The Chicago Fed National Activity Index (CFNAI) – a summary statistic of US economic data releases – increased to 0.12 from -0.42, suggesting that the US economy improved in August. Details, however, do not point to a…

The NFIB Small Business Optimism index was mostly flat in September, ticking a mere 0.3 points higher to 91.5 in September, below expectations of a more meaningful improvement to 92.0. The NFIB Small Business Optimism has…

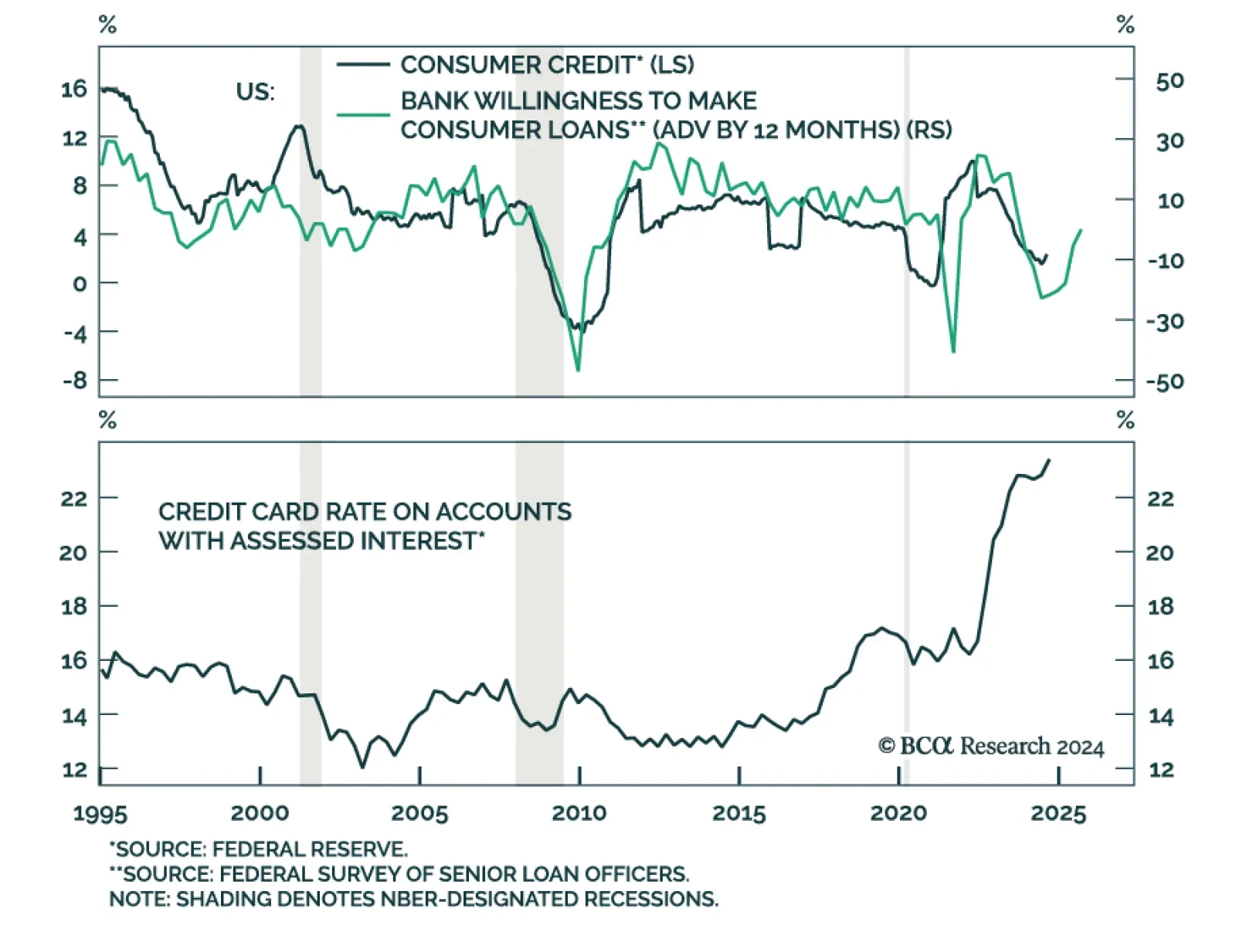

Consumer credit growth slowed in August, rising by USD 8.9 bn (to USD 5,097.6 bn outstanding) from USD 26.6 bn, disappointing expectations of a USD 12 bn monthly increase. Notably, revolving credit (which includes credit cards)…

