Slowing global growth and inflation as well as a strong trade-weighted dollar could very well put a bid under the price of Treasury bonds over the next few months, especially as speculators are still large sellers of the whole U.…

Feature Asset Allocation Amid Late-Cycle Turbulence BCA today published its 2019 Outlook, Late-Cycle Turbulence,1 our annual discussion with long-time clients Mr X and his daughter, Ms X. Recommendations This note is simply to…

Mr. X and his daughter, Ms. X, are long-time BCA clients who visit our office toward the end of each year to discuss the economic and financial market outlook. This report is an edited transcript of our recent conversation. Mr. X: I have…

Dear Client, Early next week, we will be sending you our BCA Outlook 2019 - our annual dialogue with the bearishly inclined Mr. X and his family. In this report, BCA editors will highlight the most impactful themes for the global…

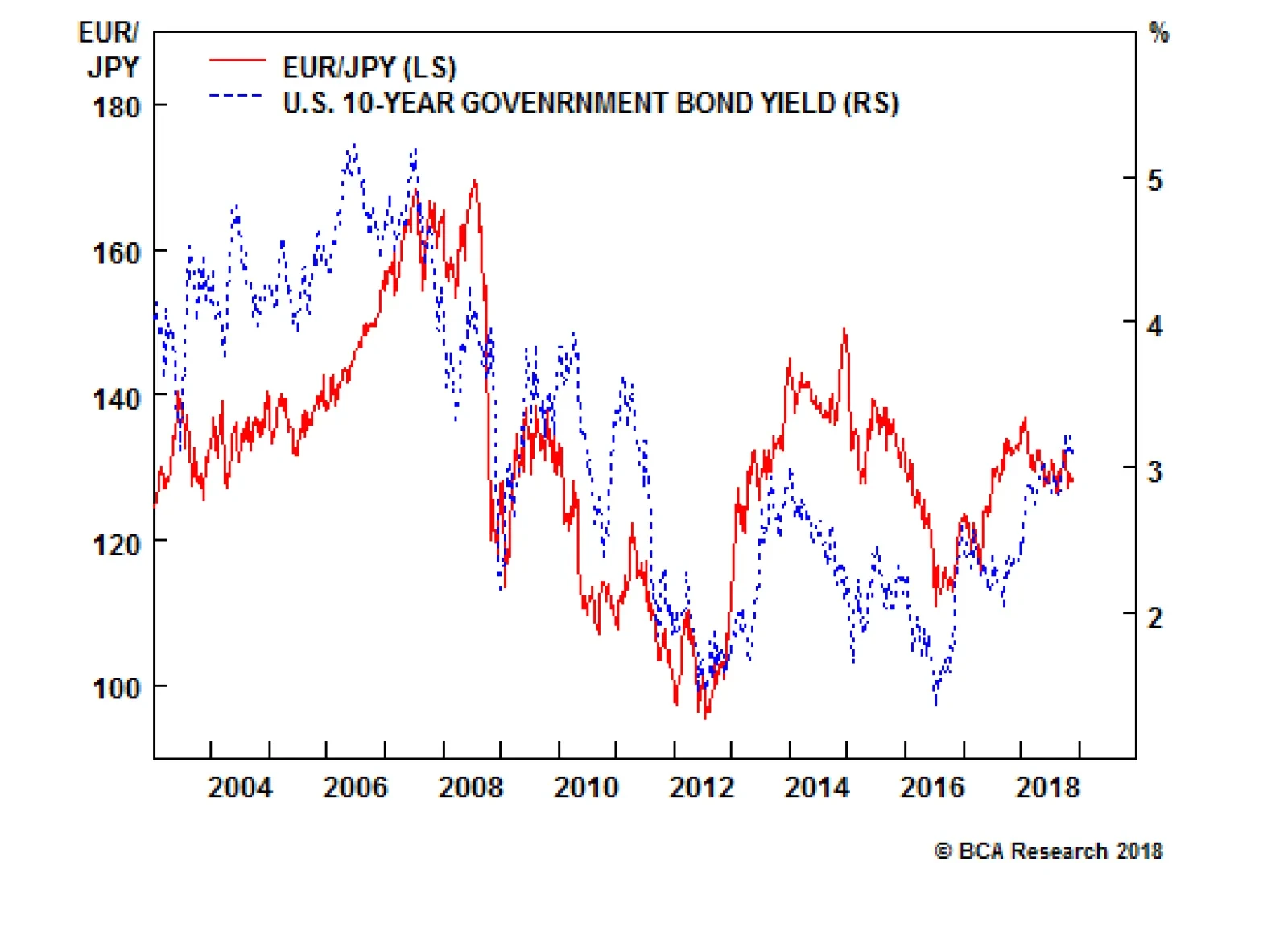

Highlights We do not view October's equity downdraft as a signal to further trim risk assets to underweight. Nonetheless, stocks have not yet fallen enough to justify buying either. The economic divergence between the U.S. and the…

Highlights Historically, the dollar exhibits positive seasonality in October and November. Technical and valuation indicators suggest that this year will be no exception. Continuing divergence between U.S. and global growth, rising…