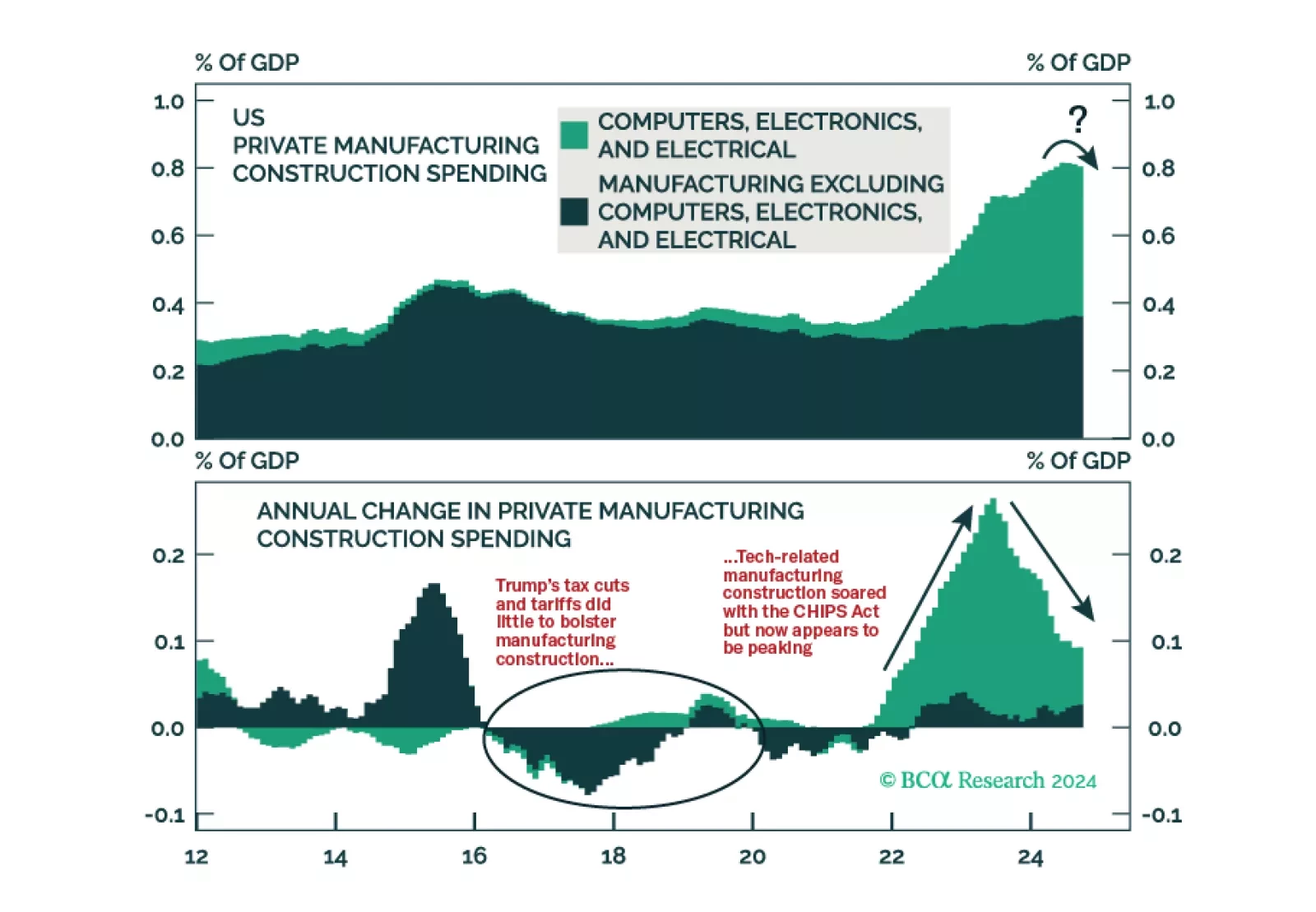

Congress will pass tax cuts by end of 2025 producing a fiscal thrust of about 0.9% of GDP in 2026. Trump will count on that stimulus as a basis for slapping tariffs on leading trade partners.China will retaliate against Trump…

