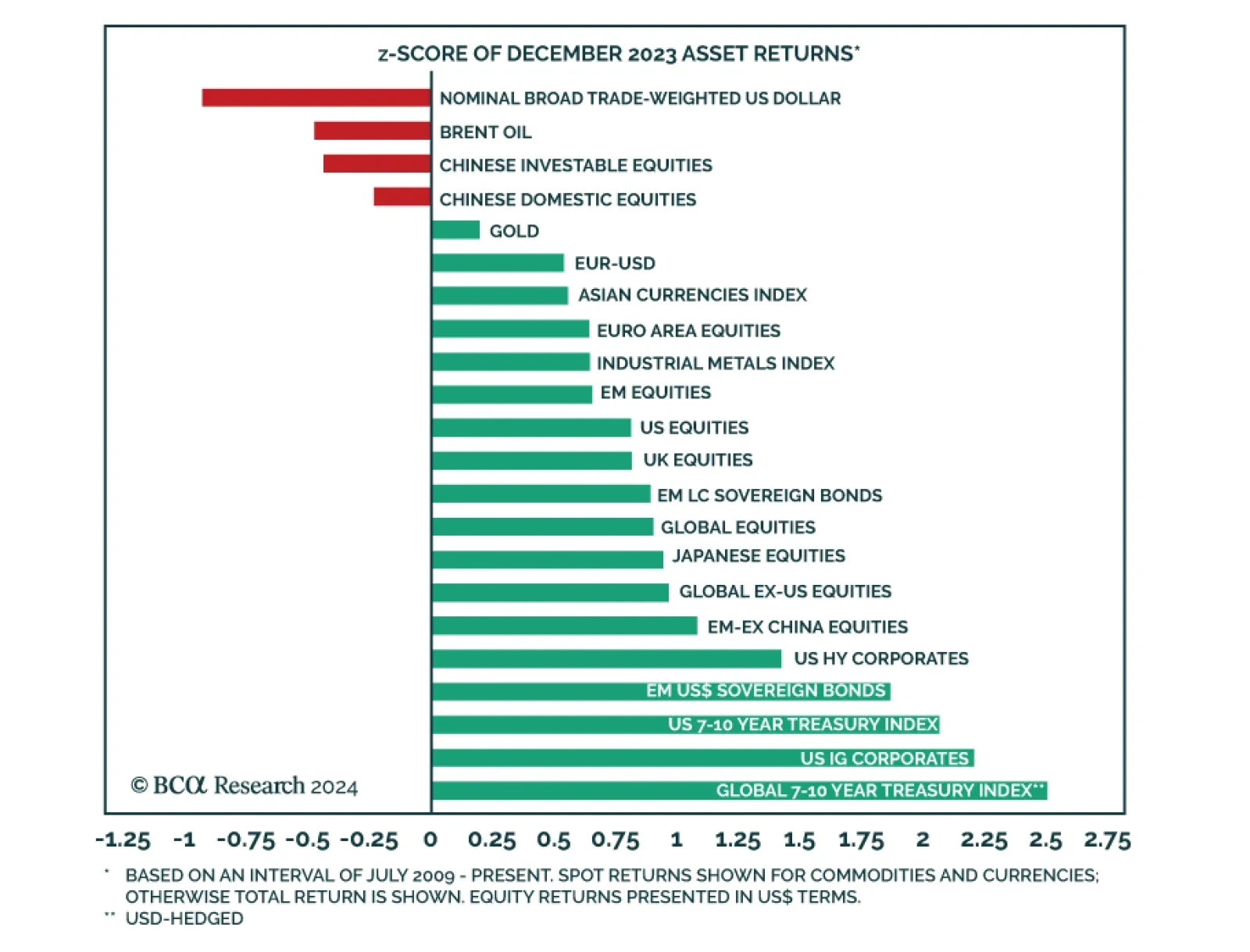

Global financial markets ended 2023 on a positive note, delivering a second consecutive month of exceptional gains in December. Fixed income once again led in terms of abnormally large returns on the back of increased…

