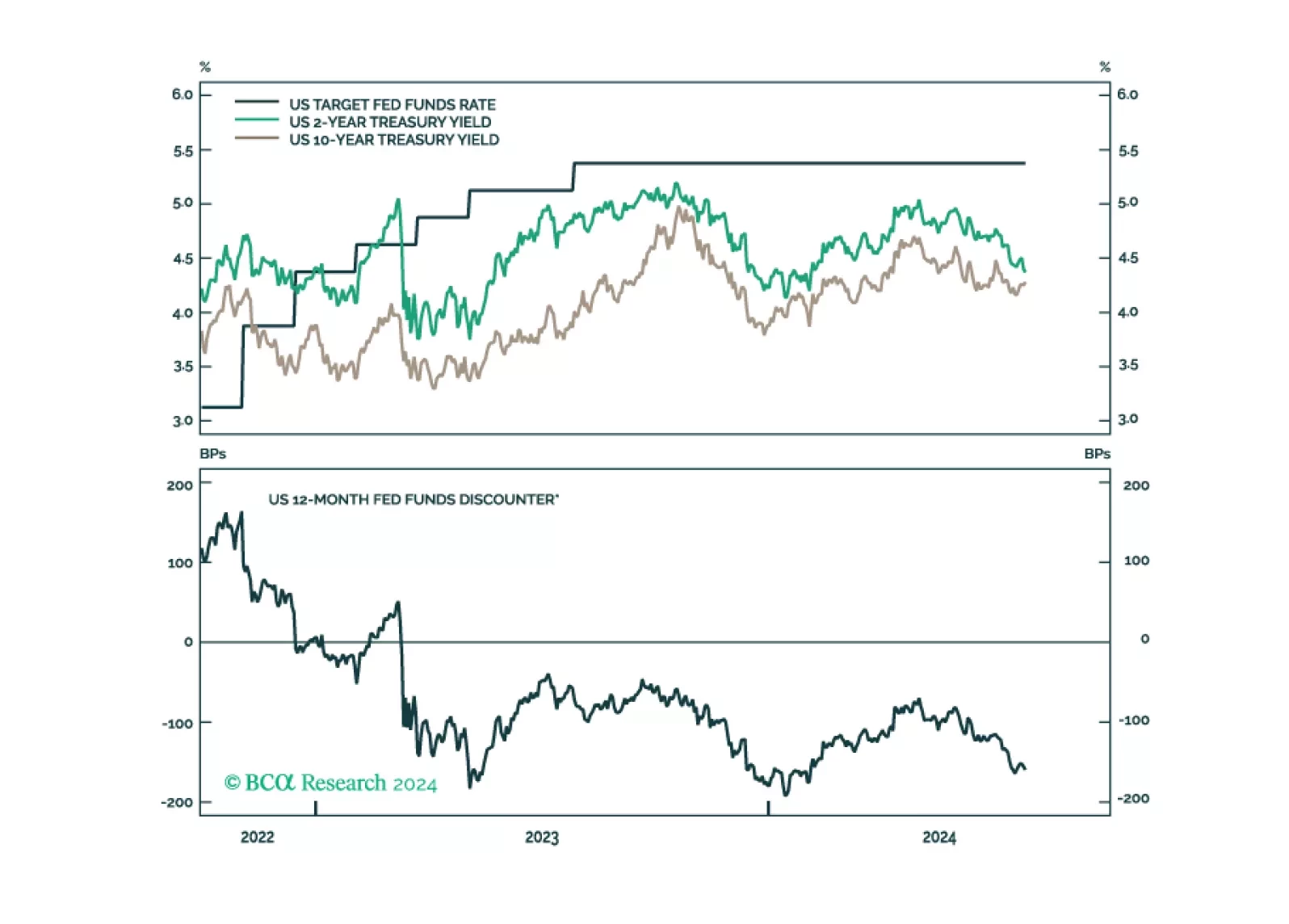

FOMC members unanimously voted in favor of keeping rates on hold in July but signaled that a September cut is on the table. Inflationary pressures have indeed continued to ease over the past several months. Notably, the…

