Investors should not get their hopes up about this week’s US-China summit. Chinese President Xi Jinping and US President Joe Biden will meet on the sidelines of the Asia Pacific Economic Cooperation (APEC) summit in San…

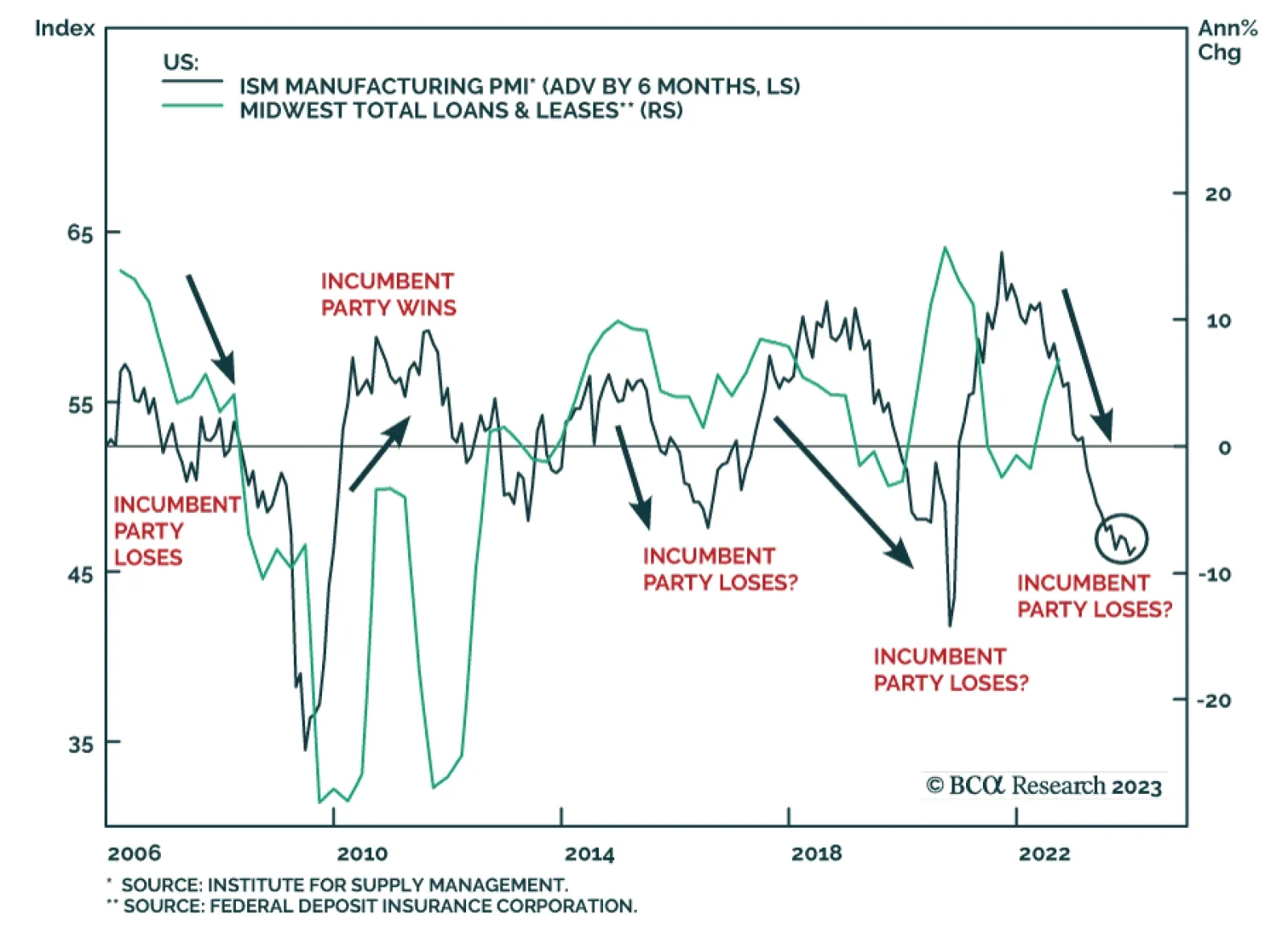

US fiscal, monetary, and foreign policies are unlikely to deliver any dovish surprises for investors in Q4, due to the impending government shutdown, persistent inflation, and instability among OPEC+ and China.