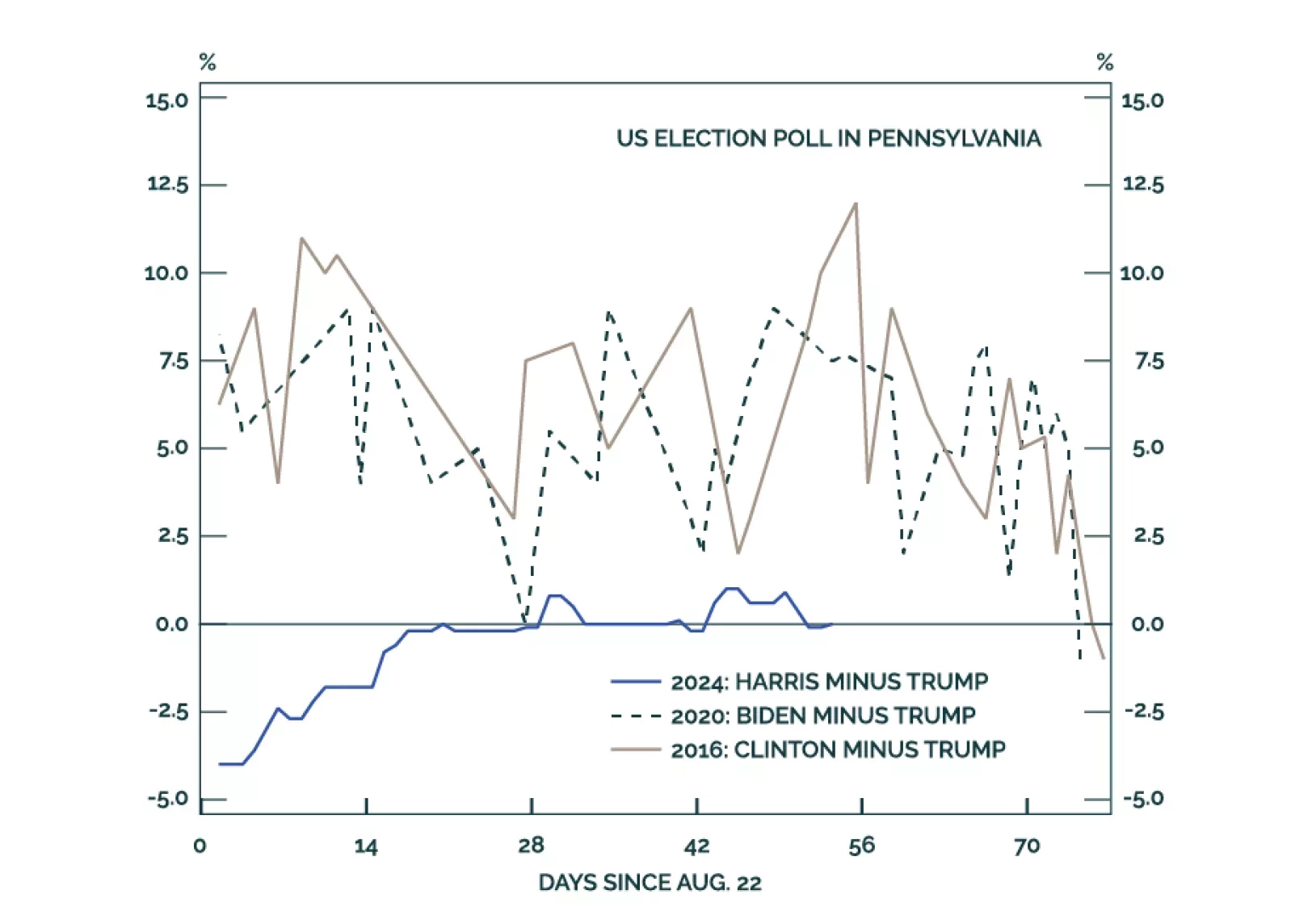

The US election underscores three long-term trends of Generational Change, Peak Polarization, and Limited Big Government. Investors should expect more volatility around the election and should assess the results before adding more…

