After considering some of the most common bullish arguments, we stand by our recession view and reiterate our defensive asset allocation recommendations.

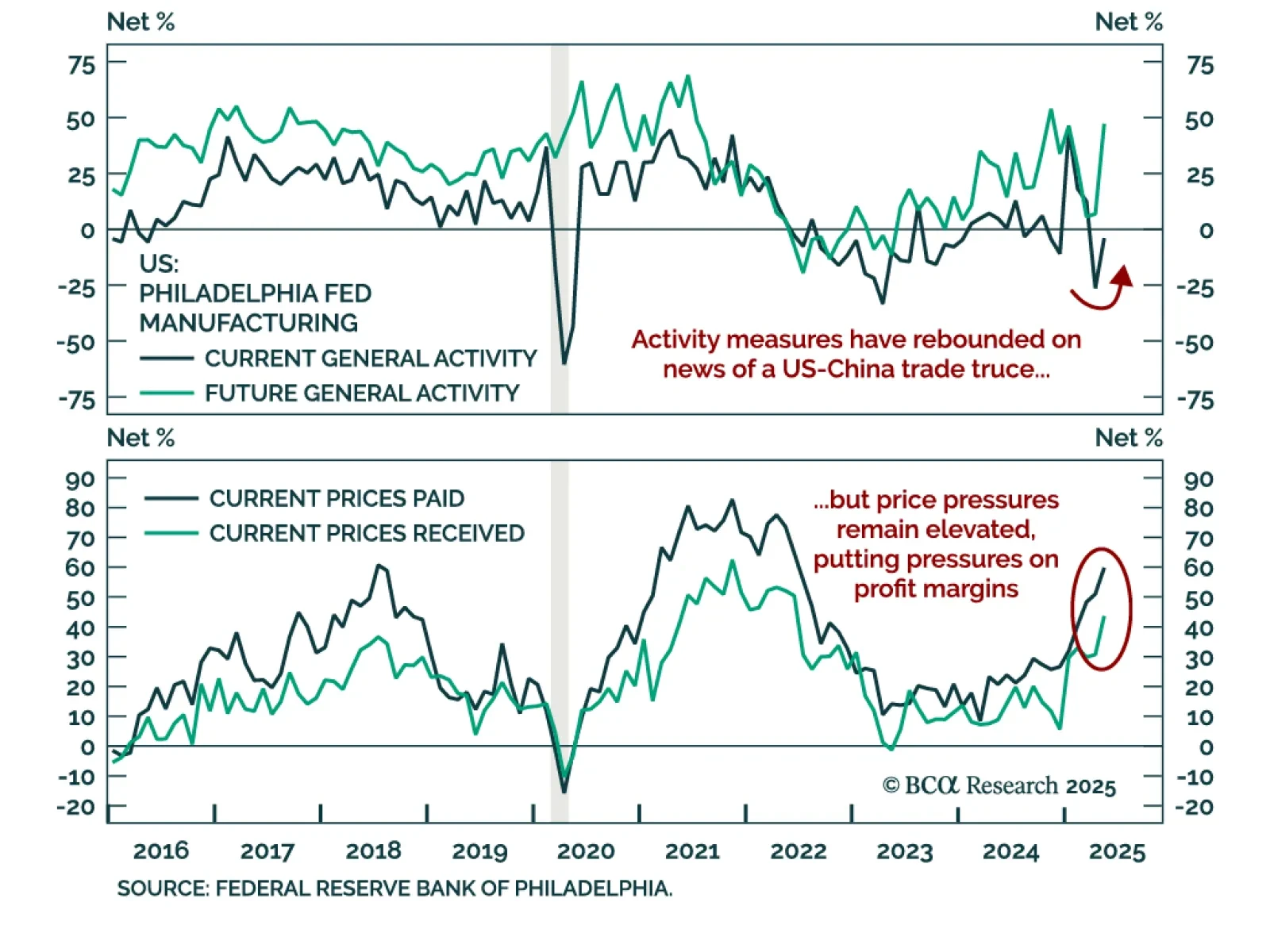

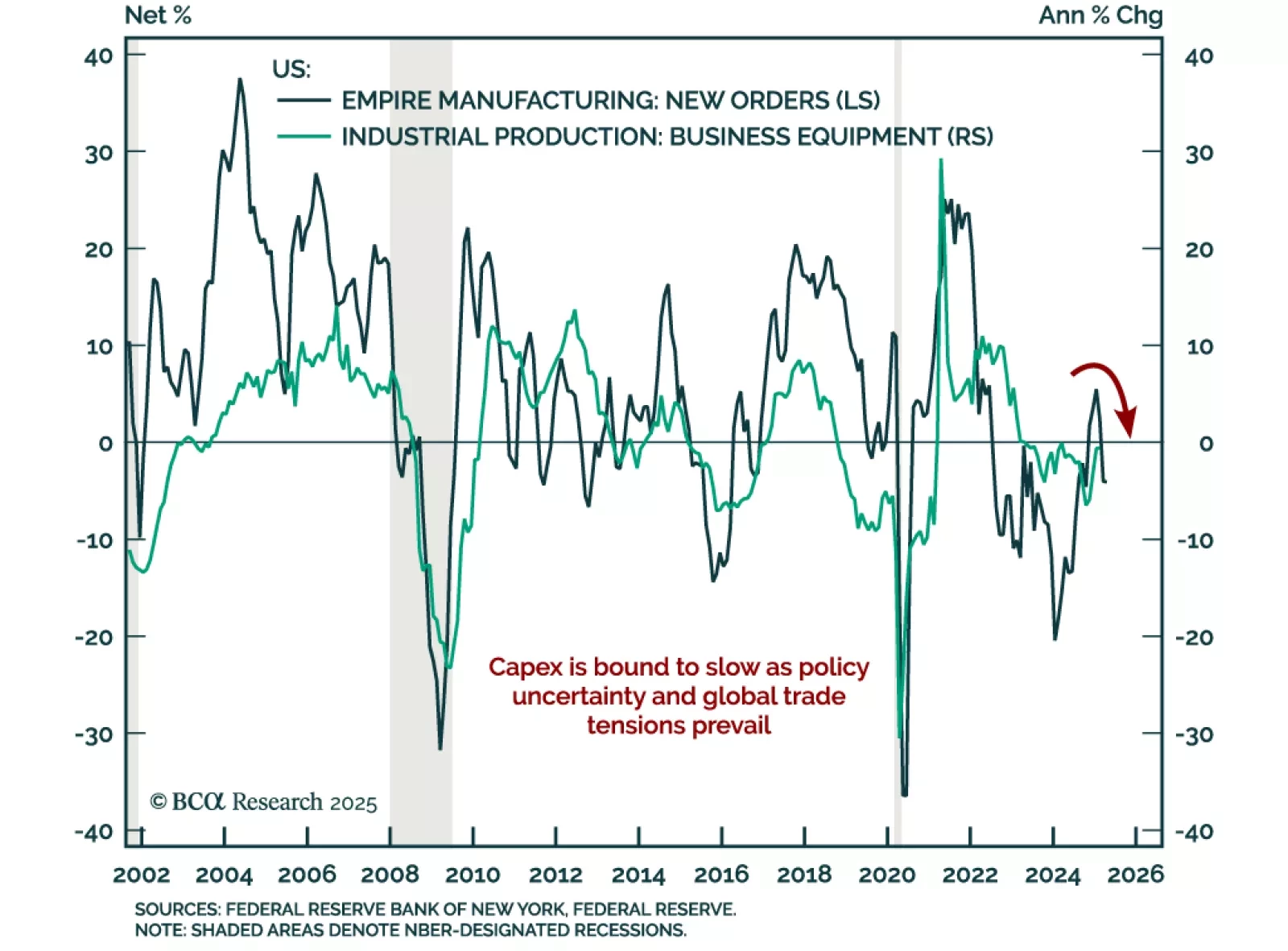

The US-China trade truce lifted short-term manufacturing sentiment in May, but margin pressures persist, reinforcing the case for defensive, domestic-focused equity positioning. The Empire and Philly Fed regional manufacturing…

A weakening economy will apply downward pressure to Treasury yields, but the Trump term premium will keep long-dated yields higher than they would otherwise be. This makes Treasury curve steepeners the most attractive trade in US…

