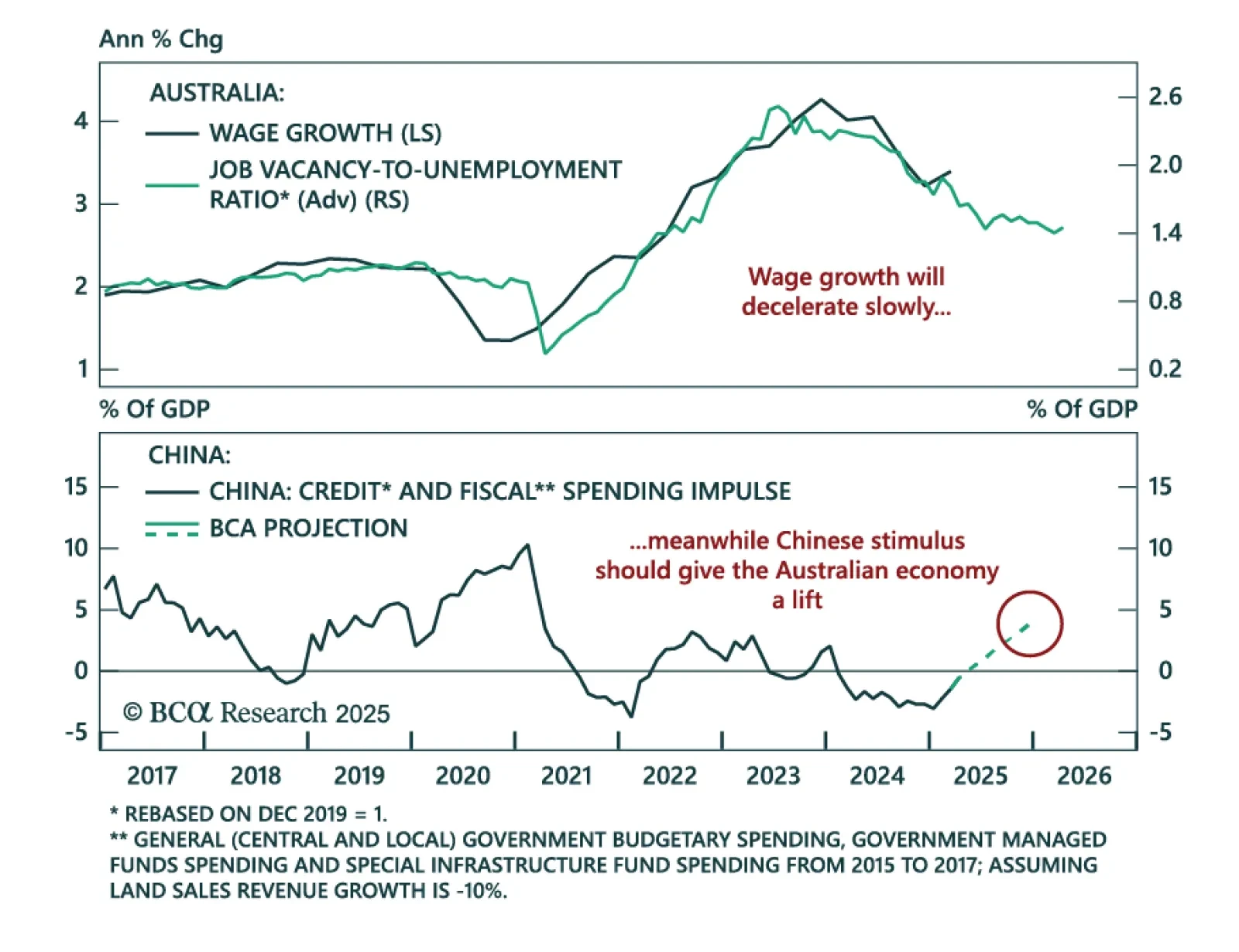

Overnight, the Reserve Bank of Australia (RBA) cut the cash rate target by 25bps to 3.85%, as widely expected. After this cut, the market still prices in about 50bps of