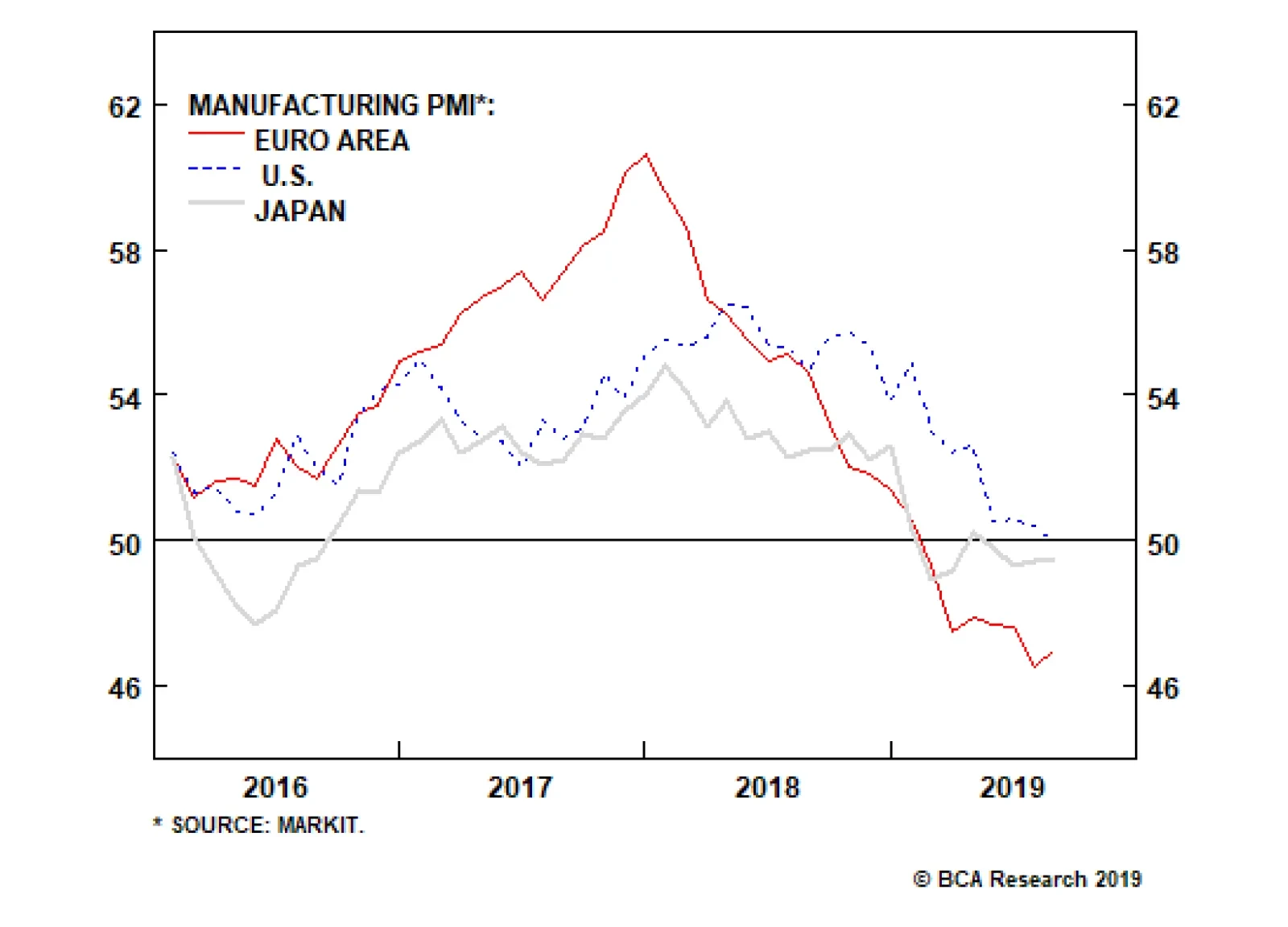

Highlights The global manufacturing cycle is likely to bottom soon, and consumption and services remain robust. The risk of recession over the next 12 months is low. This suggests that equities will continue to outperform bonds. But…

Highlights The world remains mired in a manufacturing recession. As such, it is still too early to put on fresh pro-cyclical trades. Focus on the crosses rather than outright U.S. dollar bets. Two new trade ideas: sell EUR/NOK and…

