Highlights So What? Key geopolitical risks remain unresolved and most of the improvements are transitory. Maintain a cautious tactical stance toward risk assets. Why? U.S.-China relations remain the preeminent geopolitical risk to…

Investor surveys show that the majority of investors’ top concerns are political or geopolitical in nature. Yet there is limited research devoted to quantifying these risks. The most prominent techniques involve tallying…

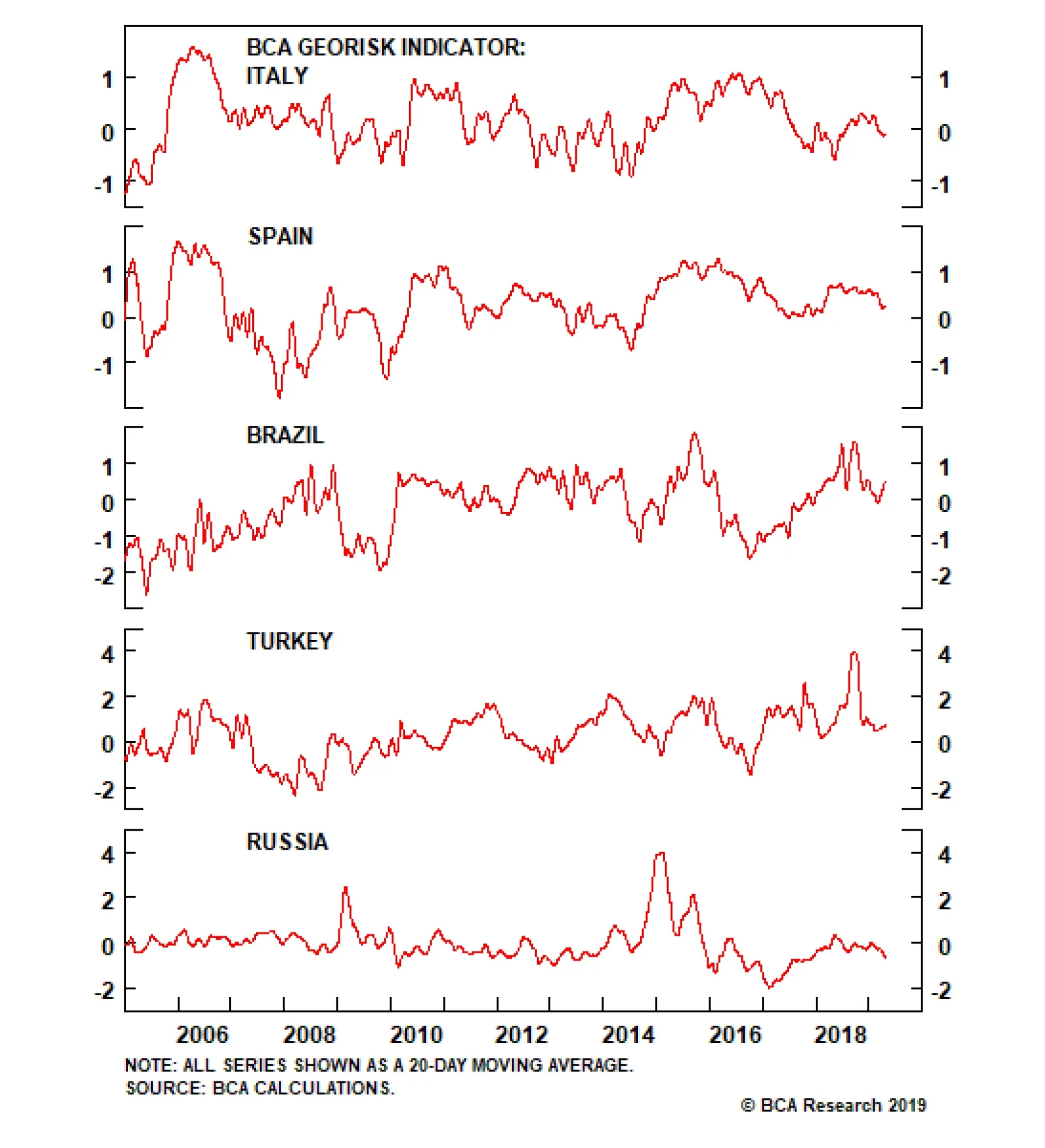

Highlights So what? Quantifying geopolitical risk just got easier. Why? In this report we introduce 10 proprietary, market-based indicators of country-level political and geopolitical risk. Featured countries include…

GAA DM Equity Country Allocation Model Update The GAA DM Equity Country Allocation model is updated as of December 31, 2018. The quant model reduced Spain’s large overweight to a slight overweight, and further downgraded the…

Highlights Five risks to our bullish dollar stance need to be monitored: further weakness in the S&P 500; rebounding gold prices; stabilizing EM exchange rates and bond prices; Spanish bank stocks at multi-decade lows; and large,…

Highlights Prediction 1: A major financial downturn will trigger the next major economic downturn, and not the other way round. Prediction 2: The straw that will break the back of a fragile financial system will be the global long…

Highlights In this Weekly Report, we review all of the individual trades in our Tactical Overlay portfolio. These are positions that are intended to complement our strategic Model Bond Portfolio, typically with shorter holding periods…

Highlights The global economic mini-cycle is set to weaken while the euro is set to grind higher. Upgrade Telecoms to overweight. Also overweight Healthcare and Airlines. Underweight Banks, Basic Materials and Energy. Overweight…