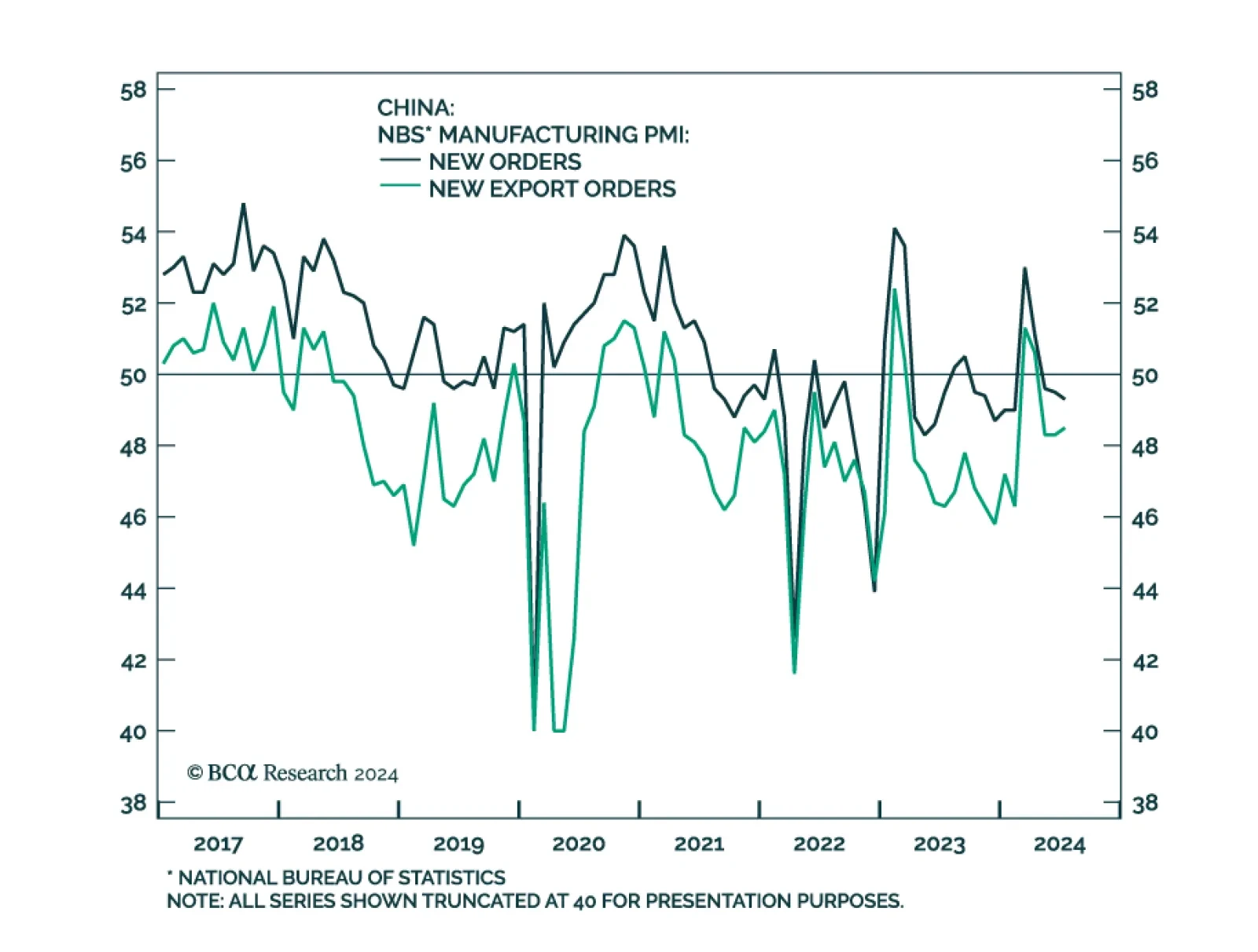

China’s NBS manufacturing PMI declined further in July, from 49.5 to 49.4, marking a third consecutive month of contraction. New orders and new export orders underscored continued weakness in both domestic and foreign…

