There is a high probability that the global economy will tip into recession in the second half of 2024. A long yen position is an excellent hedge against that risk.

In this report, we present the quarterly review of the Global Fixed Income Strategy Model Bond Portfolio. The portfolio remains positioned for slower global growth momentum over the next 6-12 months, favoring government bonds over…

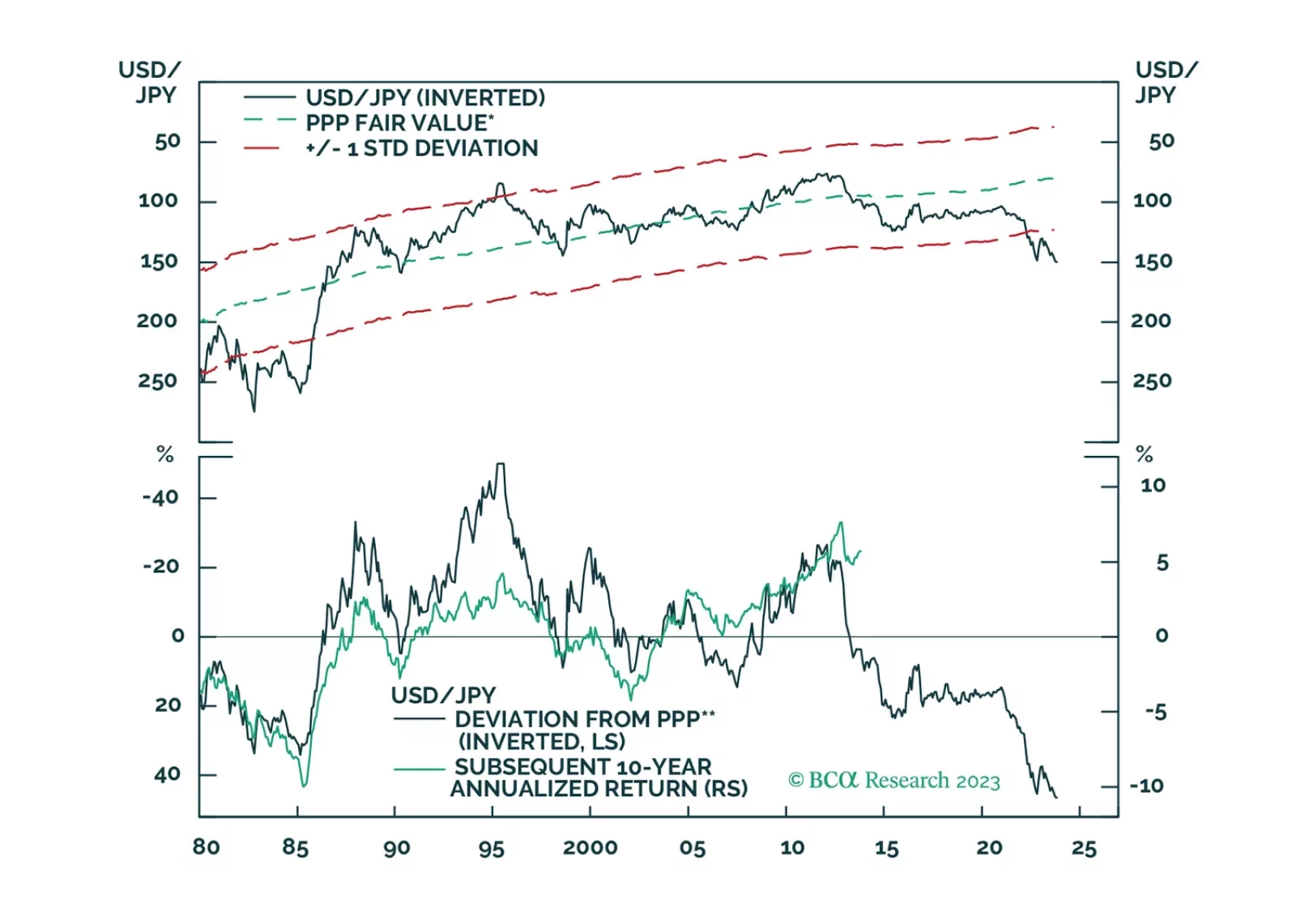

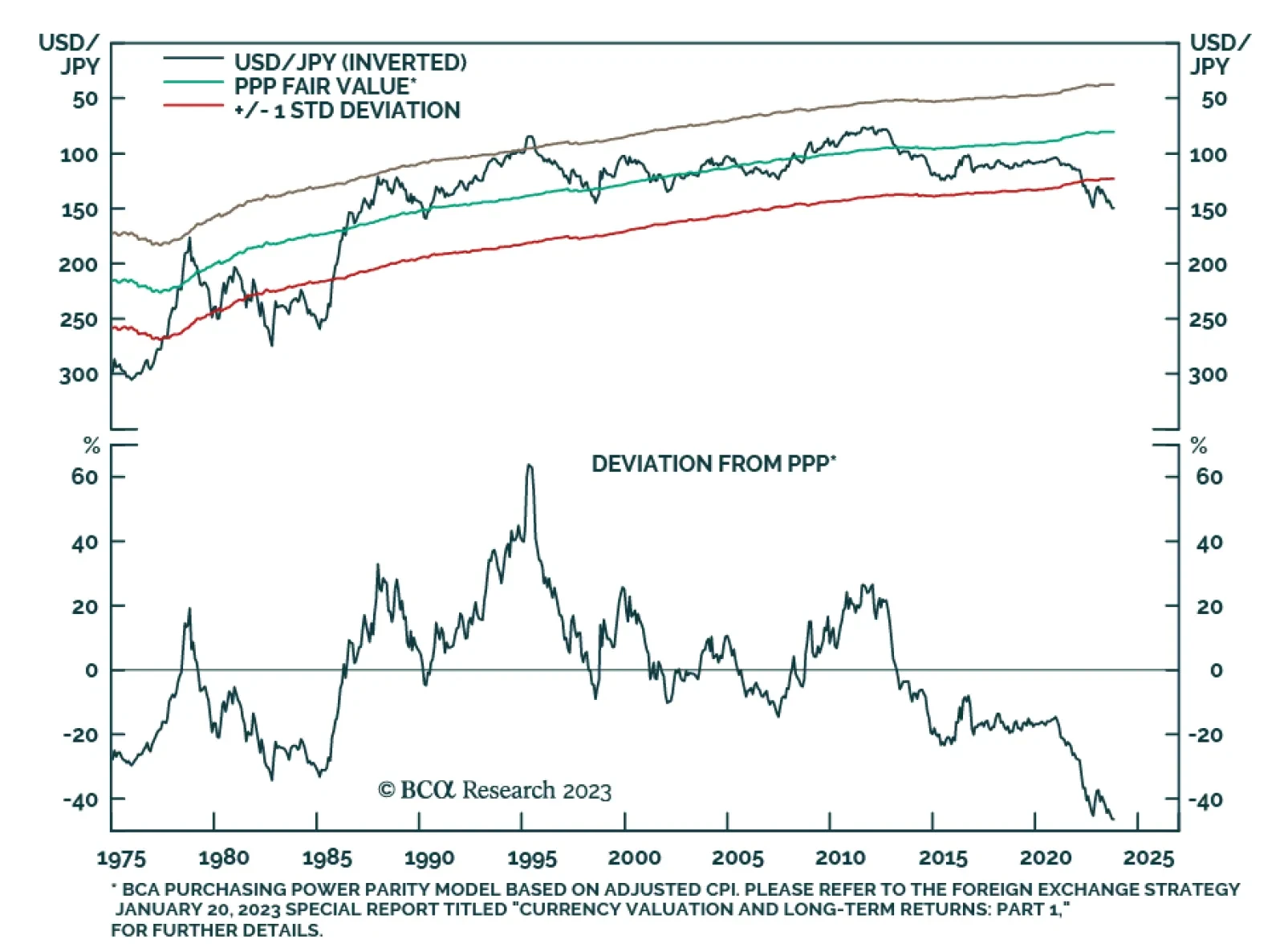

The Japanese yen has depreciated by 12.6% against the USD year-to-date. This exceeds the 1.6% depreciation and 0.8% appreciation by the euro and British pound against the US dollar respectively. With the higher-for-longer…

