On Wednesday, President Joe Biden announced that a new ban on some US investment into China’s quantum computing, advanced chips and artificial intelligence sectors will come into force next year. This latest escalation is…

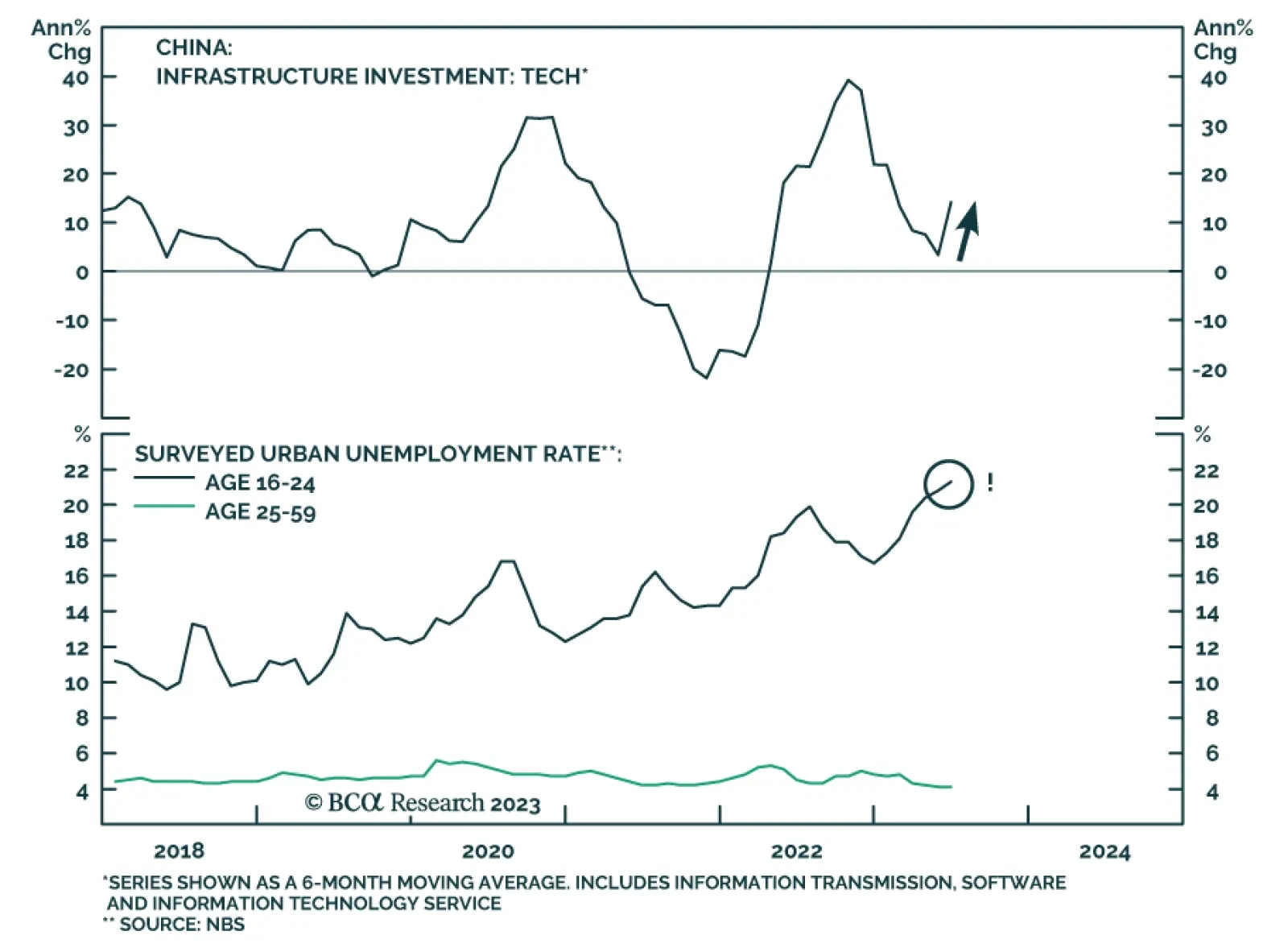

The global economy will not enjoy an “immaculate disinflation” but will suffer a very maculate one due to China’s growth slowdown and restrictive monetary policy in the developed world. Investors should stay overweight low-beta…

