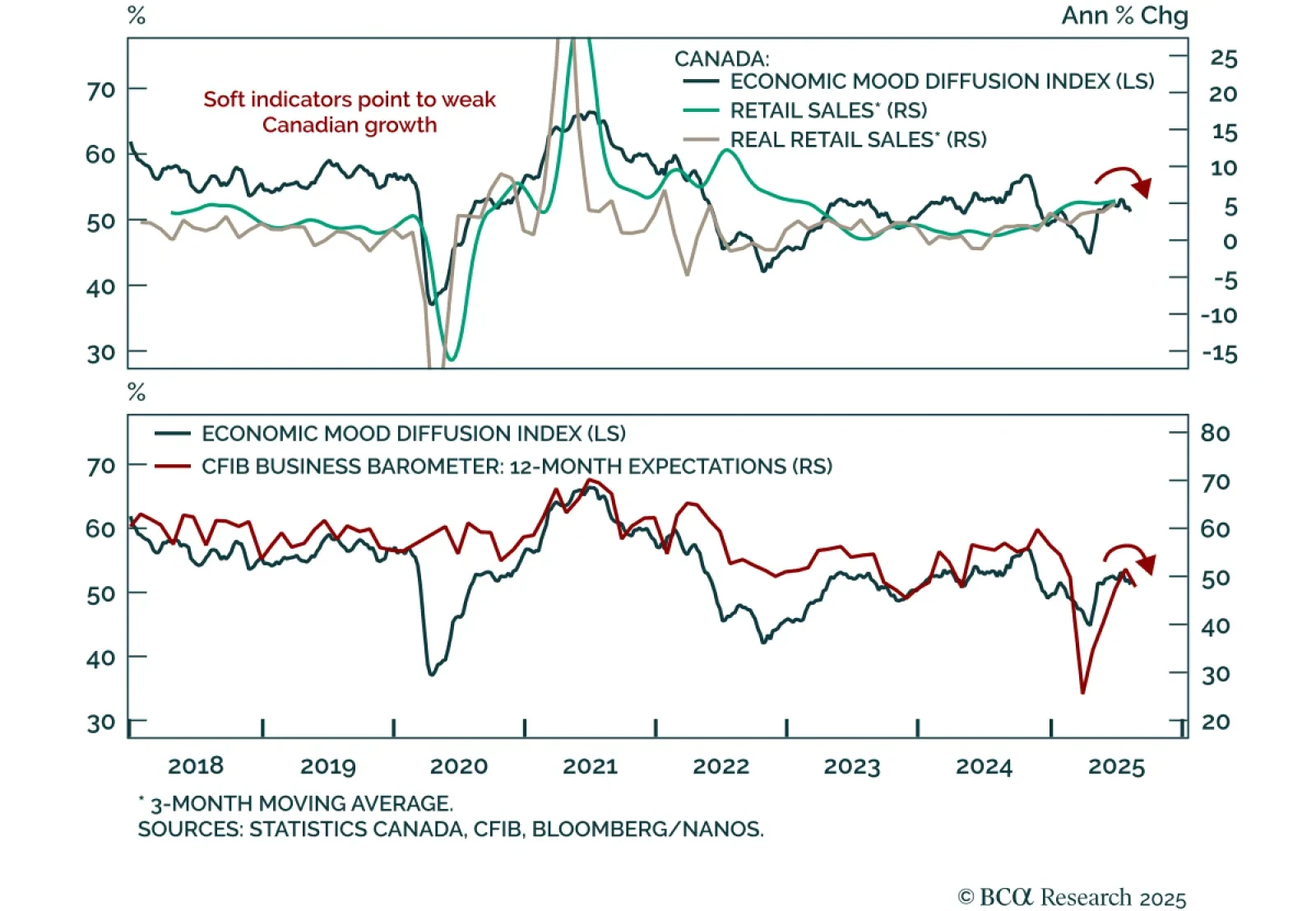

Canada’s fragile growth backdrop reinforces the case for more BoC easing than markets price. June retail sales rose 1.5% m/m, in line with expectations. Excluding autos, sales were stronger at 1.9%. However, the advance estimate…

