Stocks should continue to rally in the near term, but investors should prepare to turn more defensive towards the end of the year in advance of a recession in 2024.

The stock market’s pre-eminent growth sector is not US tech, it is French luxuries. No other sector can compare with French luxuries’ massive and sustained pricing power. The risk for French luxuries is not a China slowdown, the risk…

The profit outlook for the Eurozone continues to deteriorate. Find out what the drivers behind this deterioration are.

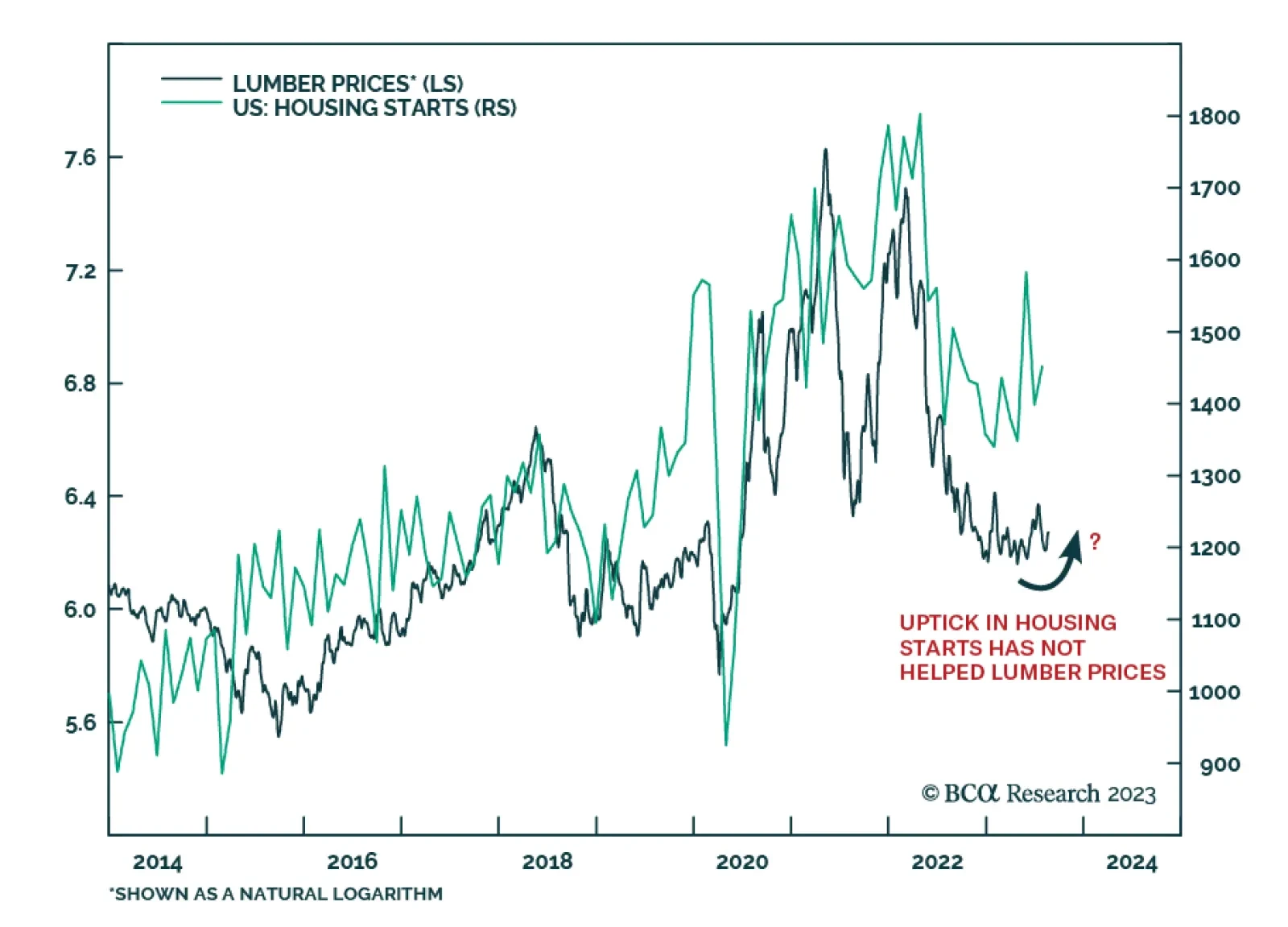

In a June insight, we discussed the possibility of a sustained lumber rally due in part to resilient housing market activity in the US and supply constraints in Canada, a major exporter of lumber. Since then, prices have remained…