Aggressive monetary tightening has always led to recession, although the timing is uncertain. The effects of high interest rates are starting to be felt. Investors should stay risk off and buy government bonds as a safe haven…

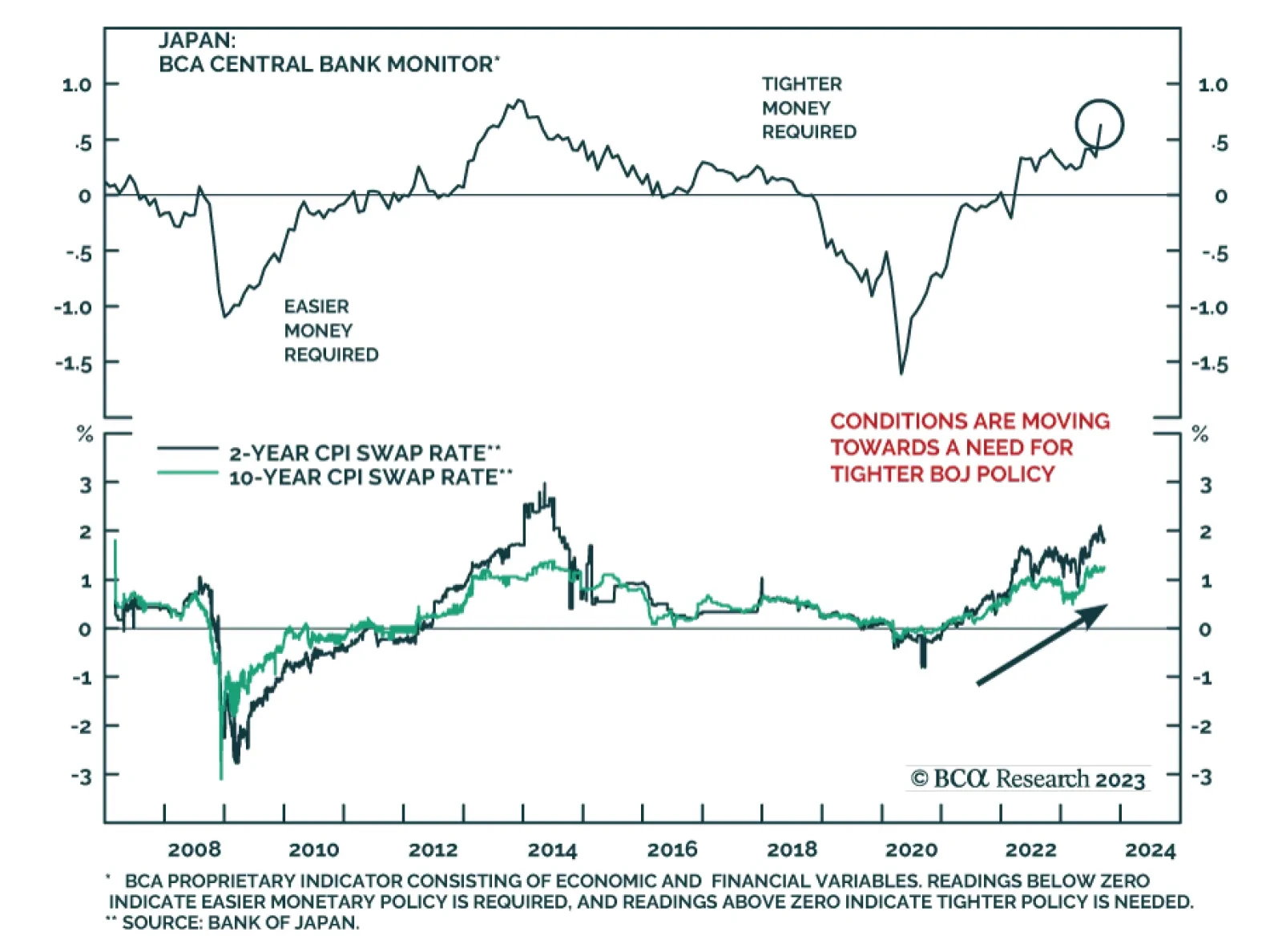

The BoJ remains an outlier among global DM central banks. While many of its peers are now debating whether to end their rate tightening cycles, the Japanese central bank has not even started raising interest rates yet.…