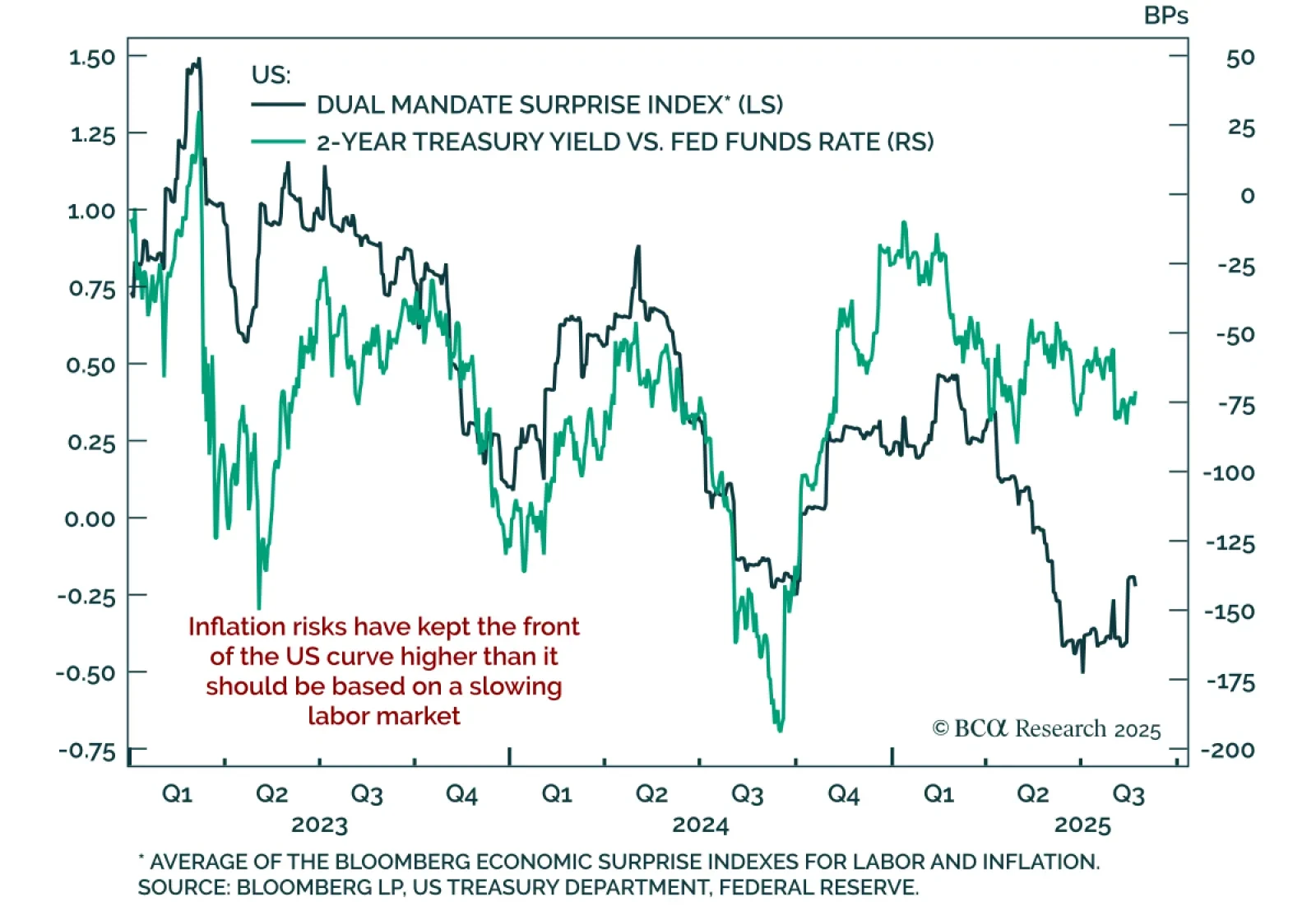

Powell’s final Jackson Hole speech signaled a dovish tilt, opening the door to a September cut. The Fed is under pressure to balance unemployment and inflation risks, with the FOMC split between “proactive” doves and “reactive” hawks…

