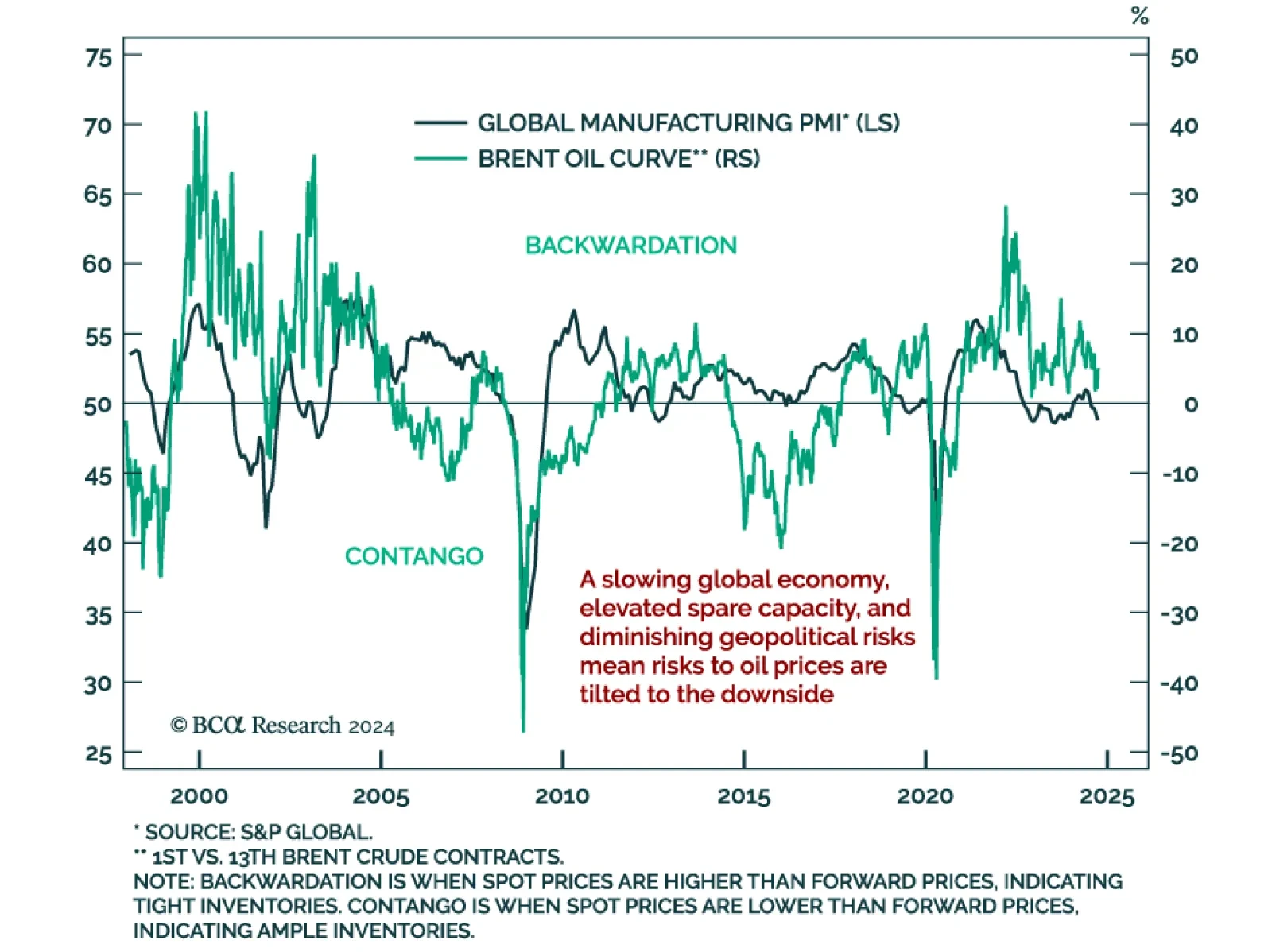

Crude prices have been trendless but volatile in 2024. Oil’s choppy price action illustrates the demand and supply tug-o-war in the market. Our bias is for crude prices to weaken on a six-to-nine months horizon. Good…

