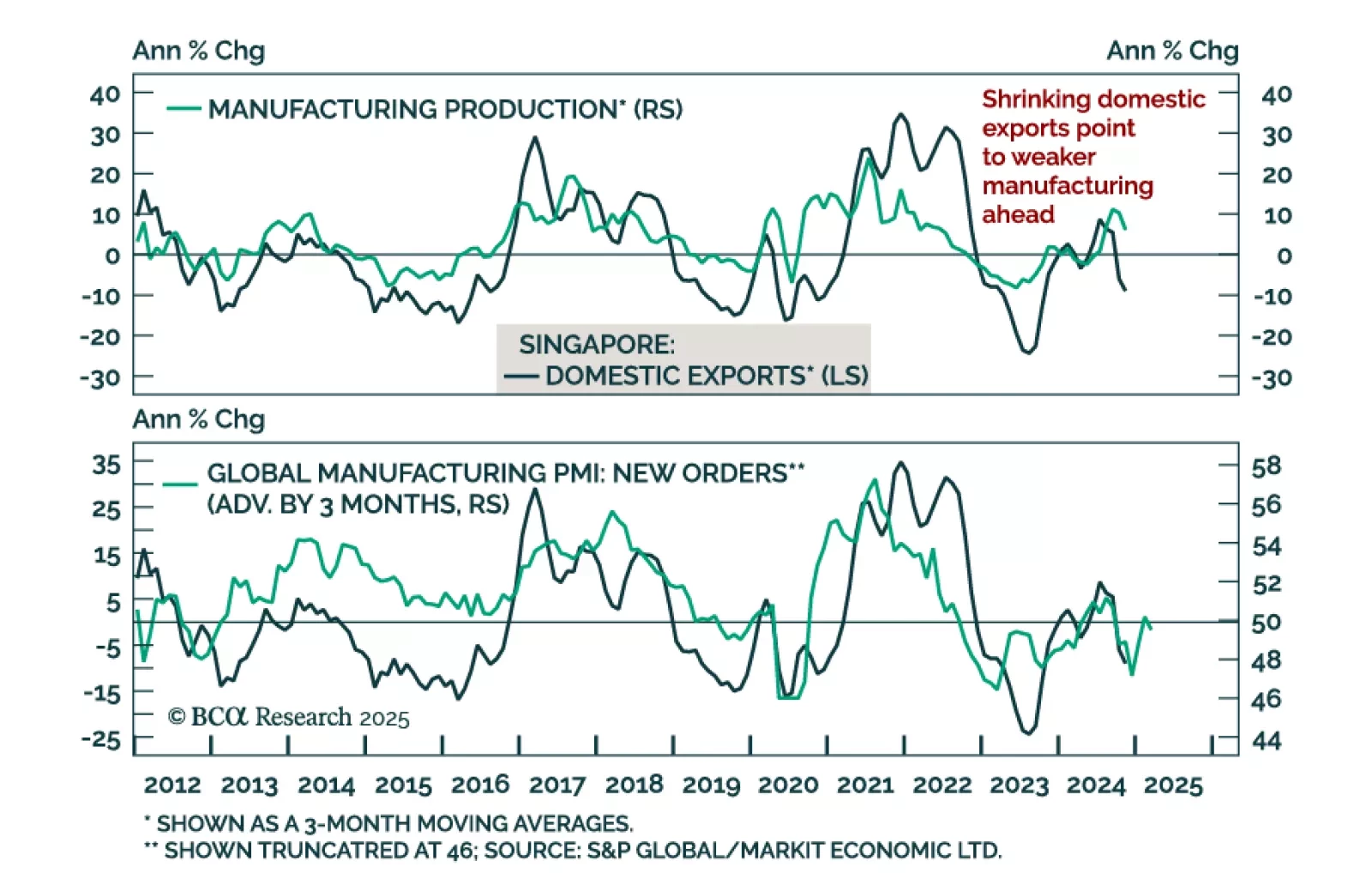

Our Emerging Markets strategists just published a report on Singapore stocks after a significant rally over the past year. Singapore’s manufacturing sector faces headwinds from contracting global new orders, which signals that a…