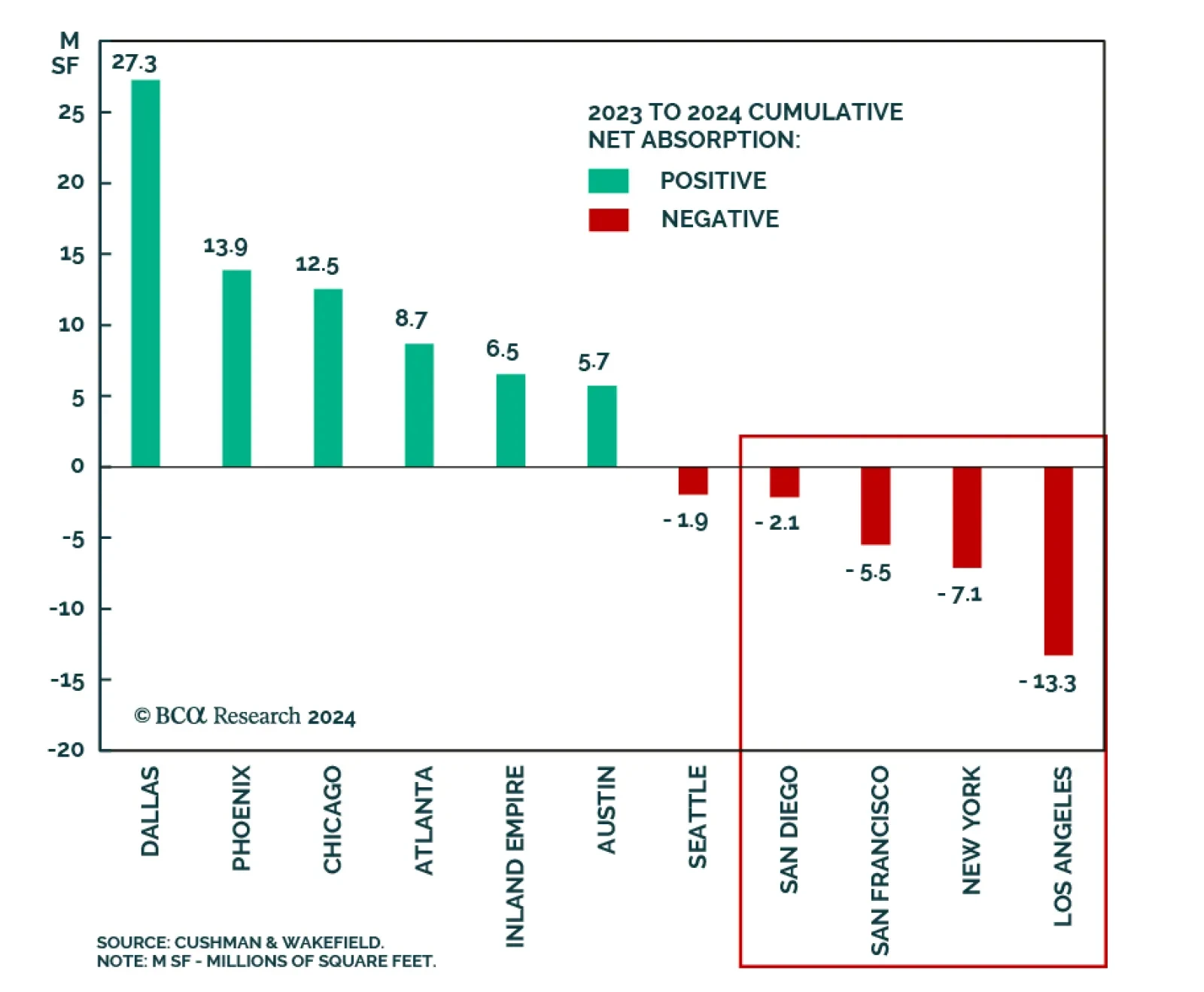

According to BCA Research’s Private Markets & Alternatives service, intra-market repricing will offer investors a unique opportunity to enter the industrial real estate space in the next two years. In the short…

