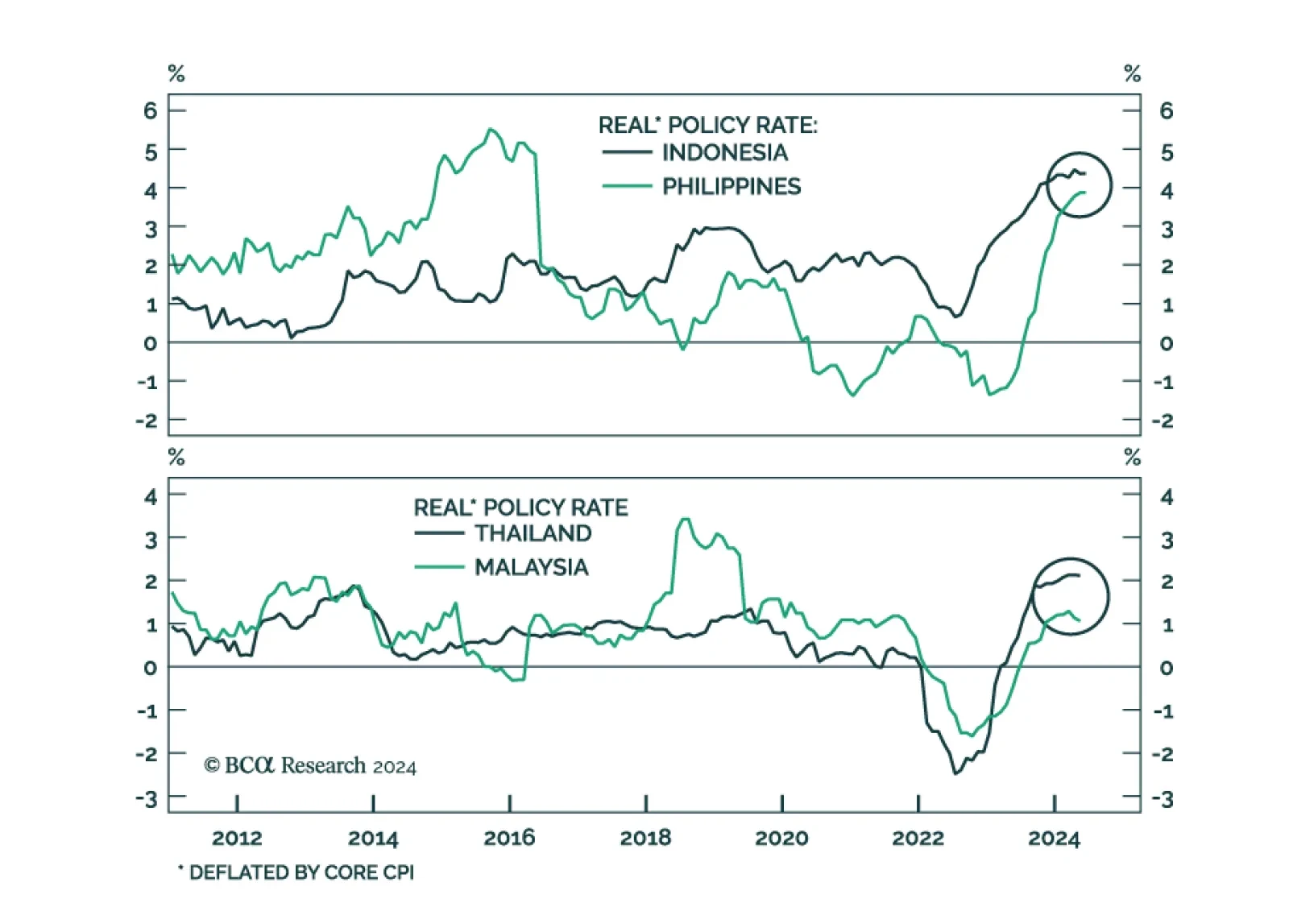

The four ASEAN stock markets (Indonesia, Malaysia, Thailand, and the Philippines) have fallen in absolute terms over the past year despite the powerful rally in the developed markets. They have also underperformed their EM…

