Stay cautious on Chinese stocks. Equity investors should use any rebound in onshore stock prices to downgrade A-shares from overweight to neutral within global and EM equity portfolios. Remain underweight Chinese investable/offshore…

In this report, we present our performance review of the BCA Research Global Fixed Income Strategy (GFIS) model bond portfolio for the Q2/2023, and the outlook and scenario analysis for the next six months. The portfolio return…

Although not our base case, there is a path for the US economy to avoid a recession over the next few years. We see the risks to stocks as tilted to the upside in the near term but to the downside over a 12-month horizon.

In this report, we dissect which markets have broken out and which ones have not, and reflect what this entails for our global macro view. Also, we analyze how the S&P 500 has been taking its cues from a change in the inflation…

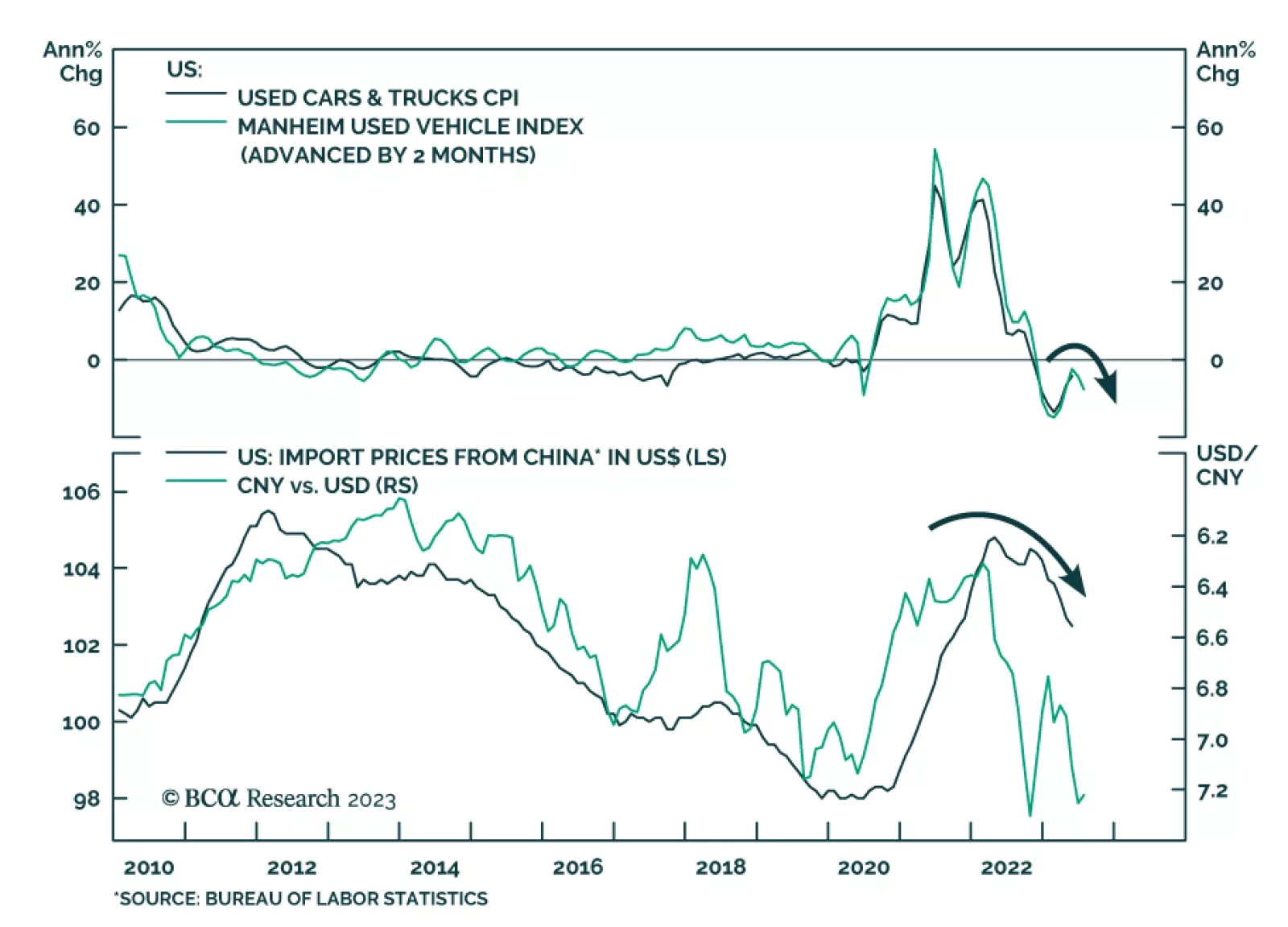

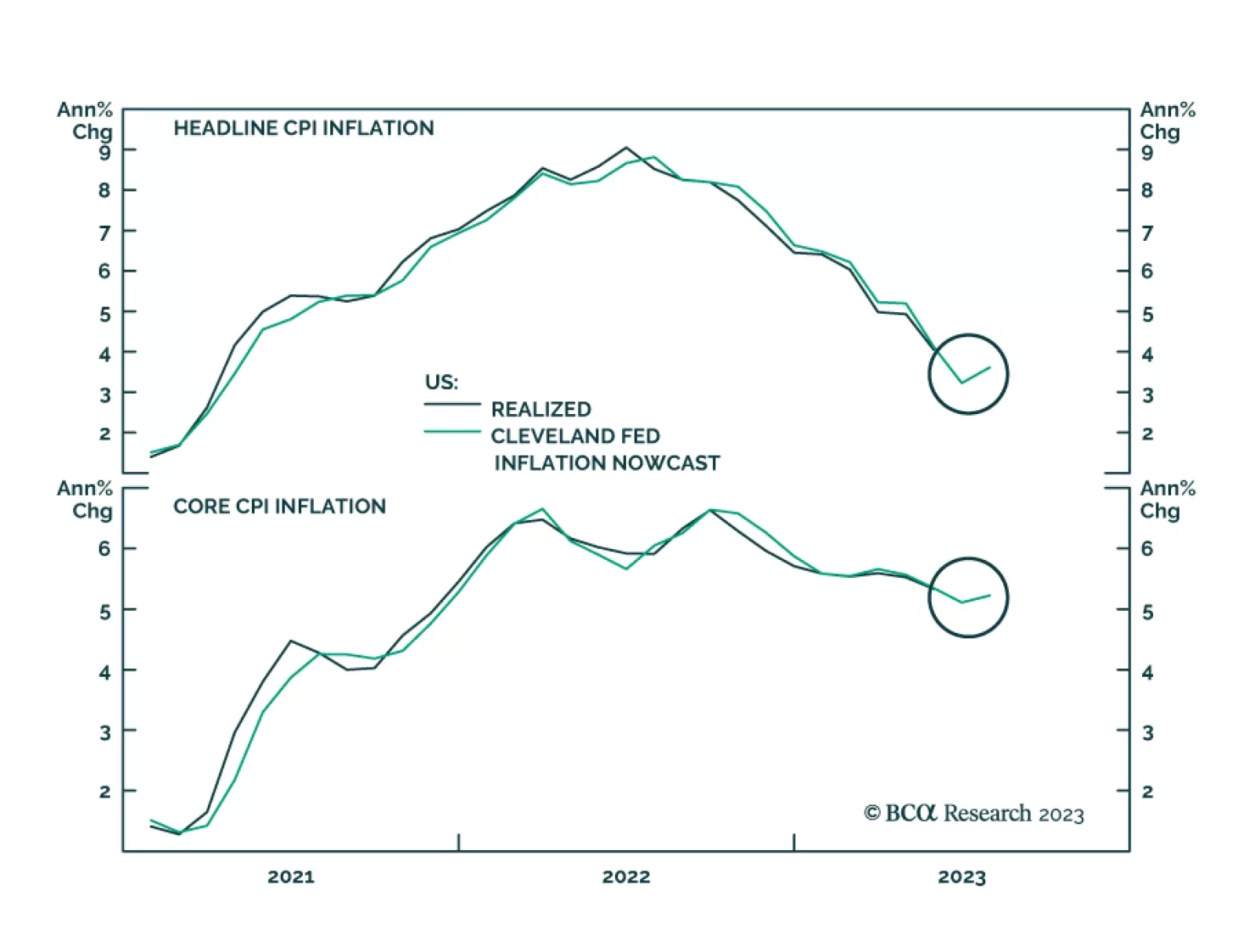

The latest update of the Manheim Used Vehicle Price Index provides a positive signal for US goods inflation. It shows used car prices fell by -4.2% m/m (-10.1% y/y) in June – its third consecutive monthly decline following…