Highlights The structural message for equities: prefer equities over bonds. As long as the global 10-year bond yield remains below 2 percent, the equity market’s rich valuation is underpinned, albeit the long-term return from…

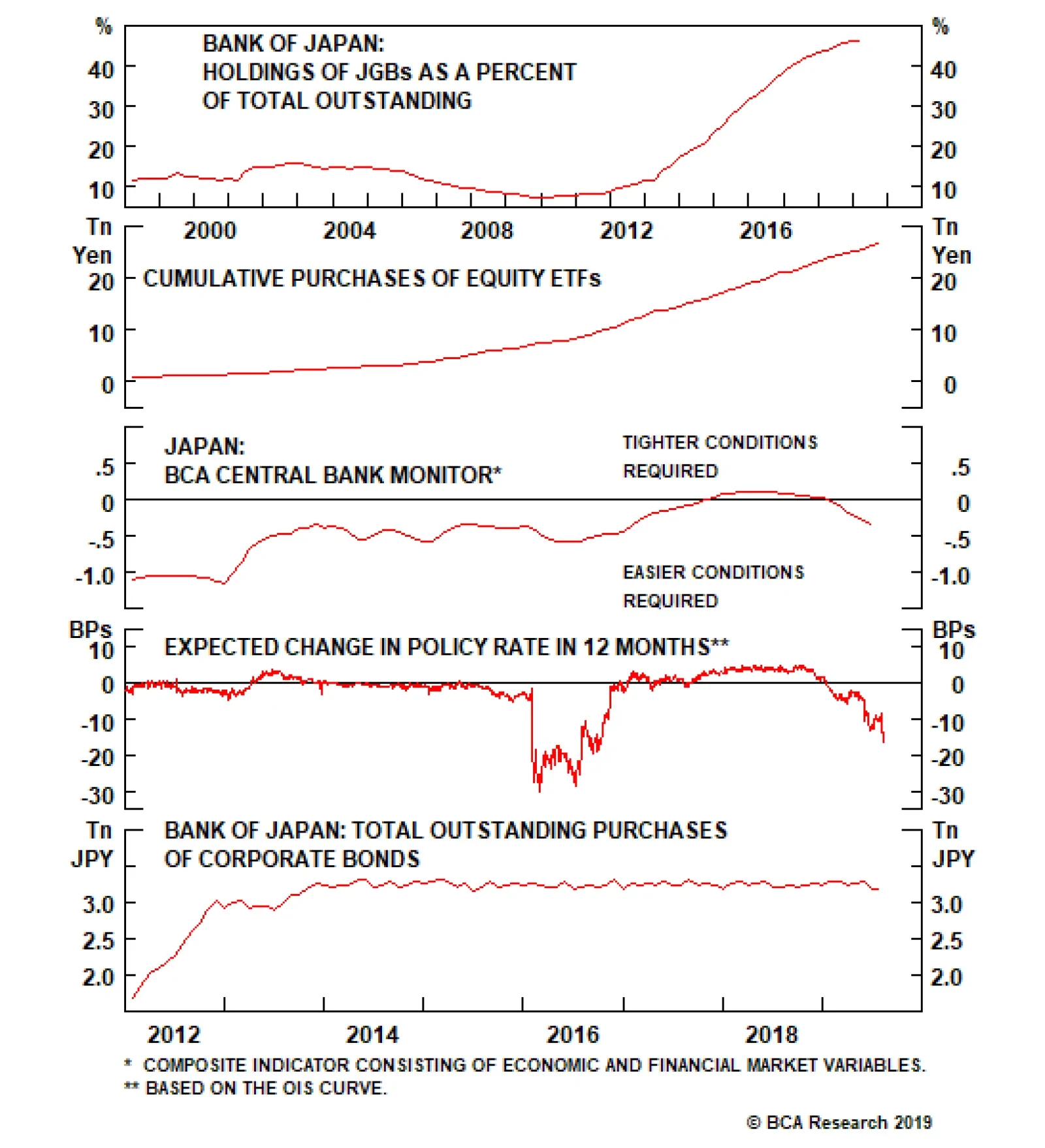

Since Kuroda became governor in 2013, the Bank of Japan has rolled out aggressive monetary easing. It has cut rates to -0.1% and introduced a policy of “yield curve control,” which aims to keep the yield on 10-year…