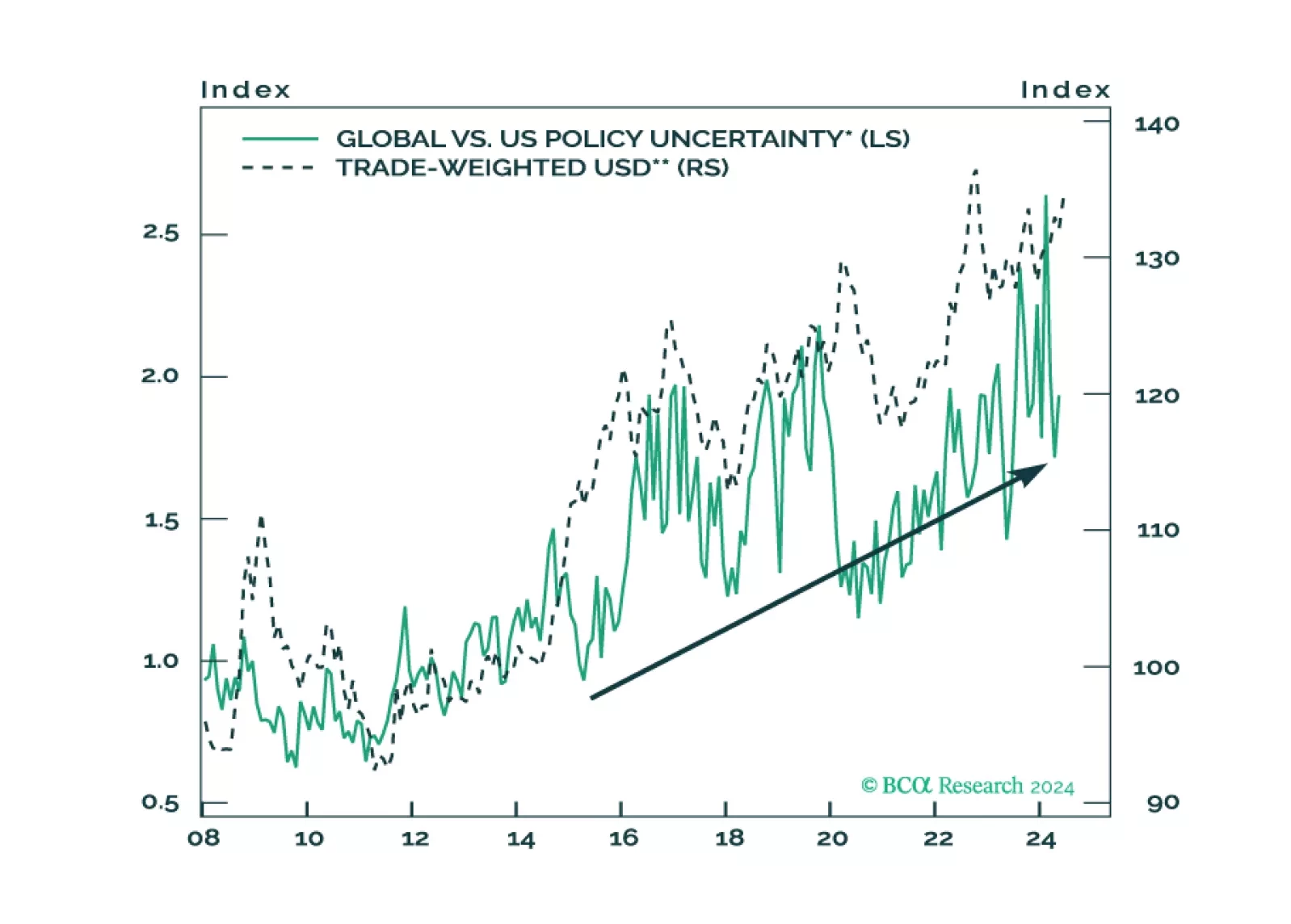

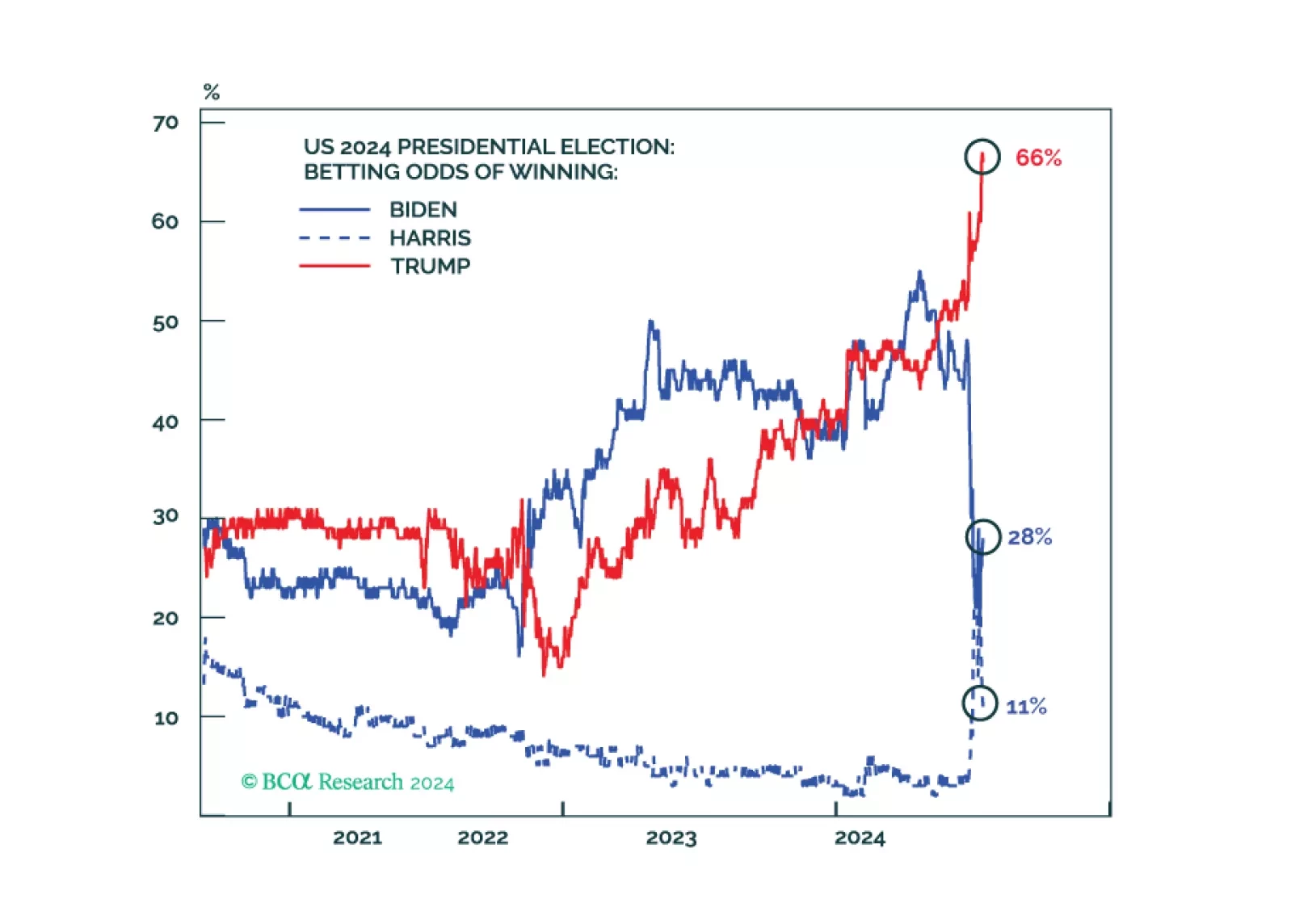

Investors should overweight US assets and de-risk their portfolios in anticipation of a major increase in policy uncertainty and geopolitical risk surrounding the US election and its global ramifications.