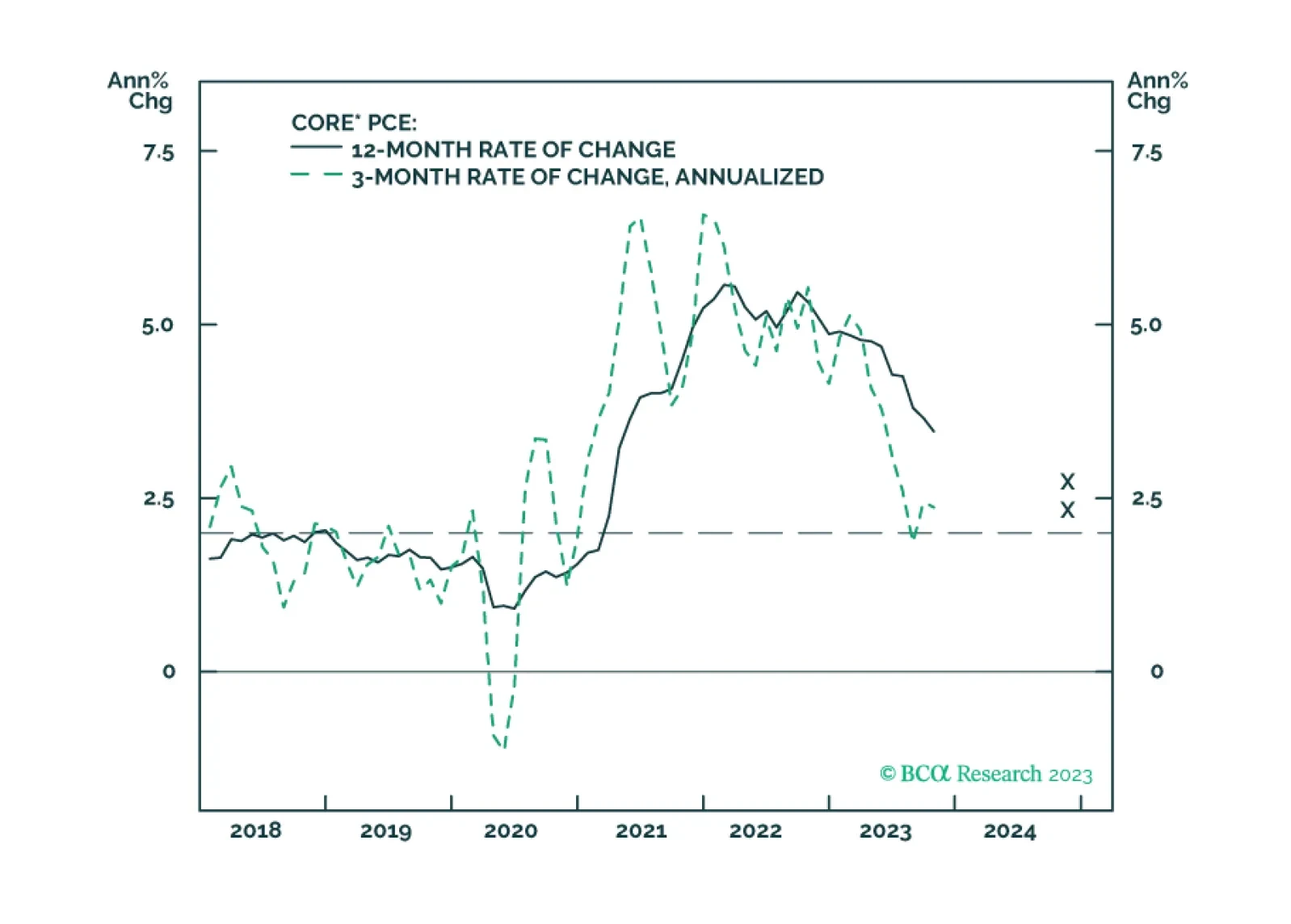

Treasury yields will sketch out a range between now and Q1 2024, with the upside determined by inflation and the downside determined by labor markets.

Our political forecasting scored wins in 2023 but we failed to capitalize on it adequately in our trade recommendations.

