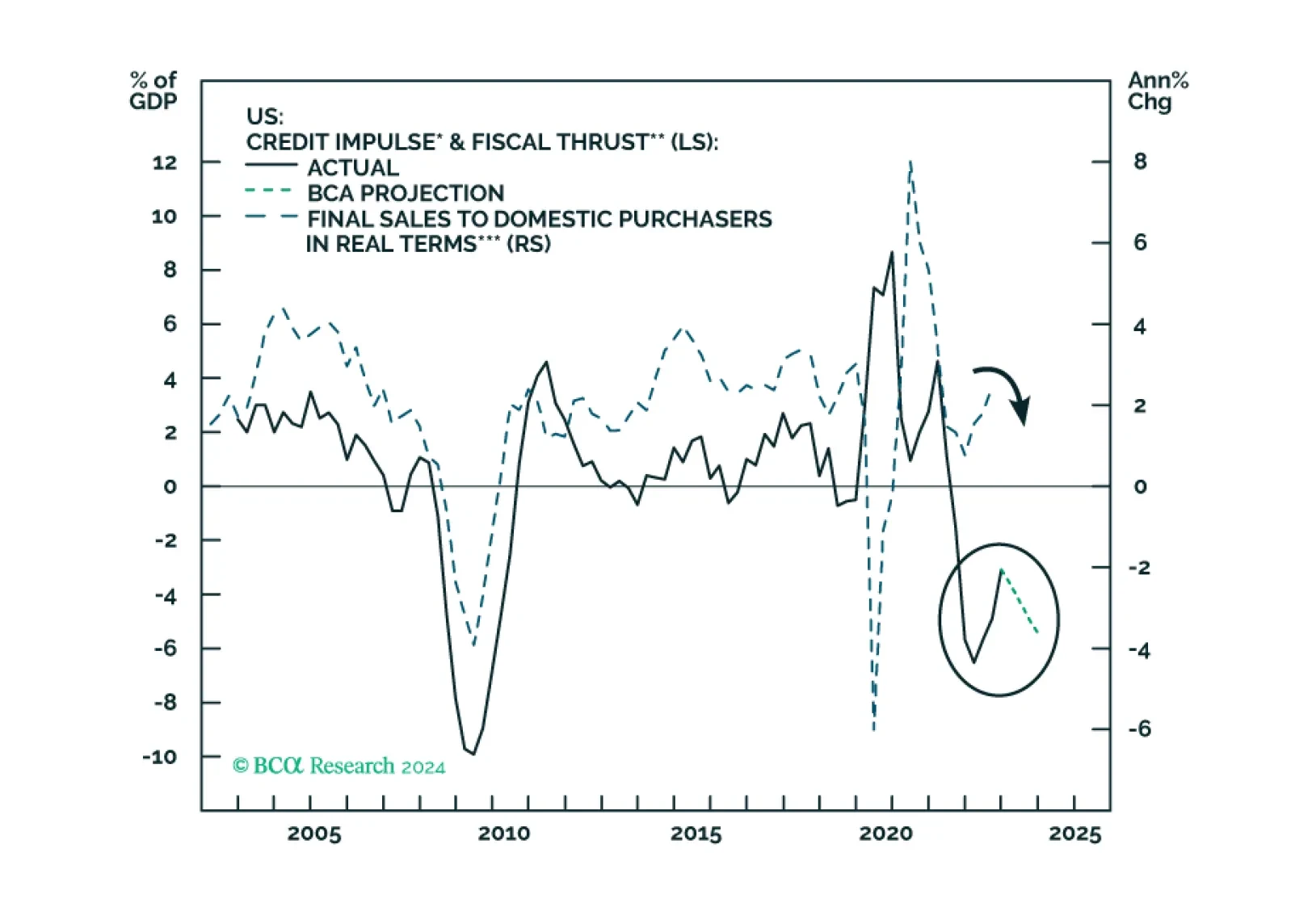

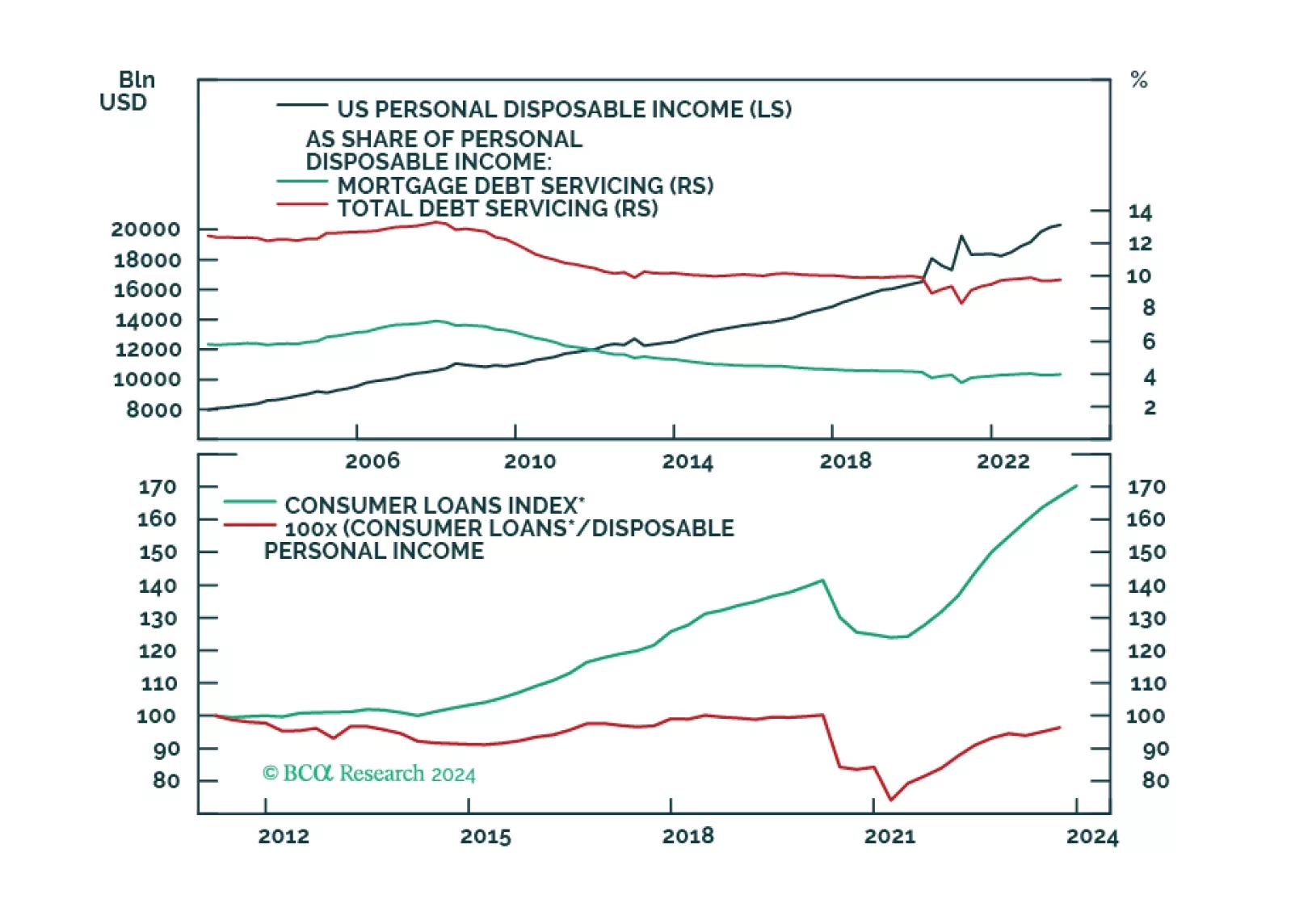

The combined US credit impulse and fiscal thrust indicator will likely relapse in 2024, heralding growth weakness. Stalling US sales volume and falling inflation, combined with sticky labor costs, will herald a non-trivial profit…

