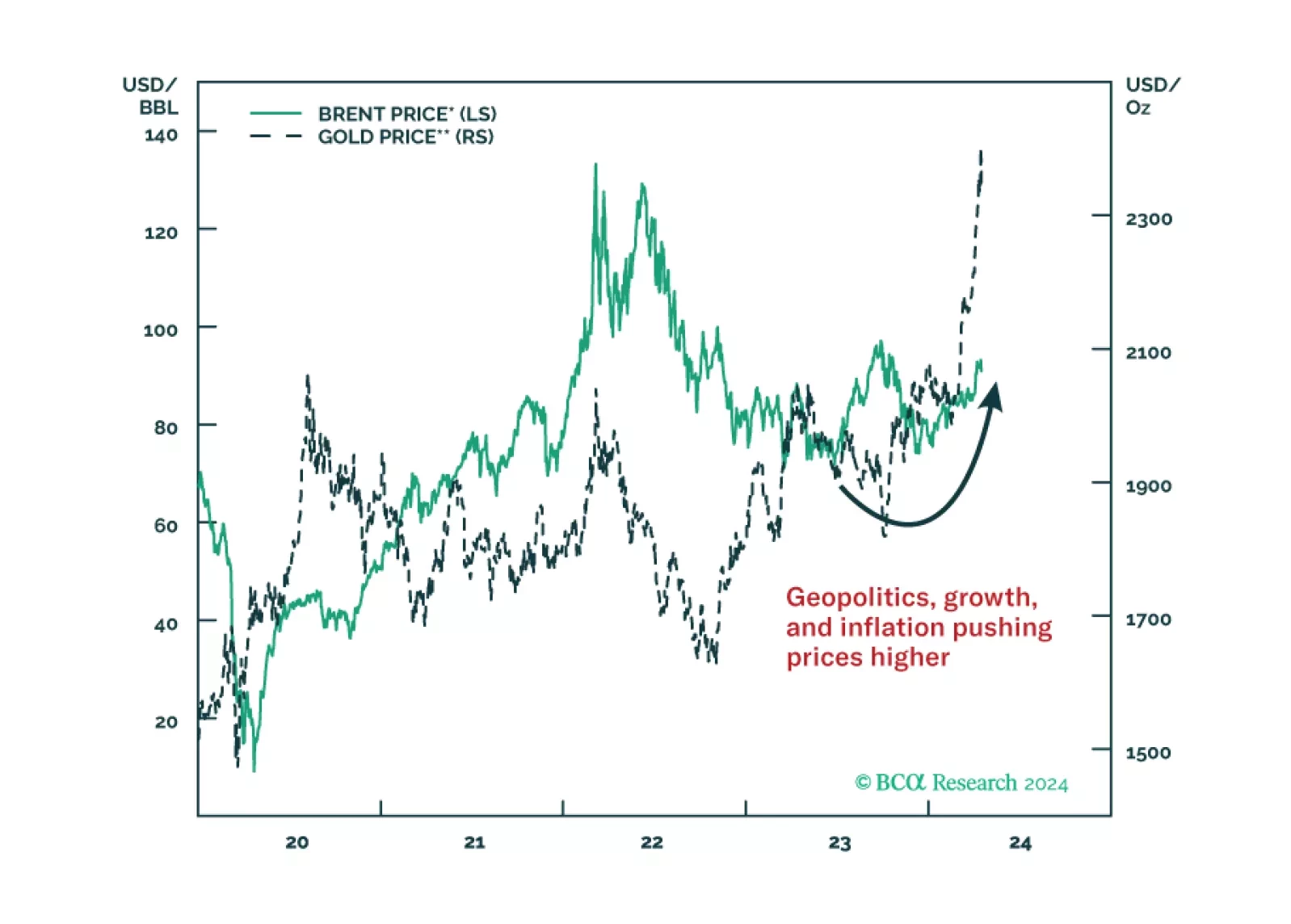

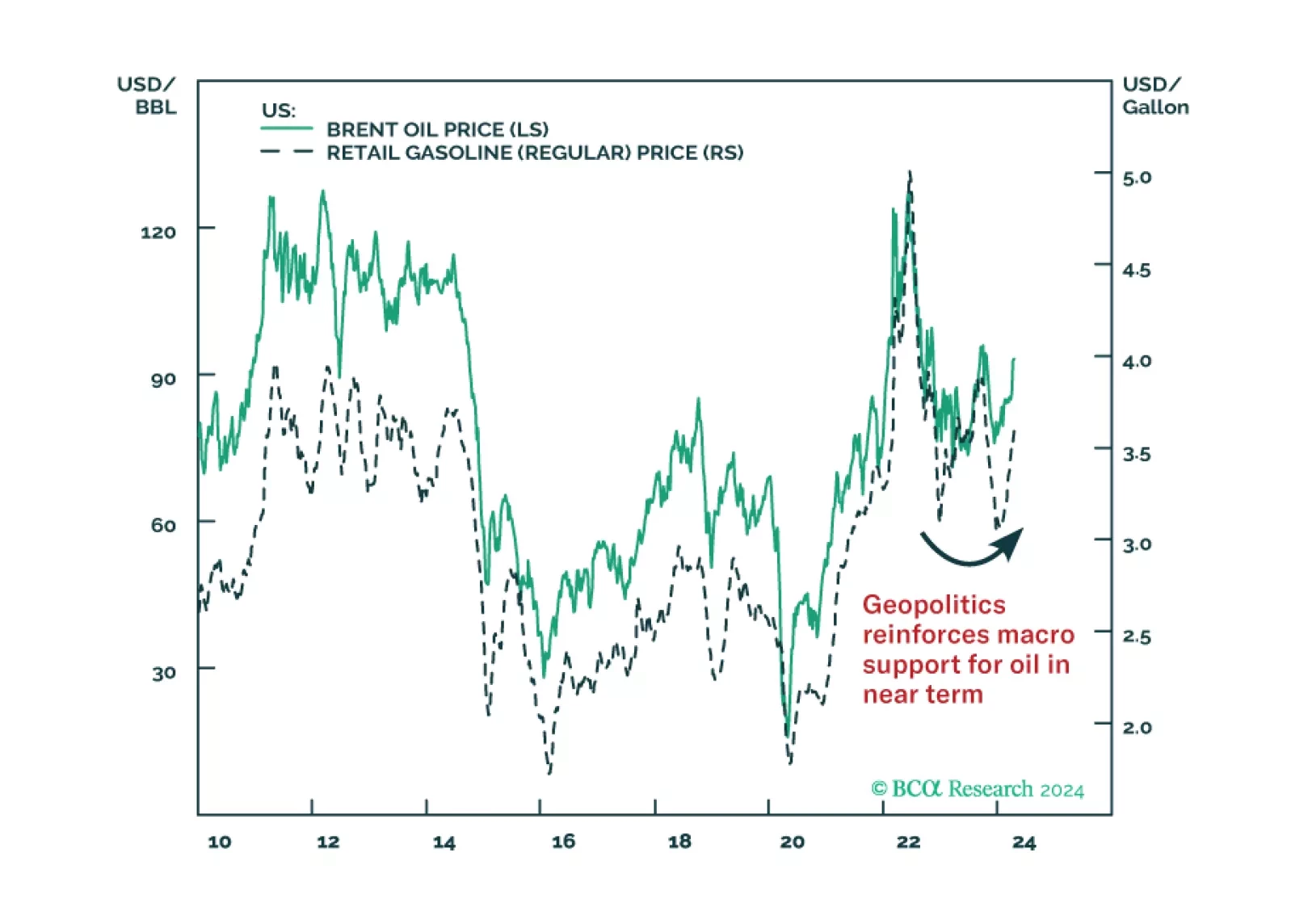

In the near term, favor oil and oil producers outside the Gulf Arab states. Over a 12-month horizon, favor US and North American equities, defensive sectors over cyclicals, and safe-assets. Within cyclicals, stick to energy and…