Today, we are sending you the BCA annual outlook for 2024. The report is an edited transcript of our recent conversation with Mr. X and his daughter, Ms. X, who are long-time BCA clients with whom we discuss the economic and…

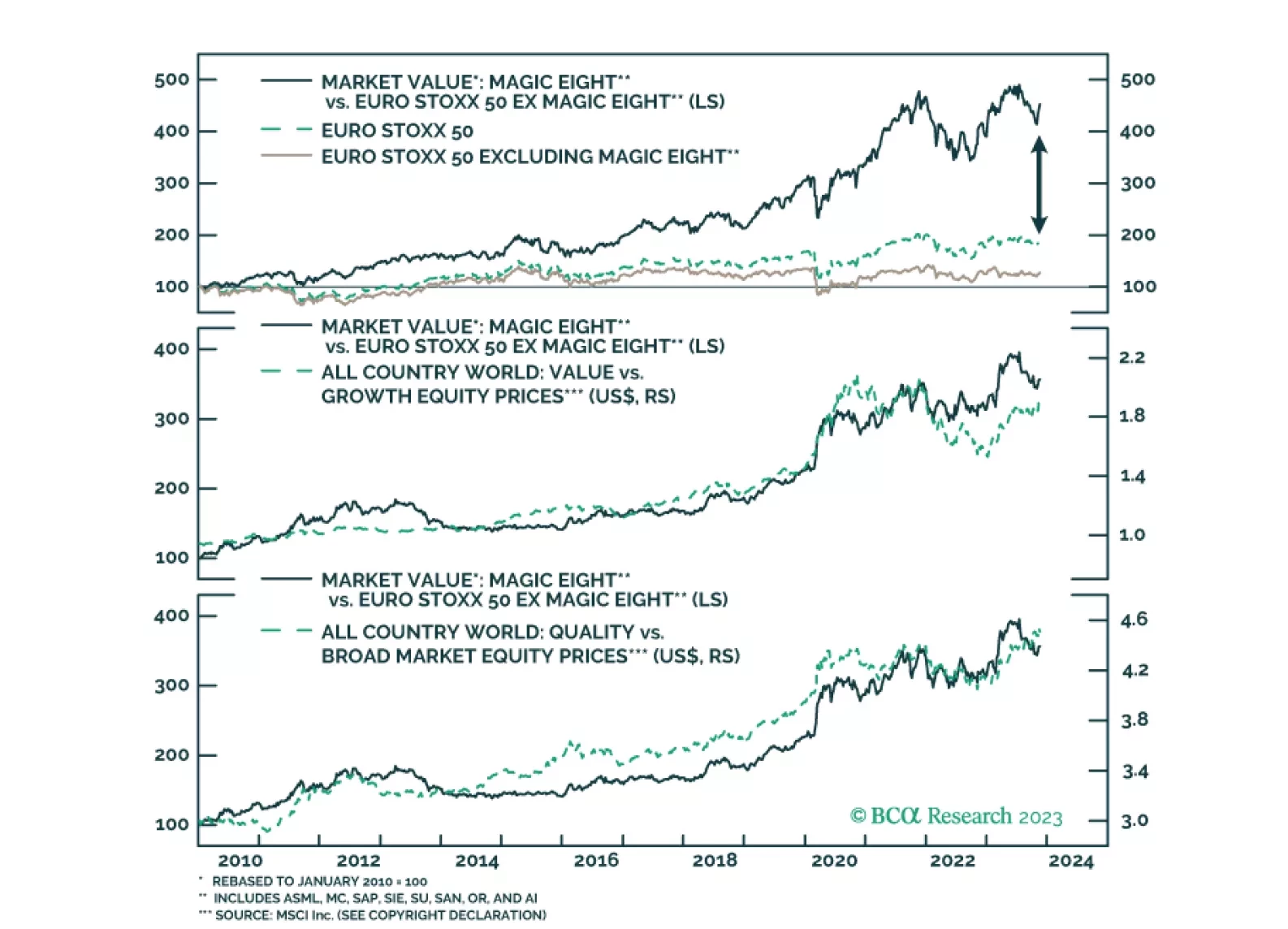

The US has the Magnificent Seven, Europe has the Magic Eight. What drives the performance of those eight stocks crucial to the European market?

