Overweight Last summer, following our recession thought experiment report1 we upgraded the S&P hypermarkets index to overweight preparing our portfolio for the inevitable recession.2 Since then, hypermarket stocks have…

Highlights Portfolio Strategy We have identified 20 reasons to start buying equities. We highlight positive catalysts that should underpin the equity market as the pandemic progresses. Investors with higher risk tolerance should…

In our 20+ years in the equity markets we have rarely seen such erratic moves on a daily basis across sectors and subindustries. While our portfolio has withstood the recent tremor, our confidence has taken the back seat with regard to our…

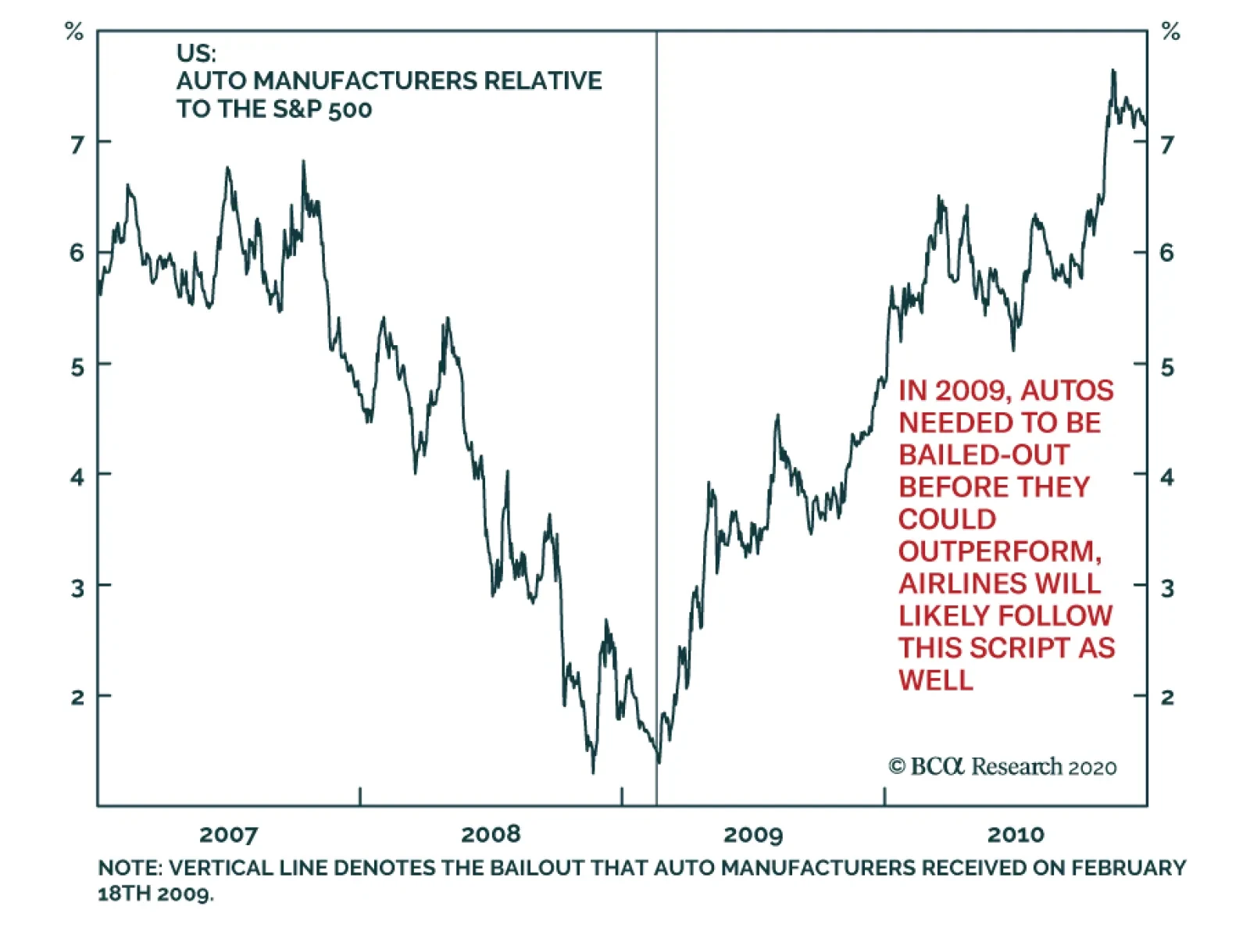

US airlines have encountered great turbulence due to COVID-19. They trade at a large discount to the S&P 500. Moreover, they have become massively oversold. While a short-term bounce is possible, it is unlikely to be more…