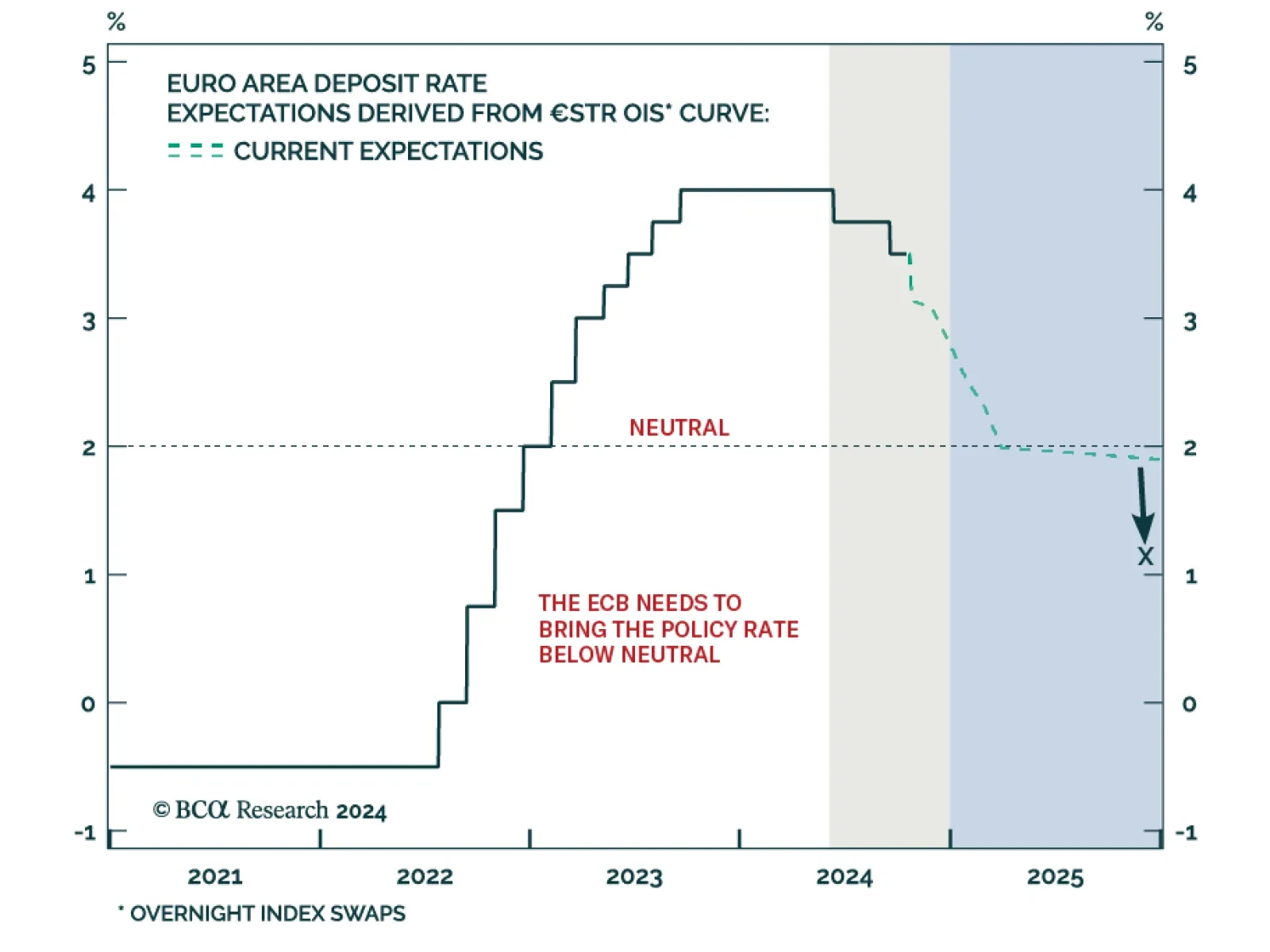

The ECB cut interest rates by 25 bps for the third time this year, lowering the deposit facility rate from 3.5% to 3.25%. While the ECB is avoiding explicitly committing to a path for policy, President Lagarde’s repeated…