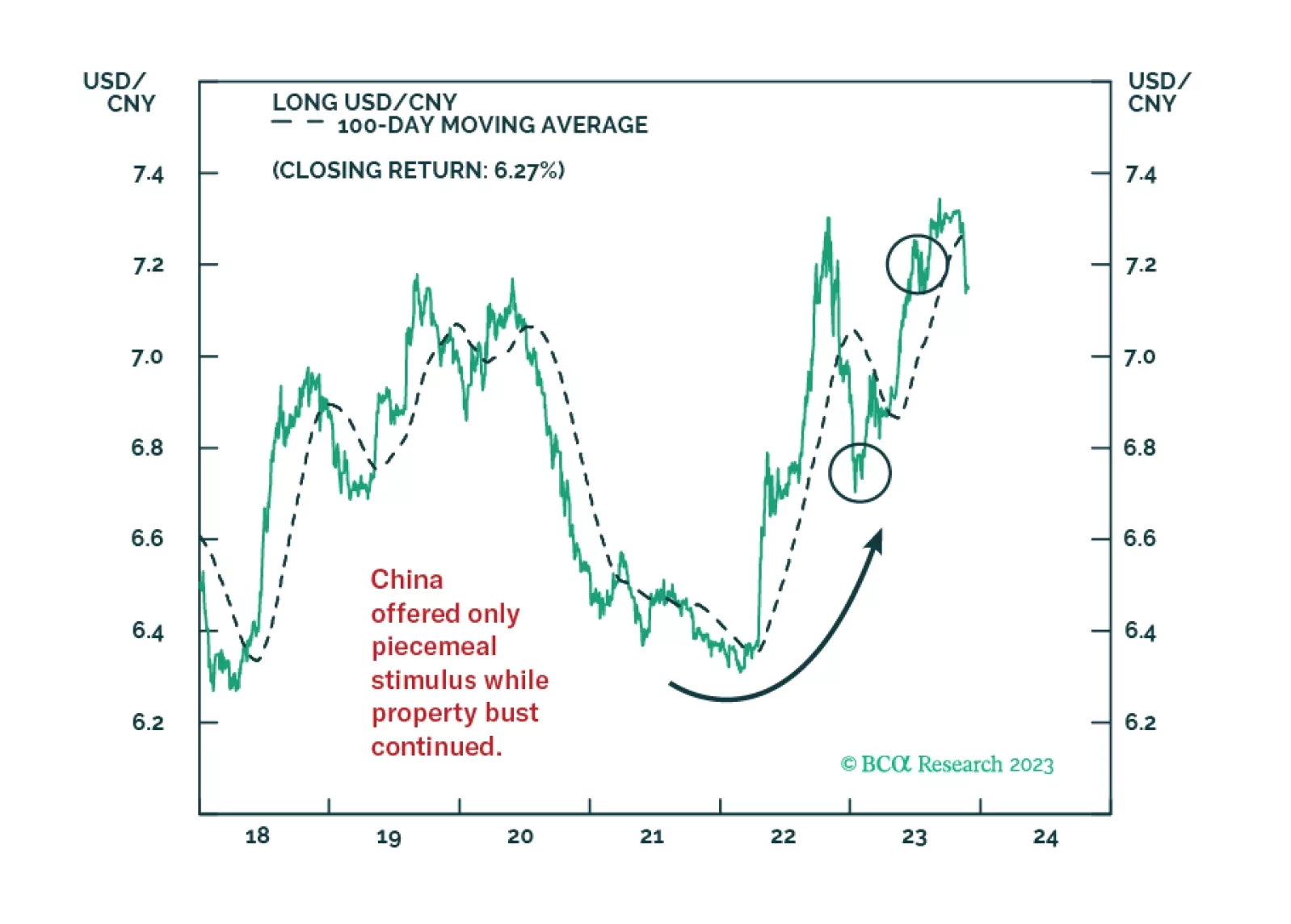

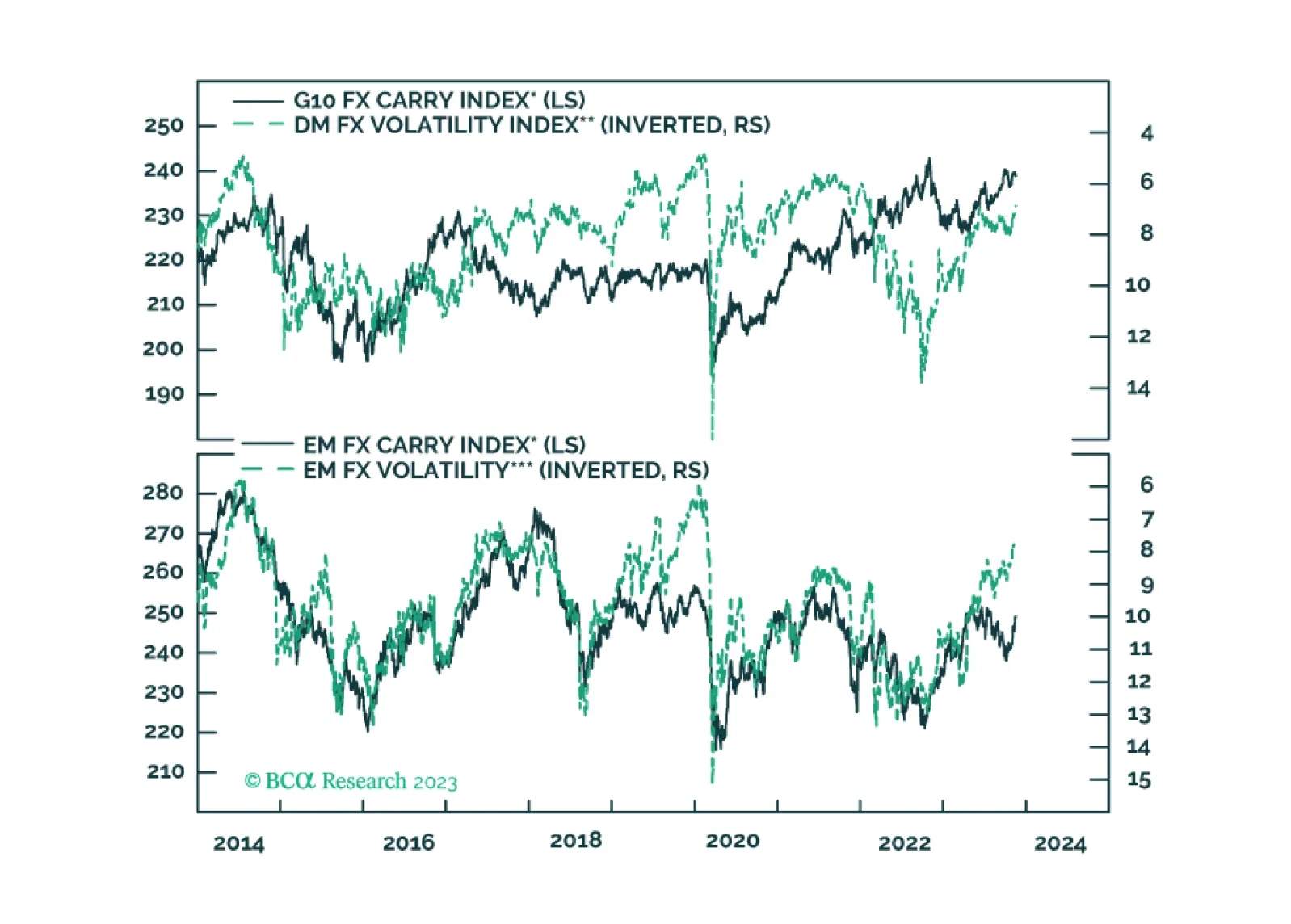

In this report, we evaluate the risk to carry trades in the coming months.