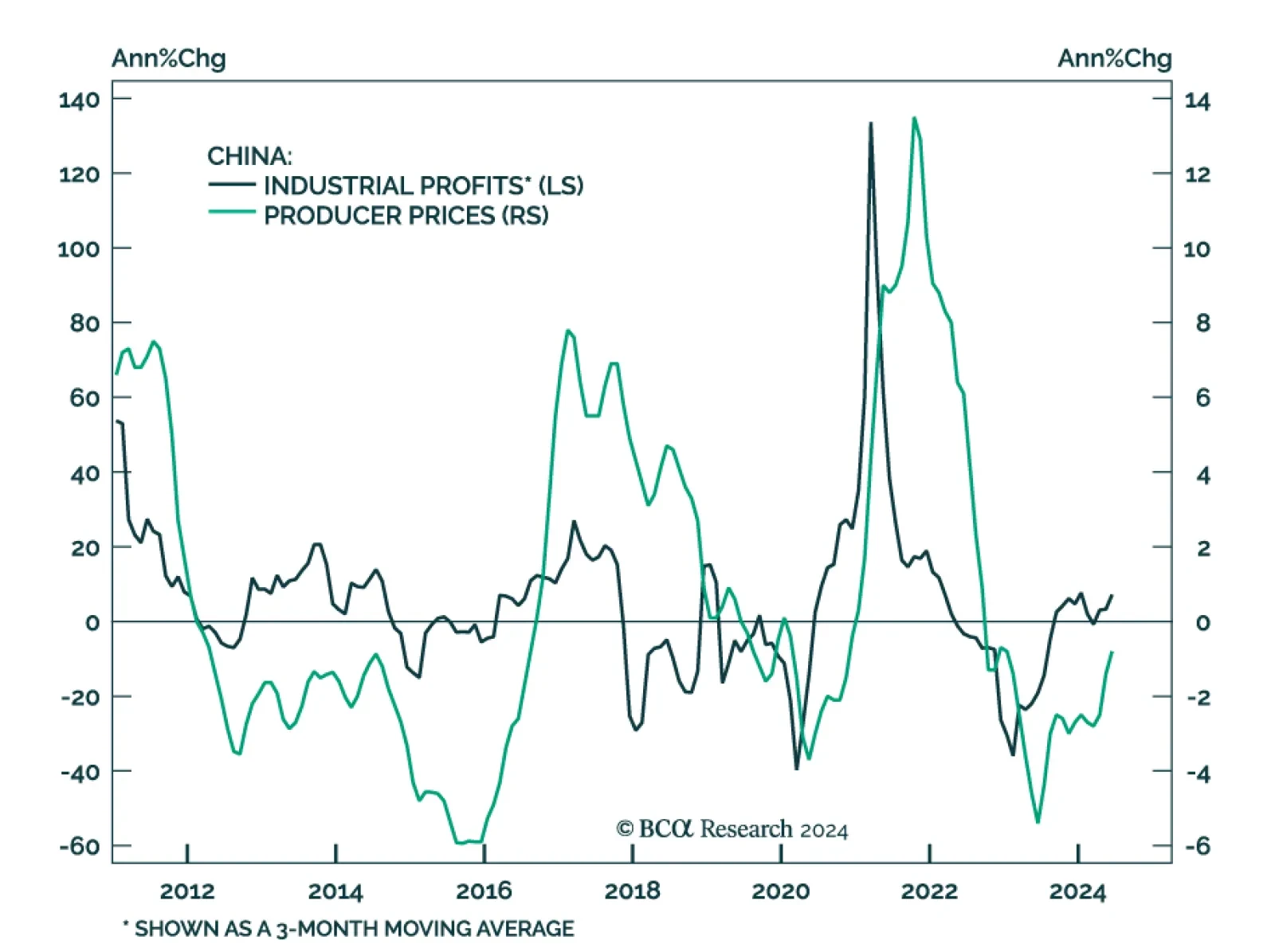

Chinese industrial profits growth accelerated in June, rising from 0.7% y/y to 3.6%. Profits expanded at 3.5% in the first half of 2024, compared to 3.4% in the first half of 2023, and suggest that China’s manufacturing…