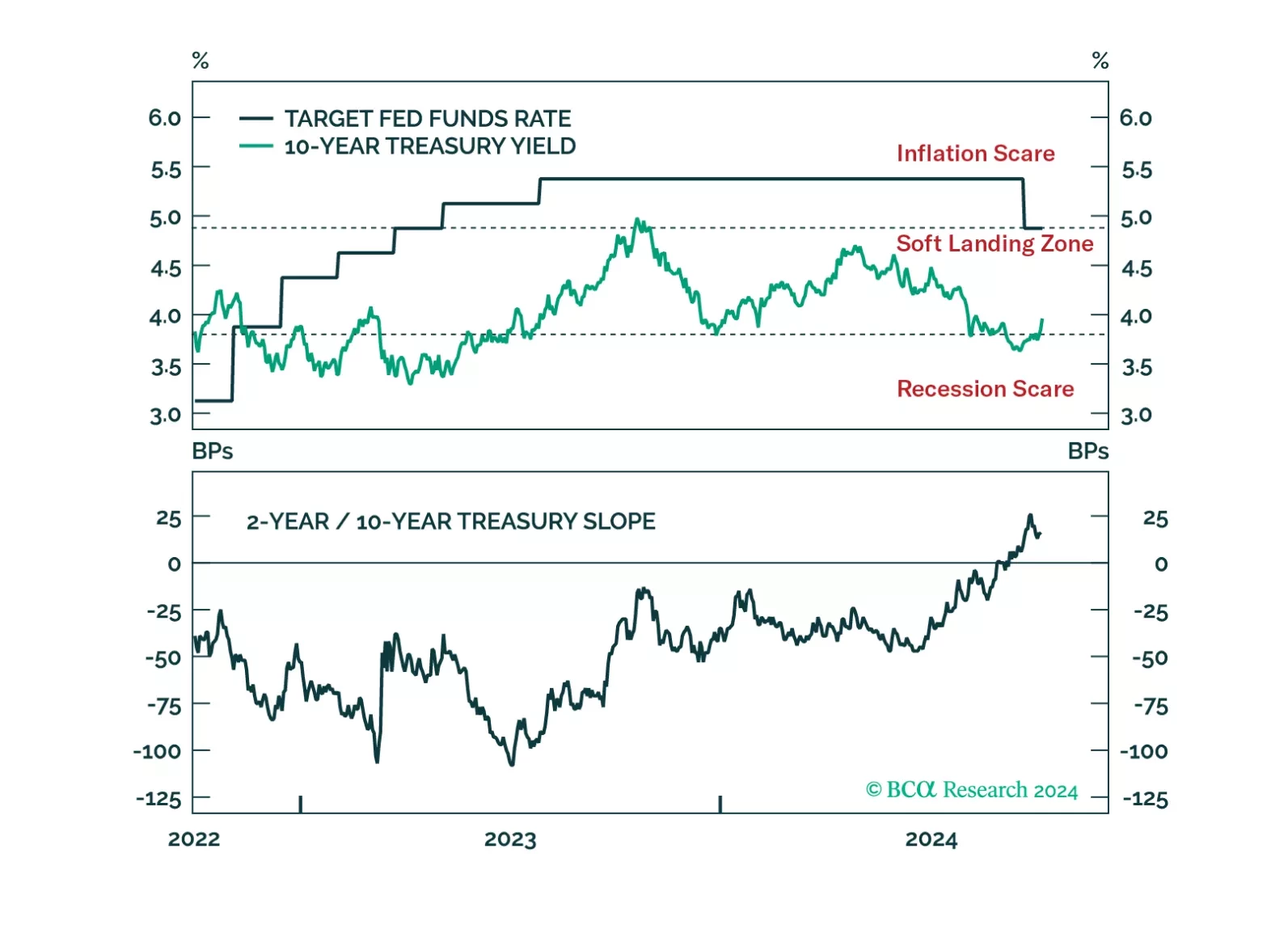

The bond market priced out a lot of recession risk after this morning’s employment report, and the 10-year Treasury yield has moved back into the Soft Landing Zone. We assess the data and consider whether we need to change our…