easing over the next six months. According to our Global…

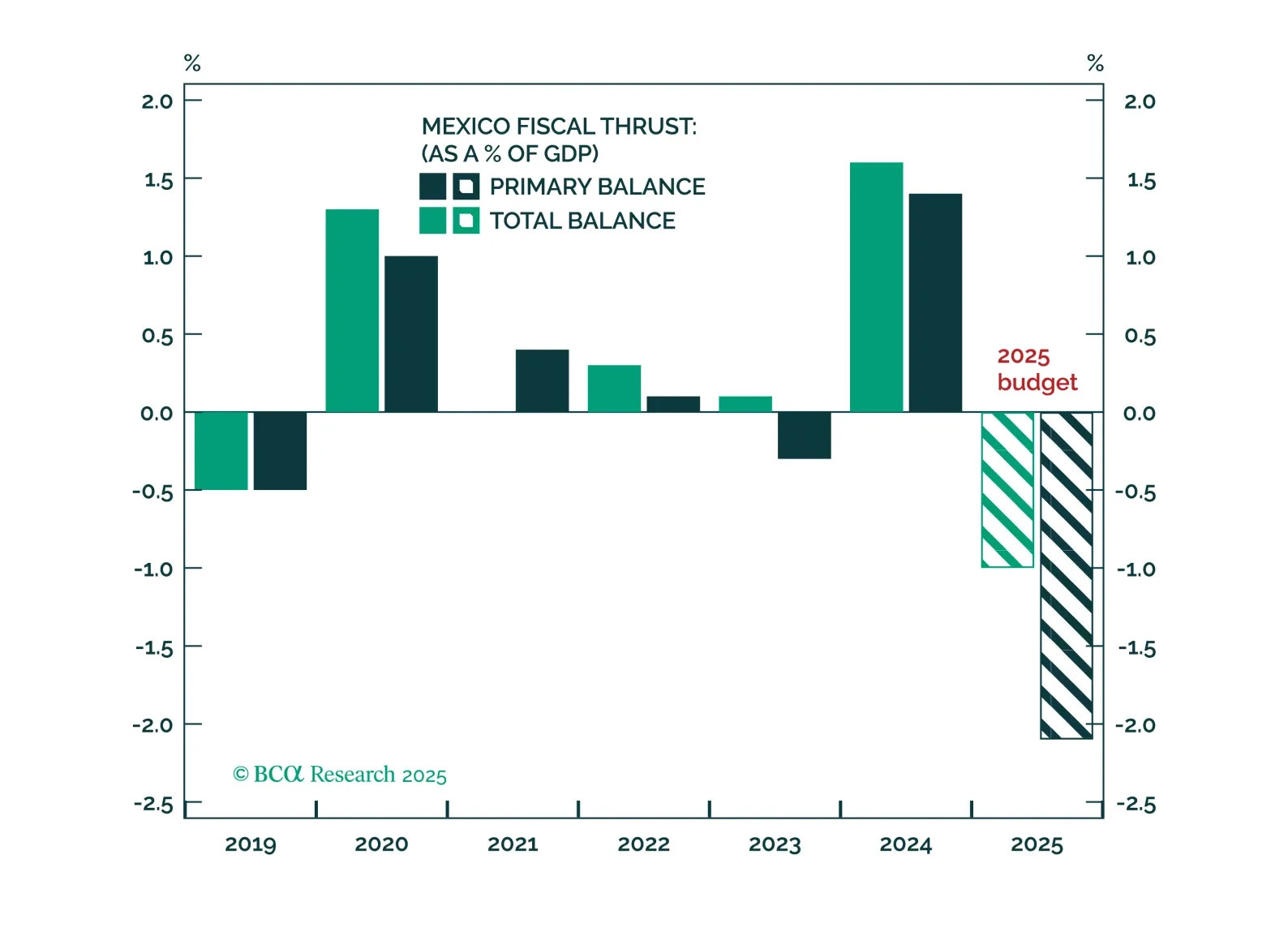

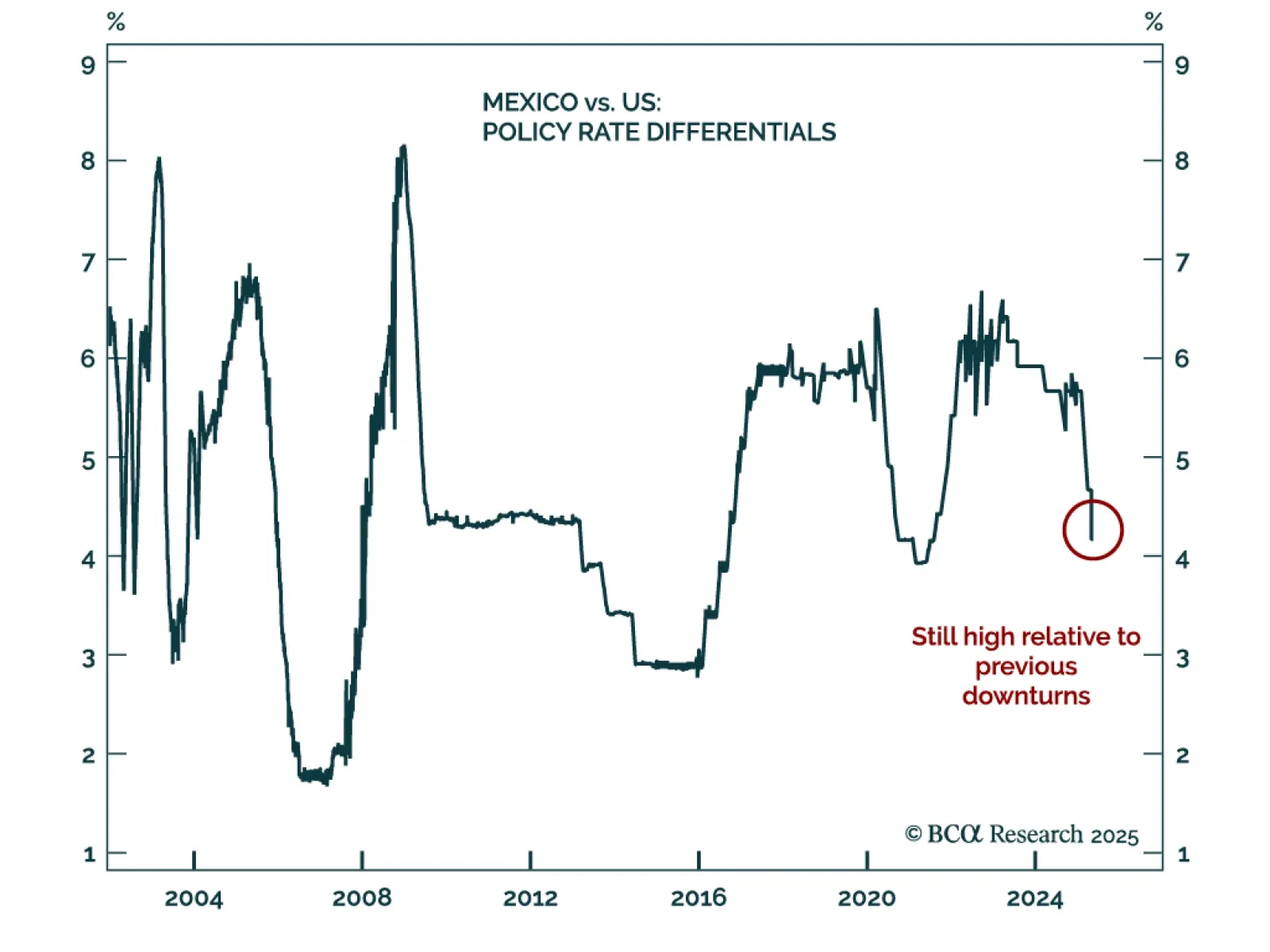

Banxico’s 50 bps rate cut reinforces our bullish view on Mexican bonds, with