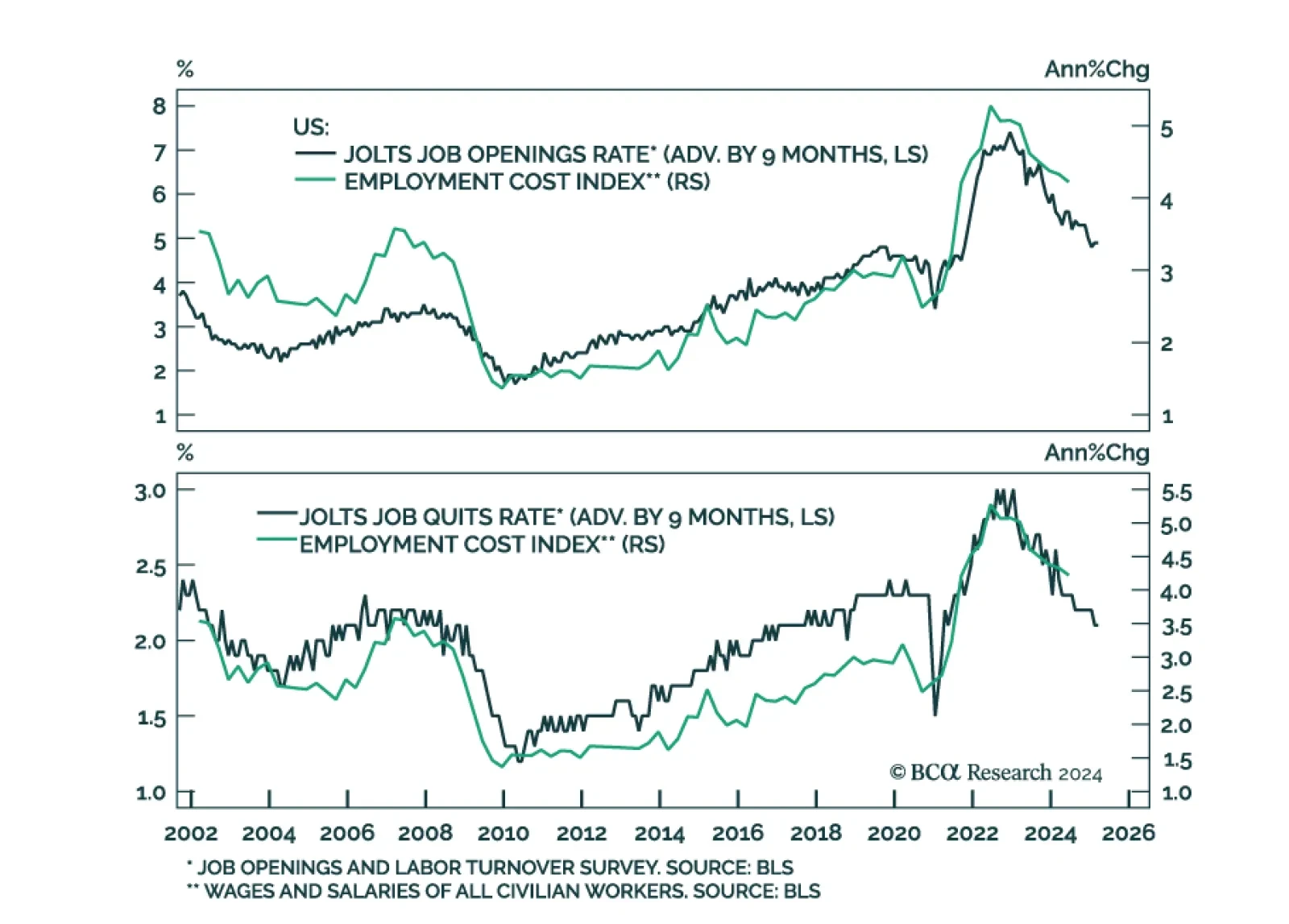

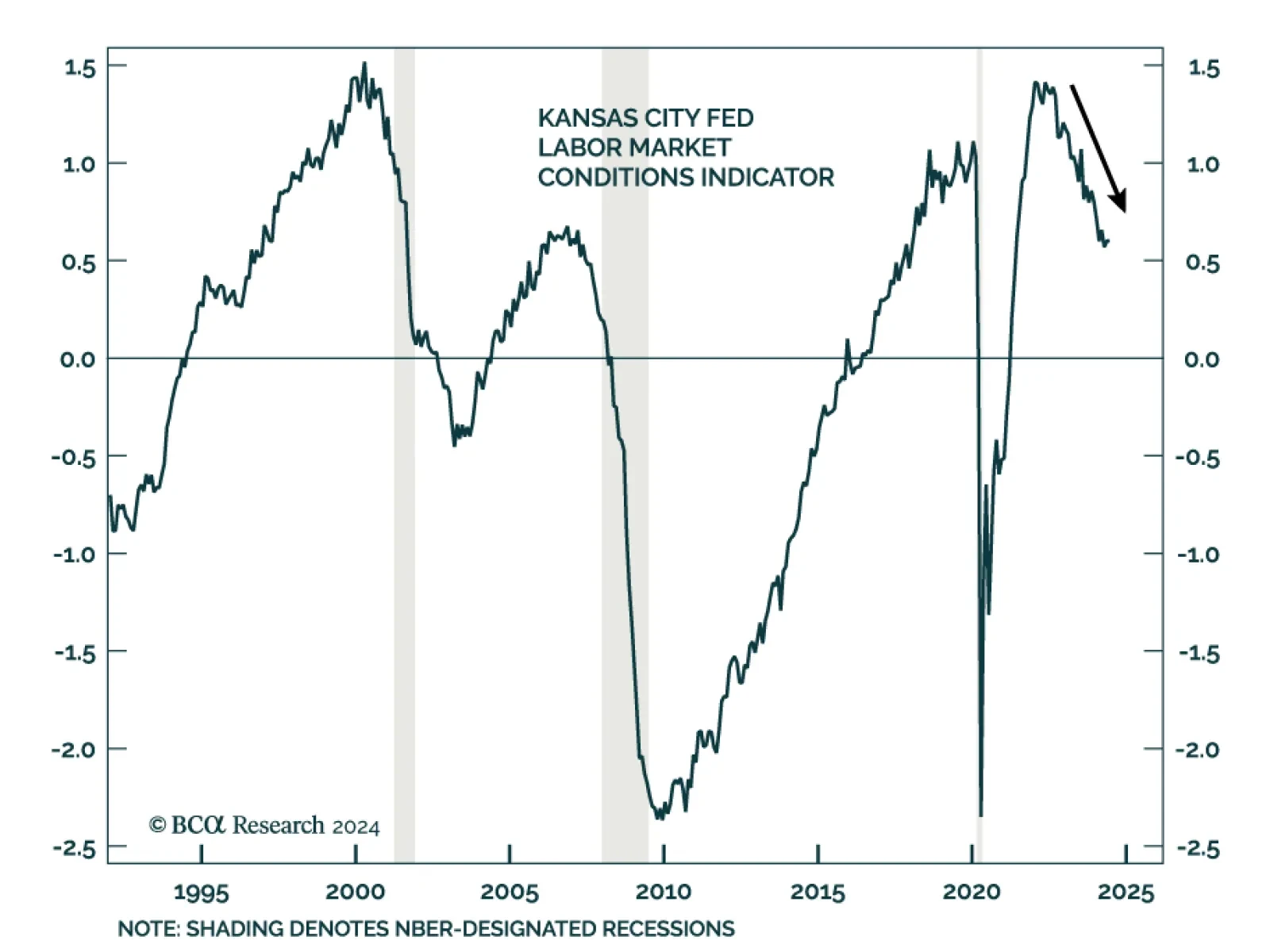

The Kansas City Labor Market Conditions Indicator (LMCI) is a broad measure of labor market trends incorporating 24 national labor market variables. It has been on a steady downtrend since 2022, though at 0.6, it remains slightly…

