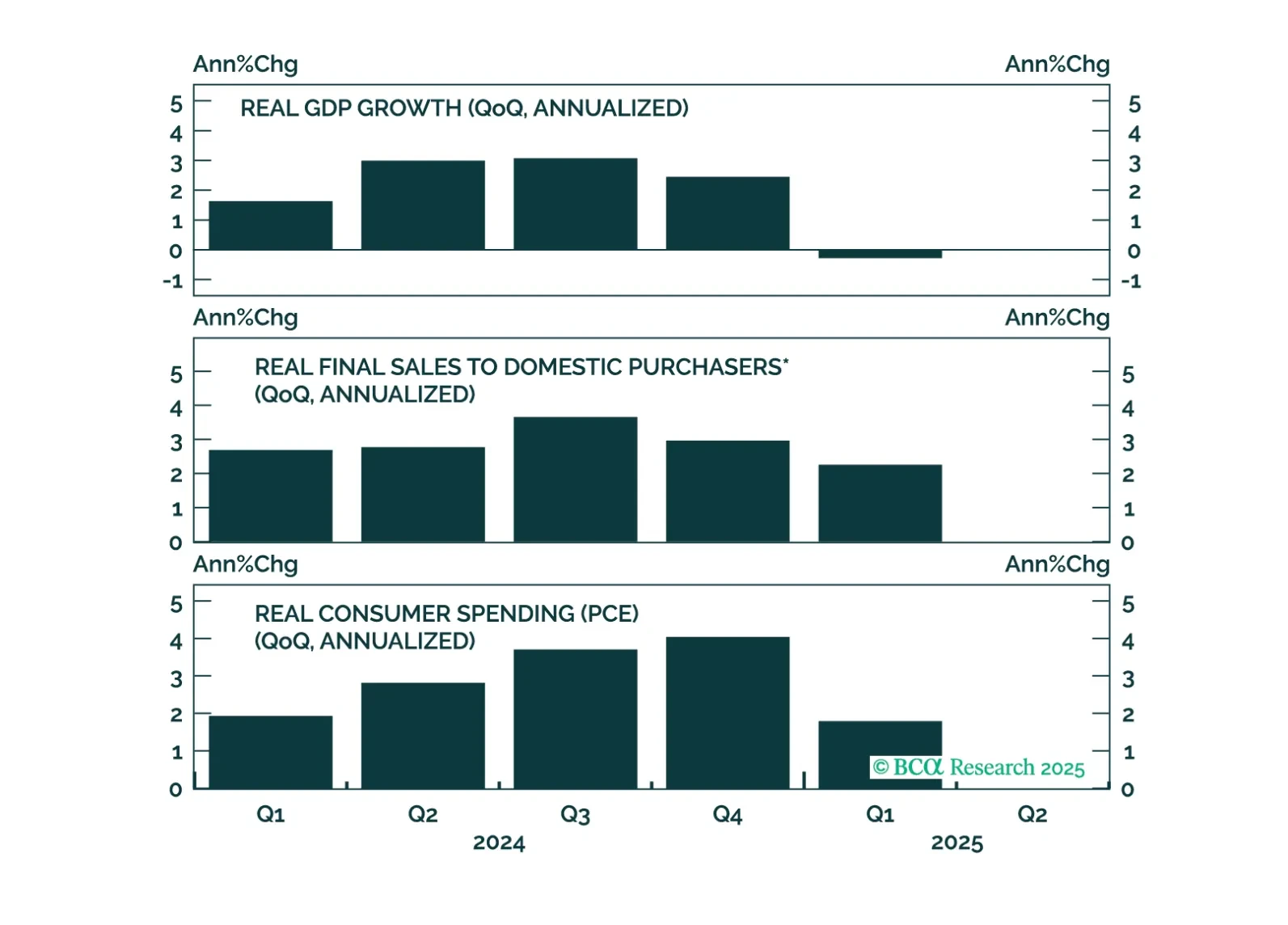

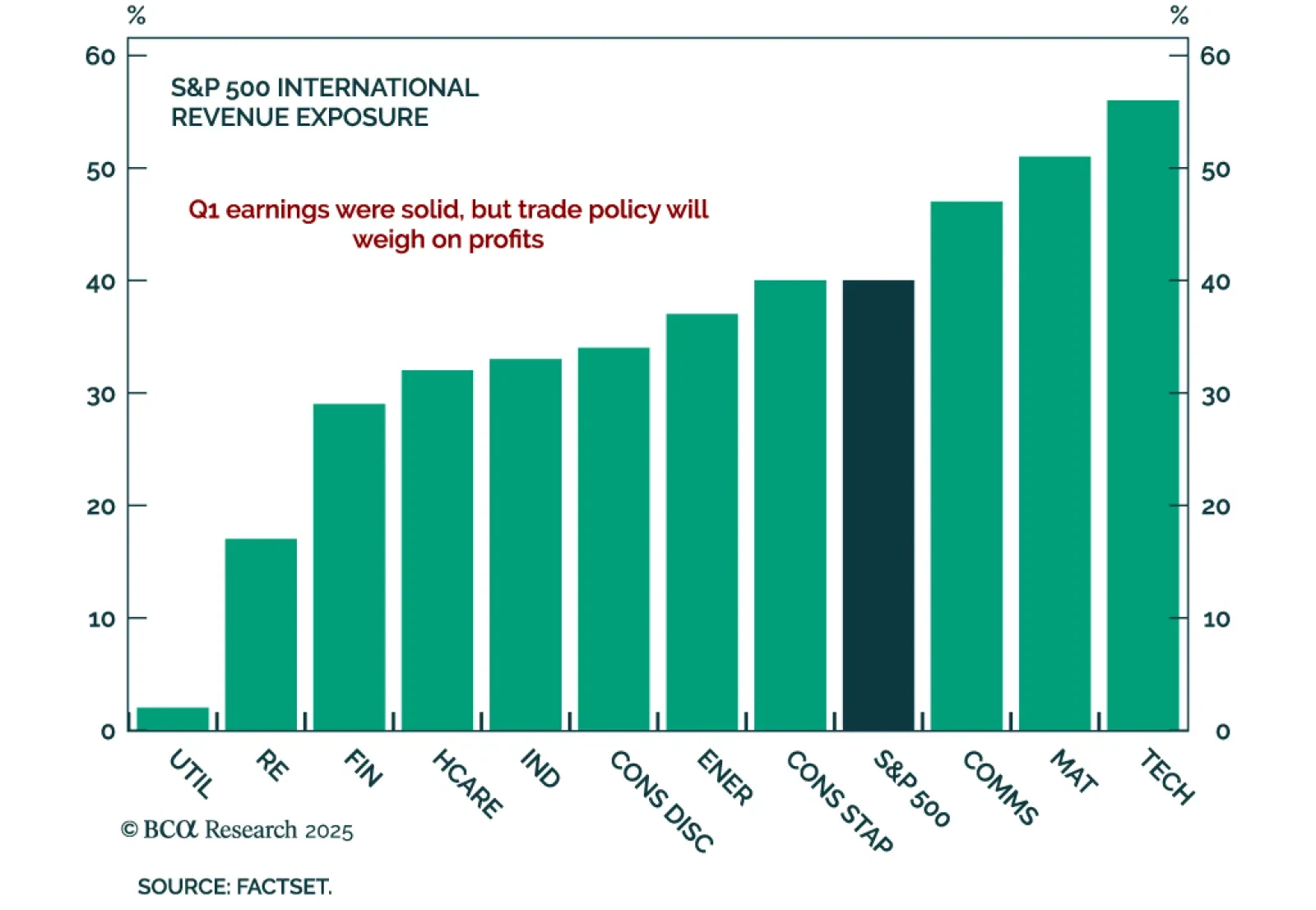

Q1 earnings point to risks for goods-focused sectors, reinforcing our US Equity strategists’ call to overweight services, upstream names, and domestic plays. With most S&P 500 companies having reported Q1 2025 earnings, the…