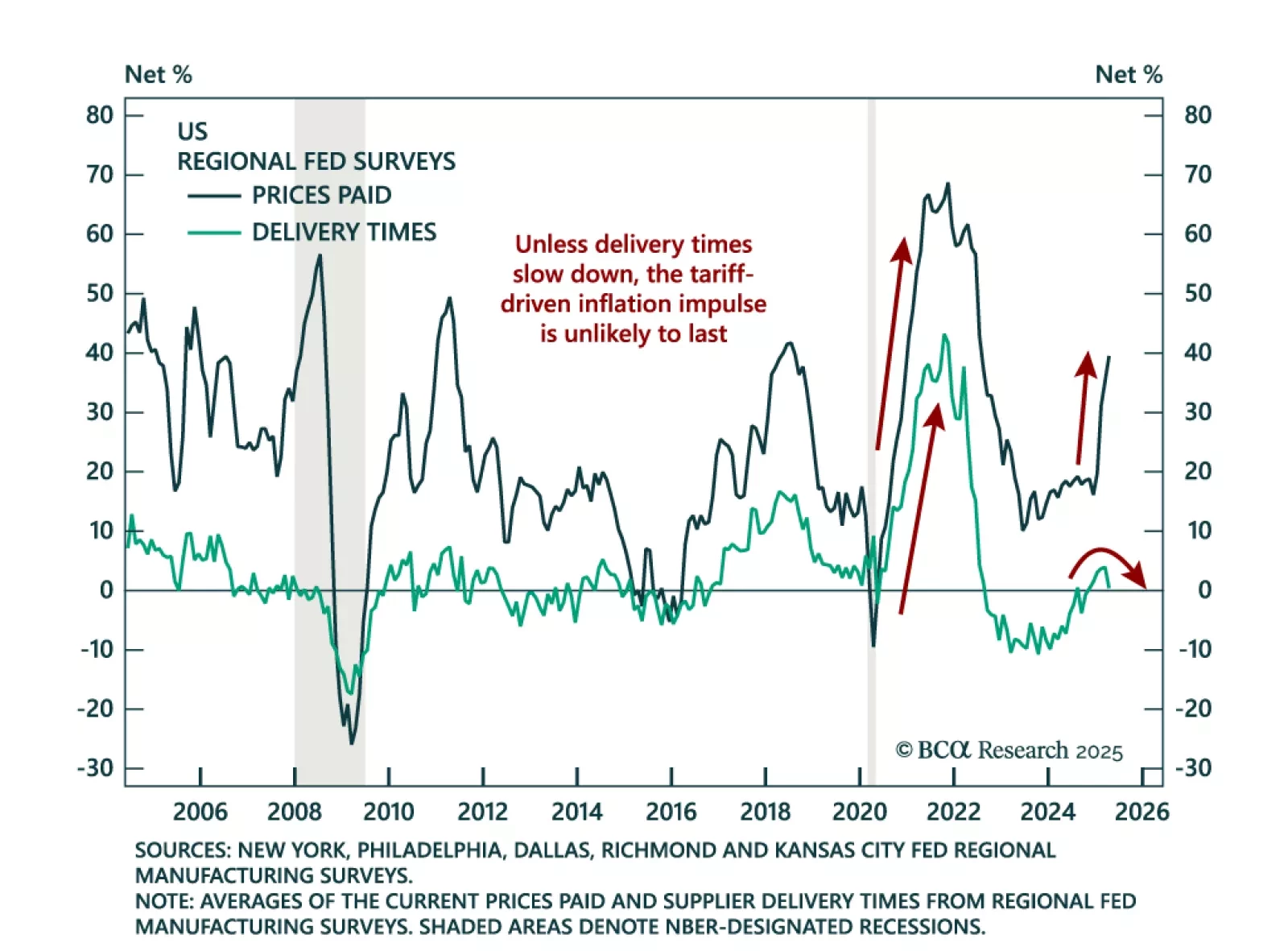

The Fed held rates steady this afternoon, and the timing of its next move will be dictated by whether the tariff shock to inflation is transitory or more long lasting.