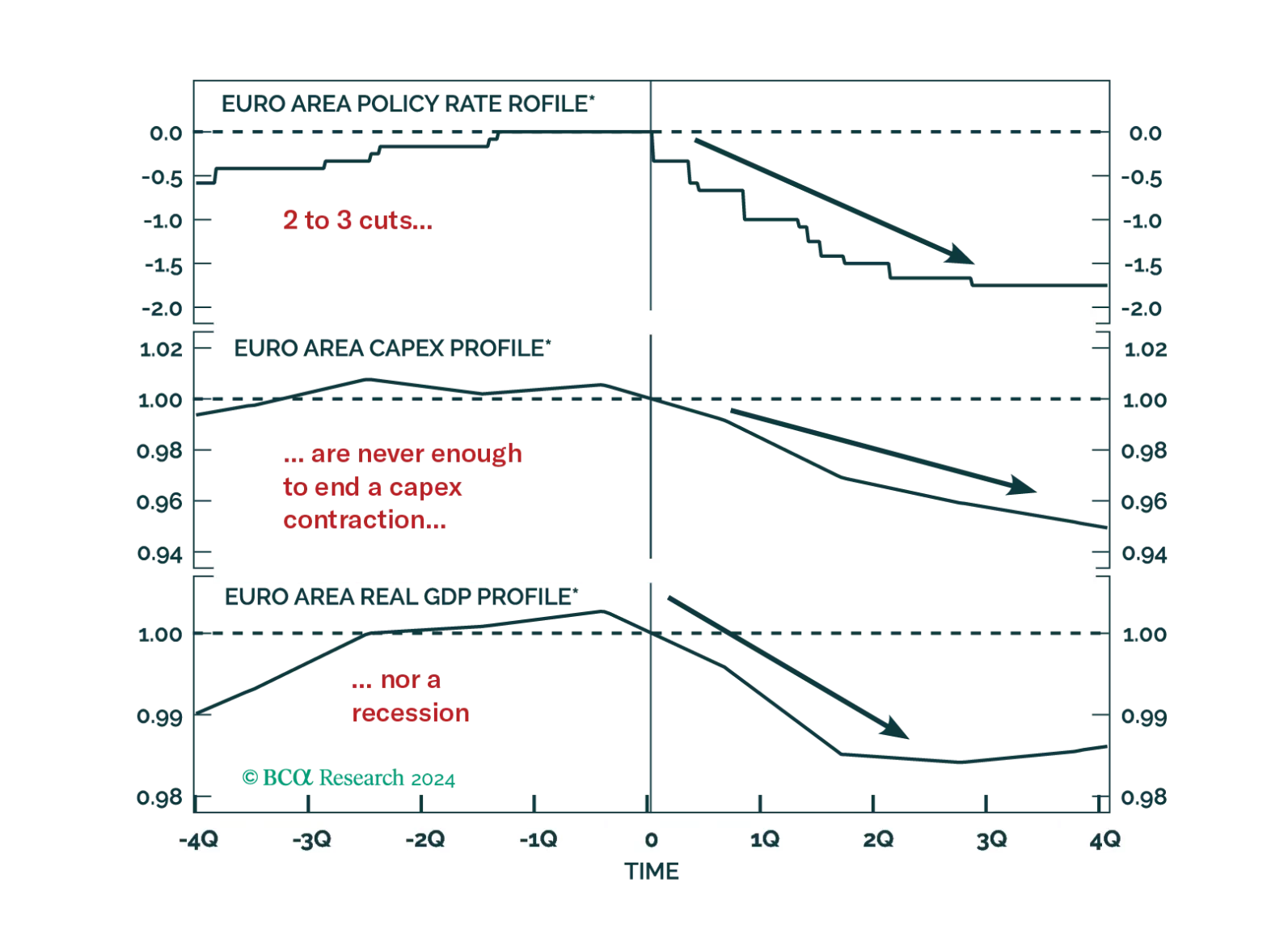

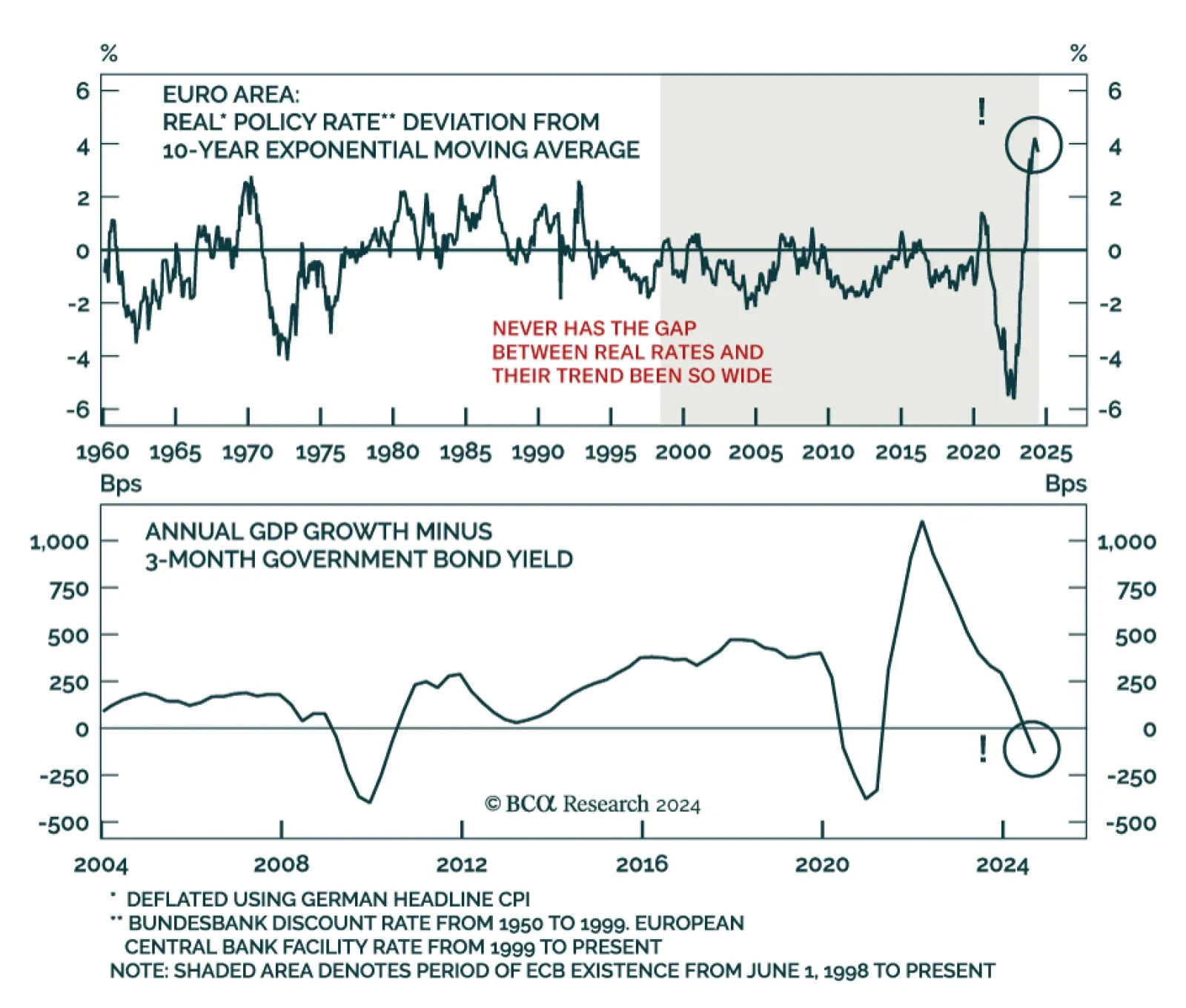

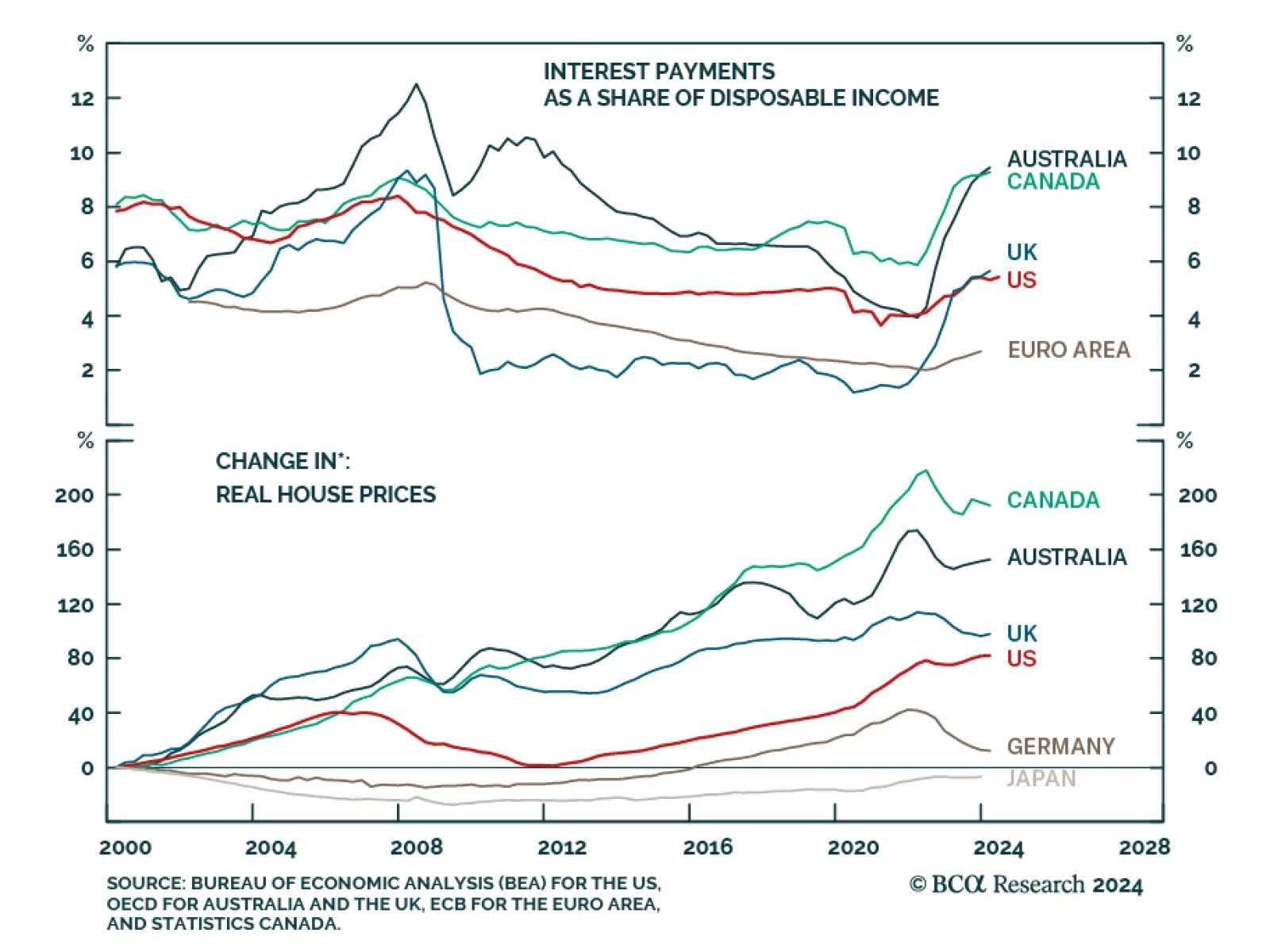

According to BCA Research’s European Investment Strategy service, a foreign shock is likely to tip the Eurozone economy into a recession