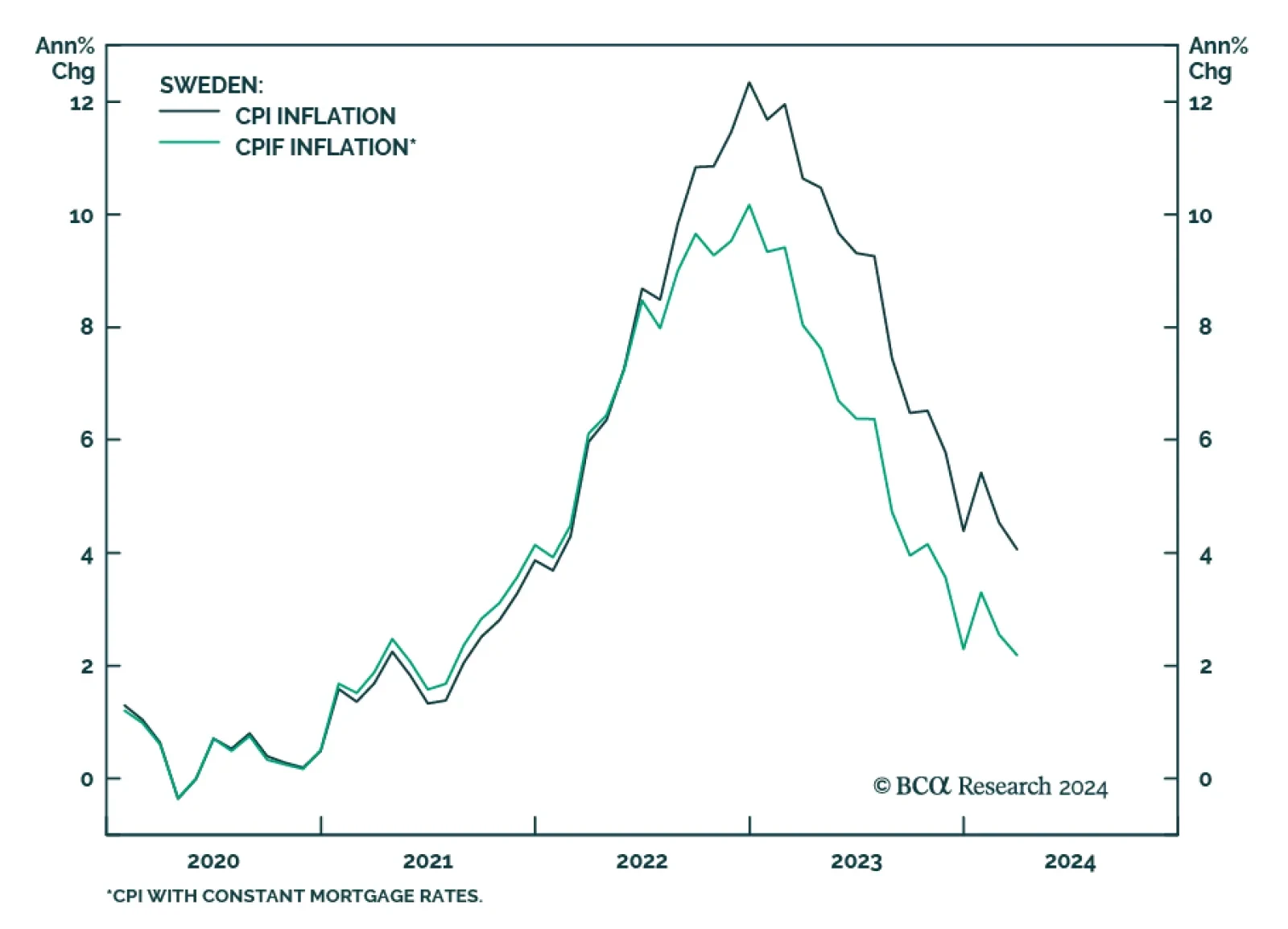

Headline inflation in Sweden came in at 4.1% in March. Lower food prices as well as lower inflation for recreation and culture were the main contributors to the drop. The biggest positive contributor was housing due to higher…

