Highlights New structural recommendation: long GBP/USD. The substantial Brexit discount in the pound makes it a long-term buy for investors who can tolerate near-term volatility. The most powerful equity play on a fading Brexit…

A more speculative and higher octane vehicle to explore the trade war-related mispricing from Part I of this Insight is via a long S&P machinery/short S&P semiconductors pair trade. Most of the drivers mentioned in…

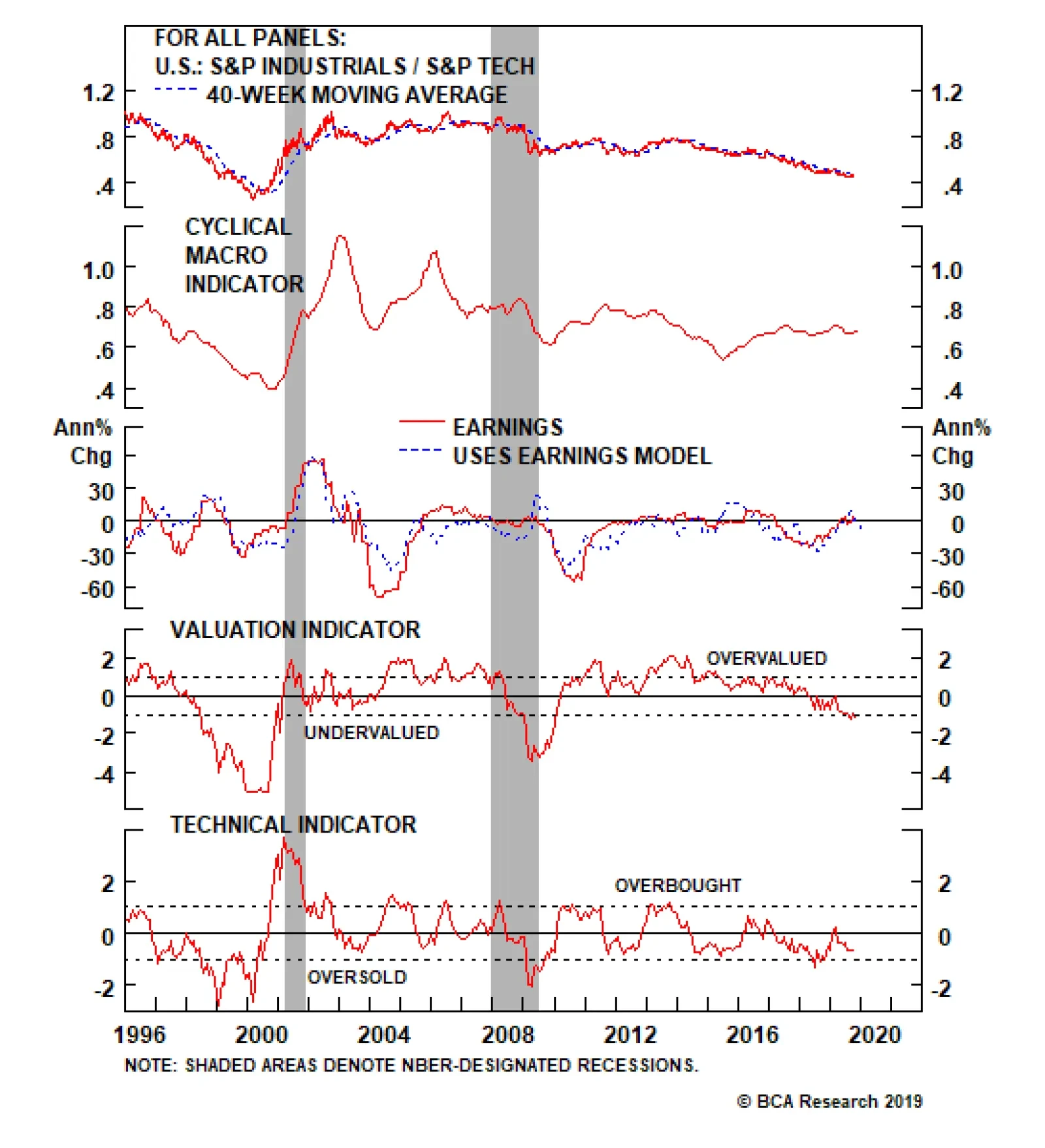

In this Monday’s Weekly Report we initiated a new long/short trade idea that will generate alpha regardless of the pair trade war outcome: long industrials/short tech. If the U.S. and China manage to iron out their…

If the U.S. and China cannot reach an agreement the metrics depicted in the previous Insight will not sink much further. There is an element of exhaustion and industrials would jump relative to tech on news of a breakdown in…