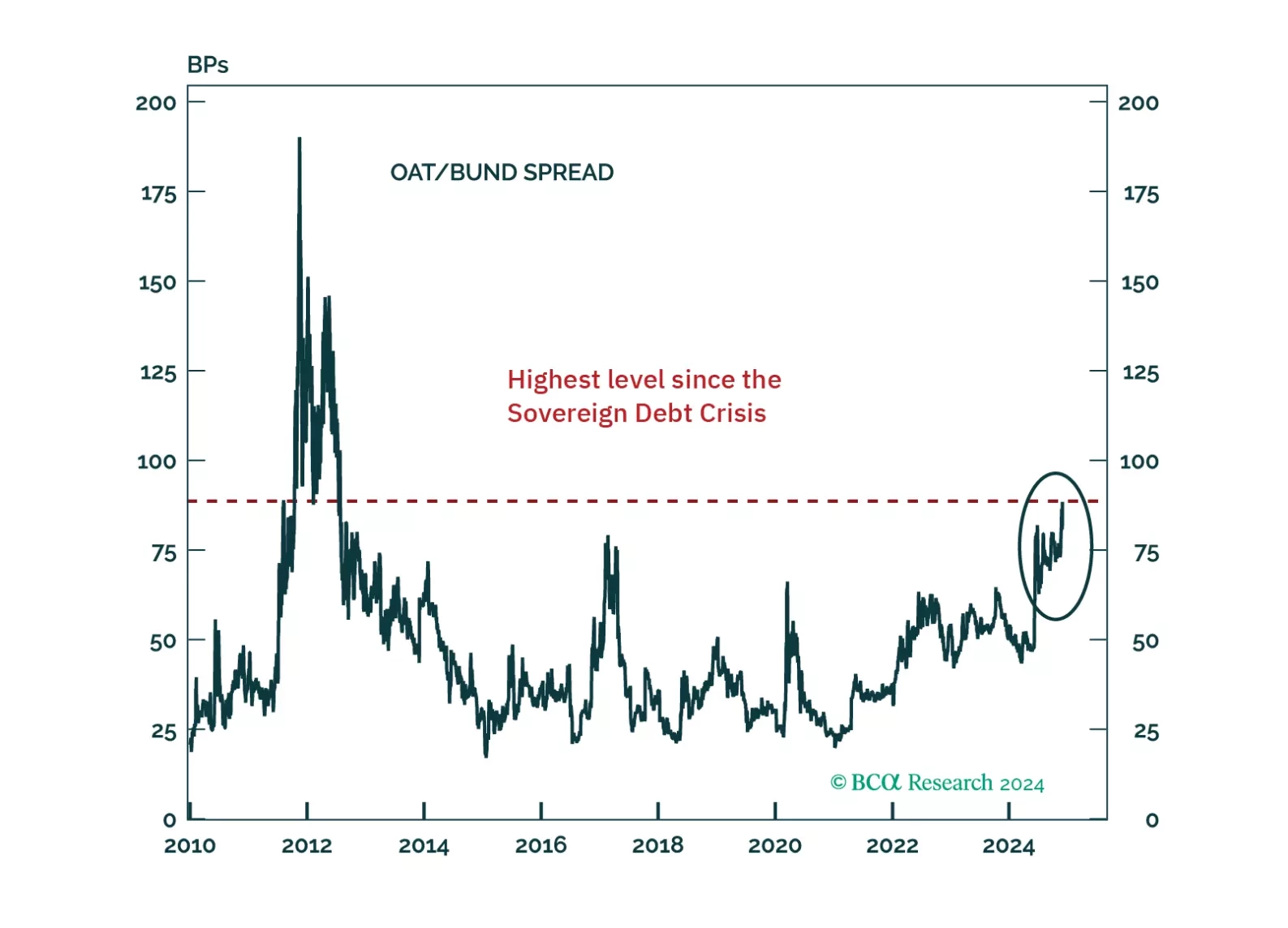

France finds itself in a unique, thorny situation. Can it heave itself out of it? And what does it mean for investors?

Our Portfolio Allocation Summary for November 2024.

