Highlights We remain bearish on the US dollar over the next 12 months. The best vehicle to express this view continues to be the Scandinavian currencies (NOK and SEK). Precious metals remain a buy so long as the dollar faces downside…

To all clients, Next week, in lieu of publishing a regular report, I will be hosting a webcast on September 15th at 10 am EDT, discussing our latest views on global fixed income markets. Sign up details for the Webcast will…

Highlights Negative Rates: The persistence of the COVID-19 pandemic is intensifying pressure on policymakers in many countries to provide more stimulus. The odds that a new central bank will join the negative policy interest rate club…

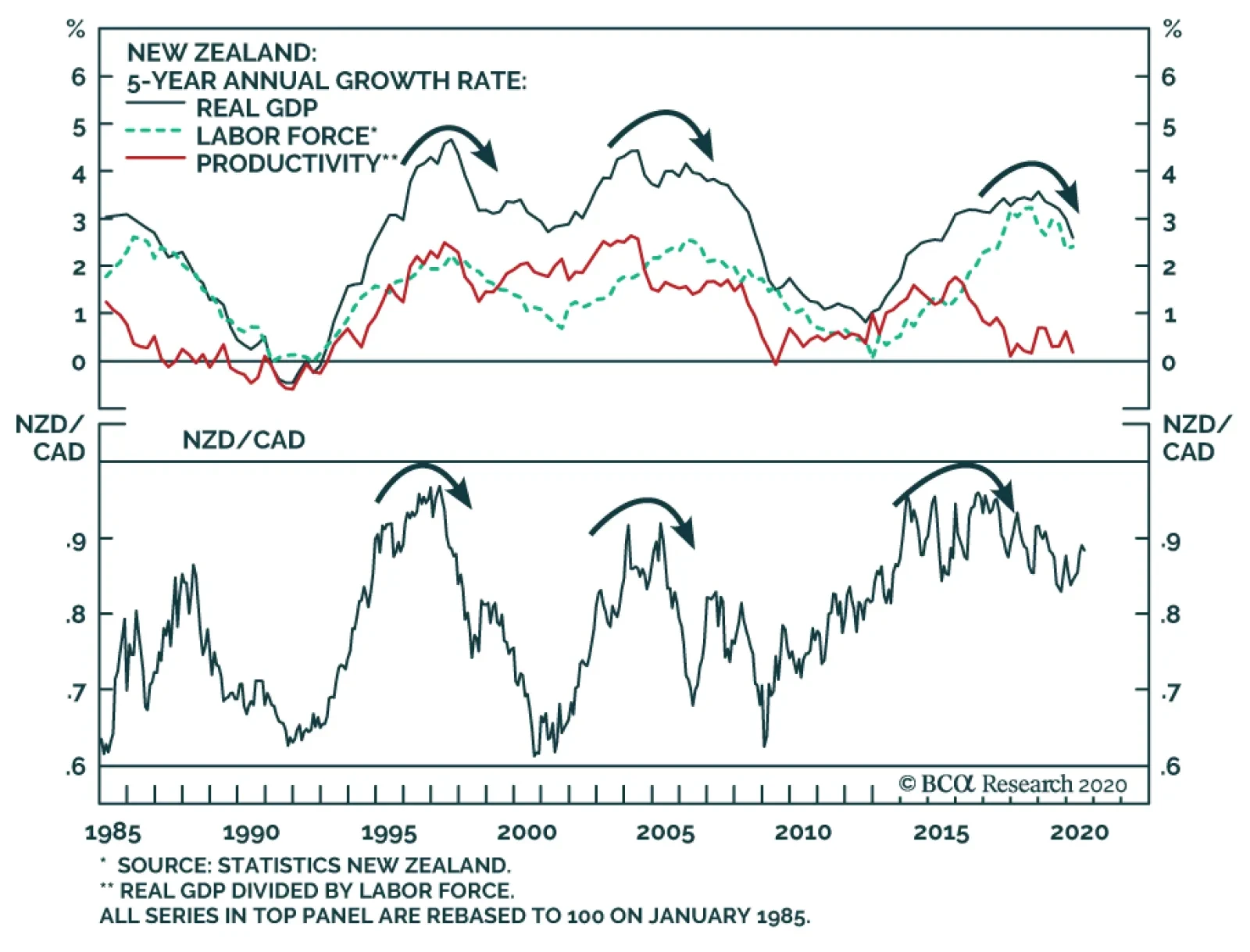

A tactical trading opportunity has also opened up to go short the NZD/CAD cross. First, the New Zealand stock market is the most defensive in the world, given the high concentration in consumer staples, healthcare and telecom…