As expected, the Bank of Japan voted unanimously to keep policy unchanged on Friday. The policy rate remains at -0.1% and the central bank maintains Yield Curve Control (YCC) on 10-year JGB yields. To the extent that the BoJ…

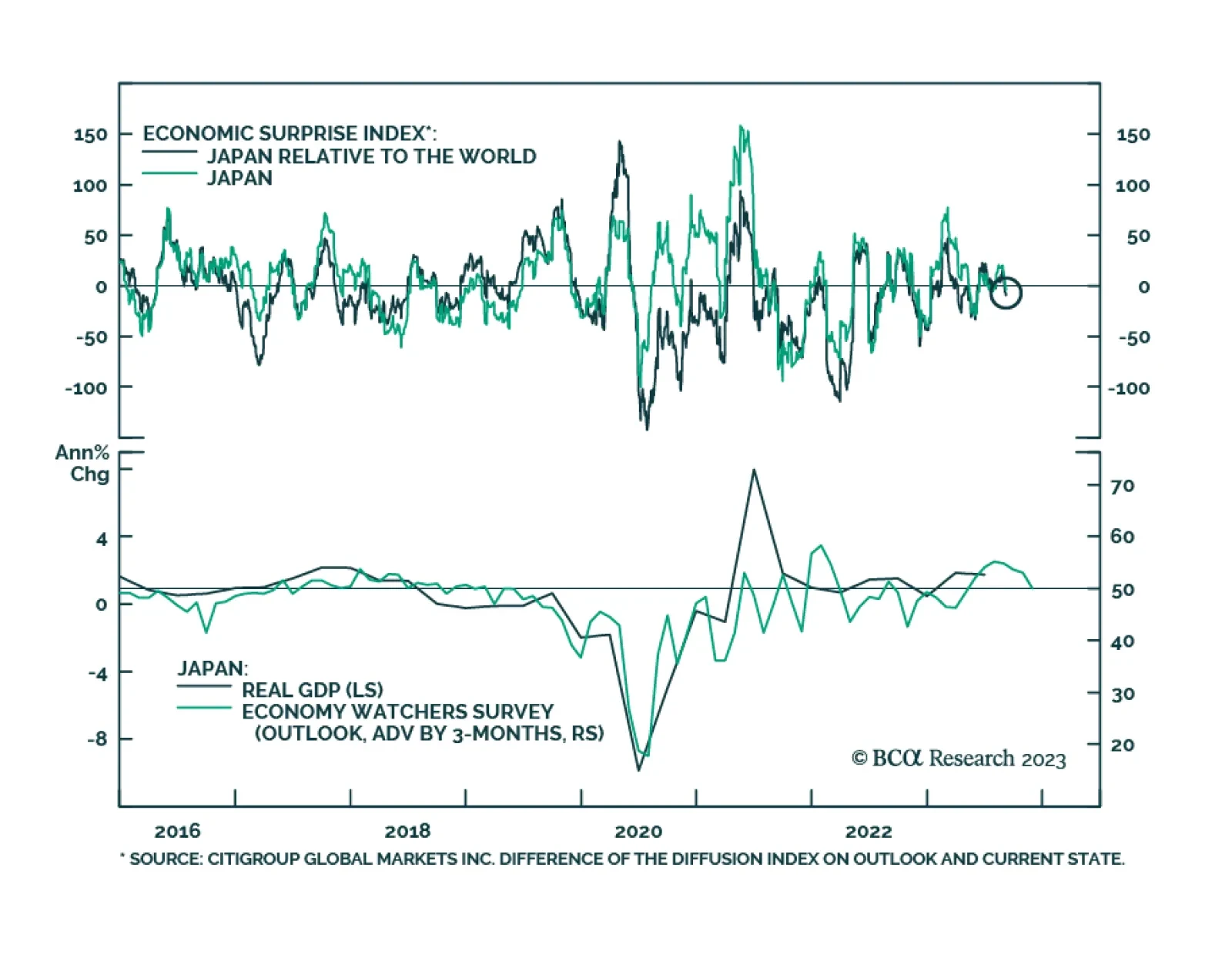

Japanese economic data delivered a negative surprise on Friday. Q2 GDP growth was revised down from 1.5% q/q to 1.2% q/q, below expectations of 1.4% q/q. The downwards revision reflects a 1% q/q decline in business spending (…

A global recession continues to be likely over the next 12 months. The impact of tighter monetary policy is slowly being felt. Government bonds look increasingly attractive as a safe haven.