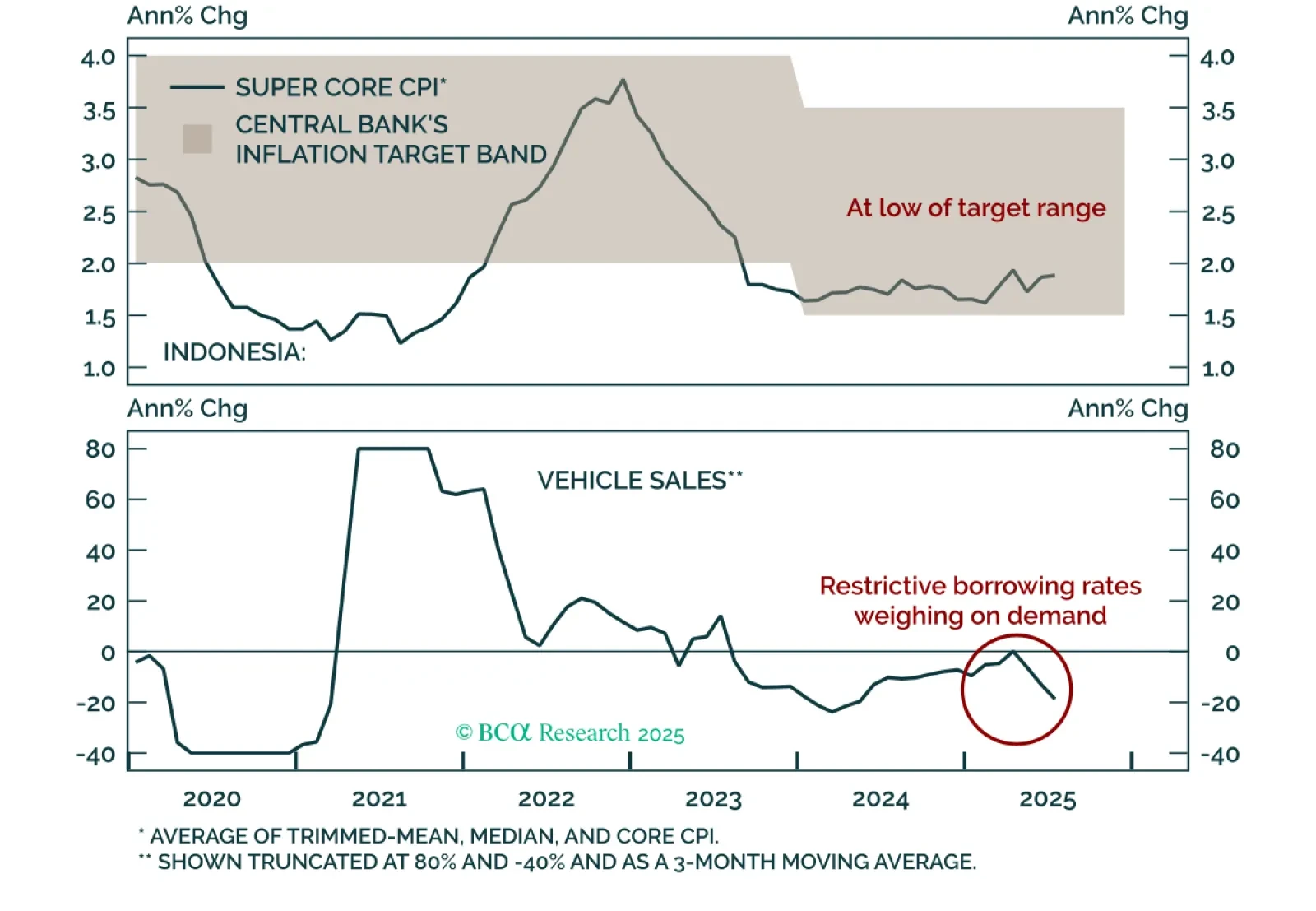

Indonesia’s surprise rate cut signals a dovish turn that will weigh on the rupiah. Bank Indonesia cut its policy rate by 25 bps to 5%, with low inflation and weak activity pointing to more easing ahead. Our Emerging Markets team…