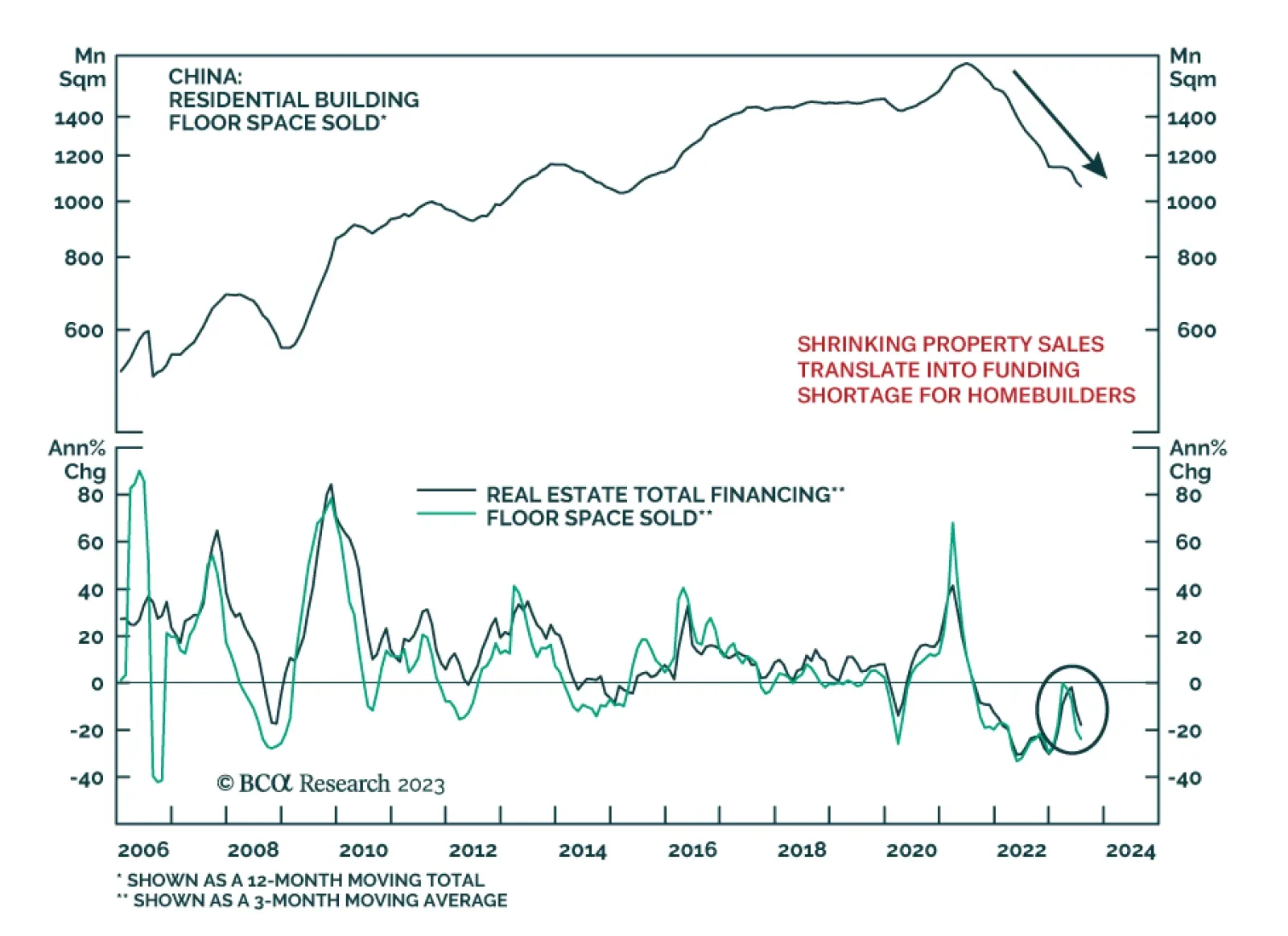

According to BCA Research’s China Investment Strategy service, although property-sector stocks in China’s onshore and offshore markets have been beaten down, they have not yet reached their bottom. The property…

