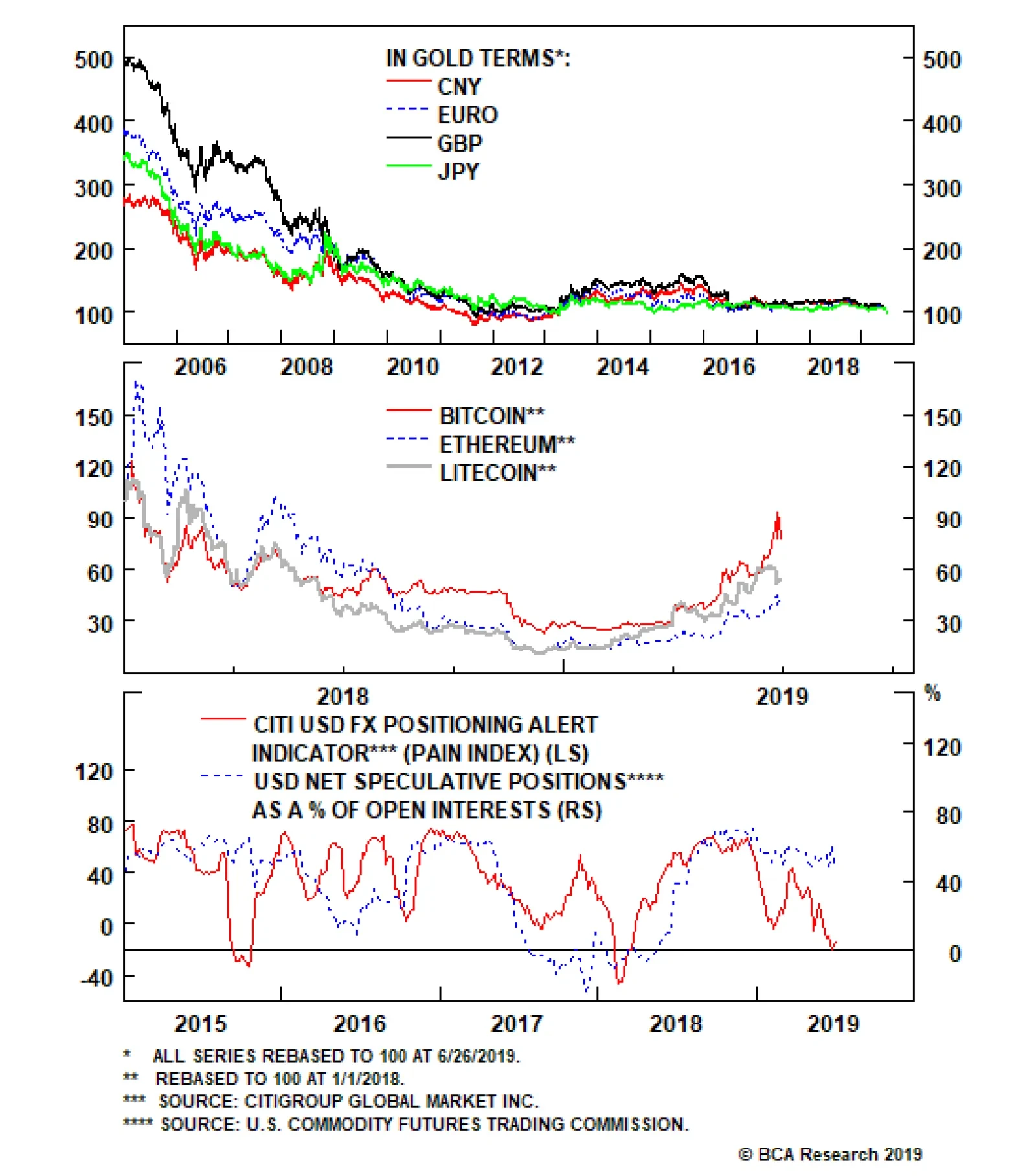

For all the talk about flexible exchange rate regimes, it seems as if the world’s major central banks have been fixing their exchange rates to the gold price. This suggests that gold price risks could be asymmetric to the…