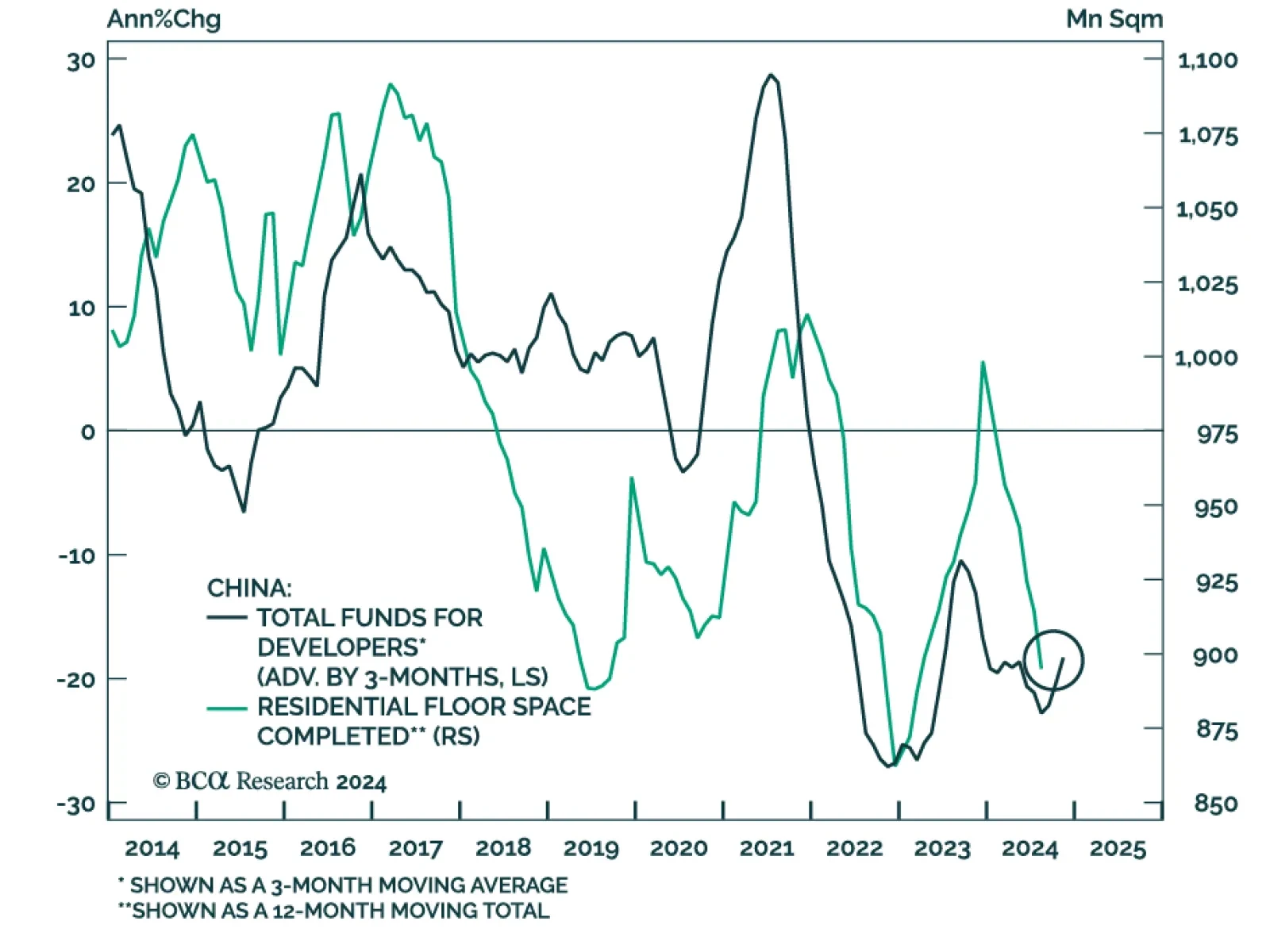

China’s Housing Administration Chief held a press conference yesterday to unveil two property-sector stimulus plans. According to our China strategists, the details were underwhelming and led to a decline in Chinese…

US retail sales beat expectations in September, rising 0.4% from August when growth was essentially flat. The control group also beat expectations at 0.7% month-on-month, accelerating from 0.3%. Growth was however somehow weak on…

