As US consumers remain one of the few engines of global growth, our US Investment Strategy colleagues took a deep dive on consumer trends, augmented with comments from US banks’ earnings calls. Middle-aged consumers have…

The global political system is destabilizing and the US will turn more hawkish in foreign policy, trade policy, or both, regardless of the election outcome. Tactically go long the dollar.

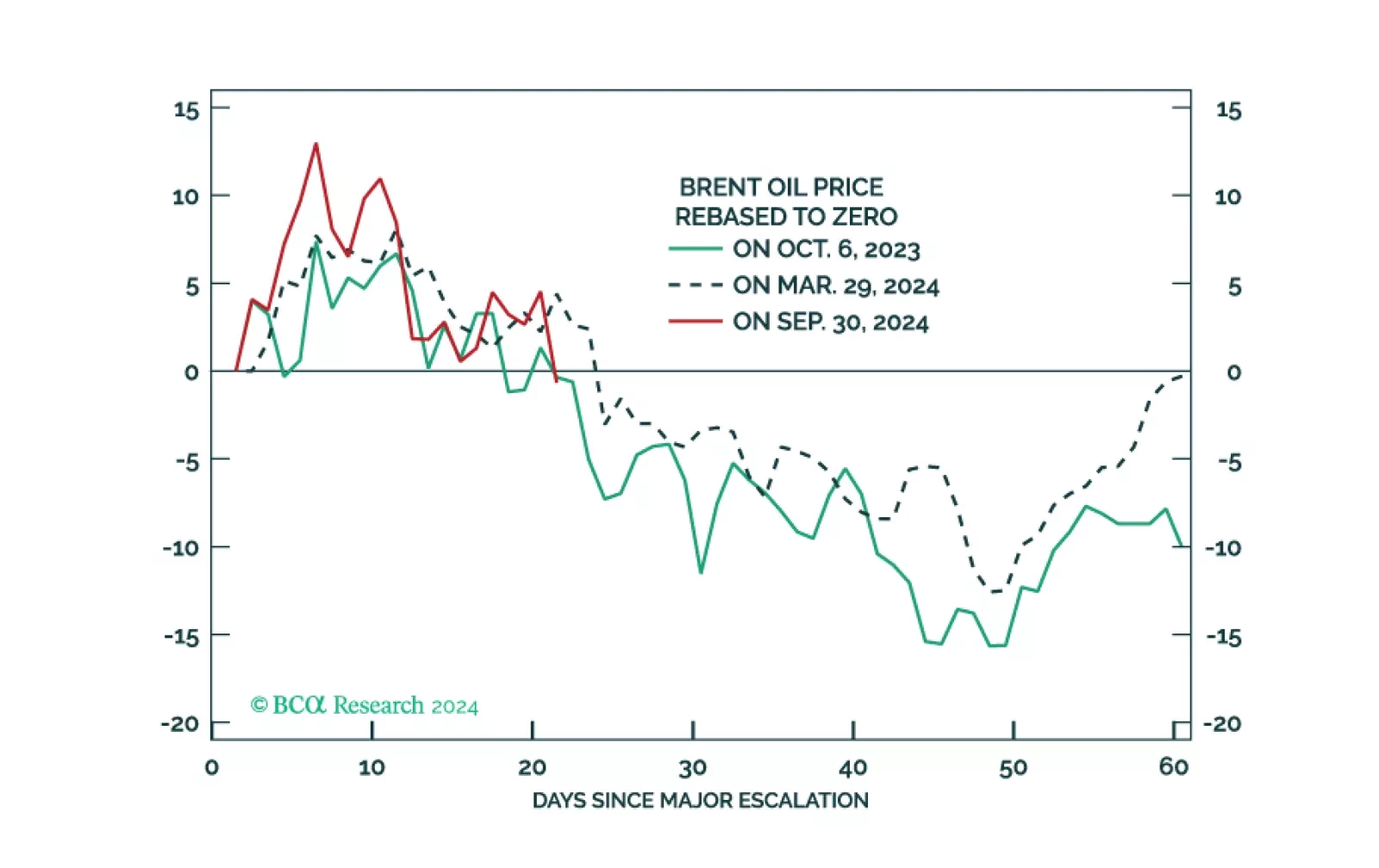

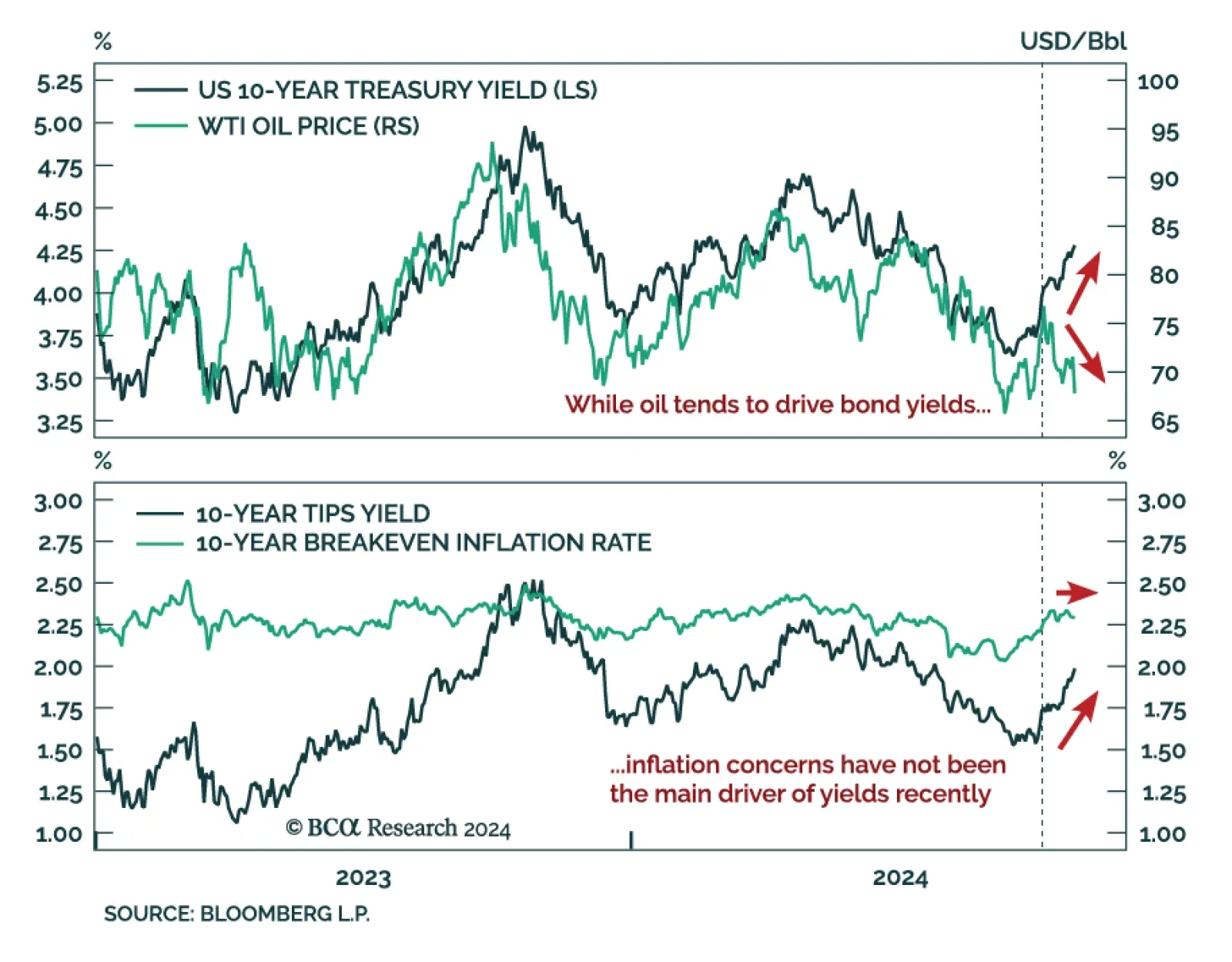

For the past two weeks, oil has sold off amid a global spike in yields. Oil prices and Treasury yields tend to be positively correlated, as oil prices are a fast-moving component of inflation, driving the inflation expectations…