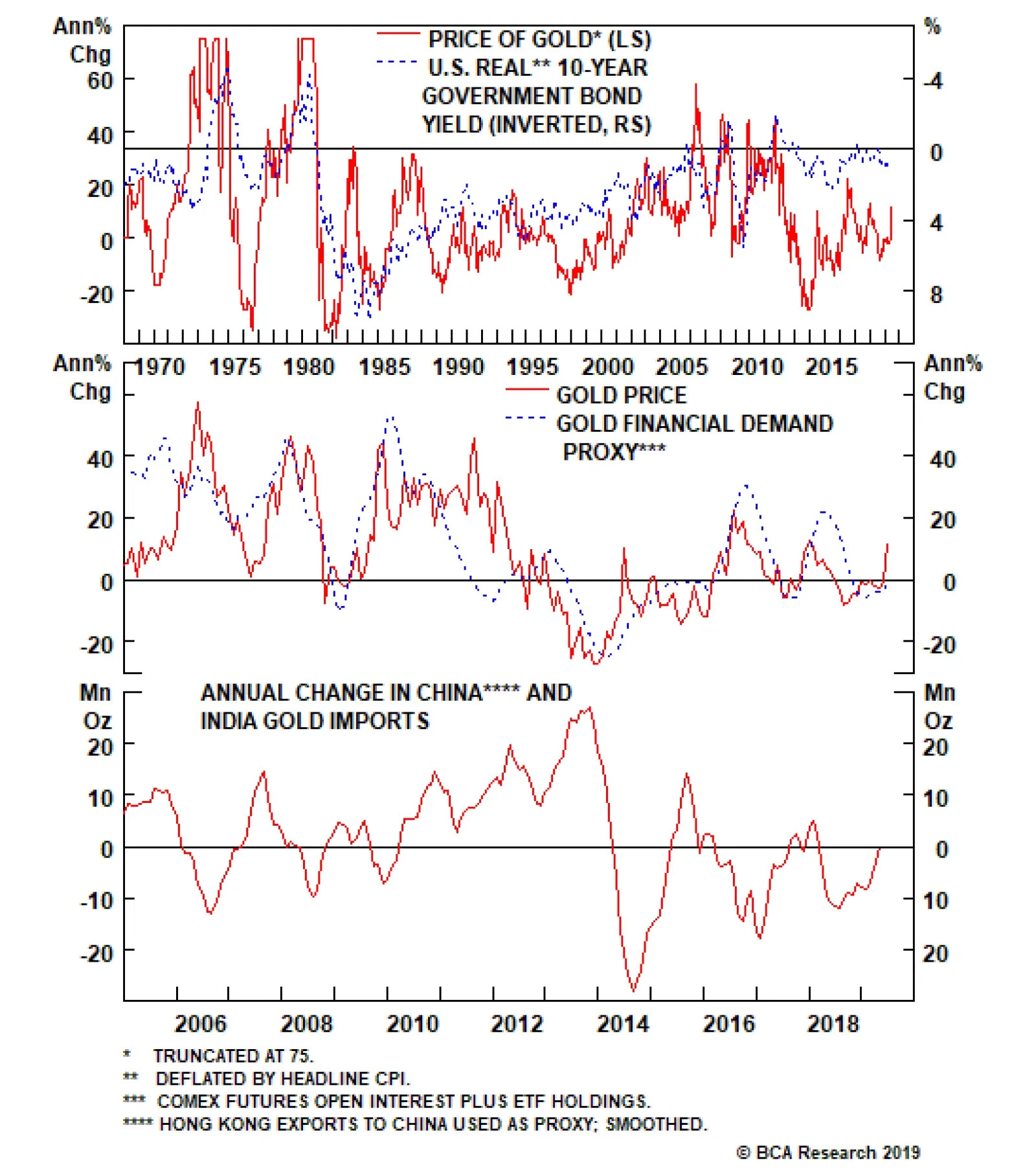

Almost every major economy now has or is inching towards negative real interest rates. Investors who are worried about the U.S. twin deficits and the crowded long Treasurys trade will shift into gold, especially as other major…