Please join us for a BCA Expert Webcast, Thursday, January 16 at 10:00 AM EDT, with Brendan Kelly, former Director for China Economics on the US National Security Council, veteran of the New York Federal Reserve, Treasury Department…

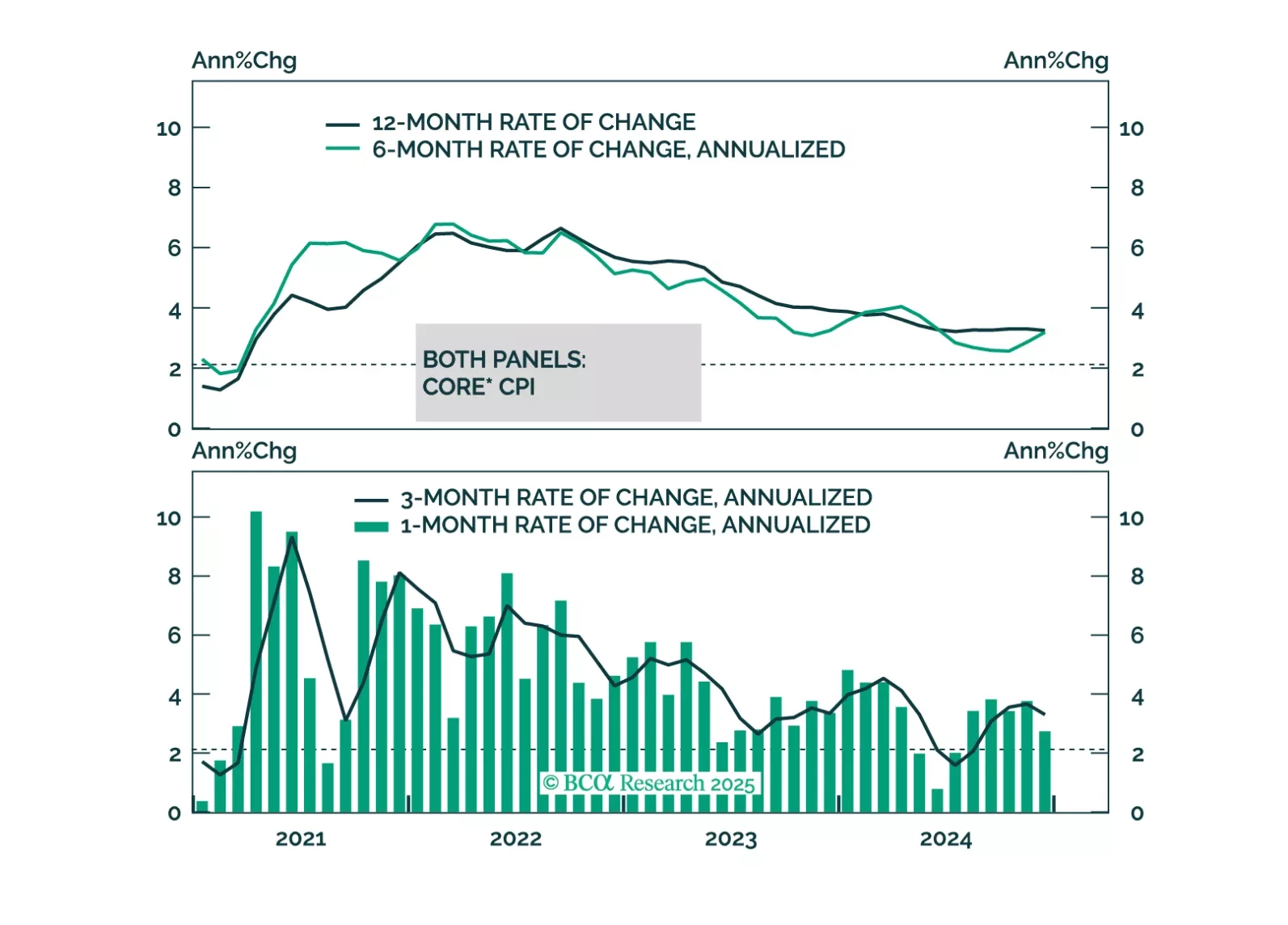

Our thoughts on this morning’s CPI release and some upside risks to inflation that could flare up in the months ahead.