This morning, the Flash PMI saw a stabilization in the European manufacturing sector. Euro area manufacturing PMI moved up to 47 from 46.5, and in Germany, it rose to 43.6 from 43.2. In Japan, the manufacturing PMI also…

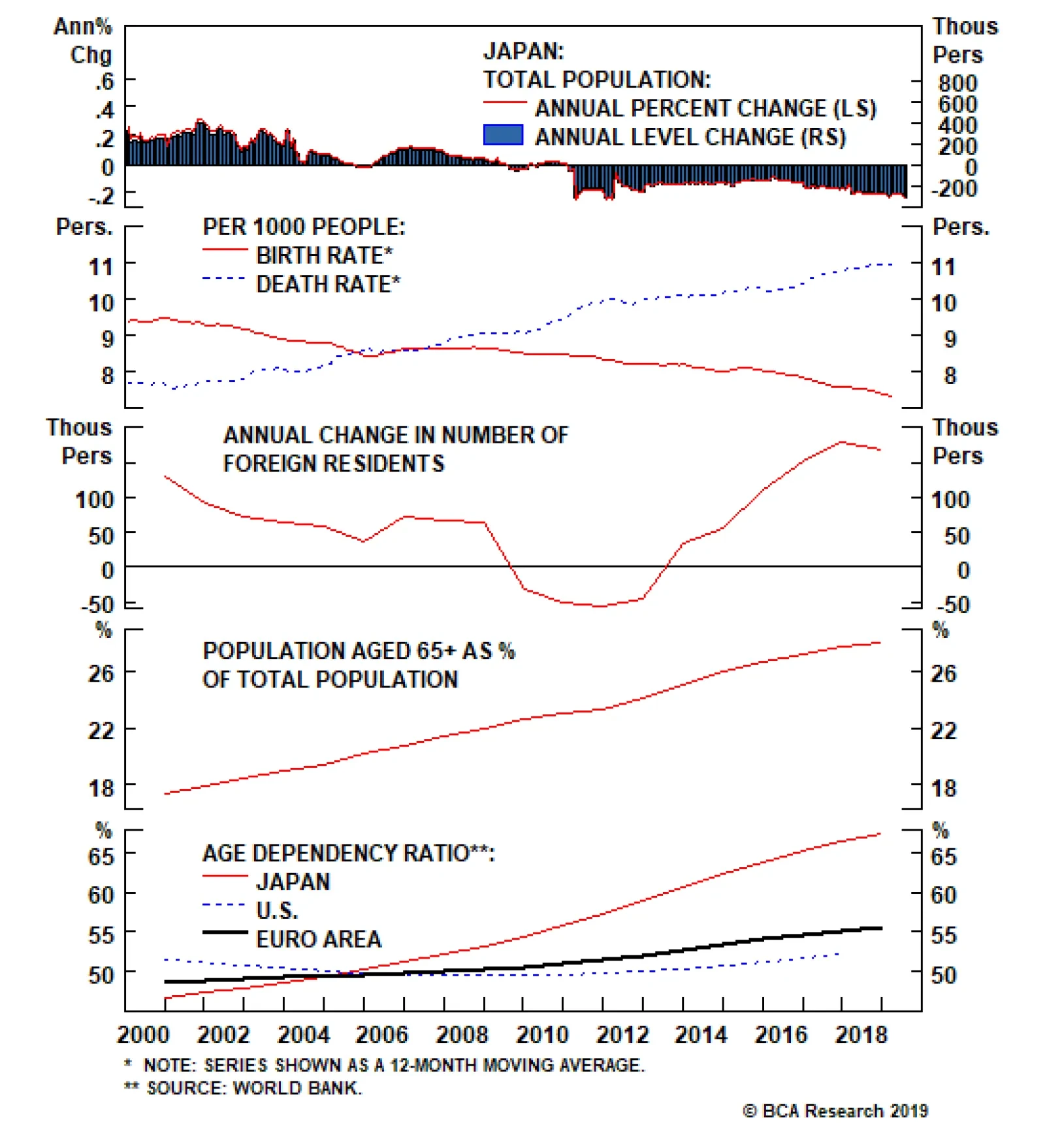

Deteriorating demographics is a key reason why inflation has remained subdued. The Japanese population peaked in 2009 and, over the past eight years, has shrunk on average by 0.2%, or 220,000 people, a year. Furthermore, the…