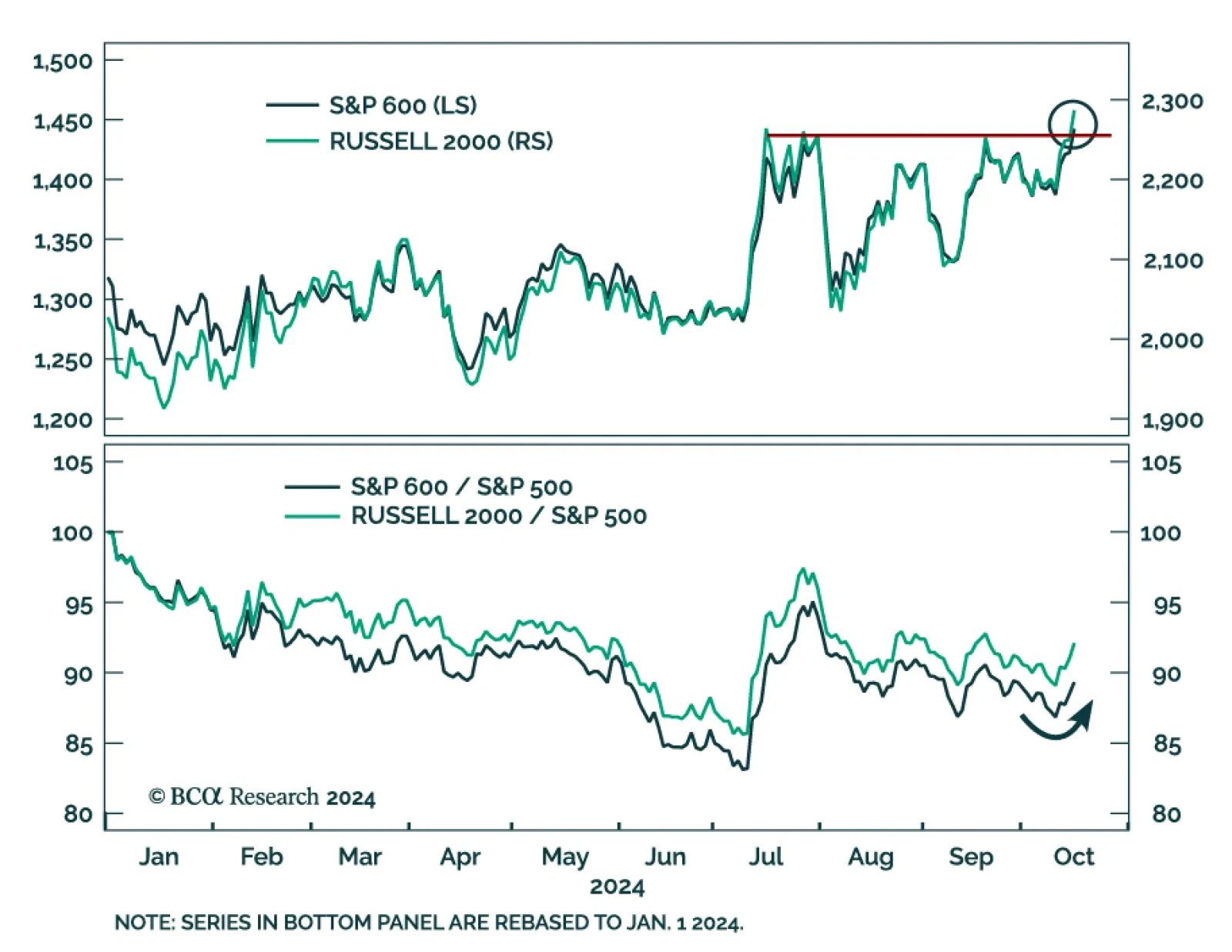

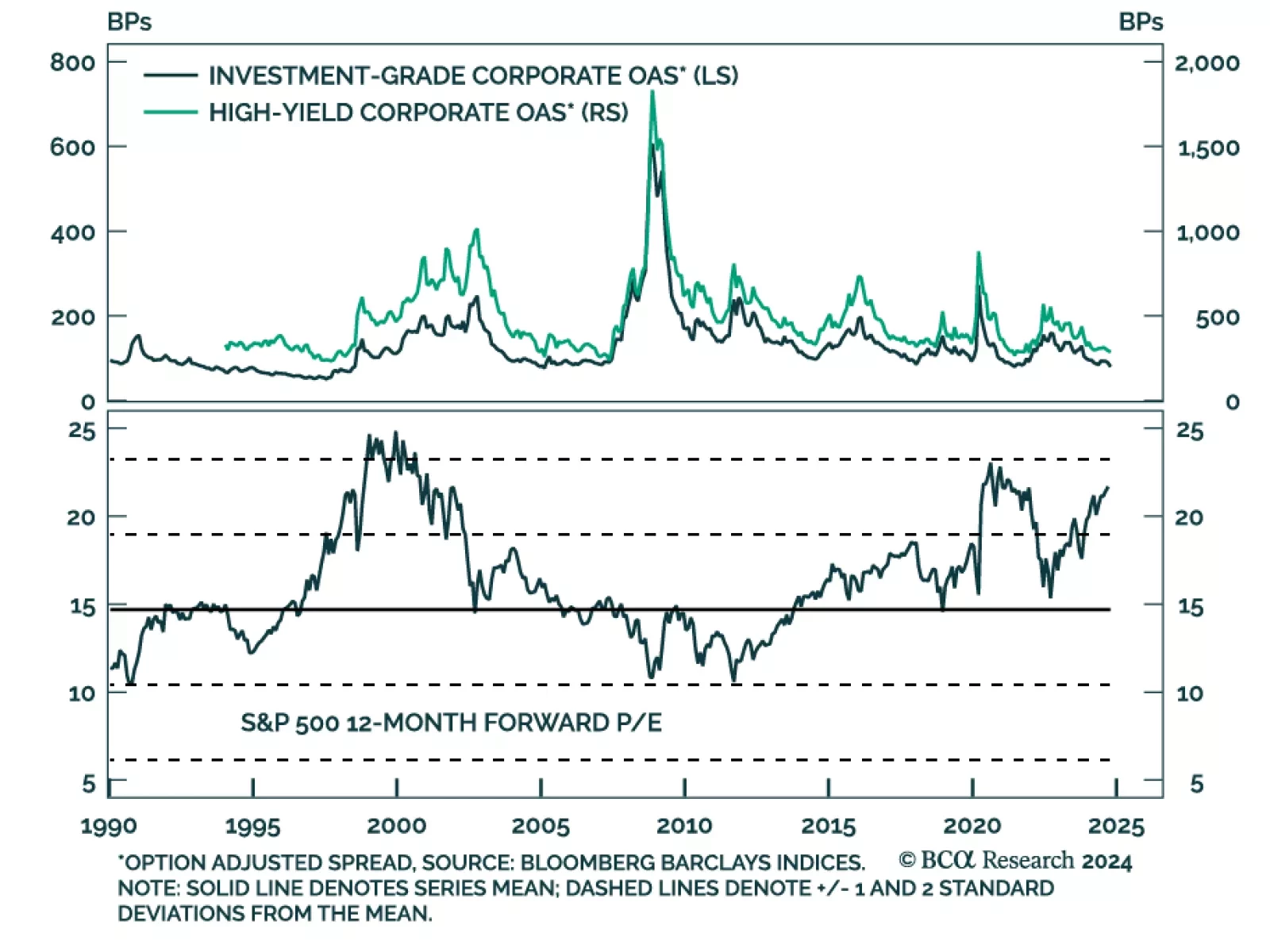

Recent economic data surprises drove equities and bond yields higher, putting our US Investment Strategy team’s bearish views to the test. They recently published a piece assessing their views considering these bullish…