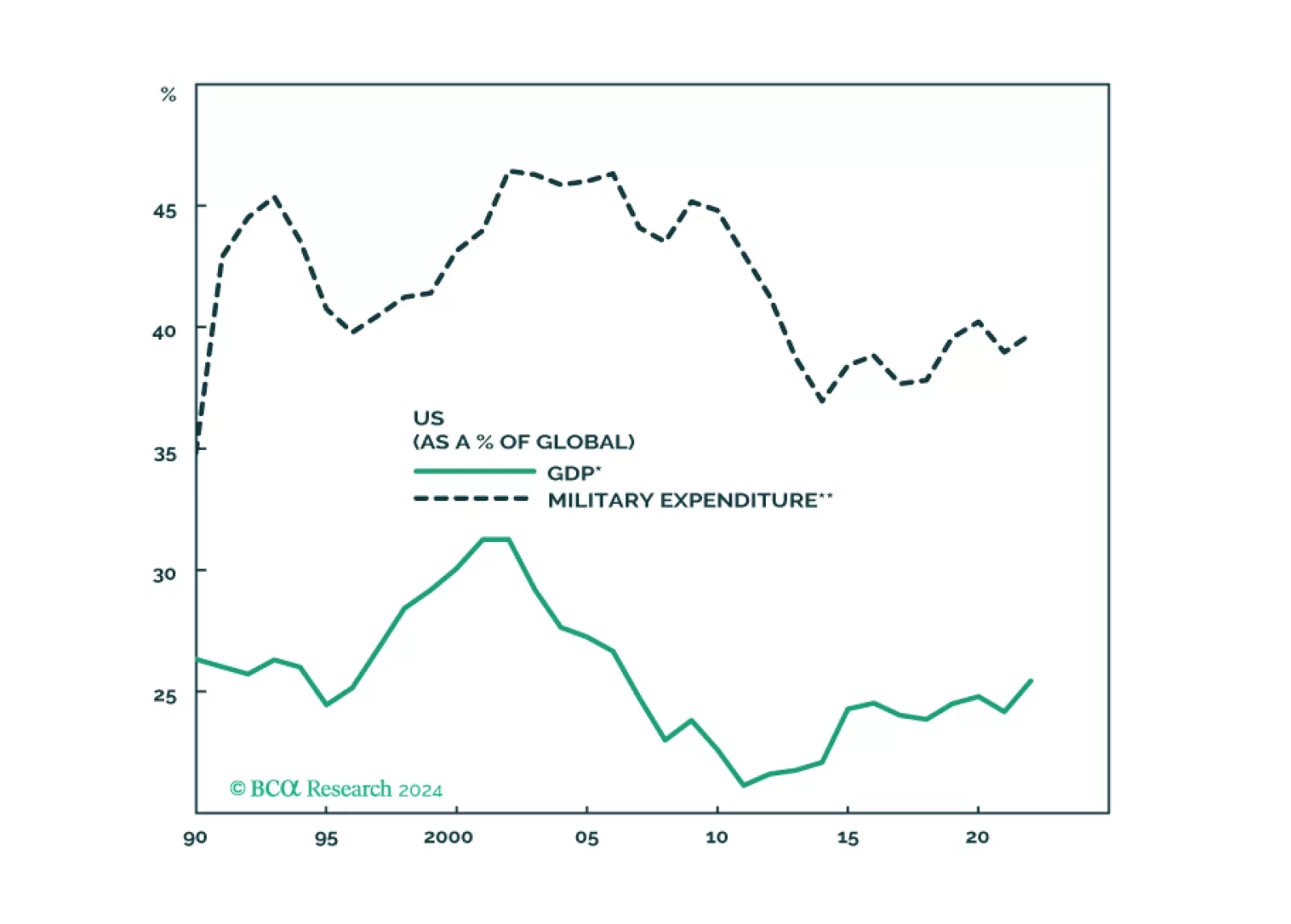

Increasing gray-zone confrontations and another round of tariff and non-tariff barriers to trade are not being reflected in commodity prices. This is keeping inflationary pressures emanating from the real economy subdued. That said,…

