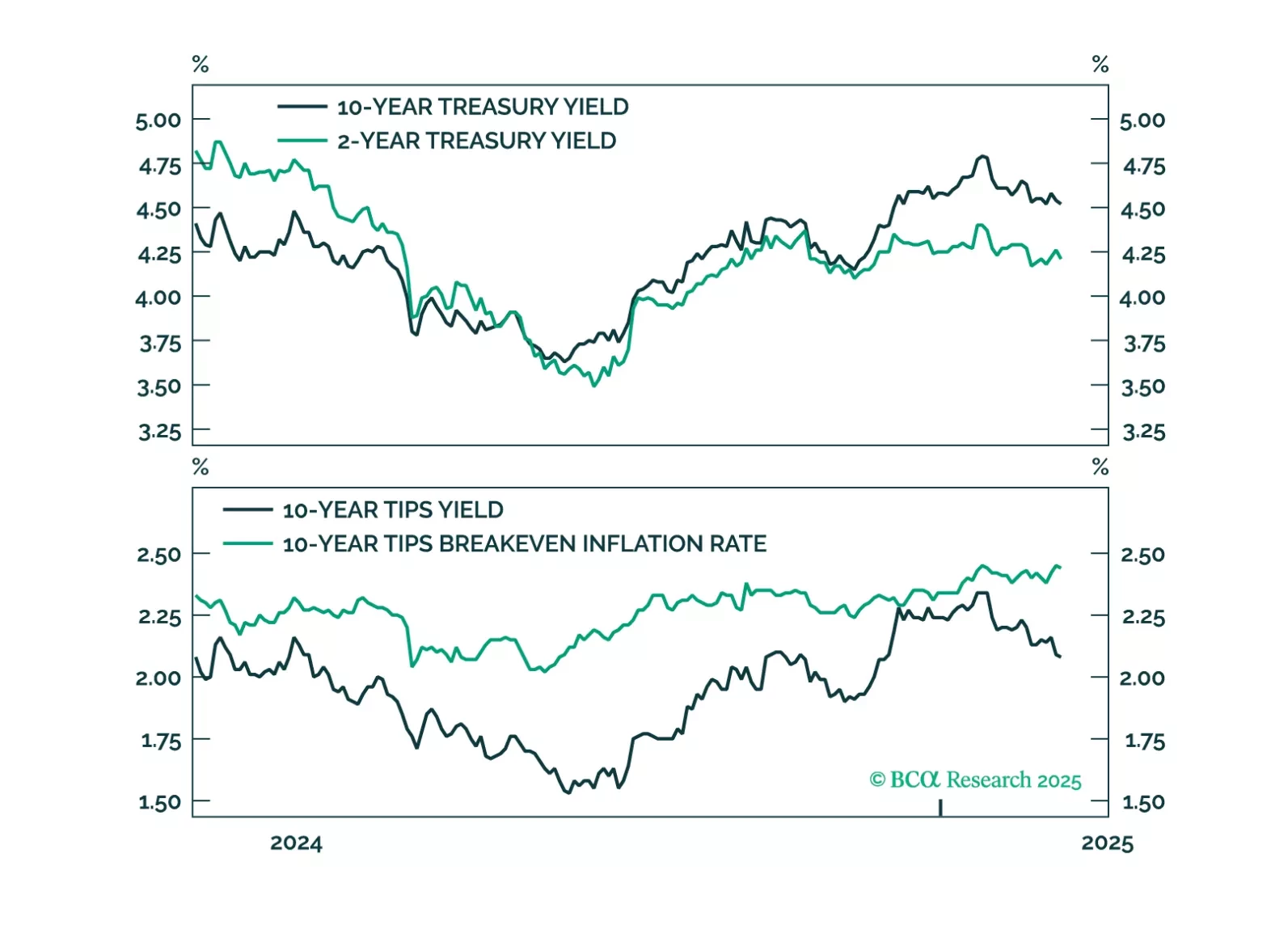

Our Emerging Market strategists published a follow-up piece to their Bessenomics note where they assess the new Treasury Secretary plan’s impact on markets. Lower interest rates are central to Bessenomics. The Trump…