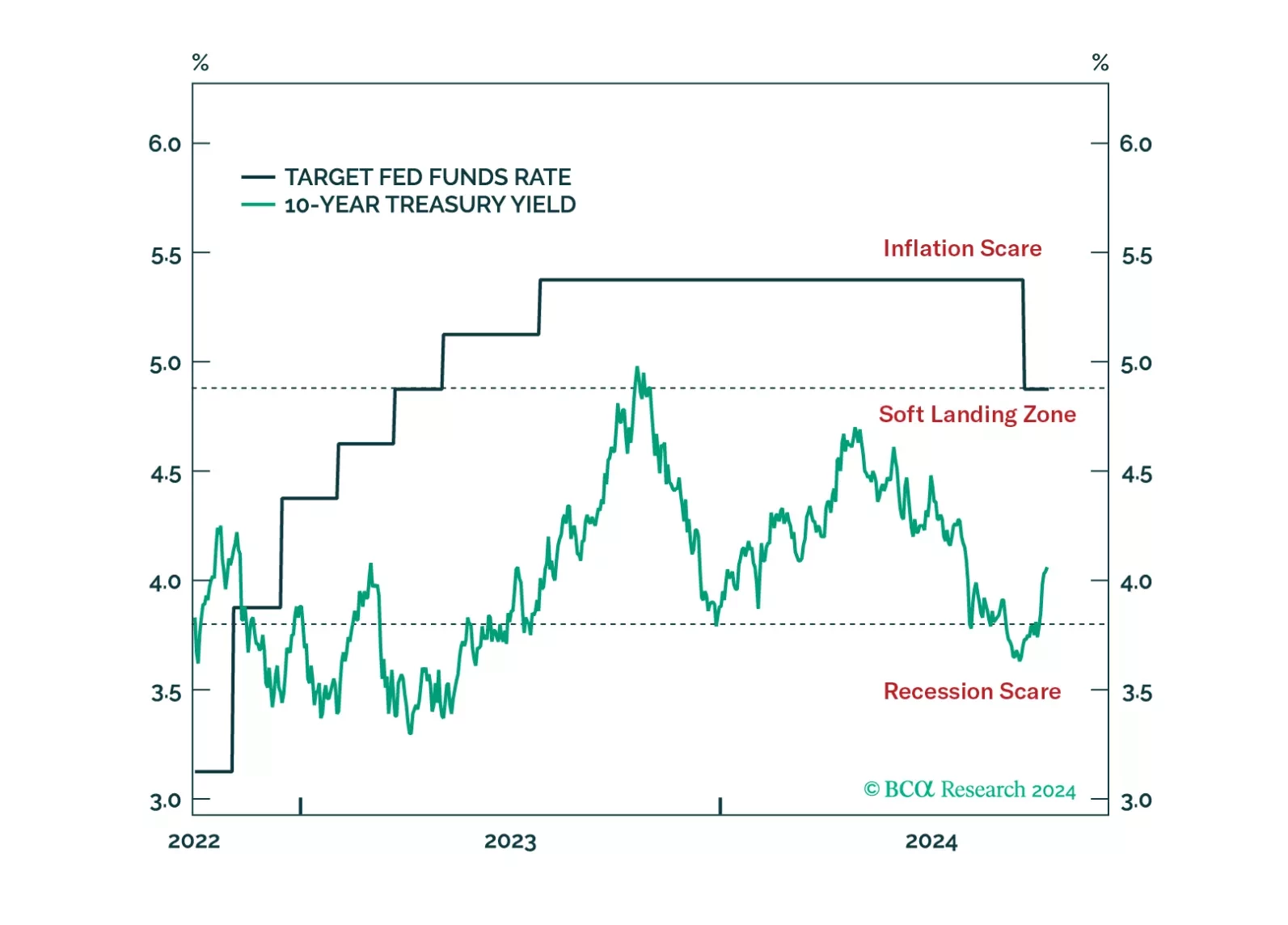

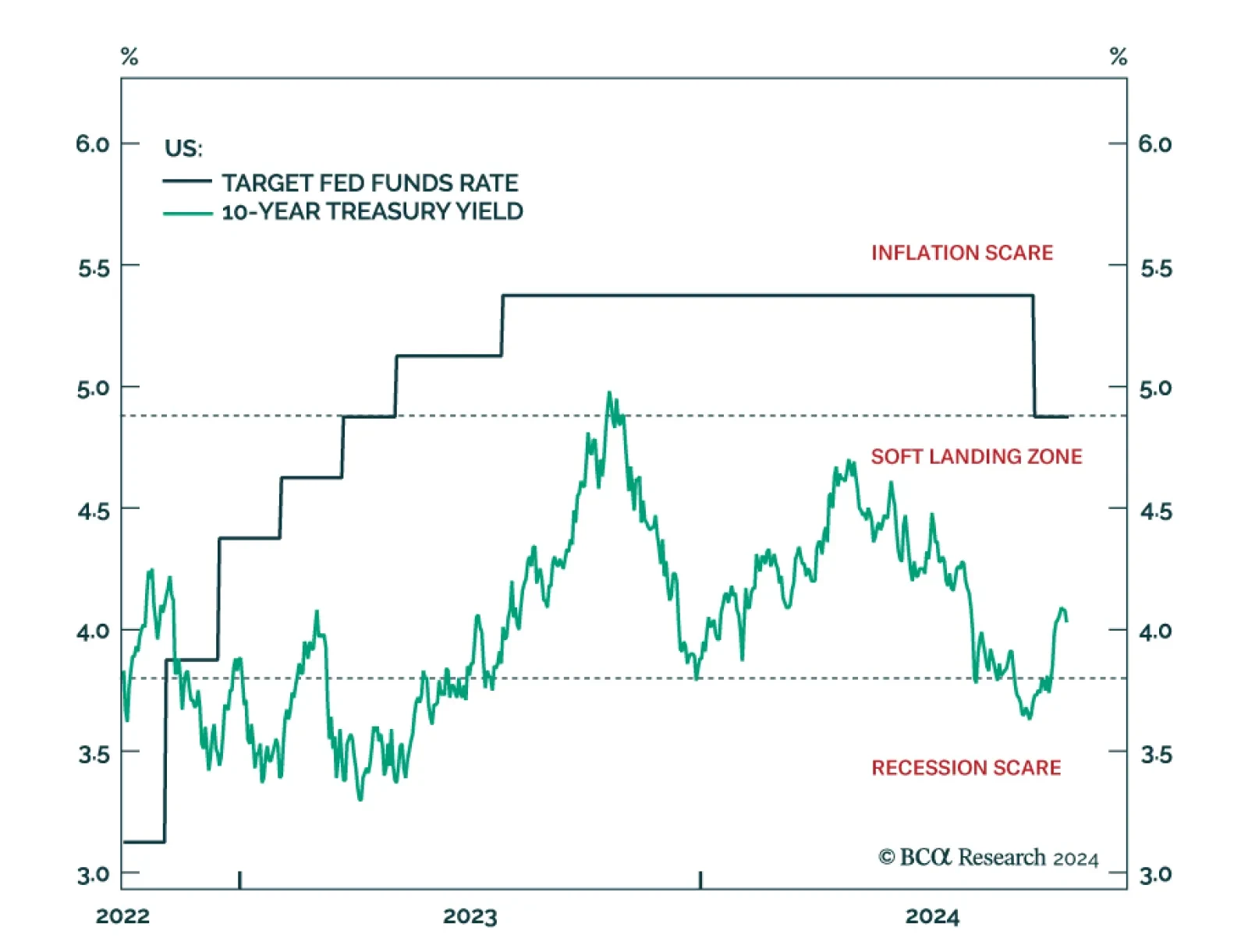

Recent positive US economic surprises drove cross-asset pricing, pushing both equities and Treasury yields higher. What do these yield levels mean for the Treasury market, and what path can we expect looking forward? Our US…