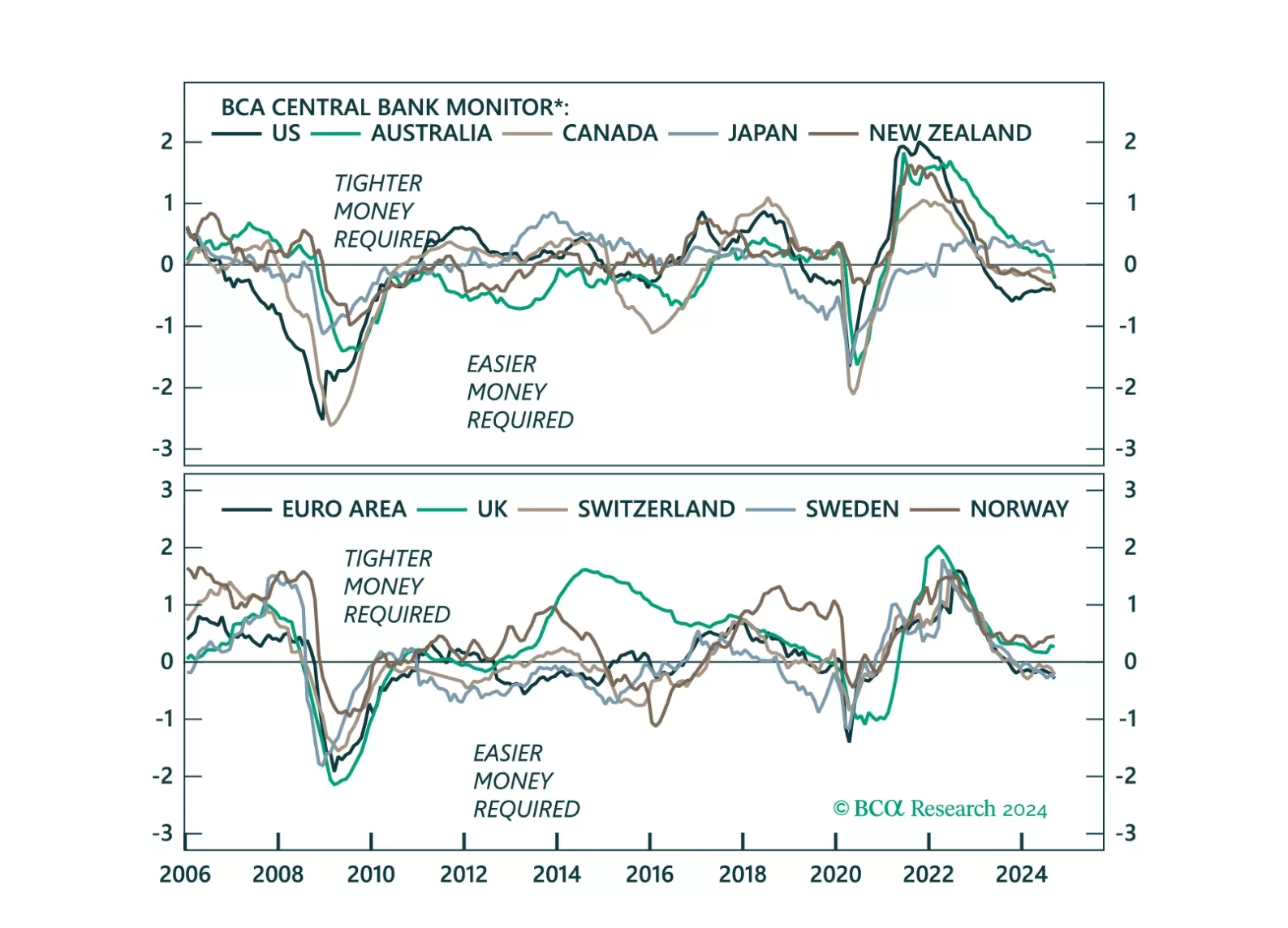

This week, we update our Central Bank Monitors (CBMs), that help us calibrate how monetary policy should be adjusted in developed-market economies. Our conclusion is that while overall, easier monetary settings are required, there a…