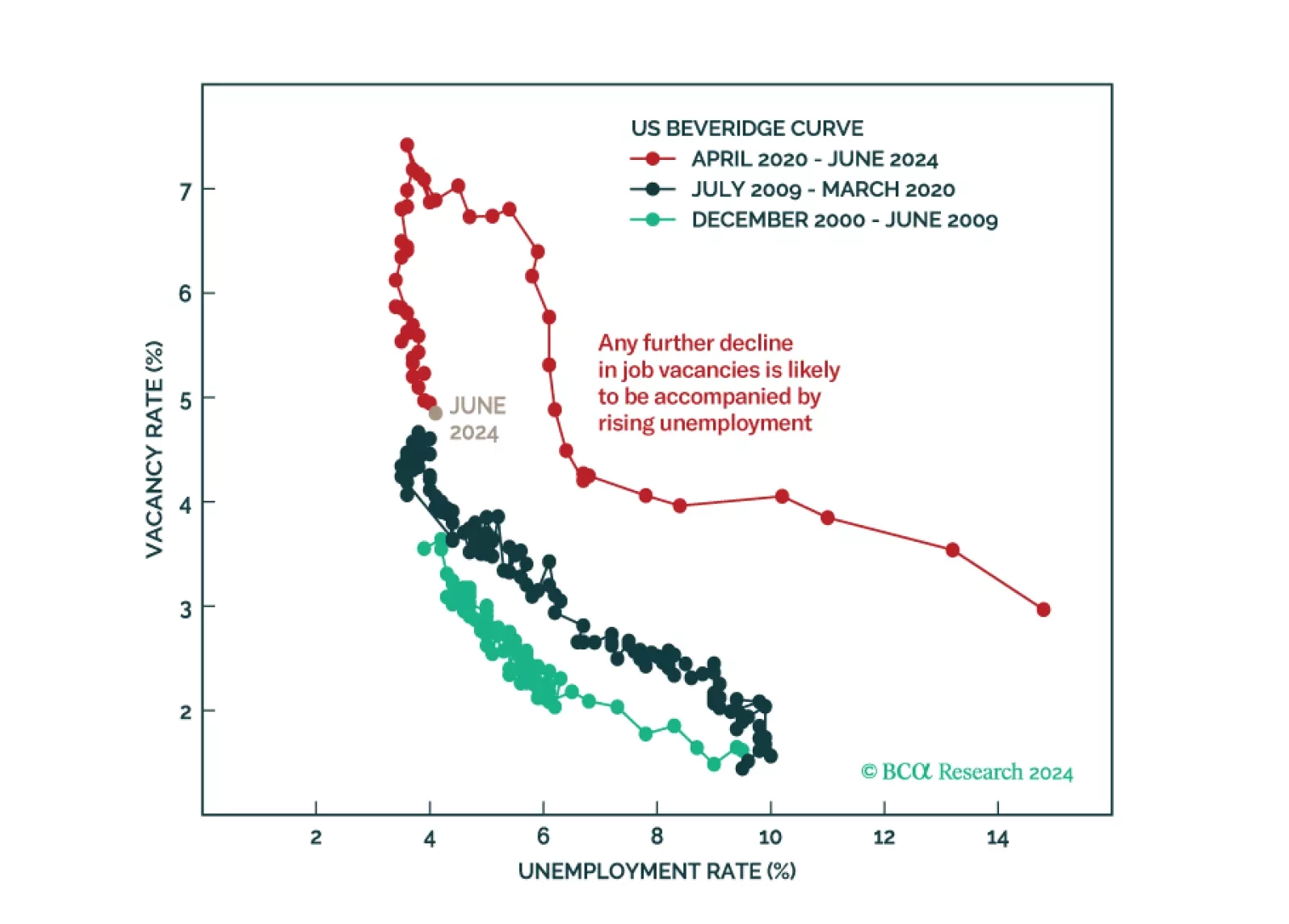

Don't buy the dip. The equity bull market is over. The US will enter a recession in late 2024 or in early 2025.