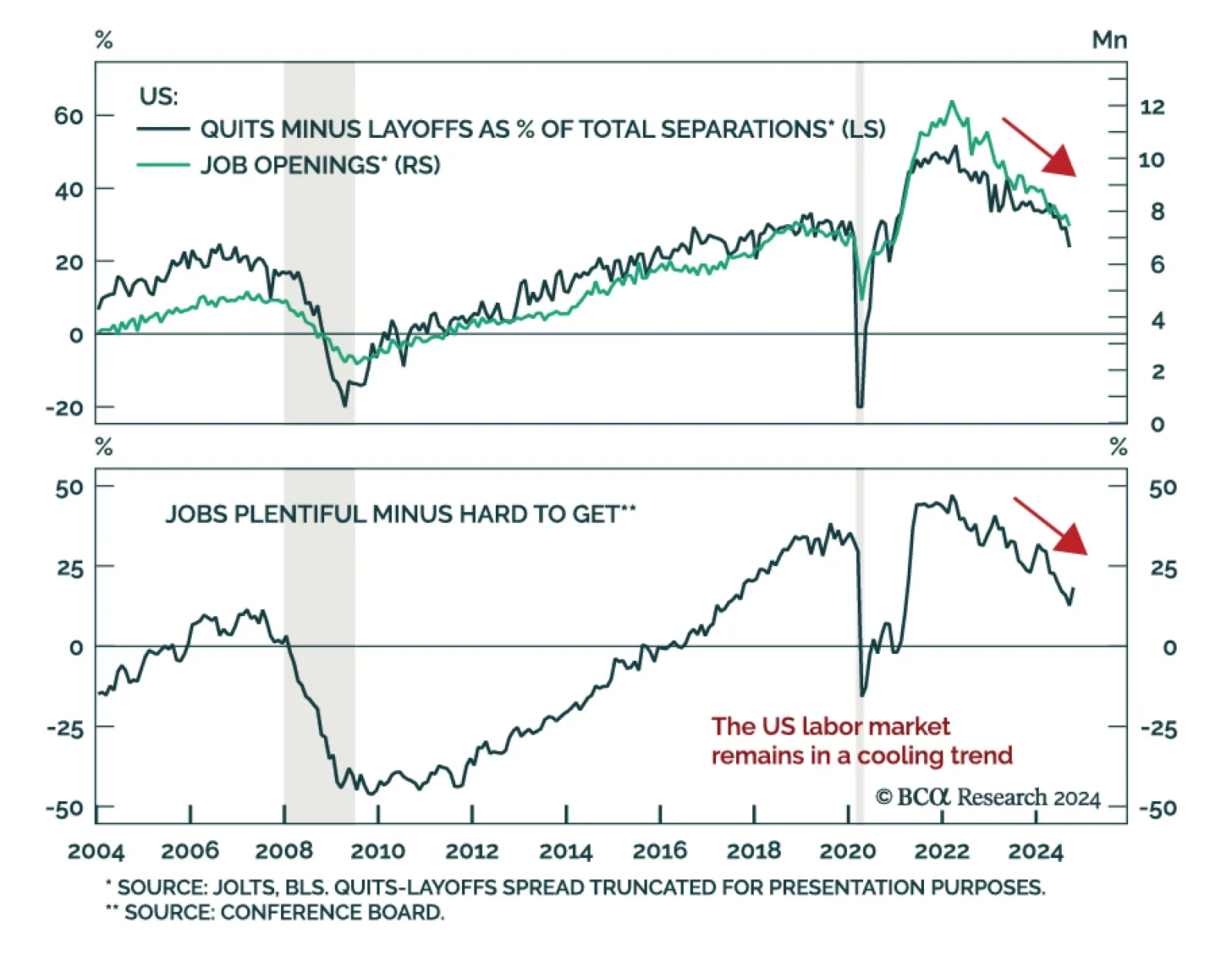

Job openings missed expectations at 7.44 million in September, a mild slowdown from August. The details of the JOLTS report were also negative, except for hirings which continue their June rebound. Meanwhile, consumer confidence…