The JPM Global manufacturing PMI declined at an accelerating pace in September (49.6 to 48.8). Moreover, international trade flows deteriorated notably with the new export orders component falling from 48.4 to 47.5. A sector…

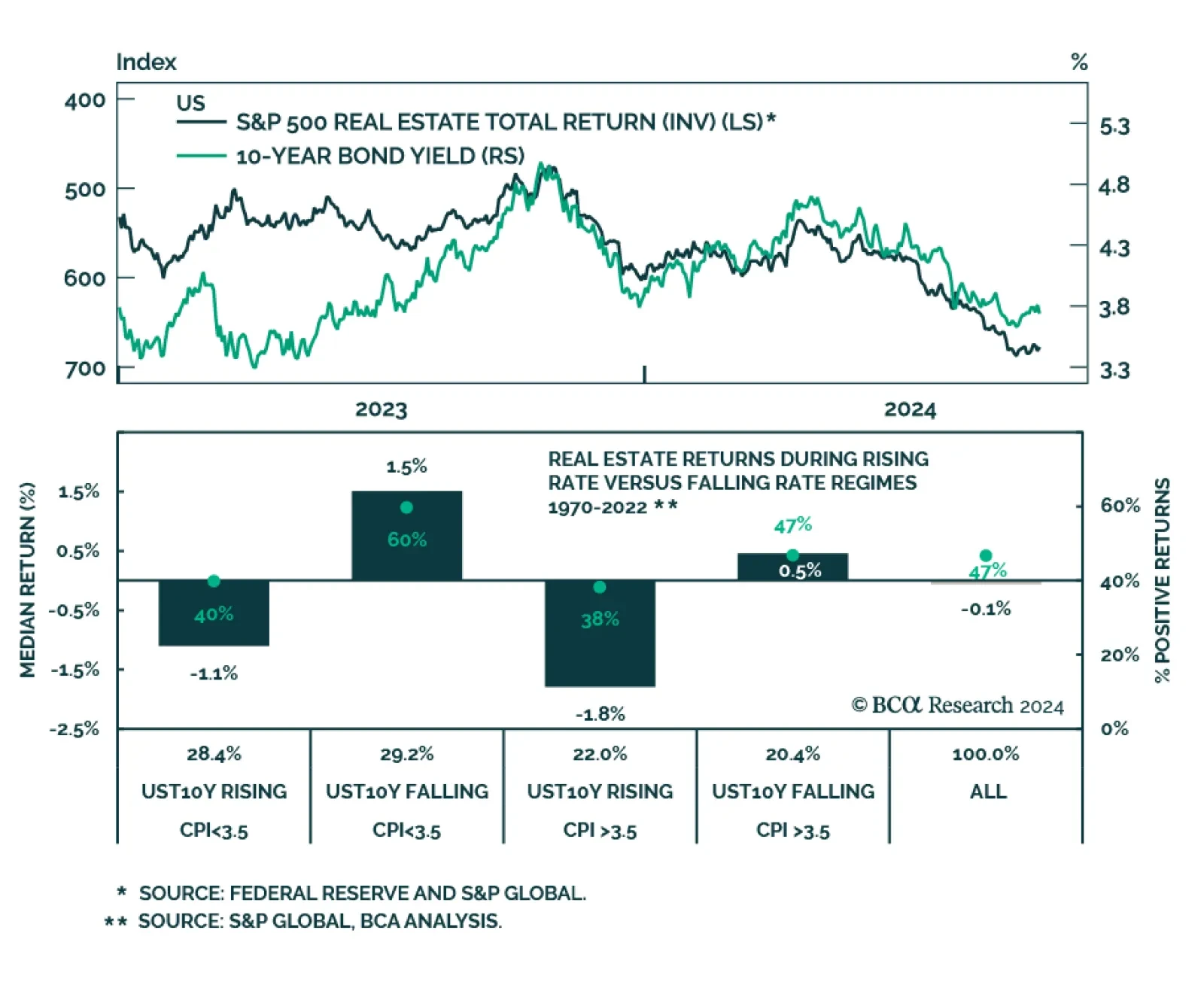

The prospects of Fed rate cuts powered the S&P 500 Real Estate index’s rally. Real estate was the best-performing sector in Q3, outperforming the S&P 500 by nearly 12%. Can this sector pursue its lead now that…