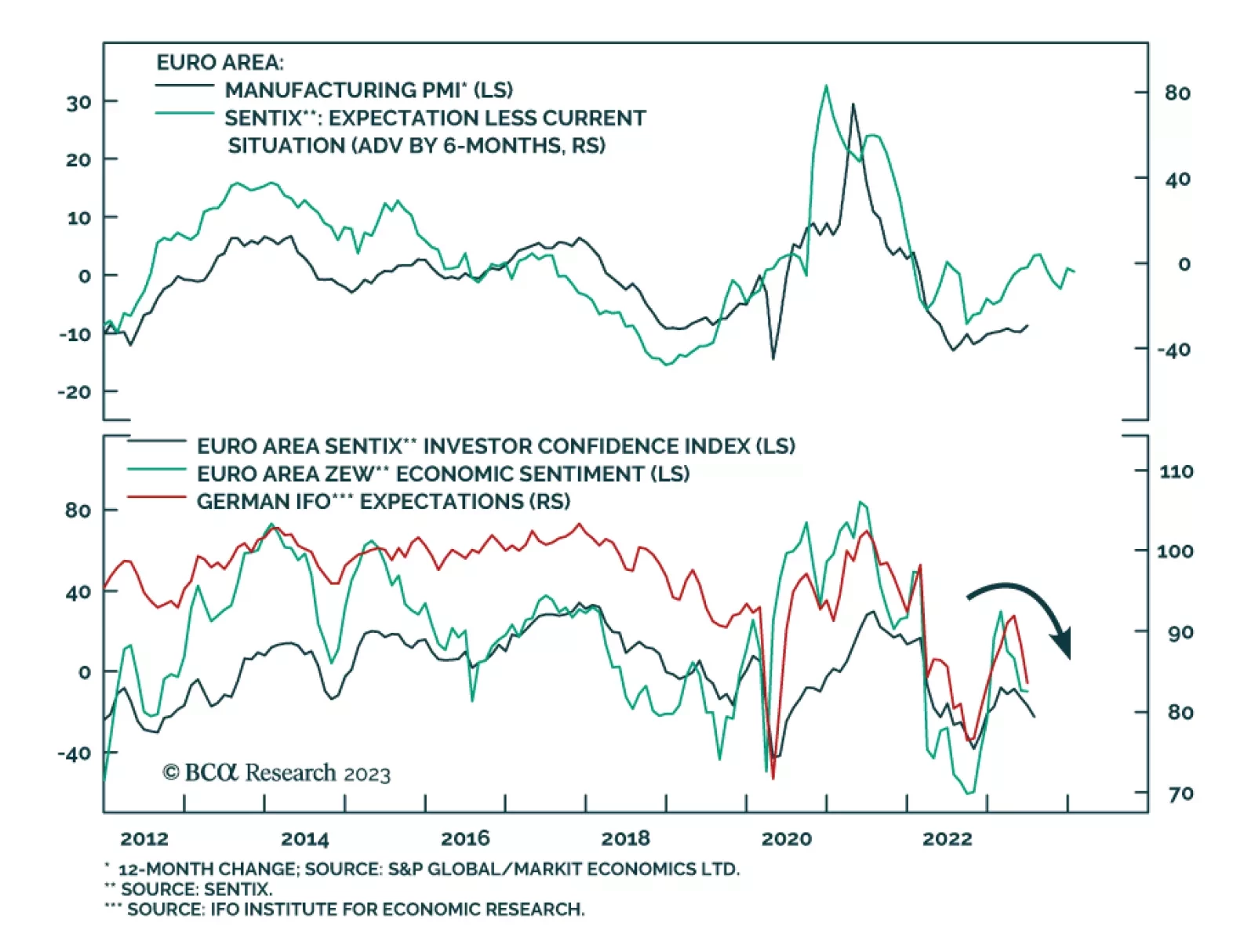

On Monday, the Eurozone Sentix sent a pessimistic signal about investor confidence in the Eurozone economy. The headline index dropped from -17.0 to -22.5 in July, significantly below expectations of a more muted deterioration to…