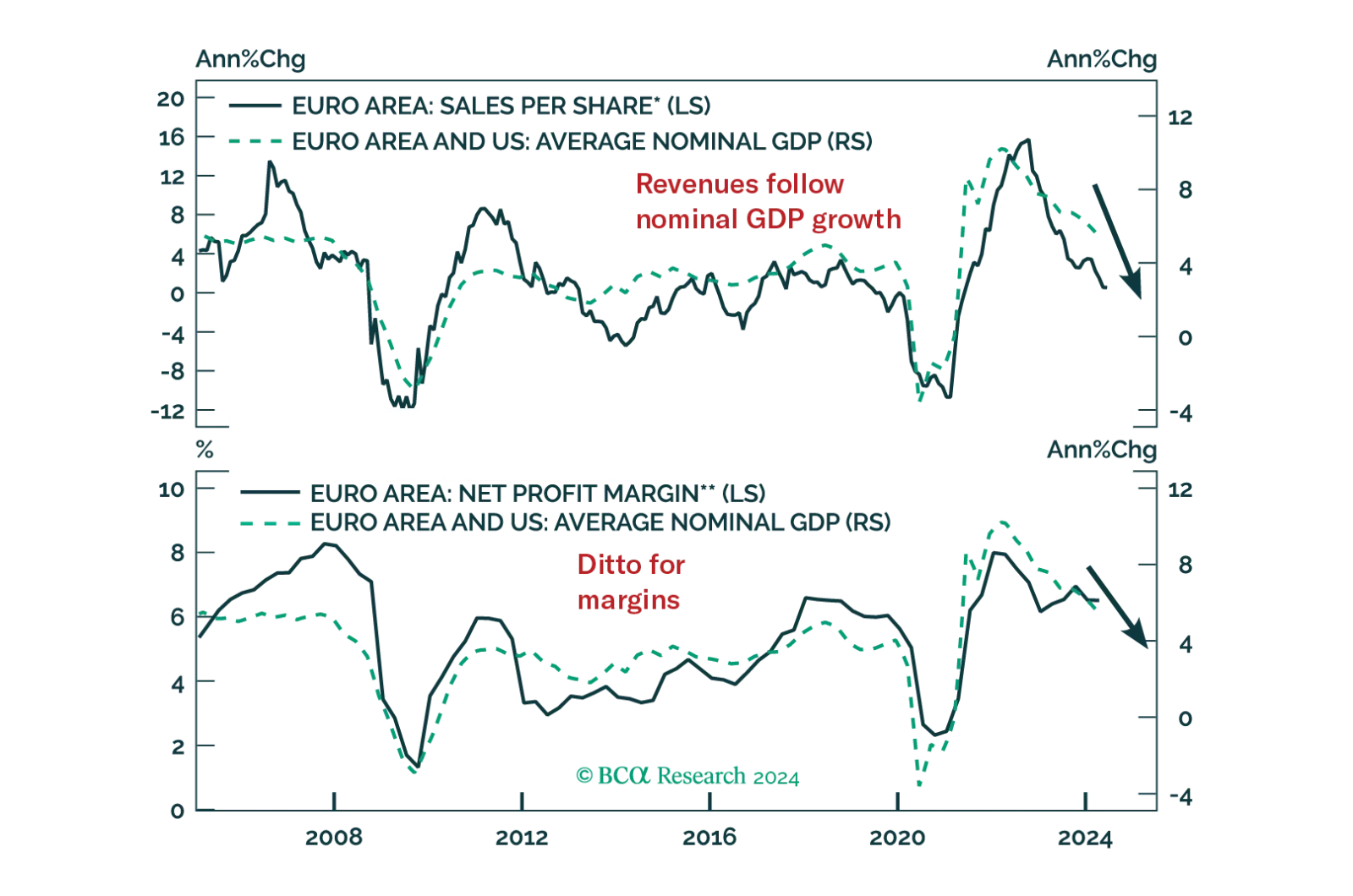

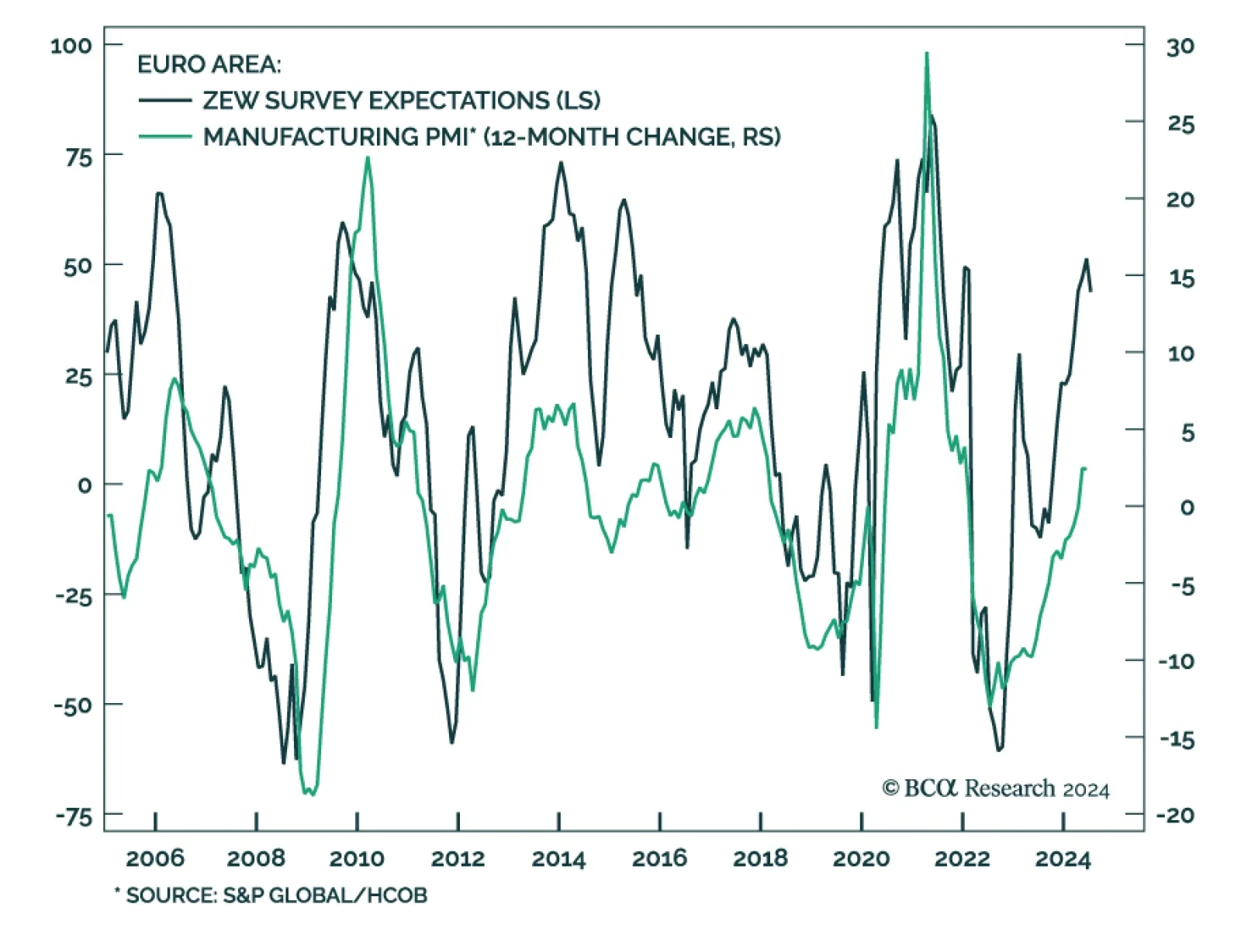

The Euro Area economy broadly surprised to the upside in the first half of 2024. Cooling inflation lifted real wages and the global late cycle amelioration benefitted the pro-cyclical Euro Area economy, but these tailwinds are…