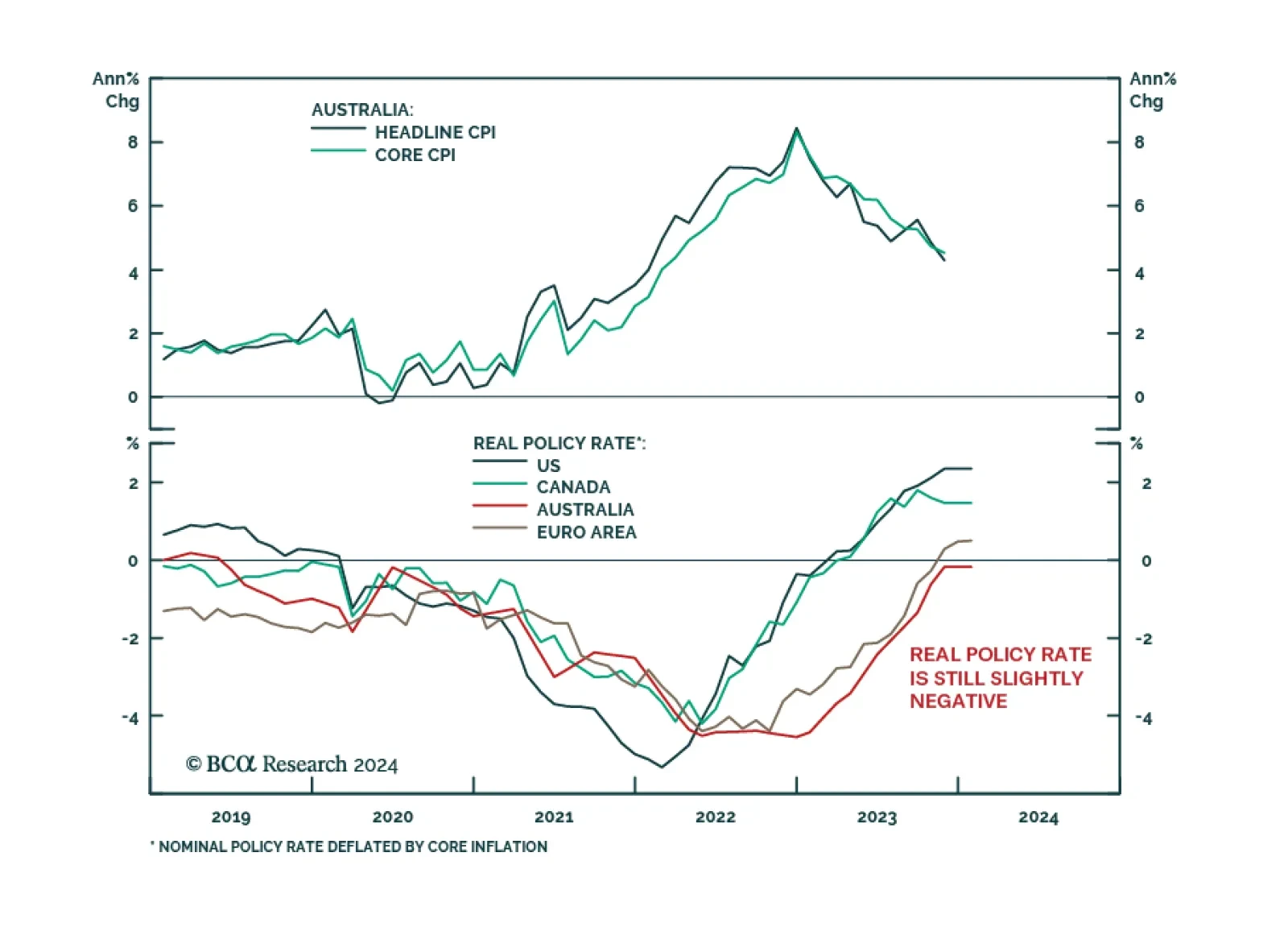

Australian CPI inflation fell from 4.9% y/y to a 22-month low of 4.3% y/y in November – slightly below expectations of 4.4%. Underlying measures of core inflation also indicate that price pressures eased in November. The…

