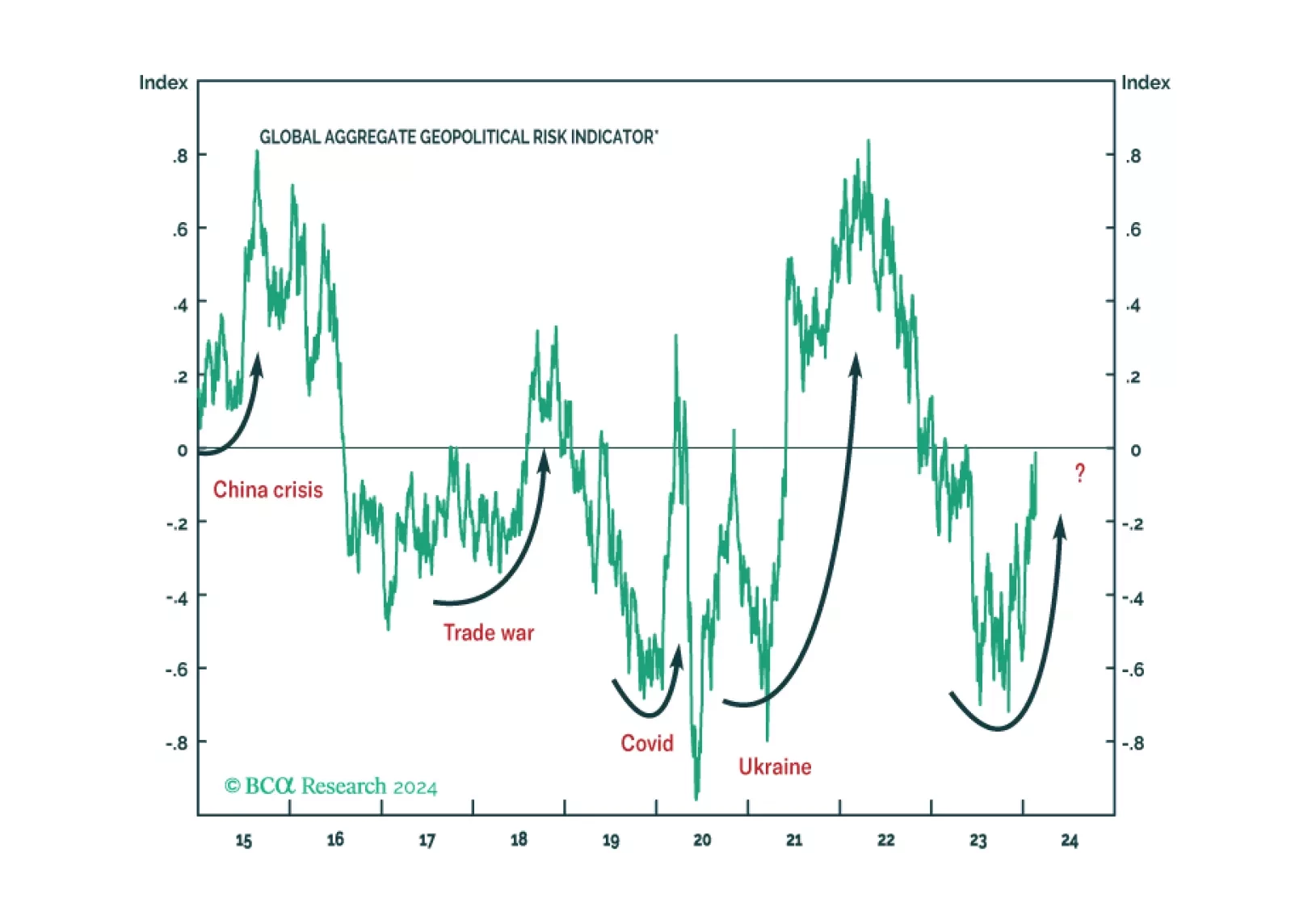

Although a strategic détente between the US and China would benefit both sides, BCA Research’s Geopolitical Strategy service warns that the trade war will continue. The team