easing likely to continue as inflation falls and growth slows. The central bank unanimously lowered its policy rate to 8.5%, and we expect further cuts…

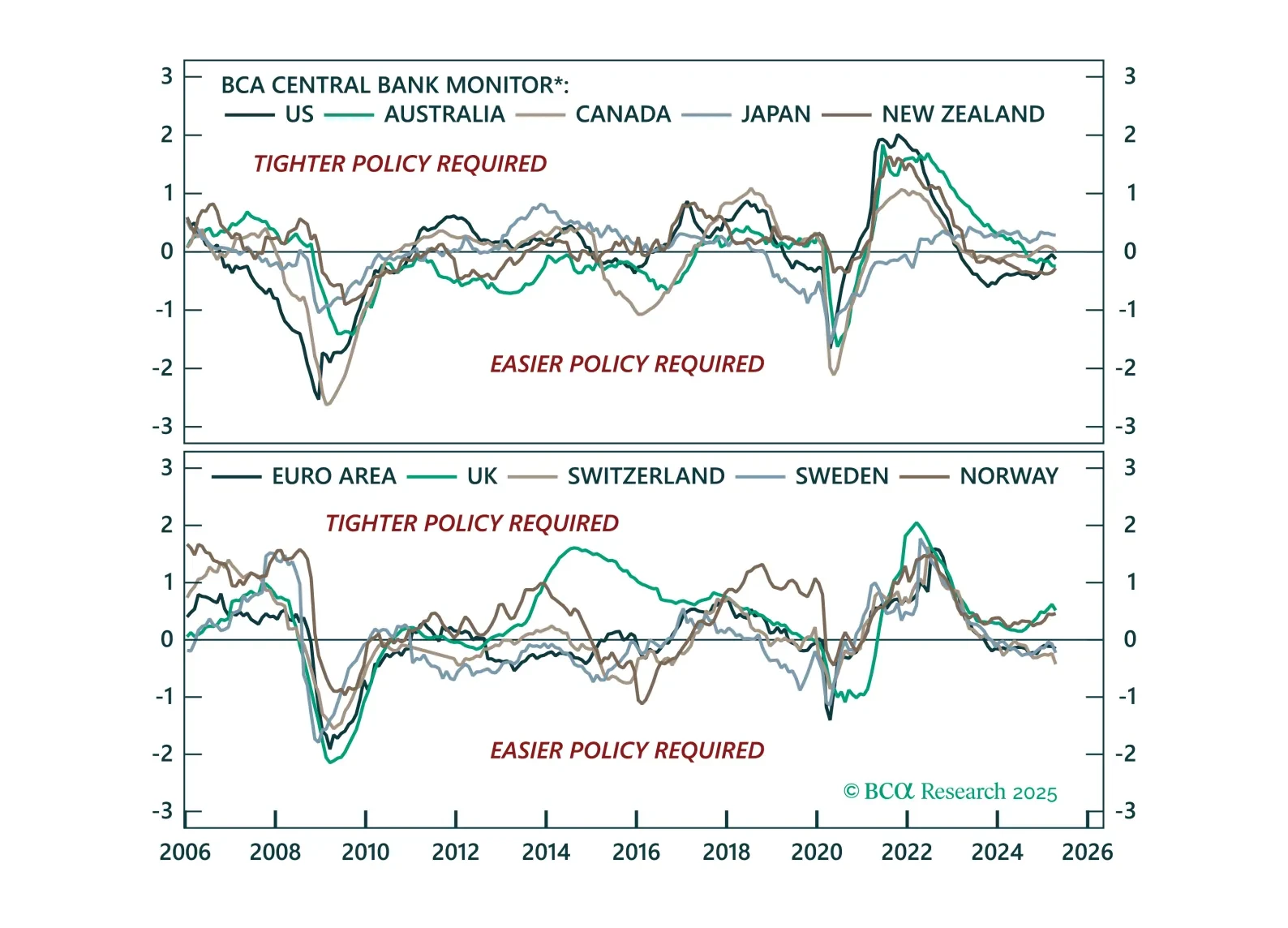

