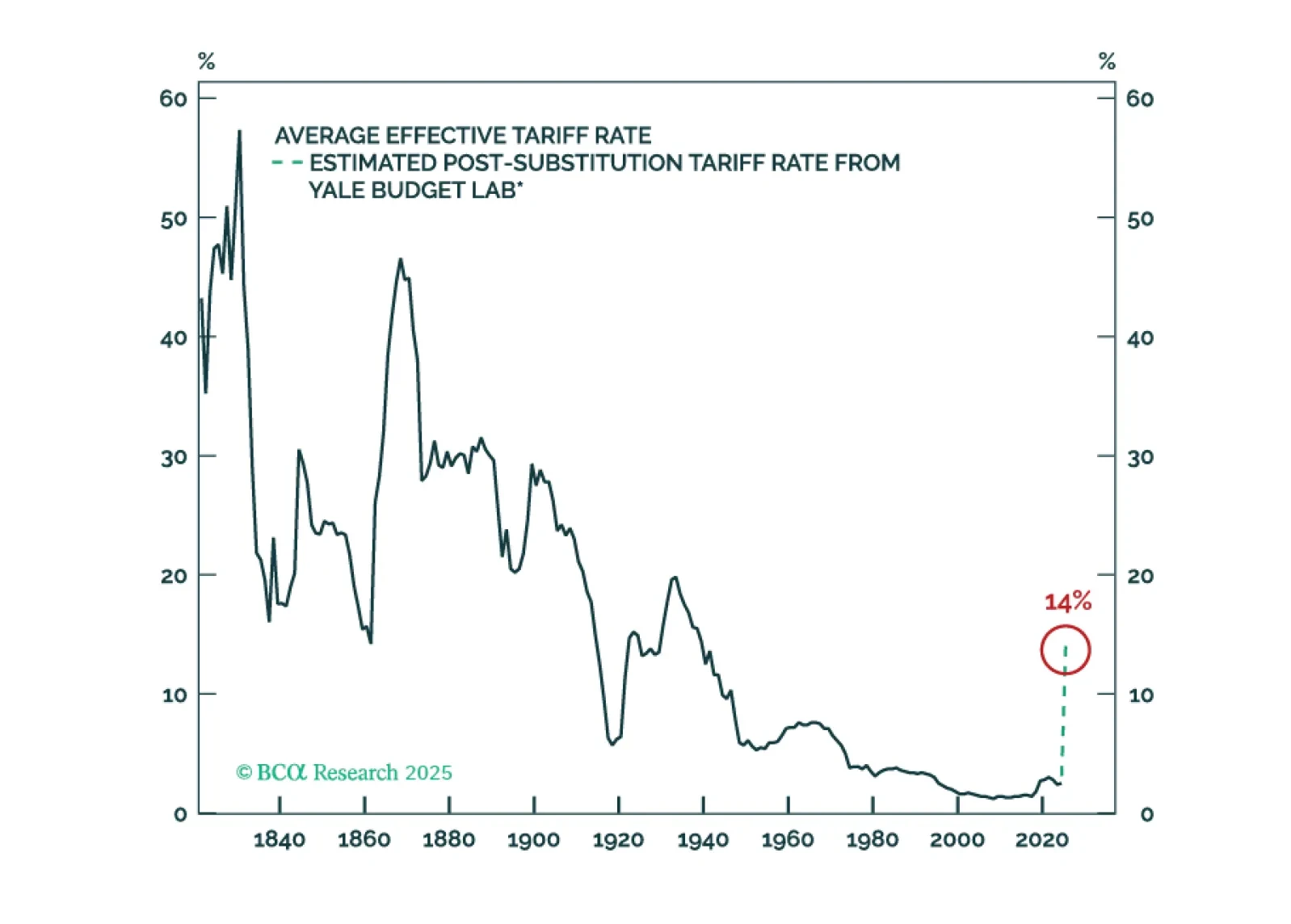

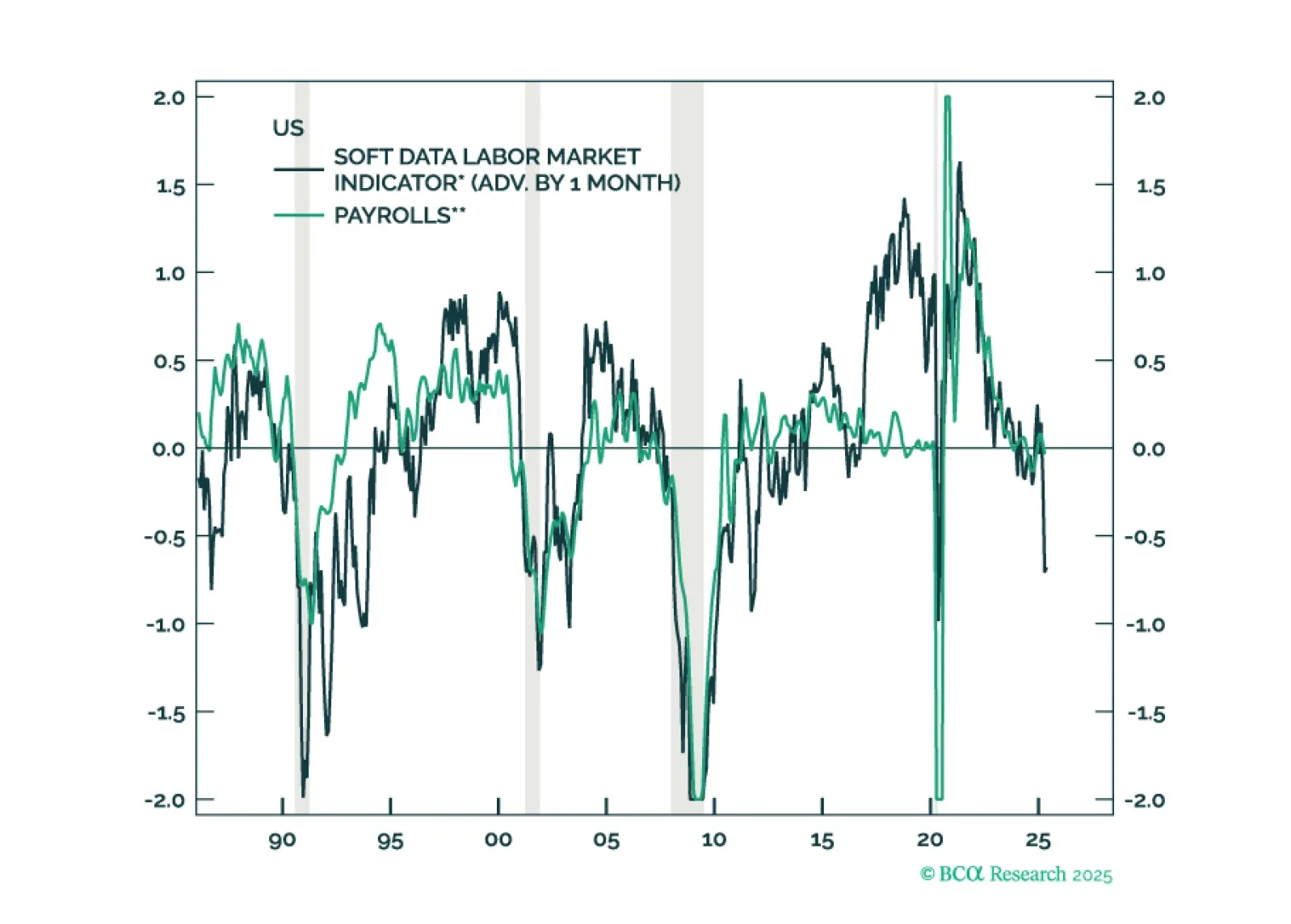

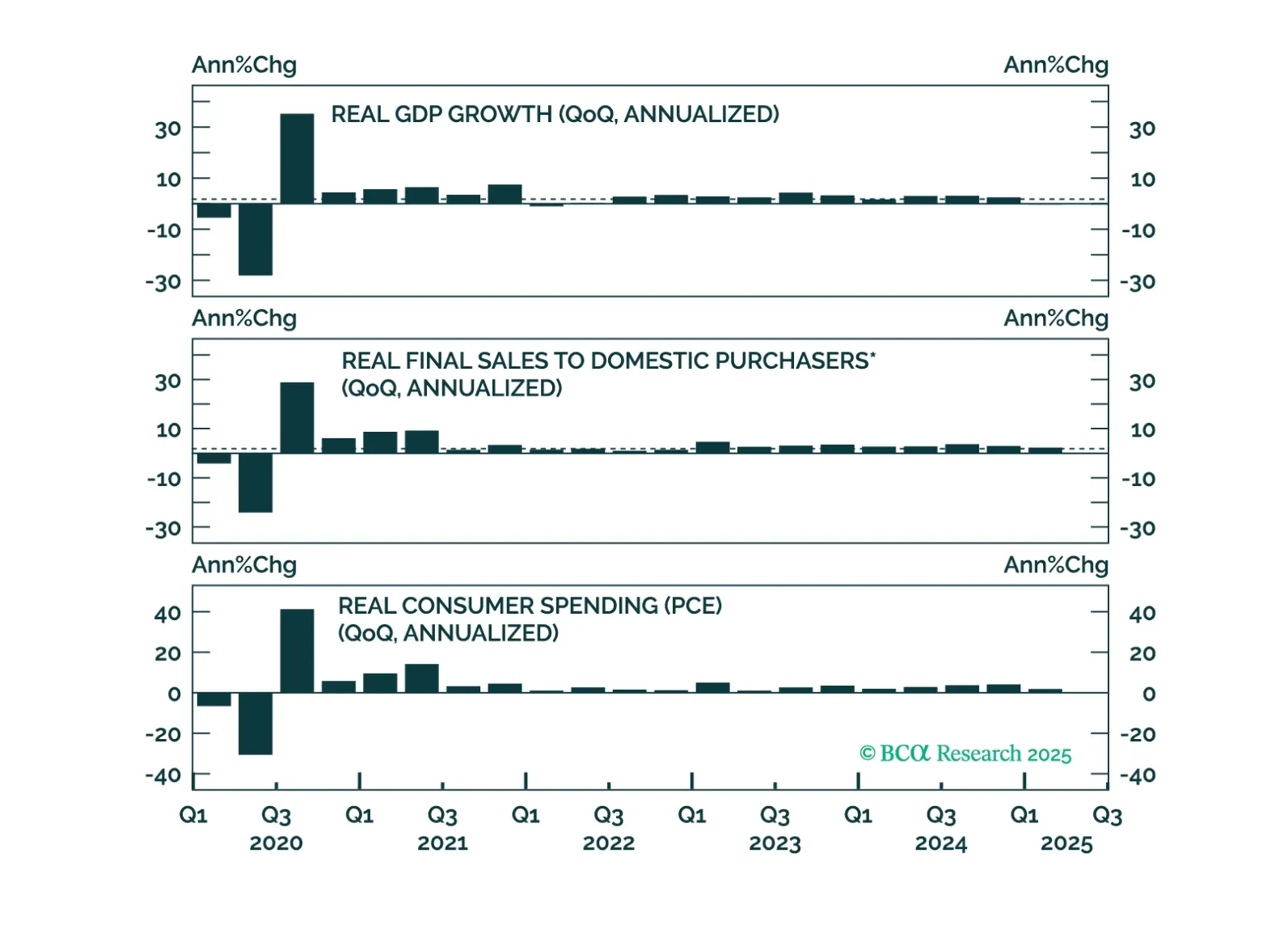