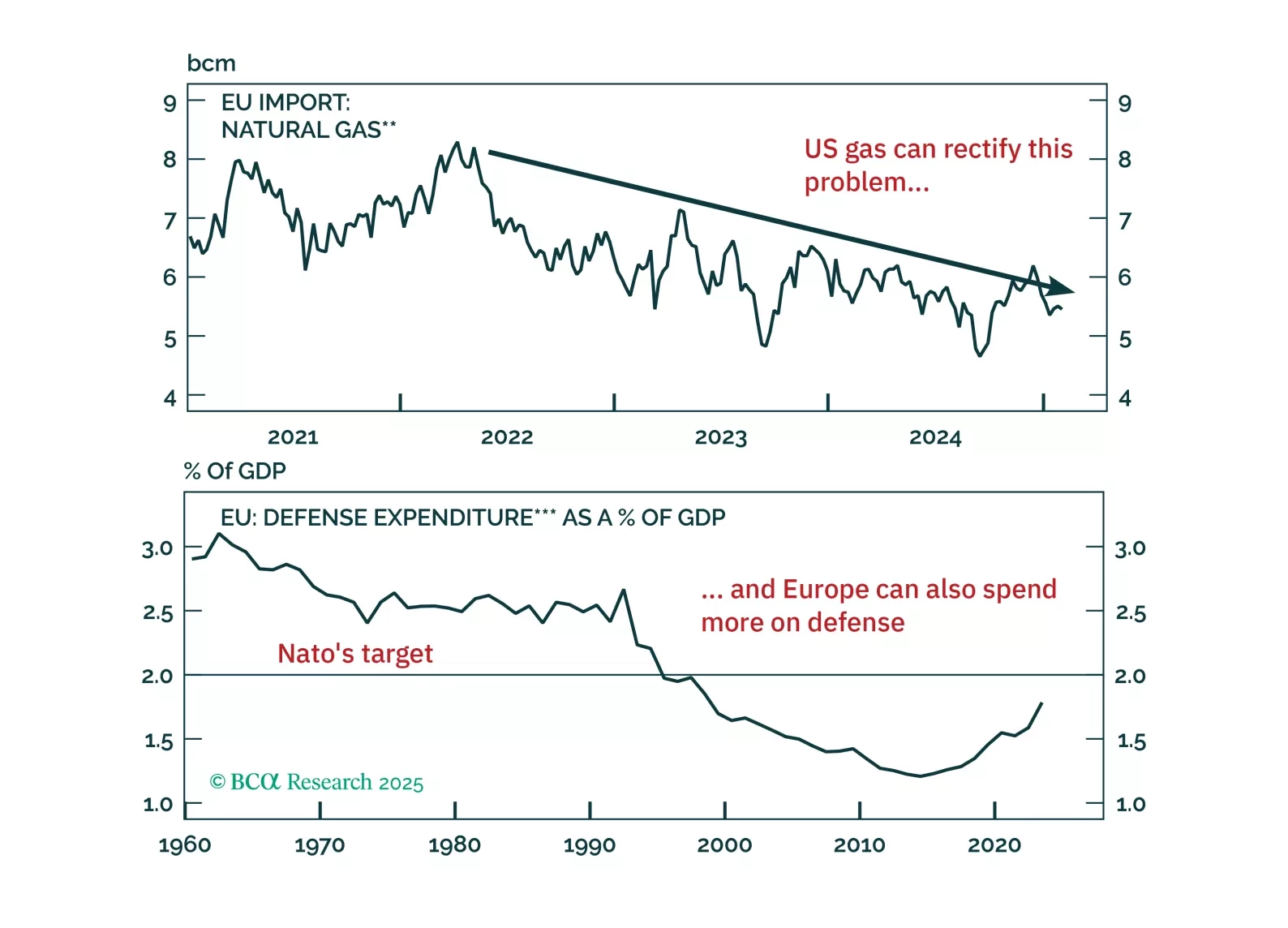

Europe is about to become President Trump’s next target. The good news: a US/EU trade war will be short as common ground to achieve a deal exists. The bad news: European assets remain at the mercy of heightened uncertainty. How…