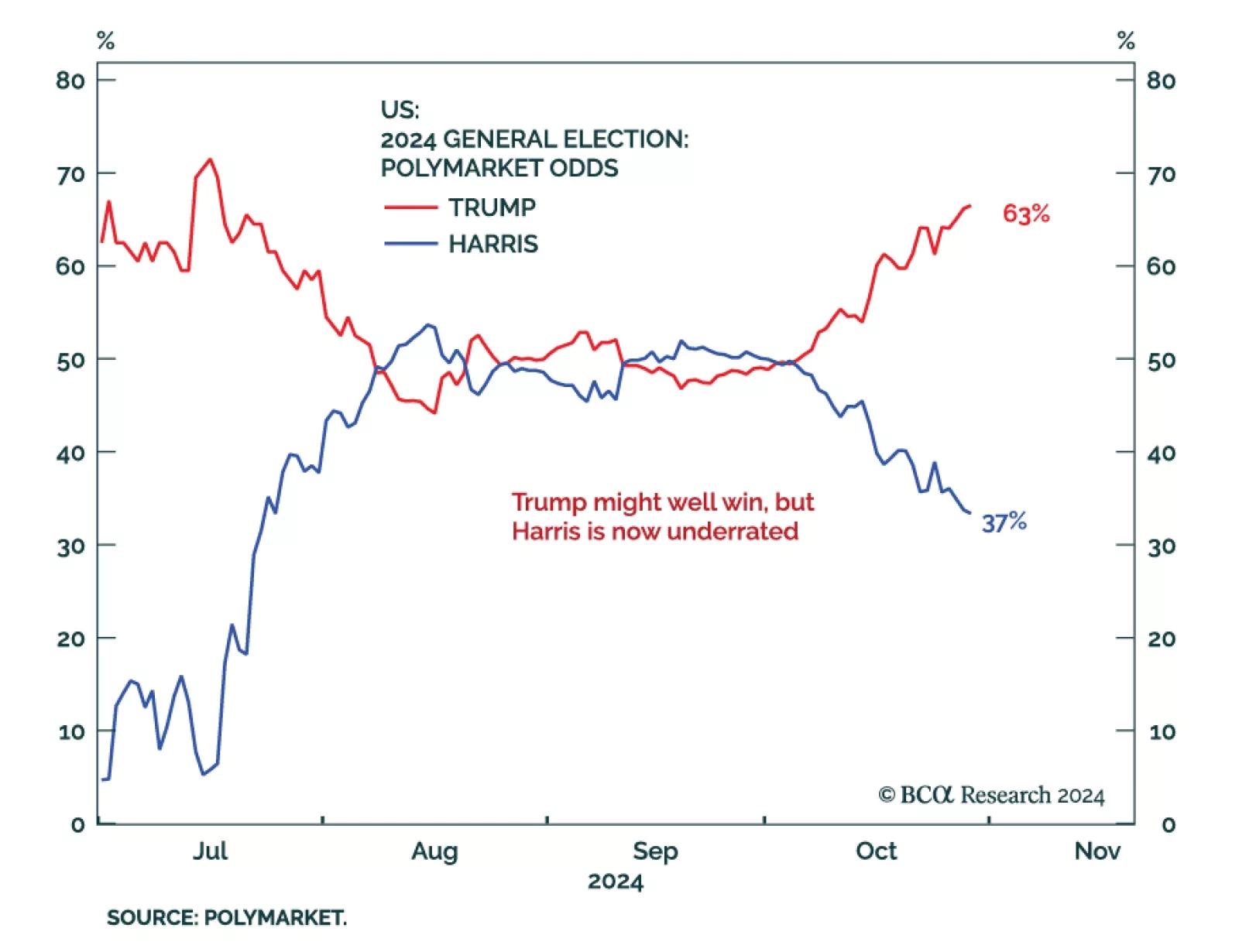

Our US Political Strategy colleagues now see 55% odds of a Trump victory, with odds of a Republican sweep at 47%. As odds of a contested election are rising, they built on their 2020 work to provide answers for next week’s…