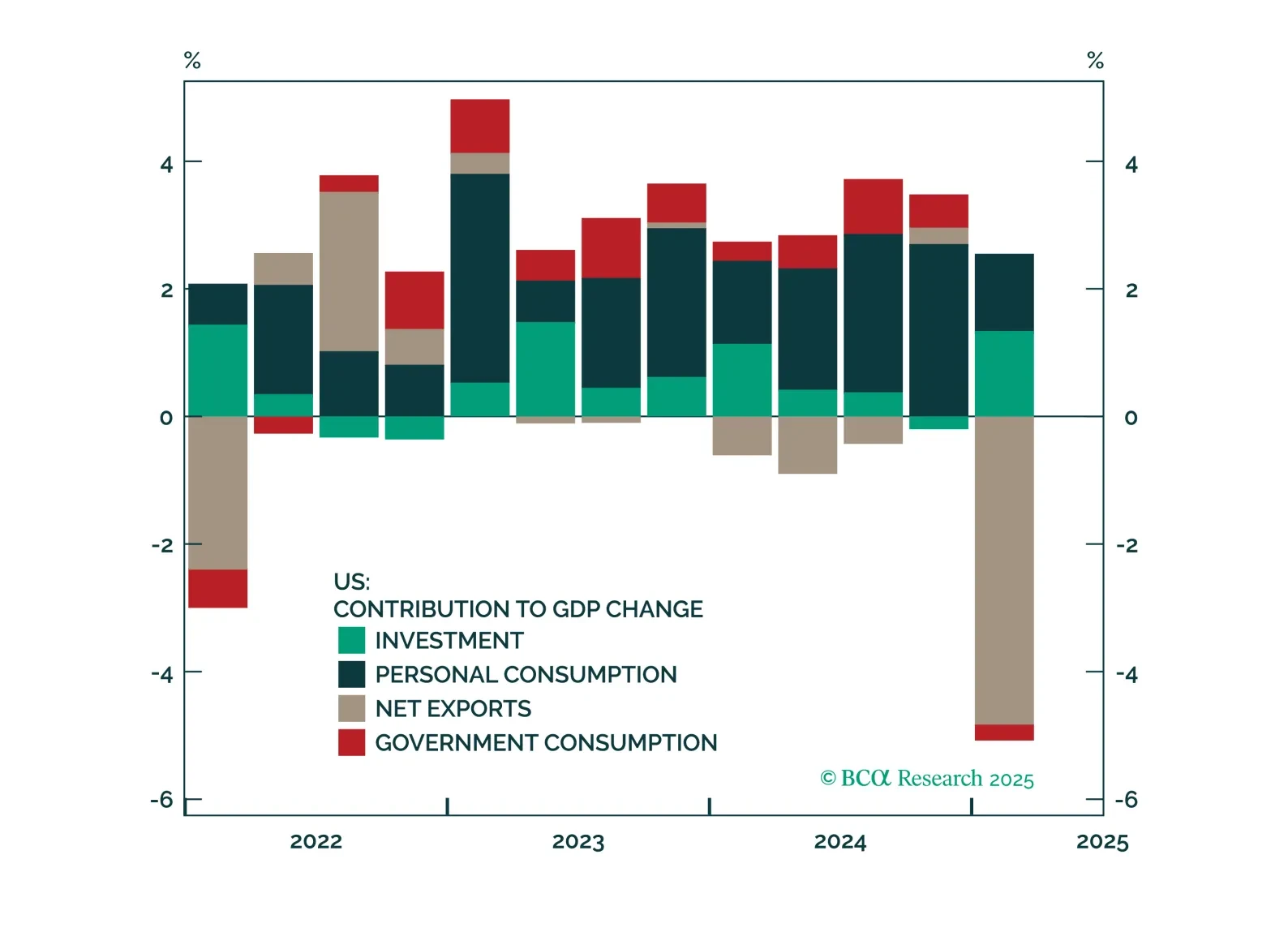

Tariff front-running behavior makes the April hard economic data difficult to interpret, but we take the strong reading from Food Services spending as a signal that the US consumer has not yet buckled.