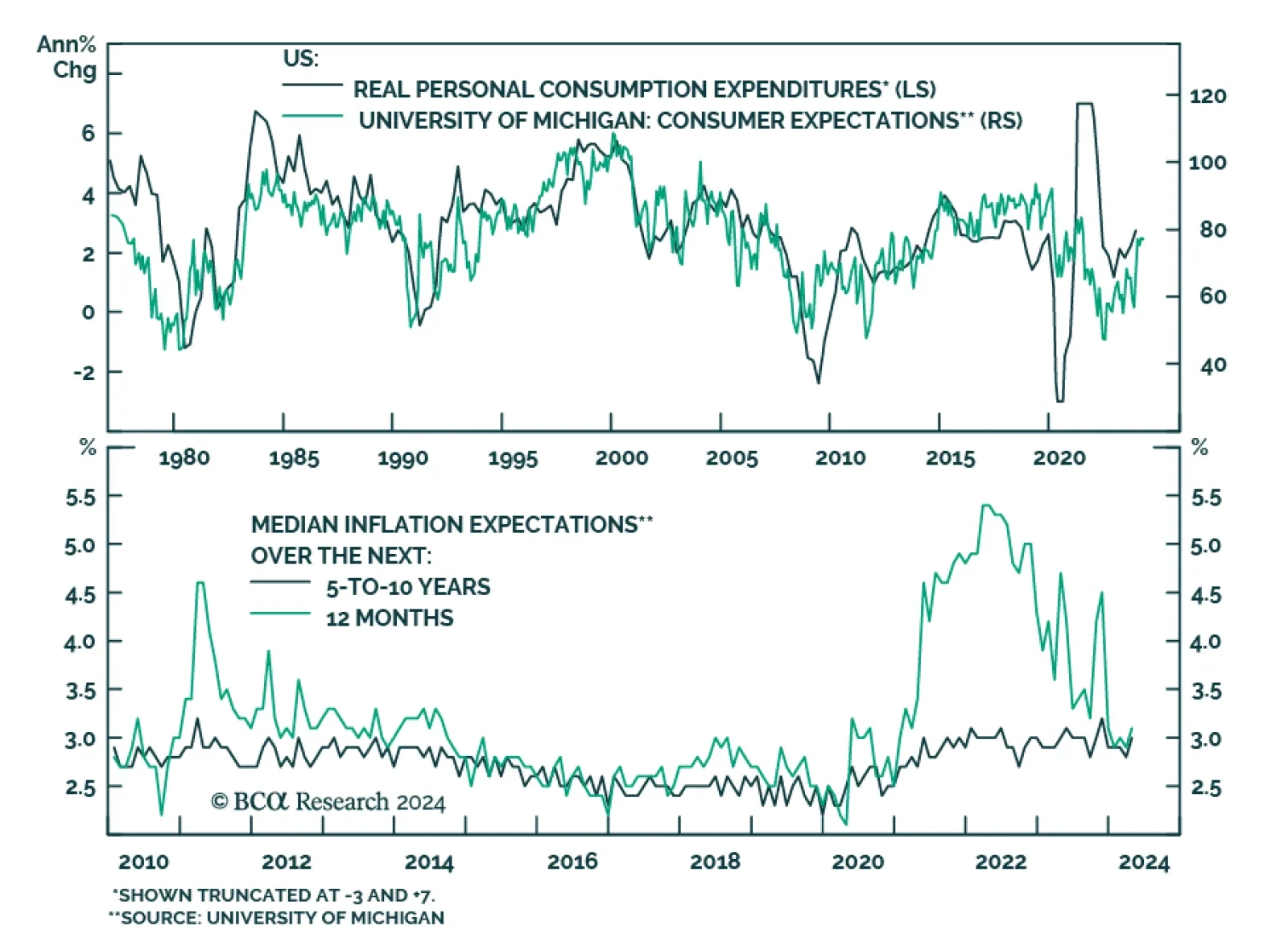

The preliminary reading of the University of Michigan gauge of consumer sentiment slid from 79.4 to 77.9 in April from 79.4, below expectations. Although both current conditions and expectations disappointed, the deterioration in…

Stay overweight US equities versus world, long US energy sector versus Middle East stocks, and long Canada and Mexico versus global-ex-US stocks.