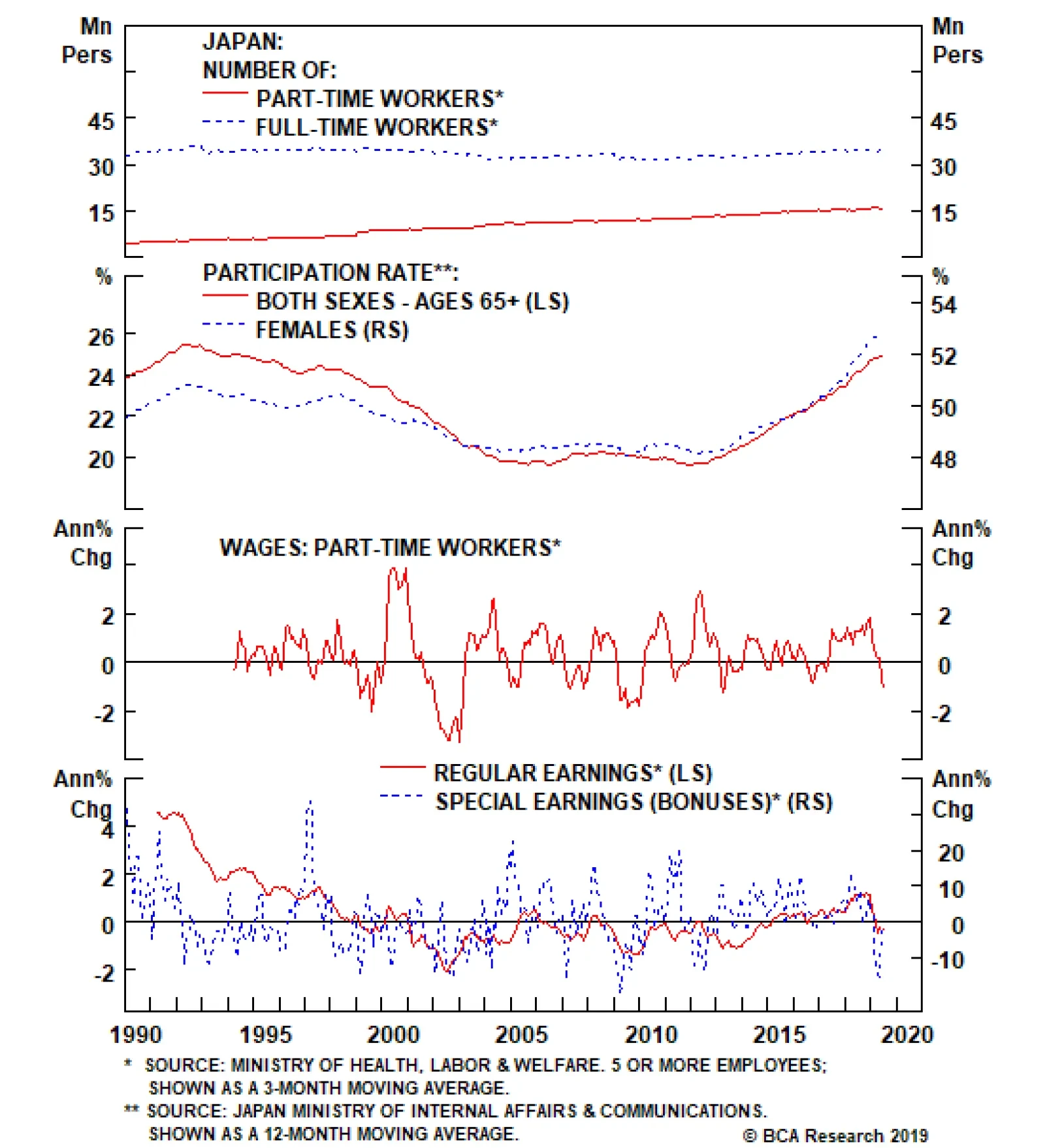

Japan’s labor market appears very tight. The unemployment rate is 2.3%, the lowest since the early 1990s, and the jobs-to-applications ratio is 1.61, the highest since the 1970s. And yet wage growth has remained stagnant,…