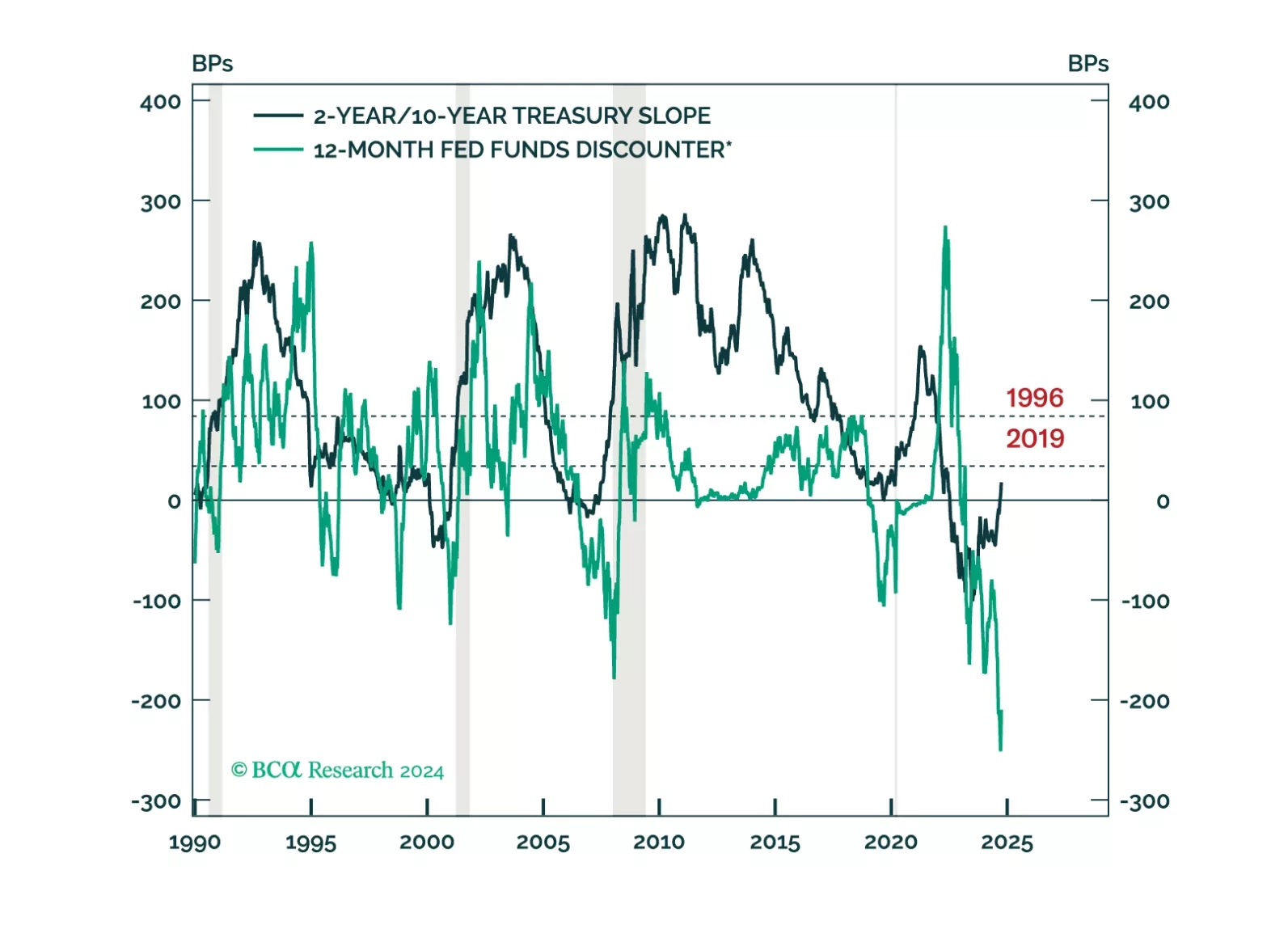

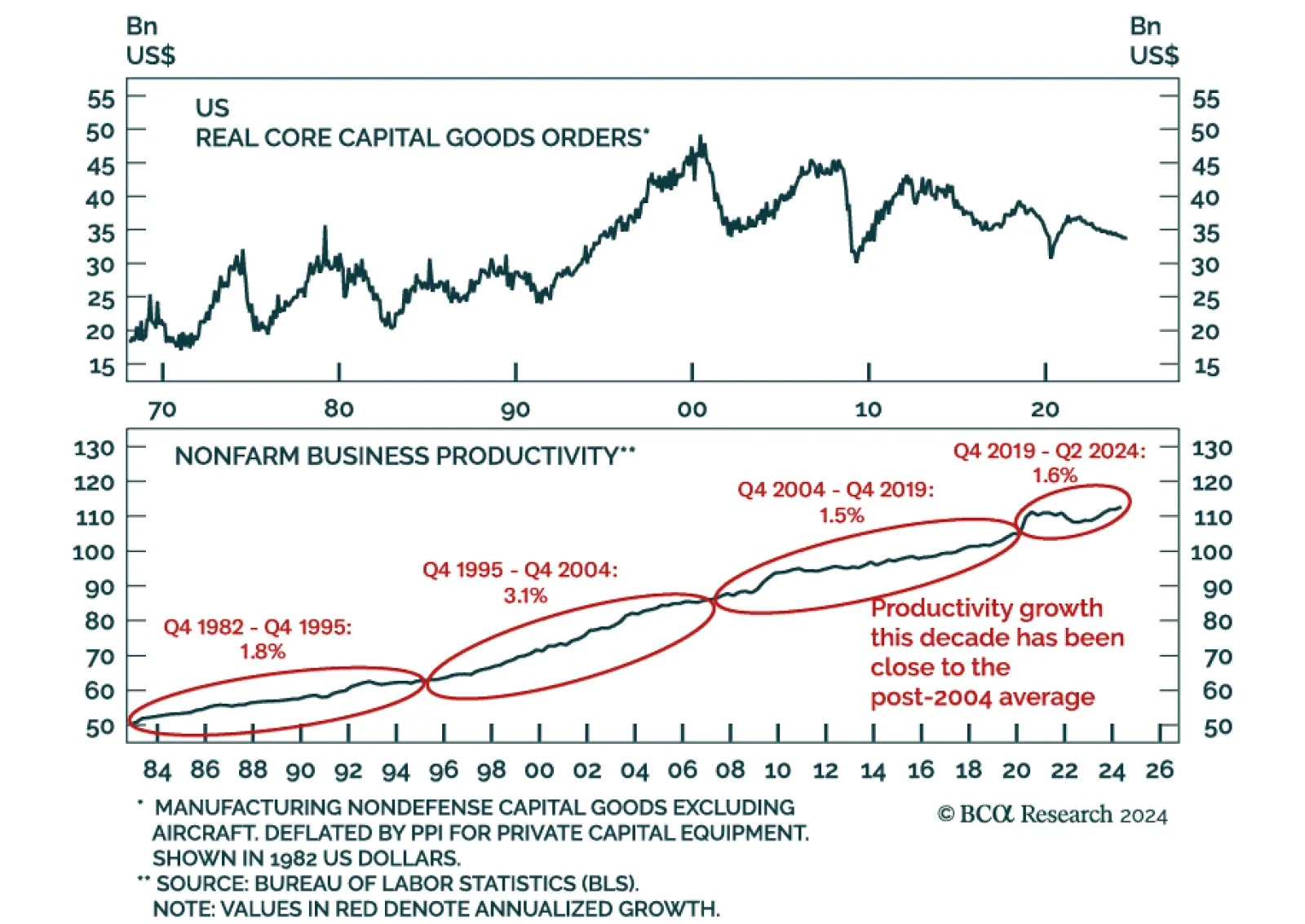

According to BCA Research’s Global Investment Strategy service, the consensus expectation of a soft landing is wishful thinking. Many investors have pointed to the mid-1990s as an example of when Fed easing paved…

Our Portfolio Allocation Summary for October 2024.