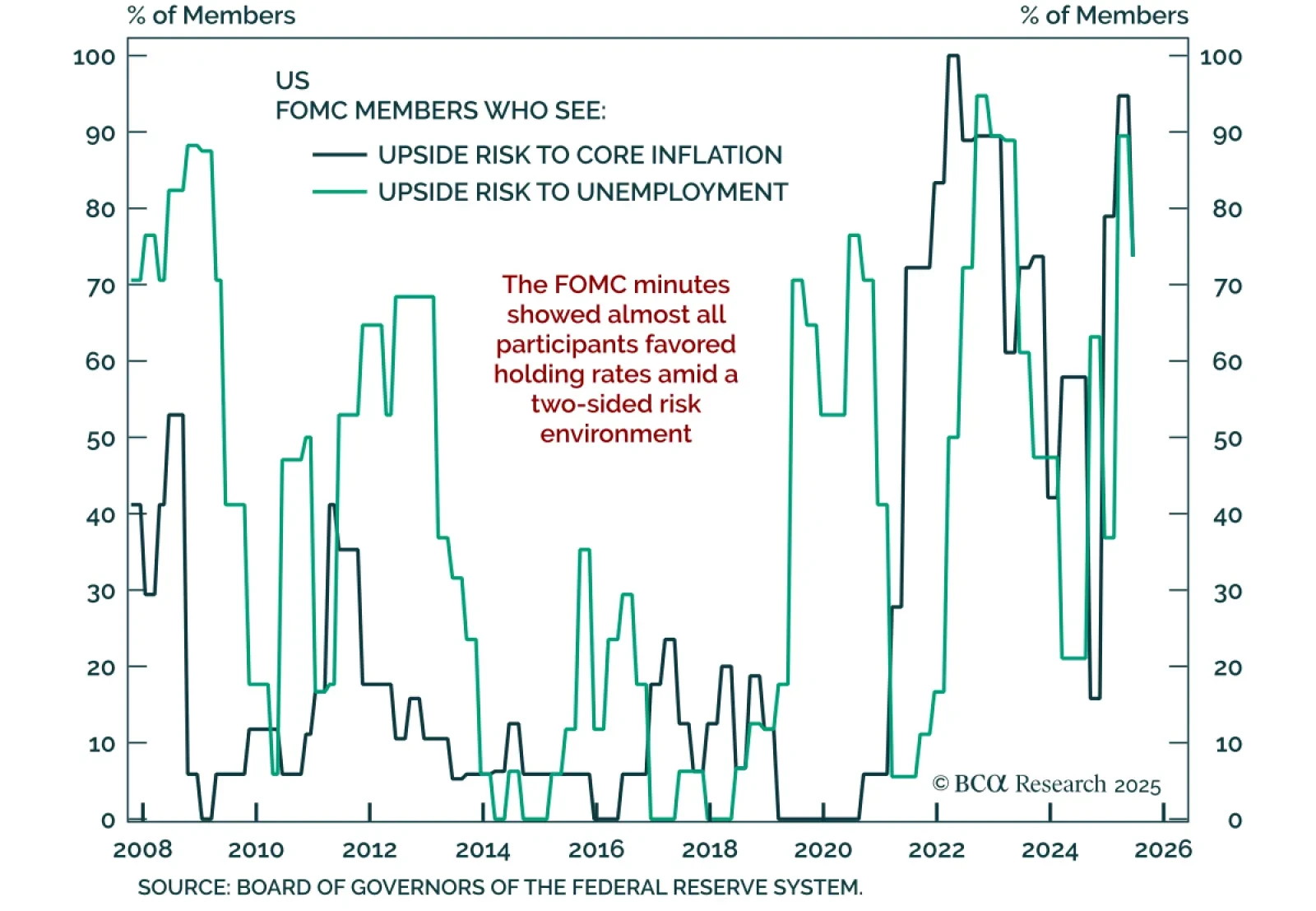

FOMC minutes showed broad support to hold in July, but the committee remains divided between proactive doves and reactive hawks. “Almost all members” favored leaving the funds rate unchanged, though two dissented for an…