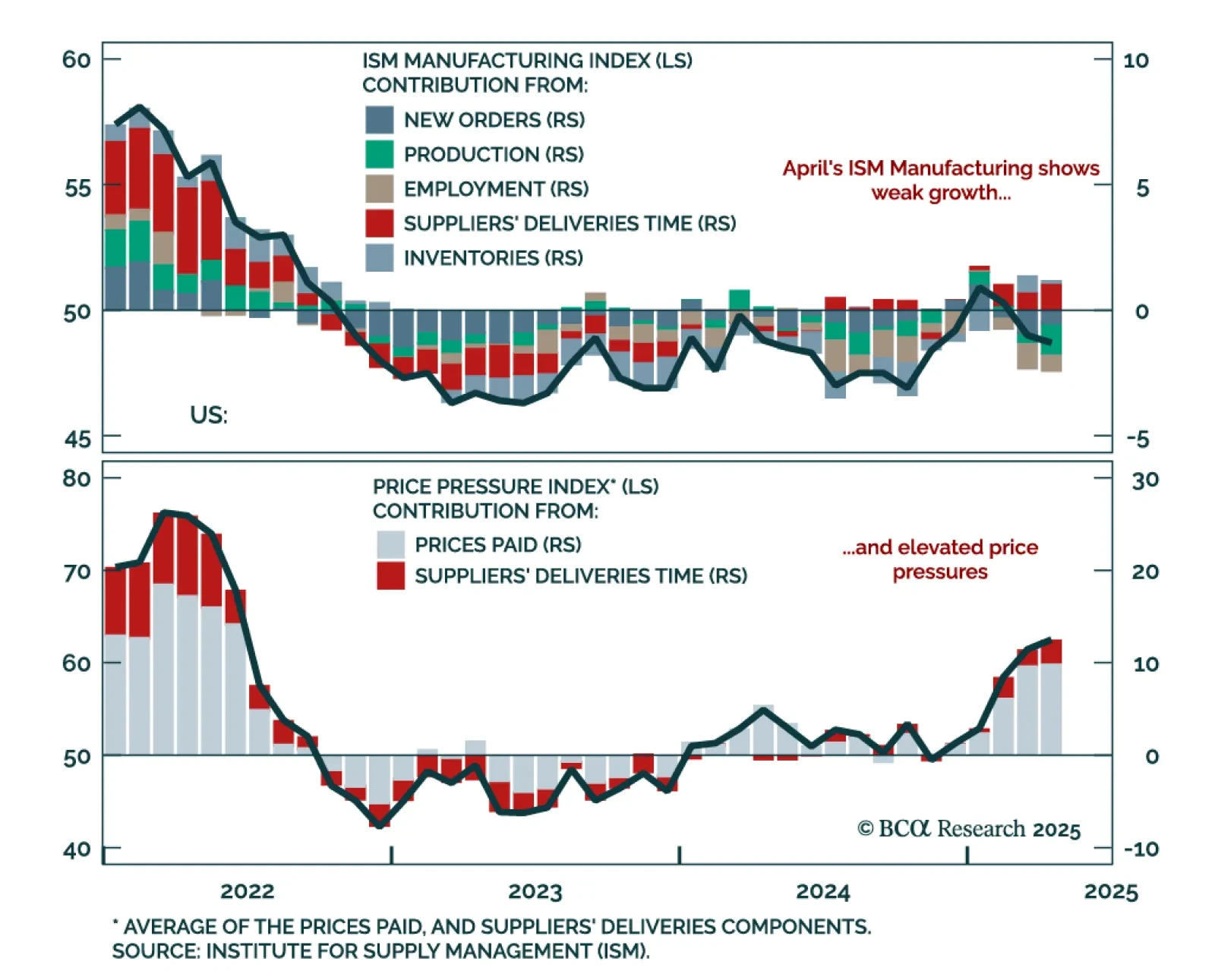

The April ISM Manufacturing adds to recession risks: Collapsing export orders and weak domestic momentum reinforce our defensive positioning. The index slipped to 48.7 from 49.0, with new orders still contracting and new export…

The April Dallas Fed Manufacturing survey adds to recent stagflationary signals, reinforcing our preference for gold over industrial commodities. The index plunged to -35.8 from -16.3 in March, with activity measures deteriorating…

