While the trade-war cease-fire agreed at the G20 summit between the U.S. and China boosted grain markets – particularly as China agreed to begin “substantial” purchases from the U.S. – the future of the trade…

Highlights Downside risks to EM assets remain substantial. Stay put. EM stocks, credit and currencies will underperform their DM counterparts in the first half of 2019. The key and necessary condition for a new secular EM bull market…

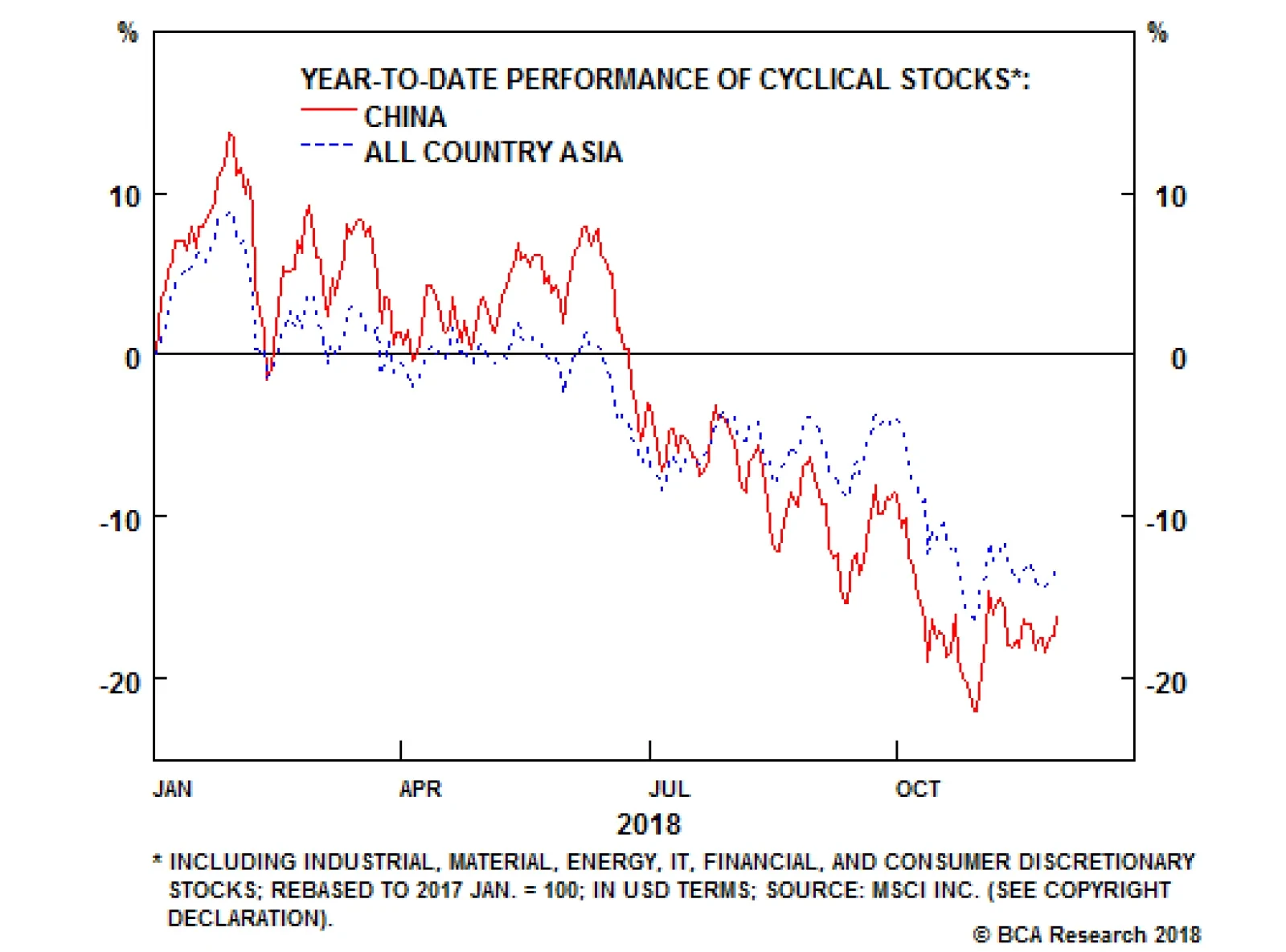

Highlights China’s old economy is set to decelerate in the first half of 2019, regardless of the recent tariff ceasefire. Our base case view is that growth will modestly firm in the second half of 2019, but timing the trough will…

