Mr. X and his daughter, Ms. X, are long-time BCA clients who visit our office toward the end of each year to discuss the economic and financial market outlook. This report is an edited transcript of our recent conversation. Mr. X: I have…

Last week’s flurry of optimism about an apparently meaningful resumption in U.S.-China trade talks were somewhat offset by less-positive comments from President Xi and Vice President Pence at the APEC summit over the…

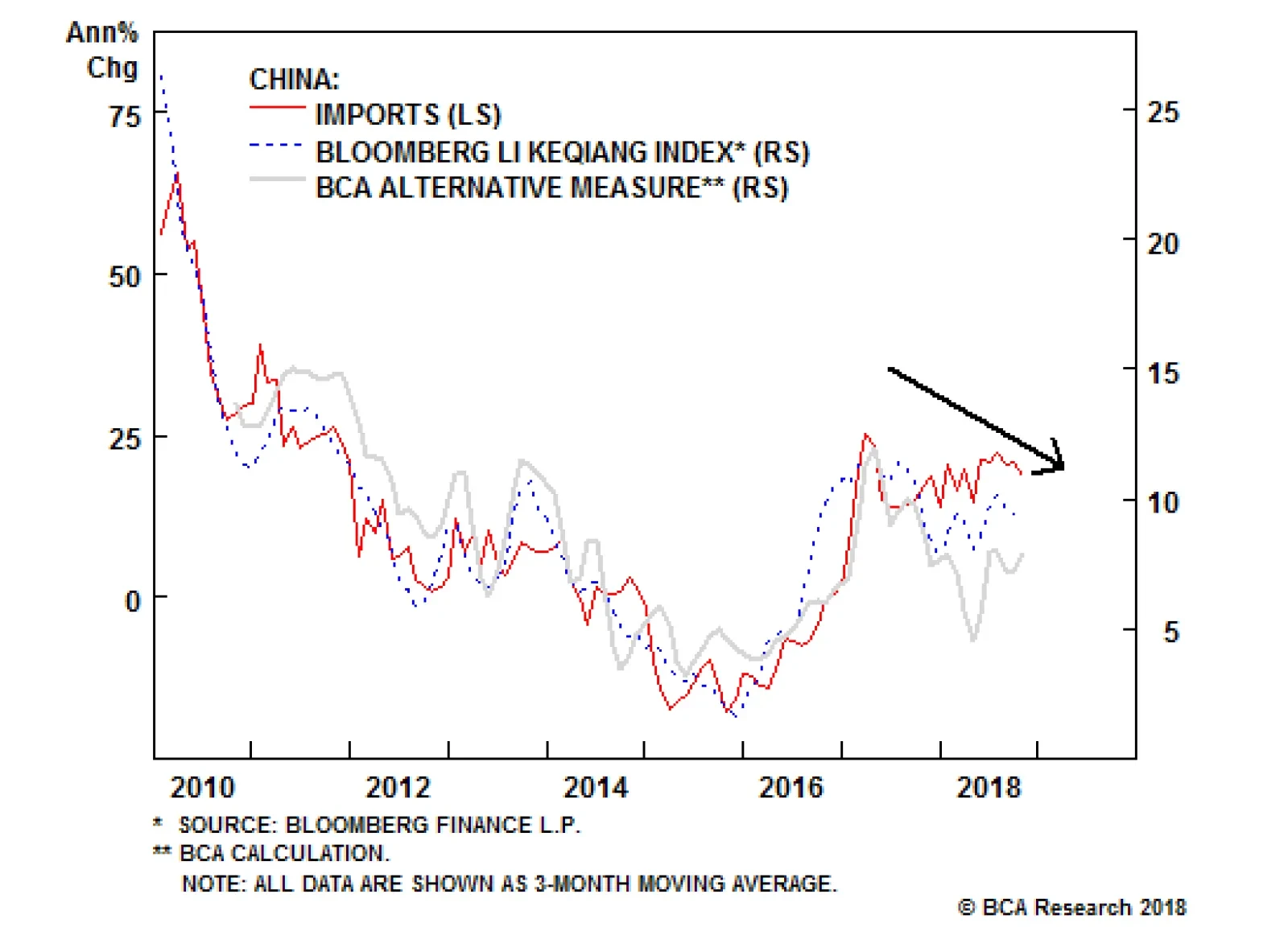

Highlights The October credit and housing market data present a gloomy picture for Chinese domestic demand. Trade remains buoyant, but exports are set to decline materially over the coming months. Many investors are focused too much…

Dear Client, Barring any major market developments, we will not be sending you a report next week. Instead, I will be working with my colleagues on BCA's Annual Outlook, which will be published on Monday, November 26. The outlook…

Highlights So What? The Trump administration is focusing on re-election in 2020, which could push the recession call into 2021. Why? The midterms were investment-relevant, just not in the way most of our clients thought. We are…

Highlights The correction in global equities is not yet over, but we would turn more constructive if stocks retreated about 6% from current levels. Among the many things bothering investors, the fate of the Chinese economy remains…

Highlights The Fed remains on a tightening course as the U.S. economy has no spare capacity, yet growth in the rest of the world is suffering as EM financial conditions are tightening. It will take more pain for the Fed to capitulate…

Highlights Heightening geopolitical tensions between the U.S. and China, higher U.S. bond yields, tightening U.S. dollar liquidity and weakening EM/China growth - all combined - constitute a bitter cocktail for EM. Barring a…