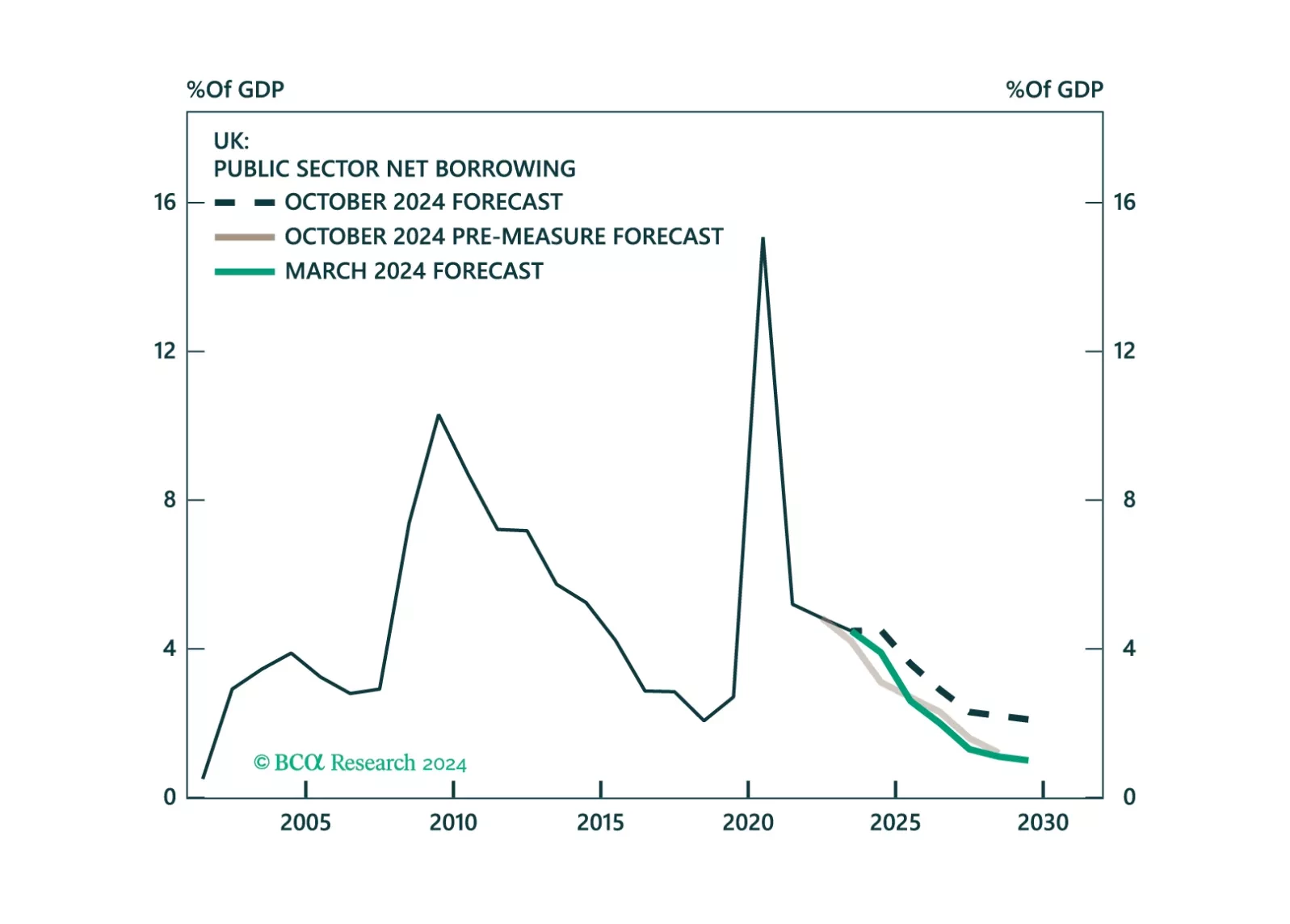

This Strategy Insight presents our view on today’s rate cut by the Bank of England as well as the budget announced by the UK government last week.