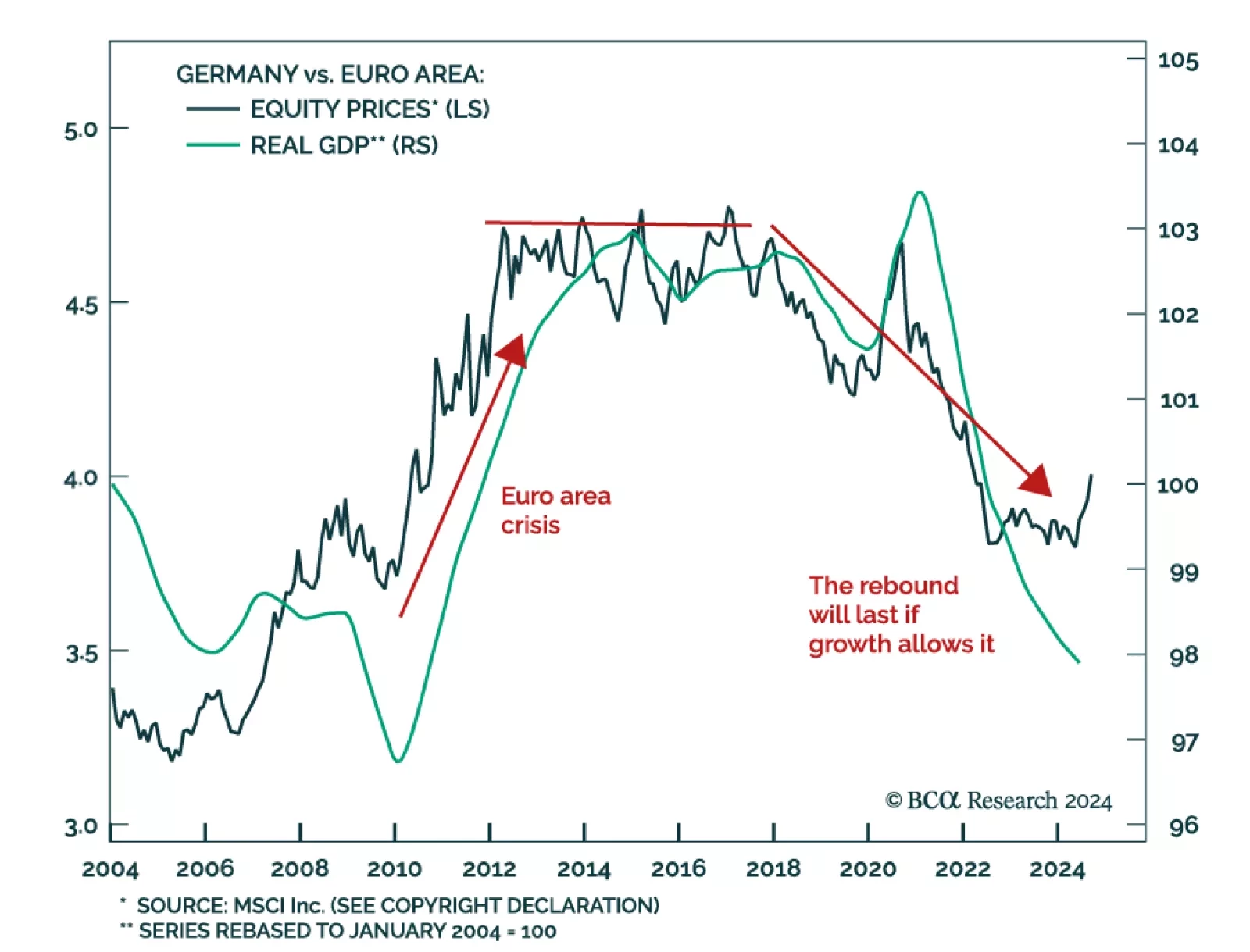

Germany’s problems are well known: Demographics, Chinese competition, underinvestment, energy dependence, and constrained fiscal policy. Our European Investment Strategy colleagues believe this bad news is priced in…