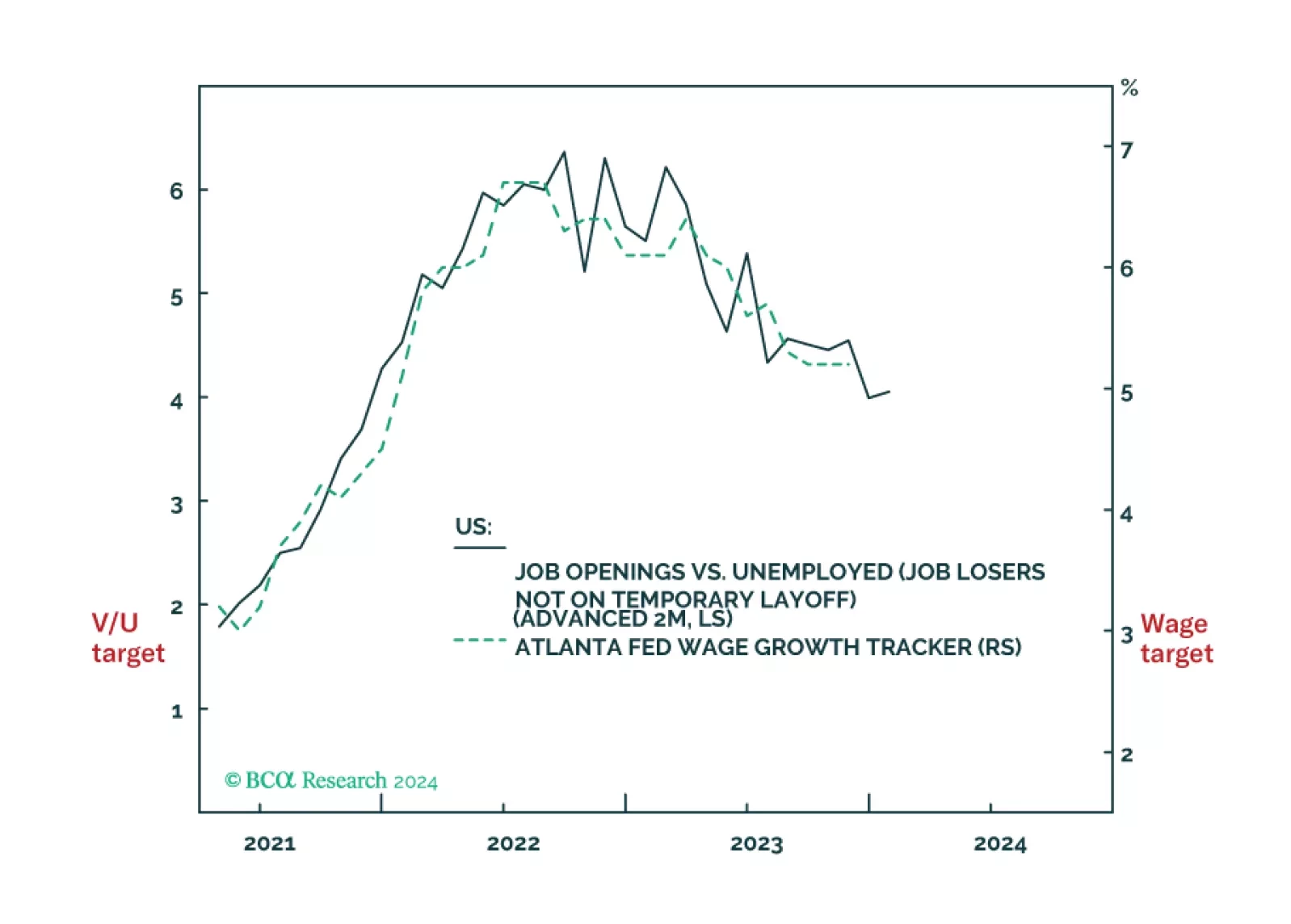

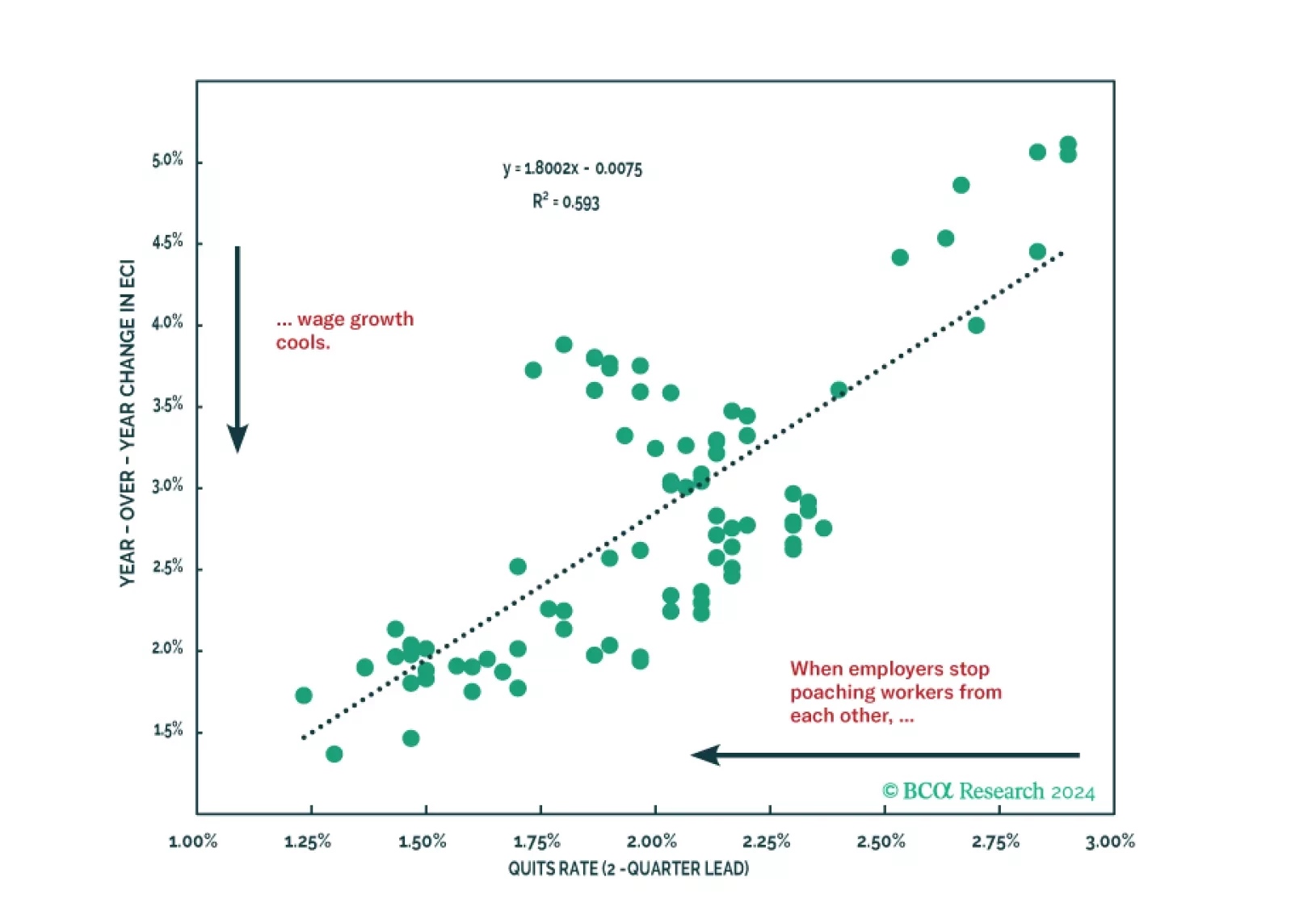

The Fed faces a dilemma. Cut rates early to avoid a recession, but at the risk of not slaying wage inflation. Or, not cut rates early to ensure that wage inflation is slayed, but at the risk of a downturn. Faced with such a dilemma,…

The market’s pricing of a soft landing means that geopolitical risks are becoming more, not less, relevant in 2024. US domestic divisions will invite challenges as foreign powers rightly fear that US policy will turn more hawkish…

