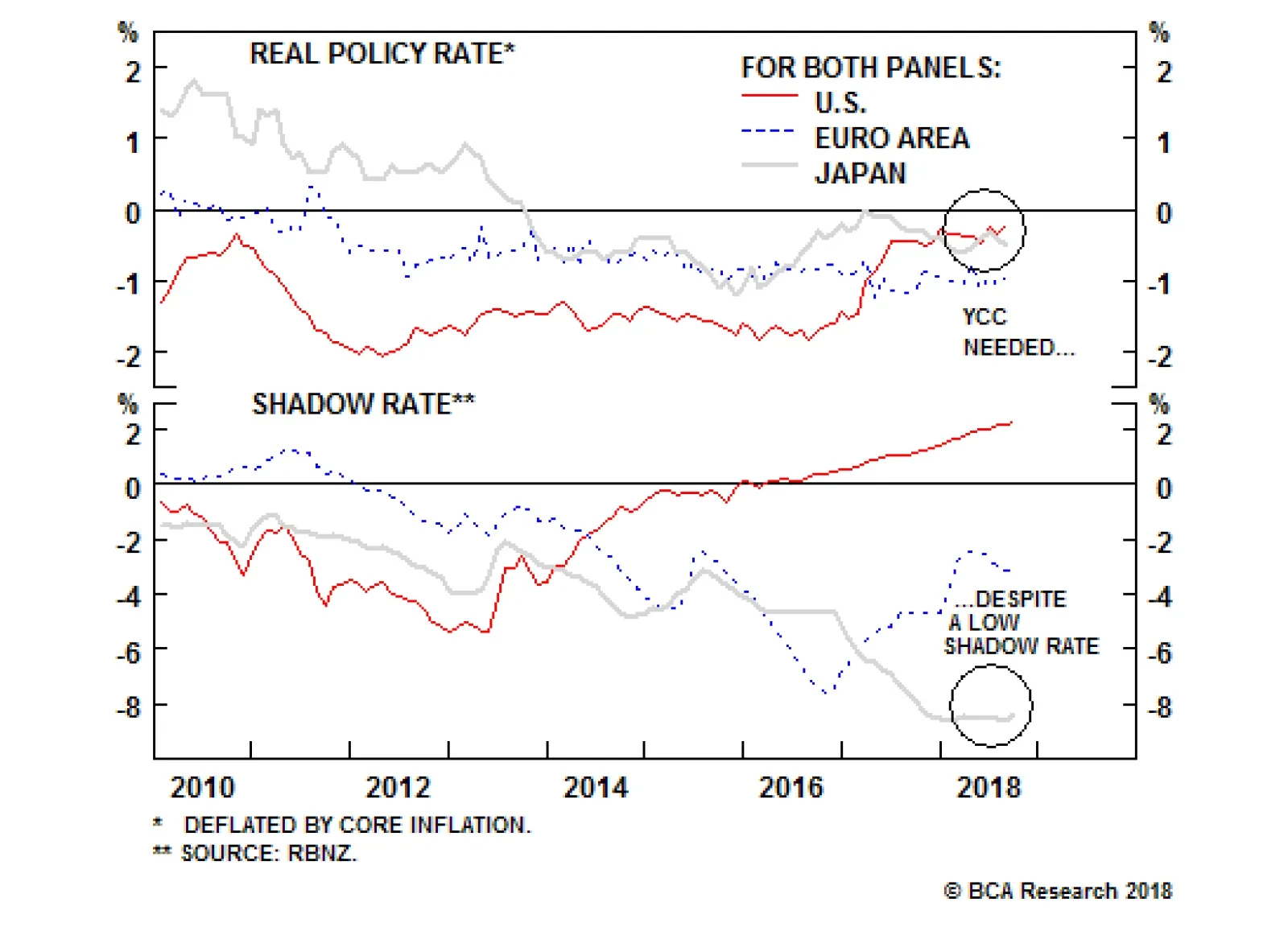

Since Japan still faces a fiscal cliff next year and inflation expectations have not yet been unmoored to the upside, the current increase in Japanese wages is not enough to push the BoJ to abandon its Yield Curve Control (YCC)…

Highlights Recommended Allocation We don't see any change over the next six to 12 months to the current trends of strong U.S. growth, continuing Fed hikes, rising long-term interest rates, and an appreciating dollar. We…

Highlights Macro outlook: Global growth will continue to decelerate into early next year on the back of brewing EM stresses and an underwhelming policy response from China. Equities: Stay neutral for now, while underweighting EM…

Highlights The U.S. dollar is likely to correct further over the coming weeks. The CAD should benefit as it is cheap and oversold, and the inflationary back-drop warrants tighter monetary conditions. This will be a bear market rally,…

Highlights In this Weekly Report, we present our semi-annual chartbook of the BCA Central Bank Monitors. The message now conveyed by the Monitors is that divergences between the cyclical pressures faced by the individual central banks…

Highlights Two key issues will remain important drivers of global financial markets in the coming quarters: the direction of the dollar and Chinese policy stimulus. Policy and growth divergences will remain tailwinds for the dollar…

Highlights It has not been a lot of fun being a corporate bond investor in 2018. Global credit markets have struggled to deliver positive returns, amid a news flow that has been overwhelming at times. Geopolitical uncertainty, shifting…