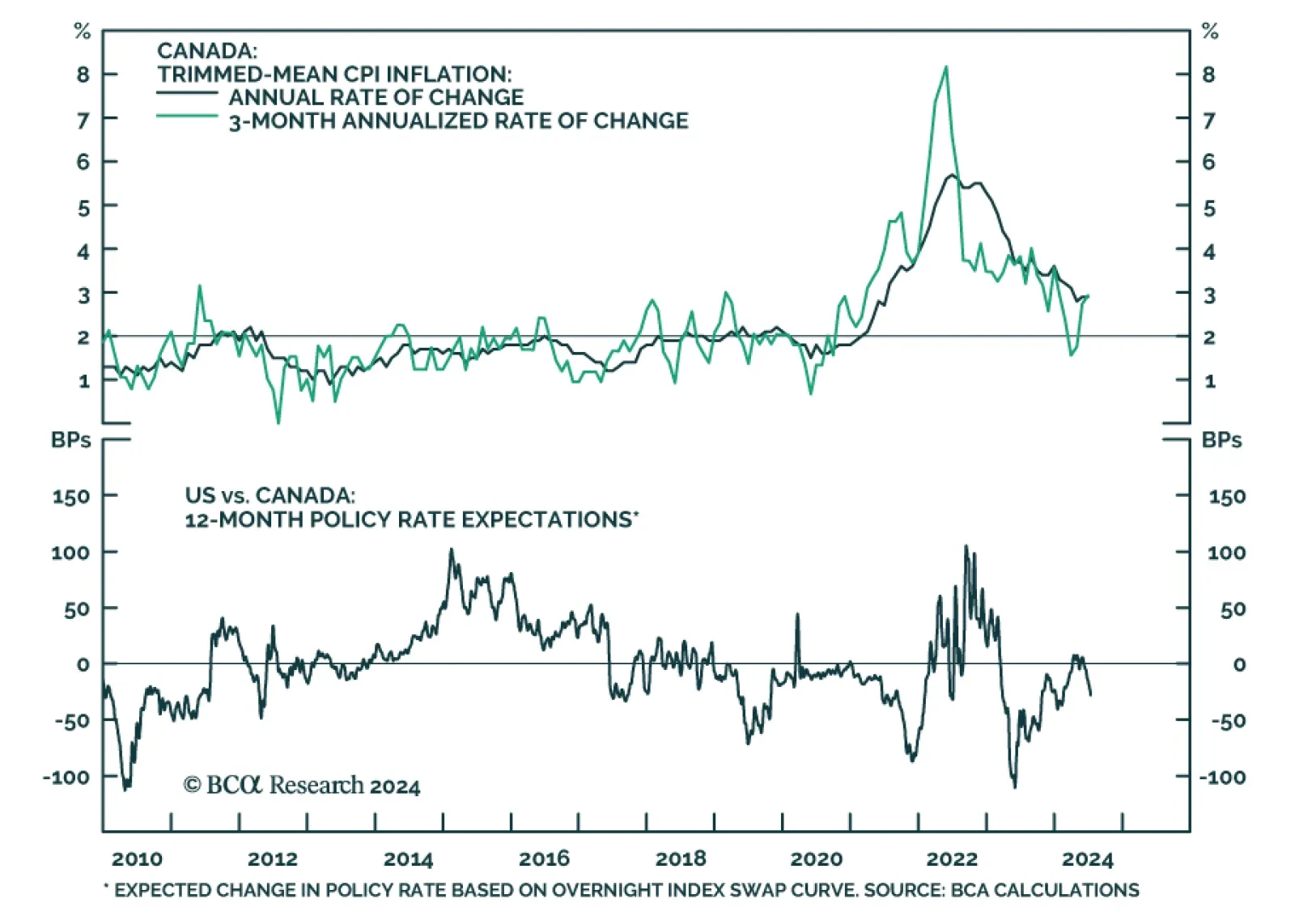

Markets had already been sussing out that the Bank of Canada (BoC) will cut rates for the second time when it meets next week, and this morning’s soft CPI report all but confirmed it. The last remaining obstacle in the…