Markets are pricing out the worst trade policy fears, and while tariffs will still dent earnings, the impact looks smaller than initially feared. With sector rotation gaining traction and oversold names rebounding, we are adjusting…

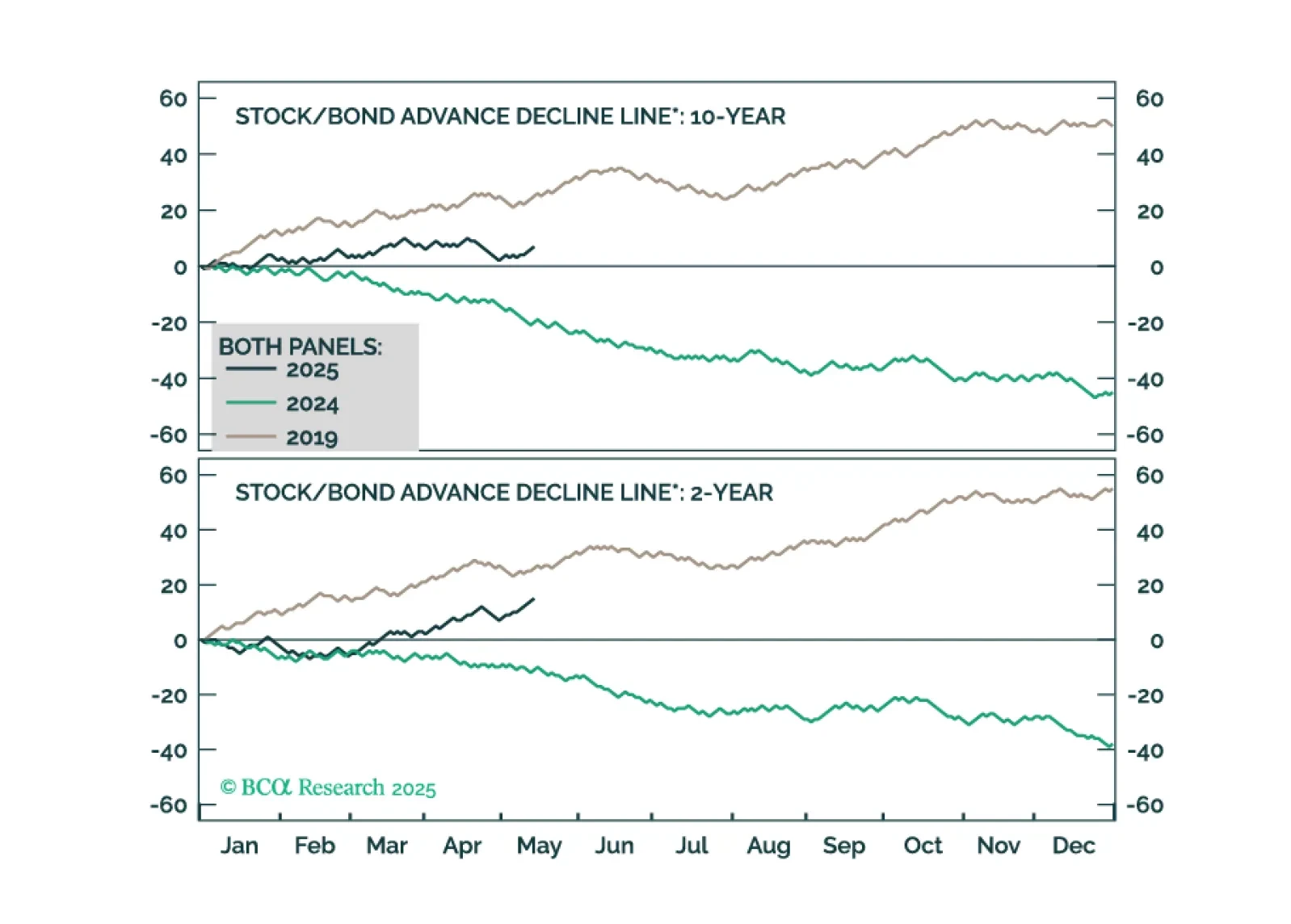

A weakening economy will apply downward pressure to Treasury yields, but the Trump term premium will keep long-dated yields higher than they would otherwise be. This makes Treasury curve steepeners the most attractive trade in US…