China’s reopening faltered and now it is applying moderate stimulus. OPEC 2.0’s production discipline is getting results, with oil prices climbing. The Fed will not be able to deliver dovish surprises in Q4 2023. Investors should…

The Fed and ECB talked a good game as they redoubled their commitments to returning core inflation to 2% p.a. at Jackson Hole. However, their outmoded inflation-fighting playbooks do not address supply tightness in commodity and…

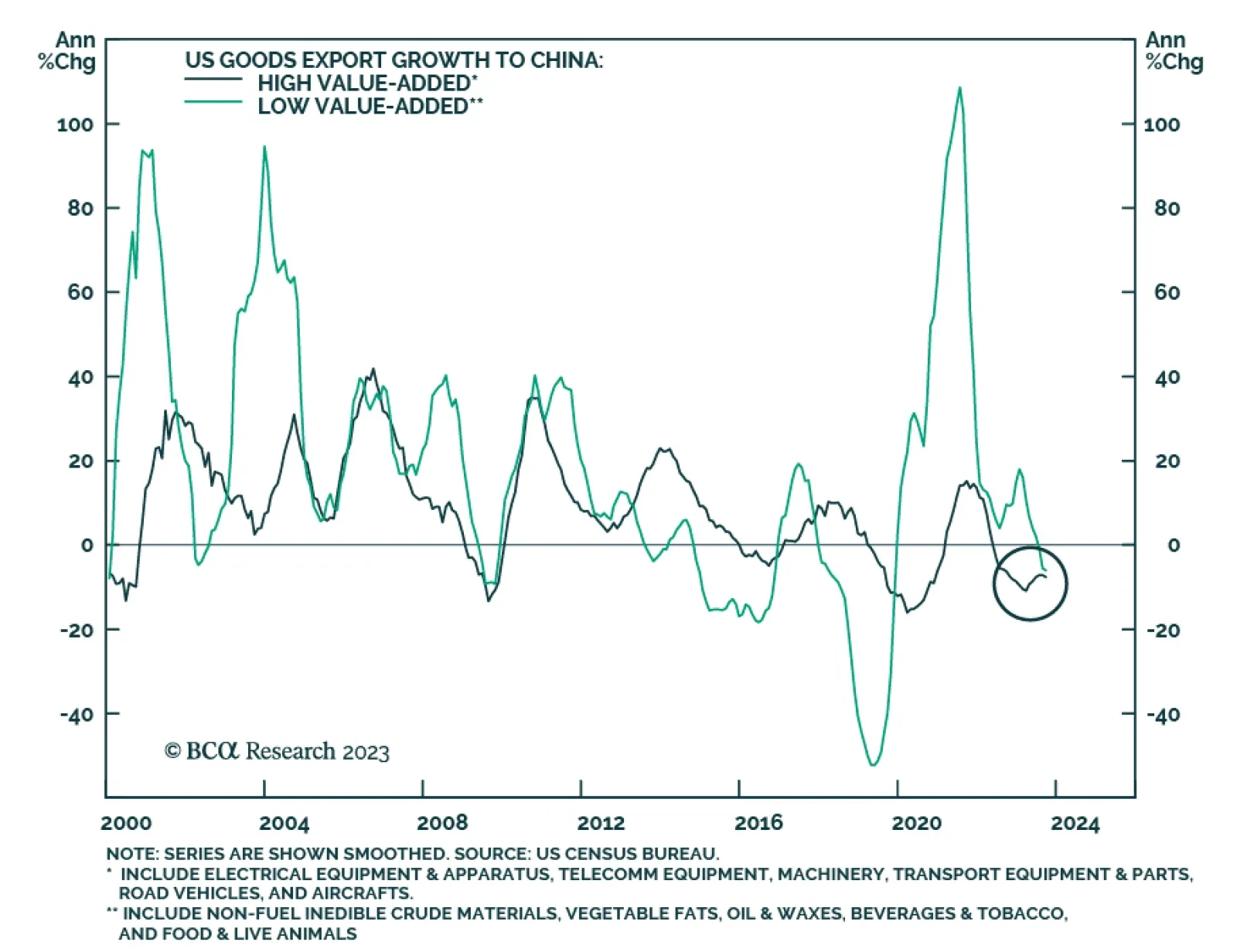

The US and China agreed to hold trade talks more regularly on August 28, even as they fell short of establishing a strategic détente or general reduction of tensions. US Commerce Secretary Gina Raimondo visited Beijing…