has argued that Biden and Xi would fail to…

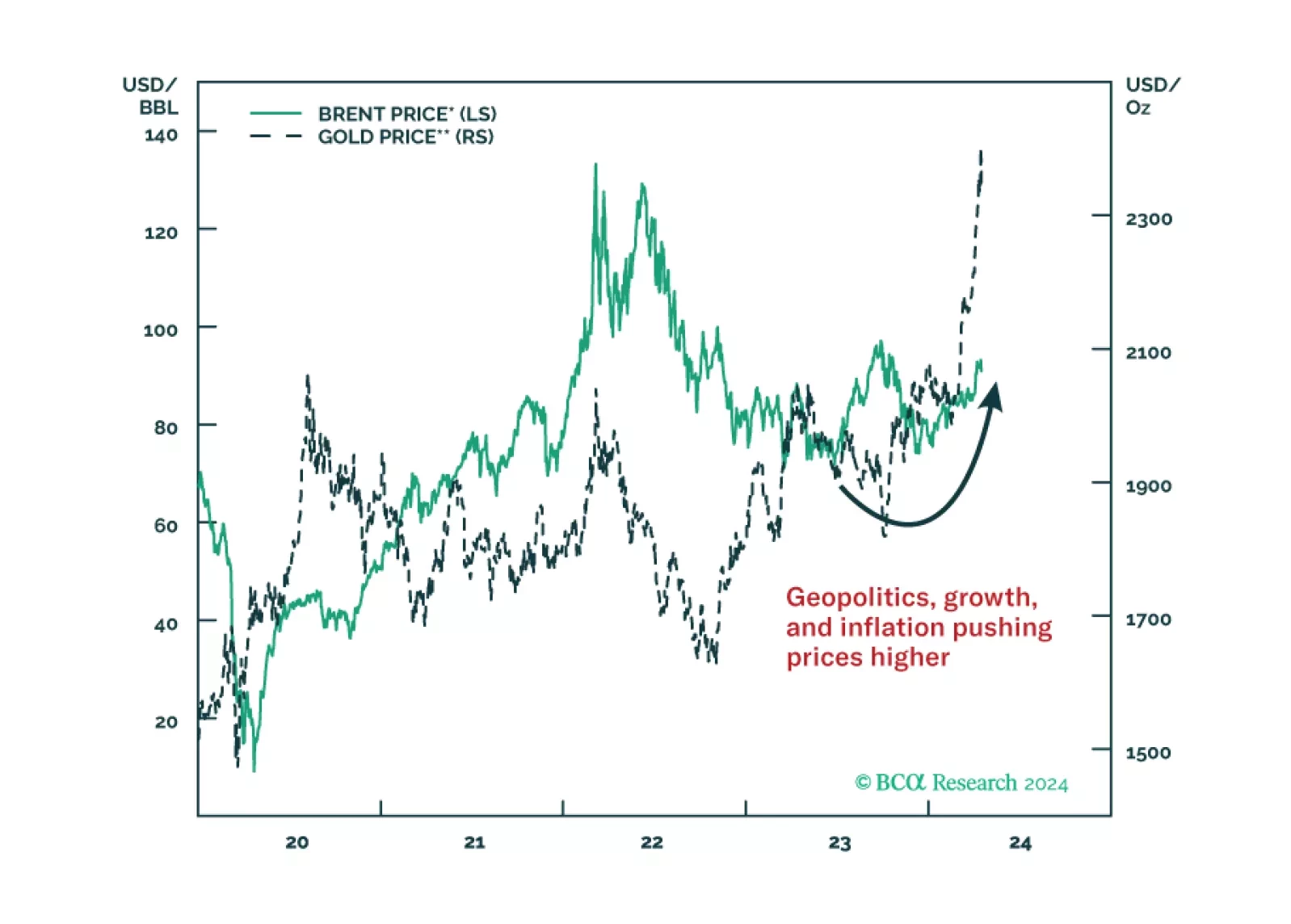

In the near term, favor oil and oil producers outside the Gulf Arab states. Over a 12-month horizon, favor US and North American