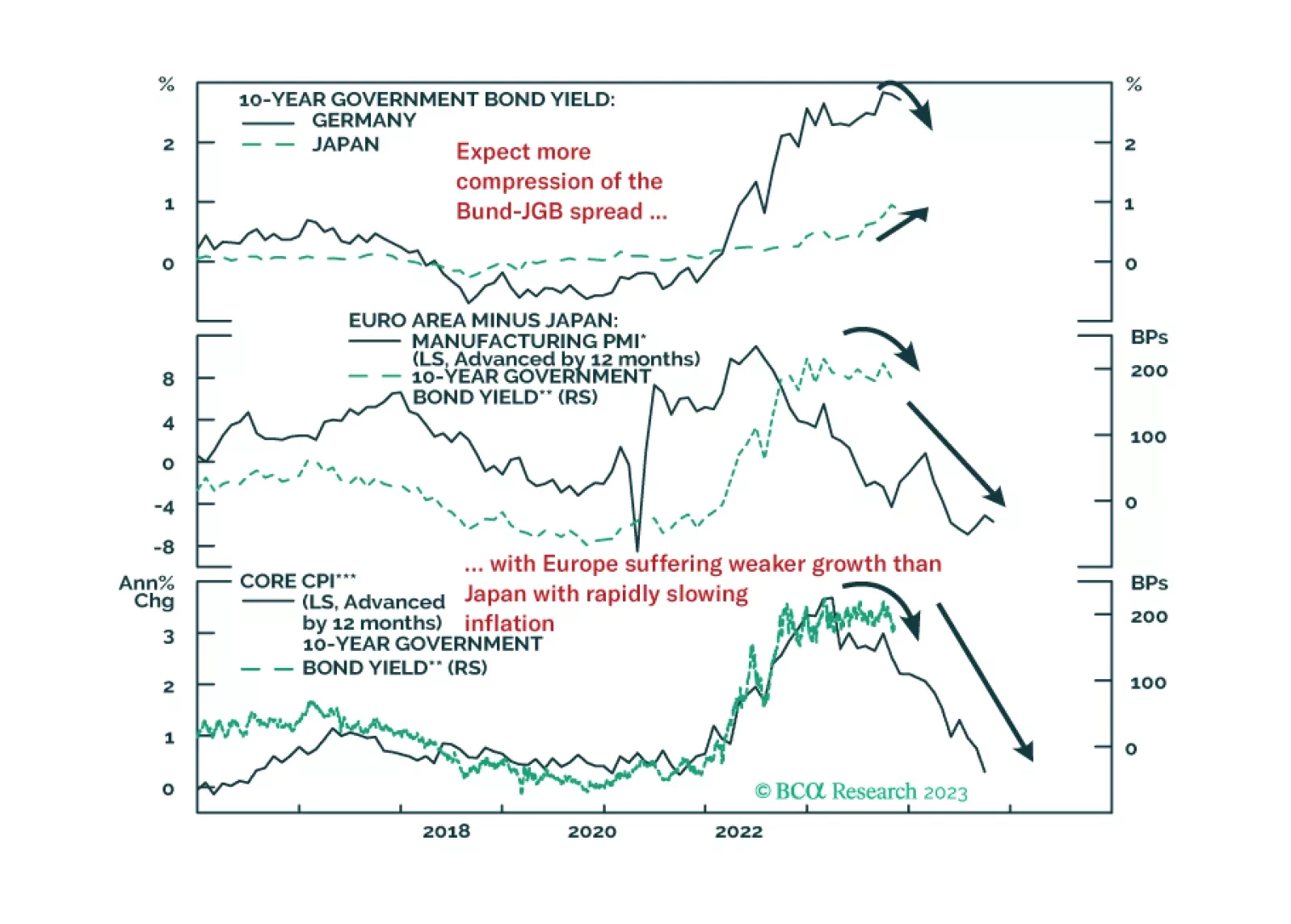

In this Insight, we review the performance and rationale for our current set of tactical fixed income trade recommendations. Our highest conviction positions also happen to be our most successful trades: positioning for a narrowing…