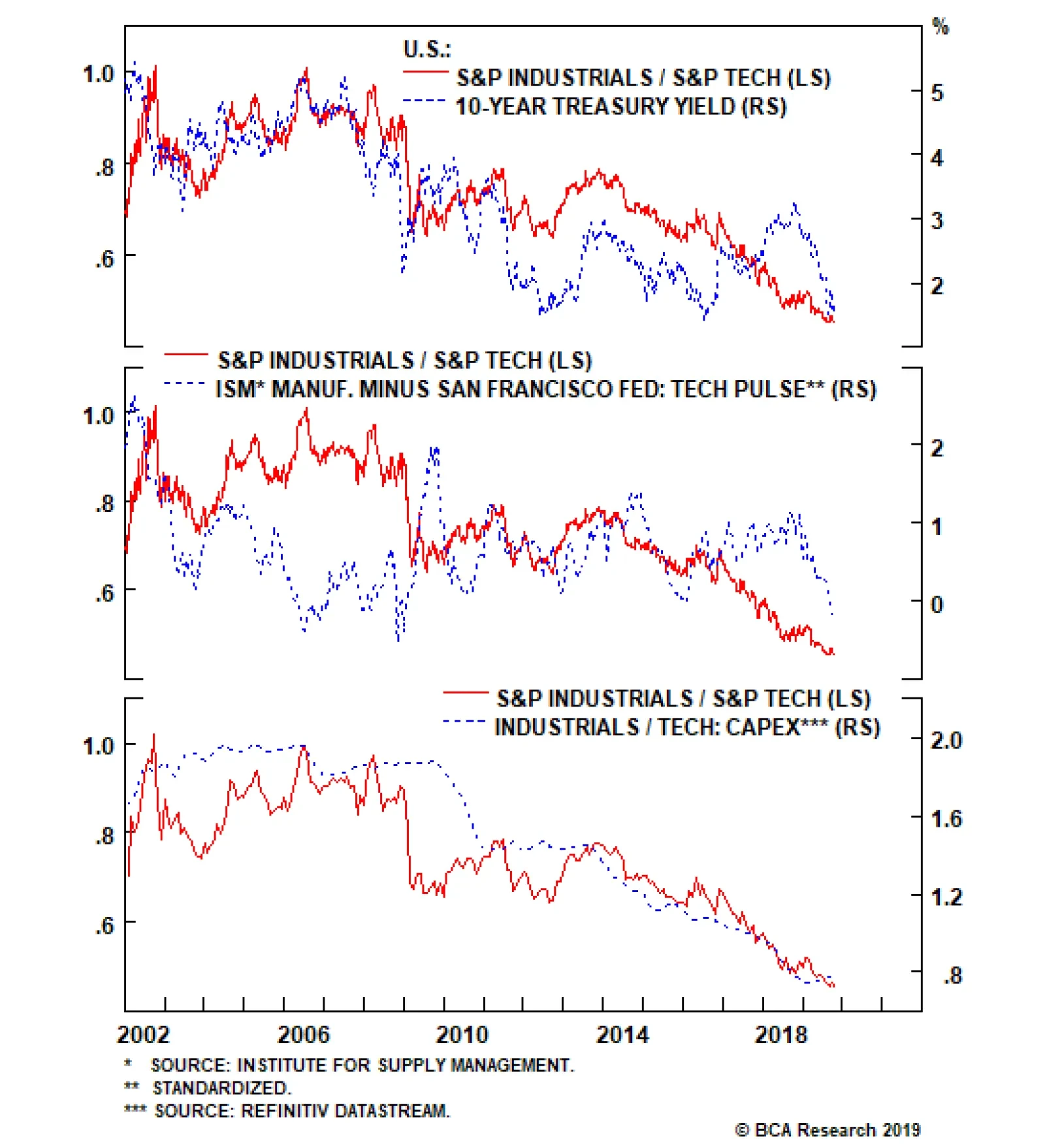

Ever since the Sino-American trade war started in March 2018, the market has punished industrials, but tech has escaped unscathed. The Fed’s tightening cycle and the Chinese policymakers’ brake slamming prompted…

Highlights Portfolio Strategy The trade-weighted U.S. dollar’s appreciation along with the still souring manufacturing data are weighing on SPX profit growth, at a time when heightened geopolitical uncertainty and a looming…

Overweight (maintain cyclical trailing stop at 27% relative return since inception) The latest ISM services report followed its sibling ISM manufacturing survey lower as we have been expecting, given the leading properties and extreme…

Remain Cyclically Overweight, But Remove from High-Conviction Overweight List Our 10% stop on the S&P software high-conviction call got triggered and we are obeying it, booking gains and removing this index from the high-…