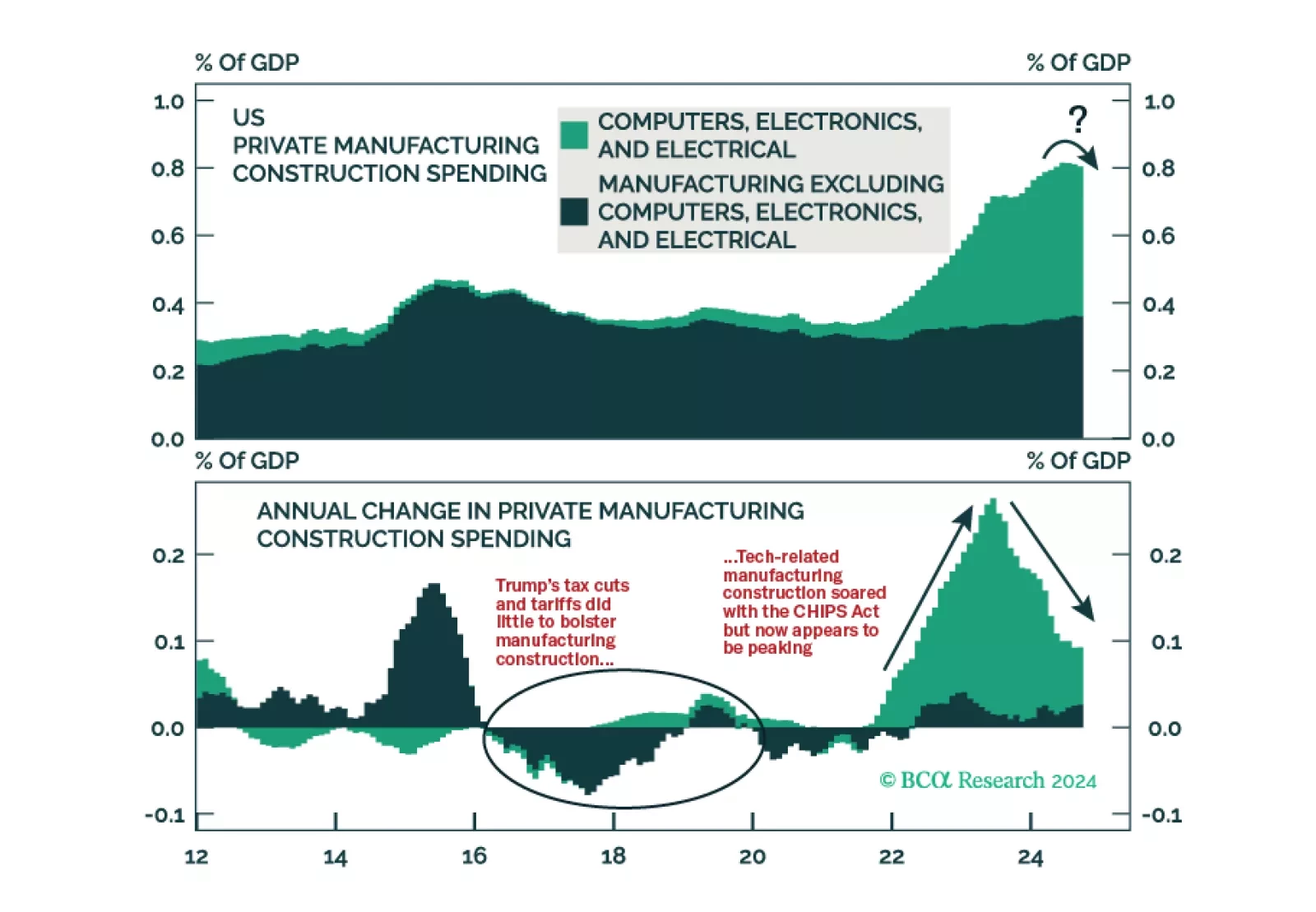

Congress will pass tax cuts by end of 2025 producing a fiscal thrust of about 0.9% of GDP in 2026. Trump will count on that stimulus as a basis for slapping tariffs on leading trade partners.China will retaliate against Trump…