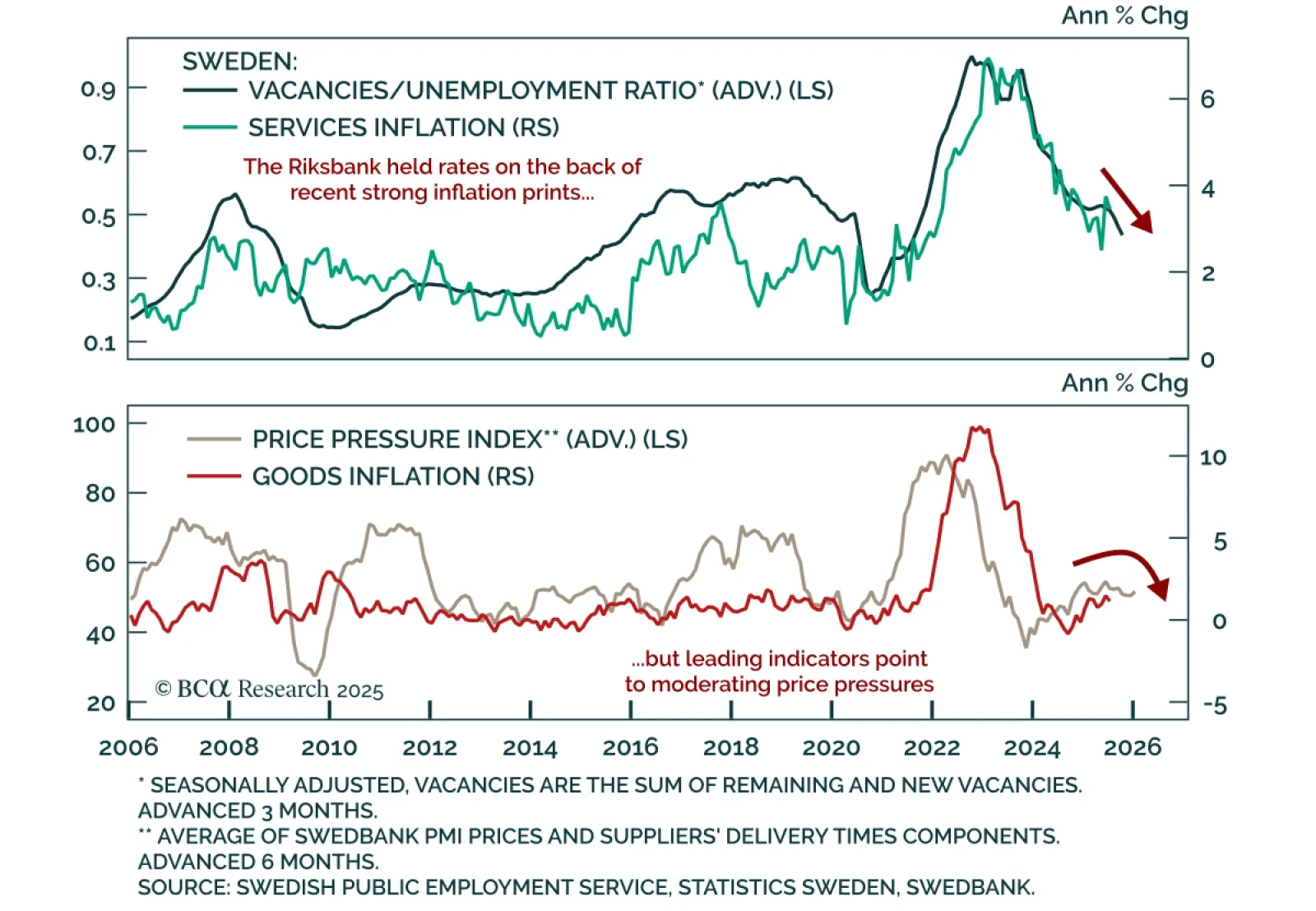

The Riksbank held at 2.0% as core inflation remains above target, though easing pressures are building. July headline inflation had slightly cooled, but core remains above both the bank’s forecast and the 1-3% target band. Inflation…