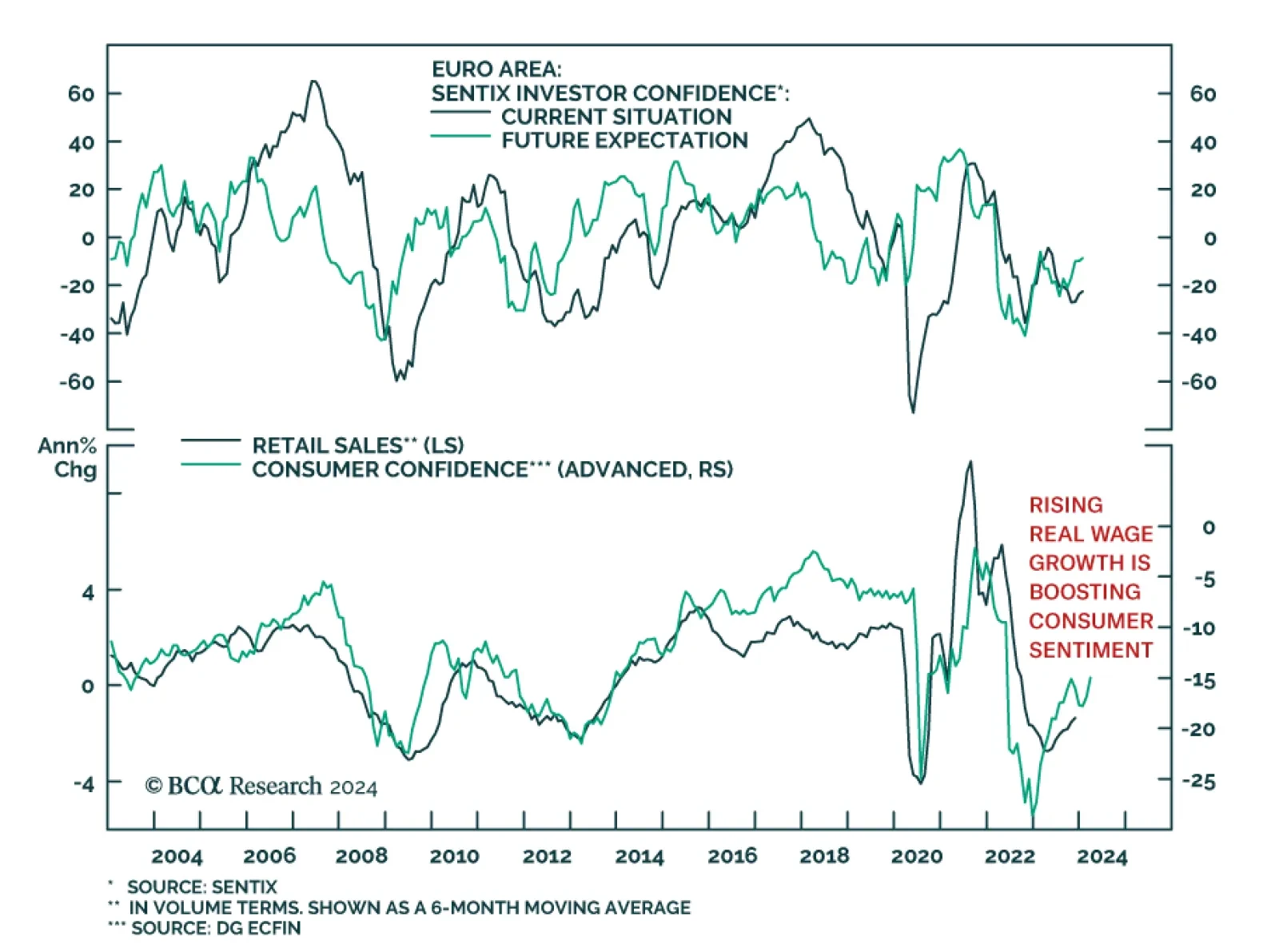

Optimism among investors and economic agents continues to improve in the Eurozone. The Sentix Economic Index for the Eurozone rose from -16.8 to -15.8 in January – in line with consensus expectations and marking the third…

Our Portfolio Allocation Summary for January 2024.

Despite the blah opening to the year, we do not think stocks have reached an inflection point. We expect that incoming data will continue to flatter the soft-landing narrative for another couple of months, helping the S&P 500 to…