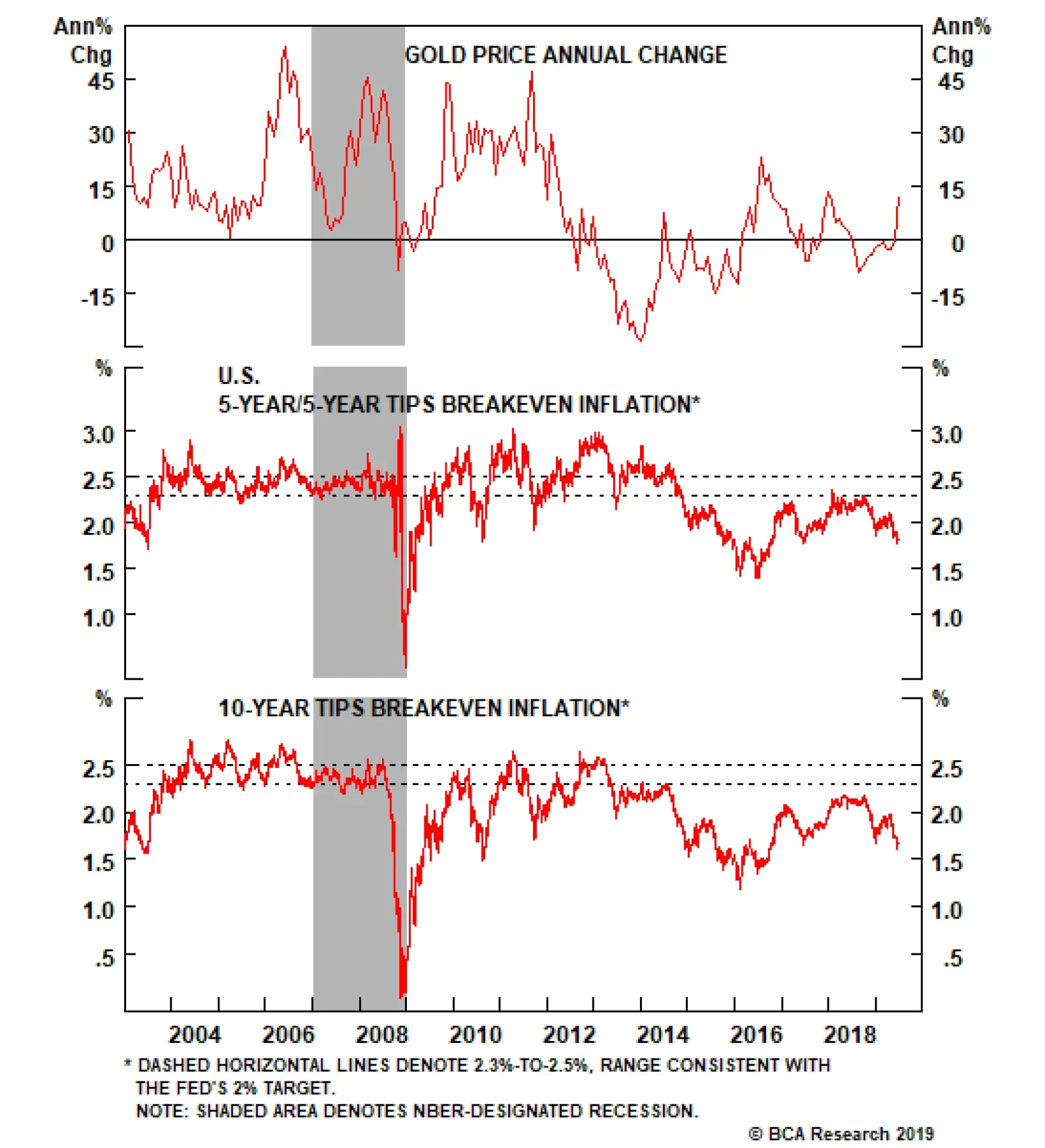

Highlights Portfolio Strategy Business sector selling price inflation is sinking like a stone following the bond market’s melting inflation expectations, at a time when wage inflation continues to expand smartly. There are good…

Highlights Fed policy is likely to proceed in two stages: An initial stage characterized by a highly accommodative monetary policy, followed by a second stage where the Fed is raising rates aggressively in response to…

Highlights The sharp fall in the bond-to-gold ratio is an important signal to pay heed to. It might suggest that confidence in the U.S. dollar is finally waning. If correct, the sharp rally in crypto currencies over the past few…

The U.S. economy remains near full employment. Investors therefore concluded that the “insurance cut” telegraphed by the Fed ahead of next month’s FOMC meeting stands a very good chance of finally goosing…