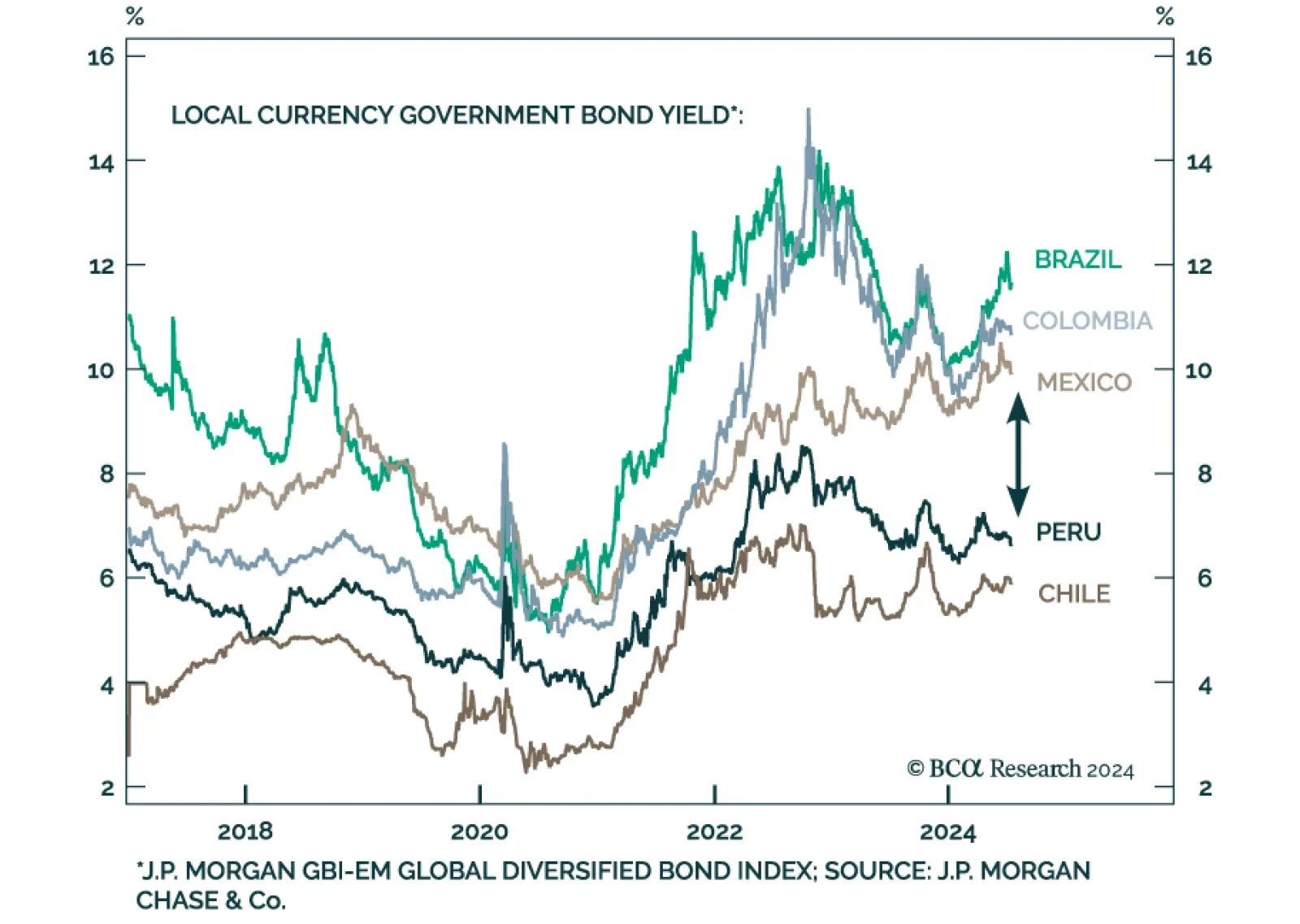

Non-trivial divergences emerged between mainstream LATAM economies after the 2021 post-pandemic boom. These growth differentials are set to continue across the cyclical horizon. According to our Emerging Markets strategists,…

