Please note that analysis on India is published below. Highlights This report reviews several financial market-based indicators and price signals from various corners of global markets that are pertinent to the global business cycle,…

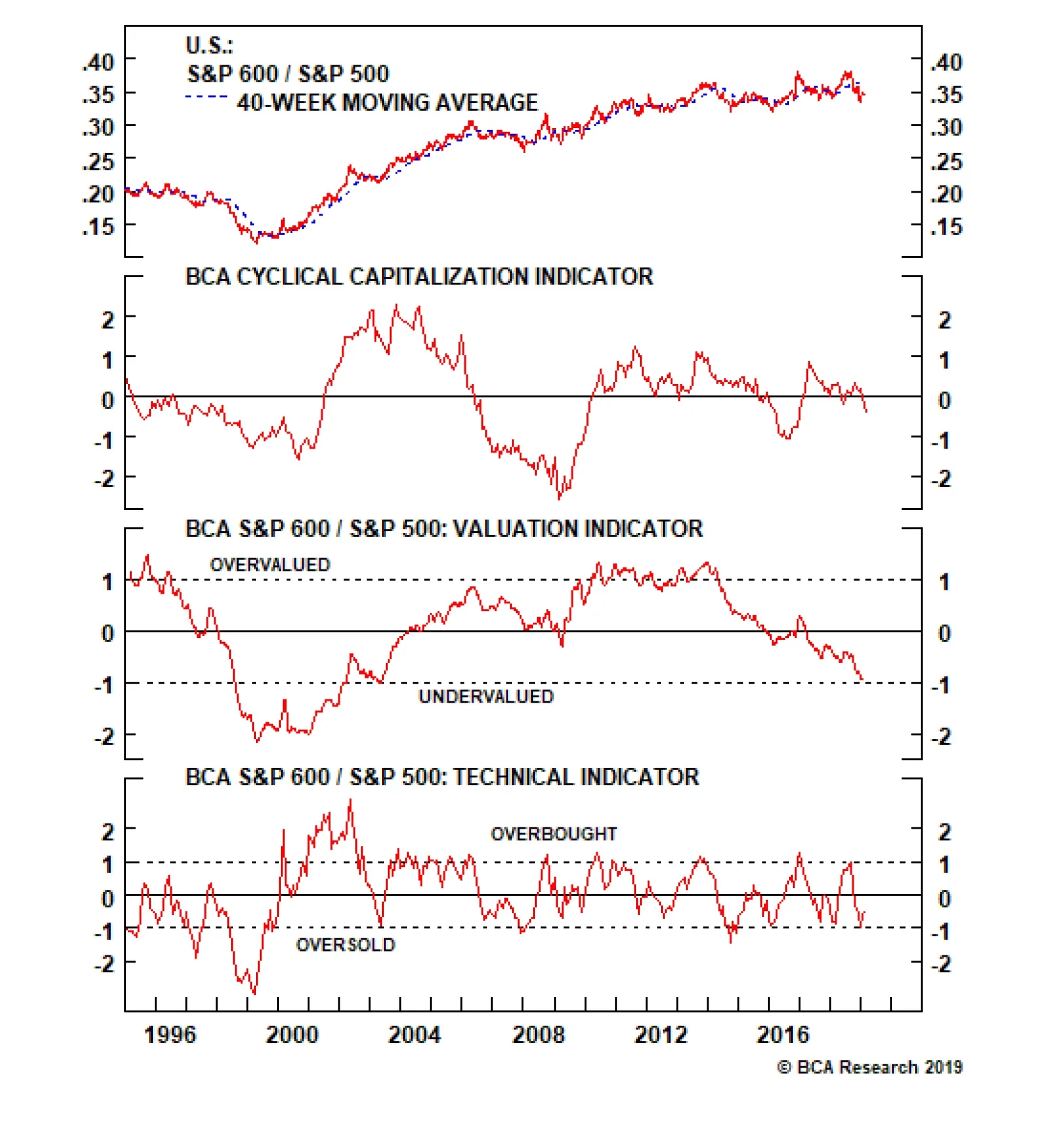

Our size CMI has been hovering near the boom/bust line, as it has for most of the last two years. Despite the neutral CMI reading, in response to the diverging (and unsustainable) debt levels of small caps vs. their large cap…