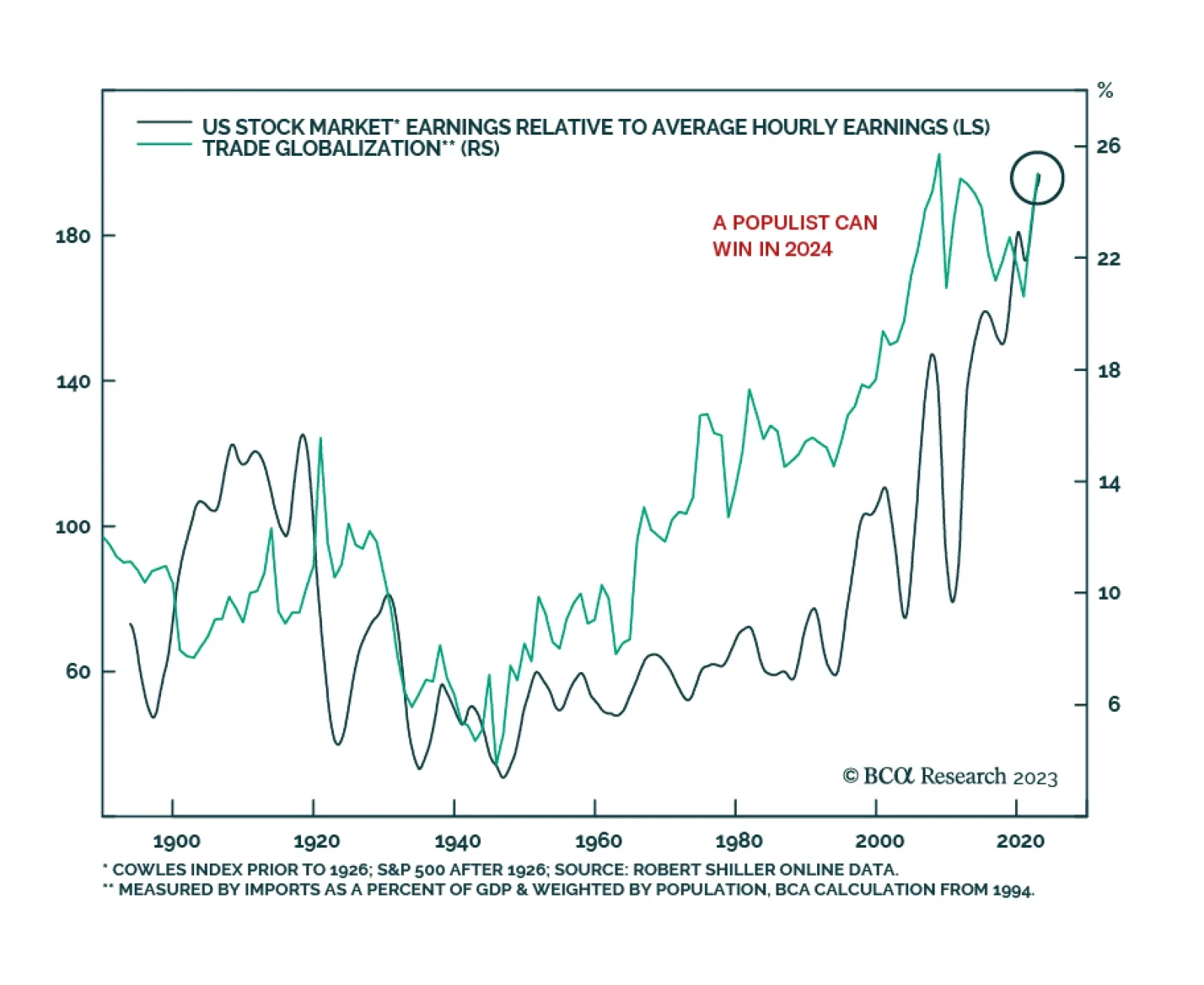

The chief question of the 2024 election is whether US anti-establishment or populist politics is a viable electoral strategy, according to BCA’s US Political Strategy. That will have domestic and global effects not only in…