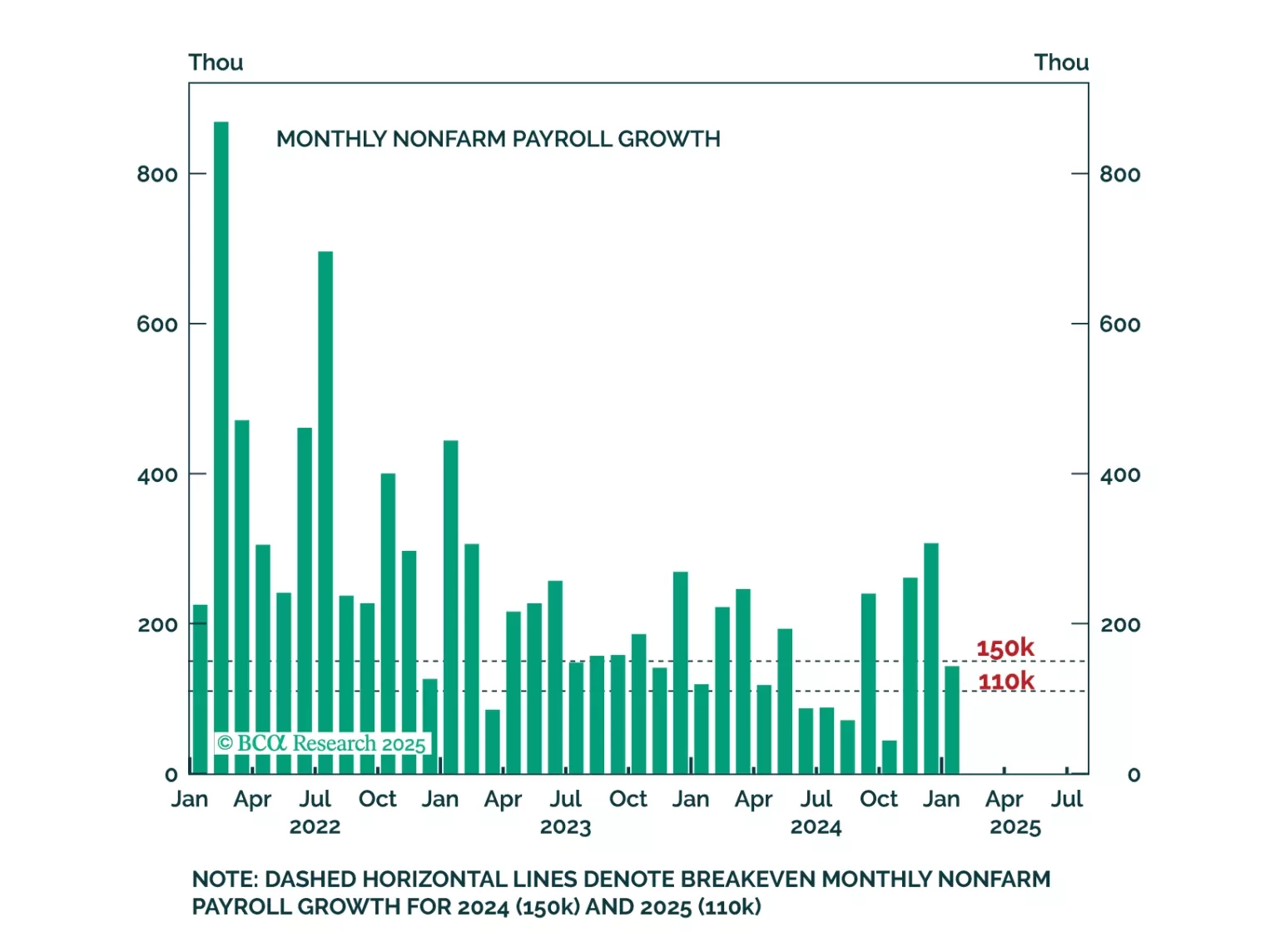

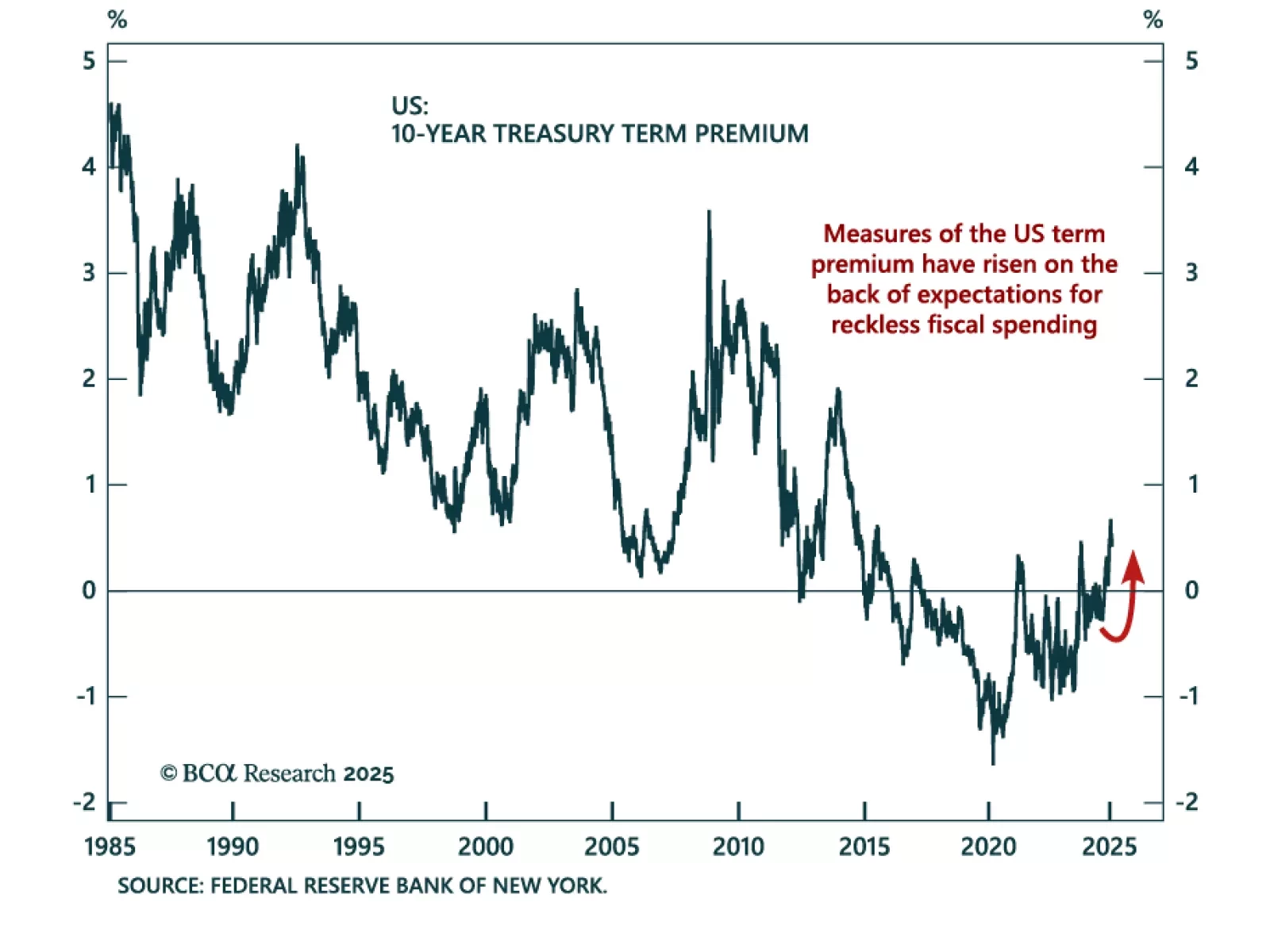

Some thoughts on this morning's employment data and Treasury Secretary Bessent's recent attempts to talk down the 10-year Treasury yield.

Treasury Secretary Scott Bessent commented that one of the Trump administration’s priority was lowering 10-year bond yields. Bessent’s 3/3/3 plan, boosting growth to 3% from deregulation, increasing US oil production by 3 mmb/d, and…

