Highlights Portfolio Strategy Firming relative demand and input cost dynamics, the Medicare For All (MFA)-induced panic selling in HMOs coupled with 5G euphoria buying in semis have set the stage for an exploitable pair trade…

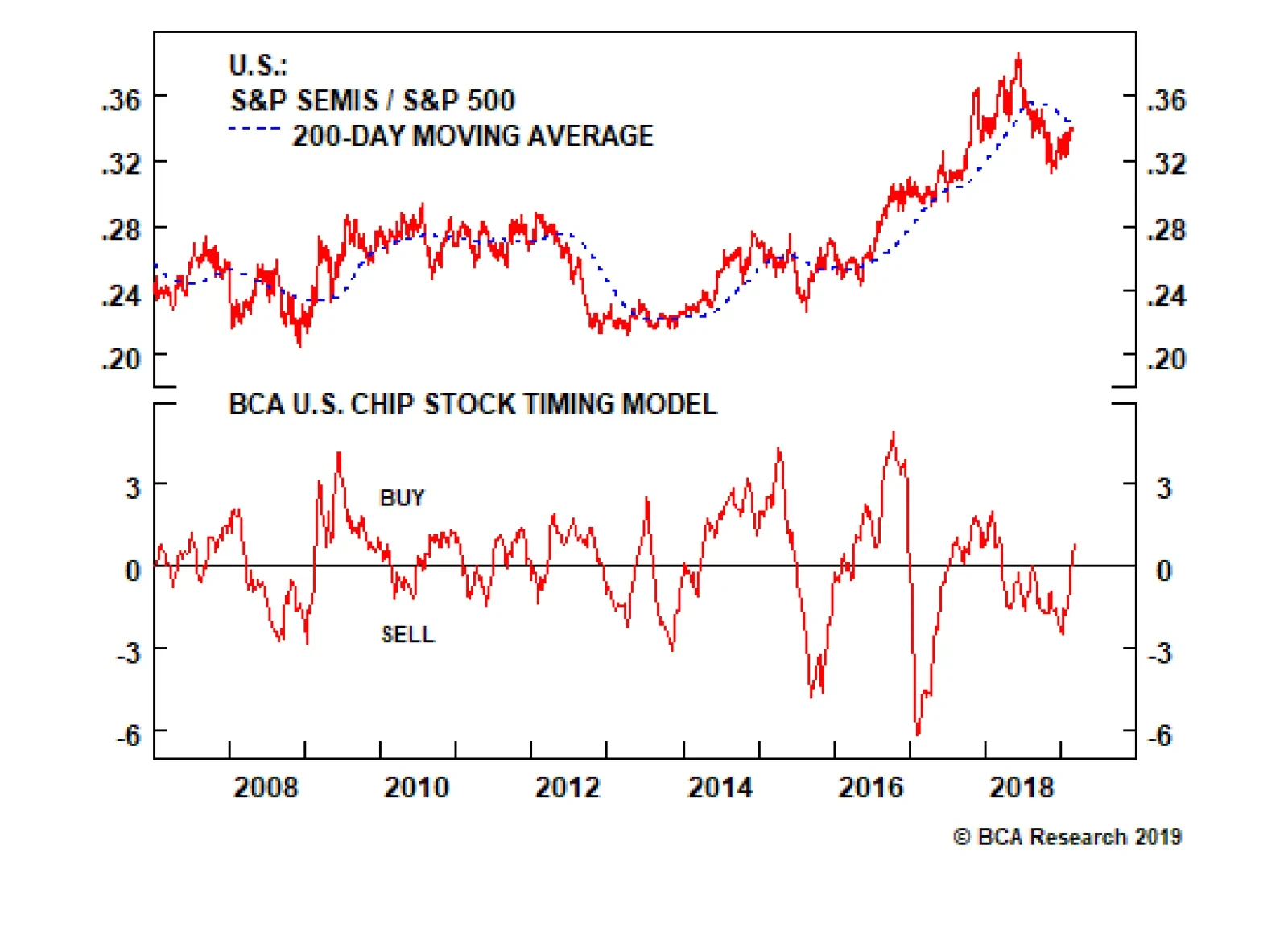

Neutral There are high odds that the chip cycle will soon take a turn for the better. Global chip sales have been decelerating for 17 months and are now on the cusp of contraction (middle panel). Over the past two decades,…

There are high odds that the chip cycle will soon take a turn for the better. Global chip sales have been decelerating for 17 months and are now on the cusp of contracting. Over the past two decades, steep contractions have been…