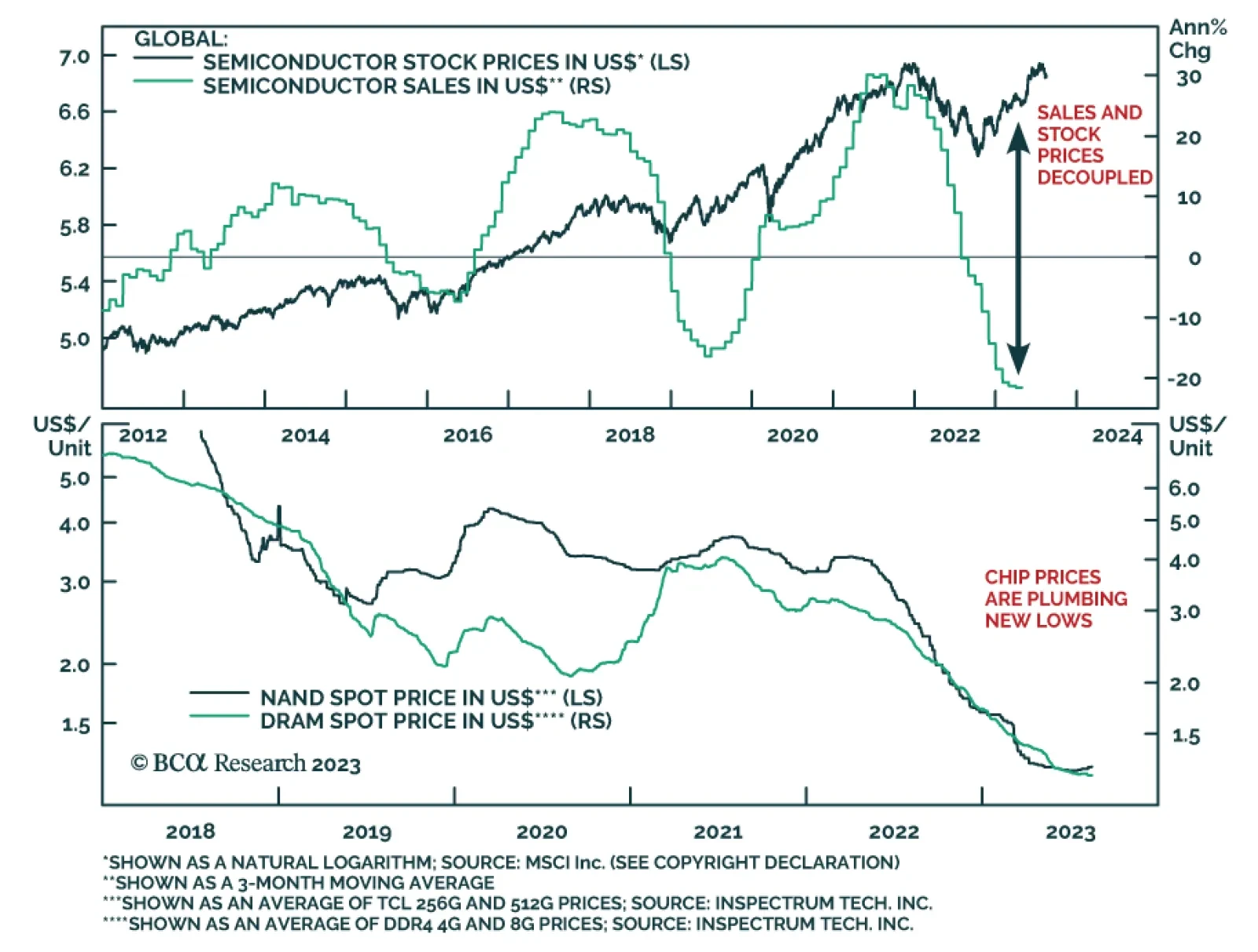

BCA Research's US Equity Strategy service downgraded Semiconductors to underweight for the following reasons: Weakening global growth: Global semiconductor sales move in lockstep with economic growth. Global growth…

Outperformance of Growth sectors most likely has run its course. It is time to shift Growth vs. Value allocation to neutral, downgrade Semis, and upgrade Energy to overweight.

On Monday, Moody’s downgraded the credit ratings of 10 small to mid-sized US banks and placed some of the biggest US banks on downgrade watch. The latter include Bank of New York Mellon, US Bancorp, State Street, and Truist…