This month, our Here, There, And Everywhere Chartpack summarizes our main thesis for 2025: the three main narratives driving markets today – fiscal profligacy, trade war, and geopolitical conflict – will peak at some point in…

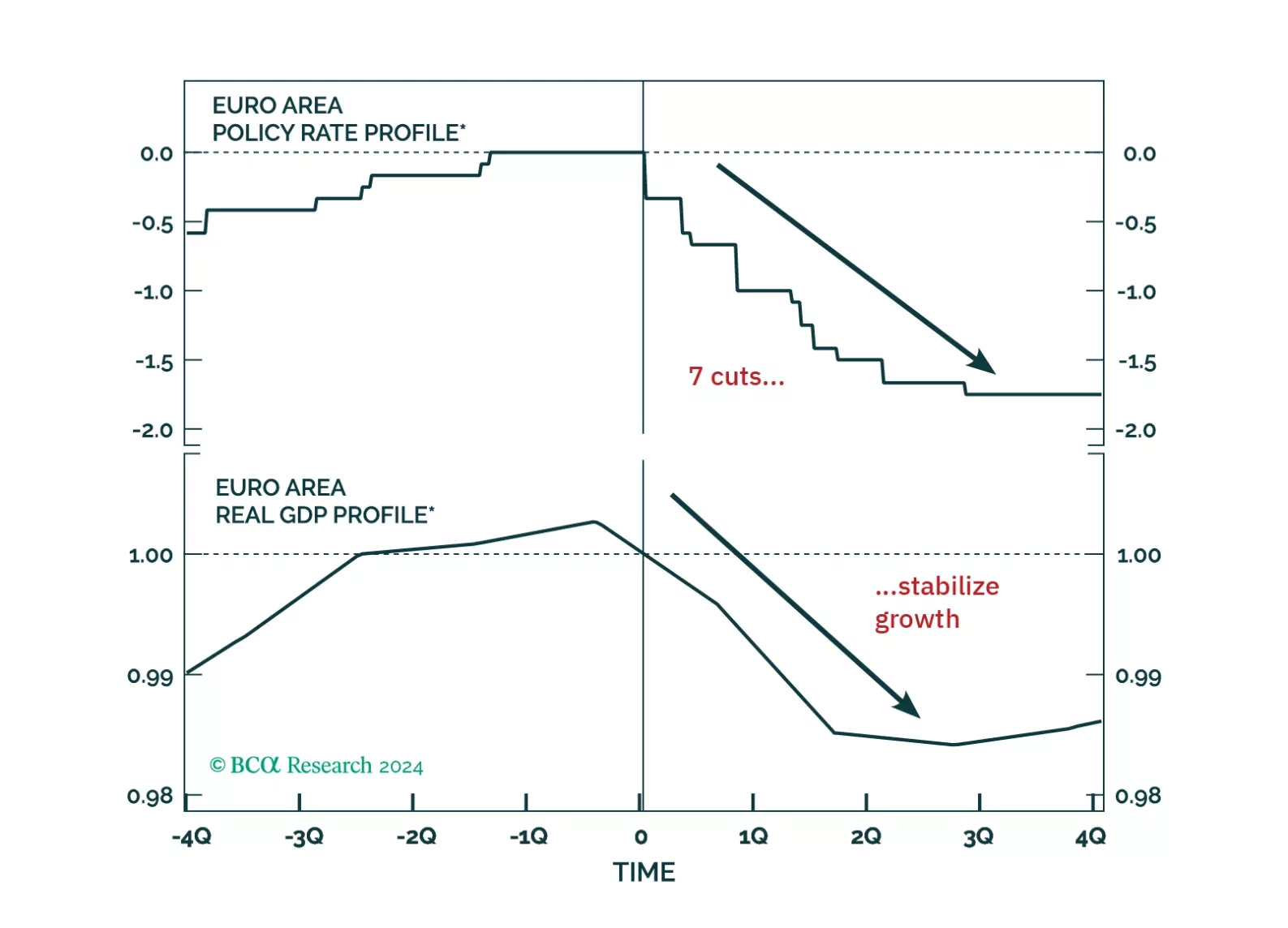

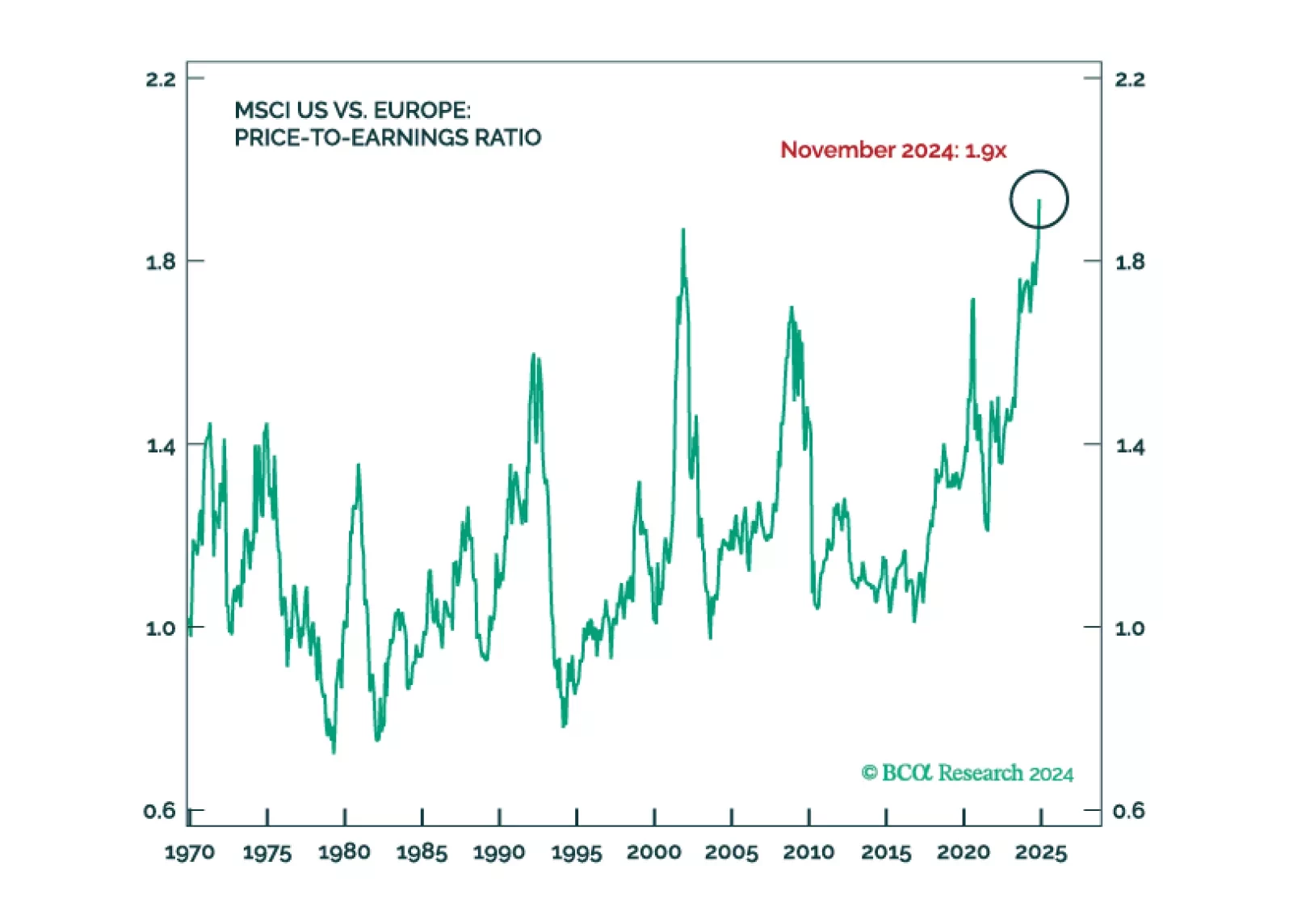

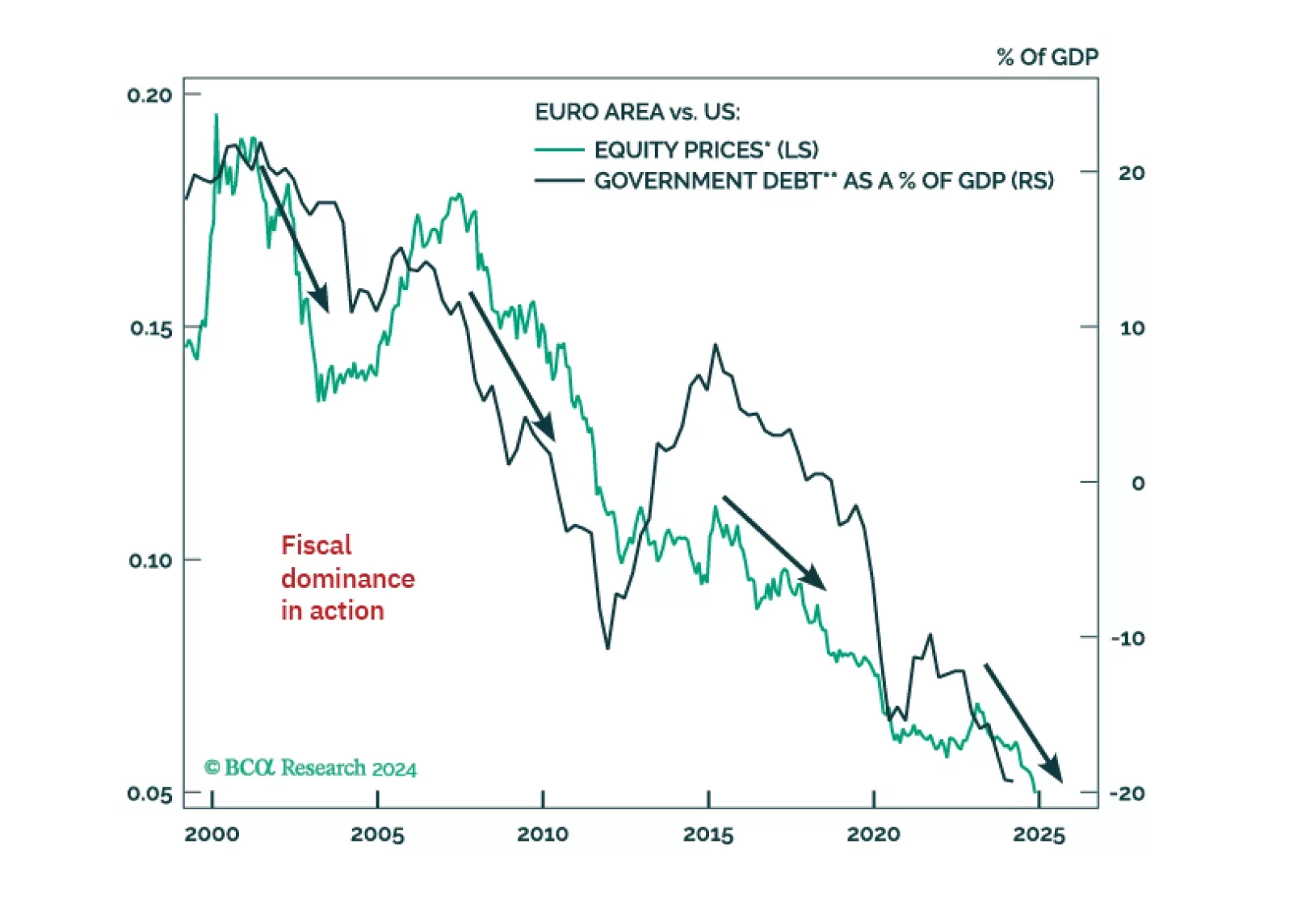

Investors have given up on European assets, which now suffer exceptional discounts to US ones. However, tighter US fiscal policy, the end of Europe’s austerity and deleveraging, the LNG Tsunami about to hit European shores, and the…