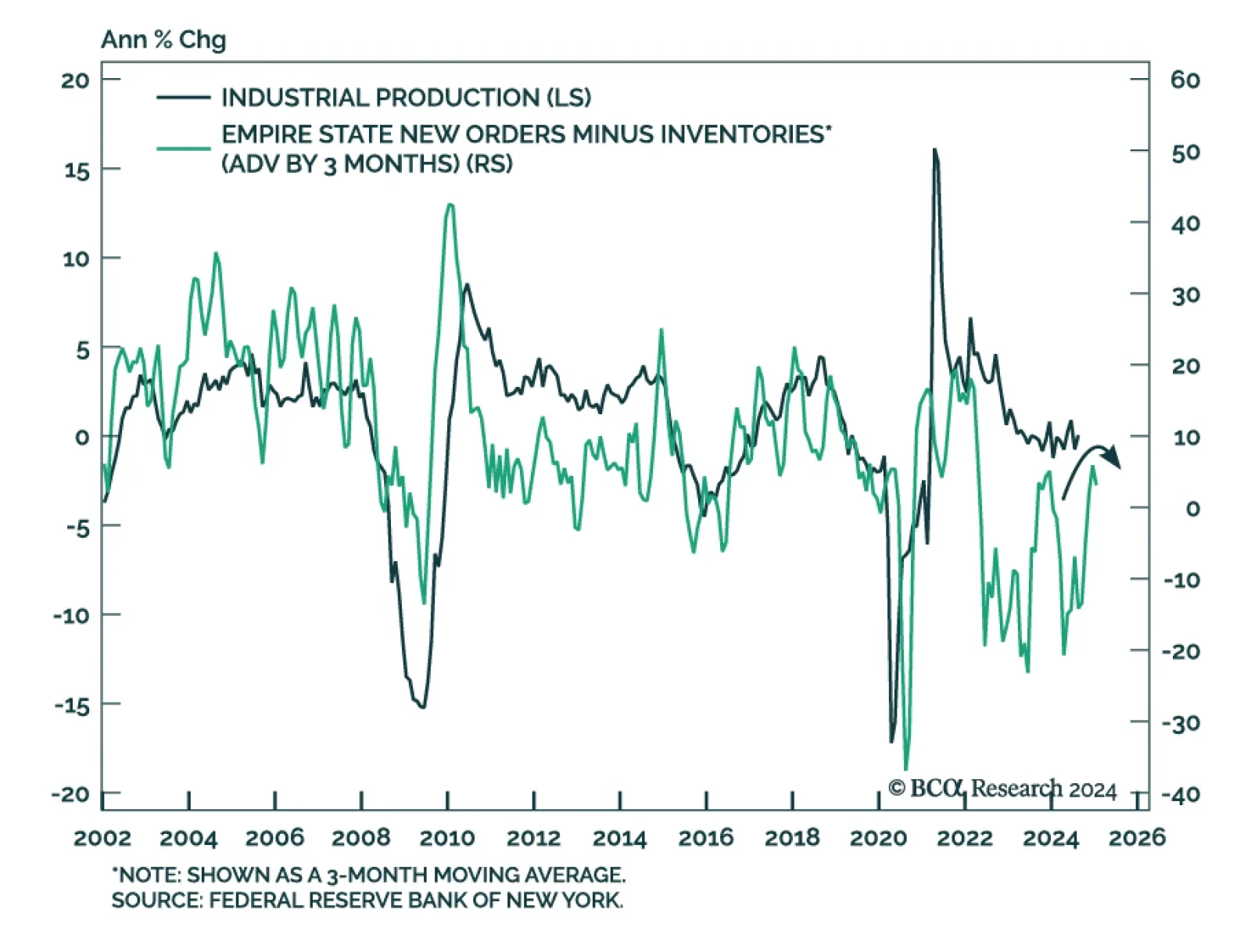

After improving throughout the summer, the October release of the first monthly regional Fed manufacturing survey sent a negative signal about US manufacturing activity. General business conditions from the Empire State…