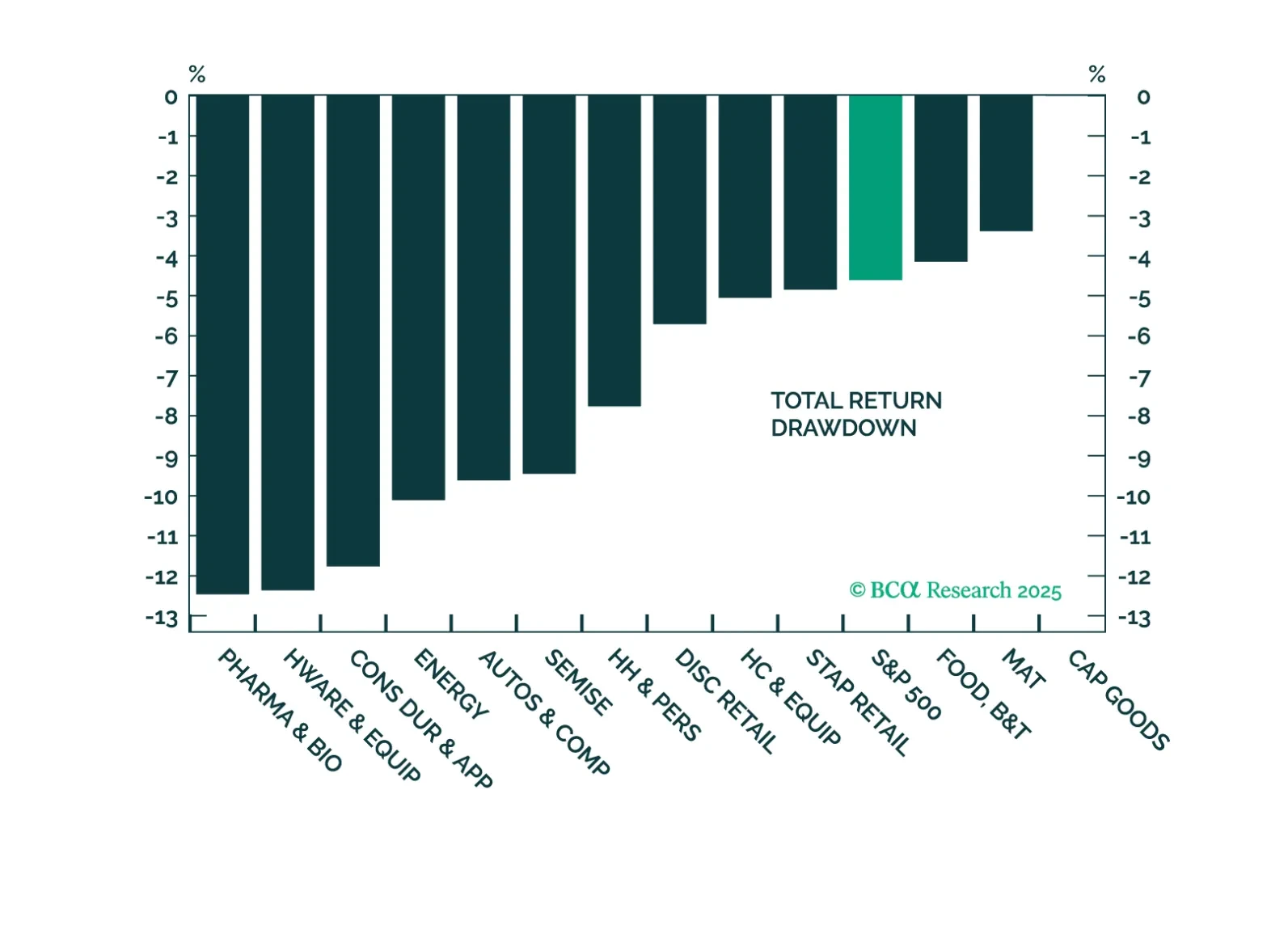

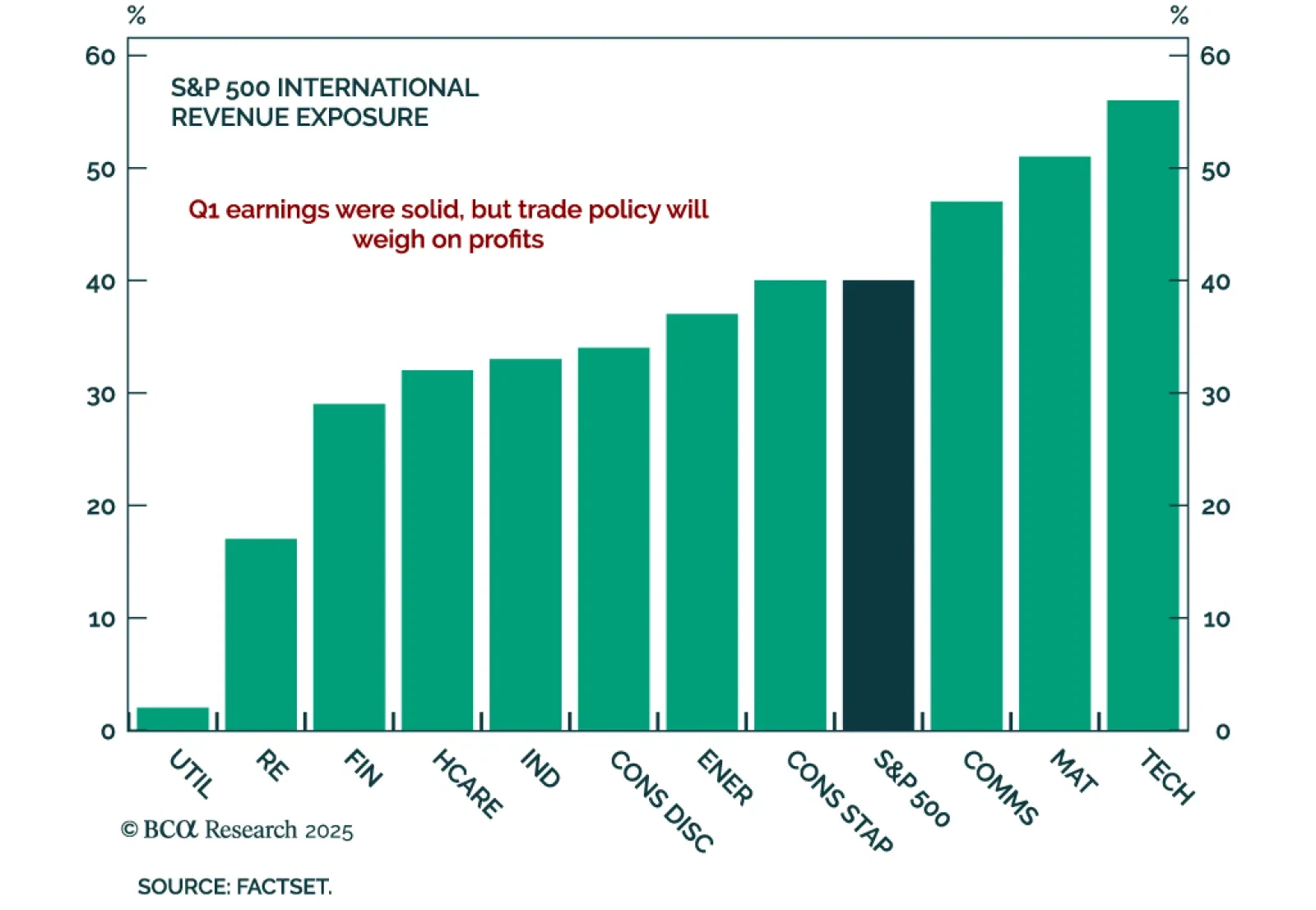

Q1 earnings point to risks for goods-focused sectors, reinforcing our US Equity strategists’ call to overweight services, upstream names, and domestic plays. With most S&P 500 companies having reported Q1 2025 earnings, the…

The Fed held rates steady this afternoon, and the timing of its next move will be dictated by whether the tariff shock to inflation is transitory or more long lasting.

Negotiations on trade, Iran, and Ukraine will prove critical this month. Markets will remain volatile because positive data surprises enable the White House to press its hawkish tariff hikes, while negative surprises force the White…

