Highlights US Reflation: The Georgia senate victories for the Democratic Party have returned the bond-bearish “Blue Sweep” scenarios to the forefront. More fiscal stimulus and an easy Fed will extend the policy-driven…

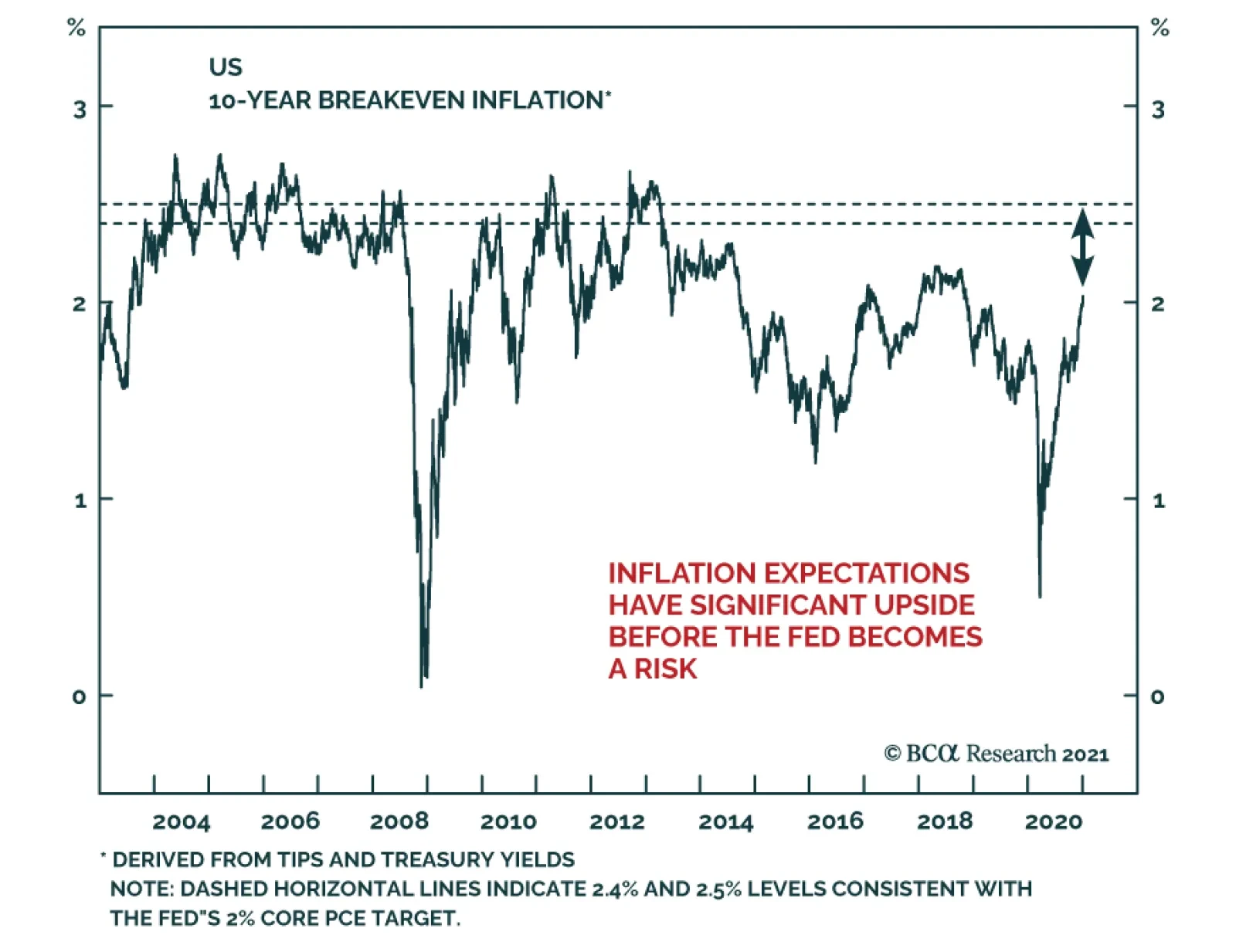

Highlights Rates: The Democratic sweep of the election has caused the uptrend in bond yields to accelerate and has benefited our recommended rates positions (below-benchmark duration, nominal and real curve steepeners, inflation curve…

Highlights A blue wave will likely supercharge the dollar’s downtrend in 2021. The key beneficiaries of this decline will be the much undervalued Scandinavian currencies, as well as those of commodity-producing countries. The…

Highlights Further fiscal easing is likely in the US now that the Democrats are set to take control of the US Senate following Tuesday’s runoff elections in Georgia. With the end of the pandemic in sight, a growing chorus of…

Highlights Markets largely ignored the uproar at the US Capitol on January 6 because the transfer of power was not in question. Democratic control over the Senate, after two upsets in the Georgia runoff, is the bigger signal. US…

Highlights 2021 Model Bond Portfolio Broad Allocations: Translating our 2021 global fixed income Key Views into recommended positioning within our model bond portfolio results in the following conclusions: target a relatively…

According to BCA Research’s Global Asset Allocation Strategy service, a rapid rollout of vaccines means that the economy should be on track to return to near-normality by the second half of 2021. Therefore, the key thing…

Highlights Global growth will accelerate over the course of 2021 as COVID-19 vaccines are distributed and economic confidence improves in response. Longer-term global bond yields see some upward pressure as growth picks up, but global…