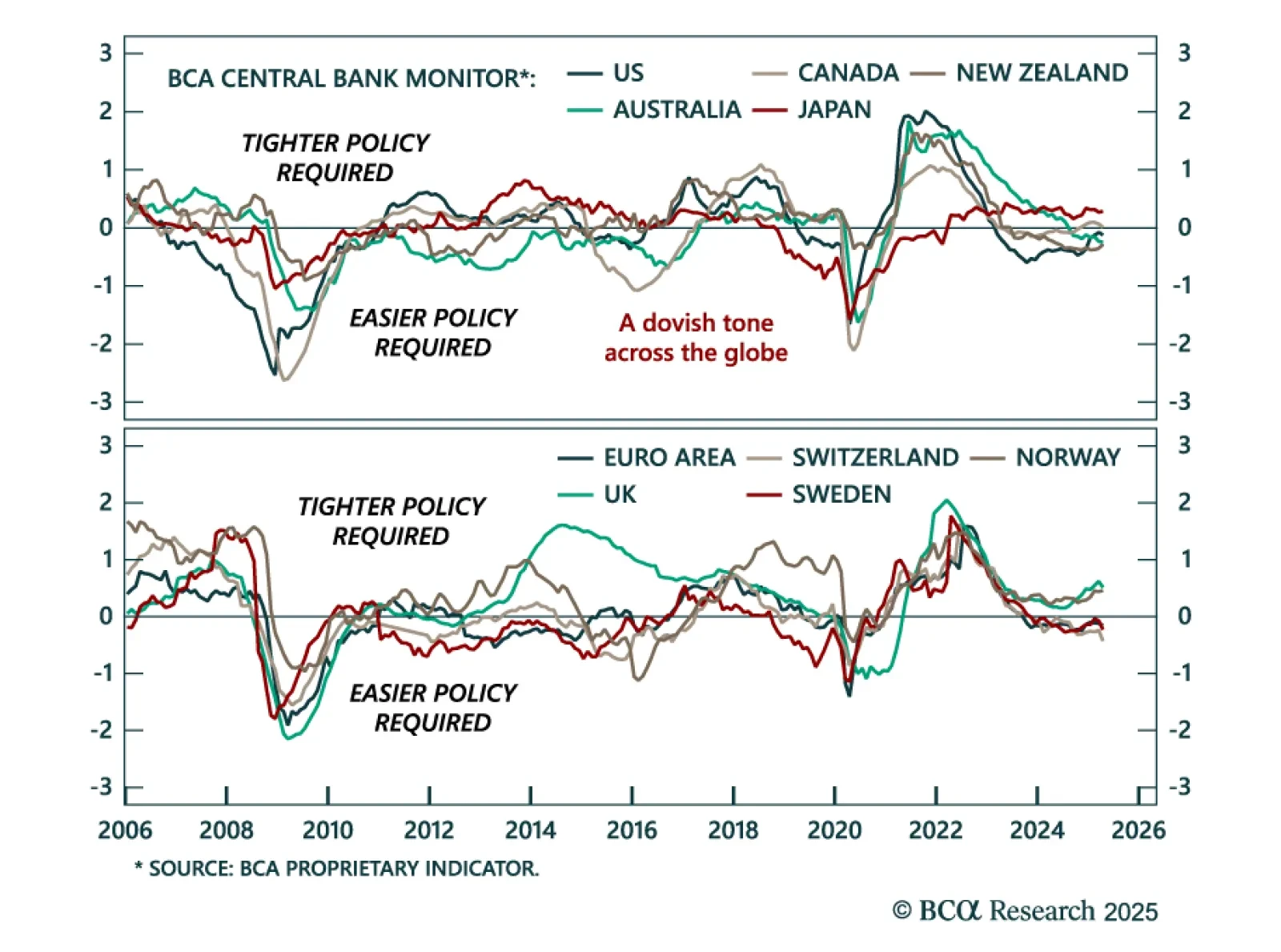

Expect broad-based dovish surprises from major central banks, and stay overweight UK and euro area government bonds. Our Global Fixed Income, European, and FX strategists published a joint update of BCA’s Central Bank Monitors. They…

The easing bias remains, but not all central banks are equal. This Central Bank Monitor update reveals who is ready to cut more and who is still pretending not to.