Highlights Our intermediate-term timing models suggest the US dollar is broadly overvalued. We are maintaining a modest procyclical currency stance (long NOK, GBP and SEK), but also have a portfolio hedge (short USD/JPY). Go…

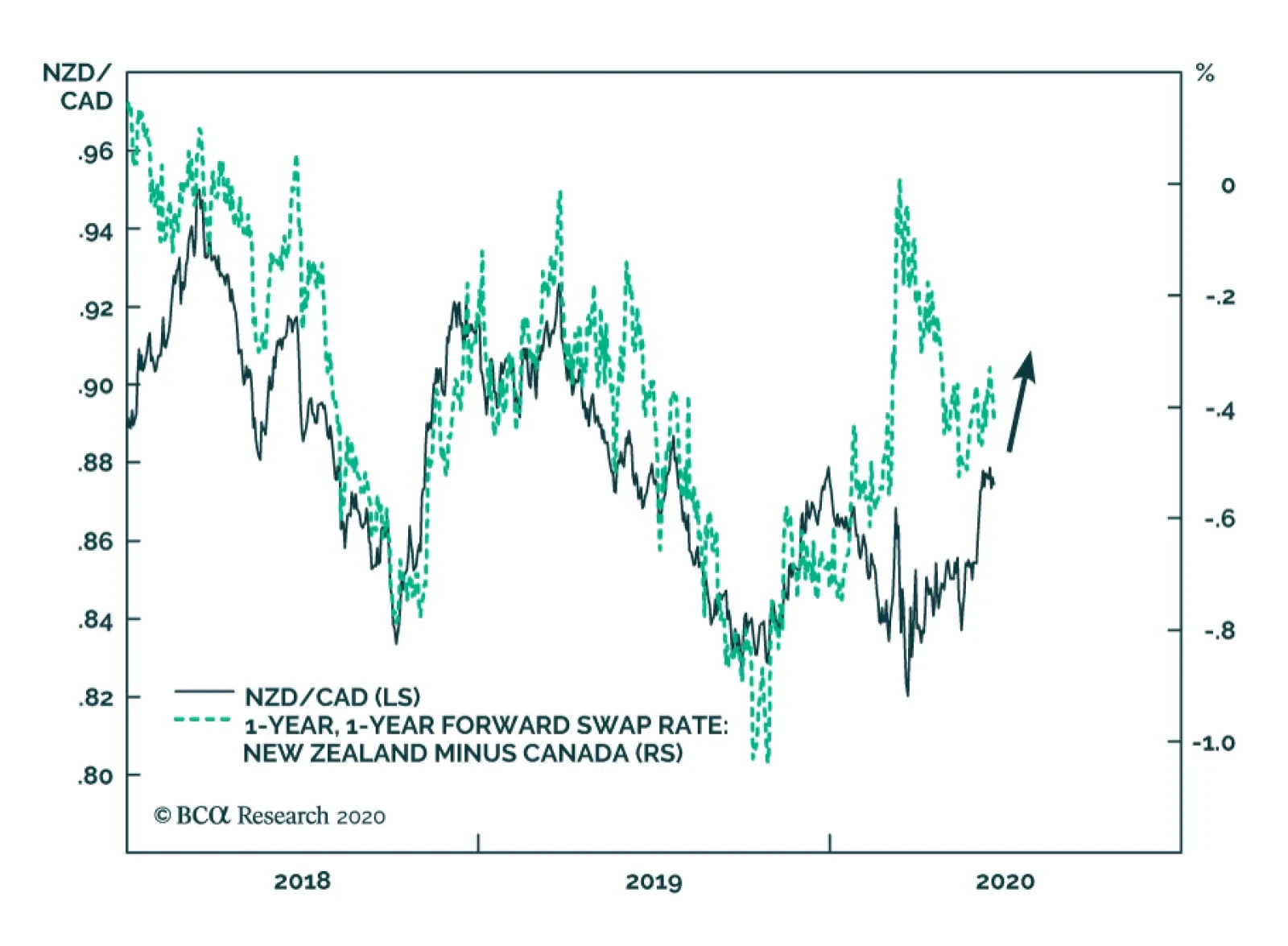

NZD/CAD is likely to appreciate over the coming six to nine months. For the past two and a half years, the NZD/CAD cross has closely followed the 1-year/1-year forward swap rate differential between Canada and New Zealand. We…