equities, defensive sectors over cyclicals, and safe-assets. Within cyclicals, stick to energy and…

Investors around Europe and North America are concerned that the stock market is increasingly overbought and vulnerable to exogenous risks. We agree and have good reasons to fear that festering geopolitical risks and the US election…

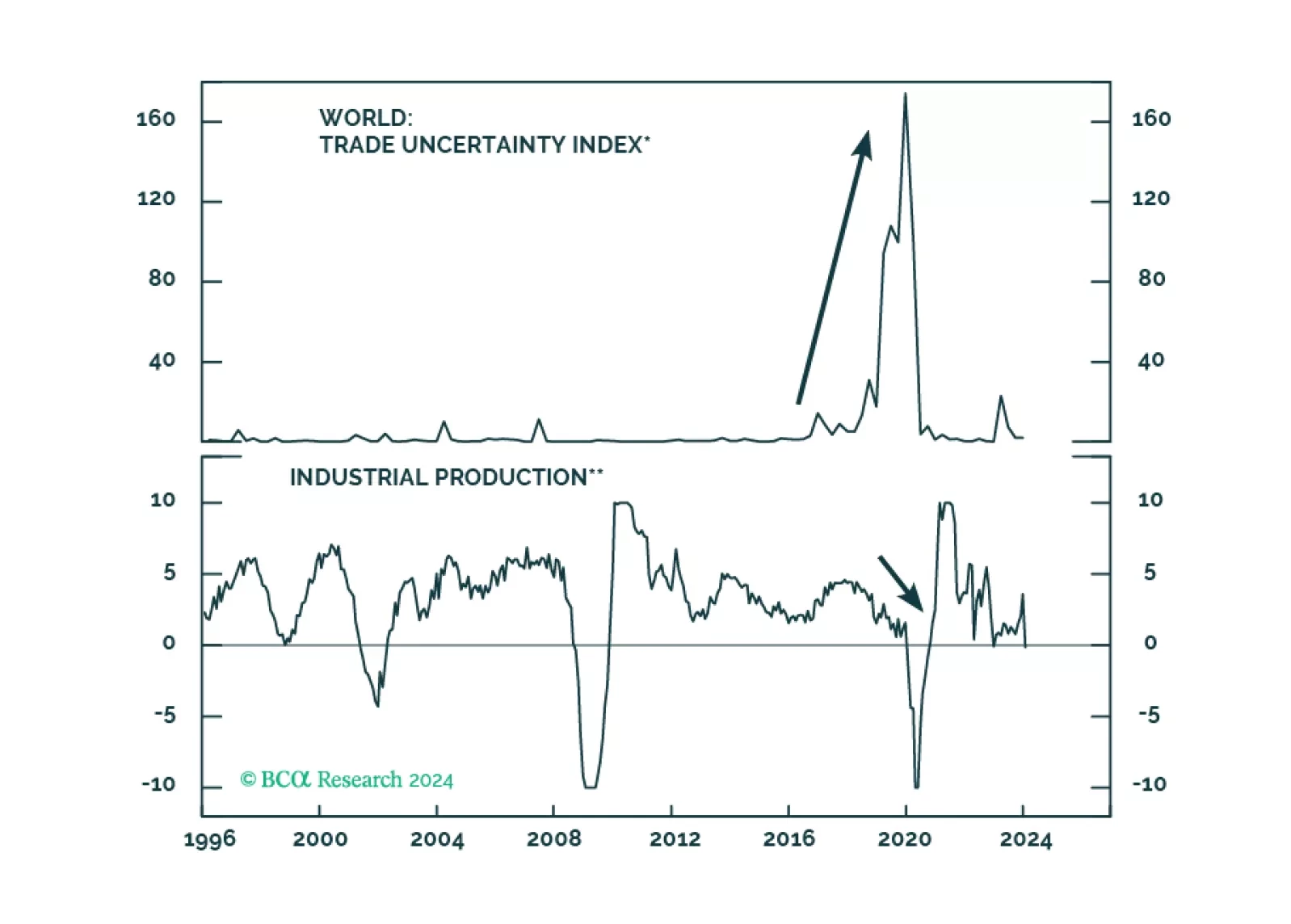

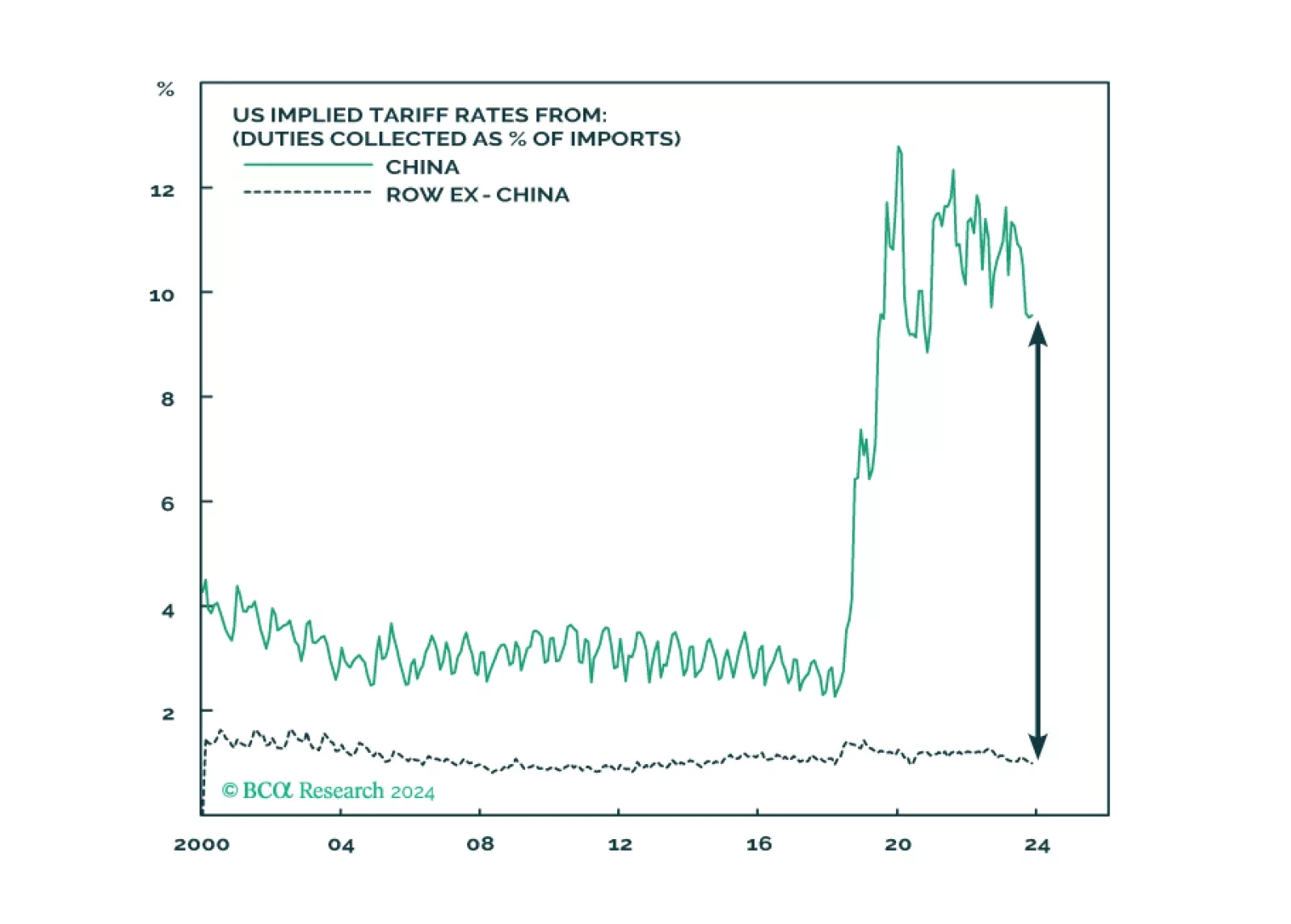