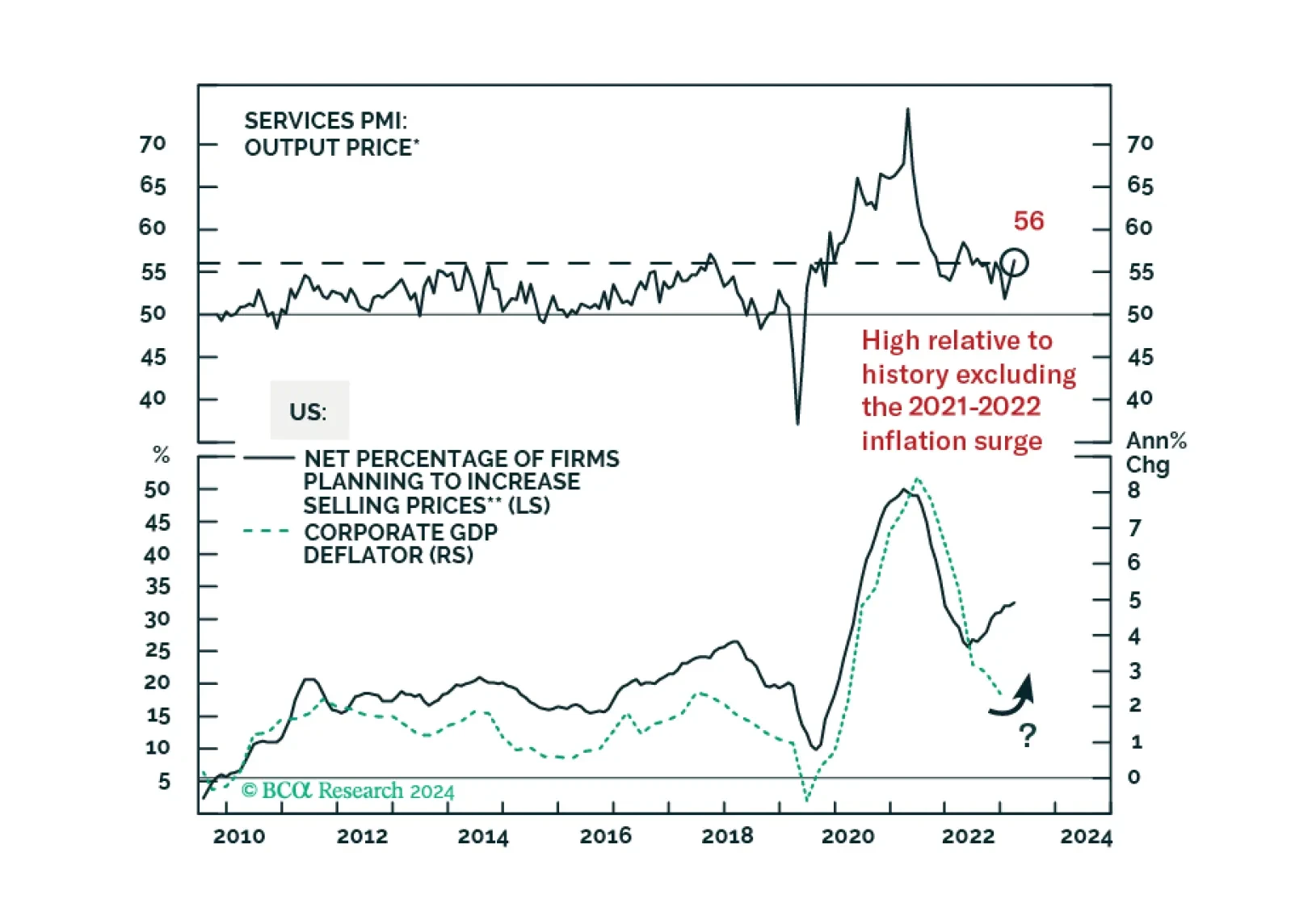

In the short run, global risk assets are vulnerable due to rising oil prices and bond yields. Cyclically, a global economic downturn will weigh on global risk assets.