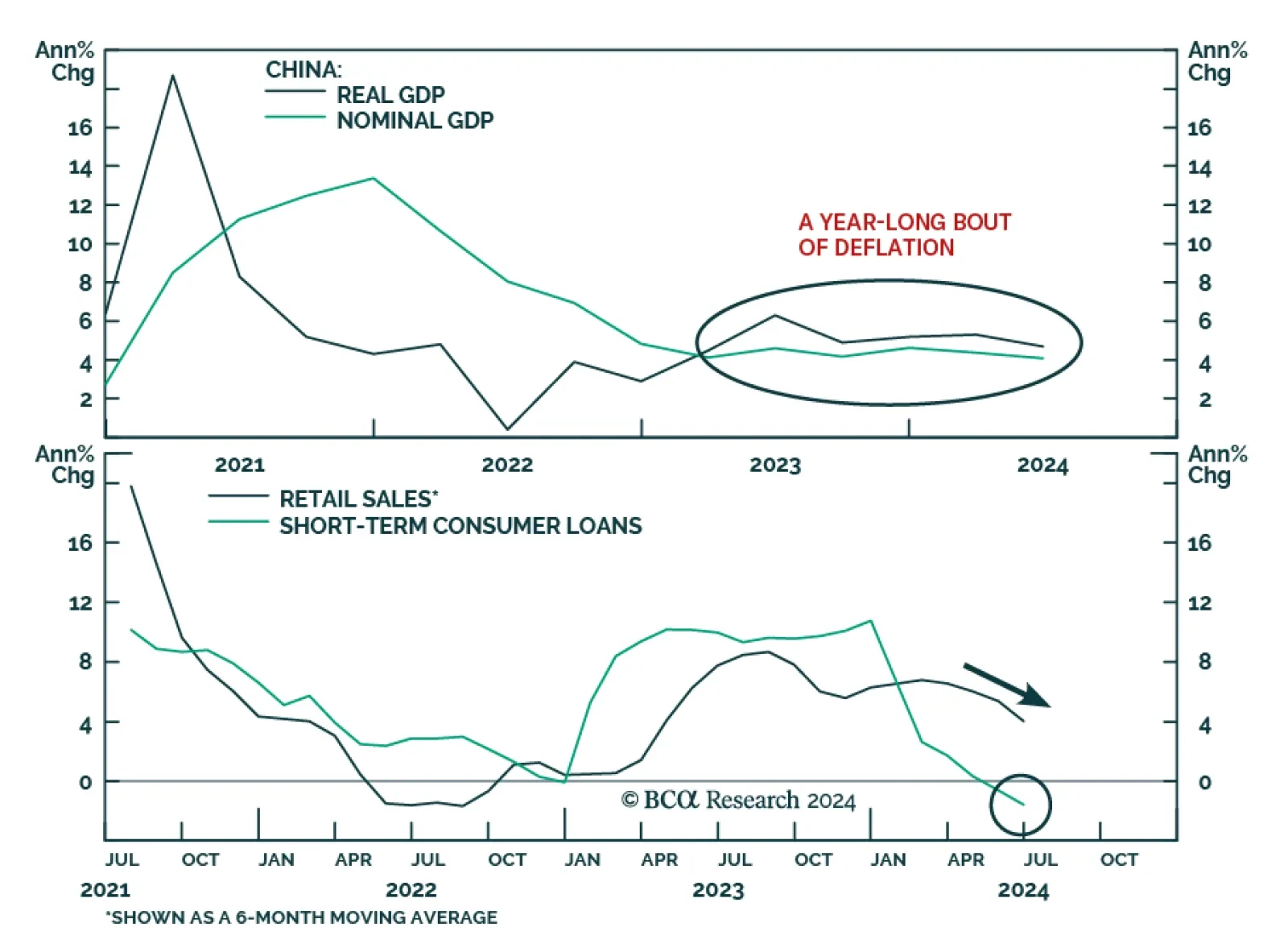

China's real GDP growth decelerated to 4.7% y/y in Q2, down from 5.3% in Q1 and below the consensus forecast of 5.1%. Domestic demand weakened, with retail sales growth sliding to 2% y/y in June, down from 3.7% in the…