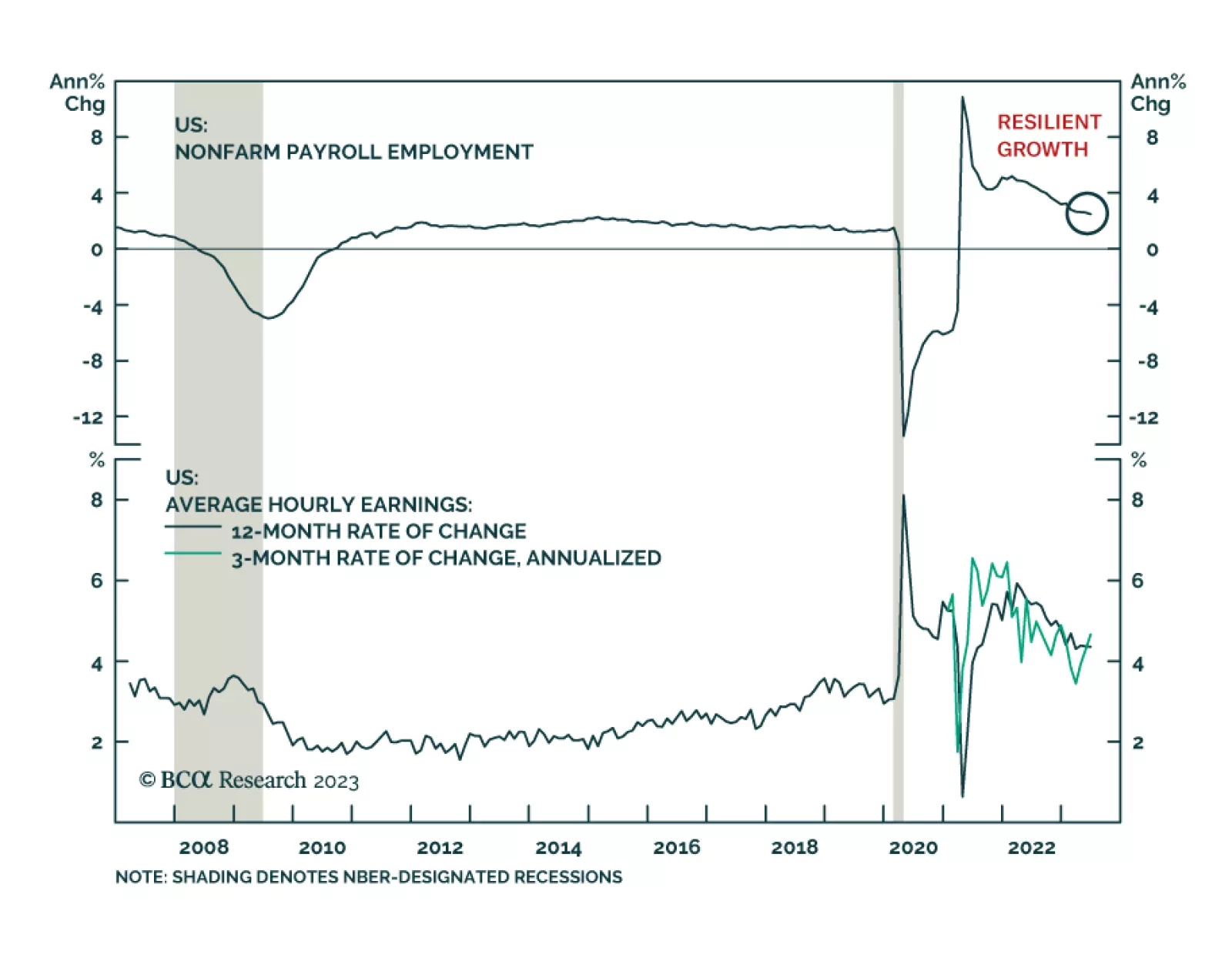

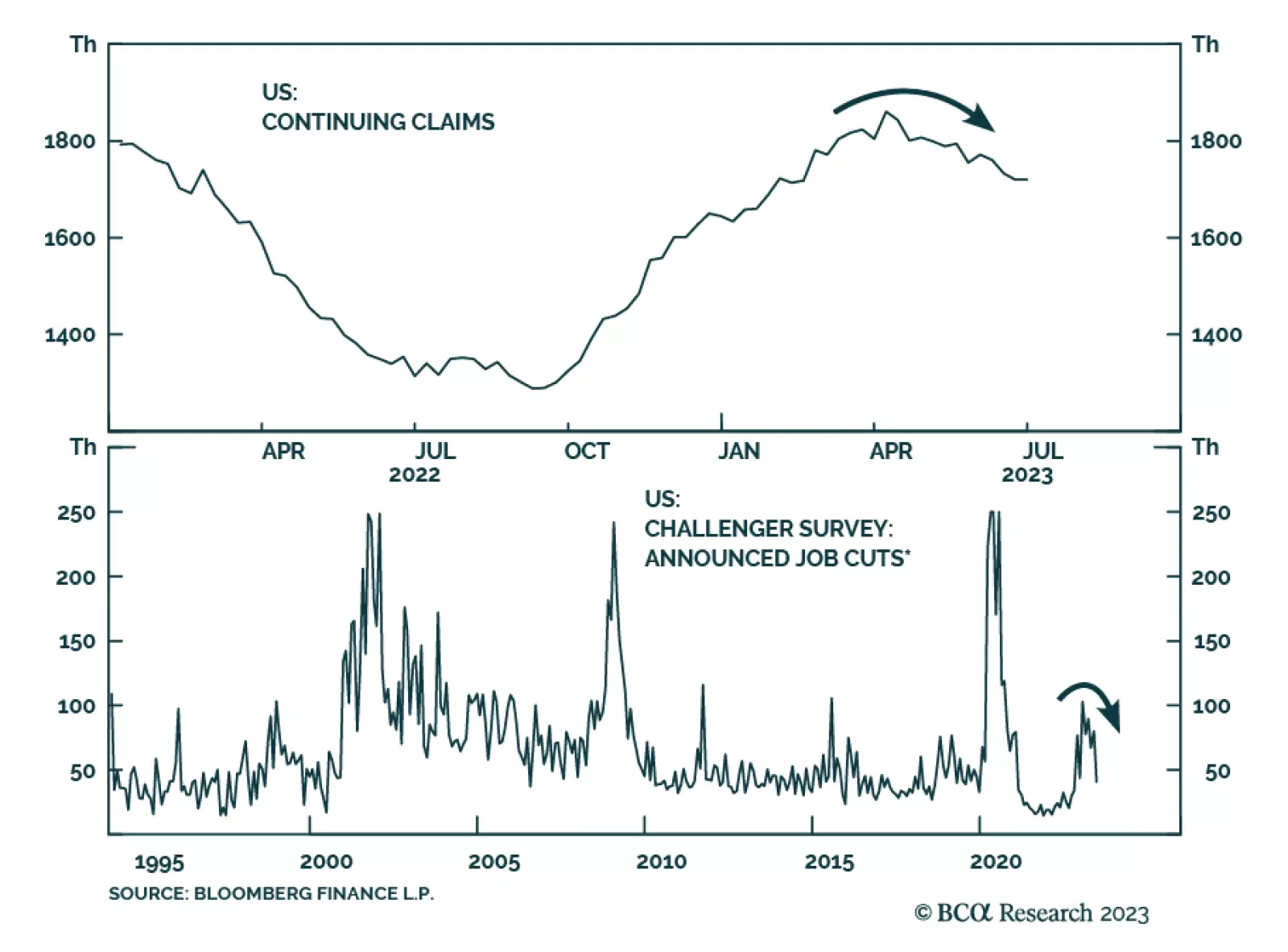

On the surface, the lower-than-anticipated job gains suggest that US labor market conditions softened last month. Friday’s jobs report revealed that the increase in nonfarm payrolls slowed from a downwardly revised 306…