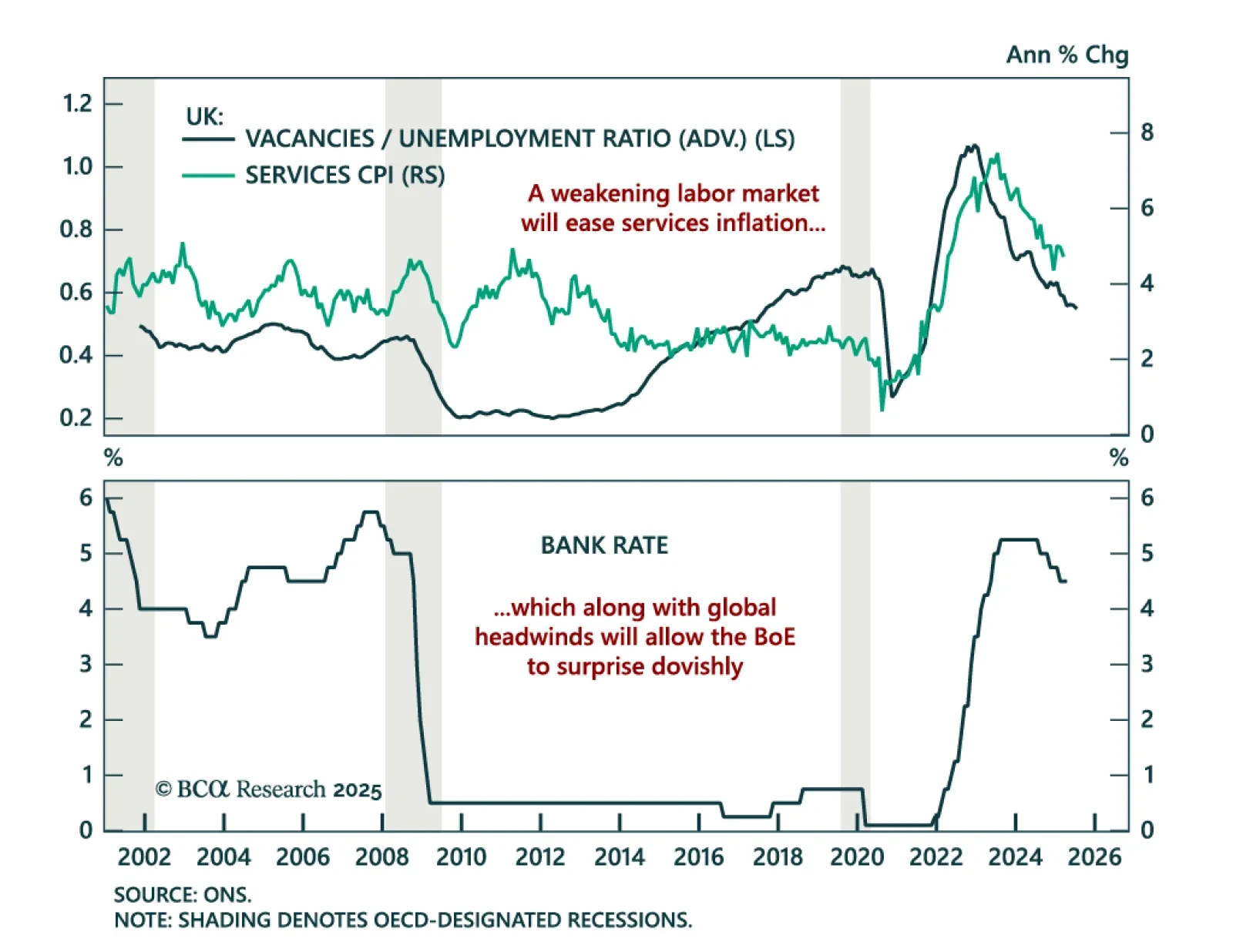

The Bank of England’s hawkish cut reinforces our Gilts overweight and tactical short GBP view as global headwinds persist. The BoE lowered rates by 25 bps to 4.25% as expected, but the MPC vote was more split than expected. Five…