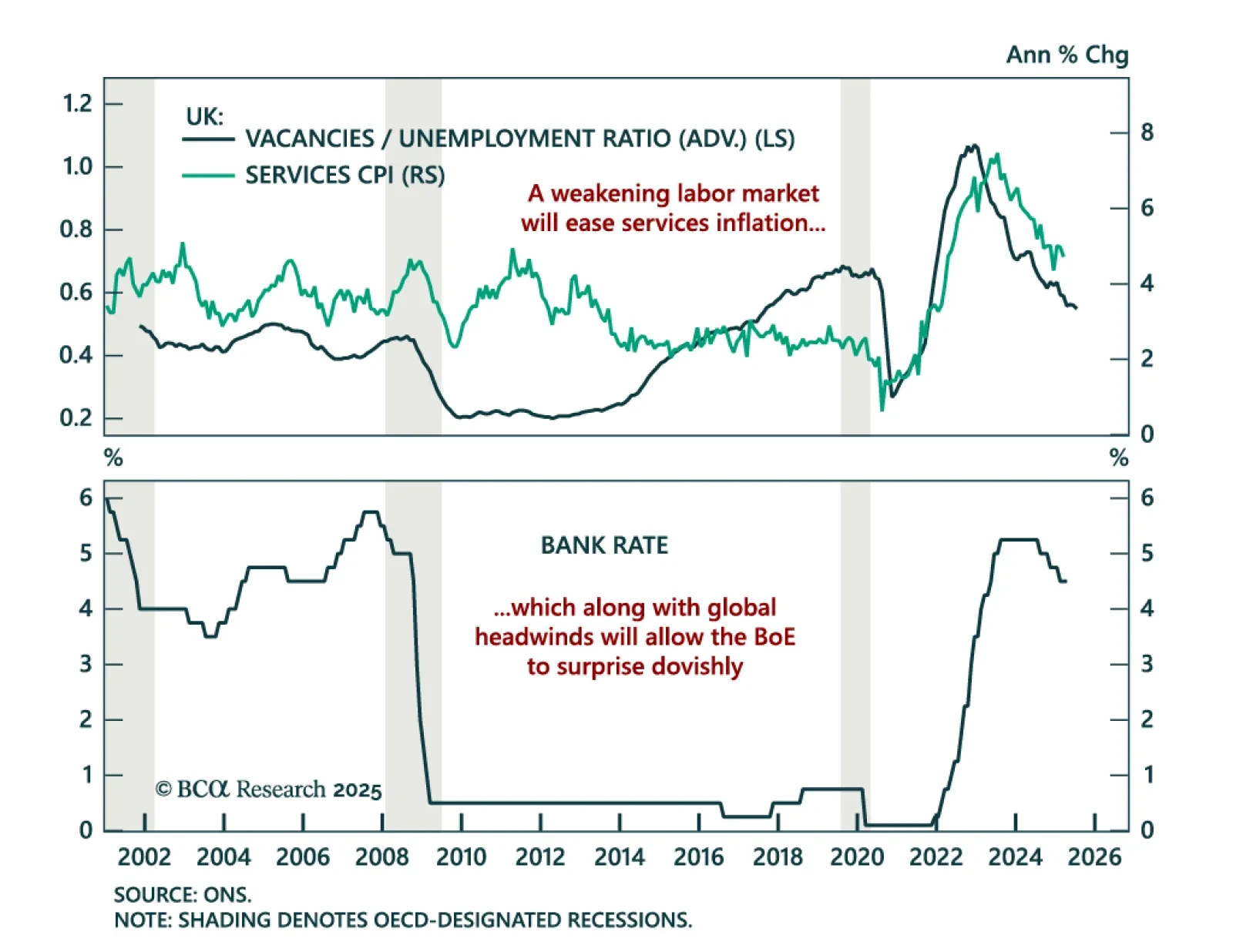

The Bank of England’s hawkish cut reinforces our Gilts overweight and tactical short GBP view as global headwinds persist. The BoE lowered rates by 25 bps to 4.25% as expected, but the MPC vote was more split than expected. Five…

The Fed held rates steady this afternoon, and the timing of its next move will be dictated by whether the tariff shock to inflation is transitory or more long lasting.