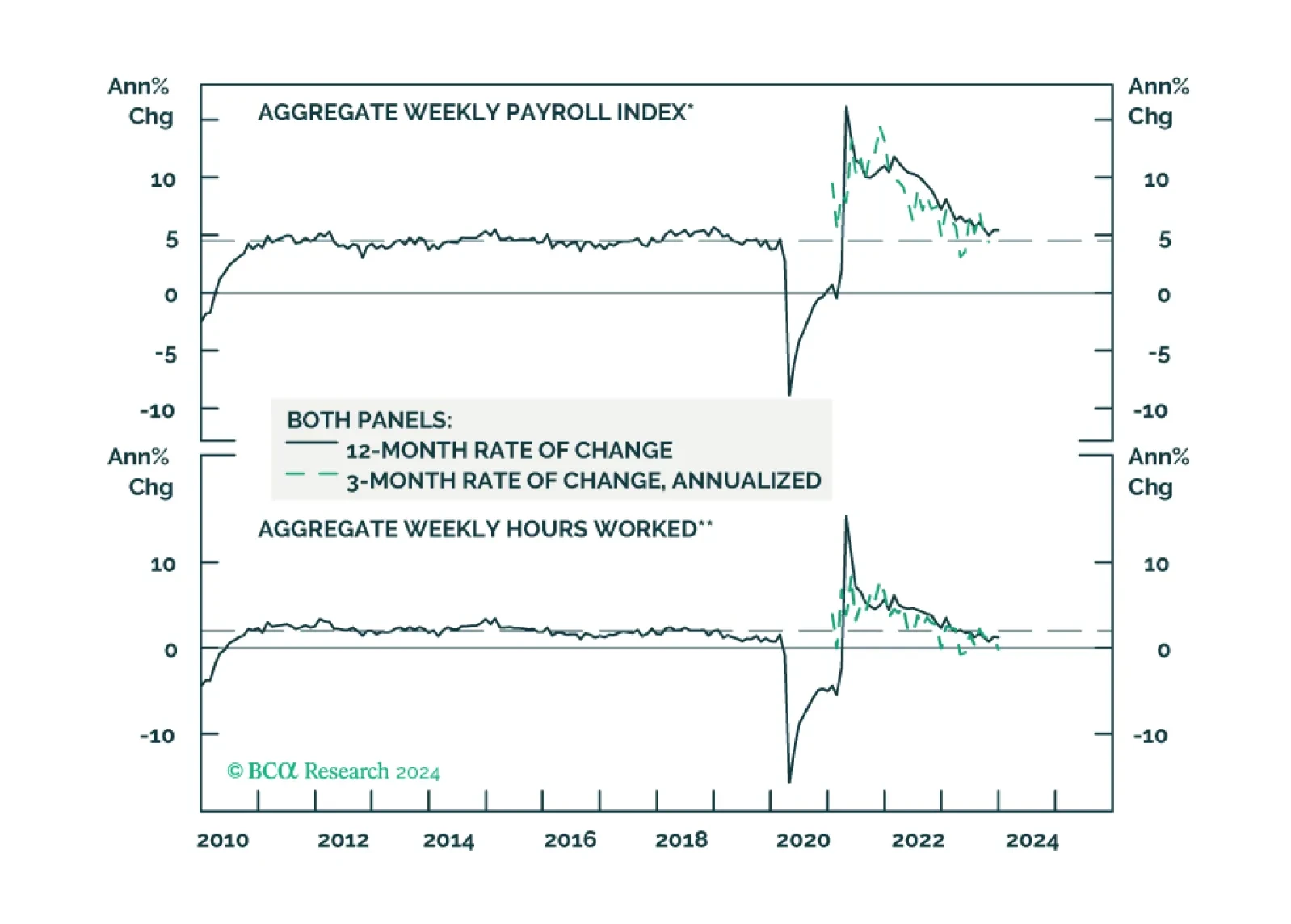

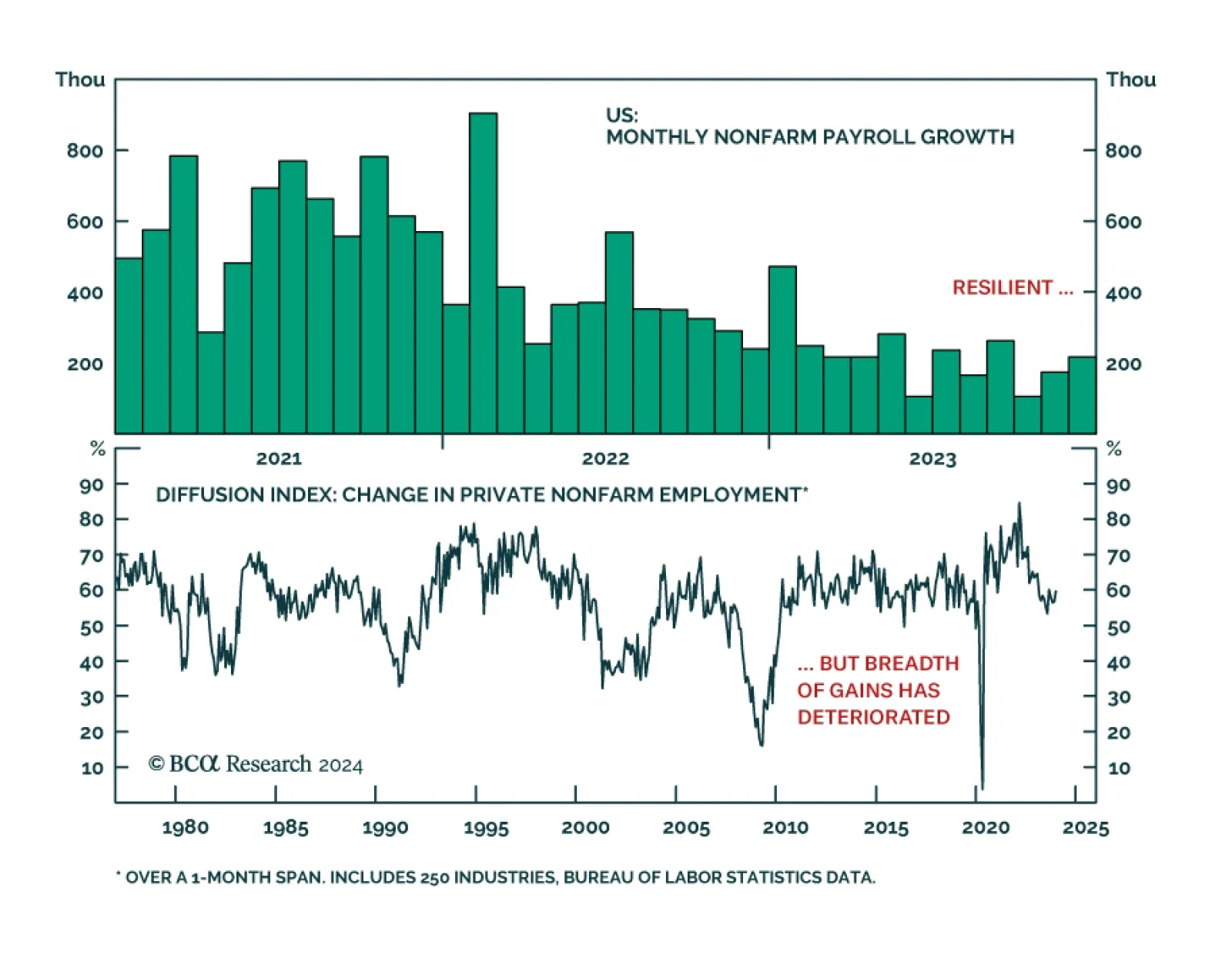

At first blush, the US establishment survey delivered a positive surprise on Friday. The increase in US nonfarm payroll employment jumped from 173 thousand to 216 thousand in