Overweight We recommend investors continue to take refuge in health care stocks within the defensive universe as the coronavirus pandemic unfolds. If severe government measures are a prerequisite to stop the spread of the…

Equities were unhinged last week, as the trifecta of the corona virus becoming a pandemic, Saudi ripping the cord out of crude oil and the convulsing bond markets made for an explosive equity market cocktail. The result was…

HighlightsPortfolio Strategy“There is blood in the streets”. Investors with higher risk tolerance should be buying into this weakness and start to deploy long-term oriented capital. S&P 500 futures fell to 2394 which is a whopping 1000…

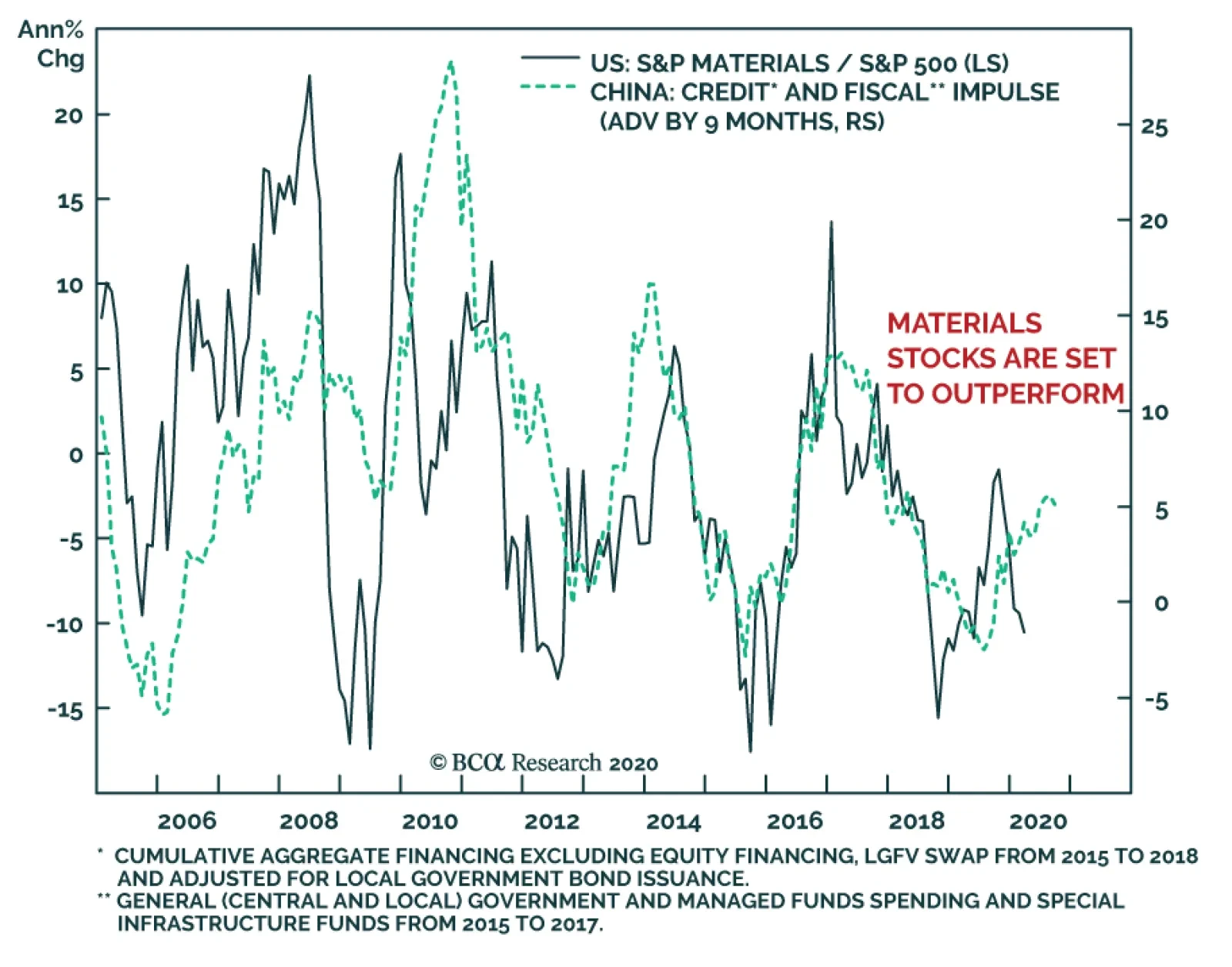

The S&P materials sector is massively oversold relative to the S&P 500, while our valuation index is at a large discount to its normal relationship to the broad market. Moreover, its forward EPS breadth and relative EPS…