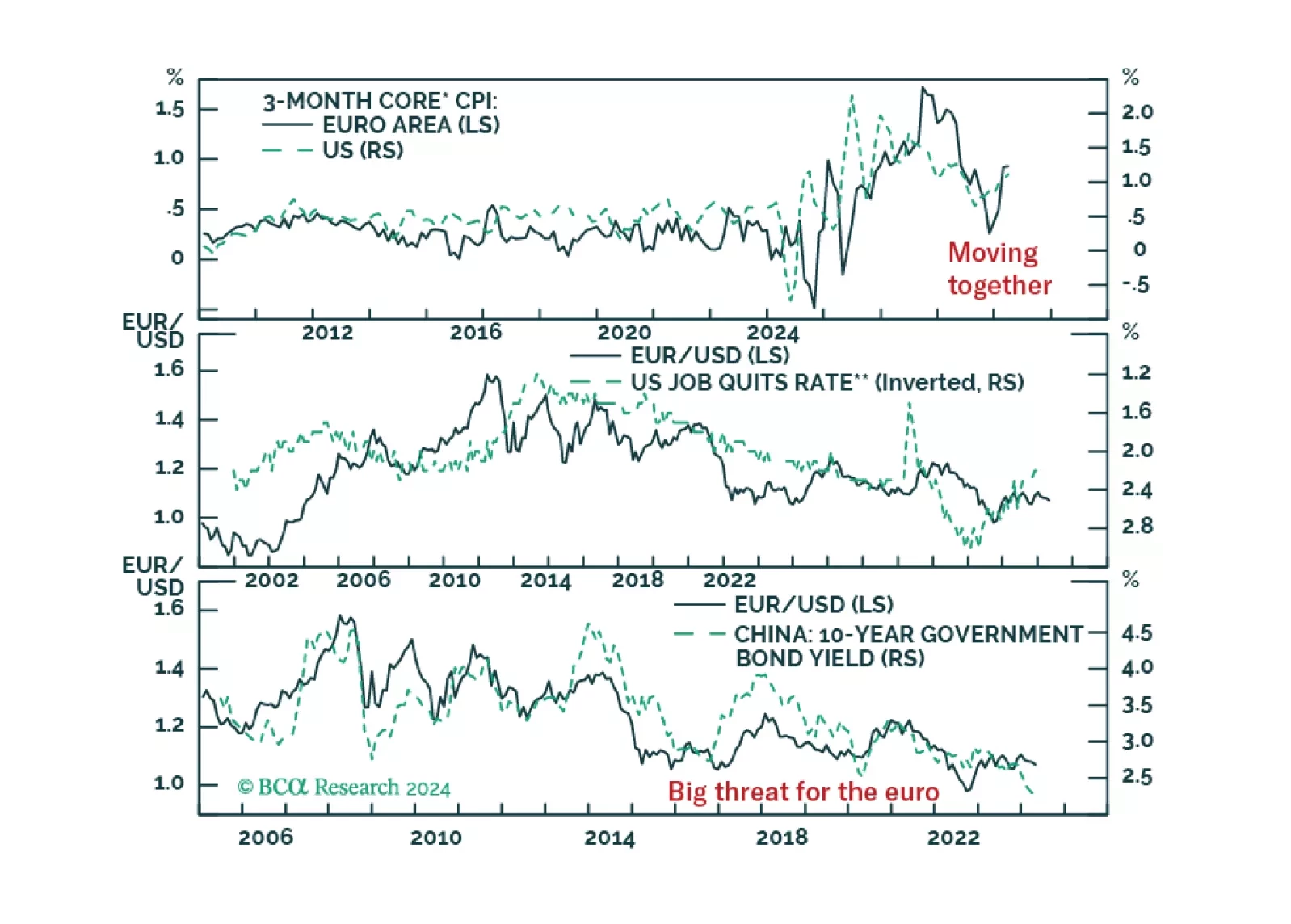

EUR/USD collapsed in the wake of last week’s hotter-than-expected US CPI report. Is this pessimism warranted and will the euro’s trading range that has prevailed since 2023 breakdown?