Negotiations on trade, Iran, and Ukraine will prove critical this month. Markets will remain volatile because positive data surprises enable the White House to press its hawkish tariff hikes, while negative surprises force the White…

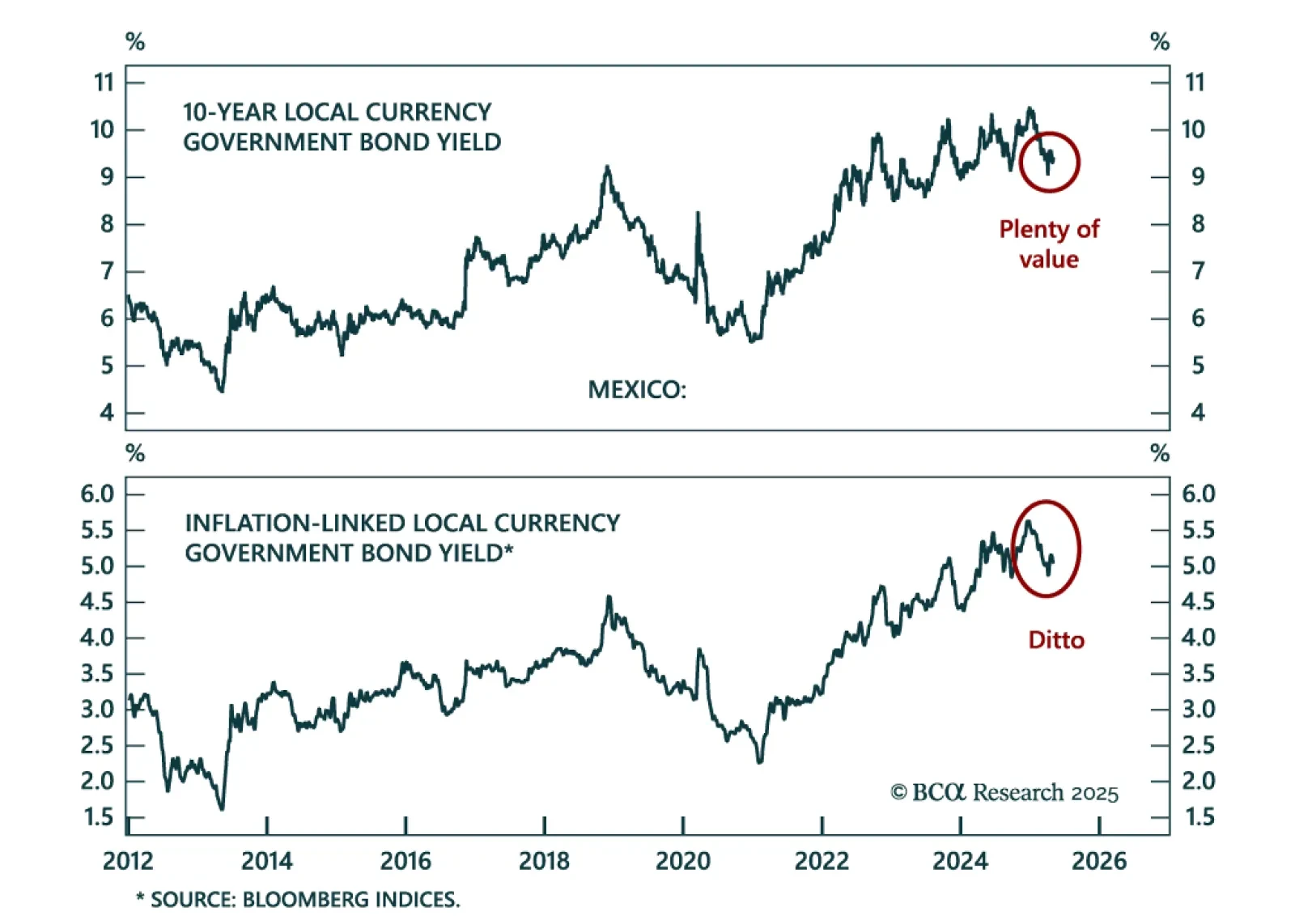

Mexico will be one of the biggest winners of the global trade war, creating a structural tailwind for its assets. Mexican risk assets and the peso are uniquely positioned to outperform while EM assets suffer as global growth slumps.…