December – beating expectations of 175 thousand…

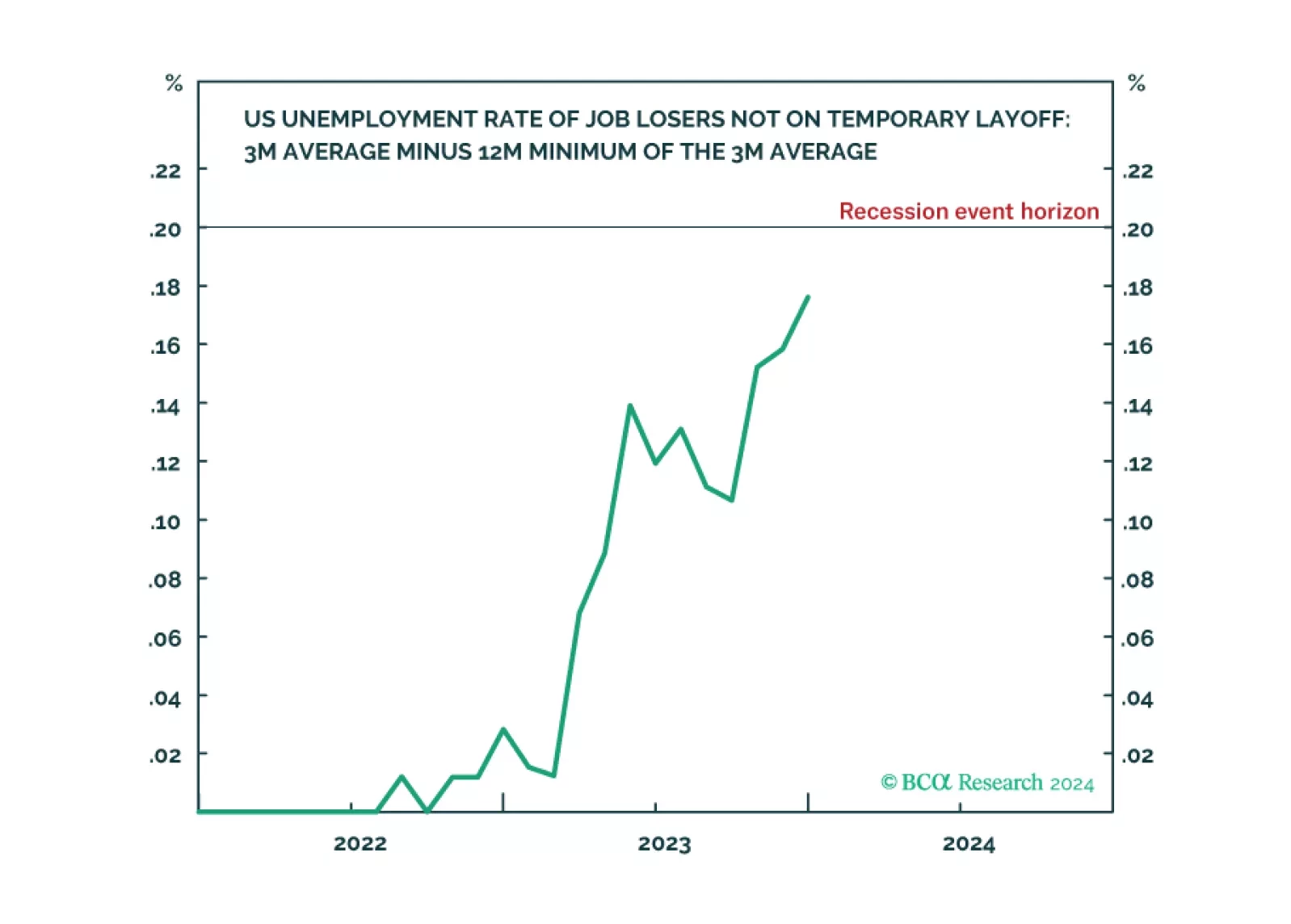

Following today’s US jobs data release, the Joshi rule real-time US recession indicator inched up to 0.18 and is now just a whisker from its recession event-horizon of 0.20.