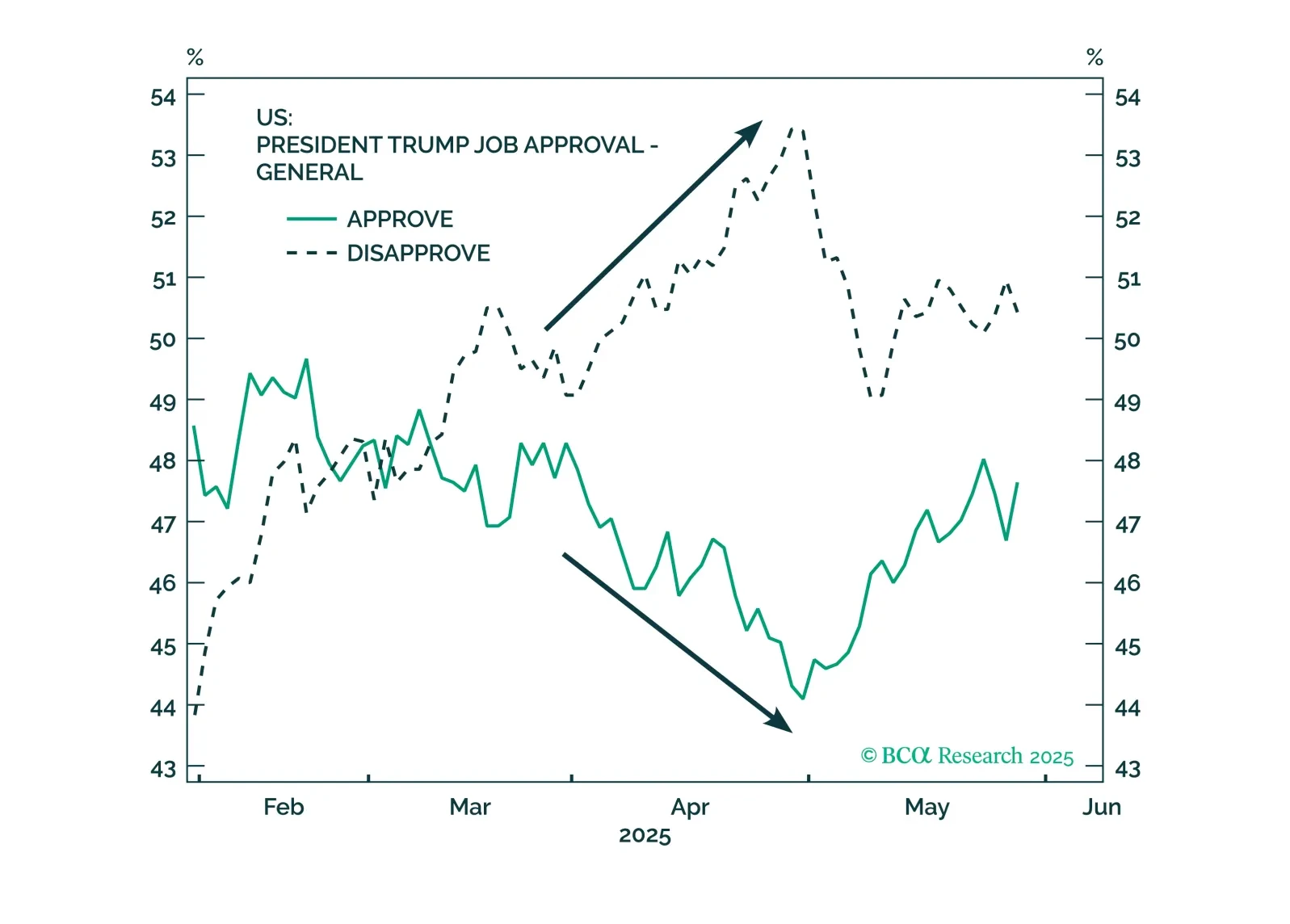

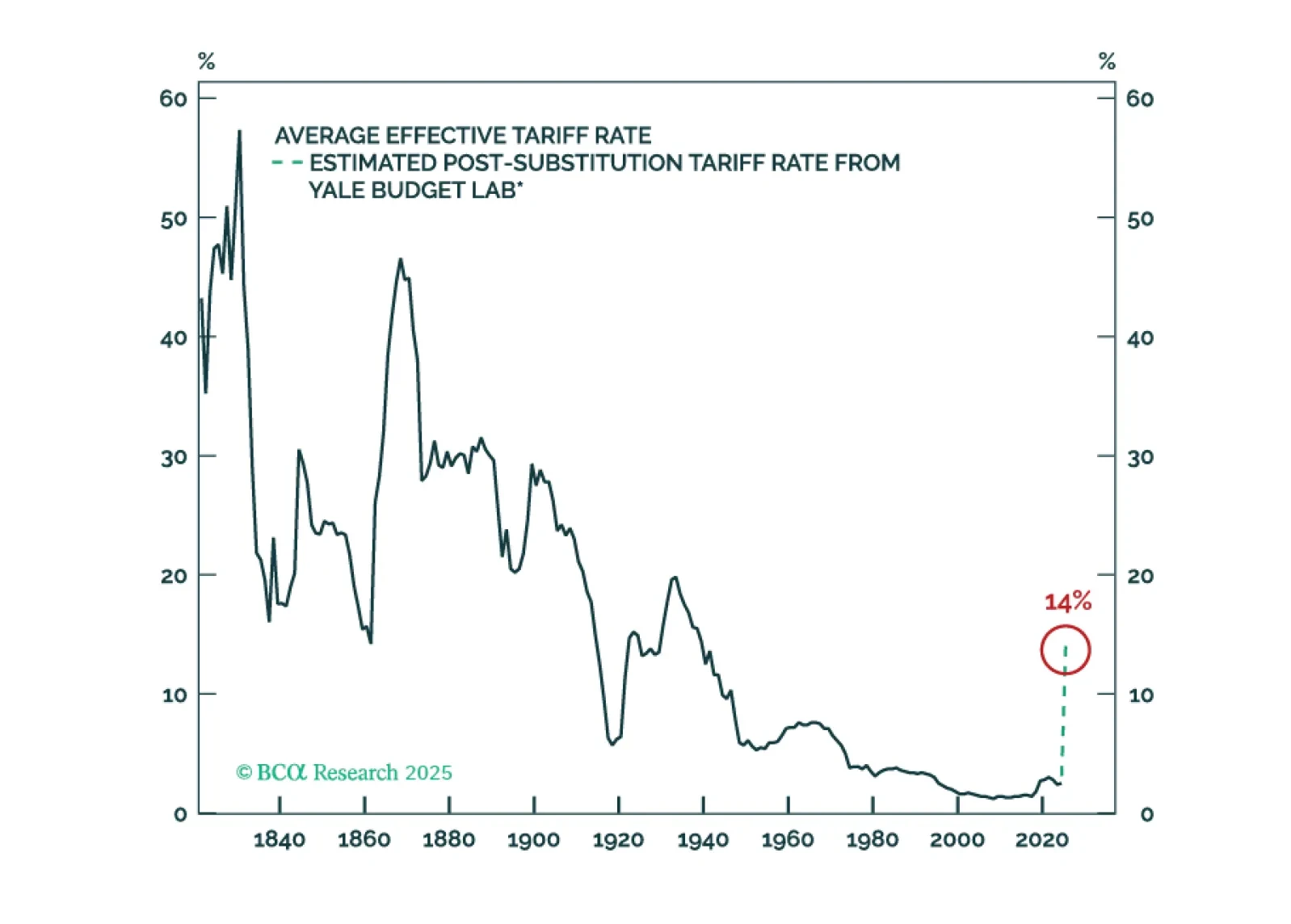

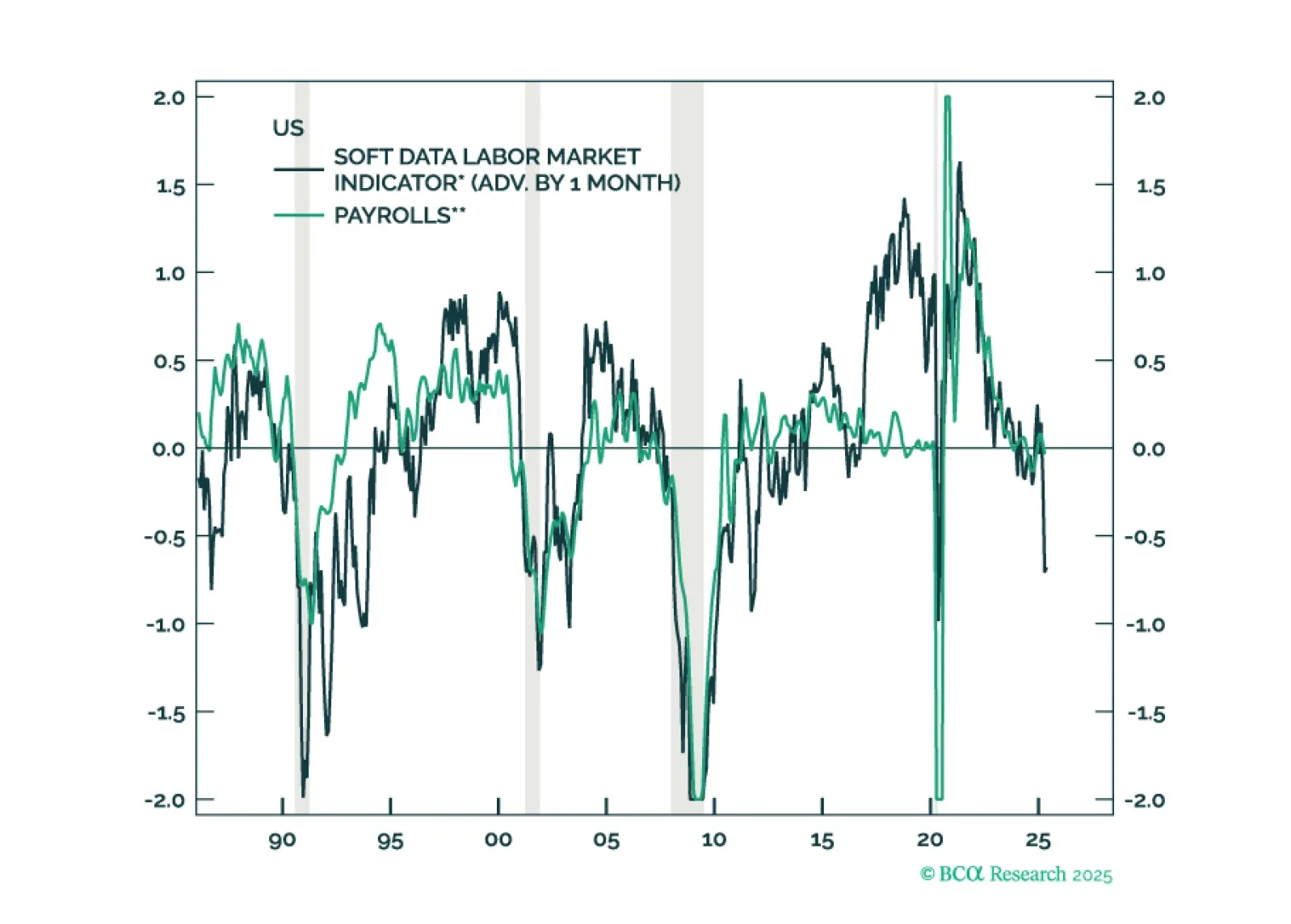

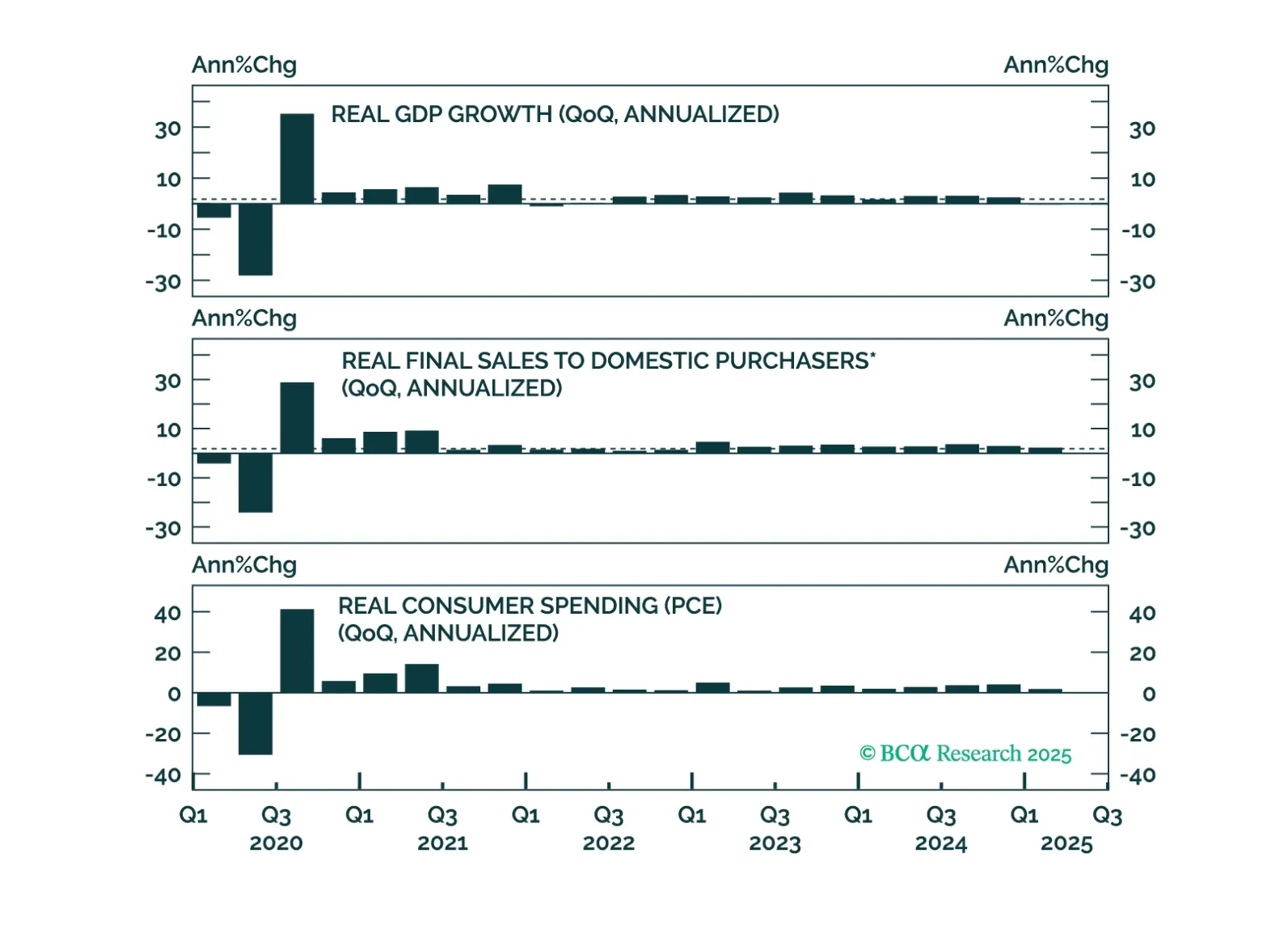