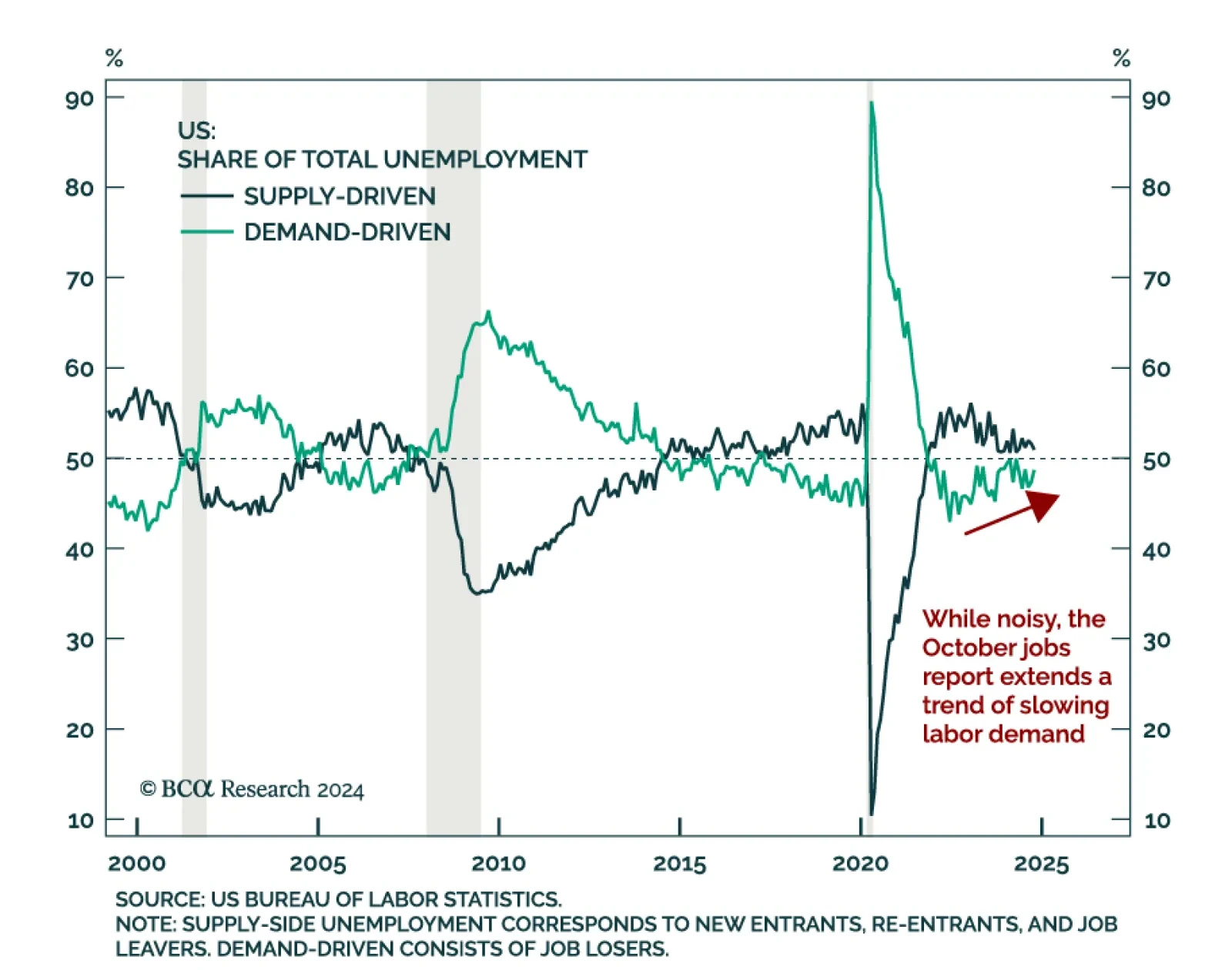

The prospect of a new trade war more than offsets the other pro-business parts of Trump’s agenda. With the labor market already weakening going into the election, we are raising our 12-month US recession probability from 65% to 75…