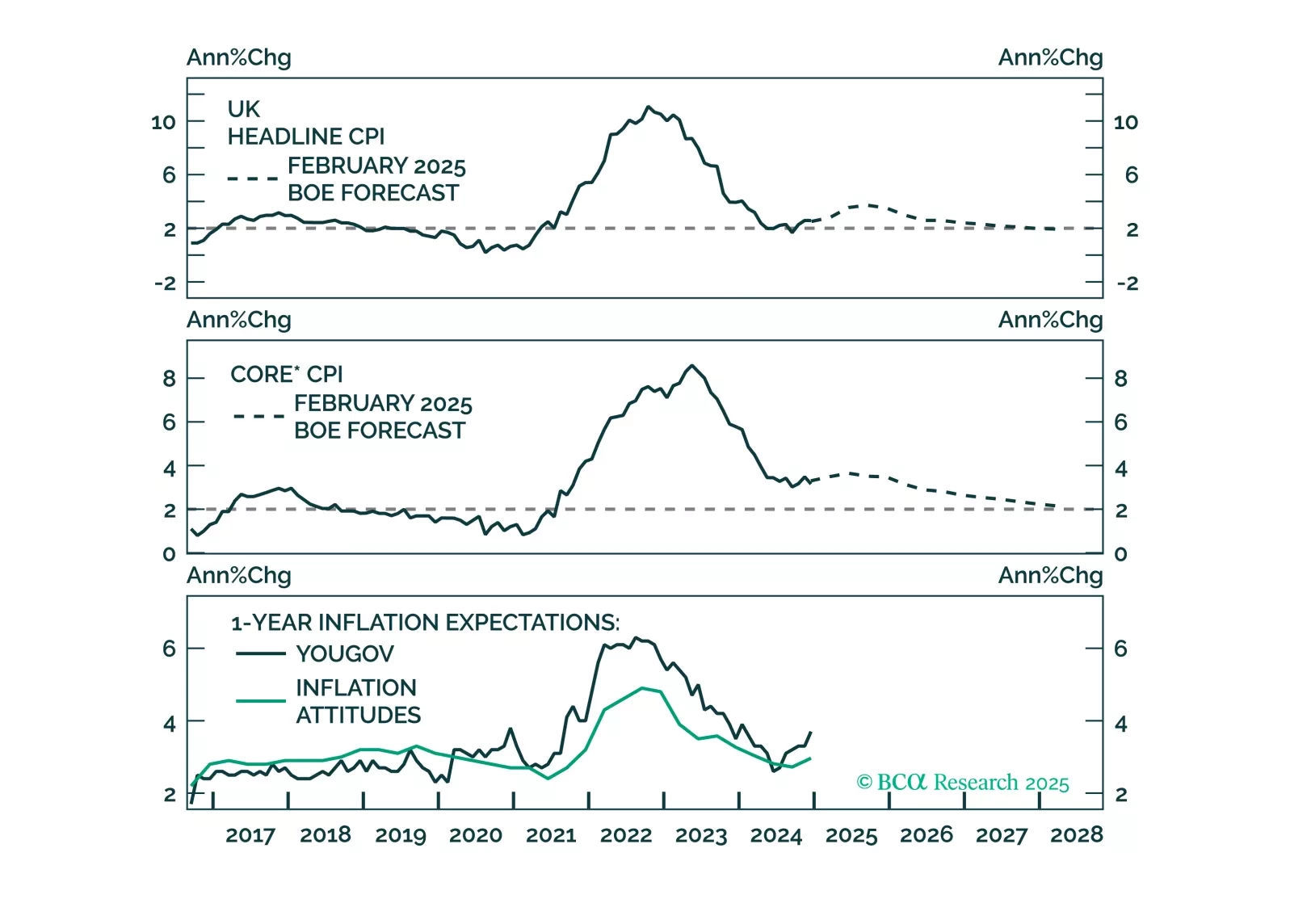

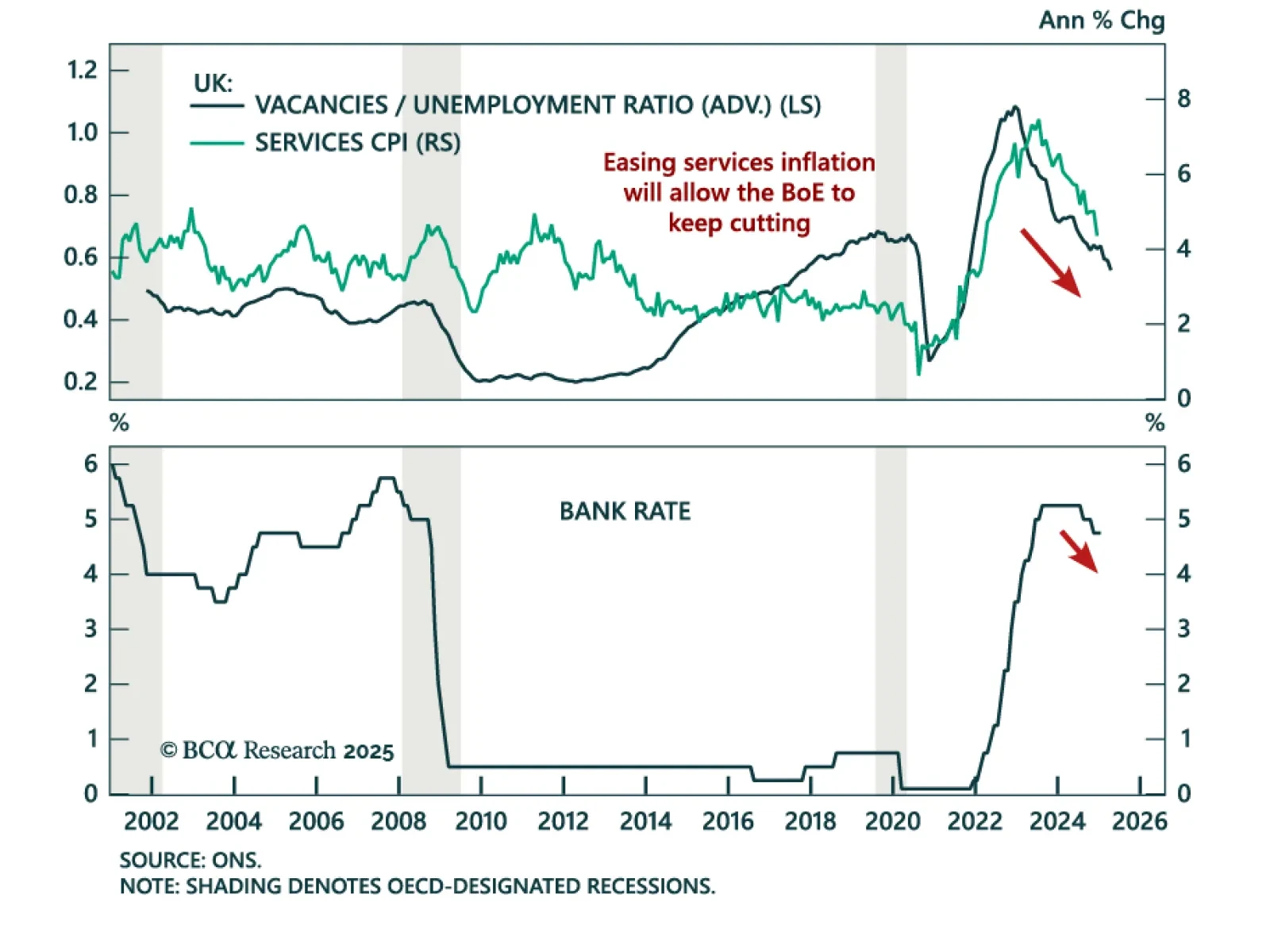

The Bank of England cut its policy rate by 25 bps to 4.5%, with two members of the MPC voting to cut 50 bps instead. The BoE acknowledged “substantial progress on disinflation”, driven by a tight policy stance and stabilized…

Following today’s Bank of England’s policy meeting, at which the policy rate was cut by 25 bps, we discuss our outlook for monetary policy in the UK. We expect the gradual easing to continue and discuss the investment implications…

Our Portfolio Allocation Summary for January 2025.