Highlights Portfolio Strategy The ongoing capex upcycle, resurgent credit growth, easy Chinese policy trifecta, upbeat signals from high frequency financial market data and depressed technicals, all suggest that a re-rating phase…

Highlights Portfolio Strategy Chinese reflation, the ongoing global capex upcycle, and the Fed induced cap on the greenback with the knock-on effect of higher commodity prices, all signal that it still pays to overweight S&P…

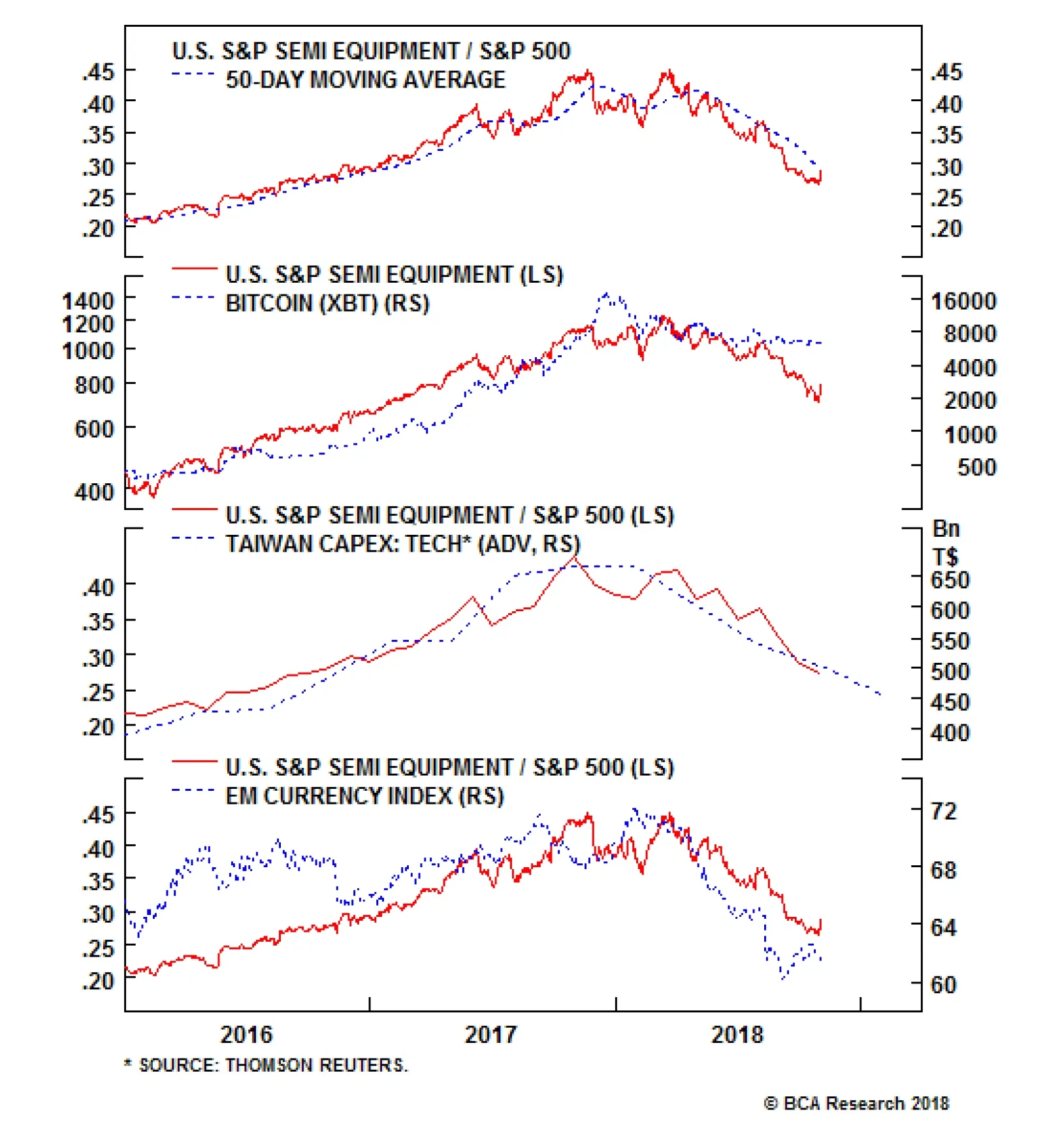

The dramatic decline in semi equipment stocks has not been arrested in the Q3 earnings season, despite relatively positive results. We think the overall negative sentiment around global tech stocks in general and valuation high-…

Highlights The long term direction for the pound is higher... ...but as the EU withdrawal bill passes through the U.K. parliament, expect a very hairy ride. The stock markets in Norway, Sweden and Denmark are driven by energy,…