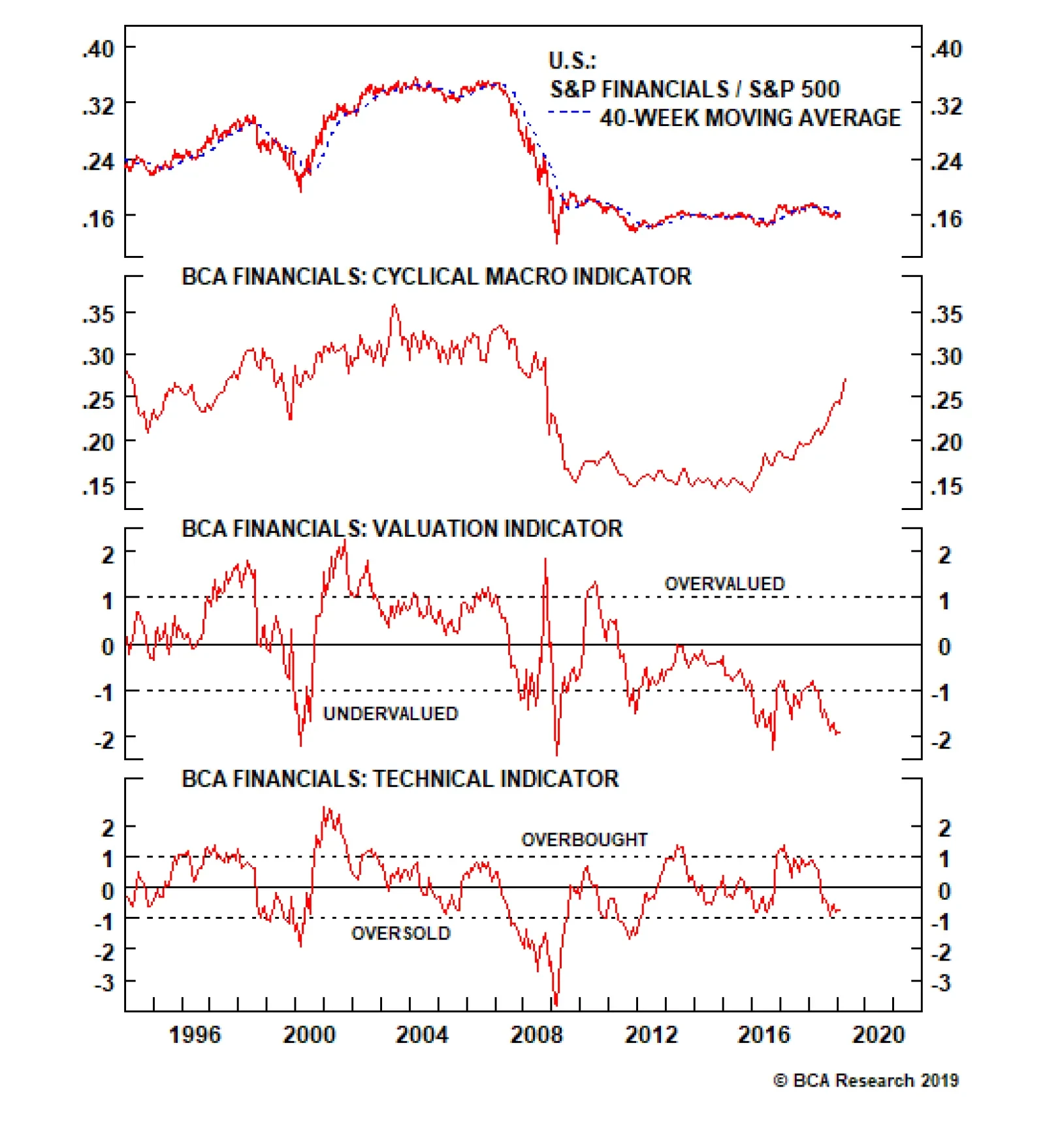

For S&P financials, the divergence between the upward thrust of our CMI and the depressed level of our valuation indicator (VI) has reached stunning levels, the former accelerating into pre-GFC territory and the latter…

Key Portfolio Highlights The S&P 500 has started 2019 with a bang as dovish cooing from the Fed has proven a tonic for equities. While we have not entirely retraced the path to the early-autumn highs, our strategy of staying…

Despite a stellar Q3 earnings print, the S&P 500 had a terrible October as EPS continues to do the hard work in lifting the market (Chart 1). Chart 1EPS Doing The Heavy Lifting We bought the dip,1 consistent with our view…

Highlights Portfolio Strategy Overbought technicals, pricey valuations, decelerating global growth, declining capex, rising indebtedness and softening operating metrics argue for hopping off the S&P railroads index. Rising…