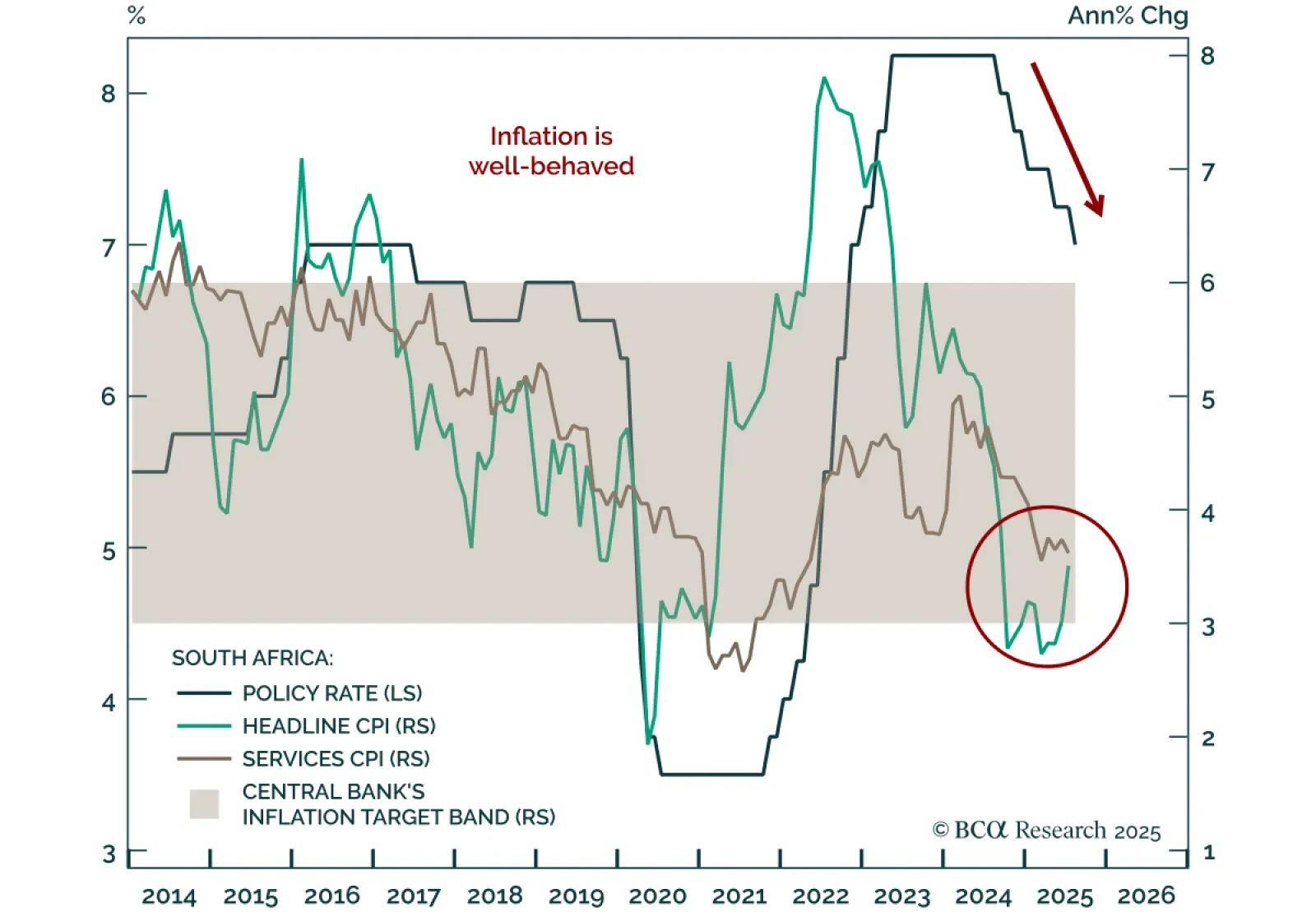

South African inflation will remain at the bottom of the SARB target range, allowing further easing. July CPI came in line with expectations at 3.5% y/y, with core at 3.0%. Our Emerging Markets strategists expect the…

July’s softer Canadian inflation, set against lingering macro weakness, reinforces the case for more BoC easing than markets are currently pricing. Headline CPI slowed to 1.7% y/y from 1.9%, below expectations, driven by lower…