Highlights In this Weekly Report, we present our semi-annual chartbook of the BCA Central Bank Monitors. All of the Monitors are now below the zero line, indicating the need for continued easy global monetary policy to help mitigate the…

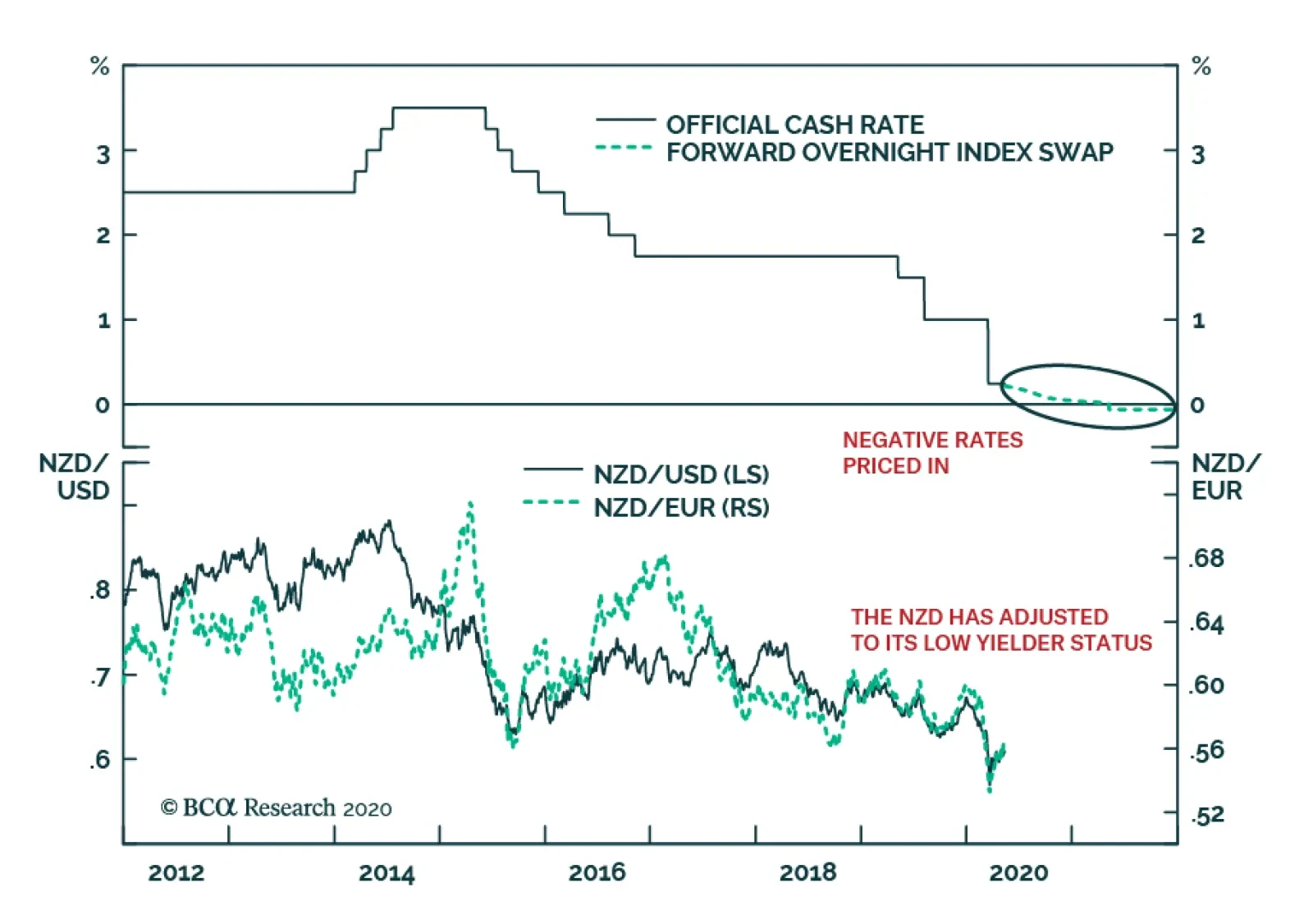

The Reserve Bank of New Zealand held the official cash rate at 0.25% but Governor Adrian Orr noted that the RBNZ could further decrease the policy rate "If and when needed". As a result, 12-month ahead expectations for…