The real threat to European equities is growth, not political risk. How low will Eurozone earnings fall during the coming recession and how much will equities decline in response?

The cyclical economy is slowing today. Republicans are now more likely to win a full sweep, crack down on immigration and trade, and at least modestly stimulate the economy. Uncertainty and volatility will rise.

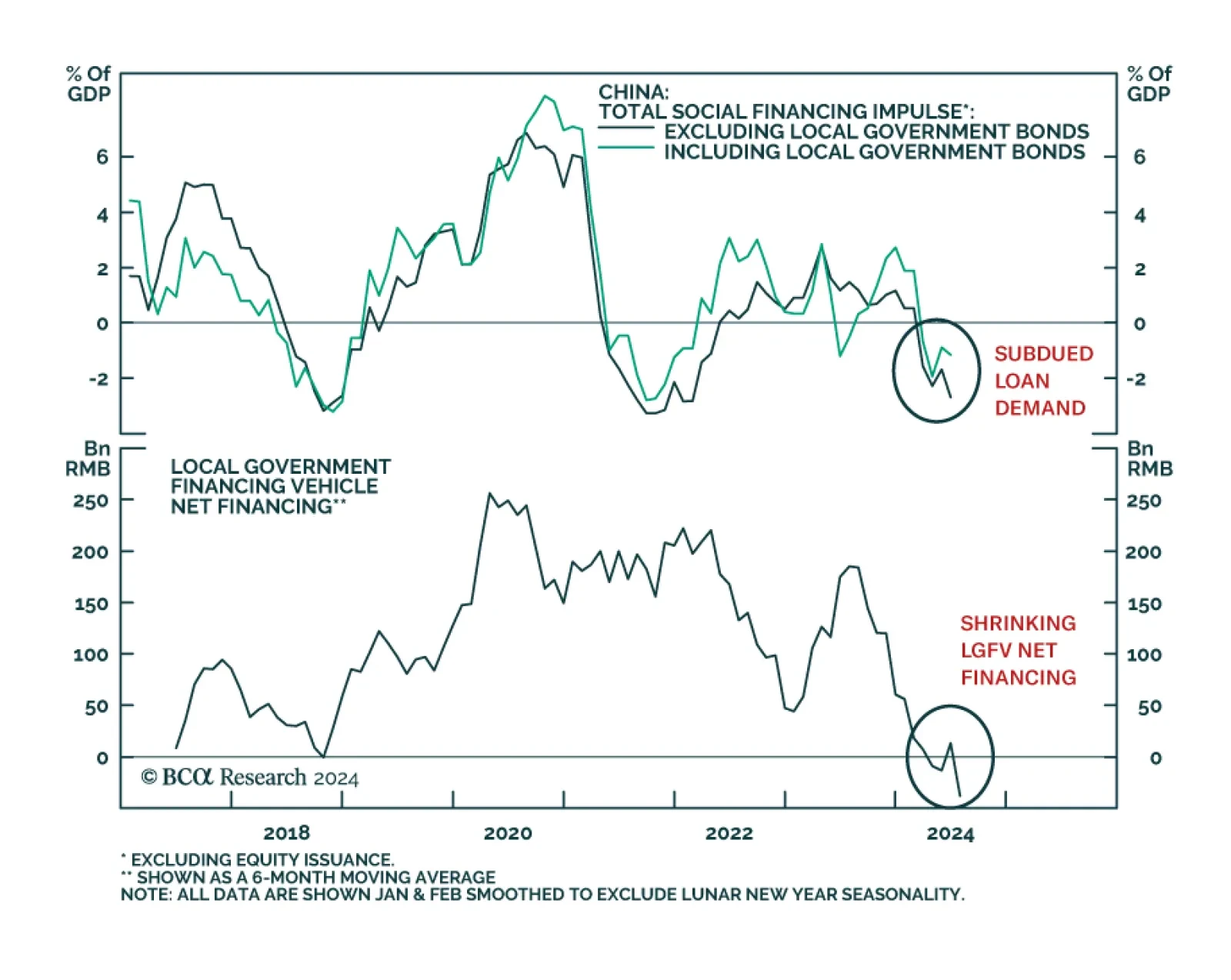

Subdued demand for credit among Chinese private-sector businesses and households persisted through June. The stock of outstanding bank loans grew by 8.3% year-on-year, marking the slowest pace since records began in 2003.…