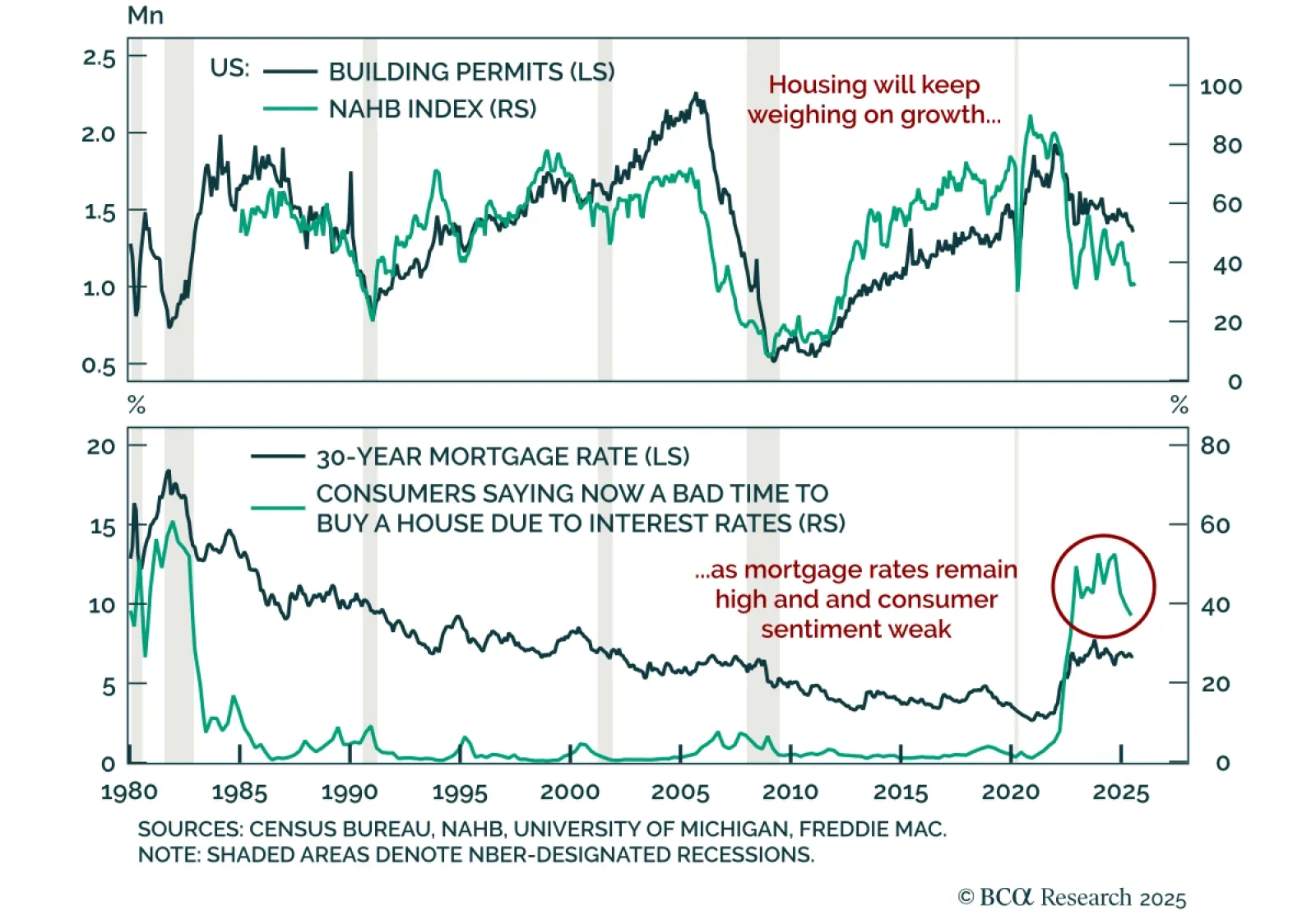

US housing data remain weak, reinforcing a fragile growth backdrop and the need for equity downside protection. July housing starts rose 5.2% m/m (annualized), but building permits fell 2.8% following a small June decline. The…

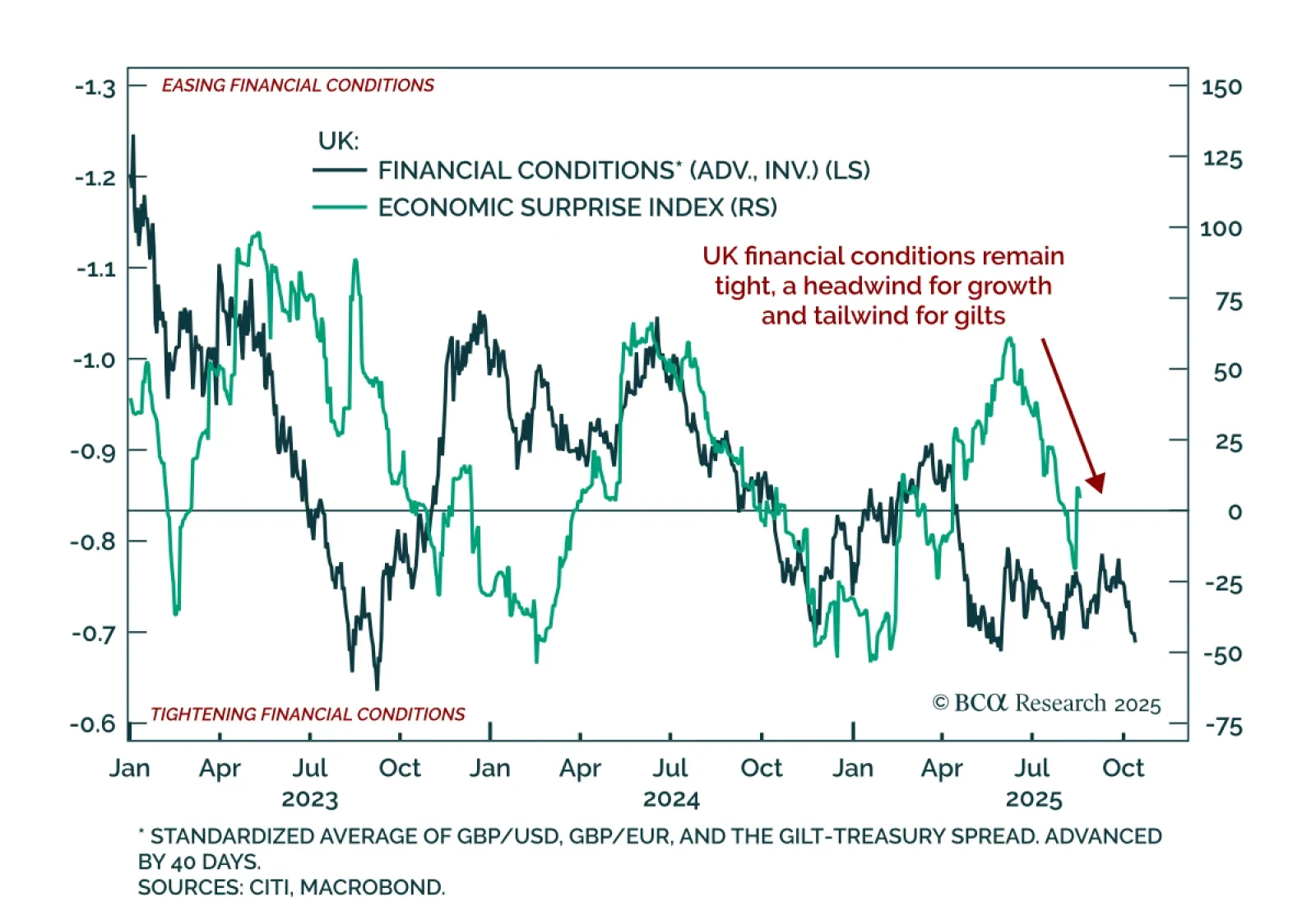

UK data momentum is fading, keeping Gilts attractive and GBP vulnerable. At 5.60%, 30-year Gilts trade at their highest yields since the late 1990s, reflecting persistent pressure on the long end across DMs. The Bank of England…