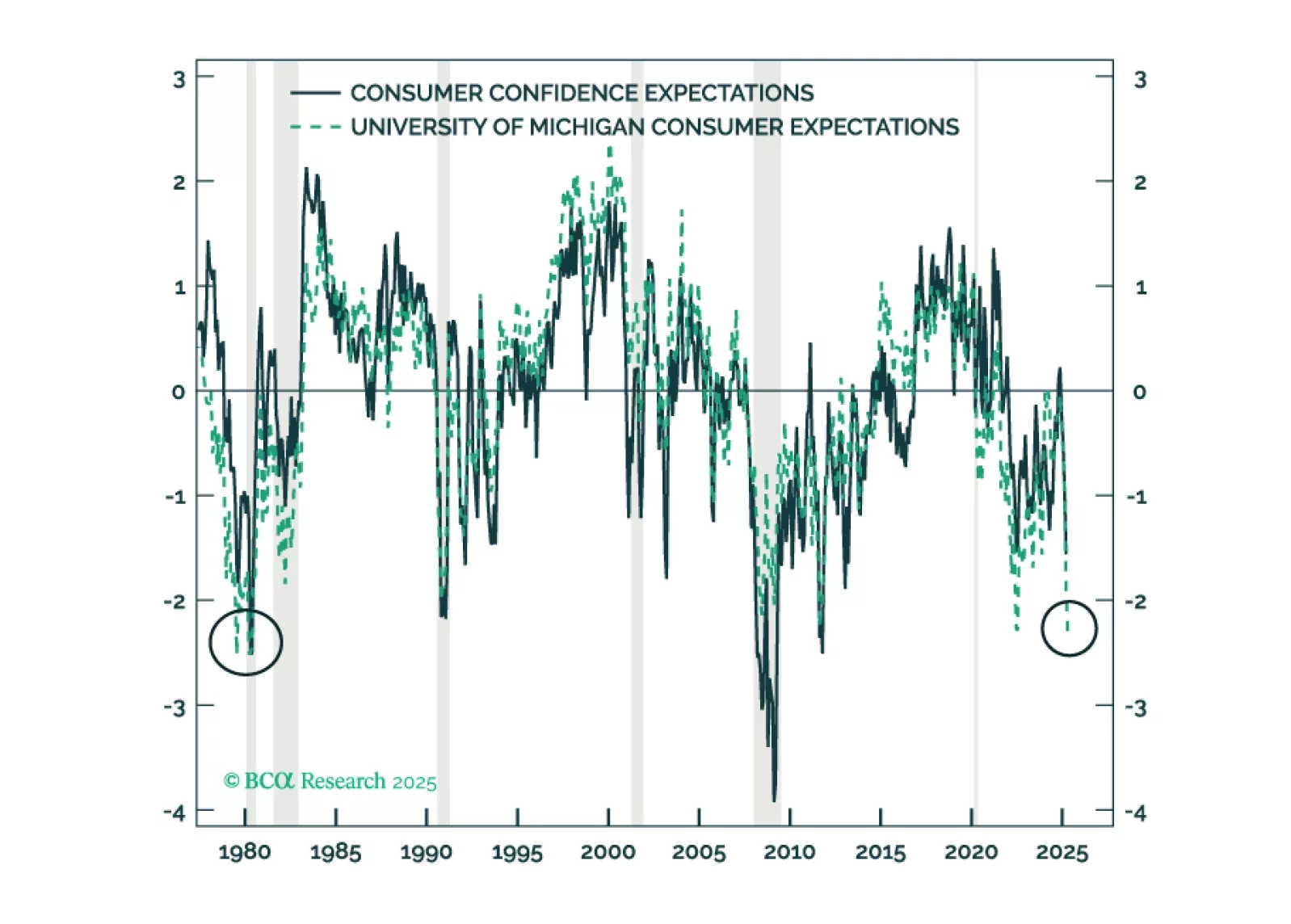

The policy-induced decline in consumer confidence has spread to businesses and investors, increasing the probability of a recession even if the administration reverses field on its aggressive tariff measures. We reiterate our…

The NY Fed Empire Manufacturing survey adds to recent stagflationary worries, reinforcing our underweight in risk assets and overweight in government bonds. The general business conditions index rose slightly to -8.1 but remains in…