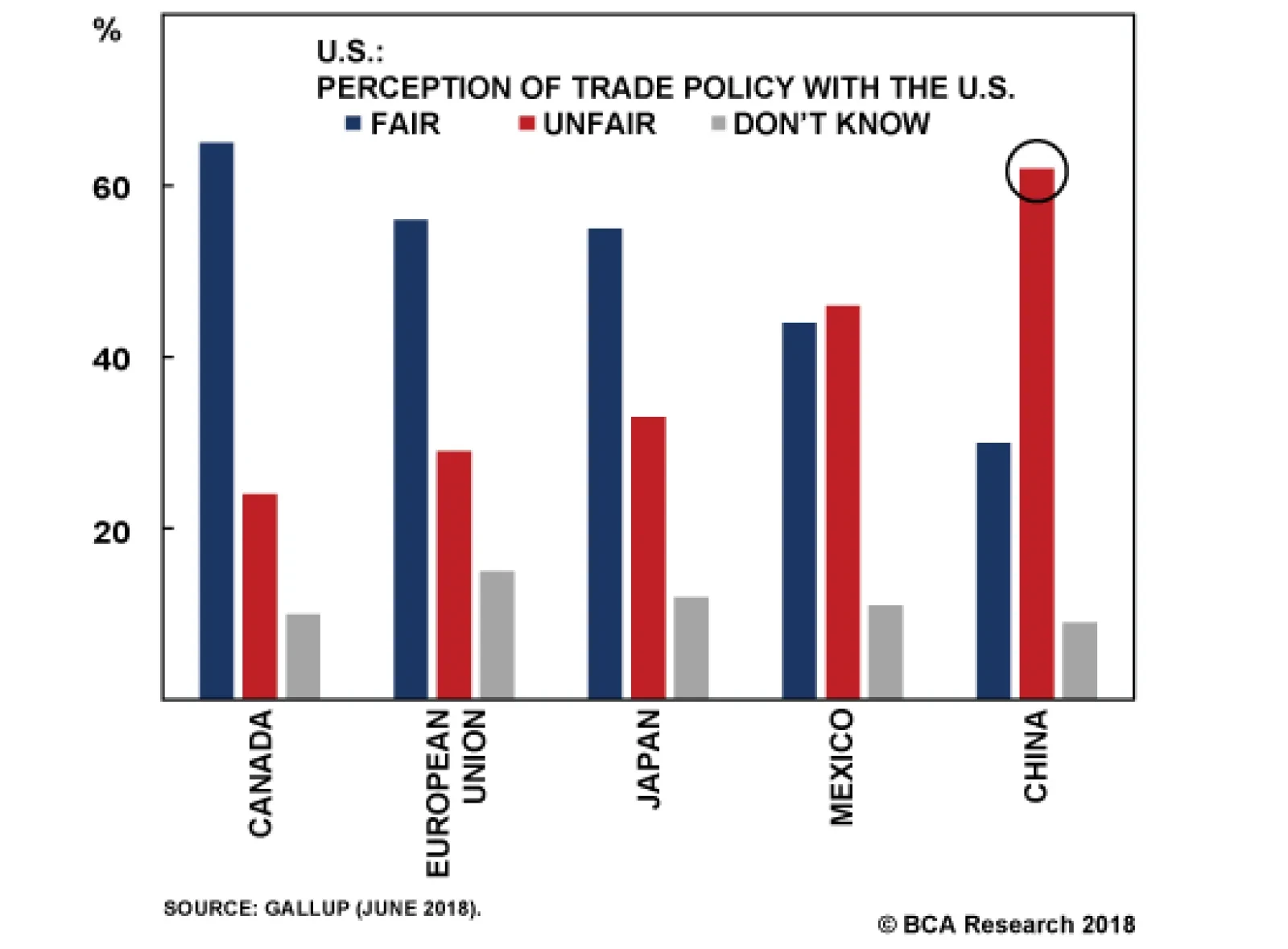

There are five reasons our geopolitical strategists doubt the sustainability of the truce: Trade imbalance: It is highly unlikely that the trade imbalance between China and the U.S. can be substantively altered over the course…

Highlights So What? The U.S.-China tariff ceasefire is a net positive, but a final deal is by no means assured. Why? In the near term there may be a play on global risk assets, but beyond that we remain cautious. Global…

The scheduled meeting between President Trump and President Xi on the sidelines of the G20 summit in Buenos Aires on December 1 has generated a fair amount of speculation that the trade war will be resolved or at least put on…

Mr. X and his daughter, Ms. X, are long-time BCA clients who visit our office toward the end of each year to discuss the economic and financial market outlook. This report is an edited transcript of our recent conversation. Mr. X: I have…