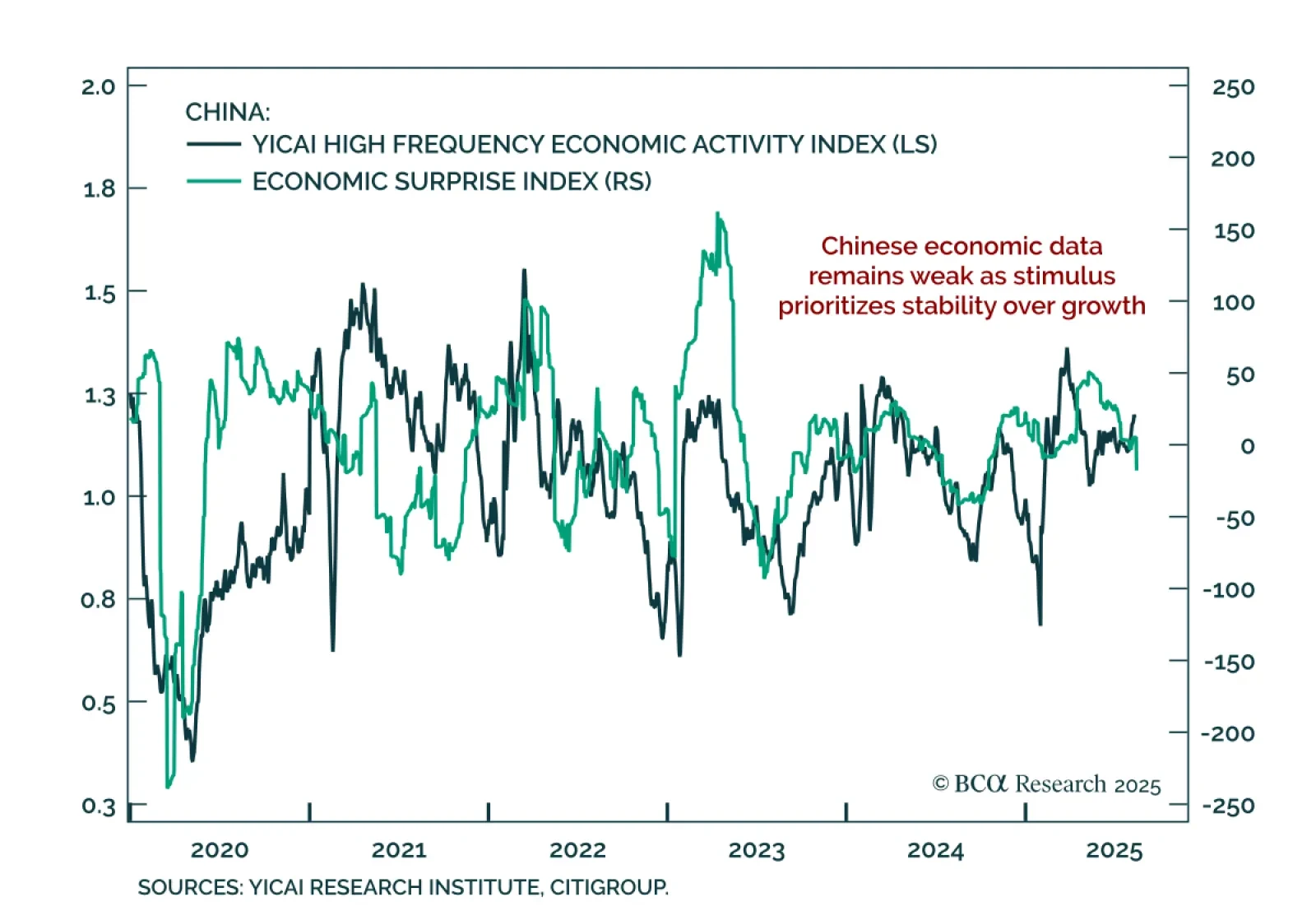

July data confirm China’s weak growth, with no near-term shift toward meaningful stimulus. New home prices fell 0.31% m/m, retail sales slowed to 3.7% y/y from 4.8%, and industrial production eased. Flooding in July disrupted…