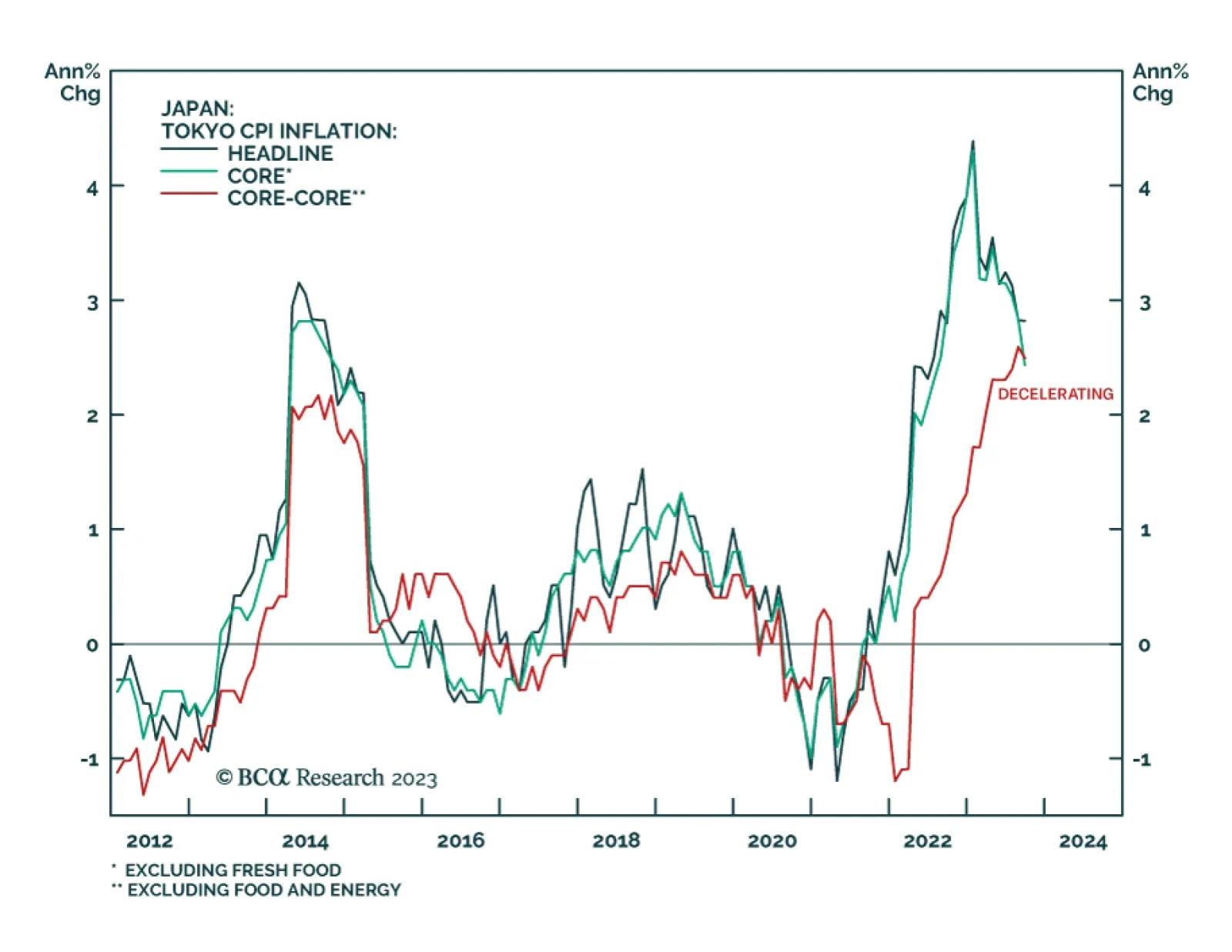

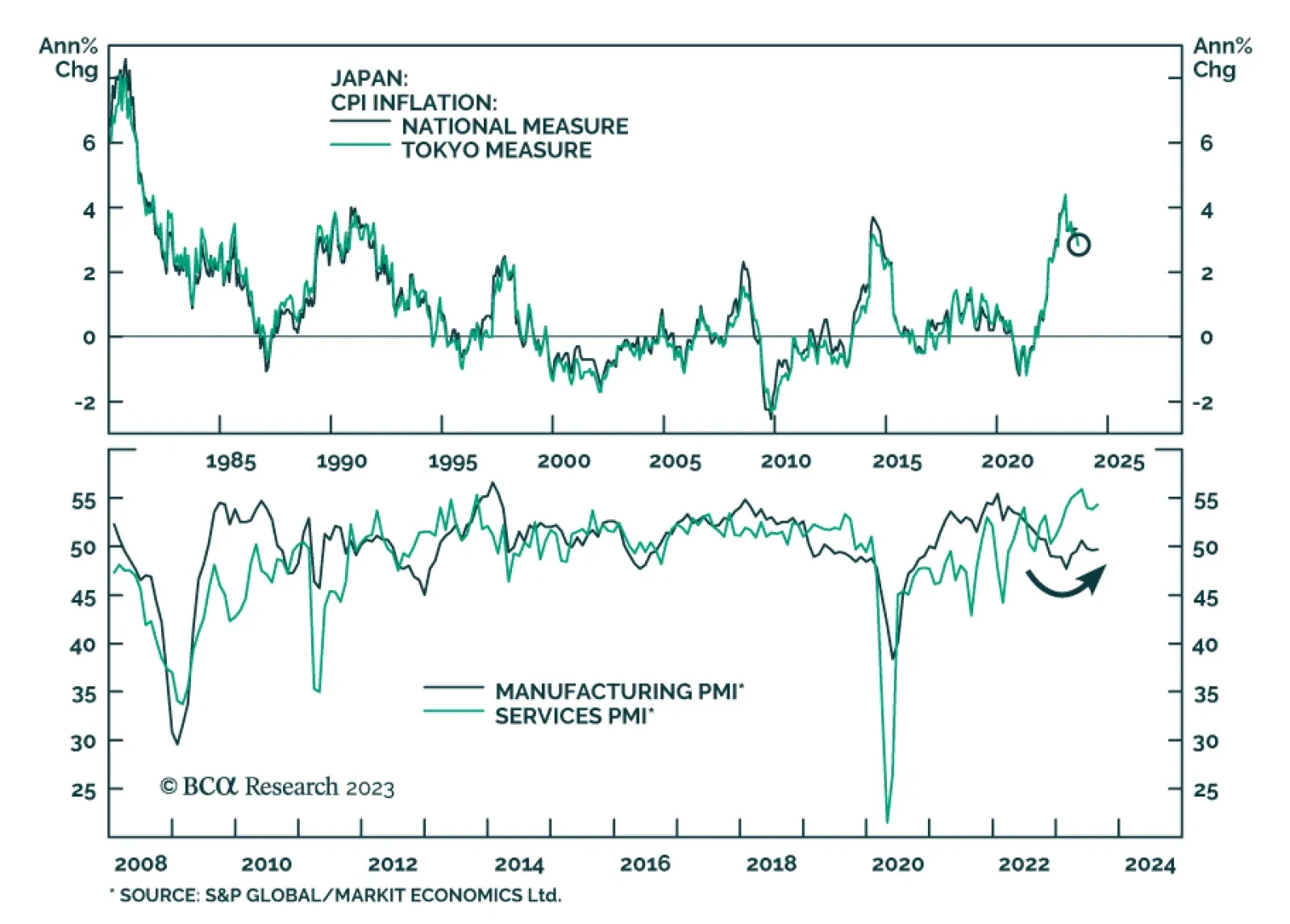

Tokyo’s headline CPI inflation fell below expectations in August, easing from 3.2% y/y to 2.9% y/y – slightly below anticipations of 3.0% y/y and the first dip below 3% in nearly one year. Similarly, the slowdown in…

In this report, we assess the best opportunities in inflation-linked bonds in the major developed economies, based on trends in growth, inflation and the stance of monetary policies in each country. We conclude that the environment…