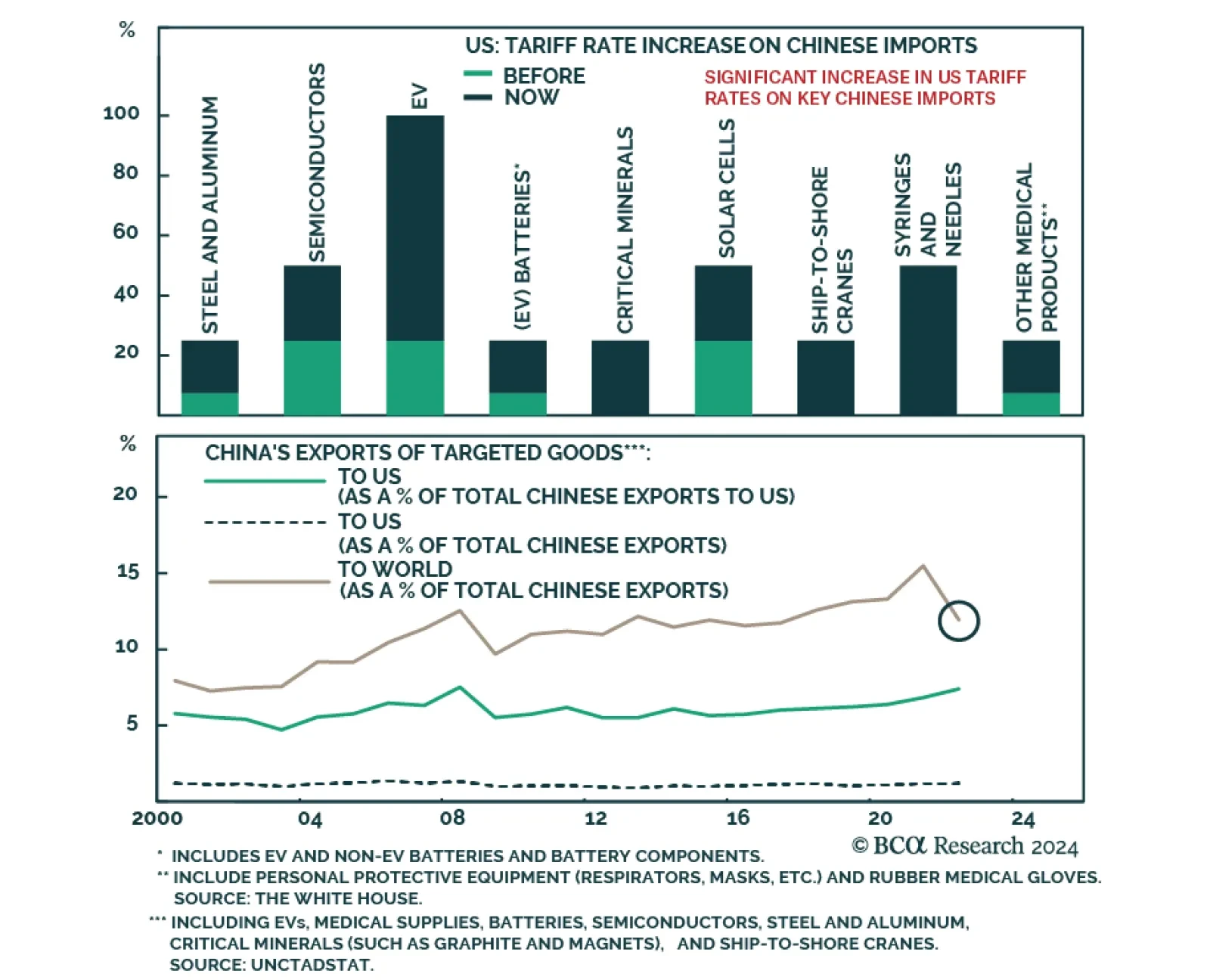

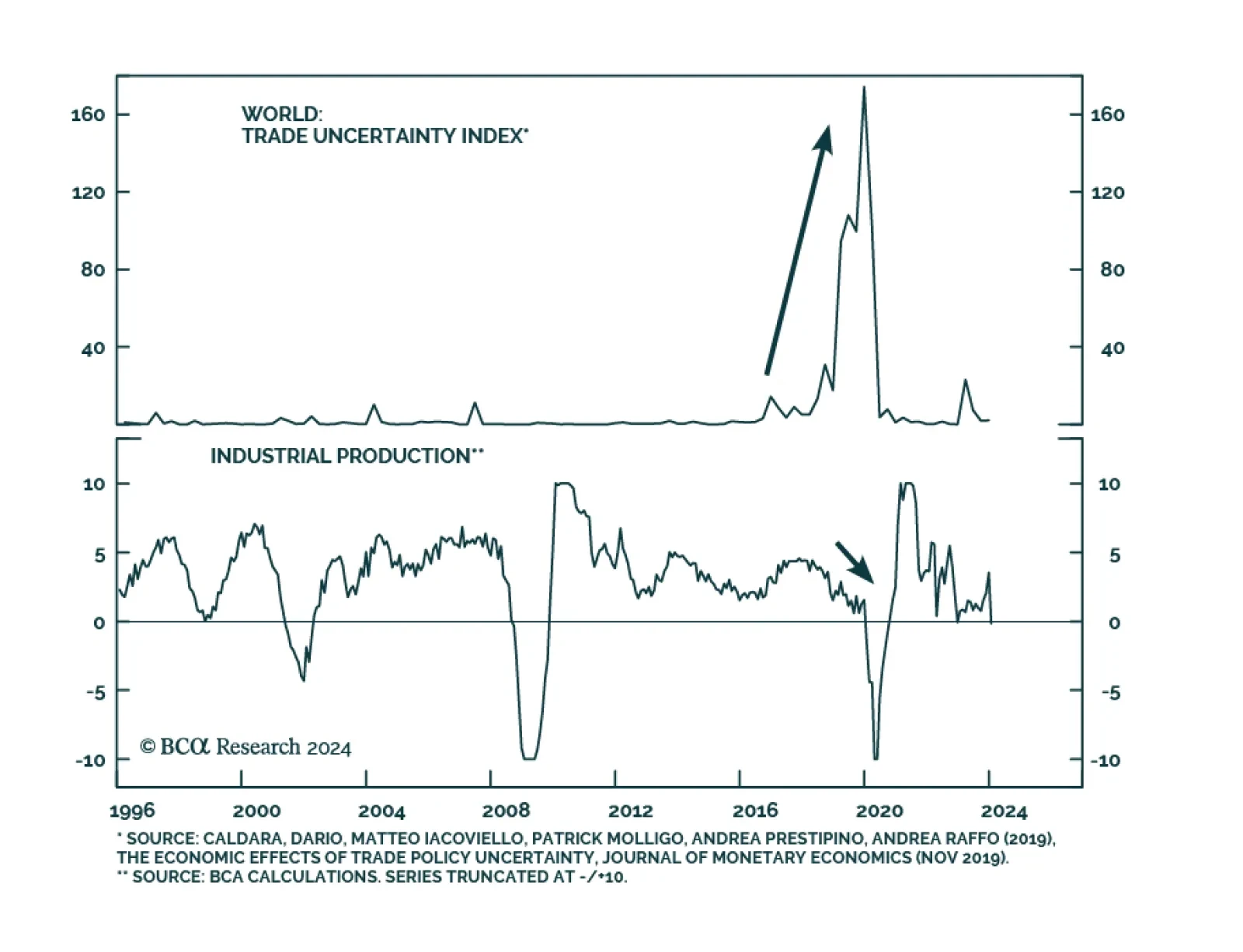

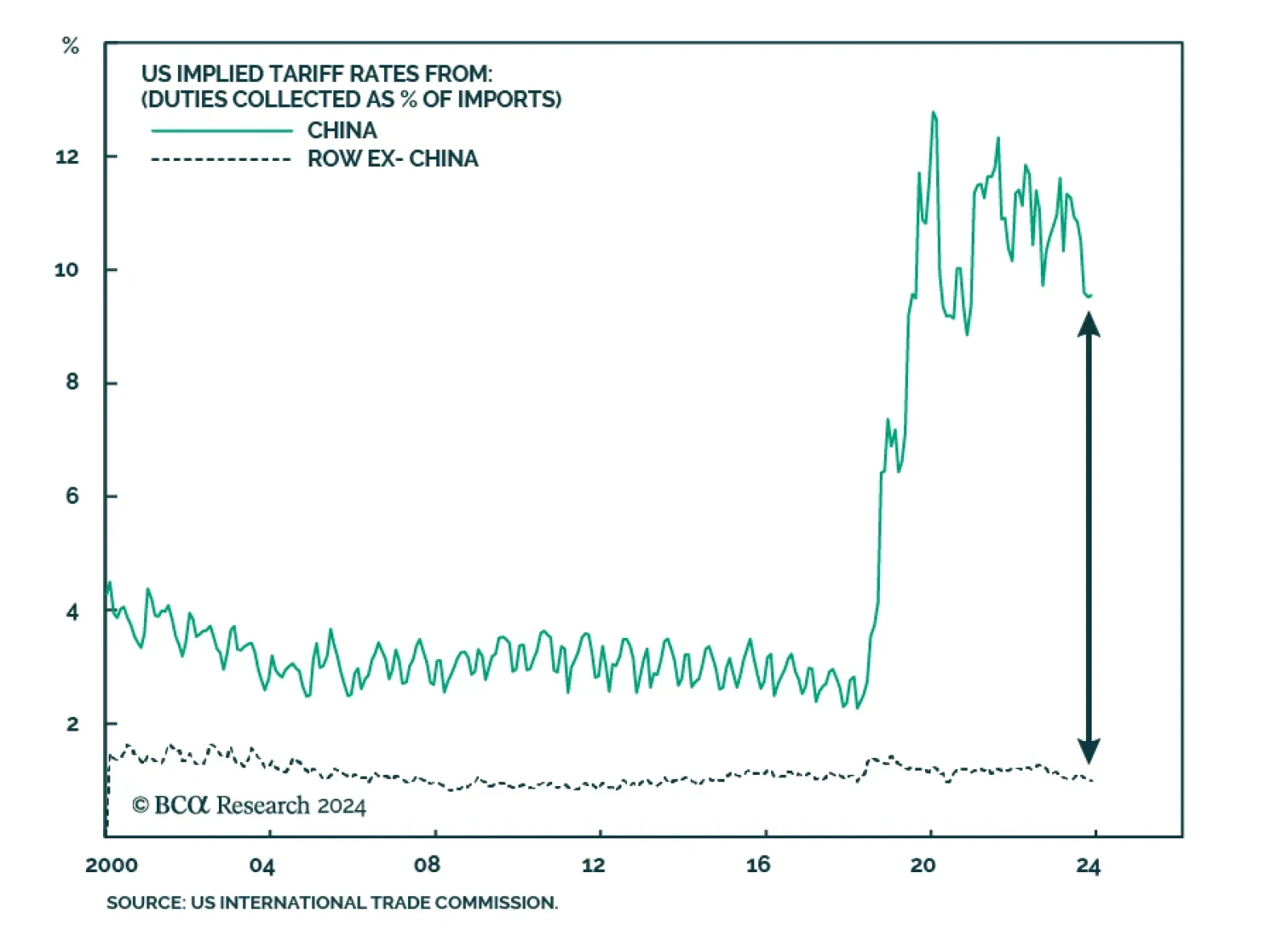

According to BCA Research’s Geopolitical Strategy and The Bank Credit Analyst services, trade policy under a