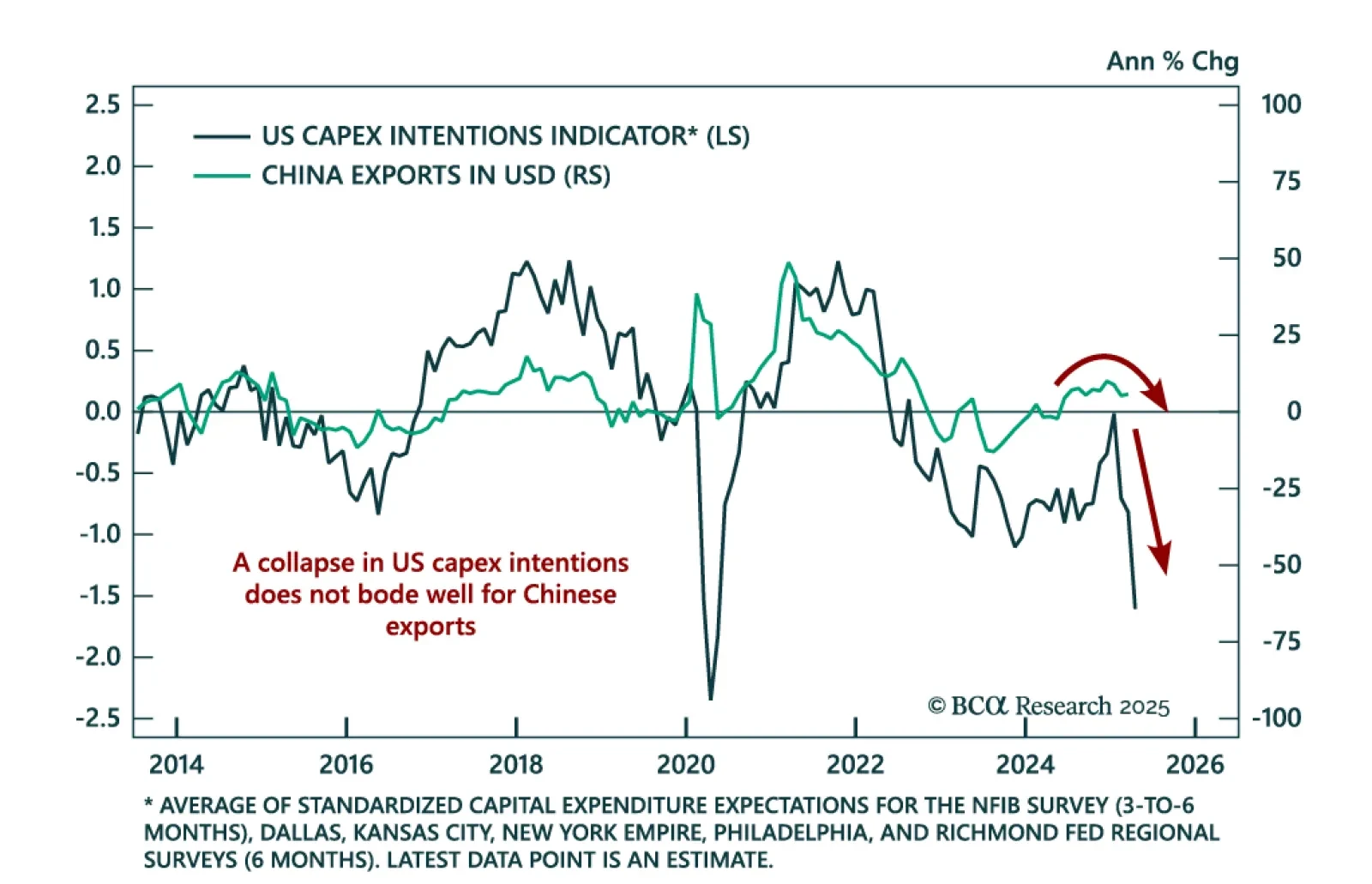

BCA’s China Investment Strategists remain defensive as China’s growth outlook is still weak. Even if some US tariff rates are rolled back, export headwinds and lagging stimulus will continue to weigh on Chinese equities. The…