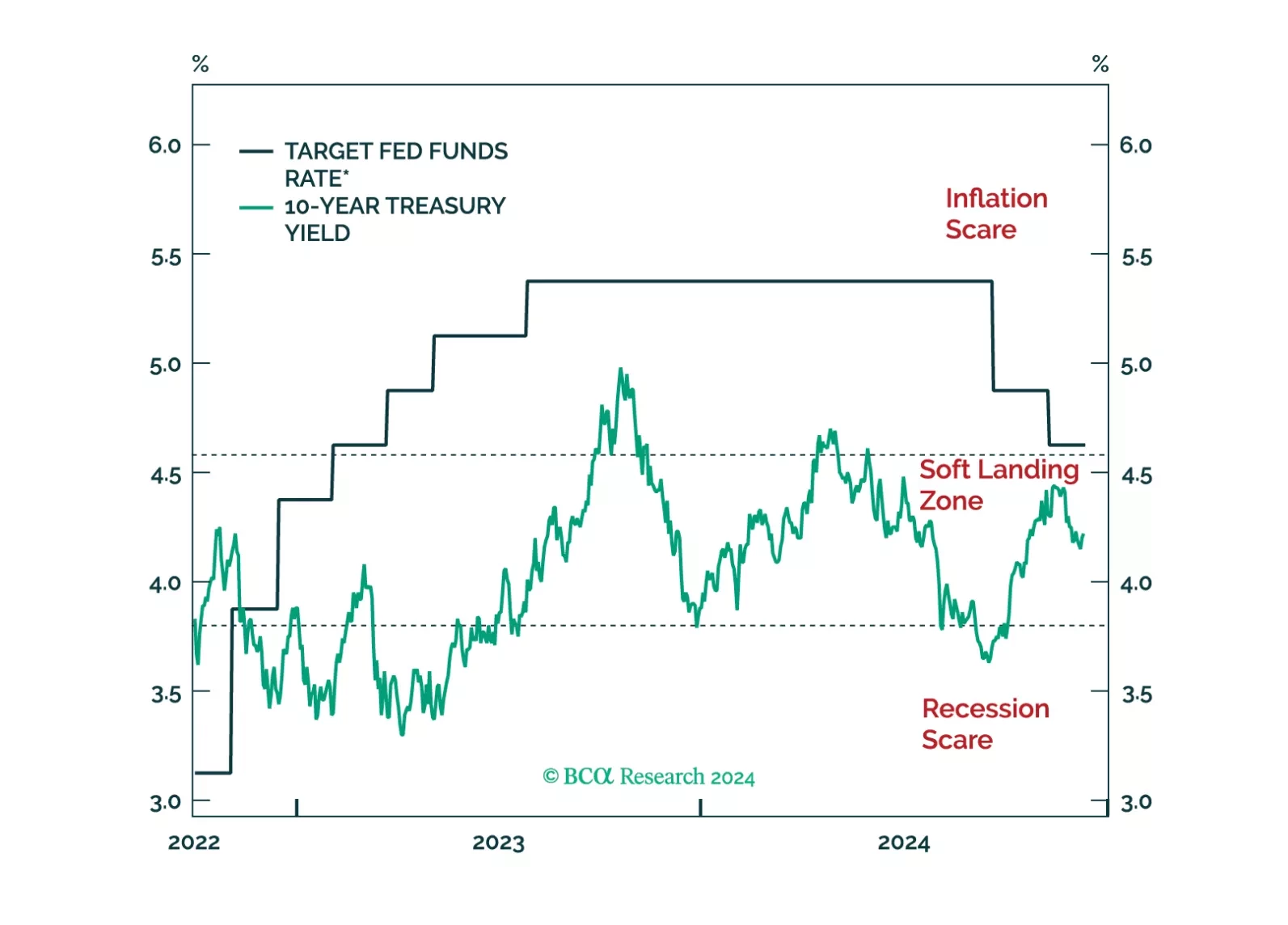

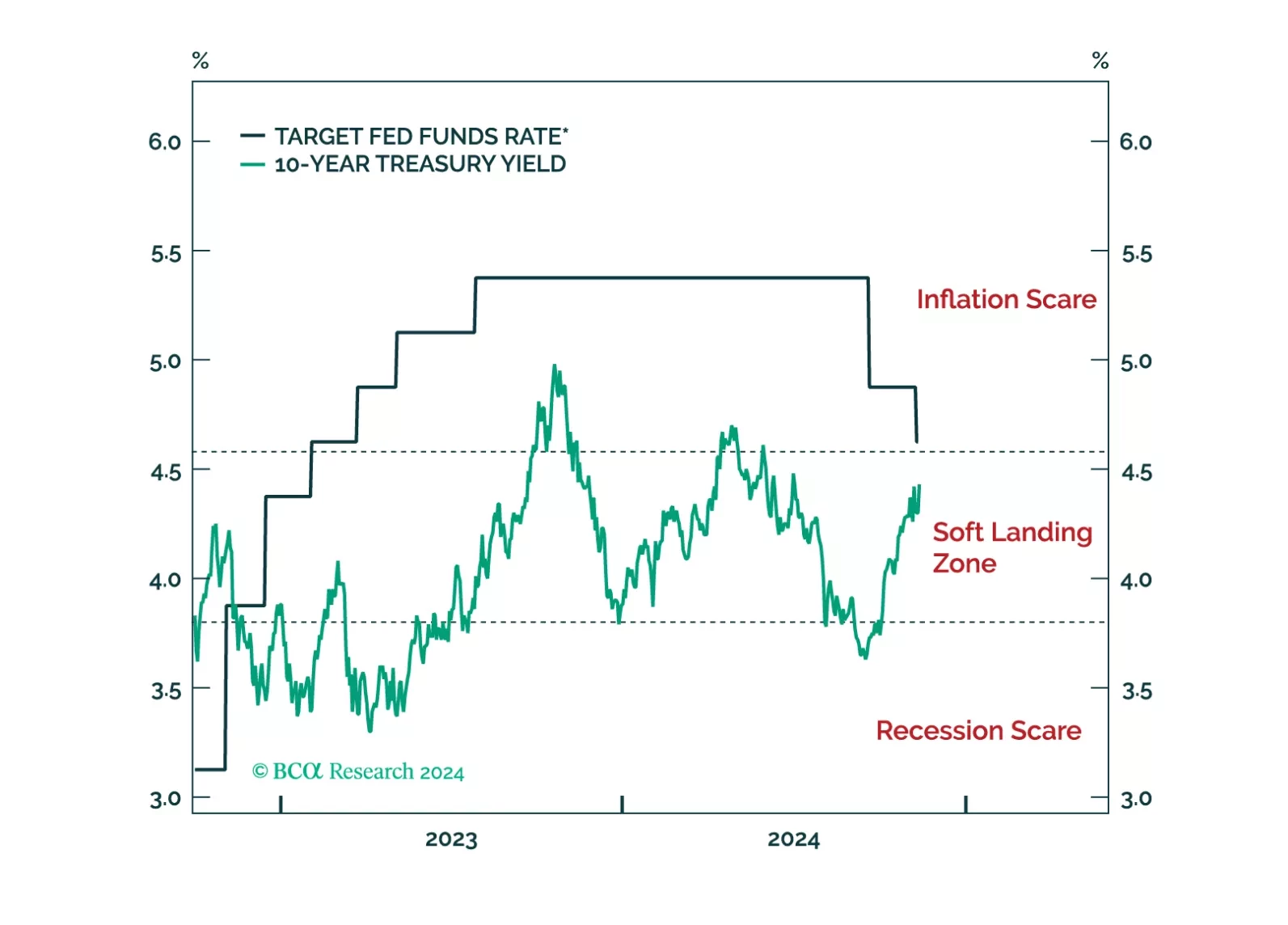

Our thoughts on the bond market’s reaction to the election and this afternoon’s FOMC meeting.

Over the next few months, Japan’s new government will ease fiscal policy, which will improve domestic demand on the margin. Monetary policy may tighten further in the short run but not too much over the long run. The geopolitical…

The October US jobs report had mixed signals and was skewed by hurricanes and industrial strikes. Unemployment met expectations by staying unchanged at 4.1%, although it rose nearly 0.1 percentage point on an unrounded basis.…