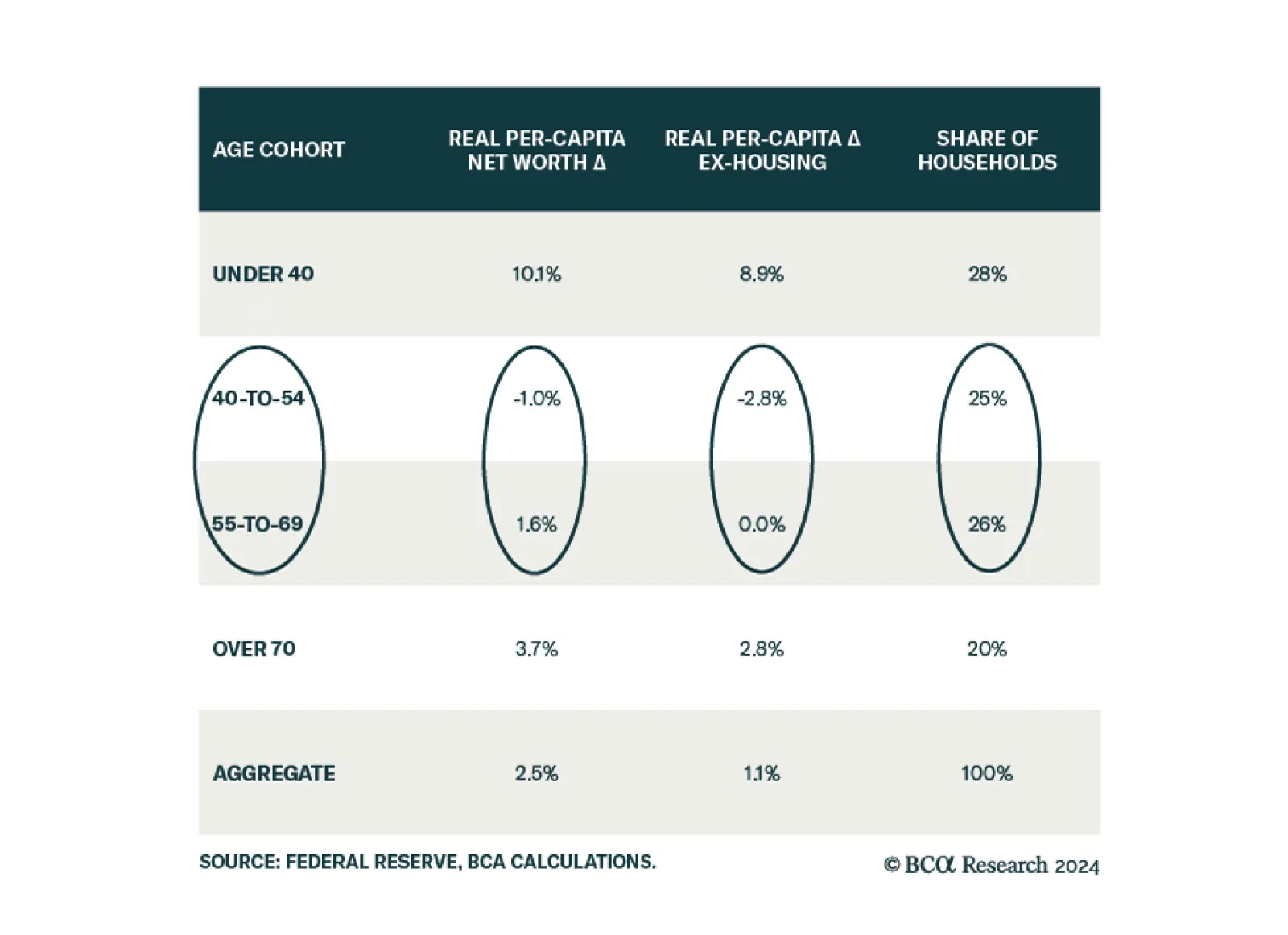

Middle-aged households have lagged youngish and older households since the pandemic and the 40-to-54 cohort is worse off than it was at the end of 2019. The fragmenting of the seemingly monolithic US consumer widens the path to a…