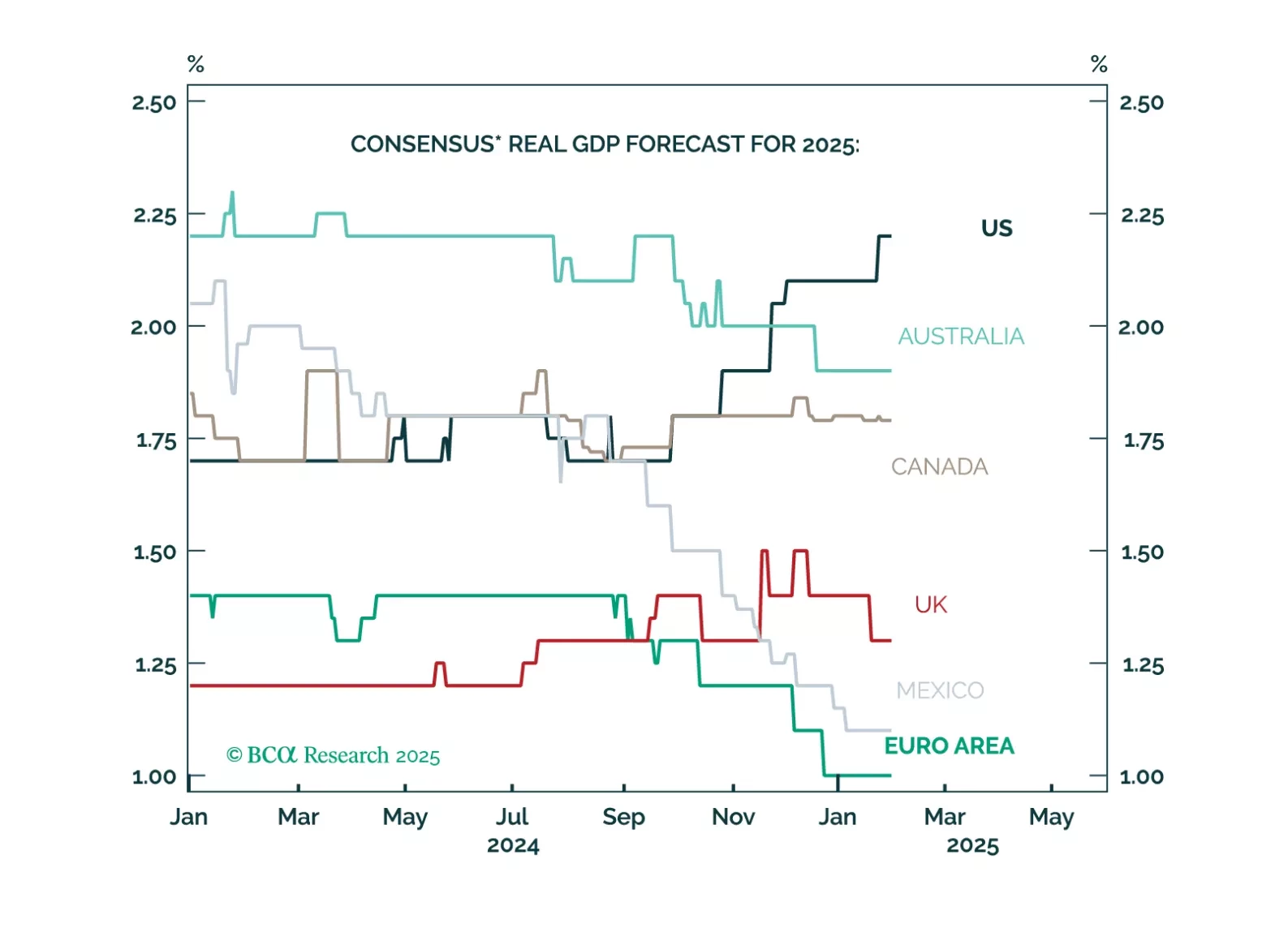

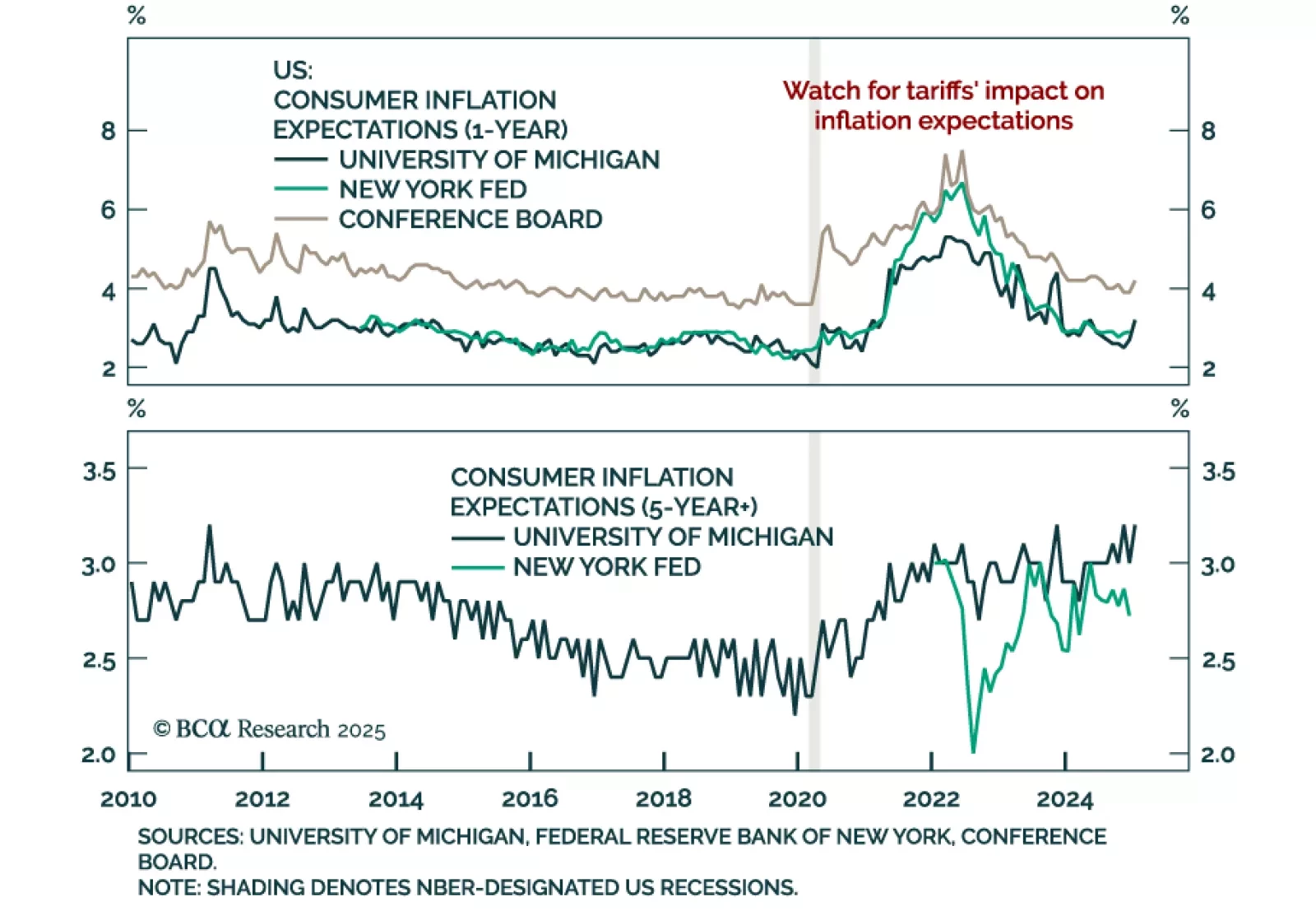

Trade tensions muddy the outlook for global central banks. The 2010s were an era of low growth and low inflation that called for easy monetary policy. The post-COVID era has been marked by overheating and high inflation calling for…