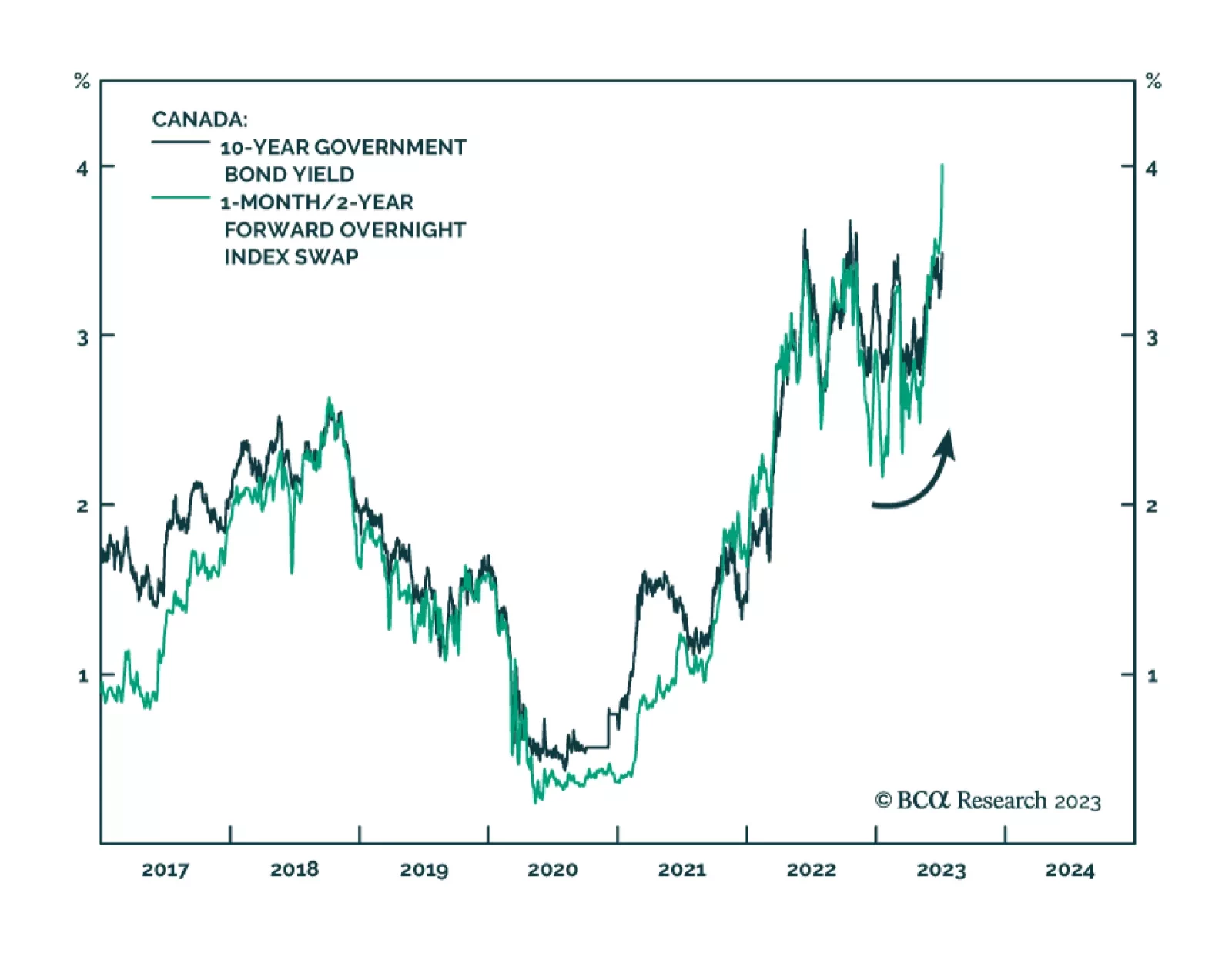

Canadian hiring surprised to the upside in June. The 60 thousand increase in employment last month – the highest since January – came in triple expectations of a 20 thousand rise and follows a 17 thousand decline in…

Last week’s labor market data signal that US employment conditions remain strong – solidifying the case for a 25 bps rate hike at the Fed’s next meeting later this month (see The Numbers). Yet in order for…

Global stocks fell and sovereign bond yields surged on Thursday following the release of stronger-than-anticipated US labor market data. Data released by Challenger, Gray, & Christmas showed job cuts declined to 40,709…