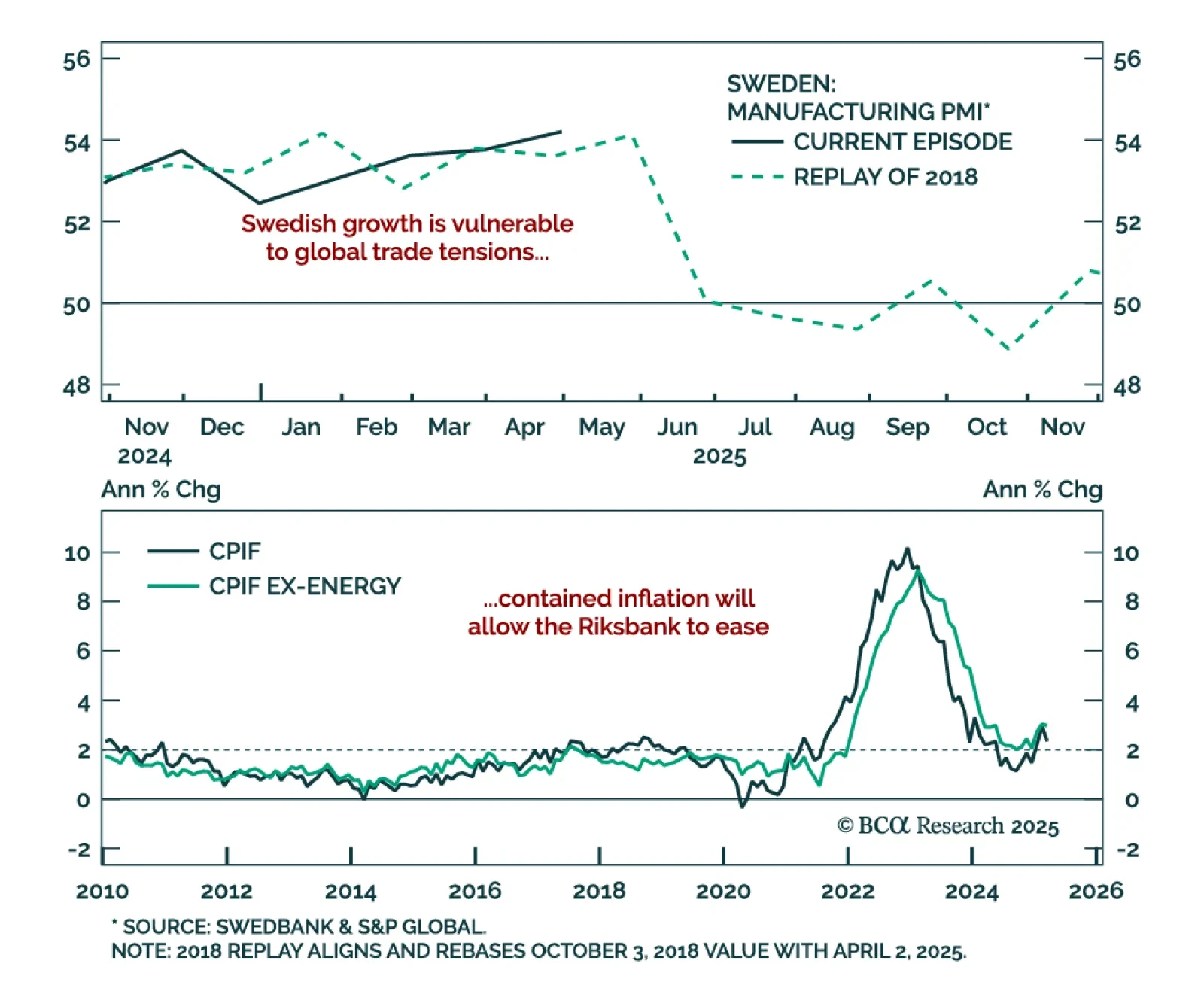

The Riksbank’s cautious stance sets up a dovish pivot, reinforcing our long Swedish bonds view and SEK fade vs. USD. The central bank held rates at 2.25% for the second time this year, with Governor Thedéen describing policy as well-…

