Feature One of BCA Research’s key geopolitical views since May 2019, outlined recently in our 2020 Outlook, is rapidly materializing: a dramatic escalation in the US-Iran conflict. On January 3 the United States successfully…

Highlights OPEC 2.0 production discipline and the capital markets’ parsimony in re funding US shale-oil producers will restrain oil supply growth. Monetary and fiscal stimulus will revive EM demand. These fundamentals will push…

Opinion polls show that the Iranian public primarily blames the government for the collapsing economy, and yet that American sanctions are siphoning off some of this anger. This could tempt Iran’s leaders to stage…

Highlights 2019 was a good year for our constraint-based method of political analysis. Trump was impeached, the trade war escalated, and China (modestly) stimulated – all as predicted. Nevertheless Trump caught us by surprise…

Highlights OPEC 2.0 agreed to cut output by another 500k b/d at its Vienna meeting last week, bringing the total official cuts by the producer coalition to 1.7mm b/d. Saudi Arabia added 400k b/d of additional voluntary cuts, bringing…

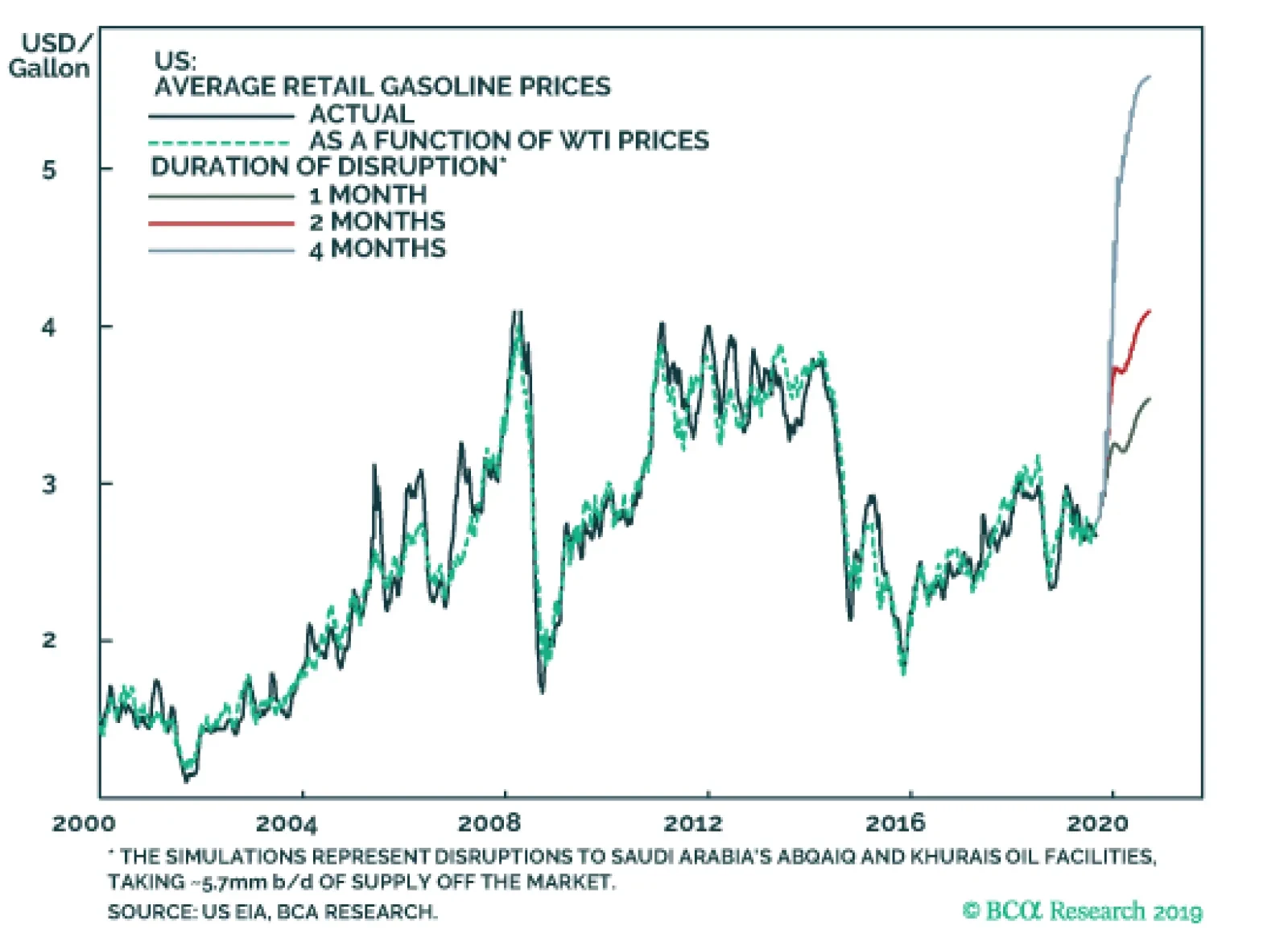

Highlights The Fed is the usual culprit for killing business cycles — but the Fed is on hold. This makes geopolitics the likeliest candidate to kill the cycle. The key geopolitical risks are US political turmoil, China’s…

Highlights A 400k b/d addition to OPEC 2.0’s official production cut of 1.2mm b/d will have little effect on actual supplies. The market already has seen ~ 2.0mm to 2.5mm b/d of output removed from the market via excess voluntary…

Highlights Lingering weakness evident in fundamental supply-demand data will fade next year, and with it the downward pressure on oil prices. Price risk is skewed to the upside: Continued monetary accommodation from systematically…

Highlights Lebanon and Iraq – the two countries most entrenched in Iran’s sphere of influence – are experiencing mass unrest. Protesters in both states are calling for the dismantling of sectarian based political…