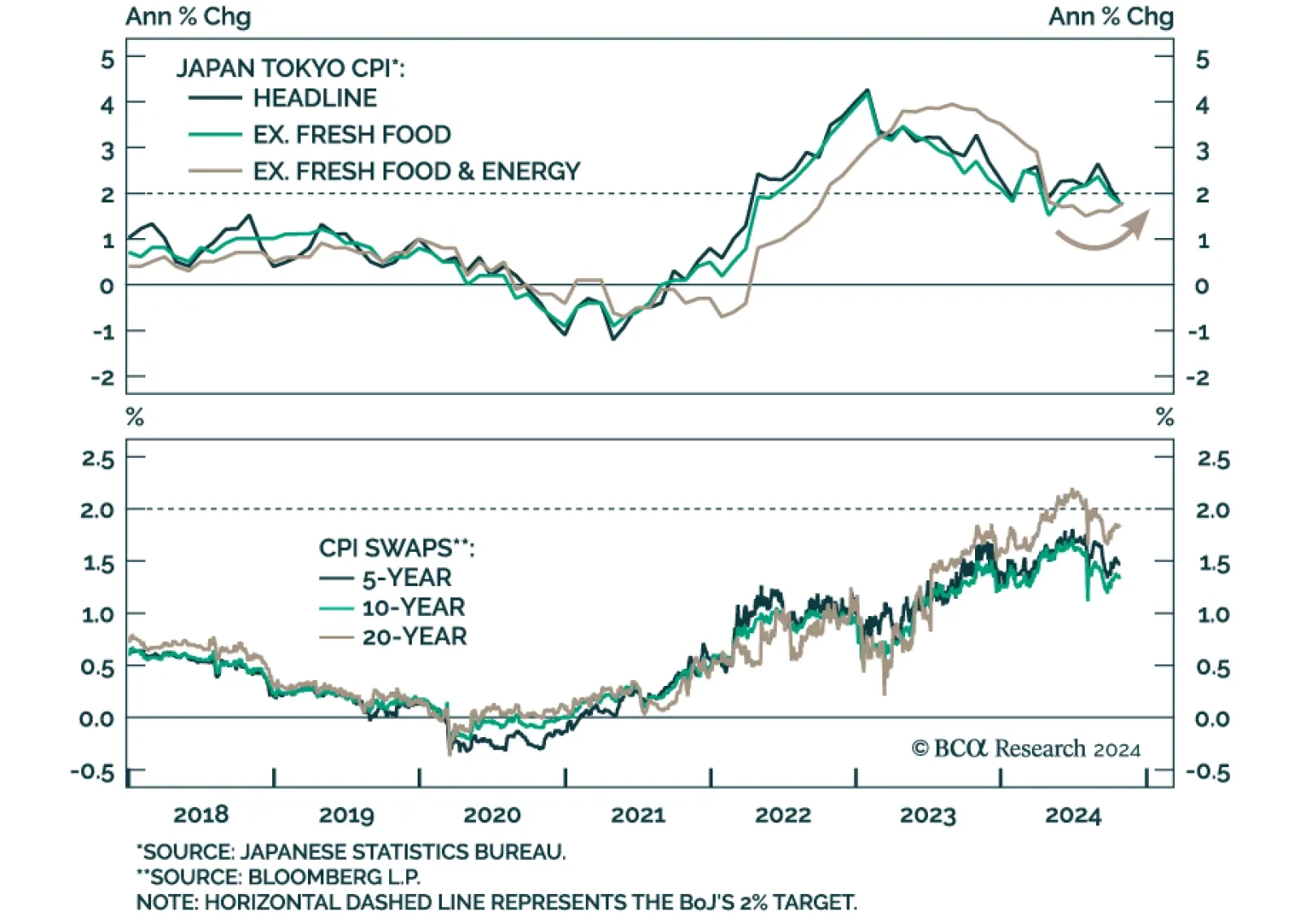

The “core core” (ex. fresh food & energy) segment of the Tokyo CPI basket beat expectations in October, printing at 1.8% year-over-year and accelerating from 1.6% in September after troughing at 1.5% in July. The…

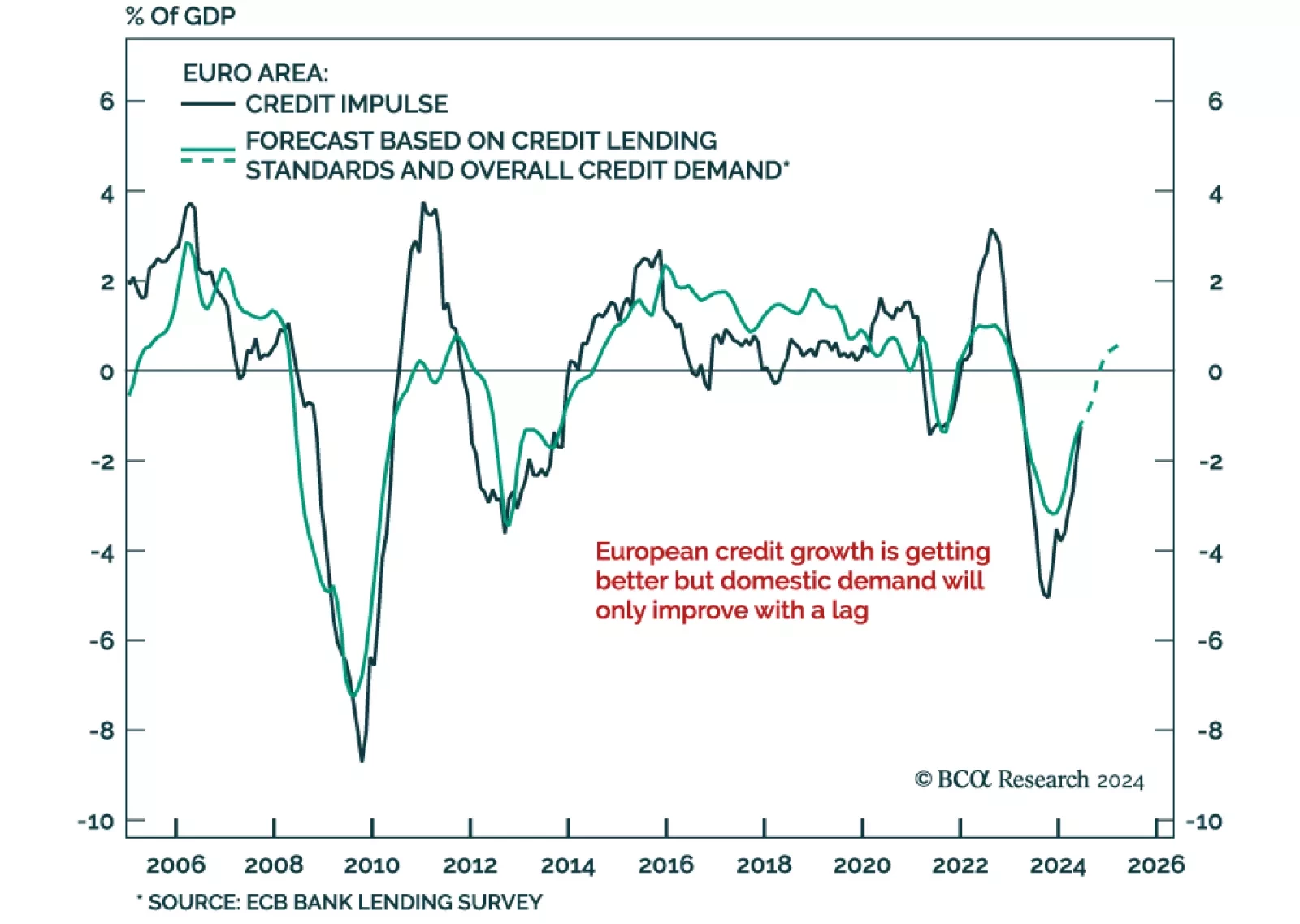

Eurozone money and credit data beat expectations, with M3 accelerating to 3.2% year-over-year in September from 2.9% a month prior. Household and corporate lending both drove the improvement. This development echoes the latest…