because important vulnerabilities have emerged domestically. Policy is restrictive…

Investors hope that the ECB rate cuts priced into the curve will be sufficient to achieve a soft landing in Europe. History argues against this view, but will this time be different?

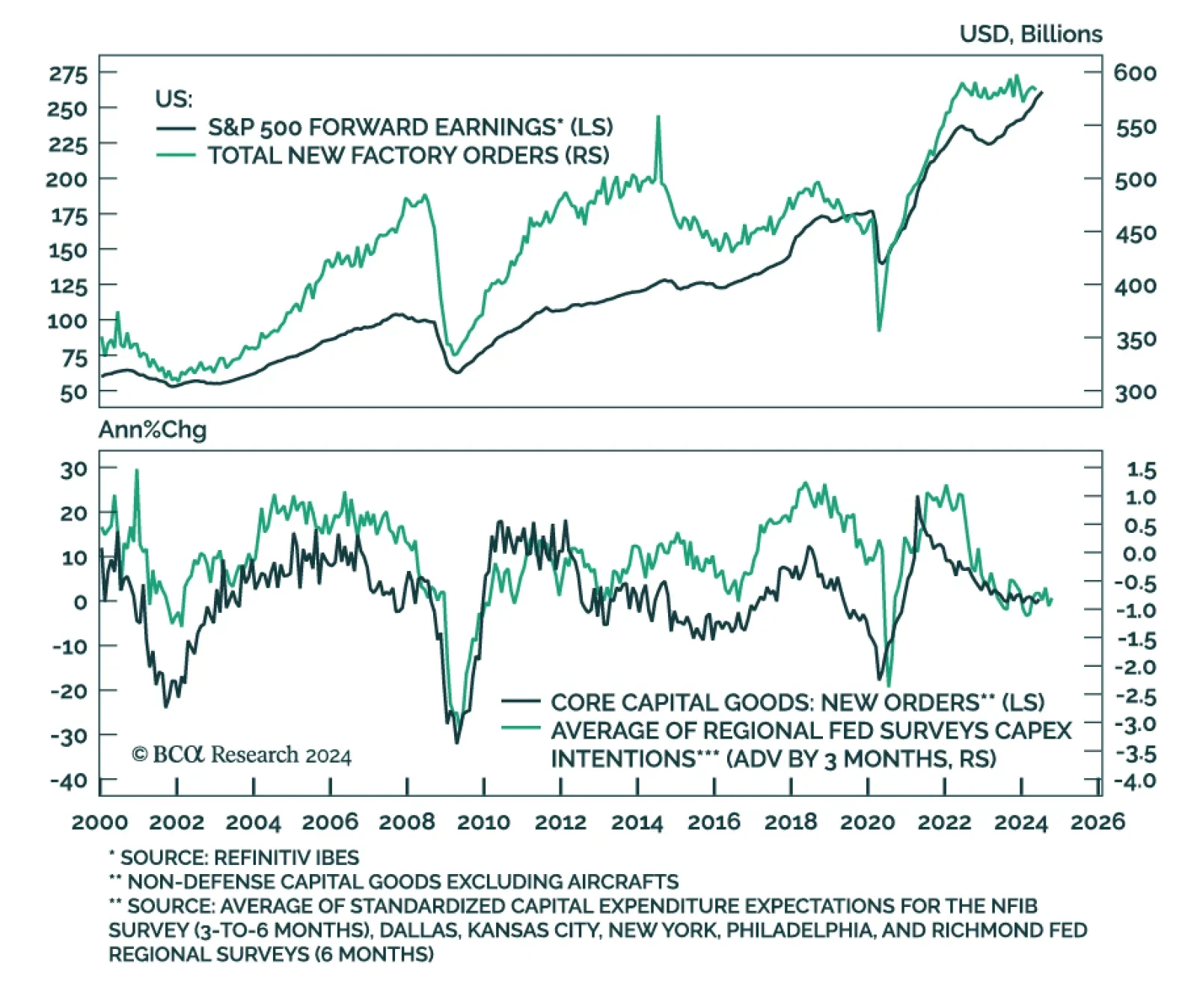

Preliminary estimates suggest that US durable goods orders plummeted in June. They contracted 6.6% m/m, largely disappointing expectations of a faster pace of growth. However, a whopping 127% monthly decrease in highly…