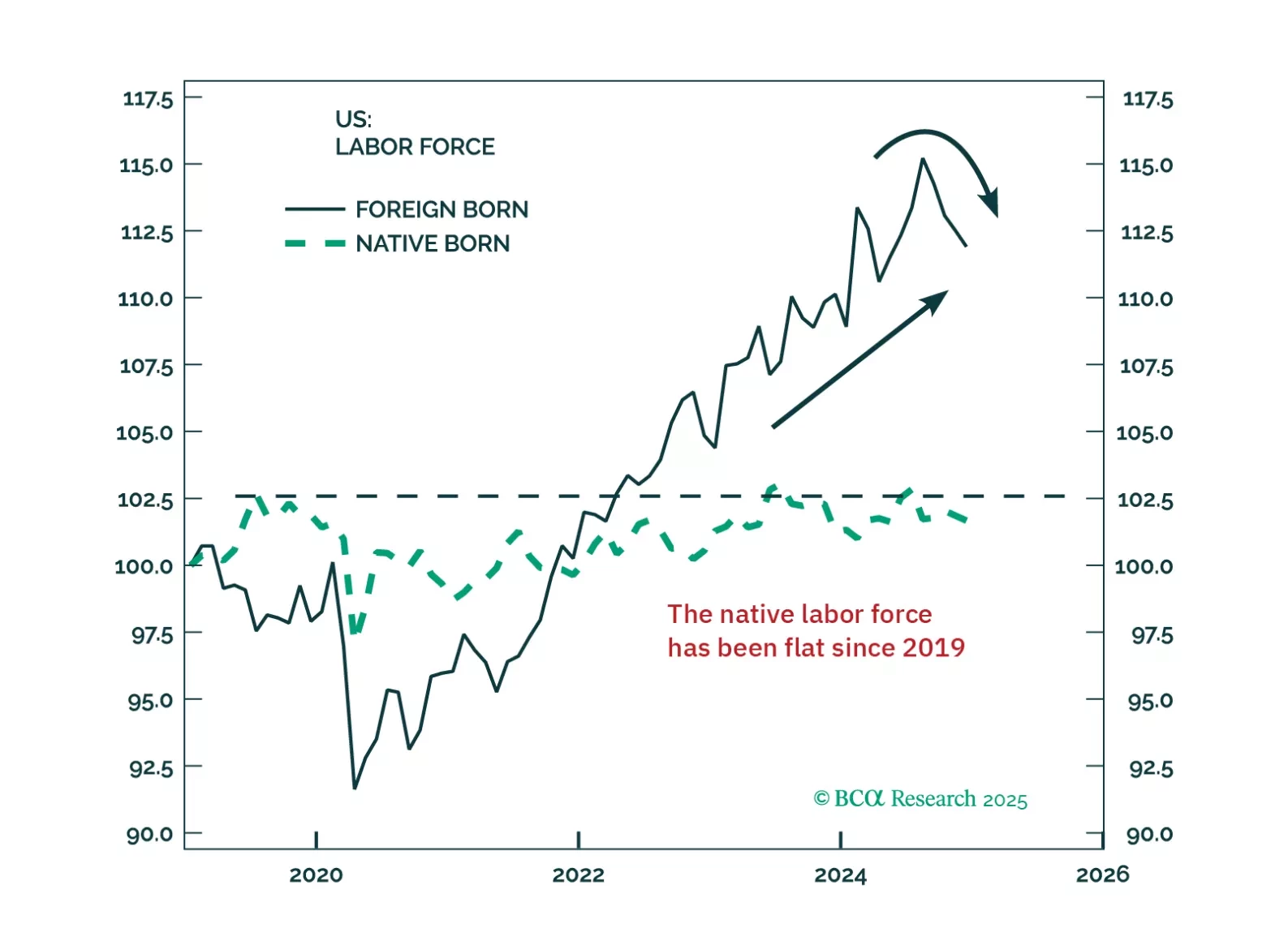

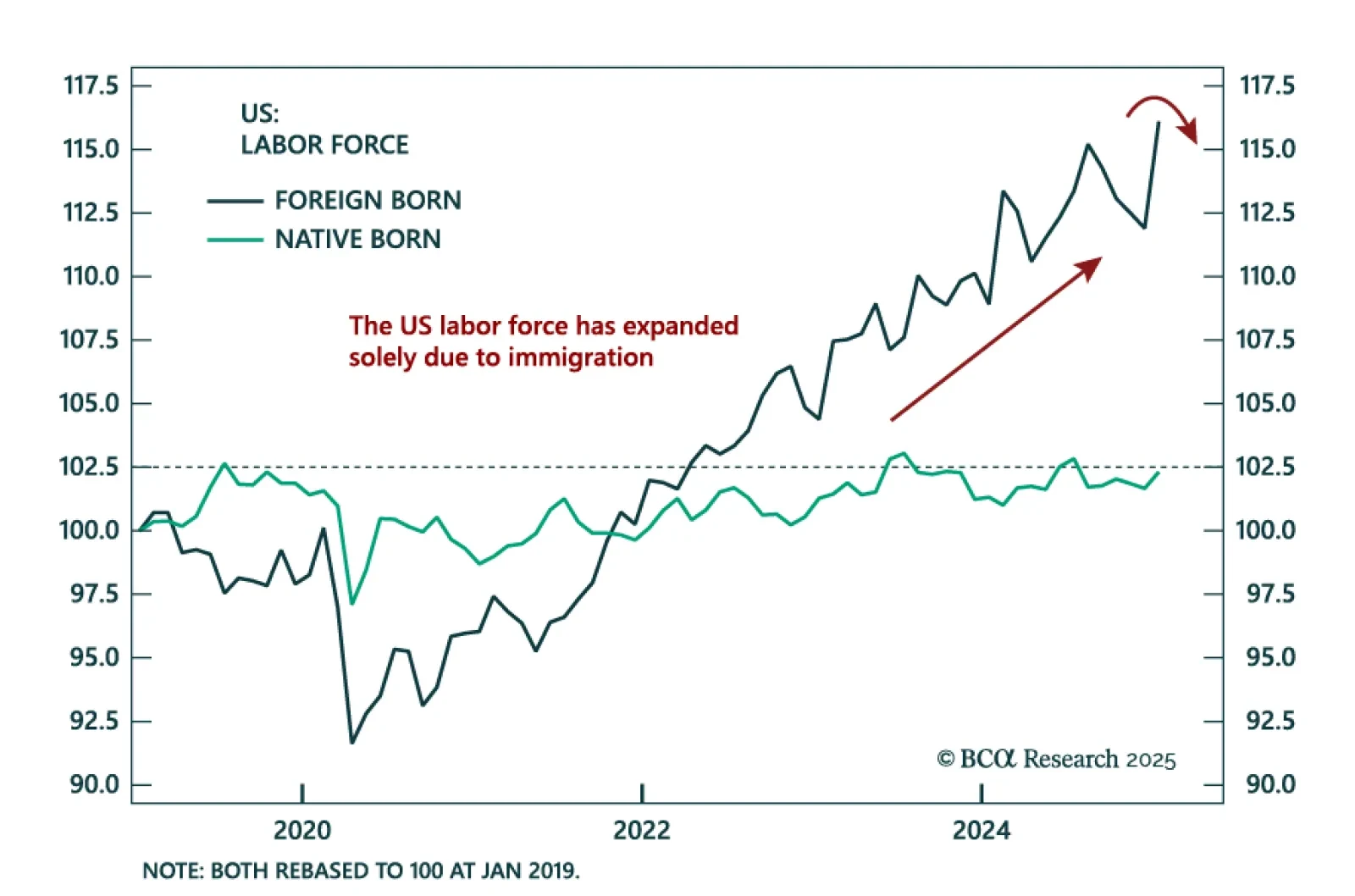

Markets and forecasters anticipate a “Golden Age” for Trump’s America, with US growth expectations soaring while the rest of the world lags. However, this extreme optimism means that there is a lot of room for disappointment. Cooling…