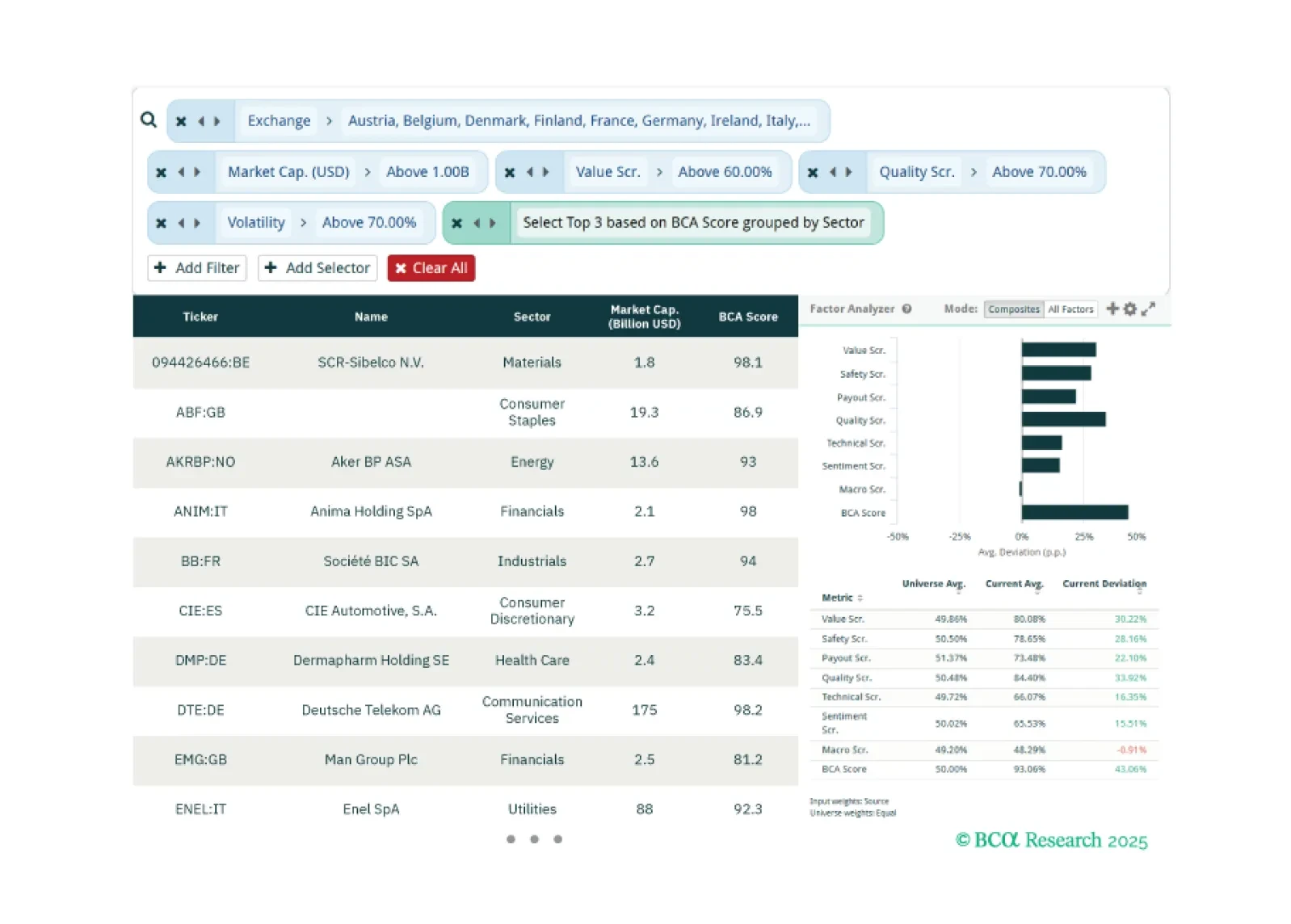

This week, our three screeners cover: Favoring European equities over US equities, cybersecurity stocks, and large caps with large moves in their BCA Score.

This year’s corporate bond sell off has hit high-yield more than investment grade, and high-yield spreads have turned relatively more attractive as a result.