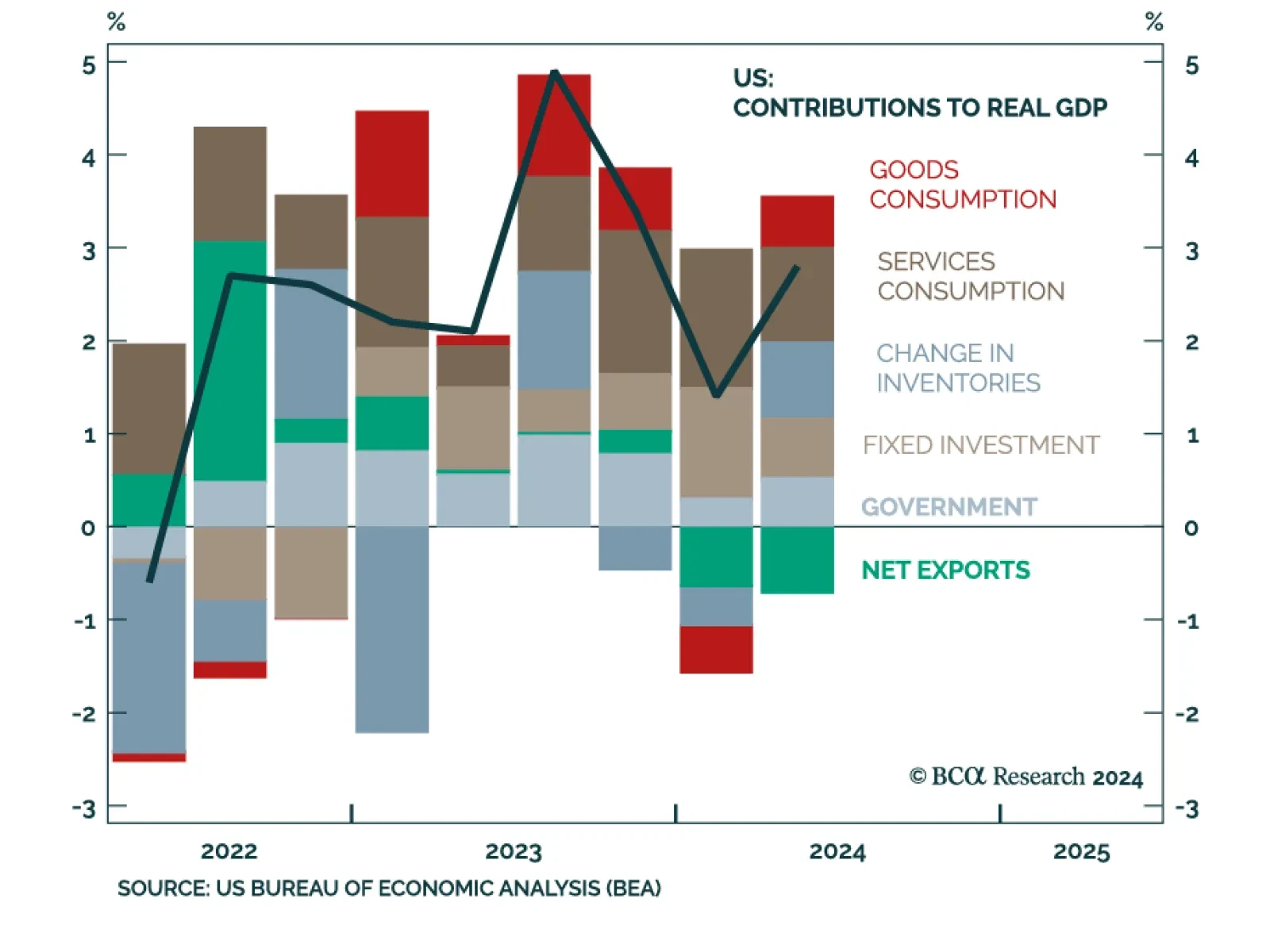

The preliminary release of Q2 2024 US GDP surprised to the upside on Thursday. The US economy grew 2.8% on an annualized basis, and 3.1% on a year-over-year basis. The two largest drivers of the acceleration were consumption (…

We have high conviction that continued labor market softening will tip the US economy into a recession by year-end or early next year. It will reverberate to the rest of the world given that the US has been the main driver of…

After this morning’s jobless claims number, we have now seen enough deterioration in our preferred labor market indicators to increase portfolio duration from “at benchmark” to “above benchmark”.