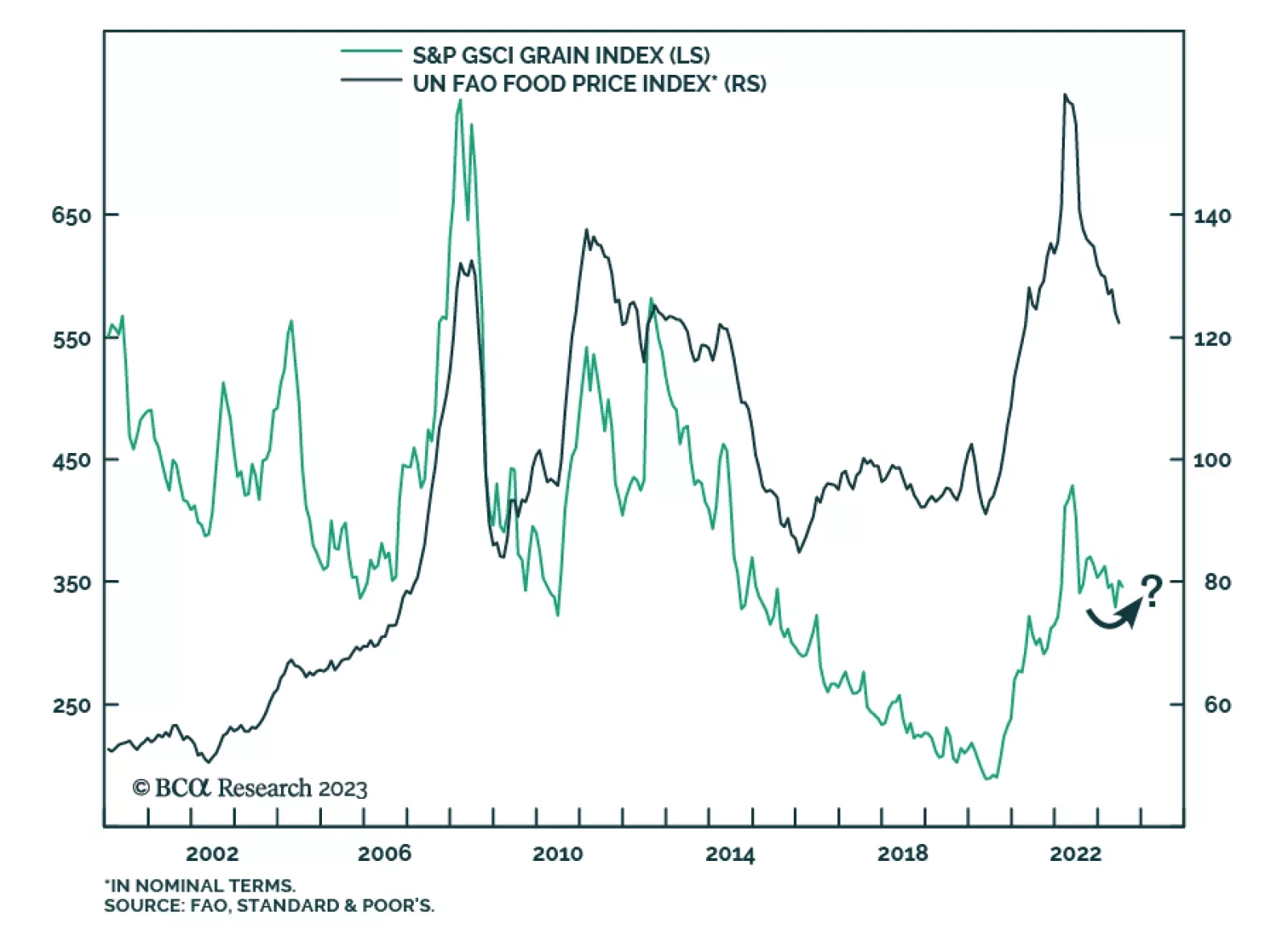

Wheat and corn prices have surged by 16% and 11%, respectively since Russia refused to renew the Black Sea Grain Initiative after it expired on July 17. The deal, which was negotiated with Turkey and the UN, allowed shipments of…

Falling inflation enables central banks to pause rate hikes, which is good news. But time goes on. Restrictive monetary policy, Chinese debt-deflation, energy supply shocks, US and global policy uncertainty, and extreme geopolitical…

The debt ceiling game’s endpoint will avoid default only if it implies economic pain. For the Republicans, the best strategy is not to lift the debt ceiling unless the Democrats cut spending a lot, or unless the economy starts to…

The initial phase of the EU’s ambitious CBAM will launch 1 October and will begin collecting a carbon tax in 2026. Between now and then, it will be challenged as it attempts to put a price tag on CO2 emissions as imports cross the EU…

Macro and geopolitical risks may spoil the narrow window for a stock market rally before recessionary trends rise to the fore.

Bullish equity sentiment may persist in the second quarter on the Fed’s pause, but tight monetary policy, financial instability, elevated recession odds, extreme US polarization and policy uncertainty, and still-high geopolitical…