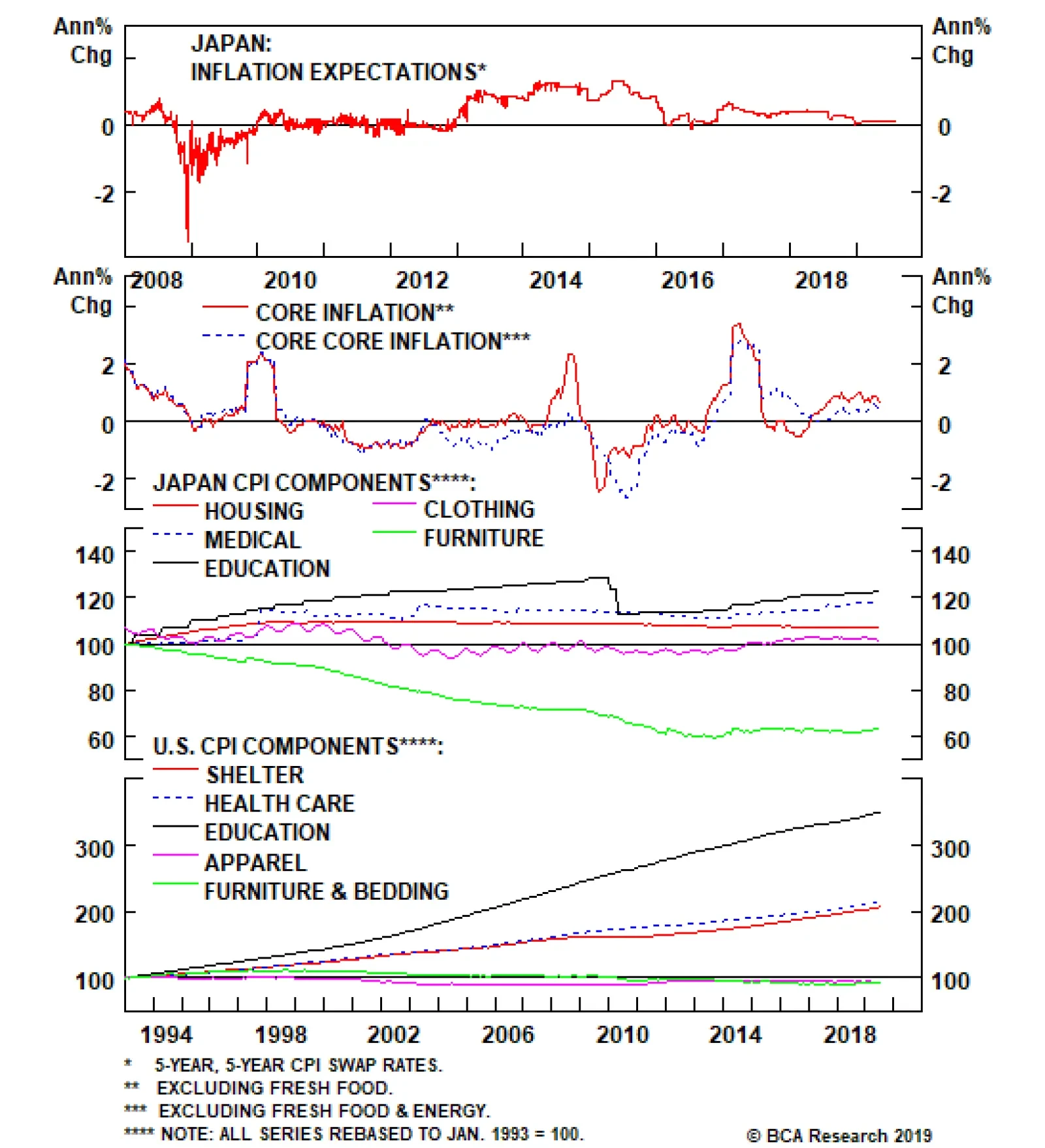

The market clearly does not believe that Bank of Japan (BoJ) Governor Haruhiko Kuroda can raise inflation to the BoJ’s target of 2%, despite negative interest rates and massive quantitative easing. The 5-year/5-year forward…