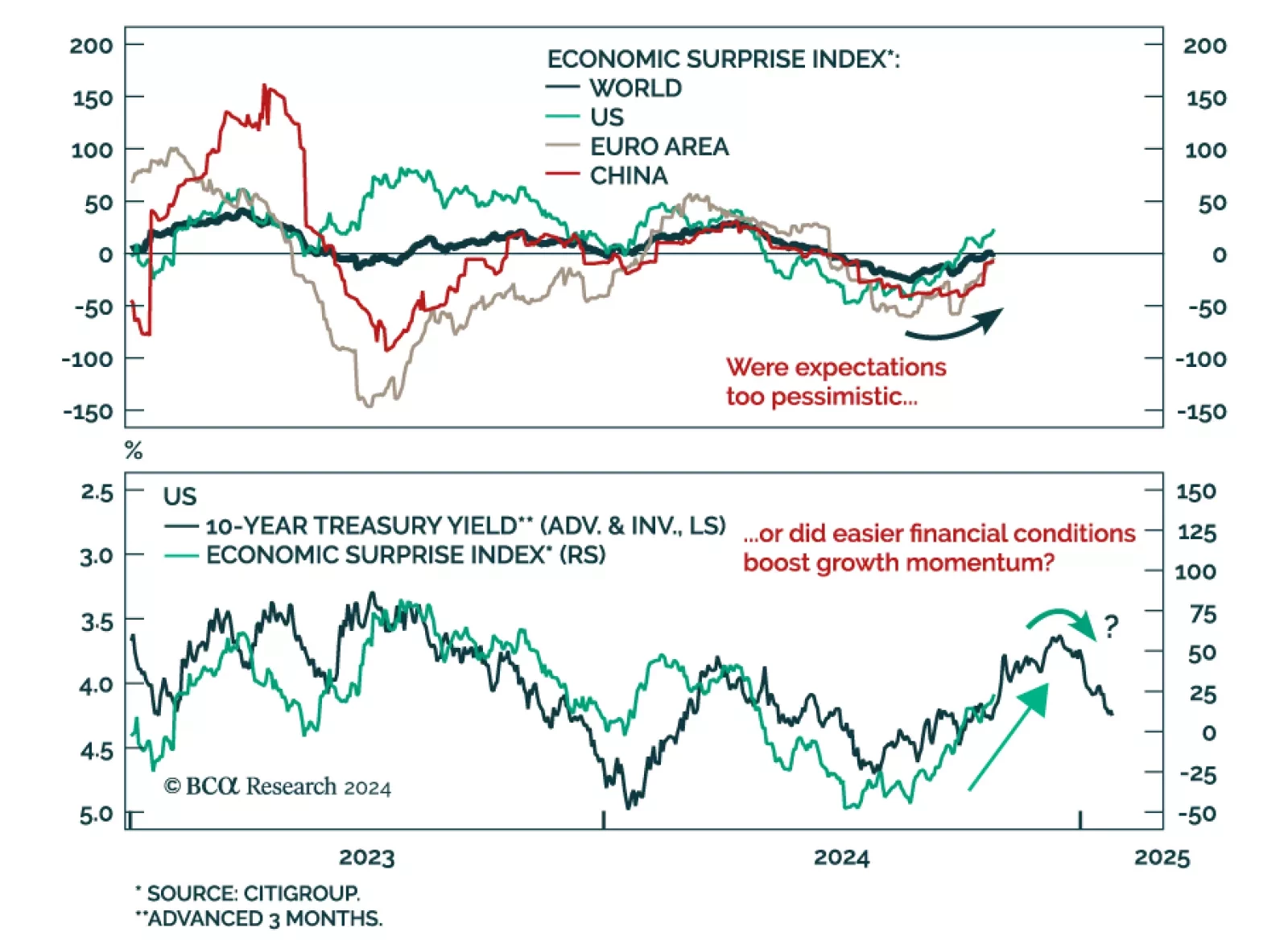

Global economic surprises have improved. Currently positive and improving in the US, they are rising from a low level in the Eurozone and China. Two explanations could explain this momentum. First, the recent easing in…