second Trump presidency represents the greatest cyclical risk to investors. In 2018, the Trump administration…

While 2024 will see various election risks, global geopolitical uncertainty is driven by the US election and its struggle with Russia, China, and Iran. The stock market can manage local domestic political risk. But it will correct…

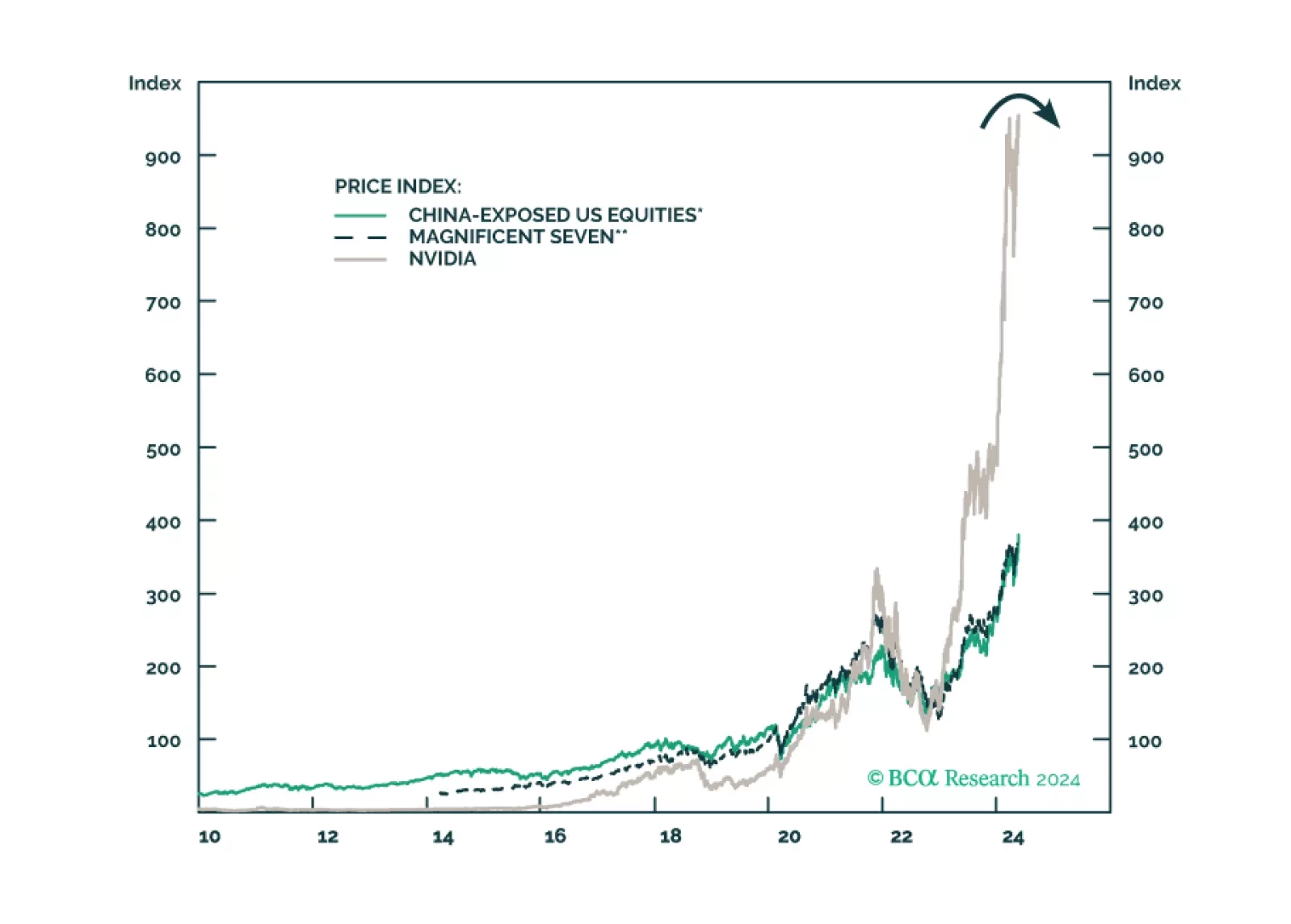

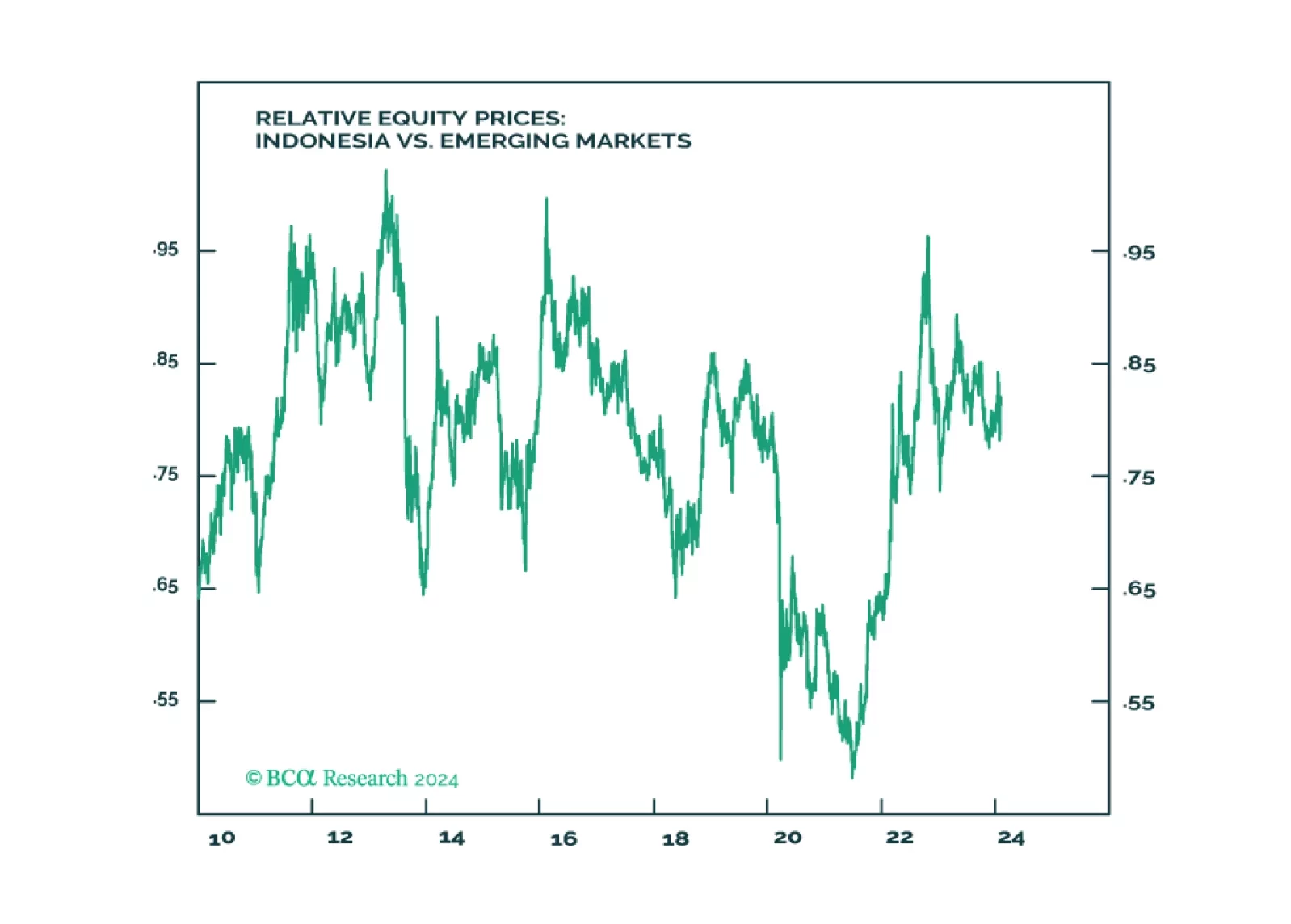

The Chinese economy continues to face deflationary pressures, reducing the odds that any intervention-driven rebound in equities will be sustained. In addition, our Geopolitical strategists have argued that US-China relations…