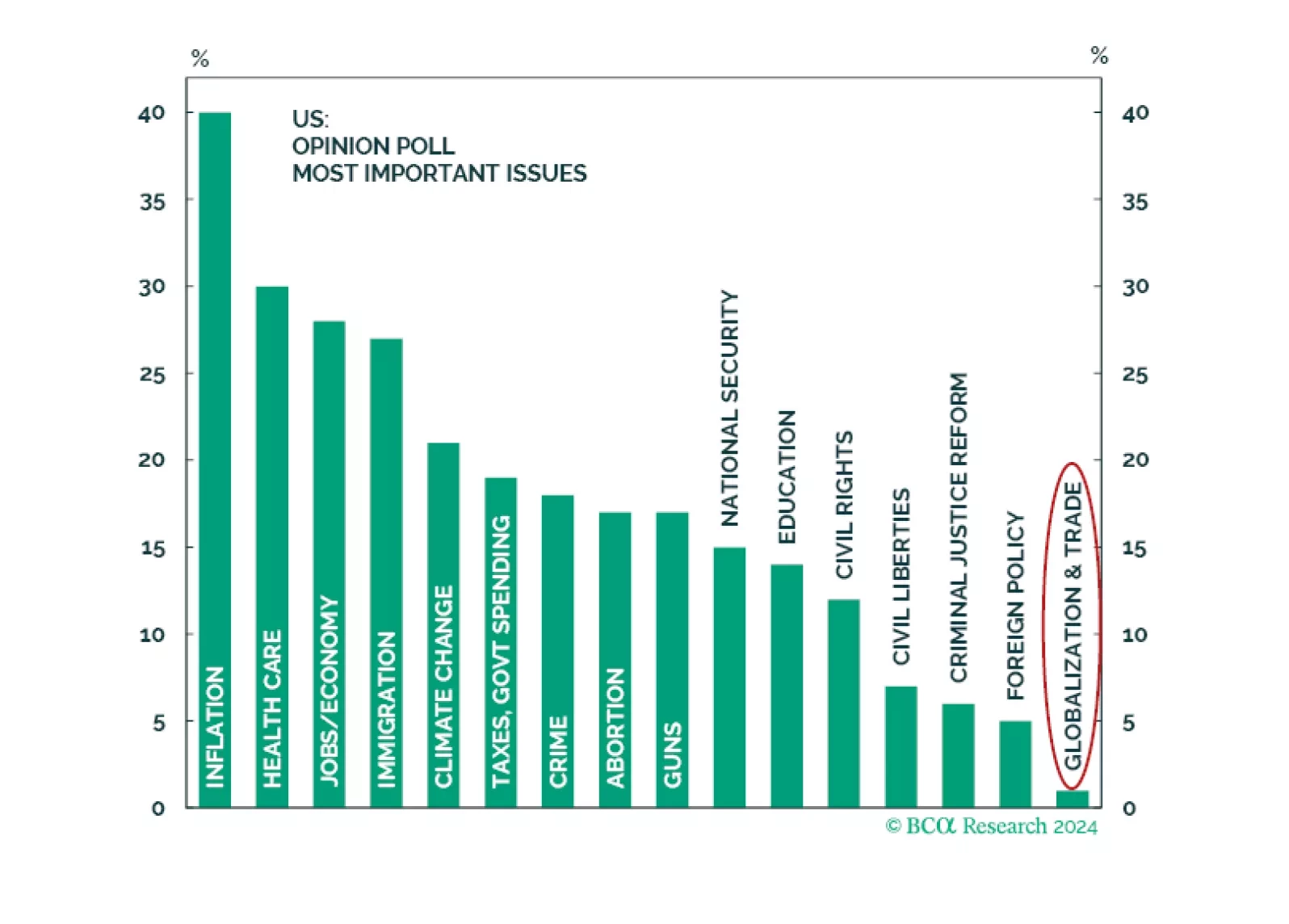

The prospect of a new trade war more than offsets the other pro-business parts of Trump’s agenda. With the labor market already weakening going into the election, we are raising our 12-month US recession probability from 65% to 75…