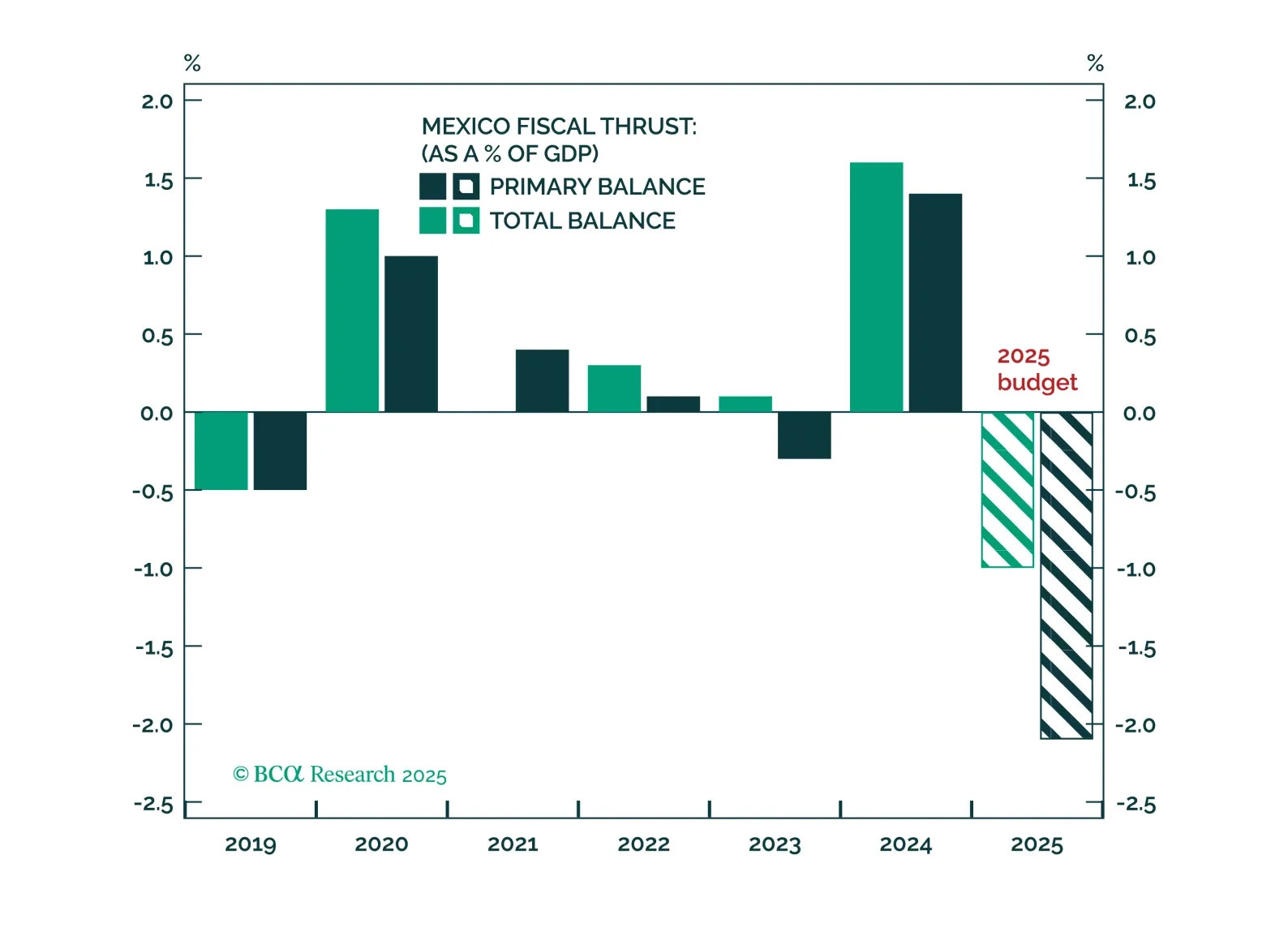

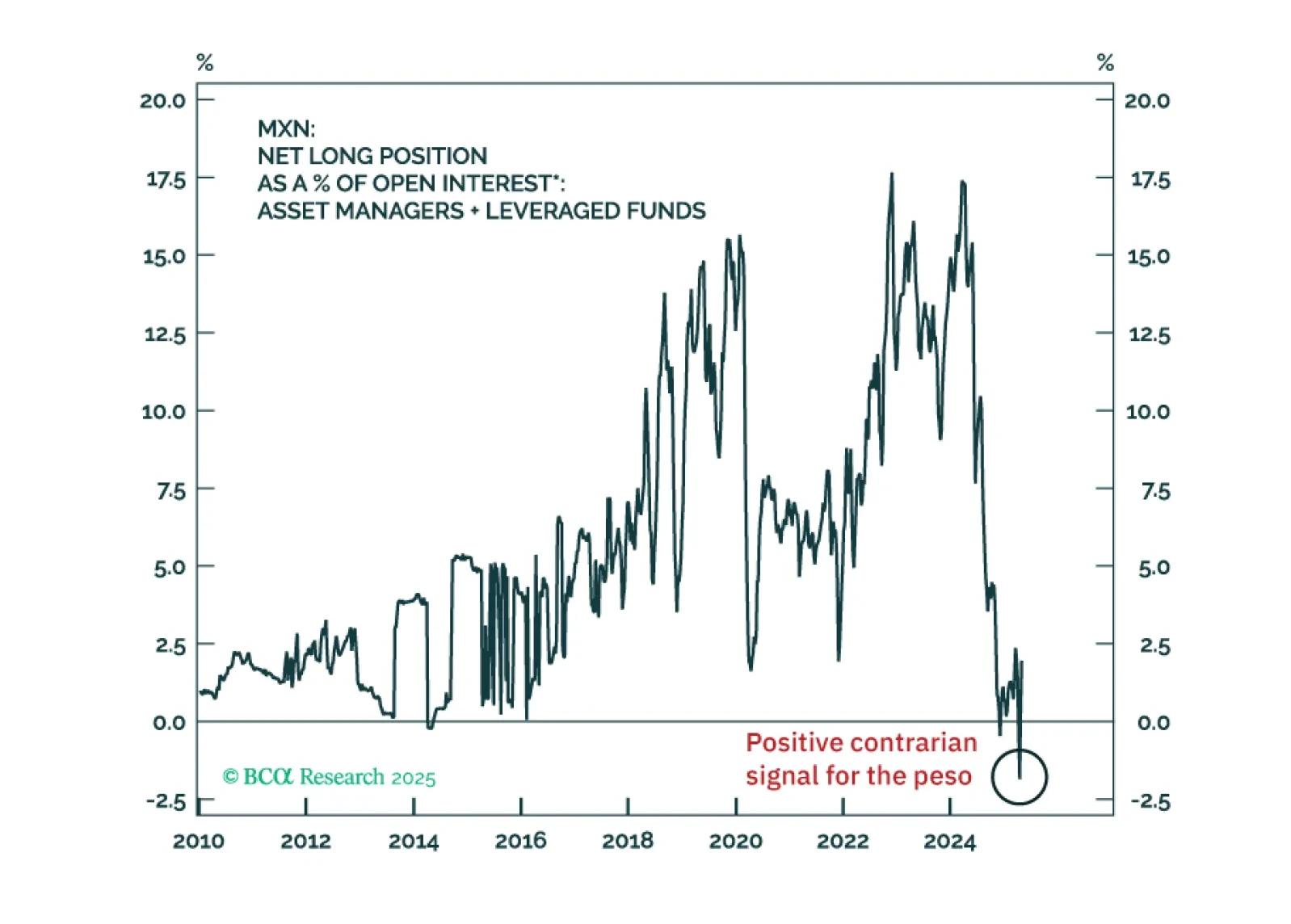

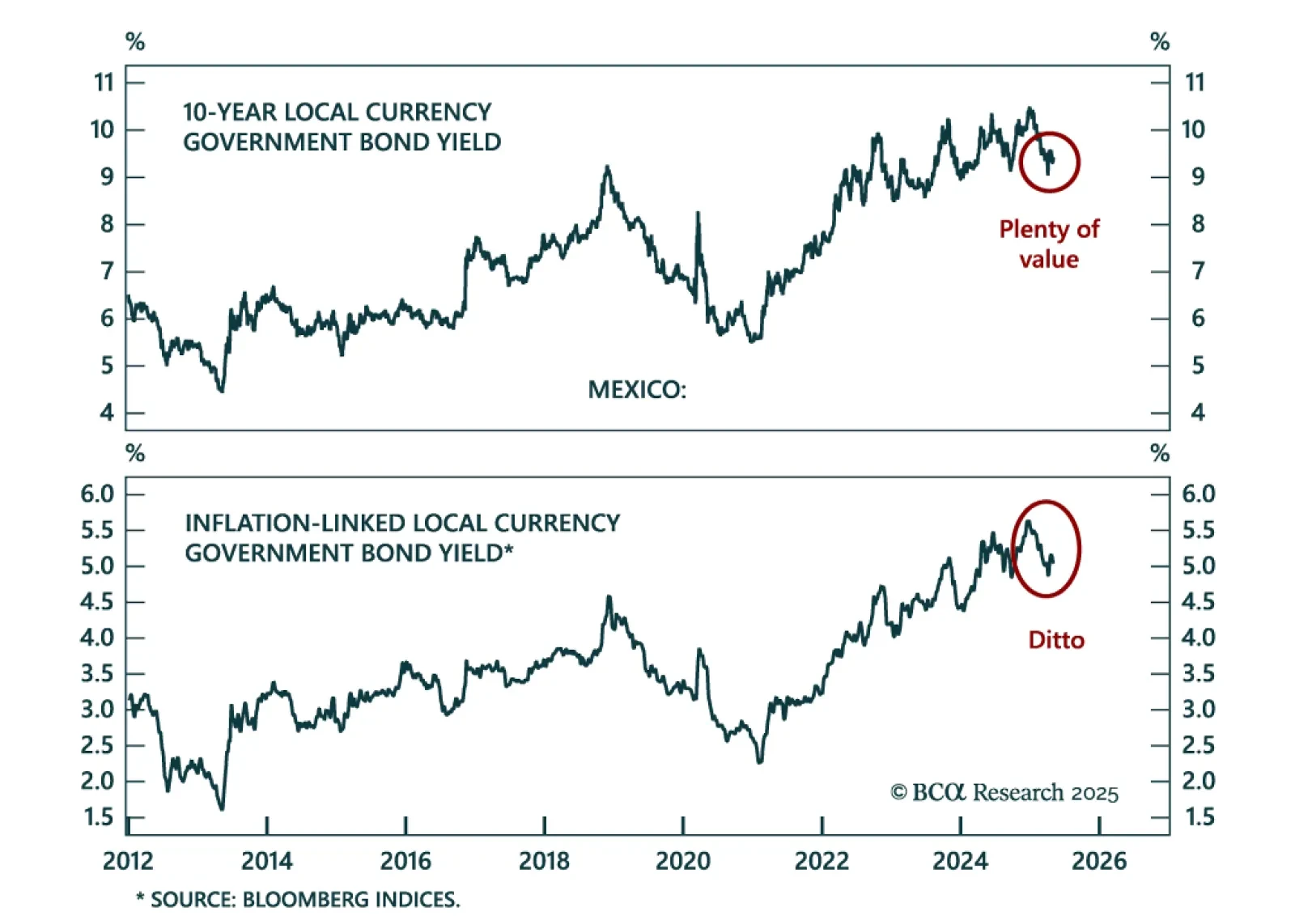

Mexico will be one of the biggest winners of the global trade war, creating a structural tailwind for its assets. Mexican risk assets and the peso are uniquely positioned to outperform while EM assets suffer as global growth slumps.…

In the long run, Mexico will emerge as one of the biggest winners of US tariffs as the US diversifies supply chains away from China. In the medium term, however, a US growth slowdown and tariffs will push Mexico into recession. In EM…