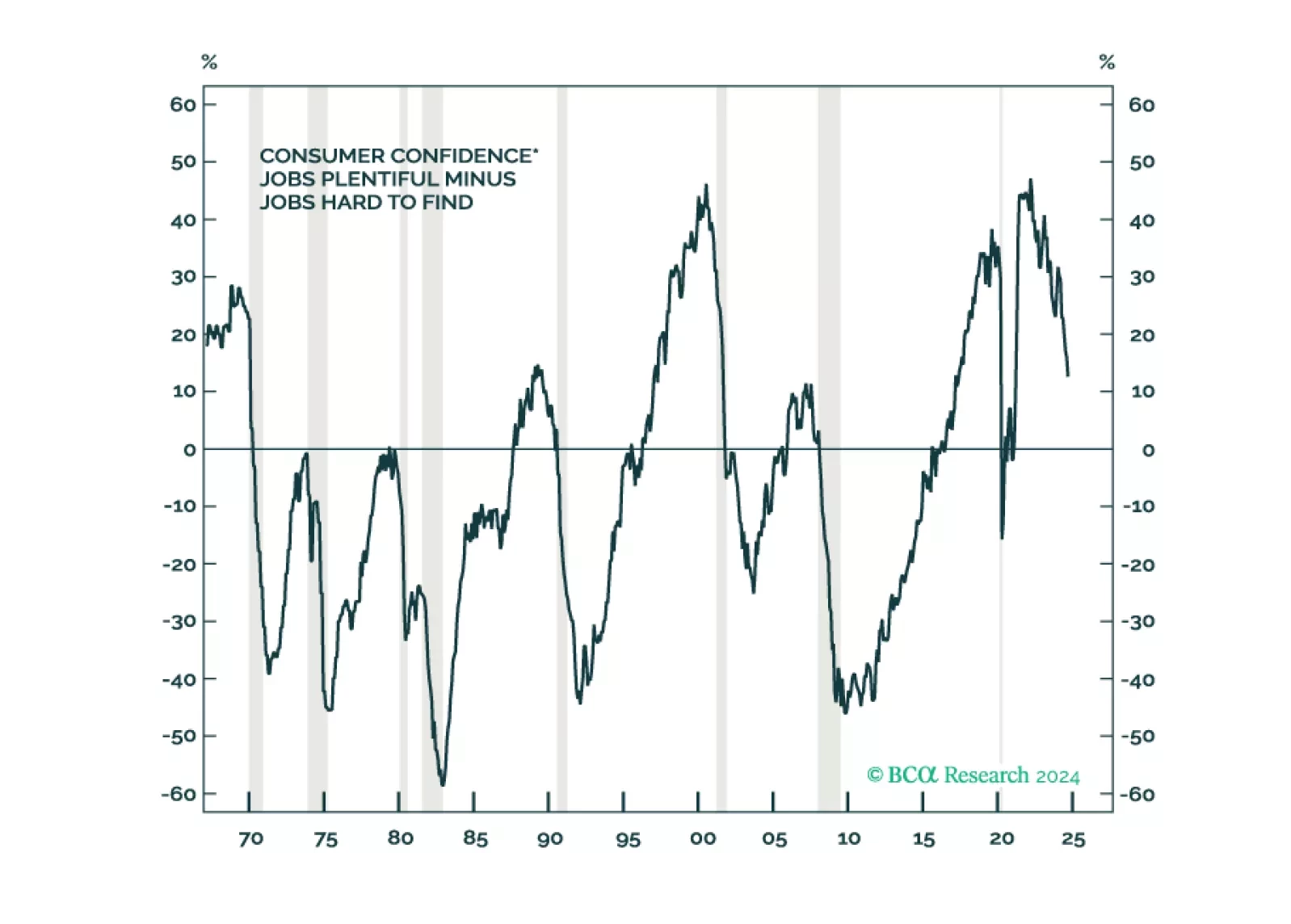

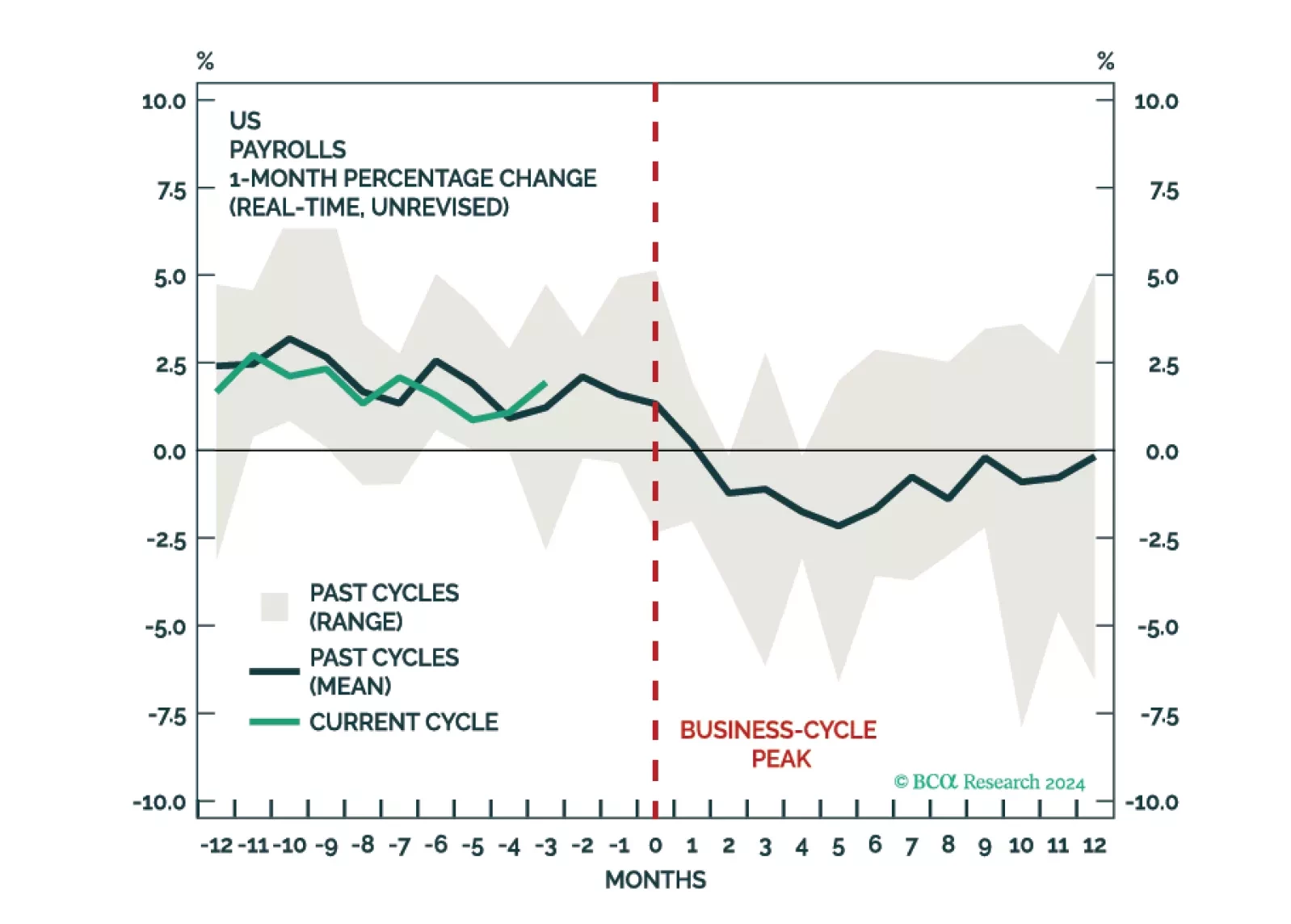

Rising stock prices and improving economic data have us re-examining our bearish thesis, but we still see deterioration in leading labor market indicators and expect it will eventually culminate in a recession. We reiterate our…

It is too early to say that the US labor market has turned the corner. We assign a 60% chance that the US will enter a recession over the next 12 months, with the downturn likely to begin in the first half of 2025. Accordingly,…

We give our thoughts on this morning’s CPI release and (lack of) market reaction. We also close our short position in January 2025 fed funds futures.