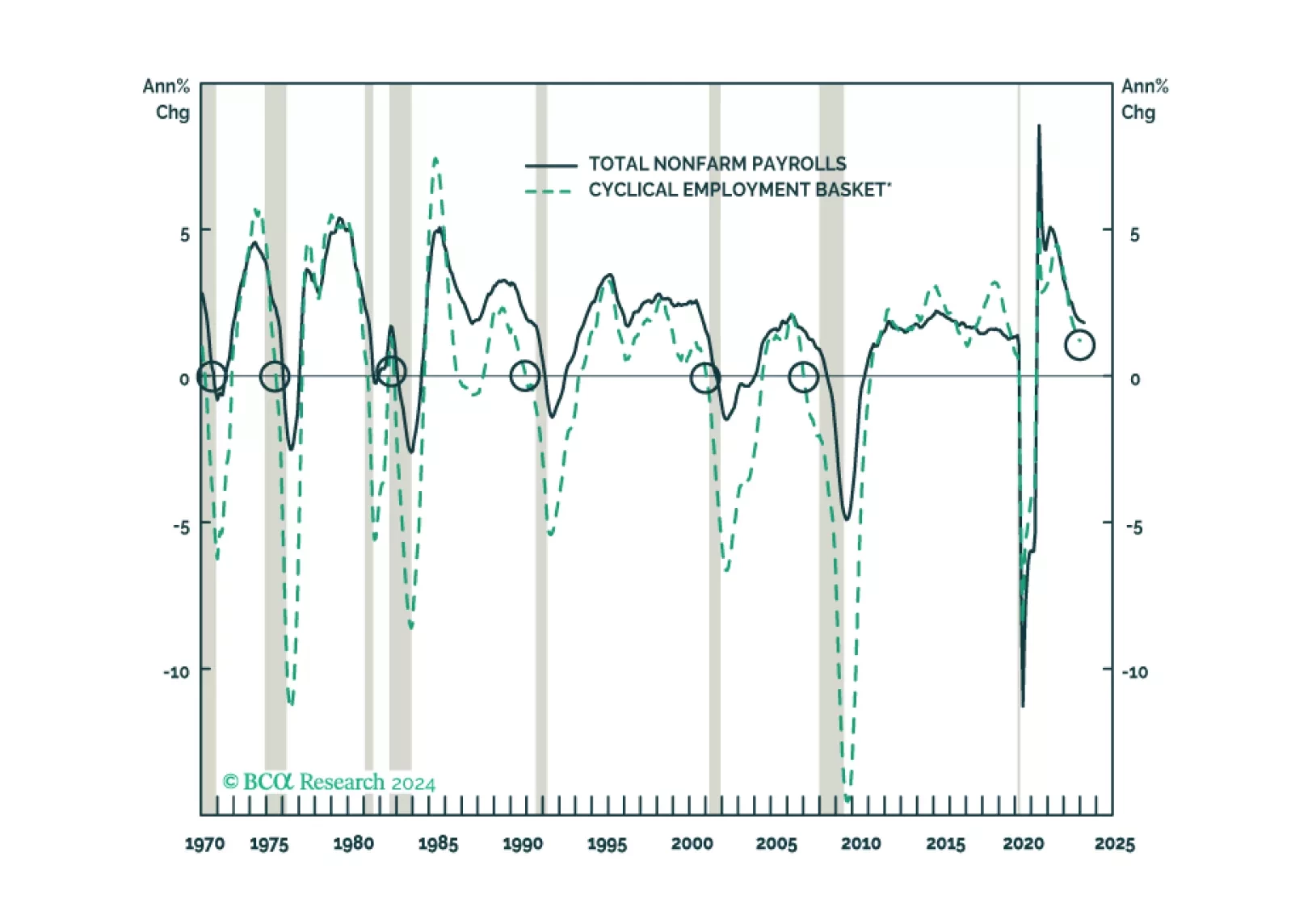

We look beneath headline data to assess the state of the labor market in cyclical goods-producing industries that have previously led overall nonfarm payrolls and in the services segments that have recently been leading the charge.…

In this report, we present our quarterly review of our Model Bond Portfolio. The anti-growth bias of the portfolio allocations hurt the portfolio performance in Q1/2024 as global growth surprised to the upside. However, we anticipate…

At today’s monetary policy meeting, the ECB gave strong hints that rate cuts will begin as soon as the next meeting in June. In this Insight, we share our thoughts on today’s meeting and discuss the implications for European bond…