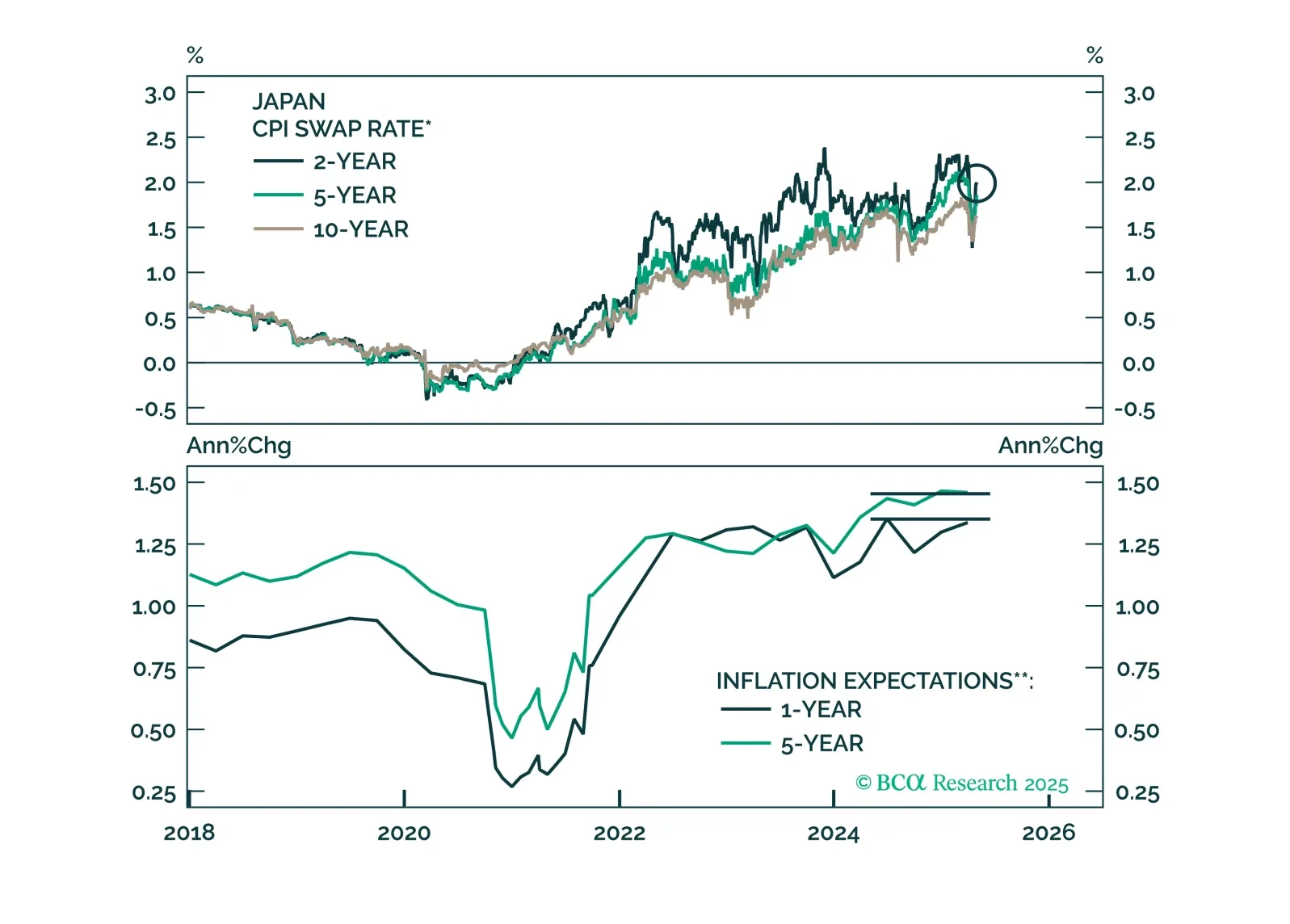

This week’s report looks at Japan, with the recent BoJ meeting. While a trade war has injected uncertainty into the Japanese economy, our conviction remains high that JGBs will underperform other government bond markets, and the yen…